Coverage Discovery®

Automated insurance discovery, maximize revenue by reducing denied claims

In 2024, Coverage Discovery identified over $60 billion in insurance coverage across 45+ million unique patient cases, turning missed opportunities into paid claims.

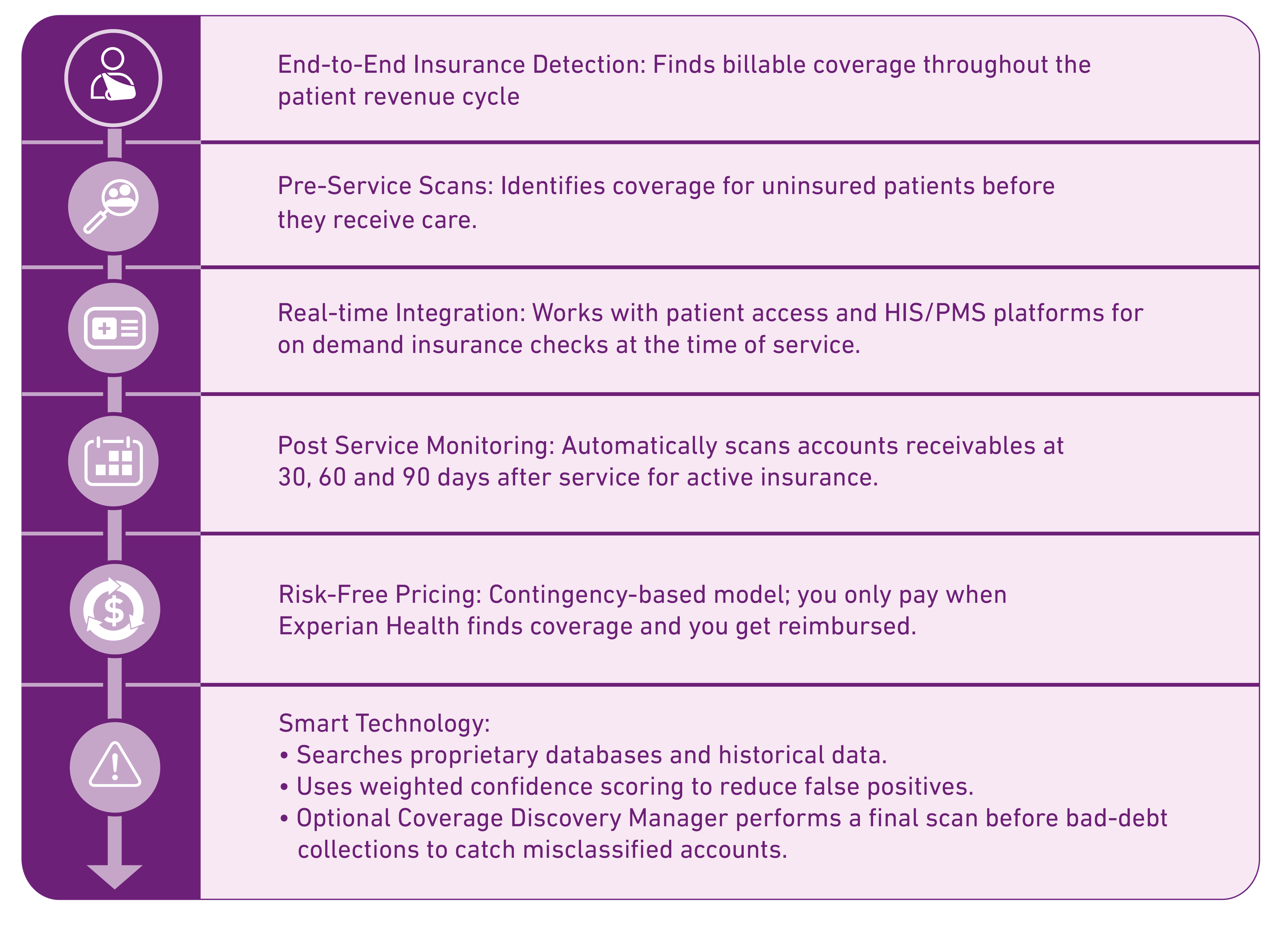

Fitting anywhere in your revenue cycle, Coverage Discovery uses multiple proprietary databases like employer information, historical search information, registration history, and demographic validation to proactively identify billable Medicare, Medicaid, and private insurance options.

See how insurance discovery can help healthcare organizations find previously unidentified coverage—while saving time and money.

Scan patients without insurance, before or after they receive care, to find previously unknown coverage.

Lower the number of accounts sent to charity and collections, with insurance discovery.

Find missed and undisclosed coverage with a unified, end-to-end strategy.

Client success story

Coverage Discovery® helps their organization find previously undisclosed insurance coverage, optimized their collections process and helps hold Payers accountable to meet service levels.

Learn how providers tackle increasing levels of uncompensated care with automated insurance discovery throughout the revenue cycle continuum.

Low-friction workflows that cover everything from booking appointments to paying bills create a satisfying patient experience and keep your revenue cycle humming.

How to navigate the complexities around Medicaid disenrollment and provide equitable care to your patient population

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.