Case Study

Published October 17, 2019

Fintech Collections & Debt RecoveryChicago-based online consumer-finance platform and service provider, OppsLoans, saw a 134% return on investment after leveraging Experian's Tax Season Payment Indicator to identify past-due customers who paid down balances by at least 10% or made a payment of $500 or more during tax season.

Discover how Experian helped them achieve this by reading this case study.

Complete the form to access the case study

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Thank you for your interest

Your free Experian resource is now available. Enjoy!

Infographic

Infographic

Driving smarter recoveries with ability-to-pay insights

Recoveries hinge on knowing who can pay, not just who owes. This infographic explores how debt buyers and collections agencies can better identify signals of true payment capacity.

Did you know?

- U.S. household debt surpassed $18 trillion in Q3 2025.1

- The average age of debt in collections is ~3.5 years.2

- The average recovery rate on delinquent accounts is ~20%.3

Read the infographic for more insights and strategies to drive smarter recoveries.

1Household Debt and Credit report, Q3 2025, Federal Reserve Bank of New York.

2Debt Collection Industry Statistics, zipdo.

3Collections Industry Statistics, Gitnux.

Infographic

Infographic

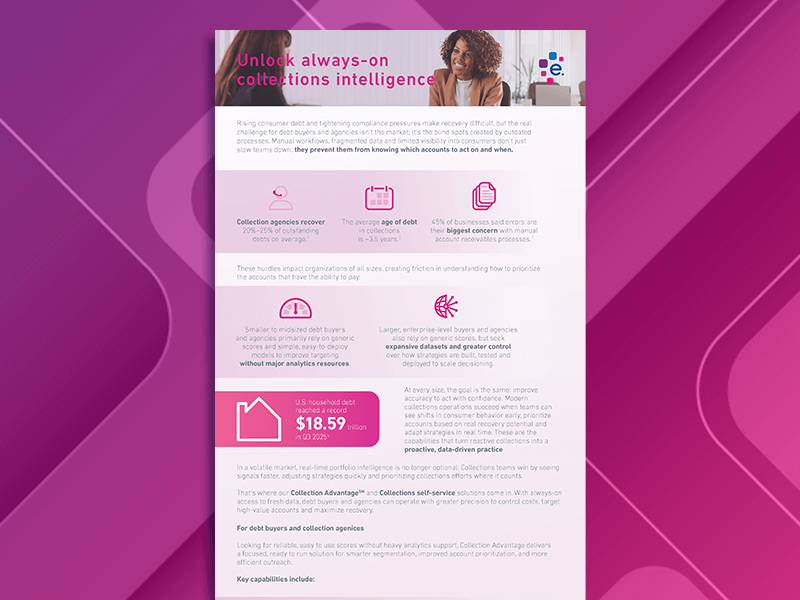

Unlock always-on collections intelligence

As market conditions shift, collections success depends on continuous, high-quality consumer data. This checklist highlights how always-on collections intelligence can help debt buyers and agencies:

- Stay ahead of consumer behavior shifts

- Adjust strategies quickly

- Concentrate collections efforts where it counts

Webinar

Webinar

Unlocking alternative data for smarter fintech decisions

Join Ashley Knight, Experian’s SVP of Product Management, and Haiyan Huang, Prosper’s Chief Credit Officer, to discover how:

- Alternative finance data is redefining how to verify and connect identities.

- Email and phone intelligence is unlocking new levels of precision in credit marketing.

- Open banking insights are becoming increasingly critical for financial inclusion and mitigating risk.

eBook

eBook

Turning collection challenges into opportunities

Without modern, data-driven strategies, agencies and debt buyers risk falling behind in an increasingly digital-first world.

In this e-book, you’ll learn how to:

- Recover more with dynamic scoring models.

- Streamline prioritization with advanced data and analytics.

- Engage faster through personalized communications and tailored outreach.

- Improve efficiency with on-demand platforms and self-service portals.