Webinar

Published September 4, 2025

Credit Decisioning Data Sources Fraud Management

Discover the transformative trends reshaping the future of underwriting, from agentic AI to alternative credit data.

A few spoilers:

- 80% of leaders will leverage alternative data vs. traditional data by 2030.

- 62% see fraud prevention as one of the key reasons for alternative data adoption

- More than 61% anticipate that scoring, decisioning and data collection will be outsourced by 2030.

Complete the form to access the webinar

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Video

Video

Santander Bank on Partnering with Experian

How a rapidly evolving fraud landscape accelerated the need for a smarter, more modern fraud strategy.

Hear directly from Warren Jones, Head of Fraud Strategy & Analytics on:

- Driving better first impressions and improving Net Promoter Scores

- Accelerating approvals by eliminating a manual review queue where 90% of alerts were fraud

- Strengthening fraud strategy through a long-term partnership with Experian

Webinar

Webinar

2026 Future of Fraud Forecast: Insights into the Next Wave of AI-Driven Fraud

This webinar breaks down the major themes from Experian’s 2026 Future of Fraud Forecast and what they signal for the year ahead. Our experts explore the trends gaining momentum, including:

The technologies accelerating the next wave of fraud activity

Where fraudsters are finding new openings across consumer and enterprise touchpoints

The strategies forward-looking teams are prioritizing now

Webinar

Webinar

Fraud or Financial Distress: Detecting Risk Early

First-party fraud can look like traditional credit risk, but the intent behind the behavior is very different. In this on-demand webinar, Experian experts show how to use early performance, identity and behavioral signals to distinguish fraud from genuine financial distress and improve portfolio outcomes.

- Learn how first-party fraud hides inside “normal” credit losses

- See which early behaviors signal deceptive intent versus hardship

- Understand how to align fraud, credit and collections strategies

- Explore practical use cases from leading financial institutions

Webinar

Webinar

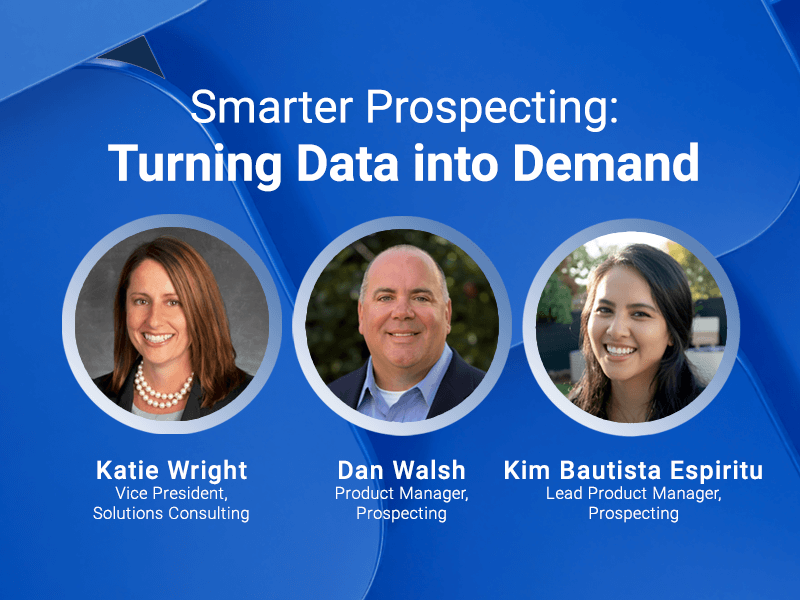

Smarter Prospecting: Turning Data into Demand

The credit marketing landscape is evolving. As competition intensifies and consumer expectations rise, financial institutions that can predict, personalize and perform at scale will define the next generation of success.

In this webinar, our experts explore how financial institutions can use connected intelligence to find, know and grow the right customers, leading to:

- Smarter acquisition

- Stronger customer retention

- More proactive growth