Report

Published July 22, 2025

Fintech Credit Decisioning Risk Management

As regulations continue to change, financial institutions must establish robust risk management practices and adopt technology that matches the scale and speed of compliance requirements.

Key priorities include:

- Strengthening model governance and transparency

- Enhancing explainability and responsible AI integration

- Reducing compliance burden through seamless automation

- Ensuring consistency across model validation and approval processes

Read our full report to learn more about the growing importance of monitoring, transparency, and automation in model risk management.

Complete the form to access the report

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Thank you for your interest

Your free Experian resource is now available. Enjoy!

Webinar

Webinar

2026 Future of Fraud Forecast: Insights into the Next Wave of AI-Driven Fraud

This webinar breaks down the major themes from Experian’s 2026 Future of Fraud Forecast and what they signal for the year ahead. Our experts explore the trends gaining momentum, including:

The technologies accelerating the next wave of fraud activity

Where fraudsters are finding new openings across consumer and enterprise touchpoints

The strategies forward-looking teams are prioritizing now

Webinar

Webinar

Smarter Prospecting: Turning Data into Demand

The credit marketing landscape is evolving. As competition intensifies and consumer expectations rise, financial institutions that can predict, personalize and perform at scale will define the next generation of success.

In this webinar, our experts explore how financial institutions can use connected intelligence to find, know and grow the right customers, leading to:

- Smarter acquisition

- Stronger customer retention

- More proactive growth

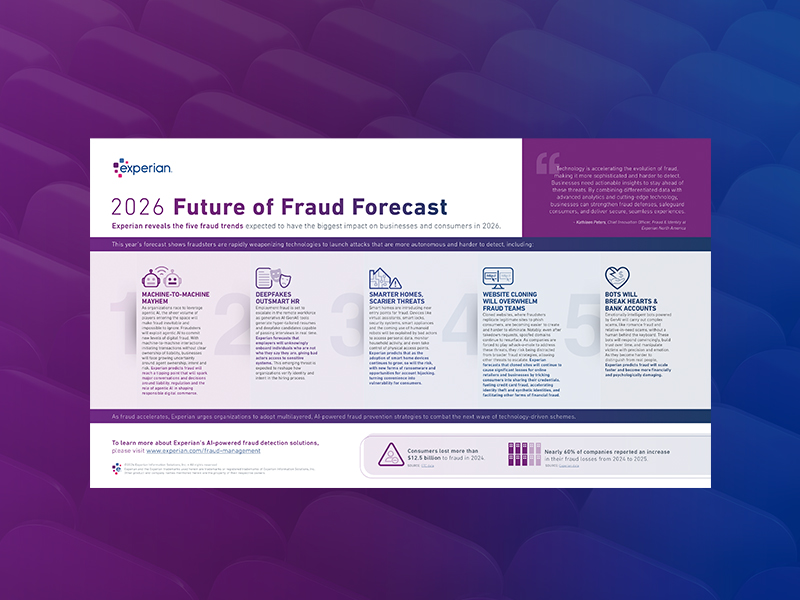

Infographic

Infographic

2026 Future of Fraud Forecast

Download Experian’s 2026 Future of Fraud Forecast to explore five fraud trends expected to have the biggest impact on businesses and consumers in the coming year, including:

- Agentic AI and machine-to-machine fraud

- Deepfake-driven employment fraud

- Smart home device exploitation

- Website cloning and emotionally intelligent fraud bots

White Paper

White Paper

Unlocking credit potential: the financial behavior and creditworthiness of ITIN holders

ITIN holders are active, responsible participants in the U.S. credit economy — yet many remain overlooked by traditional lending models.

Our white paper takes a closer look at this financially active and resilient population, revealing key insights into their credit performance and long-term growth potential.

Some findings include:

- Most ITIN holders are concentrated in states that represent a large share of the U.S. economy: California, Texas and New York.

- 76.9% of ITIN holders remained current on trades after 12 months, a rate 15% higher than SSN consumers.

- ITIN holders maintain a lower debt-to-income ratio (25%) than SSN consumers.

Read the full white paper for more insights.