White Paper

Published May 15, 2023

Collections & Debt RecoveryLearn how optimized debt management and recovery strategies can help you get ahead of a potential uptick in collections activity.

Complete the form to access the white paper

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Thank you for your interest

Your free Experian resource is now available. Enjoy!

Infographic

Infographic

Driving smarter recoveries with ability-to-pay insights

Recoveries hinge on knowing who can pay, not just who owes. This infographic explores how debt buyers and collections agencies can better identify signals of true payment capacity.

Did you know?

- U.S. household debt surpassed $18 trillion in Q3 2025.1

- The average age of debt in collections is ~3.5 years.2

- The average recovery rate on delinquent accounts is ~20%.3

Read the infographic for more insights and strategies to drive smarter recoveries.

1Household Debt and Credit report, Q3 2025, Federal Reserve Bank of New York.

2Debt Collection Industry Statistics, zipdo.

3Collections Industry Statistics, Gitnux.

Infographic

Infographic

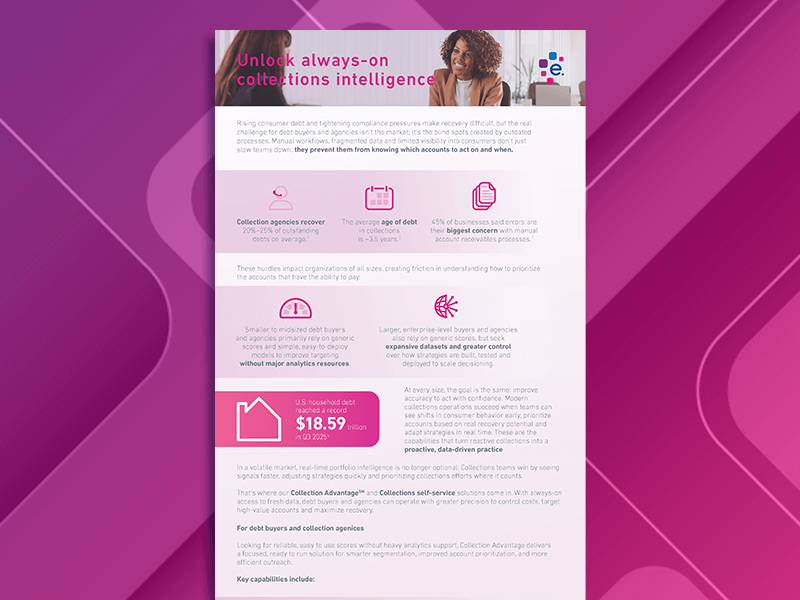

Unlock always-on collections intelligence

As market conditions shift, collections success depends on continuous, high-quality consumer data. This checklist highlights how always-on collections intelligence can help debt buyers and agencies:

- Stay ahead of consumer behavior shifts

- Adjust strategies quickly

- Concentrate collections efforts where it counts

eBook

eBook

Turning collection challenges into opportunities

Without modern, data-driven strategies, agencies and debt buyers risk falling behind in an increasingly digital-first world.

In this e-book, you’ll learn how to:

- Recover more with dynamic scoring models.

- Streamline prioritization with advanced data and analytics.

- Engage faster through personalized communications and tailored outreach.

- Improve efficiency with on-demand platforms and self-service portals.

Infographic

Infographic

Checklist: Modernizing Your Collection Strategy

Changes in consumer behavior and advancements in data and technology mean that traditional collection methods may no longer produce the best results.

Download our checklist for four key signs that your strategy needs updating and how modern solutions can help:

- Lack of proper account prioritization

- Low engagement and high call avoidance

- Outdated scoring or models

- Inefficient manual processes