Webinar

Published October 14, 2022

Fintech Fraud ManagementDiscover consumer credit and economic trends and how you can modernize your collections strategy.

Complete the form to access the webinar

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

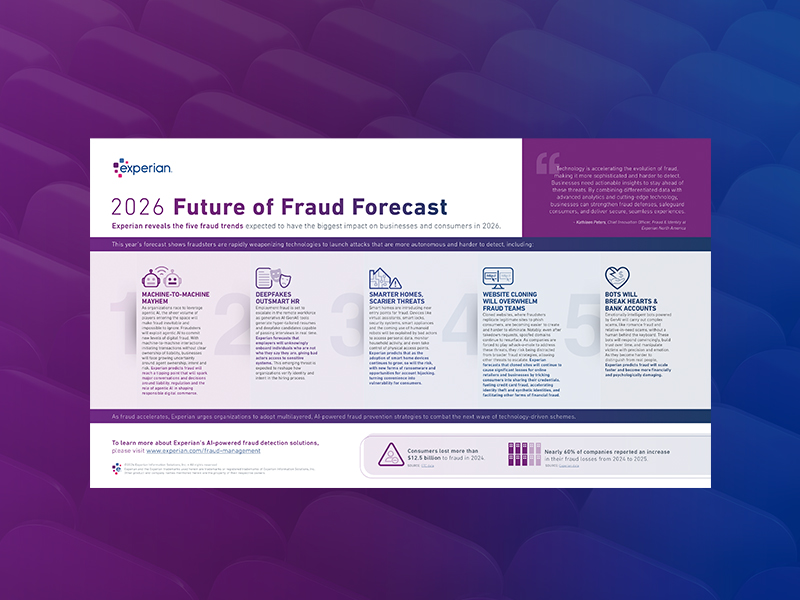

Infographic

Infographic

2026 Future of Fraud Forecast

Download Experian’s 2026 Future of Fraud Forecast to explore five fraud trends expected to have the biggest impact on businesses and consumers in the coming year, including:

- Agentic AI and machine-to-machine fraud

- Deepfake-driven employment fraud

- Smart home device exploitation

- Website cloning and emotionally intelligent fraud bots

Webinar

Webinar

Unlocking alternative data for smarter fintech decisions

Join Ashley Knight, Experian’s SVP of Product Management, and Haiyan Huang, Prosper’s Chief Credit Officer, to discover how:

- Alternative finance data is redefining how to verify and connect identities.

- Email and phone intelligence is unlocking new levels of precision in credit marketing.

- Open banking insights are becoming increasingly critical for financial inclusion and mitigating risk.

Report

Report

Identity and fraud insights for merchants

Consumers expect e-commerce experiences to be seamless and secure but, as fraud threats evolve, merchants are struggling to keep pace — and consumers are losing trust in merchants. Drawing on this year’s U.S. identity and fraud insights, this report explores the key factors contributing to the e-commerce trust gap.

You’ll learn:

- What’s driving consumer concerns in e-commerce.

- Consumers’ preferred security methods for seamless, safe transactions

- Actionable recommendations to enhance merchants’ fraud stacks

Report

Report

2026 Data Breach Industry Forecast

The scale of global cyberattacks continues to rise, and 2026 is poised to be the year of AI in cybersecurity.

In our 13th annual Data Breach Industry Forecast, we share our top predictions for the year ahead, including:

- The rise of synthetic identities built from stolen data

- AI overtaking human error as the top cause of breaches

- The growing risk of AI and quantum computing cyberattacks

- Emerging threats like mutating malware, brain hacking and a shrinking gender gap among hackers

Gain insight into the trends shaping the future of data security. Download the full forecast to prepare for what’s ahead.