Welcome to the Experian Thought Leadership Hub

Gain insights into the fast-changing world of consumer and business data through our extensive library of resources.

42 resultsPage 1

Infographic

Infographic

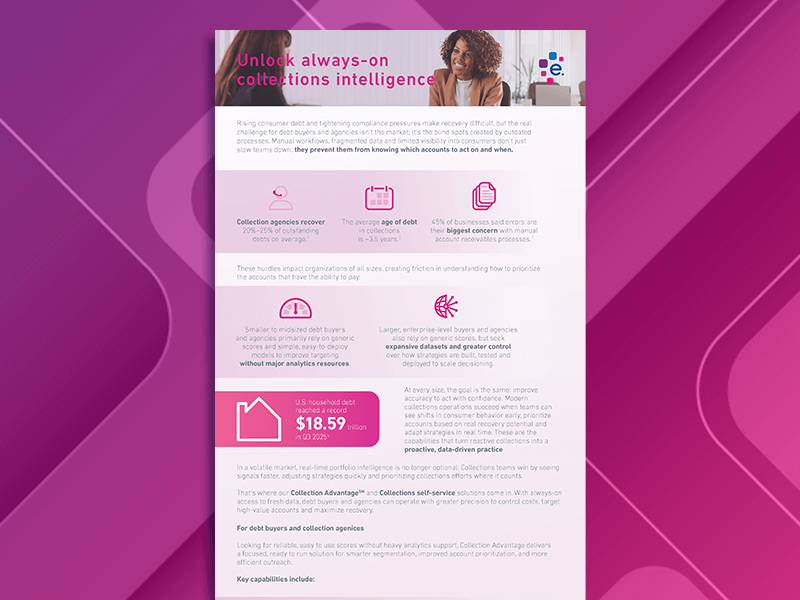

Recoveries hinge on knowing who can pay, not just who owes. This infographic explores how debt buyers and collections agencies can better identify signals of true payment capacity.

Did you know?

Read the infographic for more insights and strategies to drive smarter recoveries.

1Household Debt and Credit report, Q3 2025, Federal Reserve Bank of New York.

2Debt Collection Industry Statistics, zipdo.

3Collections Industry Statistics, Gitnux.

Infographic

Infographic

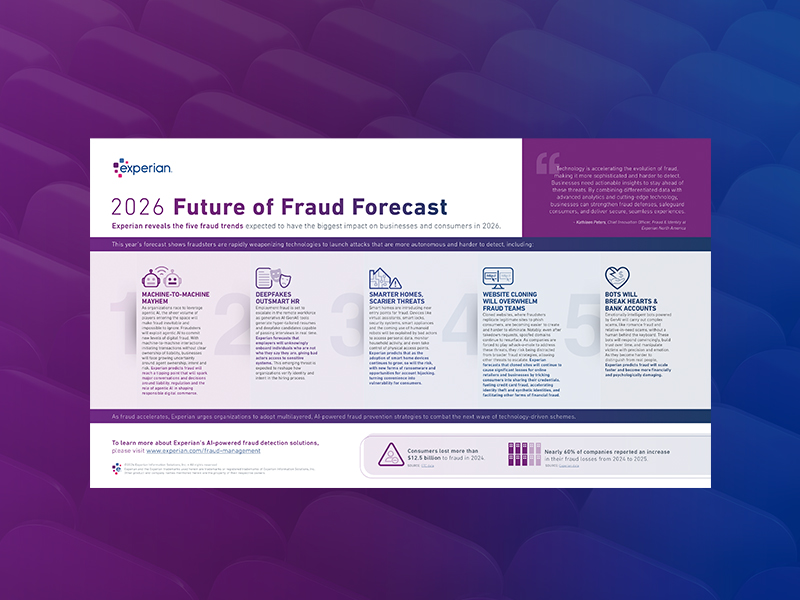

Download Experian’s 2026 Future of Fraud Forecast to explore five fraud trends expected to have the biggest impact on businesses and consumers in the coming year, including:

Infographic

Infographic

As market conditions shift, collections success depends on continuous, high-quality consumer data. This checklist highlights how always-on collections intelligence can help debt buyers and agencies:

Infographic

Infographic

Changes in consumer behavior and advancements in data and technology mean that traditional collection methods may no longer produce the best results.

Download our checklist for four key signs that your strategy needs updating and how modern solutions can help:

Infographic

Infographic

Home equity lending is shifting fast and hidden risks could be costing you.

Infographic

Infographic

Rental fraud is surging, driven by generative AI (GenAI) and automation, overwhelming leasing systems and increasing financial risk. Experian helps rental companies detect fraud early, protect revenue, and maintain seamless leasing experiences.

Infographic

Infographic

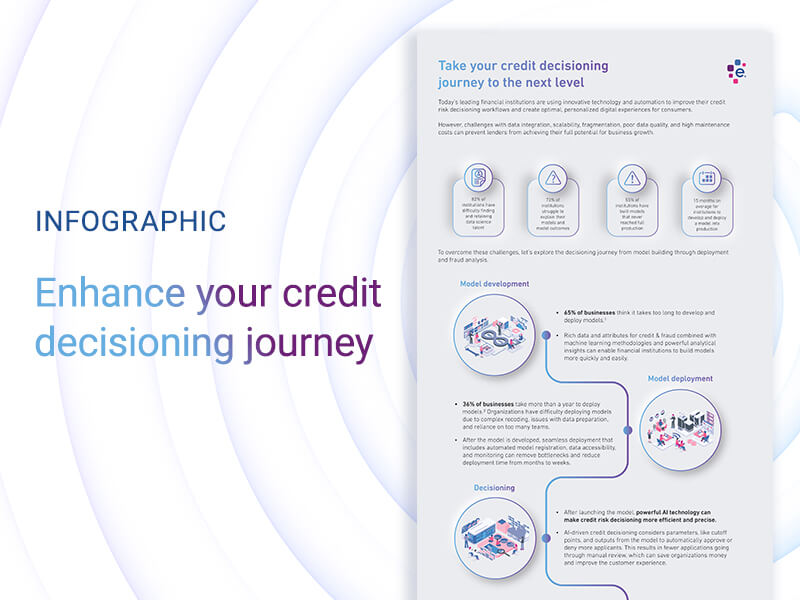

Financial institutions face several challenges during the credit decisioning process, such as poor data quality, scalability issues, data fragmentation, and high maintenance costs. Experian can help lending institutions enhance their credit decisioning journey at every step, through:

Discover how your organization can take your credit decisioning journey to the next level with the Experian Ascend Platform™.

Infographic

Infographic

Millions of U.S. households remain unbanked, yet many possess the ability to borrow responsibly. Read our infographic to learn how you can leverage real-time cashflow data to: