Report

Published February 27, 2024

Commercial Commercial InsightsNorth American economic strength is riding on the backs of the resilient U.S. Consumer. For the past two years, the fear of an imminent recession rang in the ears of economists and consumers alike, radiating declining confidence in growth and the ability to prolong spending behaviors consumers grew accustomed to during pandemic recovery. Those fears have been pushed aside as consumers beat holiday spending expectations, upending retailers' anxiety entering the season.

Complete the form to access the report

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Thank you for your interest

Your free Experian resource is now available. Enjoy!

Report

Report

Q3 2025 Main Street Report

The holidays are here, and Black Friday sparks a surge in consumer spending. U.S. small businesses are proving remarkably resilient despite persistent economic challenges. Inflation held at 3.0% in September, and interest rates remain elevated, yet entrepreneurs are capitalizing on seasonal demand through digital innovation and disciplined financial strategies.

August saw 428,937 new business applications, a 10% year-over-year increase driven by minority and younger founders, while the Experian Small Business Index™ rose to 41.1, signaling improved credit health. With average credit card APRs exceeding 21.5%, small firms are shifting toward installment loans to finance inventory and holiday promotions, ensuring structured repayment and sustainable growth.

This adaptability positions local retailers to turn economic headwinds into opportunities, leveraging festive shopping momentum to strengthen their foothold in a competitive market.

Video

Video

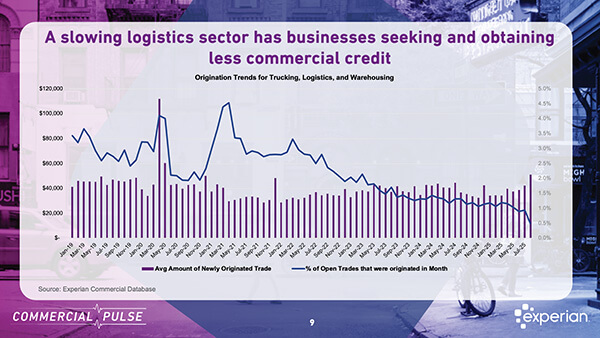

Rising Delinquencies Signal Growing Risk in Transportation & Warehousing

As the U.S. economy continues to recalibrate post-pandemic, the transportation and warehousing segments of the logistics sector are signaling caution. While the broader logistics industry has remained in expansion mode, Experian’s latest Commercial Pulse Report reveals that delinquencies are rising—an early warning of growing risk in two of the economy’s most critical subsectors.

Check out the full report to see how these trends could impact your strategy!

Video

Video

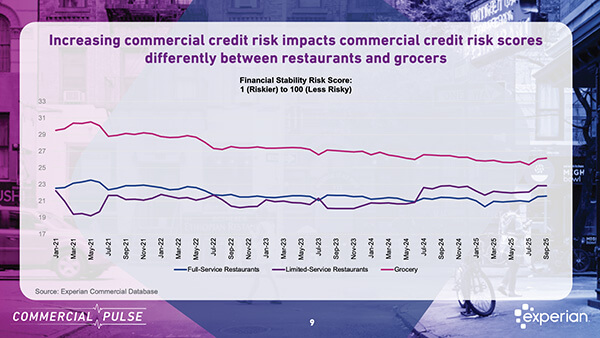

Under Pressure: How Rising Food Costs Are Changing Restaurant Credit Behavior

Experian’s latest Commercial Pulse Report dives into the financial health of the restaurant sector amid rising costs and shifting consumer behavior.

Key insights:

- Menu prices at Full-Service Restaurants rose 4.6% in August — outpacing inflation.

- Limited-Service Restaurants are showing improved credit risk scores, suggesting stronger adaptability.

- Credit access is tightening across the board, with average credit limits falling below $6,000.

- Revolving credit utilization is climbing — an early signal of potential cash flow strain.

What does this mean for lenders and decision makers?

✅ Not all restaurant types face the same risks.

✅ Segmenting credit strategies is more important than ever.

✅ Watch utilization and inquiry trends closely — they may be early indicators of distress.

Check out the full report to see how these trends could impact your strategy!

Video

Video

Credit Signals in Construction: Early Warnings for Lenders and Risk Leaders

The construction industry has experienced significant growth over the last seven years, but fresh data reveals mounting signs of financial stress that commercial lenders and Chief Risk Officers should be closely monitoring.

Check out the full report to see how these trends could impact your strategy!