Webinar

Published May 23, 2023

Fintech Fraud ManagementExperts discuss pressures impacting fintech growth and innovations that will redefine the way identity risks and confidence are recognized.

Complete the form to access the webinar

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Video

Video

Santander Bank on Partnering with Experian

How a rapidly evolving fraud landscape accelerated the need for a smarter, more modern fraud strategy.

Hear directly from Warren Jones, Head of Fraud Strategy & Analytics on:

- Driving better first impressions and improving Net Promoter Scores

- Accelerating approvals by eliminating a manual review queue where 90% of alerts were fraud

- Strengthening fraud strategy through a long-term partnership with Experian

Webinar

Webinar

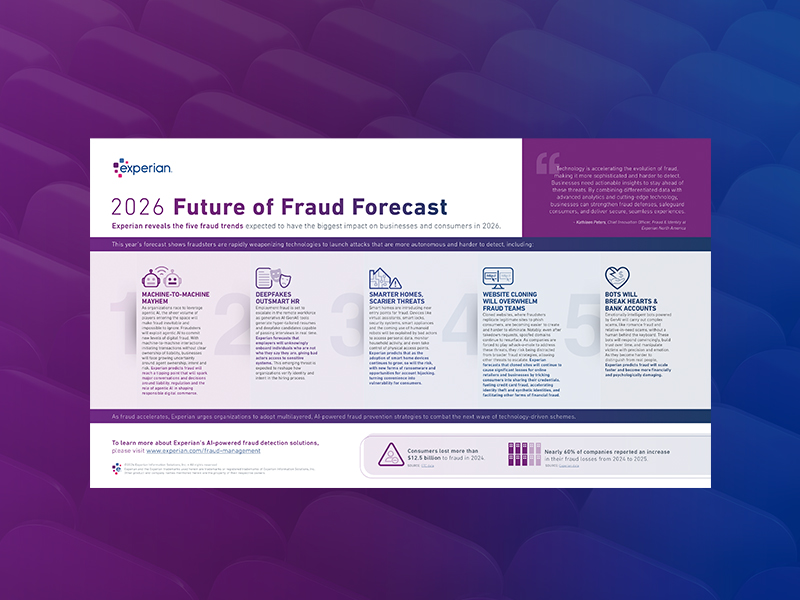

2026 Future of Fraud Forecast: Insights into the Next Wave of AI-Driven Fraud

This webinar breaks down the major themes from Experian’s 2026 Future of Fraud Forecast and what they signal for the year ahead. Our experts explore the trends gaining momentum, including:

The technologies accelerating the next wave of fraud activity

Where fraudsters are finding new openings across consumer and enterprise touchpoints

The strategies forward-looking teams are prioritizing now

Webinar

Webinar

Fraud or Financial Distress: Detecting Risk Early

First-party fraud can look like traditional credit risk, but the intent behind the behavior is very different. In this on-demand webinar, Experian experts show how to use early performance, identity and behavioral signals to distinguish fraud from genuine financial distress and improve portfolio outcomes.

- Learn how first-party fraud hides inside “normal” credit losses

- See which early behaviors signal deceptive intent versus hardship

- Understand how to align fraud, credit and collections strategies

- Explore practical use cases from leading financial institutions

Infographic

Infographic

2026 Future of Fraud Forecast

Download Experian’s 2026 Future of Fraud Forecast to explore five fraud trends expected to have the biggest impact on businesses and consumers in the coming year, including:

- Agentic AI and machine-to-machine fraud

- Deepfake-driven employment fraud

- Smart home device exploitation

- Website cloning and emotionally intelligent fraud bots