Welcome to the Experian Thought Leadership Hub

Gain insights into the fast-changing world of consumer and business data through our extensive library of resources.

73 resultsPage 1

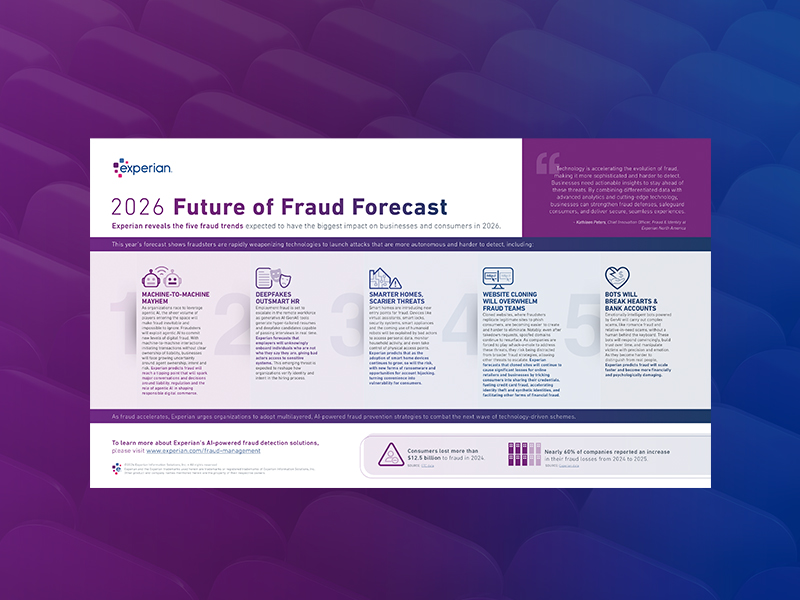

Infographic

Infographic

Download Experian’s 2026 Future of Fraud Forecast to explore five fraud trends expected to have the biggest impact on businesses and consumers in the coming year, including:

Report

Report

Consumers expect e-commerce experiences to be seamless and secure but, as fraud threats evolve, merchants are struggling to keep pace — and consumers are losing trust in merchants. Drawing on this year’s U.S. identity and fraud insights, this report explores the key factors contributing to the e-commerce trust gap.

You’ll learn:

Report

Report

The scale of global cyberattacks continues to rise, and 2026 is poised to be the year of AI in cybersecurity.

In our 13th annual Data Breach Industry Forecast, we share our top predictions for the year ahead, including:

Gain insight into the trends shaping the future of data security. Download the full forecast to prepare for what’s ahead.

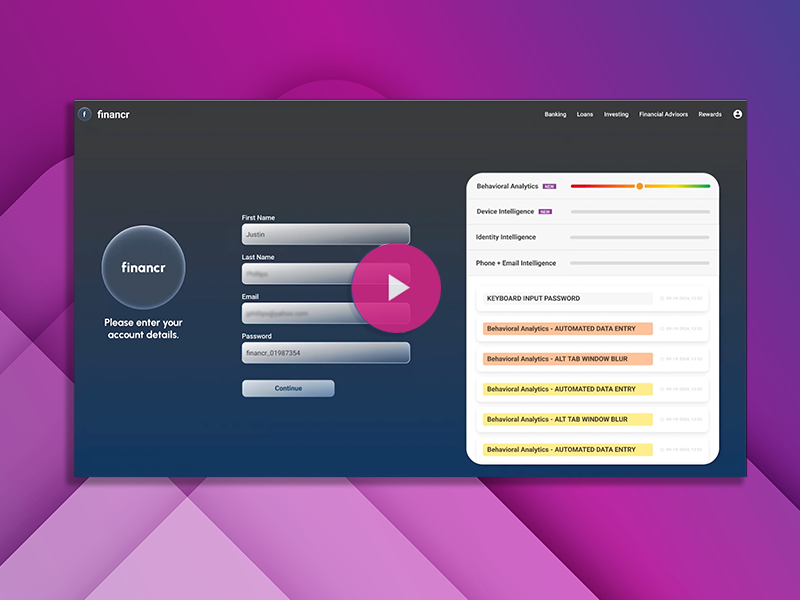

Video

Video

Fraud doesn’t happen in silos — and neither should your defense.

Watch this product demo to see how Experian’s connected fraud prevention solution brings behavioral analytics, identity verification and digital intelligence together to:

Webinar

Webinar

Consumers expect convenience online, but fraud concerns continue to challenge retailers’ ability to deliver frictionless experiences. In this on-demand webinar, you’ll learn:

Infographic

Infographic

Home equity lending is shifting fast and hidden risks could be costing you.

Webinar

Webinar

Learn how background screeners can modernize employment verifications and improve outcomes:

Report

Report

First-party fraud is notoriously difficult to separate from credit risk — but first-payment default (FPD) can be the key to earlier, more accurate fraud detection.

Key insights:

Infographic

Infographic

Rental fraud is surging, driven by generative AI (GenAI) and automation, overwhelming leasing systems and increasing financial risk. Experian helps rental companies detect fraud early, protect revenue, and maintain seamless leasing experiences.