Office of Foreign Assets Control (OFAC)

Watchlist screening solutions and identity verification

OFAC is an office of the U.S. Treasury responsible for outlining and prosecuting trade sanctions to support national security and protect against targeted individuals and entities, including foreign countries or individuals engaging in organized international crime. According to the Federal Financial Institutions Examination Council (FFIEC), meeting OFAC compliance consists of blocking accounts and other property of specific countries, entities and individuals, as well as prohibiting or rejecting unlicensed trade and financial transactions.

Building your OFAC compliance program

In order to keep your organization on track to comply with OFAC regulations, your organization must establish and maintain a written program to meet compliance, taking into account the risks your business faces. For example, you need to consider the geographies in which you conduct business, customers you serve or transactions you typically complete to determine the level of sophistication your program should include. Once you understand these risks to your organization, OFAC calls for policies and procedures to be established for reviewing your transactions and the people involved.

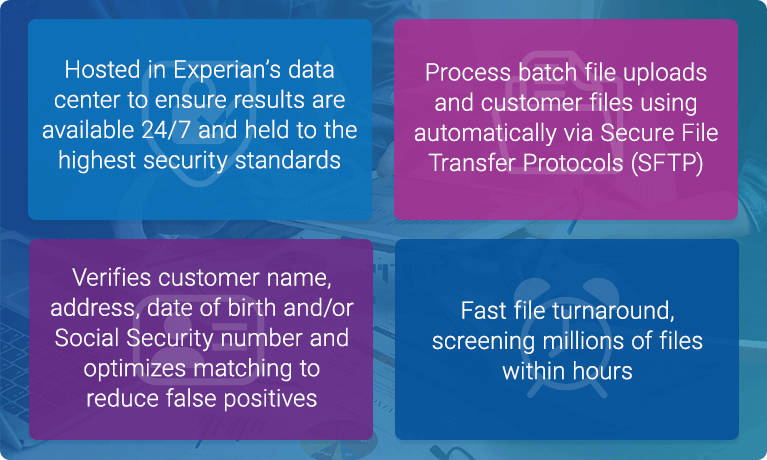

Businesses can search and match names against compliance and global watchlists. Real-time data service can be accessed in many ways — including the ability to plug the data directly into your data environment.

Our solutions allow you to remain compliant with OFAC regulations and mitigate your risk of significant fines or imprisonment.

With better matching capabilities to compare contact details with government lists, we can return a score indicating the probability of a match.

We are unable to address personal credit report and/or membership inquiries via this business form. Visit Experian.com/help or call 888-397-3742 for consumer assistance.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.