Infographic

Published August 14, 2023

Credit DecisioningLeverage data and AI to enhance the precision, speed and agility of decision-making processes.

Complete the form to access the infographic

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Thank you for your interest

Your free Experian resource is now available. Enjoy!

Webinar

Webinar

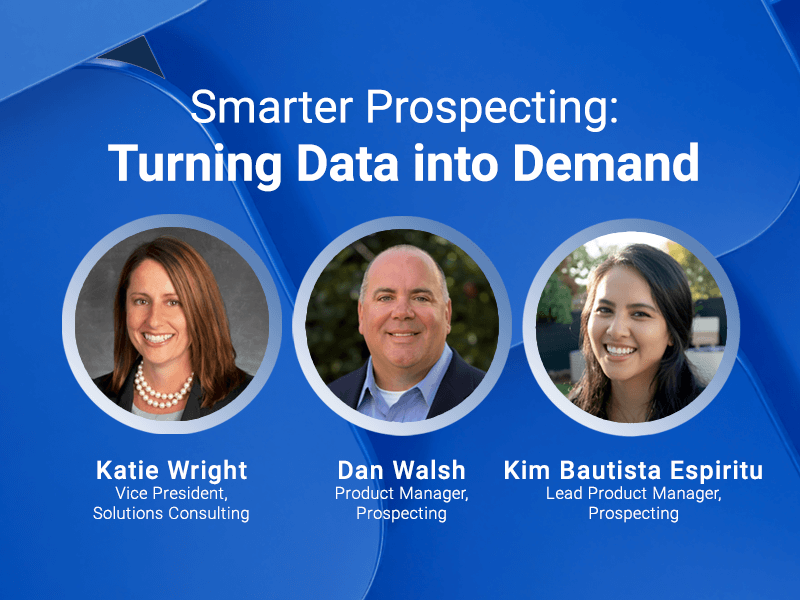

Smarter Prospecting: Turning Data into Demand

The credit marketing landscape is evolving. As competition intensifies and consumer expectations rise, financial institutions that can predict, personalize and perform at scale will define the next generation of success.

In this webinar, our experts explore how financial institutions can use connected intelligence to find, know and grow the right customers, leading to:

- Smarter acquisition

- Stronger customer retention

- More proactive growth

Webinar

Webinar

Unlocking alternative data for smarter fintech decisions

Join Ashley Knight, Experian’s SVP of Product Management, and Haiyan Huang, Prosper’s Chief Credit Officer, to discover how:

- Alternative finance data is redefining how to verify and connect identities.

- Email and phone intelligence is unlocking new levels of precision in credit marketing.

- Open banking insights are becoming increasingly critical for financial inclusion and mitigating risk.

Webinar

Webinar

Refine Your Risk Decisions: Using Decision Trees to Drive Performance

Improve your credit risk decisions with advanced approaches to validating and optimizing decision trees. Learn how stronger models drive smarter, more consistent outcomes across your portfolio.

- Enhance model accuracy

- Strengthen underwriting and collections

- Improve decision speed and consistency

- Align data science and risk teams

Case Study

Case Study

Unlocking member insights with alternative data

Every lending decision you make relies on data, but what if that data only tells part of the story? Download our use case to meet two borrowers, Claudia and John, and discover how alternative data can help you:

- Reveal hidden financial stability in members.

- Identify early warning signs of risk.

- Enable more accurate and inclusive lending decisions.

- Drive stronger member relationships.