Federal Financial Institutions Examination Council (FFIEC) guidance

Identity authentication services for internet banking to strengthen FFIEC compliance.

This council is an interagency group, consisting of:

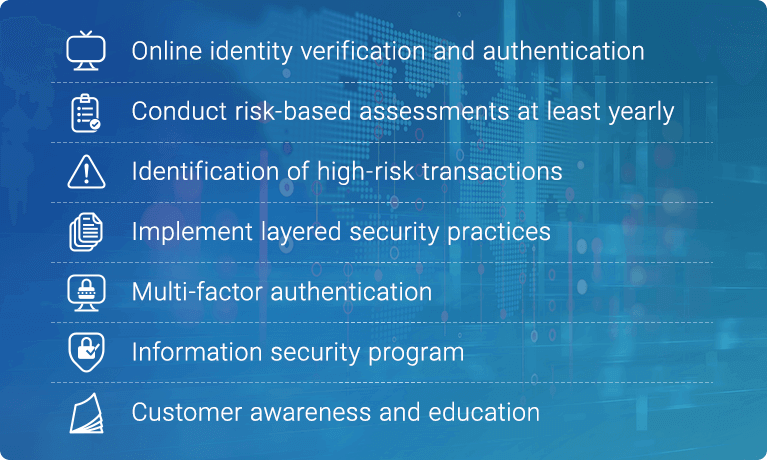

This council outlines uniform principles, standards, and reporting forms and systems for the federal examination of financial institutions, holding companies and related subsidiaries. This guidance empowers financial institutions to assess their risk, safeguard customer information, prevent money laundering and terrorist financing, and overall reduce fraud and identity theft in their portfolios.

Leverage sophisticated knowledge-based authentication, as well as enable flexible, multifactor authentication capabilities.

Work with specialized advisors who assess current authentication strategies and help meet compliance.

Lean on our trusted fraud and identity platform to spot fraudulent transactions fast.

We are unable to address personal credit report and/or membership inquiries via this business form. Visit Experian.com/help or call 888-397-3742 for consumer assistance.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.