Video

Published November 15, 2022

IdentityExperian's Kathleen Peters weighs in on the importance of privacy and security, a personalized experience, and leveraging data when it comes to building an effective identity strategy.

Complete the form to access the video

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Webinar

Webinar

2026 Future of Fraud Forecast: Insights into the Next Wave of AI-Driven Fraud

This webinar breaks down the major themes from Experian’s 2026 Future of Fraud Forecast and what they signal for the year ahead. Our experts explore the trends gaining momentum, including:

The technologies accelerating the next wave of fraud activity

Where fraudsters are finding new openings across consumer and enterprise touchpoints

The strategies forward-looking teams are prioritizing now

Webinar

Webinar

Protecting Employees’ Identities and Financial Wellbeing

Experian experts discuss how companies are integrating credit education, identity protection, and financial wellness into their employee benefits offerings.

Watch our on-demand webinar to discover:

- Why traditional benefits are no longer enough.

- How to deliver all-in-one financial protection.

- Real-world results from Experian-powered solutions.

- What your employees really want from their benefits.

Report

Report

Protecting Paychecks and Identities

Learn how you can move beyond single-point employee benefit solutions and embrace a more holistic approach that combines:

- Credit education to help employees understand and take control of their credit health

- Financial wellness tools to support budgeting and day-to-day financial confidence

- Identity protection to safeguard what employees have worked hard to build

Infographic

Infographic

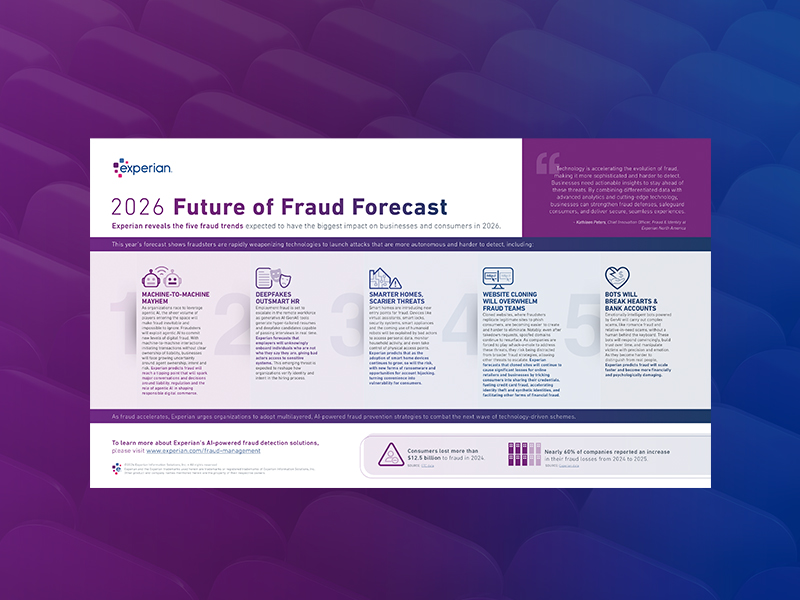

2026 Future of Fraud Forecast

Download Experian’s 2026 Future of Fraud Forecast to explore five fraud trends expected to have the biggest impact on businesses and consumers in the coming year, including:

- Agentic AI and machine-to-machine fraud

- Deepfake-driven employment fraud

- Smart home device exploitation

- Website cloning and emotionally intelligent fraud bots