White Paper

Published September 30, 2025

Banks Credit Unions Advanced Analytics & Modeling Credit Decisioning Risk Management

Generative AI is a powerful force that’s driving higher efficiency and productivity in credit risk management for financial institutions. Read our latest white paper to discover how lenders can improve the credit risk management process to:

- Streamline operating expenses

- Enhance compliance

- Increase lending volume

- Reduce credit and fraud losses

Complete the form to access the white paper

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Thank you for your interest

Your free Experian resource is now available. Enjoy!

Tip Sheet

Tip Sheet

Experian Score Choice Bundle

Discover how Experian’s Score Choice Bundle can empower lenders with modern data and transparent pricing:

- Access VantageScore 4.0 and FICO® 2 in every transaction

- Gain deeper insight using expanded, modern consumer data

- Simplify workflows with predictable pricing and bundled scoring

- Support broader access to homeownership with faster model adoption

Webinar

Webinar

2026 Future of Fraud Forecast: Insights into the Next Wave of AI-Driven Fraud

This webinar breaks down the major themes from Experian’s 2026 Future of Fraud Forecast and what they signal for the year ahead. Our experts explore the trends gaining momentum, including:

The technologies accelerating the next wave of fraud activity

Where fraudsters are finding new openings across consumer and enterprise touchpoints

The strategies forward-looking teams are prioritizing now

Webinar

Webinar

Smarter Prospecting: Turning Data into Demand

The credit marketing landscape is evolving. As competition intensifies and consumer expectations rise, financial institutions that can predict, personalize and perform at scale will define the next generation of success.

In this webinar, our experts explore how financial institutions can use connected intelligence to find, know and grow the right customers, leading to:

- Smarter acquisition

- Stronger customer retention

- More proactive growth

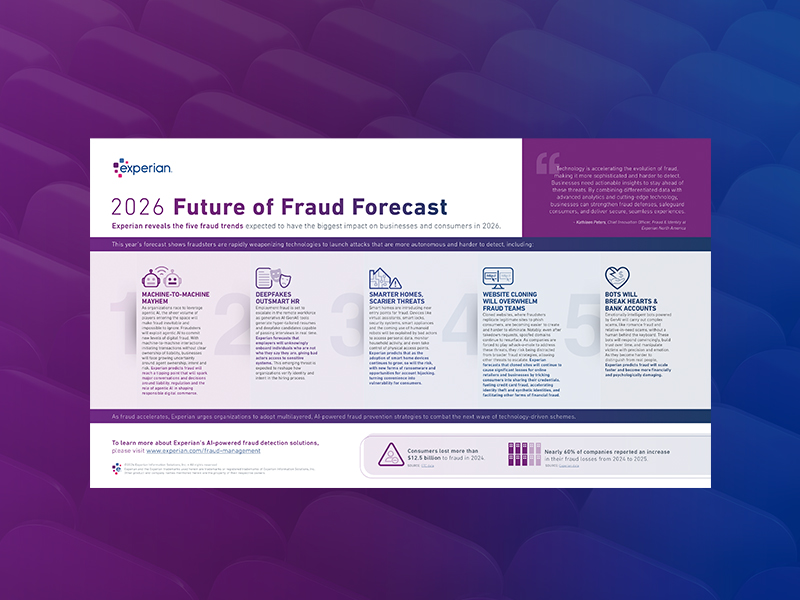

Infographic

Infographic

2026 Future of Fraud Forecast

Download Experian’s 2026 Future of Fraud Forecast to explore five fraud trends expected to have the biggest impact on businesses and consumers in the coming year, including:

- Agentic AI and machine-to-machine fraud

- Deepfake-driven employment fraud

- Smart home device exploitation

- Website cloning and emotionally intelligent fraud bots