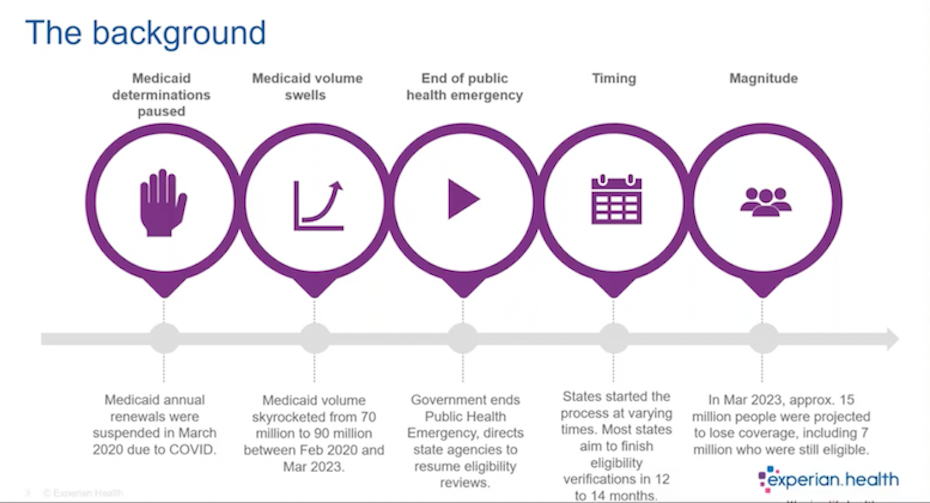

More than 13 million Americans have lost Medicaid coverage since continuous enrollment came to an end in April 2023. Unwinding the emergency provisions requires states to determine which individuals remain eligible for Medicaid, leading to widespread disenrollment. The Medicaid redetermination process created a major admin burden for agencies and providers, and now, the impact of that burden on patients has become clear: more than 7 million of those who lost coverage were disenrolled because of administrative processes, and not due to ineligibility.

While some will find coverage elsewhere, many will be left without insurance. These coverage gaps disrupt health services with adverse effects for patients and providers. In a recent webinar, Kate Ankumah and Mindy Pankoke, Product Managers at Experian Health, reflect on the Medicaid redetermination process and discuss how providers can mitigate the effects of redetermination heading into 2024.

Recap: Medicaid continuous enrollment provision timeline

How does the Medicaid redetermination process work?

The redetermination process, led by state agencies, involves reviewing Medicaid rosters and automatically renewing coverage for individuals that still qualify, based on benefits or other government data. When coverage cannot be confirmed automatically, states need to reach out to patients to fill in the gaps. If the individual is no longer eligible (or does not provide the necessary data), they will be removed from coverage lists. Many patients are confused about the process and may not even realize they’re no longer covered, leading to delays and distress when they try to access care. This blog post breaks down the 5 things providers can do if a patient loses Medicaid coverage.

1. Tighten up insurance eligibility verification processes

During the webinar discussion, Kate Ankumah explains that implementing a reliable eligibility verification tool is essential to reduce financial risk, increase revenue and streamline staff workflows:

“With our Eligibility product, we connect to more than 900 payers with search optimization. Providers don’t need to send the same information over and over – we’ll run through the search options ourselves and find the information as quickly as possible. Then we standardize the data so front desk staff can read all the responses in the same way. We also build in alerts. A couple of clients have alerts set up for Medicaid redetermination dates that pop up if a patient is due for redetermination so the front desk staff know to have a conversation with them about it.”

Eligibility also includes an optional Medicare beneficiary identifier (MBI) lookup service, to check if any patients who may have been disenrolled from Medicaid are now eligible for Medicare.

2. Find missing coverage with Coverage Discovery

Providers may also want to automate the search for any active coverage that may have been overlooked. Coverage Discovery searches for possible billable government or commercial insurance to eliminate unnecessary write-offs and give patients peace of mind. Using advanced search heuristics, millions of data points and powerful confidence scoring, this tool checks for coverage across the entire patient journey. If the patient’s status changes, their bill won’t be sent to the wrong place.

In 2021, Coverage Discovery identified previously unknown billable coverage in more than 27.5% of self-pay accounts, preventing billions of dollars from being written off.

3. Quickly identify patients who may be eligible for Medicaid and financial assistance

The lack of clarity around enrollment and eligibility is disruptive for claims and collections teams. How can they handle reimbursements and billing efficiently if financial responsibility is unclear? Denial rates are already a top concern for providers, and staff cannot afford to waste time seeking Medicaid reimbursement for disenrolled patients. Patient collections also take a hit when accounts are wrongly designated as self-pay.

With Patient Financial Clearance, providers can quickly determine if patients are likely to qualify for financial support, then assign them to the right financial pathway, using pre- and post-service checks. Self-pay patients can be screened for Medicaid eligibility before treatment or at the point of service, and then routed to the Medicaid Enrollment team or auto-enrolled as charity care if appropriate. Post-visit, the tool evaluates payment risk to determine the most suitable collection policy for those with an amount to pay and can set up customized payment plans based on the patient’s ability to pay.

Patient Financial Clearance also runs back-end checks to catch patients who have already been sent a bill but may qualify for Medicaid or provider charity programs. This helps secure reimbursement and means patients are less likely to be chased for bills they can’t pay.

4. Screen and segment patients according to their propensity to pay

Optimizing collections processes is always a smart move for providers, but particularly now that federal support has ended. Collections Optimization Manager uses advanced analytics to segment patient accounts based on propensity to pay and send them to the appropriate collections team. Drawing on Experian’s consumer credit data, Collections Optimization Manager’s segmentation models are powered by robust and proprietary algorithms. These models screen out Medicaid and charity eligibility, so collections staff focus their time on the right accounts.

Case study: See how University of California San Diego Health (UCSDH) increased collections from around $6 million to over $21 million in just two years using Collections Optimization Manager.

5. Make it simpler for patients to manage and pay bills

The reality is that many patients affected by the unwinding of continuous enrollment will be on low incomes. When more than half of patients say they’d struggle to pay an unexpected medical bill of $500, providers should make it easier for patients to gauge their upcoming bills. Patient Financial Advisor and PatientSimple® can help patients navigate the payment process with pre-service estimates, access to payment plans and convenient payment methods they can access on a computer or mobile device.

Together, these tools can help providers manage Medicaid changes efficiently and offer extra support to patients who may be facing disenrollment.

Watch the webinar to see the full discussion on how Medicaid redetermination is affecting providers and find out how Experian Health’s digital solutions can help healthcare organizations quickly and easily verify insurance coverage.