White Paper

Published October 17, 2023

Data Quality & ManagementLearn about five common misconceptions about strategy optimization.

Complete the form to access the white paper

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Thank you for your interest

Your free Experian resource is now available. Enjoy!

Tip Sheet

Tip Sheet

Experian Score Choice Bundle

Discover how Experian’s Score Choice Bundle can empower lenders with modern data and transparent pricing:

- Access VantageScore 4.0 and FICO® 2 in every transaction

- Gain deeper insight using expanded, modern consumer data

- Simplify workflows with predictable pricing and bundled scoring

- Support broader access to homeownership with faster model adoption

eBook

eBook

Agility & Transparency with Integrated Feature Management

Instead of relying on reactive, fragmented data, financial institutions need streamlined, governed and integrated feature development capabilities to accelerate model development and enhance transparency.

Experian Feature Builder provides:

- Centralized data access

- Advanced lineage tracking

- Streamlined feature registry

- Key statistical reporting

- Comprehensive feature lifecycle support

Read our latest e-book to discover how your organization can transform raw data into custom, high-value features quickly and easily.

eBook

eBook

Win More Business and Minimize Risk with Loan Loss Analysis

Lending institutions can gain an edge on the competition by determining what happens when a loan gets booked elsewhere. With loan loss analysis, lenders can learn more about where these lost loans are booked, the average loan amount, the interest rate, the loan term length, and the average risk score.

Analyzing this information can help lenders:

- Improve lead quality

- Target the right consumers

- Acquire more high-quality loans

- Increase cross-sell opportunities

Infographic

Infographic

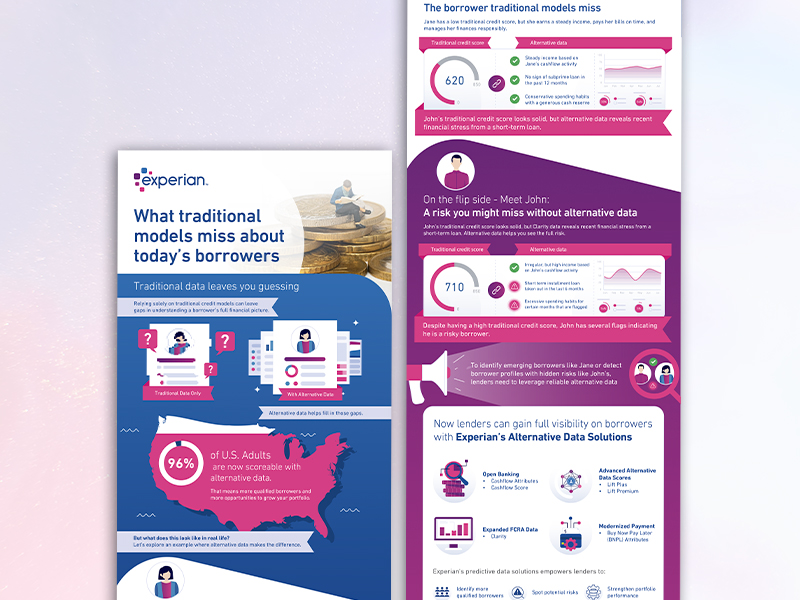

What traditional models miss about today's borrowers

Relying solely on traditional credit scores can leave you with a limited view into consumers’ financial stability.

See how integrating alternative data can help you:

- Identify more qualified borrowers

- Spot potential risks

- Strengthen portfolio performance