Experian Hunter

Fighting against fraud in partnership with businesses by combining fraud intelligence

Fraud is evolving. Application and account takeover fraud are on the rise, and businesses lose up to 5% of revenue annually to fraud*. Hunter empowers organisations to fight back with intelligent, configurable tools that integrate seamlessly into existing systems.

Maximise fraud savings and operational efficiency with intelligent, configurable fraud detection

$9bn

in fraud loss savings every year

3.6m

confirmed and suspected fraud cases annually

35%

average increase in fraud detection

57:1

Typical ROI for financial institutions

* All stats are a result of studies conducted by Experian Software Solutions’ Global Identity and Fraud Analytics team in 2025.

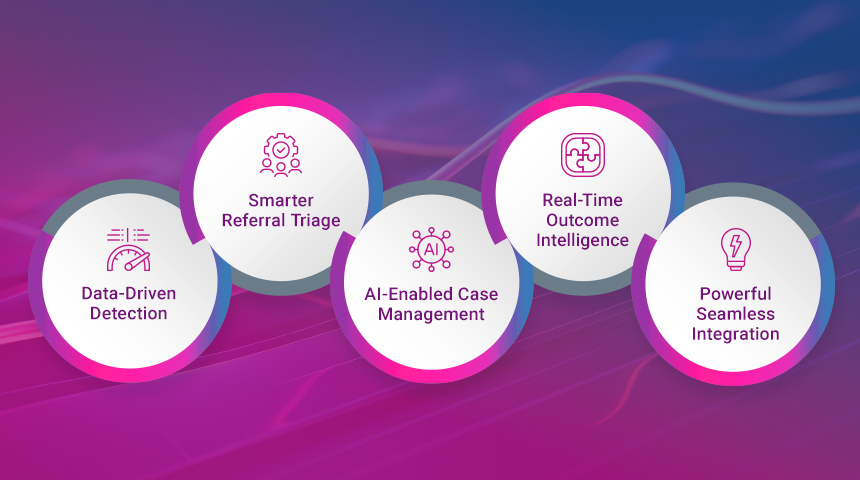

Hunter combines five powerful components to deliver a flexible fraud detection solution:

We are unable to address personal credit report and/or membership inquiries via this business form. Visit Experian.com/help or call 888-397-3742 for consumer assistance.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

*ACFE Occupational Fraud 2024: A report to the nations