Welcome to the Experian Thought Leadership Hub

Gain insights into the fast-changing world of consumer and business data through our extensive library of resources.

387 resultsPage 19

Webinar

Webinar

See Experian Assistant, our latest innovation in GenAI technology, in action – taking financial institutions to the next level by increasing productivity and scaling expertise. In this webinar, discover how to drive higher productivity and customer engagement, minimize time spent writing code, and improve understanding of data and attributes.

Report

Report

Dive into Experian Clarity Services' latest quarterly report on alternative financial services (AFS). Our comprehensive analysis of key metrics and scores offers valuable insights into consumer behavior in the AFS sector.

This quarter's report covers:

Elevate your understanding of the AFS industry. Access the Experian Clarity Services Quarterly Insights Report now to uncover insights that fuel success in today’s dynamic financial landscape.

Report

Report

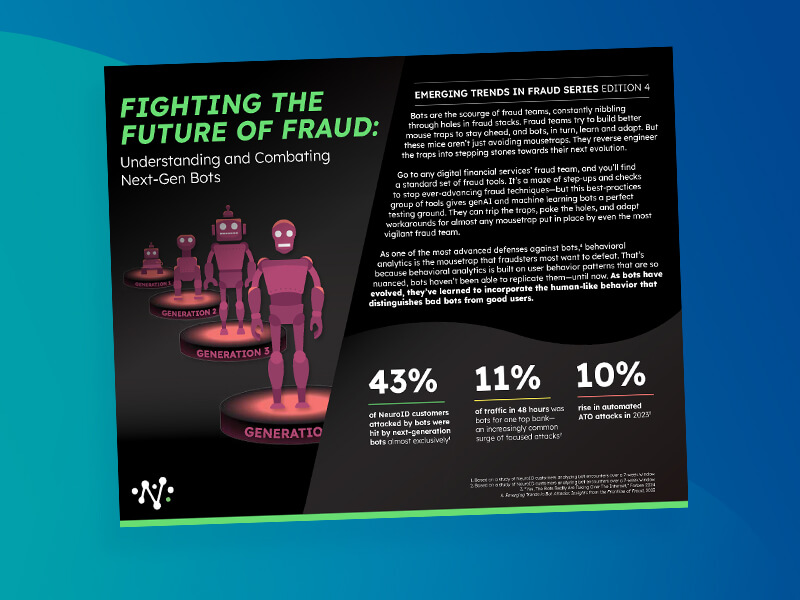

Bots are an ever-present threat to today’s digital businesses: fraudsters leverage them in multiple ways and meticulously tailor attacks to beat their targets’ defenses. Read an analysis of bot attack strategies and the keys to identifying a forthcoming attack.

This report includes:

Webinar

Webinar

Join our industry experts as they discuss national economics and credit trends and housing and auto sector trends as of October 2024.

Listen now to get insights on:

Report

Report

Read the latest regional consumer spending and economic growth trends, as well as our in-house macroeconomic forecasts for the year ahead.

Key insights:

White Paper

White Paper

An analysis of five fraud ring attacks across five different digital industries, including a breakdown of who was targeted and why, background information and future predictions on evolving fraud ring styles and strategies, and investigations into how fraud rings choose their victims.

Video

Video

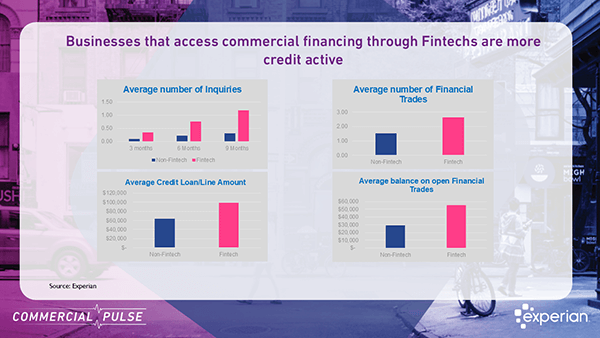

As published on the Business Information blog in a post titled Fintechs Transforming Financing and Growth - the fintech industry has grown by 140% since 2018, with North America leading at 34% of global market share. This video recaps some of our research including:

Check out the full report to see how these trends could impact your strategy!

Report

Report

As the labor market has cooled, the granular details of hiring, unemployment and wages have become increasingly critical in understanding the health of the U.S. economy. Our new Labor Market Monitor tracks data from a variety of sources to shed light on the layers of the labor market beyond just headline job creation.

Report

Report

The better-than-expected September Jobs Report adds to the list of data that suggests the U.S. economy is heading for a soft landing. While challenges remain, the current backdrop is one of strong economic activity, a solid labor market, and a more accommodative Fed. Get North America Chief Economist Joseph Mayans’ charts and key takeaways on recent developments.