Tag: Experian Boost

Alternative credit scoring has become mainstream. Lenders that use alternative credit scores can find opportunities to expand their lending universe without taking on additional risk and more accurately assess the credit risk of traditionally scoreable consumers. Obtaining a more holistic consumer view can help lenders improve automation and efficiency throughout the customer lifecycle. What is alternative credit scoring? Alternative credit scoring models incorporate alternative credit data* that isn't typically found on consumer credit reports. These scores aren't necessarily trying to predict alternative outcomes. The goal is the same — to understand the likelihood that a borrower will miss payments in the future. What's different is the information (and sometimes the analytical techniques) that inform these predictions.Traditional credit scoring models solely consider information found in consumer credit reports. There's a lot of information there — Experian's consumer credit database has data on over 245 million consumers. But although traditional consumer data can be insightful, it doesn't necessarily give lenders a complete picture of consumers' creditworthiness. Alternative credit scores draw from additional data sources, including: Alternative financial services: Credit data from alternative financial services (AFS) can tell you about consumers' experiences with small-dollar installment loans, single-payment loans, point-of-sale financing, auto title loans and rent-to-own agreements. Buy Now Pay Later: Buy Now Pay Later (BNPL) borrowing is popular with consumers across the scoring spectrum, and lenders can use access to open BNPL loans to better assess consumers' current capacity. Rental payments: Landlords, property managers, collection companies, rent payment services and consumer-permissioned data can give lenders access to consumers' rent payment history. Full-file public records: Credit reports generally only include bankruptcy records from the previous seven to ten years. However, lenders with access to full-file public records can also learn about consumers' property deeds, address history, and professional and occupational licenses. READ: Take a deep dive into Experian's State of Alternative Credit Data report to learn more about the different types of alternative credit data and uses across the loan lifecycle. With open banking, consumers can now easily and securely share access to their banking and brokerage account data — and they're increasingly comfortable doing so. In fact, 70% would likely share their banking data for better loan rates, financial tools or personalized spending insights.Tools like Experian Boost allow consumers to add certain types of positive payment information to their Experian credit reports, including rent, utility and select streaming service payments. Some traditional scores consider these additional data points, and users have seen their FICO Score 8 from Experian boosted by an average of 13 points.1 Experian Go also allows credit invisible consumers to establish a credit report with consumer-permissioned alternative data. The benefits of using alternative credit data The primary benefit for lenders is access to new borrowers. Alternative credit scores help lenders accurately score more consumers — identifying creditworthy borrowers who might otherwise be automatically denied because they don't qualify for traditional credit scores. The increased access to credit may also align with lenders' financial inclusion goals.Lenders may additionally benefit from a more precise understanding of consumers who are scoreable. When integrated into a credit decisioning platform, the alternative scores could allow lenders to increase automation (and consumers' experiences) without taking on more credit risk. The future of alternative credit scoring Alternative credit scoring might not be an alternative for much longer, and the future looks bright for lenders who can take advantage of increased access to data, advanced analytics and computing power.Continued investment in alternative data sources and machine learning could help bring more consumers into the credit system — breaking barriers and decreasing the cost of basic lending products for millions. At the same time, lenders can further customize offers and automate their operations throughout the customer lifecycle. Partnering with Experian Small and medium-sized lenders may lack the budget or expertise to unlock the potential of alternative data on their own. Instead, lenders can turn to off-the-shelf alternative models that can offer immediate performance lifts without a heavy IT investment.Experian's Lift PlusTM score draws on industry- leading mainstream credit data and FCRA-regulated alternative credit data to provide additional consumer behavior insights. It can score 49% of mainstream credit-invisible consumers and for thin file consumers with a new trade, a 29% lift in scoreable accounts. Learn more about our alternative credit data scoring solutions. Learn more * When we refer to “Alternative Credit Data," this refers to the use of alternative data and its appropriate use in consumer credit lending decisions as regulated by the Fair Credit Reporting Act (FCRA). Hence, the term “Expanded FCRA Data" may also apply in this instance and both can be used interchangeably.1Experian (2023). Experian Boost

According to Experian’s State of the Automotive Finance Market Report: Q2 2022, the average new vehicle interest loan rate for consumers with a credit score between 501 and 600, also referred to as subprime, was 9.75%—compared to prime consumers with a credit score between 661 and 780, who had an average new vehicle interest loan rate of 4.03% this quarter.

For decades, the credit scoring system has relied on traditional data that only examines existing credit captured on a credit report – such as credit utilization ratio or payment history – to calculate credit scores. But there's a problem with that approach: it leaves out a lot of consumer activity. Indeed, research shows that an estimated 28 million U.S. adults are “credit invisible," while another 21 million are “unscorable."1 But times are changing. While conventional credit scoring systems cannot generate a score for 19 percent of American adults,1 many lenders are proactively turning to expanded FCRA-regulated data – or "alternative data" – for solutions. Types of expanded FCRA-regulated data By tapping into technology, lenders can access expanded FCRA-regulated data, which offers a powerful and complete view of consumers' financial situations. Expanded public record data This can include professional and occupational licenses, property deeds and address history – a step beyond the limited public records information found in standard credit reports. Such expanded public record data is available through consumer reporting agencies and does not require the customer's permission to use it since it's a public record.1 “Experian has partnerships with these agencies and can access public records that provide insight into factors like income and housing stability, which have a direct correlation with how they'll perform," said Greg Wright, Chief Product Officer for Experian Consumer Information Services. “For example, lenders can see if a consumer's professional license is in good standing, which is a strong correlation to income stability and the ability to pay back a loan." Rental payment data Experian RentBureau draws updated rental payment history data every 24 hours from property managers, electronic rent payment services and collection companies. It can also track the frequency of address changes. “Such information can be a good indicator of risk," said Wright. “It allows lenders to make informed judgments about the financial health and positive payment history of consumers." Consumer-permissioned data With permission from consumers, lenders can look at different types of financial transactions to assess creditworthiness. Experian Boost™, for example, enables consumers to factor positive payment history, such as utilities, cell phone or even streaming services, into an Experian credit file. “Using the Experian Boost is free, and for most users, it instantly improves their credit scores," said Wright. “Overall, those 'boosted' credit scores allow for fairer decisioning and better terms from lenders – which gives customers a second chance or opportunity to receive better terms." Financial Management Insights Financial Management Insights considers data that is not captured by the traditional credit report such as cash flow and account transactions. For instance, this could include demand deposit account (DDA) data, like recurring payroll deposits, or prepaid account transactions. “Examining bank account transaction data, prepaid accounts, and cash flow data can be a good indicator of ability to pay as it helps verify income, which gives lenders insights into consumers' cash flow and ability to pay," Wright added. Clarity Credit Data With Experian's Clarity Credit Data, lenders can see how consumers use expanded FCRA-regulated data along with their related payment behavior. It provides visibility into critical non-traditional loan information, including more insights into thin-file and no-file segments allowing for a more comprehensive view of a consumer's credit history. Lift Premium™ By using multiple sources of expanded FCRA-regulated data to feed composite scores, along with artificial intelligence and machine learning, Lift Premium™ can vastly increase the number of consumers who can be scored. For example, research shows that Lift Premium™ can score 96 percent of American adults – a significant increase from the 81 percent that are scorable with conventional scores relying on only traditional credit data. Additionally, such enhanced composite scores could enable 6 million of today's subprime population to qualify for “mainstream" (prime or near-prime) credit.1 How is expanded FCRA-regulated data changing the credit scoring system? The current credit scoring system is rapidly evolving, and modern technology is making it easier for lenders to access expanded FCRA-regulated data. Indeed, this data disruption is changing lender business in a positive way. “When lenders use expanded credit data assets, they see that many unscorable and credit invisible consumers are in fact creditworthy," said Wright. “Layering in expanded FCRA-regulated data gives a clearer picture of consumers' financial situation." By expanding data assets, tapping into artificial intelligence and machine learning, lenders can now score many more consumers quickly and accurately. Moreover, forward-thinking lenders see these expanded data assets as offering a competitive edge: it's estimated that modern credit scoring methods could allow lenders to grow their pool of new customers by almost 20 percent.1 Case study: Consumer-permissioned data To date, over 9 million people have used Experian Boost. The technology uses positive payment history as a way to recognize customers who exhibit strong credit behaviors outside of traditional credit products. “Boosted" consumers were able to add on average 14 points to their FICO scores in 2022 so far, making many eligible for additional financial products with better terms or better product offerings. Active Boost consumers, post new origination performed on par or better than the average U.S. originator, consistently over time. “In other words, having this additional lens into a consumer's financial health means lenders can expand their customer base without taking on additional credit risk," explains Wright. The bottom line The world of credit data is undergoing a revolution, and forward-thinking lenders can build a sound business strategy by extending credit to consumers previously excluded from it. This not only creates a more equitable system, but also expands the customer base for proactive lenders who see its potential in growing business. Learn more 1Oliver Wyman white paper, “Financial Inclusion and Access to Credit,” January 12, 2022.

Nearly 28 million American consumers are credit invisible, and another 21 million are unscorable.1 Without a credit report, lenders can’t verify their identity, making it hard for them to obtain mortgages, credit cards and other financial products and services. To top it off, these consumers are sometimes caught in cycles of predatory lending; they have trouble covering emergency expenses, are stuck with higher interest rates and must put down larger deposits. To further our mission of helping consumers gain access to fair and affordable credit, Experian recently launched Experian GOTM, a first-of-its-kind program aimed at helping credit invisibles take charge of their financial health. Supporting the underserved Experian Go makes it easy for credit invisibles and those with limited credit histories to establish, use and grow credit responsibly. After authenticating their identity, users will have their Experian credit report created and will receive educational guidance on improving their financial health, including adding bill payments (phone, utilities and streaming services) through Experian BoostTM. As of January 2022, U.S. consumers have raised their scores by over 87M total points with Boost.2 From there, they’ll receive personalized recommendations and can accept instant card offers. By leveraging Experian Go, disadvantaged consumers can quickly build credit and become scorable. Expanding your lending portfolio So, what does this mean for lenders? With the ability to increase their credit score (and access to financial literacy resources), thin-file consumers can more easily meet lending eligibility requirements. Applicants on the cusp of approval can move to higher score bands and qualify for better loan terms and conditions. The addition of expanded data can help you make a more accurate assessment of marginal consumers whose ability and willingness to pay aren’t wholly recognized by traditional data and scores. With a more holistic customer view, you can gain greater visibility and transparency around inquiry and payment behaviors to mitigate risk and improve profitability. Learn more Download white paper 1Data based on Oliver Wyman analysis using a random sample of consumers with Experian credit bureau records as of September 2020. Consumers are considered ‘credit invisible’ when they have no mainstream credit file at the credit bureaus and ‘unscorable’ when they have partial information in their mainstream credit file, but not enough to generate a conventional credit score. 2https://www.experian.com/consumer-products/score-boost.html

Today’s lending market has seen a significant increase in alternative business lending, with companies utilizing new data assets and technology. As the lending landscape becomes increasingly competitive, consumers have more choices than ever when it comes to lending products. To drive profitable growth, lenders must find new ways to help applicants gain access to the loans they need. How Spring EQ is leveraging Experian BoostTM Home equity lender Spring EQ turned to Experian’s first-of-its-kind financial tool that empowers consumers to add positive payments directly into their credit file to assist applicants with attaining the best loan opportunities and rates. By using Experian BoostTM, which captures the value of consumer’s utility and telecom trade lines, in their current lending process, Spring EQ can help applicants near approval or risk thresholds move to higher risk tiers and qualify for better loan terms and conditions. Driving growth with consumer-permissioned data Over 40 million consumers in the U.S. either have no credit file or have insufficient information in their files to generate a traditional credit score. Consumer-permissioned data empowers these individuals to leverage their online financial data and payment histories to gain better access to loans and other financial services while providing lenders with a more comprehensive view of their creditworthiness. According to Experian research, 70% of consumers see the benefits of sharing additional financial information and contributing positive payment history to their credit file if it increases their odds of approval and helps them access more favorable credit terms. Read our case study for more insight on using Experian Boost to: Make better lending decisions Offer or underwrite credit to more people Promote the right credit products Increase conversion and utilization rates Read case study Learn more about Experian Boost

There are more than 100 million people in the United States who don’t have a fair chance at access to credit. These people are forced to rely on high-interest credit cards and loans for things most of us take for granted, like financing a family car or getting an apartment. At Experian, we have a fundamental mission to be a champion for the consumer. Our commitment to increasing financial inclusion and helping consumers gain access to the financial services they need is one of the reasons we have been selected as a Fintech Breakthrough Award winner for the third consecutive year. The Fintech Breakthrough Awards is the premier awards program founded to recognize the fintech innovators, leaders and visionaries from around the world. The 2020 Fintech Breakthrough Award program attracted more than 3,750 nominations from across the globe. Last year, Experian took home the award for Best Overall Analytics Platform for our Ascend Analytical Sandbox™, a first-to-market analytics environment that promised to move companies beyond just business intelligence and data visualization to data insights and answers they could use. The year prior, Experian won the Consumer Lending Innovation Award for our Text for Credit™ solution, a powerful tool for providing consumers the convenience to securely bypass the standard-length ‘pen & paper’ or keystroke intensive credit application process while helping lenders make smart, fraud protected lending decisions. This year, we are excited to announce that Experian has been selected once again as a winner in the Consumer Lending Innovation category for Experian Boost™. Experian Boost – with direct, active consumer consent – scans eligible accounts for ‘boostable’ positive payment data (e.g., utility and telecom payments) and provides the means for consumers to add that data to their Experian credit reports. Now, for the very first time, millions of consumers benefit from payments they’ve been making for years but were never reflected on their credit reports. Since launching in March 2019, cumulatively, more than 18 million points have been added to FICO® Scores via Experian Boost. Two-thirds of consumers who completed the Experian Boost process increased their FICO Score and among these, the average score increase has been more than 13 points, and 12% have moved up in credit score category. “Like many fintechs, our goal is to help more consumers gain access to the financial services they need,” said Alex Lintner, Group President of Experian Consumer Information Services. “Experian Boost is an example of our mission brought to life. It is the first and only service to truly put consumers in control of their credit. We’re proud of this recognition from Fintech Breakthrough and the momentum we’ve seen with Experian Boost to date.” Contributing consumer payment history to an Experian credit file allows fintech lenders to make more informed decisions when examining prospective borrowers. Only positive payment histories are aggregated through the platform and consumers can remove the new data at any time. There is no limit to how many times one can use Experian Boost to contribute new data. For more information, visit Experian.com/Boost.

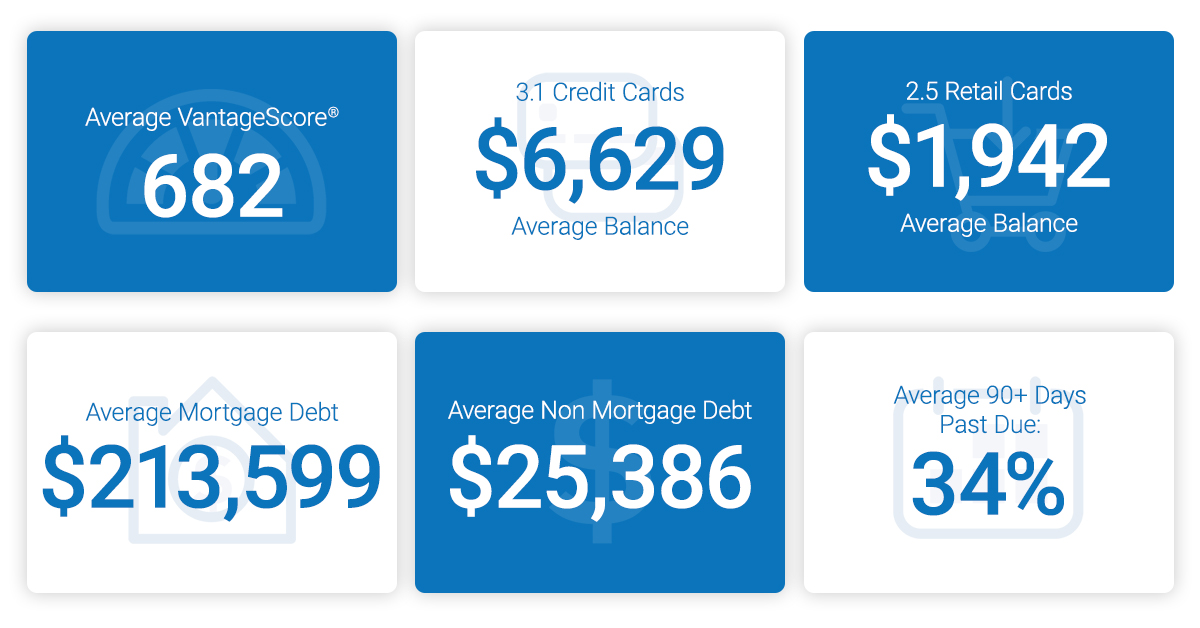

As consumers prepare for the next decade, we look at how we’re rounding out this year. The results? The average American credit score is 682, an eight-year high. Experian released the 10th annual state of credit report, which provides a comprehensive look at the credit performance of consumers across America by highlighting consumer credit scores and borrowing behaviors. And while the data is spliced to show men vs. women, as well as provides commentary at the state and generational level, the overarching trend is up. Even with the next anticipated economic correction often top of mind for financial institutions, businesses and consumers alike, 2019 was a year marked by more access, more spending and decreasing delinquencies. Things are looking up. “We are seeing a promising trend in terms of how Americans are managing their credit as we head into a new decade with average credit scores increasing two points since 2018 to 682 – the highest we’ve seen since 2011,” said Shannon Lois, Senior Vice President and Head of EAS, Analytics, Consulting & Operations for Experian Decision Analytics. “Average credit card balances and debt are up year over year, yet utilization rates remain consistent at 30 percent, indicating consumers are using credit as a financial tool and managing their debts responsibly.” Highlights of Experian’s State of Credit report: 3-year comparison 2017 2018 2019 Average number of credit cards 3.06 3.04 3.07 Average credit card balances $6,354 $6,506 $6,629 Average number of retail credit cards 2.48 2.59 2.51 Average retail credit card balances $1,841 $1,901 $1,942 Average VantageScore® credit score[1, 2] 675 680 682 Average revolving utilization 30% 30% 30% Average nonmortgage debt[3] $24,706 $25,104 $25,386 Average mortgage debt $201,811 $208,180 $231,599 Average 30 days past due delinquency rates 4.0% 3.9% 3.9% Average 60 days past due delinquency rates 1.9% 1.9% 1.9% Average 90+ days past due delinquency rates 7.3% 6.7% 6.8% In the scope of the credit score battle of the sexes, women have a four-point lead over men with an average credit score of 686 compared to 682. Their lead is a continued trend since 2017 where they’ve bested their male counterparts. According to the report, while men carry more non-mortgage and mortgage debt than women, women have more credit cards and retail cards (albeit they carry lower balances). Generationally, Generations X, Y and Z tend to carry more debt, including mortgage, non-mortgage, credit card and retail card, than older generations with higher delinquency and utilization rates. Segmented by state and gender, Minnesota had the highest credit scores for both men and women, while Mississippi was the state with the lowest average credit score for females and Louisiana was the lowest average credit score state for males. As we round out the decade and head full-force into 2020, we can reflect on the changes in the past year alone that are helping consumers improve their financial health. Just to name a few: Experian launched Experian BoostTM in March, allowing millions of consumers to add positive payment history directly to their credit file for an opportunity to instantly increase their credit score. Since then, there has been over 13 million points boosted across America. Experian LiftTM was launched in November, designed to help credit invisible and thin-file consumers gain access to fair and affordable credit. Long-standing commitments to consumer education, including the Ask Experian Blog and volunteer work by Experian’s Education Ambassadors, continue to offer assistance to the community and help consumers better understand their financial actions. From what we can tell, this is just the beginning. “Understanding the factors that influence their overall credit profile can help consumers improve and maintain their financial health,” said Rod Griffin, Experian’s director of consumer education and awareness. “Credit can be used as a financial tool. Through this report, we hope to provide insights that will help consumers make more informed decisions about credit use as we prepare to head into a new decade.” Learn more 1 VantageScore® is a registered trademark of VantageScore Solutions, LLC. 2 VantageScore® credit score range is 300 to 850. 3 Average debt for this study includes all credit cards, auto loans and personal loans/student loans.

Experian Boost provides a unique opportunity to help dealers build loyalty while helping consumers.

Alex Lintner, Group President at Experian, recently had the chance to sit down with Peter Renton, creator of the Lend Academy Podcast, to discuss alternative credit data,1 UltraFICO, Experian Boost and expanding the credit universe. Lintner spoke about why Experian is determined to be the leader in bringing alternative credit data to the forefront of the lending marketplace to drive greater access to credit for consumers. “To move the tens of millions of “invisible” or “thin file” consumers into the financial mainstream will take innovation, and alternative data is one of the ways which we can do that,” said Lintner. Many U.S. consumers do not have a credit history or enough record of borrowing to establish a credit score, making it difficult for them to obtain credit from mainstream financial institutions. To ease access to credit for these consumers, financial institutions have sought ways to both extend and improve the methods by which they evaluate borrowers’ risk. By leveraging machine learning and alternative data products, like Experian BoostTM, lenders can get a more complete view into a consumer’s creditworthiness, allowing them to make better decisions and consumers to more easily access financial opportunities. Highlights include: The impact of Experian Boost on consumers’ credit scores Experian’s take on the state of the American consumer today Leveraging machine learning in the development of credit scores Expanding the marketable universe Listen now Learn more about alternative credit data 1When we refer to "Alternative Credit Data," this refers to the use of alternative data and its appropriate use in consumer credit lending decisions, as regulated by the Fair Credit Reporting Act. Hence, the term "Expanded FCRA Data" may also apply in this instance and both can be used interchangeably.

The universe has been used as a metaphor for many things – vast, wide, intangible – much like the credit universe. However, while the man on the moon, a trip outside the ozone layer, and all things space from that perspective may seem out of touch, there is a new line of access to consumers. In Experian's latest 2019 State of Alternative Credit Data report, consumers and lenders alike weigh in on the growing data set and how they are leveraging the data in use cases across the lending lifecycle. While the topic of alternative credit data is no longer as unfamiliar as it may have been a year or two ago, the capabilities and benefits that can be experienced by financial institutions, small businesses and consumers are still not widely known. Did you know?: - 65% of lenders say they are using information beyond the traditional credit report to make a lending decision. - 58% of consumers agree that having the ability to contribute payment history to their credit file make them feel empowered. - 83% of lenders agree that digitally connecting financial account data will create efficiencies in the lending process. These and other consumer and lender perceptions of alternative credit data are now launched with the latest edition of the State of Alternative Credit Data whitepaper. This year’s report rounds up the different types of alternative credit data (from alternative financial services data to consumer-permissioned account data, think Experian BoostTM), as well as an overview of the regulatory landscape, and a number of use cases across consumer and small business lending. In addition, consumers also have a lot to say about alternative credit data: With the rise of machine learning and big data, lenders can collect more data than ever, facilitating smarter and more precise decisions. Unlock your portfolio’s growth potential by tapping into alternative credit data to expand your consumer universe. Learn more in the 2019 State of Alternative Credit Data Whitepaper. Read Full Report View our 2020 State of Alternative Credit Data Report for an updated look at how consumers and lenders are leveraging alternative credit data.

Earlier this month, Experian joined FinovateSpring in San Francisco, CA to demonstrate innovations impacting financial health to over 1,000 attendees. The Finovate conference promotes real-world solutions while highlighting short-form demos and key insights from thought-leaders on digital lending, banking, payments, artificial intelligence and the customer experience. With more than 100 million Americans lacking fair access to credit, it's more important than ever for companies to work to improve the financial health of consumers. In addition to the show's abundance of fintech-centered content, Experian hosted an exclusive, cutting-edge breakout series demonstrating innovations that are positively impacting the financial health of consumers across the nation. Finovate Day One Overview While fintechs, banks, venture capitalist, entrepreneurs and industry analysts ascended on the general conference floor for a fast-paced day of demos, a select subset gathered for a luncheon presented by Experian North America CEO, Craig Boundy, and Group President, Alex Lintner. Attendees were given an in-depth look at new, alternative credit data streams and tools that are helping to increase financial access. Demos included: Experian Boost™: a free, groundbreaking online platform that allows consumers to instantly boost their credit scores by adding telecommunications and utility bill payments to their credit file. More than half a million consumers have leveraged Experian Boost, increasing their score by an average of 13 points. Cumulatively, Experian Boost has helped add more than 2.8 million points to consumers’ credit scores. Ascend Analytical Sandbox™: A first-of-its-kind data and analytics platform that gives companies instant access to more than 17 years of depersonalized credit data on more than 220 million U.S. consumers. It has been the most successful product launch in Experian’s history and recently earned the title of “Best Overall Analytics Platform” at this year’s Fintech Breakthrough Awards. Alternative Credit Data: Comprised of data from alternative credit sources, this data helps lenders make smarter and more informed lending decisions. Additionally, Experian’s Clear Data Platform is next-level credit data that adds supplemental FCRA-compliant credit data to enrich decisions across the entire credit spectrum. This new platform features alternative credit data, rental data, public records, consumer-permissioned data and more Upon conclusion of the luncheon, Alpa Lally, Experian’s Vice President of Data Business at Consumer Information Services, was interviewed for the HousingWire Podcast with Jacob Gaffney, HousingWire Editor in Chief, to discuss how new forms of data streams are helping improve consumers’ access to credit by giving lenders a clearer picture of their creditworthiness and risk. “Alternative credit data is different than traditional credit data and helps us paint a fuller picture of the consumer in terms of their ability to pay, willingness to pay and stability. It helps consumers get better access overall to the credit they deserve so that they can actively participate in the economy,” said Lally. Finovate Day Two Overview On the last day of the conference, expert speakers took to the main stage to analyze the latest fintech trends, opportunities and challenges. Alex Lintner and Sandeep Bhandari, Chief Strategy Officer and Chief Risk Officer at Affirm, participated in a fireside chat titled “Improving the Financial Health of America’s 100 Million Credit Underserved Consumers.” Moderated by David Penn, Finovate Analyst, the session explored the latest innovations, trends and technologies – from machine learning to alternative data – that are making a difference in positively impacting the financial health of Americans and expanding financial opportunities for underserved consumers. The panel discussed the efforts made to put financial health at the center of their business and the impact it’s had on their organizations. Following the fireside chat, Experian hosted a second lunch briefing, presented by Vijay Mehta, Chief Innovation Officer, and Greg Wright, EVP Chief Product Officer. The lunch included exclusive table discussions and open conversations to help attendees leave with a better understanding of the importance of prioritizing financial health to build trust, reach new customers and ultimately grow their business. "We are actively seeking out unresolved problems and creating products and technologies that will help transform the way businesses operate and consumers thrive in our society. But we know we can't do it alone," Experian North American CEO, Craig Boundy said in a recent blog post on Experian's fintech partnerships and Finovate participation. "That's why over the last year, we have built out an entire time of account executives and other support staff that are fully dedicated to developing and supporting partnerships with leading fintech companies. We've made significant strides that will help us pave the way for the next generation of lending while improving the financial health of more people around the world." For more information on how Experian is partnering with fintechs, visit experian.com/fintech or read our recent blog article on consumer-permissioned data for an in-depth discussion on Experian BoostTM.

Millions of consumers lack credit history and/or have difficulty obtaining credit from mainstream financial institutions. To ease access to credit for “invisible” and below prime consumers, financial institutions have sought ways to both extend and improve the methods by which they evaluate borrowers’ risk. This initiative to effectively score more consumers has involved the use of alternative credit data.1 Alternative credit data is FCRA-compliant data that is typically not included in a traditional credit report and is used to deliver a more complete view into a consumer’s creditworthiness. “Alternative credit data helps us paint a fuller picture of a consumer so they can get better access to the financial services they need and deserve,” said Alpa Lally, Vice President of Data Business at Experian. Experian recently sponsored the FinovateSpring conference in San Francisco, where Alpa had a chance to sit down with Jacob Gaffney, Editor-in-Chief of the HousingWire News Podcast, to discuss ways consumers can improve their credit scores. As an immigrant, Alpa spoke personally about the impact of having a limited credit history and how alternative credit data can help drive greater access to credit for consumers and profitable growth for lenders through more informed lending decisions. Highlights include: How alternative and traditional credit data differ Types of alternative credit data being used by lenders How “credit-invisibles” can best leverage alternative credit data Alternative credit data product solutions, including Experian BoostTM Listen now 1When we refer to “Alternative Credit Data,” this refers to the use of alternative data and its appropriate use in consumer credit lending decisions, as regulated by the Fair Credit Reporting Act. Hence, the term “Expanded FCRA Data” may also apply in this instance and both can be used interchangeably.

Earlier this month, Experian joined the nation’s largest community of online lenders at LendIt Fintech USA 2019 in San Francisco, CA to show over 5,000 attendees from 50 countries the ways consumer-permissioned data is changing the credit landscape. Experian Consumer Information Services Group President, Alex Lintner, and FICO Chief Executive Officer, Will Lansing, delivered a joint keynote on the topic of innovation around financial inclusion and credit access. The keynote addressed the analytical developments behind consumer-permissioned data and how it can be leveraged to responsibly and securely extend credit to more consumers. The session was moderated by personal finance expert, Lynnette Khalfani-Cox, from The Money Coach. “Consumer-permissioned data is not a new concept,” said Lintner. “All of us are on Facebook, Twitter, and LinkedIn. The information on these platforms is given by consumers. The way we are using consumer-permissioned data extends that concept to credit services.” During the keynote, both speakers highlighted recent company credit innovations. Lansing talked about UltraFICO™, a score that adds bank transaction data with consumer consent to recalibrate an existing FICO® Score, and Lintner discussed the newly launched Experian Boost™, a free, groundbreaking online platform that allows consumers to instantly boost their credit scores by adding telecommunications and utility bill payments to their credit file. “If a consumer feels that the information on their credit files is not complete and that they are not represented holistically as an applicant for a loan, then they can contribute their own data by giving access to tradelines, such as utility and cell phone payments,” explained Lintner. There are approximately 100 million people in America who do not have access to fair credit, because they are subprime, have thin credit files, or have no lending history. Subprime consumers will spend an additional $200,000 over their lifetime on the average loan portfolio. Credit innovations, such as Experian Boost and UltraFICO not only give consumers greater control and access to quality credit, but also expand the population that lenders can responsibly serve while providing a differentiated and competitive advantage. “Every day, our data is used in one million credit decisions; 350 million per year,” said Lintner. “When our data is being used, it represents the consumers’ credit reputation. It needs to be accurate, it needs to be timely and it needs to be complete.” Following the keynote, Experian, FICO, Finicity and Deserve joined forces in a breakout panel to dive deeper into the concept of consumer-permissioned data. Panel speakers included Greg Wright, Chief Product Officer at Experian’s Consumer Information Services; Dave Shellenberger, Vice President of Product Management at FICO; Nick Thomas, Co-Founder, President and Chief Technology Officer at Finicity, and Kalpesh Kapadia, Chief Executive Officer at Deserve. “As Alex described in today’s keynote, consumer-permissioned data is not a new concept,” said Greg Wright. “The difference here is that Experian, FICO and Finicity are applying this concept to credit services, working together to bring consumer-permissioned data to mass scale, so that lenders can reach more people while taking on less risk.” For an inside look at Experian and FICO’s joint keynote, watch the video below, or visit Experian.com and boost your own credit score.

Experian Boost gives consumers greater control over their credit profiles by allowing them to add non-traditional credit information to their Experian credit file.