Welcome to the Experian Thought Leadership Hub

Gain insights into the fast-changing world of consumer and business data through our extensive library of resources.

387 resultsPage 13

Report

Report

While the U.S. economy continues to outperform expectations, the labor market remains solid and consumers are well-positioned, there remain a few challenges ahead in 2025 that could cloud the economic outlook including potential inflationary pressures and continued affordability issues in the housing market. As these trends play out over the course of the year, businesses must stay on top of the latest economic developments.

Experian’s Chief UK Economist Mohammed Chaudhri’s latest report shares his forecast for the rest of the year and beyond with insights into the latest economic trends and developments.

Video

Video

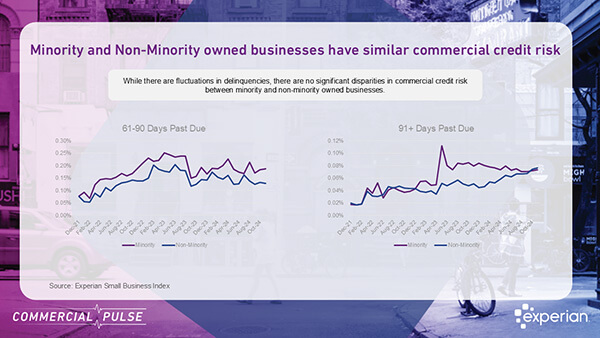

In this episode, we discuss the growing economic crosswinds affecting small businesses, recent employment trends, consumer spending patterns, and the impressive growth of minority-owned businesses in the U.S. We highlight the challenges and opportunities these businesses face, particularly in accessing needed capital.

📌 41% of new commercial accounts are minority-owned, yet access to capital remains a barrier.

📌 44% of minority-owned businesses are less than six years old, showing strong entrepreneurial momentum.

📌 Industries like retail, construction, and healthcare are fueling this expansion.

For lenders, this represents an untapped market and a business opportunity with high growth potential.

Check out the full report to see how these trends could impact your strategy!

Report

Report

The U.S. small business landscape entered 2025, navigating short-term volatility as the new administration began implementing policy changes amid ongoing global uncertainties. Throughout the fourth quarter of 2024, the election cycle introduced expectations of tax policy adjustments, government efficiency initiatives, and regulatory reforms aimed at bolstering U.S. consumers and small businesses; however, uncertainty over the scope and timing of these policies led to cautious lending and business investment. Inflationary pressures persisted, keeping borrowing costs elevated, while global risks, ranging from energy price fluctuations to supply chain disruptions, added complexity to the operating environment.

Consumer resilience remained a key stabilizer, yet signs of spending fatigue emerged, raising concerns about demand sustainability. Despite these headwinds, strong cash flows and solid holiday spending encouraged lenders to signal a measured easing of underwriting standards. As 2025 progresses, small businesses must stay agile, adapting to evolving domestic policies and global market shifts to seize opportunities and sustain growth in a changing landscape.

Report

Report

Key themes and emerging trends shaping financial services in 2025, using research and insight from leading industry analysts. Themes include:

Tip Sheet

Tip Sheet

Recent statistics reveal a direct connection between employee identity theft and business vulnerabilities. Compromised employee credentials can be a common entry point for fraudsters and putting your organization’s cybersecurity at risk.

Report

Report

While all eyes are on the impact of tariffs, immigration policy, and other proposals coming out of the new administration, the five key trends that I’ll be watching in 2025 have been playing out over the last couple of years and will be important to how the economy and lending market unfolds in the year ahead.

Trends include:

eBook

eBook

Credit risk, fraud, and compliance have long operated in silos, but forward-thinking organizations are unlocking new opportunities through convergence.

Read our e-book to learn how aligning these critical functions can help you:

White Paper

White Paper

In today's fast-paced world, locating individuals quickly is crucial for debt collectors and lenders. TrueTrace™, Experian’s leading skip tracing software, has undergone significant enhancements, improving data accuracy and expanding data sources.

These upgrades offer:

Call blocking, mislabeling, and increased scam activity have led to a decline in RPC rates. TrueTrace addresses these challenges with enhanced data accuracy, using an identity graph to tie data from disparate sources to a unique identity profile for each consumer.

TrueTrace's enhancements represent a significant advancement in skip tracing technology, helping businesses achieve better results and operational efficiency.