All posts by Laura Burrows

In our latest Experian fireside chat, Unlocking Alternative Data for Smarter Fintech Decisions, two powerhouse voices in the industry, Ashley Knight, SVP of Product Management at Experian, and Haiyan Huang, Chief Credit Officer at Prosper Marketplace, came together for an exclusive discussion on how alternative data is transforming risk, marketing and growth strategies across the fintech space. Now available to watch on demand, the conversation reveals the data-driven innovations that are empowering fintechs to reach new markets, improve decision-making, and build more inclusive financial experiences. What you'll learn During the session, Ashley and Haiyan explored how fintech leaders are utilizing alternative data to address real-world challenges with smarter, more scalable solutions. Topics include: Identity matching redefined: Discover how Individual Taxpayer Identification Numbers (ITINs), Clarity insights, and device intelligence empower fintechs to gain a competitive edge in verifying and validating identities for thin-file or underserved applicants. Precision credit marketing: Learn how email and phone intelligence help fintechs more accurately connect with qualified consumers, driving better engagement and higher conversion rates. Enhanced risk management with real-time data: Discover how Buy Now, Pay Later (BNPL) data and open banking insights are providing fintechs with a more comprehensive view of consumer financial behavior, beyond what traditional credit scores can reveal. To understand how fintech professionals are approaching alternative data, we asked attendees to weigh in throughout the webinar. Here's what we learned: What the audience had to say Which alternative asset is most important for the underwriting of the insurance? 50% chose open banking. 38% selected behavioral/device intelligence. 12% pointed to asset ownership. Takeaway: Open banking is leading the way, but fintechs are clearly embracing a multi-dimensional data approach. 2. Are you currently using ITINs or planning to in the future? 53% said yes. 47% said no. Takeaway: The adoption of ITINs is gaining momentum, supporting efforts to expand access to underrepresented segments. 3. What’s the most compelling reason to use open banking data? 70% said to better assess risk. 10% said to say yes to more consumers. 10% said to price more effectively. 10% said to improve marketing and personalization. Takeaway: Risk assessment remains the top use case, but marketers and pricing teams are starting to take notice. Why it matters Alternative data isn’t just a trend; it’s a response to the urgent need for smarter, more inclusive lending models. As fintechs continue to grow, the ability to reach new audiences, personalize offers, and manage risk with greater accuracy is no longer a competitive advantage; it’s a requirement. Whether you're already integrating cash flow, open banking, and behavioral insights, or just beginning to explore the possibilities, this webinar offers valuable frameworks and firsthand examples from industry leaders who are putting alternative data into action. Don’t miss this opportunity to catch up on the conversation that's helping define the future of fintech innovation. Watch on-demand webinar

Today’s consumers expect more from their banks, credit unions, and financial services providers than just basic transaction services. According to an MX Technologies report, one in three consumers feels providers do not do enough to support their financial needs. At the same time, 50% of banking consumers expect personalized offers for tools, products, and services to help them reach their financial goals.1 The same study found that more than half want financial providers to help them better manage their finances. As customers increasingly turn to their financial institutions for trustworthy information on achieving financial wellness, these institutions have a great opportunity to offer value-added financial services that meet those needs. Adopting a customer-centric approach—one that enables them to provide the specific resources and guidance customers are seeking—is essential for fostering stronger relationships. This, in turn, can be crucial for driving growth, increasing market share, and gaining a competitive edge. What are value-added financial services? Value-added financial services are offerings that go beyond basic financial products, such as bank accounts or loans, to provide additional benefits, convenience or personalized support to customers. These services aim to improve customer satisfaction and set a financial institution apart from competitors, and can include features such as loyalty programs, advanced fraud prevention, data analytics, online access to services and financial planning tools. How value-added financial services can build engagement and trust Savvy financial institutions are adapting to the evolving demands of consumers by offering innovative tools that help their customers make informed financial decisions and enhance their financial literacy. Offering value-added financial services, such as management and planning tools, along with advanced security and fraud protection, provides financial institutions with an essential way to increase customer engagement and foster greater loyalty. By providing deeper insights, better personalization, and reliable financial experiences, institutions can help customers manage their financial health more effectively. Addressing growing concerns over identity threats Fraud and identity theft are top-of-mind concerns for consumers these days as incidence of such attacks are on the rise. A recent Security.org study found that a staggering 60% of U.S. credit card holders have been victims of fraud, with 45% experiencing multiple instances.2 Meanwhile, the U.S. Federal Trade Commission (FTC) received over 1.1 million complaints of identity theft in 2024, resulting in financial losses exceeding $12.7 billion. For financial institutions, this creates an opportunity to address consumer concerns through value-added financial services. Solutions that help detect fraud early and monitor credit health can provide invaluable peace of mind. Institutions that offer services such as credit monitoring, identity alerts, and financial management tools can help customers stay protected while also opening the door to valuable recurring revenue streams. Best-in-class value-added financial services Experian® is uniquely positioned to support financial institutions with best-in-class value-added financial services. By leveraging a complete suite of financial health solutions, institutions can engage, educate and empower customers to be more in control of their financial lives. Our suite of solutions include: Credit monitoring and alert solutions – These advanced tools help increase retention and keep consumers engaged with robust credit monitoring that detects potential fraud and provides alerts, enabling them to respond more quickly. Credit report and score solutions – Provides customers with credit information and guidance to better understand, manage and strengthen their financial well-being. Financial management solutions – With a suite of comprehensive credit and financial management tools, financial institutions can improve a customer’s experience by providing a single platform to link accounts across different institutions and unify financial data. As customers regularly engage with the platform to manage both short and long-term financial goals, institutions can improve longer-term retention. Identity monitoring and alert solutions – This tool helps increase consumer engagement with continuous personal data monitoring and alerts. It empowers consumers to spot potential fraud, assess risks, and respond before they become a victim of identity theft. Identity restoration services – In the face of rising incidence of identity theft, this powerful suite of restoration services helps consumers navigate the complex identity recovery process and mitigate future financial harm. Gaining a competitive advantage As consumers increasingly demand exceptional customer service, offering innovative products and personalized solutions is key to preventing customer churn. When financial institutions deliver value-added financial services, they gain a competitive advantage. Failure to deliver the service, convenience, and personalized products or tools that consumers demand risks losing them to other providers. According to J.D. Powers, up to 54% of consumers will leave their bank in the next year, costing institutions millions. Salesforce reported that 72% of consumers indicated that better deals made them switch to another brand. Financial institutions that offer innovative value-added financial services benefit from continuous engagement that helps build trust and loyalty while generating recurring revenue through subscription-based offerings. Our innovative offerings saw: Credit alert login rates ten times higher than the financial services industry benchmark. Email open rates for alerts more than two times that of the national average for financial services. Top-performing clients with over 25% of their enrolled customers log in to the portal at least once per month. Consumers are opening twice as many credit cards and three times as many savings accounts when using regularly personalized features. Reasons to partner with us When it comes to providing accurate, real-time financial data that can lead to crucial insights for better decision making, Experian is an ideal partner. Our personalized, value-added financial service can be seamlessly integrated and embedded into your existing systems, making it easier for you to meet consumer demands for tools that help them make informed financial choices and improve their financial literacy. Learn more about our value-added financial services 1 https://www.experian.com/content/dam/marketing/na/thought-leadership/business/documents/infographic-fostering-relationships-to-unlock-growth.pdf 2https://www.experian.com/blogs/insights/infographic-stronger-customer-relationships/

Debt collection is rapidly evolving. Traditional methods are becoming increasingly ineffective as consumer preferences shift, regulations tighten and operational inefficiencies lead to bottlenecks.Agencies and debt buyers that rely on outdated strategies are experiencing the consequences: lower recovery rates, increased compliance risks and weaker consumer engagement. However, there’s good news — modern tools, powered by advanced data, analytics and digital platforms, are transforming these challenges into opportunities. Common collections challenges: Real-world scenarios In our latest e-book, we examine four fictional scenarios that illustrate how collections teams are addressing today’s primary challenges by updating their methods. Here’s a preview: Smarter segmentation = Higher recovery: Sally, head of collections at Midwest Debt Solutions, realized her team’s one-size-fits-all approach was costing them. By adopting advanced segmentation powered by data and analytics, she shifted her focus from chasing low-value accounts to targeting those most likely to repay, boosting recovery rates and team morale. Better data in, better decisions out: Jerry, a risk analyst at Bay & Associates, relied on a legacy credit model that overlooked crucial alternative signals. By incorporating trended credit data, utility payments and behavioral signals, his team significantly enhanced their prioritization approach and forecasting accuracy. Modern engagement for the modern consumer: John, a collections agent, was having trouble reaching consumers through traditional methods, such as phone calls and letters. With a digital self-service platform, John’s team gained real-time insight into engagement preferences and was able to connect through the channels consumers use, like SMS and email. Personalization at scale: Rachel, an account manager at Union Collections, knew manual processes were slowing her team down. By implementing personalized communications and multichannel outreach, they enhanced consumer experiences, increased repayment rates and minimized compliance risks — all while saving time. Why it matters These scenarios share a common thread: with the right tools, data and strategy, collections teams can turn today’s pain points into measurable progress. At Experian®, we help agencies: Prioritize accounts more effectively with advanced segmentation. Make smarter predictions using dynamic, modern scoring models. Streamline operations with self-service platforms and automation. Strengthen consumer relationships with personalized outreach. Download the e-book Want to dive deeper into each use case? Access the full e-book to learn how forward-thinking agencies are adapting their collections strategies to recover more, spend less and build stronger consumer relationships. Download the e-book

Delivering a superior customer experience has become the key goal for nearly every business across almost every industry. The banking industry is no exception. A recent trend highlighting the importance of customer experience is the drop in customer loyalty. Customer expectations are higher than ever, heightening competition between traditional banks and newer market entrants. This creates a need for banks to stand out and succeed by offering a superior customer experience. That experience starts with customer engagement in banking. According to a recent Forrester study, only two out of 10 retail banks regularly engage with customers to enhance their experience. The same study found that when retail banks consistently focus on improving the customer experience, they tend to grow more than three times faster than their competitors that do not. Forrester also found that over 70% of retail banks consider digital customer engagement essential for their current success and future growth.1 The key to customer engagement in banking: understanding the customer The good news for banks is that when they engage with customers by offering the services and guidance they want, those customers tend to respond with increased loyalty. Research indicates that 54% of customers rely on their banks to help them achieve their financial objectives. Most encouragingly, this same research indicates that 71% of actively engaged customers are likely to stay with their bank for the foreseeable future.2 At the heart of today’s evolving efforts to retain customers and build stronger loyalty are innovative tools that deliver on consumer demand for greater personalization and digital experiences in day-to-day engagement with the bank. With rising interest rates and more choices in financial services, consumers are actively seeking better rates for savings accounts, loans, and credit products. A 2024 Salesforce survey reveals that 72% of consumers are motivated to switch providers in search of better deals.3 Another report indicates that 50% of banking customers expect personalized offers for tools, products, and services to help them achieve their financial goals.4 In response to this trend, banks have an opportunity to go above and beyond to attract and retain customers by focusing on delivering exceptional customer service, innovative product offerings and personalized solutions to prevent customer churn. This requires embracing innovative approaches to engagement. For example, banks can leverage customer engagement services that empower customers to better manage their financial well-being. Such services might include smart tools that provide timely alerts and reminders, enabling customers to avoid delinquency and stay current with their payments. Strategies for enhancing engagement Banks aiming to enhance customer engagement can achieve this by utilizing data-driven insights, innovative technologies and customized partner solutions to foster loyalty and long-term trust. Customer engagement strategies should consider the following: Omnichannel experience – Banks aim to deliver a seamless, consistent experience across all touchpoints, whether it is a branch, mobile device, online platform, or contact center. Customers should be able to start an interaction on one channel and finish it on another without any friction. Connecting physical and digital touchpoints builds trust, convenience, and loyalty. Financial wellness tools and empowerment - Banks can utilize customer engagement services to provide customers with smart financial management tools, including budgeting dashboards, automated savings features, credit score monitoring, and investment advice. Providing customers with real-time insights into their financial health enhances engagement and fosters long-term loyalty. Identity protection and security tools – Banks can build trust through proactive identity protection, continuous monitoring and alerts that help customers feel protected and in control. Customer education and financial literacy – The bank can engage customers through educational content like webinars, tutorials, and in-app tips that help clarify financial products and promote better decision-making. Educated customers tend to be more confident, satisfied, and more likely to expand their relationship with the bank. Personalization through data and analytics – Banks can utilize data to deliver highly personalized recommendations, product offers, and experiences specific to individual life stages, behaviors, and goals. Predictive analytics can forecast needs, such as suggesting mortgage advice when spending and saving habits indicate a possible interest in homebuying, thus improving relevance and connection. It can also alert customers about savings opportunities. This kind of proactive engagement helps build stronger relationships. Customer engagement services: the key to driving revenue growth and enduring relationships At Experian®, we offer world-class customer engagement services that can enable banks to meet customer expectations and build stronger, long-lasting relationships. By providing tailored financial services and credit education, banks can help customers reach their financial goals. At the same time, banks can build stronger trust by empowering customers to avoid risks and take action to recover when identity theft occurs. All our solutions can be smoothly integrated into a bank’s existing ecosystem, making it quicker and easier to deliver these services to customers. As banks continue to seek ways to deliver exceptional customer experiences, it is essential to offer innovative tools and services that better engage customers. Customer engagement in banking is crucial for attracting and retaining clients. When banks go the extra mile to meet the evolving needs of customers, they are repaid with greater loyalty and long-term trust. Learn more about our customer engagement services Download the infographic 1https://www.kameleoon.com/blog/18-stats-understand-future-cx-optimization-and-banking2https://www.postgrid.com/customer-engagement-strategies-banking/3https://www.experian.com/content/dam/marketing/na/thought-leadership/business/documents/infographic-fostering-relationships-to-unlock-growth.pdf4https://www.experian.com/content/dam/marketing/na/thought-leadership/business/documents/infographic-fostering-relationships-to-unlock-growth.pdf

Artificial intelligence (AI) is transforming industries worldwide, and financial services are no exception. One of the most impactful applications is AI credit scoring, a modern approach that uses advanced algorithms to assess consumer creditworthiness with precision, fairness and efficiency.AI credit scoring addresses traditional limitations by introducing more advanced, data-driven techniques. Instead of relying solely on static, historical data points, AI models can process vast amounts of diverse information in real time, spotting patterns and predicting behaviors more accurately. How AI is being used in credit scoring Traditional credit scoring has long relied on structured data such as payment history, credit utilization, and length of credit history. While effective, these models can be limited in capturing a holistic view of an individual’s financial behavior. AI credit scoring expands this view by: Leveraging alternative data: AI models can analyze non-traditional data sources such as rental payments, utility bills, and even digital transaction histories, providing a broader perspective for those with limited credit history. Real-time analysis: Machine learning enables lenders to evaluate applicants faster by instantly processing large amounts of data. Pattern recognition: AI systems identify subtle behavioral and financial patterns that may indicate creditworthiness beyond what traditional models can detect. Continuous learning: Unlike static scoring systems, AI-based models may improve over time as they ingest more data and refine their predictions. Using these methods, AI credit score systems create a richer, more nuanced picture of a borrower’s financial health, making lending more inclusive and predictive. The benefits of AI credit scoring The adoption of AI in credit scoring has created significant benefits for lenders, regulators, and consumers alike: Improved accuracy: AI models draw on a broader range of data, reducing reliance on limited or outdated metrics. Financial inclusion: Millions of consumers globally remain outside the traditional credit system. AI credit scoring allows lenders to evaluate previously overlooked applicants, such as young adults, recent immigrants, or gig economy workers. By factoring in alternative data, lenders can serve historically underserved individuals. Faster and more efficient processes: AI can automate large portions of the decision-making workflow, significantly reducing the time it takes to approve applications. This means faster access to credit for consumers and reduced operational costs for lenders. Fraud detection and risk mitigation: Advanced machine learning models can detect anomalies in borrower behavior that may indicate fraud or identity theft. By flagging these risks earlier, lenders protect both themselves and their customers. Enhanced customer experience: AI-driven insights help lenders design more personalized products and repayment plans. Institutions can better understand customer needs and financial behaviors by offering tailored solutions that improve loyalty and trust. Challenges of AI in credit scoring While the promise of AI is transformative, it also brings new challenges that financial institutions must navigate carefully. Bias and fairness: AI models may inadvertently replicate biases in training data, raising concerns about fairness and equity. Transparency: Complex algorithms can be challenging to explain to regulators, lenders, and consumers, creating a "black box" perception. Data privacy: Using alternative data for credit scoring requires strict compliance with privacy regulations and consumer consent. Regulatory alignment: As AI evolves, credit scoring must comply with evolving financial and consumer protection laws. Why partner with us At Experian®, we understand that trust, accuracy, and transparency are essential in the financial ecosystem. By combining decades of expertise in credit data with AI solutions, we deliver AI credit score solutions that empower lenders to make smarter, fairer, and faster decisions. With us as your trusted partner, you can embrace AI-powered credit solutions confidently and responsibly. Global data expertise: We leverage one of the world’s most comprehensive credit databases, ensuring high-quality insights. Responsible AI: Our solutions are built with fairness, transparency, and regulatory compliance at the forefront. Proven results: We partner with financial institutions worldwide to unlock opportunities for lenders and consumers through AI-driven insights. Commitment to inclusion: Our AI credit scoring tools are designed to expand financial access for underserved communities. The rise of AI credit scoring marks a new era in financial services, where accuracy, speed, and inclusivity converge to benefit lenders and consumers alike. While challenges remain, responsible use of AI ensures that credit scoring becomes more transparent, fair, and effective. Learn more

Nearly 19 million U.S. households remain unbanked or credit-invisible,1 not due to a lack of financial responsibility but because traditional credit models alone may not include key financial behaviors. These individuals often save, earn and budget wisely, yet conventional scoring systems do not recognize them. We’ve recently partnered with Plaid, the trusted leader in open finance, to change that. Together, we’re putting cash flow underwriting front and center — giving lenders access to real-time, consumer-permissioned financial data that paints a fuller, more accurate picture of creditworthiness. Why cash flow data matters now In the U.S., many consumers with limited credit histories want to build their profiles but don’t know how. Cash flow underwriting bridges this gap. Cash flow insights reveal real-world financial activity — like income patterns, spending habits and account balances — in real time. This empowers lenders to make smarter, faster and more inclusive credit decisions, while helping consumers gain access to the financial services they deserve. What cash flow insights deliver By incorporating cashflow data into your decisioning strategy, you can: See beyond the score with a richer view of a consumer’s financial health. Accelerate approvals with more accurate and timely insights. Expand access to credit while strengthening portfolio diversity and reducing risk. Download our infographic to see how cash flow underwriting is reshaping lending — and how you can lead the change. Download infographic 1Mullen, C. (2024, November 13). Underbanked US population grows to 14.2%, FDIC finds. Banking Dive.

Lending fraud – what is it? Lending fraud is a deceptive practice in which individuals or entities intentionally provide false or misleading information during the loan application process to secure credit or financial gain. This can include using fake identities, inflating income, forging documentation, or applying for loans without the intention of repayment. The consequences are significant: lenders suffer financial losses, consumers experience identity theft or damaged credit scores, and the economic system bears increased risk and regulatory scrutiny. Loan fraud is a growing concern across consumer, commercial, and mortgage lending sectors, affecting institutions of all sizes. How do I safeguard my organization from loan fraud? Preventing lending fraud is a complex, ongoing challenge that requires a multi-layered and holistic approach. As fraud tactics become more sophisticated, especially with the rise of generative AI and digital lending channels, financial institutions must continually evolve their defenses. Strong identity verification is the first line of defense. Lenders should implement advanced authentication tools beyond basic KYC (Know Your Customer) checks. This includes biometric verification, document verification, and device intelligence —technologies that assess the authenticity of the user and the device used during the application process. These tools can help detect synthetic identities — false identities created using a blend of real and fabricated information — increasingly used in loan fraud schemes. Another crucial strategy is real-time data analytics and behavioral monitoring. Lenders can quickly identify anomalies that may indicate fraudulent activity by analyzing applicant behavior, credit history, device usage patterns, and geolocation data in real time. For example, if an applicant submits multiple loan applications from different IP addresses in a short time frame, that could raise a red flag for potential lending fraud. Employee training and awareness are also essential. Frontline staff must be equipped to identify warning signs, such as inconsistencies in application documents or rushed, high-pressure loan requests. Regular fraud prevention training helps employees stay alert and aligned with the organization’s risk management protocols. 57% of financial institutions reported direct fraud losses exceeding $500,000 in the past year, with 25% exceeding $1 million.1 Consumers reported losing more than $12.5 billion to fraud in 2024, which represents a 25% increase over the prior year.2 In addition, robust internal controls and auditing mechanisms are critical in prevention. Organizations should regularly audit loan origination processes and investigate unusual approval patterns to detect insider fraud or systemic vulnerabilities. Finally, consumer education is a vital, often overlooked, aspect of combating loan fraud. Lenders should provide resources to help customers understand the risks of identity theft, encourage them to monitor their credit reports regularly, and empower them to report any suspicious activity. A well-informed customer base can be a valuable early warning system for fraud. With digital lending becoming the norm, preventing lending fraud means staying ahead of increasingly tech-savvy fraudsters. Leveraging data, technology, and education together builds a stronger, more resilient fraud defense framework. Lending fraud + Experian – How we can help With access to the industry’s most advanced fraud detection and identity verification tools, partnering with us gives you a potent edge in combating lending fraud. As a global leader in data, analytics, and technology, our comprehensive and accurate sets of consumer information enable you to spot risks that might be invisible through conventional means. Our approach combines rich data insights with powerful machine learning algorithms, delivering fraud prevention tools that are intelligent, scalable, and highly adaptive. Our fraud detection technologies are designed to protect every stage of the lending lifecycle. From real-time identity verification and multi-factor authentication solutions to behavioral biometrics and device intelligence, so you can detect synthetic identities, manipulated applications, and other forms of loan fraud before they lead to financial loss. In an era where trust is currency, partnering with us doesn’t just help protect against lending fraud — it enhances your reputation as a secure, responsible lender. You gain the confidence of your customers by providing safe, streamlined lending experiences while meeting compliance requirements and reducing operational risk. With us, you’re not just reacting to fraud—you’re anticipating it, preventing it, and confidently growing your business. Learn more 1State of Fraud Benchmark Report. Alloy. (2024). 2New FTC Data Show a Big Jump in Reported Losses to Fraud to $12.5 Billion in 2024. Federal Trade Commission. (2025, March 10).

In today's fast-paced financial landscape, consumer expectations are higher than ever. Financial institutions must rethink their strategies to stay ahead of rising interest rates, intense competition, and the need to innovate constantly. To thrive, it’s not just about offering the best rates—it's about building deeper, more meaningful relationships with customers and delivering personalized, proactive value that drives loyalty and growth.

In today’s digital landscape, where data breaches and cyberattacks are rampant, businesses face increasing security challenges. One of the most prevalent threats is credential stuffing—a cyberattack in which malicious actors use stolen username and password combinations to gain unauthorized access to user accounts. As more personal and financial data gets leaked or sold on the dark web, these attacks become more sophisticated, and the consequences for businesses and consumers alike can be devastating.But there are ways to proactively fight credential stuffing attacks and protect your organization and customers. Solutions like our identity protection services and behavioral analytics capabilities powered by NeuroID, a part of Experian, are helping businesses prevent fraud and ensure a safer user experience. What is credential stuffing? Credential stuffing is based on the simple premise that many people reuse the same login credentials across multiple sites and platforms. Once cybercriminals can access a data breach, they can try these stolen usernames and passwords across many other sites, hoping that users have reused the same credentials elsewhere. This form of attack is highly automated, leveraging botnets to test vast numbers of combinations in a short amount of time. If an attacker succeeds, they can steal sensitive information, access financial accounts, or carry out fraudulent activities. While these attacks are not new, they have become more effective with the proliferation of stolen data from breaches and the increased use of automated tools. Traditional security methods—such as requiring complex passwords or multi-factor authentication (MFA)—are useful but not enough to prevent credential stuffing fully. How we can help protect against credential stuffing We offer comprehensive fraud prevention tools and multi-factor authentication solutions to help you identify and mitigate credential stuffing threats. We use advanced identity verification and fraud detection technology to help businesses assess and authenticate user identities in real-time. Our platform integrates with existing authentication and risk management solutions to provide layered protection against credential stuffing, phishing attacks, and other forms of identity-based fraud. Another key element in our offering is behavioral analytics, which goes beyond traditional methods of fraud detection by focusing on users' data entry patterns and interactions. NeuroID and Experian partner to combat credential stuffing We recently acquired NeuroID, a company specializing in behavioral analytics for fraud detection, to take the Experian digital identity and fraud platform to the next level. Advanced behavioral analytics is a game-changer for preventing credential-stuffing attacks. While biometrics track characteristics, behavioral analytics track distinct actions. For example, with behavioral analytics, every time a person inputs information, clicks in a box, edits a field, and even hovers over something before clicking on it or adding the information to it, those actions are tracked. However, unlike biometrics, this data isn’t used to connect to a single identity. Instead, it’s information businesses can use to learn more about the experience and the intentions of someone on the site. NeuroID and Experian’s paired fraud detection capabilities offer several distinct advantages in preventing credential stuffing attacks: Real-time threat detection: Analyze thousands of behavioral signals in real-time to detect user behavior that suggests bots, fraud rings, credential stuffing attempts, or any number of other cybercriminal attack strategies. Fraud risk scoring: Based on behavioral patterns, assign a fraud risk score to each user session. High-risk sessions can trigger additional authentication steps, such as CAPTCHA or step-up authentication, helping to stop credential stuffing before it occurs. Invisible to the user: Unlike traditional authentication methods, behavioral analytics work seamlessly in the background. Users do not need to take extra steps—such as answering additional security questions or entering one-time passwords. Adaptive and self-learning: As users interact with your website or app, our system continuously adapts to their unique behavior patterns. Over time, the system becomes even more effective at distinguishing between legitimate and malicious users without collecting any personally identifiable information (PII). Why behavioral data is critical in combating credential stuffing Credential stuffing attacks rely on the ability to mimic legitimate login attempts using stolen credentials. Behavioral analytics, however, can spot the subtle differences between human and bot behavior, even if the attacker has the correct credentials. By integrating behavioral analytics, you can: Prevent automated attacks: Bots often interact with websites in unnatural ways—speeding through form fields, using erratic mouse movements, or attempting logins from unusual or spoofed geographic locations. Behavioral analytics can flag these behaviors before an account is compromised. Detect account takeovers early: If a legitimate user’s account is taken over, behavioral analytics can detect the change in interactions. By monitoring behavior, businesses can detect account takeover attempts much earlier than traditional methods. Lower false positive rates: Traditional fraud prevention tools often rely on rigid rule-based systems that can block legitimate users, especially if their login patterns slightly differ from the norm. On the other hand, behavioral analytics analyzes a user's real-time behavioral data without relying on traditional static data such as passwords or personal information. This minimizes unnecessary flags on legitimate customers (while still detecting suspicious activity). Improve customer experience: Since behavioral analytics is invisible to users and requires no extra friction (like answering security questions), the login and transaction verification process is much smoother. Customers are not inconvenienced, and businesses can reduce the risk of fraud without annoying their users. The future of credential stuffing prevention Credential stuffing is a growing threat in today’s interconnected world, but with the right solutions, businesses can significantly reduce the risk of these attacks. By integrating our fraud prevention technologies and behavioral analytics capabilities, you can stay ahead of the curve in securing user identities and preventing unauthorized access. The key benefits of combining traditional identity verification methods with behavioral analytics are higher detection rates, reduced friction for legitimate users, and an enhanced user experience overall. In an era of increasingly sophisticated cybercrime, using data-driven behavioral insights to detect user riskiness is no longer just a luxury—it’s a necessity. Learn more Watch webinar

The open banking revolution is transforming the financial services landscape, offering banks and financial institutions unprecedented access to consumer-permissioned data. However, during our recent webinar, “Navigating Open Banking: Strategies for Banks and Financial Institutions,” over 78% of attendees stated that they do not currently have an open banking strategy in place. This highlights a significant gap in the industry. By tapping into consumer-permissioned data, you can develop more personalized products, streamline credit decisioning, and improve overall customer engagement. With the right strategies, open banking offers a pathway to growth, innovation, and enhanced customer experiences. Here’s a snippet from the webinar’s Q&A session with Ashley Knight, Senior Vice President of Product Management, who shared her perspective on open banking trends and opportunities. Q: What specific analytic skill is the most important when working on open banking data?A: The ability to parse and transform raw data, a deep understanding of data mining, experience in credit risk, and general modeling skills to improve underwriting. Q: What lessons did the U.S. learn from the experience of other countries that implemented open banking? A: The use cases are common globally; typical uses of open banking data include second-chance underwriting to help score more consumers and customer management, which involves assessing cashflow data to leverage on an existing portfolio (first-party data). This can be used in various ways, such as cross-sell, up-sell, credit line increase, and growing/retaining deposits. Q: Does Experian have access to all a consumer’s bank accounts in cases where the consumer has multiple accounts?A: Data access is always driven by consumer permission unless the organization owns this data (i.e., first-party data). Where first-party data is unavailable, we collect it through clients or lenders who send it to us directly, having gained the proper consent. Yes, we can intake data from multiple accounts and provide a categorization and attribute calculation. Q: Where does the cashflow data come from? Is it only credit card spending?A: It includes all spending data from bank accounts, checking accounts, credit cards, savings, debit cards, etc. All of this can be categorized, and we can calculate attributes and/or scores based on that data. Q: What is the coverage of Experian’s cashflow data, and how is it distributed across risk bands?A: Cashflow data moves through Experian directly from consumer permissioning for B2B use cases or from institutions with first-party data. We perform analytics and calculate attributes on that portfolio. Don’t miss the chance to learn from our industry leaders on how to navigate the complexities of open banking. Whether you are a seasoned professional or just starting to explore its potential, this webinar will equip you with the knowledge you need to stay ahead. Watch on-demand recording Learn more Meet our expert Ashley Knight, Senior VP of Product Management, Experian Ashley leads our product management team focusing on alternative data, scores, and open banking. She fosters innovation and drives financial inclusion by using new data, such as cash flow, analytics, and Experian’s deep expertise in credit.

Effective collection strategies are critical for the financial health of credit unions. Unlike traditional banks, credit unions often emphasize member relationships and community values, making the collection process more tactful. Crafting a strategy that balances the need for financial stability with member-centric values is essential. Here’s a step-by-step guide on how to create an effective credit union collection strategy. 1. Understand your members The foundation of an effective credit union collection strategy is understanding your members. Credit unions often serve specific communities or groups, and members may face unique financial challenges. By analyzing member demographics, financial behavior, and common reasons for delinquency, you can tailor your approach to be more vigilant and effective. Segment members: Group members based on factors like loan type, payment history, and financial behavior. This allows for targeted communications and outreach strategies. Member communication preferences: Determine how your members prefer to be contacted—whether by phone, email, or in person. This can increase engagement and responsiveness. 2. Prioritize compliance Compliance with regulations is non-negotiable in the collections process. Ensure that your strategy adheres to all relevant laws and guidelines. Fair Debt Collection Practices Act (FDCPA): Ensure that your team is fully trained on the FDCPA and that your practices comply with its requirements. State and local regulations: Be aware of any state or local regulations that may impact your collections process. This could include restrictions on contact methods or times. Internal audits: Regularly conduct internal audits to ensure compliance and identify any areas of risk. 3. Leverage technology for efficiency Technology can streamline the collection process, making it more efficient and a better member experience. Automated reminders: Use automated systems to send reminders before and after payment due dates. This reduces the likelihood of missed payments due to forgetfulness. Data analytics: Use data analytics to identify trends in member behavior, establish a collections prioritization strategy, and predict potential delinquencies. This allows your team to be proactive rather than reactive. Digital communication channels: Implement digital communication options, such as text messages or chatbots to make it easier for members to interact with the credit union. 4. Establish clear communication protocols Early and frequent communication is key to preventing delinquency and managing it when it occurs. Create clear protocols for member communication that prioritize empathy and treatment plans over demands. Early intervention: Reach out to members as soon as they miss a payment. Early intervention can prevent minor issues from escalating. Consistent communication: Ensure that your communication is consistent across all channels. Whether a member receives a call, an email, or a letter, the message should be clear and aligned with the credit union’s values. Human understanding: Train your collections team to use a compassionate tone. Members are more likely to respond positively when they feel understood and respected. 5. Offer flexible payment solutions Flexibility is crucial when working with members who are struggling financially. Offering a range of payment solutions can help members stay on track and reduce the likelihood of default. Customized treatment plans: Offer customizable payment plans that fit the member’s financial situation. This could include lower payments over a longer term or temporary payment deferrals. Loan modifications: In some cases, modifying the terms of the loan—such as extending the repayment period or lowering the interest rate—may be necessary to help the member succeed. Debt consolidation options: If a member has multiple loans, consider offering debt consolidation to simplify their payments and reduce their overall financial burden. 6. Train your collection team Your collection team is the frontline of your strategy. Providing them with the right training and tools is essential for success. Ongoing training: Regularly update your team on the latest regulations, best practices, and communication techniques. This keeps them informed and prepared to handle various situations. Better decision making: Empower your team to make decisions that align with the credit union’s values. This could include offering payment extensions or waiving late fees in certain situations. Regular support: Working in collections can be complex. Provide resources and support to help your team manage stress and maintain a positive attitude. 7. Monitor and adjust your strategy A successful credit union collection strategy is dynamic. Regularly monitor its performance and adjust as needed. Key performance indicators (KPIs): Track KPIs such as delinquency rates, recovery rates, roll-rates and member satisfaction to gauge the effectiveness of your strategy. Member feedback: Survey members who have gone through the collections process. Their insights can help you identify areas for improvement. Continuous improvement: Use data and feedback to continuously refine your strategy. What worked last year may not be as effective today, so staying adaptable is key. Creating an effective credit union collections strategy requires a balance of empathy, effective communication, and compliance. By understanding your members, communicating clearly, offering flexible solutions, leveraging technology, and continuously improving your approach, you can develop a strategy that not only reduces delinquency but also strengthens member relationships. In today’s fiercely competitive landscape, where efficiency and efficacy stand paramount, working with the right partner equipped with innovative credit union solutions can dramatically transform your outcomes. Choosing us for your debt collection needs signifies an investment in premier analytics, advanced debt recovery tools, and unmatched support. Learn more Watch credit union collection chat This article includes content created by an AI language model and is intended to provide general information.

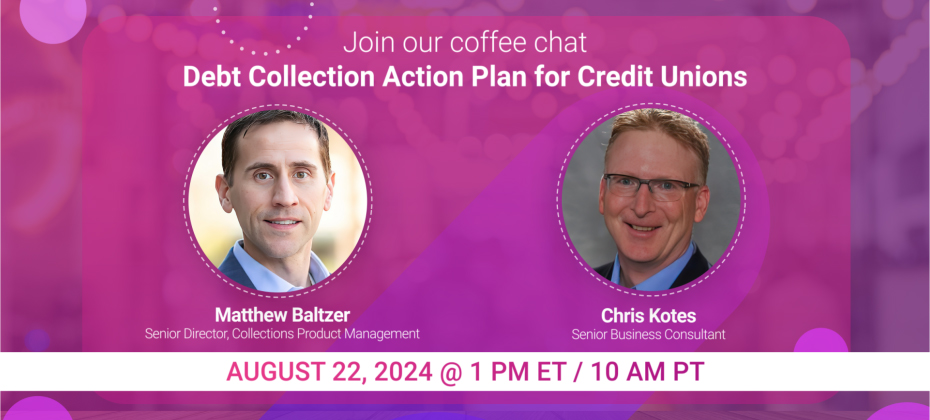

With the noticeable uptick in delinquencies, credit unions face more significant hurdles in effectively managing overdue accounts. In this challenging financial landscape, it’s imperative that you refine your account management processes to remain competitive, preserve the well-being of your members, assure operational efficiency, and increase profitability. Implementing efficient collection approaches not only improves loss rates but also helps with member retention, which is the backbone of your success. Grab a cup of coffee and join our experts on August 22 @ 1:00 p.m. ET/ 10:00 a.m. PT, for an engaging conversation on credit union collection trends and successful account management strategies. Highlights include: Current landscape: Gain valuable insight and understanding into the current debt collection environment for credit unions. Navigating challenges: Discover effective tips and strategies to tackle obstacles in your business, improve loss rates, and enhance member retention. Real-time Q&A: Participate in a live Q&A session where our experts will address your questions. Watch on-demand

With rising consumer debt and an increasing number of consumers defaulting on loans, effective debt recovery strategies have never been more critical. Skip-tracing is the first-step in effective debt collection. This essential practice helps locate individuals who have become difficult to find, ensuring that you can recover outstanding debts efficiently. In this blog post, we'll explore skip-tracing best practices, offering valuable insights and practical tips and tools. Understanding and implementing these collection strategies can enhance your debt recovery efforts, improve overall efficiency, and increase your recovery rates. Understanding the importance of skip-tracing Skip-tracing is the process of locating individuals who have moved or otherwise become difficult to find. This technique is particularly important for financial institutions and debt collectors, enabling them to contact debtors and recover outstanding payments. Given the high stakes involved, mastering skip-tracing best practices is crucial for ensuring successful debt recovery. How to create an effective skip-tracing strategy 1. Use comprehensive skip-tracing data sources One of the foundational elements of an effective skip-tracing strategy is the use of comprehensive skip-tracing data sources. You can gather valuable information about a debtor's whereabouts by leveraging multiple databases, including public records, credit reports, and alternative data sources. The more data sources you utilize, the better chance of making right-party contact. 2. Prioritize data privacy While skip-tracing is essential for debt recovery, it's crucial to prioritize data privacy. Always adhere to the latest consumer contact debt collection regulations. This protects the individual's privacy and safeguards your organization from potential legal issues. 3. Stay updated with regulatory changes The regulatory landscape for debt collection and contacting consumers is constantly evolving. Staying updated with the latest changes ensures that your skip-tracing practices remain compliant with the law. Regularly review industry regulations, obtain proper consent from consumers and adjust your strategies accordingly. 4. Train your team Skip-tracing requires specialized skills and knowledge. Investing in regular training for your team ensures that they are equipped with the latest techniques and best practices. Offer workshops, webinars, and certification programs to keep your team up to date and improve their effectiveness. 5. Utilize skip-tracing software Skip-tracing software can significantly streamline the process and improve accuracy. Look for software solutions that offer comprehensive data integration, advanced search capabilities, and user-friendly interfaces. Implementing the right software can save time and resources while increasing right-party contact. 6. Monitor and evaluate performance Regularly monitoring and evaluating the performance of your skip-tracing efforts is essential for continuous improvement. Track key metrics such as right-party contact rates, time taken to locate individuals, contact method and cost. Use this data to identify areas for improvement and adjust your strategies accordingly. 7. Adapt to changing circumstances The world of debt management is dynamic, and circumstances can change rapidly. Be prepared to adapt your skip-tracing strategies to evolving situations. Whether it's changes in debtor behavior, new technology, or shifts in the regulatory landscape, staying flexible ensures that your skip-tracing efforts remain effective. Why choose Experian® for skip-tracing solutions Skip-tracing is a critical tool for financial institutions and debt collectors, enabling them to locate individuals and recover outstanding debts efficiently. Understanding and implementing collection best practices can improve your efforts and overall success rates. As a global leader in data and analytics, we offer extensive expertise and cutting-edge skip-tracing tools tailored to meet your unique needs. Comprehensive data integration: Our skip-tracing tools integrate data from multiple sources, including credit reports, alternative data, public records, and proprietary databases. This comprehensive approach ensures that you have access to accurate and up-to-date information, improving right-party contact. Recent and reliable data: While many data providers rely on static or stale data, our skip-tracing data is frequently updated, so you can avoid inaccurate, outdated information. More than 1.3 billion updates are made per month, including new phone numbers, new addresses, new employment, payment history, and more. Advanced technology: Our skip-tracing solutions leverage advanced technology, including AI and ML, to analyze data quickly and accurately. Our state-of-the-art algorithms identify patterns and connections to help you locate individuals more efficiently. Commitment to data privacy: We prioritize data privacy and adhere to the highest ethical standards. Our skip-tracing solutions are designed to protect personal information while ensuring compliance with industry regulations. You can trust us to handle data responsibly and ethically. Ready to take your skip-tracing efforts to the next level? Learn more Access white paper

Open banking has been leveraged for years in the U.S. The anticipated U.S. regulation under section 1033 of the Dodd-Frank Act, combined with the desire to expand lending universes, has increased interest and urgency among financial institutions to incorporate open banking flows into their workstreams. With technological improvements, increased data availability, and increasing consumer awareness around the benefits of data value exchange, financial service providers can use consumer-permissioned data to gain new insights. For example, access to bank account transactional data, permissioned appropriately, provides important attributes into risk, spend and income behaviors, and financial health, while equipping institutions with intelligence they can harness to help meet various business objectives. Current state of open banking Open Banking use cases are extensive and will continue to expand as access to permissioned data becomes more common. Second chance underwriting, where a lender retrieves additional insights to potentially reverse the primary declination, is the most prevalent use case in the market today. Where a consumer may have limited or no credit history, this application of cashflow attributes and scores in a decisioning flow can help many consumers access financial services where they cannot be fully underwritten on credit data alone. And it is not just consumer behavior and willingness to permission their data that will accelerate open banking in financial services. The technology enabling access, security, standardization, and categorization is equally critical. New and existing players across the ecosystem are rolling out new solutions to drive results for financial institutions. The benefits of open banking are vast as highlighted recently by Craig Focardi, Principal Analyst at Celent: “The final adoption of the CFPB’s proposed rule under Section 1033 will accelerate open banking in the US,” said Focardi. “Although open banking is operating effectively under existing consumer protection/privacy and related laws and regulations, this modern opening banking rule will enhance consumer control over their data for privacy and security, help consumers better manage their finances, and help them find the best products and banking relationships. For financial institutions, it will level the competitive playing field for smaller financial institutions, increase competition for customer relationships, and incentivize all financial institutions to invest in technology, data, and analytics to adopt open banking more quickly.” Despite the wealth of information that open banking can offer, institutions are at varying stages of maturity when it comes to using this data in production, with fintechs and challenger banks leading the way. However, most banks are researching and planning to take advantage of the insights unlocked through open banking – particularly cashflow data. But why is there not wider adoption when this ‘new’ data can offer such rich and actionable insights? The answer varies, but it is top of mind for risk officers, analysts and marketers. Some financial institutions are worried about application drop-off as consumers move through a data consent journey. Others are taking a wait-and-see approach as they are concerned about incorporating open banking flows only to see regulation upend the application of permissioned data. Regardless of readiness, most organizations are in various stages of testing new permissioned data sources to understand the implications. Experian has helped many financial institutions understand the power of consumer-permissioned data through analytics and specific tests leveraging client transactional data and our cash flow models. On aggregate, we see cashflow data perform well on its own in determining a consumer’s likelihood of going 60 days past due over 12 months; however, it is best used in combination with traditional and alternative credit data to achieve optimal performance of underwriting models. But what about consent? Will consumers be open to permissioning their data? From our research, we see that consumers are willing to give permission if the benefits are explained and they understand how their data will be used. In fact, 70% of consumers report they are likely to share banking data for better loan rates, financial tools, or personalized spending insights.1 Experian reveals new solutions for open banking We at Experian are excited about the benefits open banking can provide, including: Giving more control to consumers: Consumers are hungry for more control over their data. We have seen this ourselves with Experian Boost®. When the benefits of data sharing are properly explained, and consumers can control when and how that data is used, it is empowering and allows consumers the potential to unlock new financial opportunities. Improving risk assessment: As mentioned above, analysis shows that cash flow data (transactional open banking data) is very predictive on its own. Adding our credit data delivers even greater predictability, enabling lenders to score more consumers and offer the right products, services, and pricing. Augmenting existing strategies: Open banking is not a new strategy; it augments and improves many existing processes. Institutions do not need to start something from scratch; they can layer incremental data into existing processes for an improved risk assessment, deeper insights, and a better customer experience. Open banking is not a new strategy; it augments and improves many existing processes. Institutions do not need to start something from scratch; rather, they can layer incremental data into existing processes for an improved risk assessment, deeper insights, and a better customer experience. We’re helping institutions unlock the power of open banking data by transforming transaction data into precise categories, a foundational component of cashflow analytics that feeds into the calculation of attributes and scores. These new Cashflow Attributes can be easily plugged into existing underwriting, analytic, and account management use cases. Early indicators show that Cashflow Attributes can boost predictive accuracy by up to 20%, allowing lenders to drive revenue growth while mitigating risk.2 Open banking is emerging in the industry across various use cases. Many are only just realizing the potential insights and benefits this can have to consumers and their organizations. How will you leverage open banking? Learn more about how we're helping address open banking 1Atomik Research survey of 2,005 U.S. adults online, matching national demographics. Fieldwork: March 17-21, 2024. 2Experian analysis based on GINI predictability. GINI coefficient measures income or wealth inequality within a population, with 0 indicating perfect equality and 1 indicating perfect inequality, reflecting predictive capability.

Dealing with delinquent debt is a challenging yet crucial task, and when faced with economic uncertainties, the need for effective debt management and collections strategies becomes even more pressing. Thankfully, advanced analytics offers a promising solution. By leveraging data-driven insights, you can enhance operational efficiency, better prioritize accounts, and make more informed decisions. This article explores how advanced analytics can revolutionize debt collection and provides actionable strategies to implement treatment. Understanding advanced analytics in debt collection Advanced analytics involves using sophisticated techniques and tools to analyze complex datasets and extract valuable insights. In debt collection, advanced analytics can encompass various methodologies, including predictive modeling, machine learning (ML), data mining, and statistical analysis. Predictive modeling Predictive modeling leverages historical data to forecast future outcomes. By applying predictive models to debt collection, you can estimate each account's repayment likelihood. This helps prioritize your efforts toward accounts with a higher chance of recovery. Machine learning Machine learning algorithms can automatically identify patterns in large datasets, enabling more accurate predictions and classifications. For debt collectors, this means better segmenting delinquent accounts based on likelihood of repayment, risk, and customer behavior. Data mining Data mining involves exploring large datasets to unearth hidden patterns and correlations. In debt collection, data mining can reveal previously unnoticed trends and behaviors, allowing you to tailor your strategies accordingly. Statistical analysis Statistical methods help quantify relationships within data, providing a clearer picture of the factors influencing debt repayment and focusing on statistically significant repayment drivers, which aids in refining collection strategies. Benefits of advanced analytics in delinquent debt collection The benefits of employing advanced analytics in delinquent debt collection are multifaceted and valuable. By integrating these technologies, financial institutions can achieve greater efficiency, reduce operational costs, and improve recovery rates. Enhanced prioritization and decisioning With data and predictive analytics, you can gain a complete view of existing and potential customers to determine risk exposure and prioritize accounts effectively. By analyzing payment histories, credit scores, and other consumer behavior, you can enhance your collectoins prioritization strategies and focus on accounts more likely to pay or settle. This ensures that resources are allocated efficiently, and decisions are informed, maximizing your return on investment. Watch: In our recent tech showcase, learn how to harness the power of our industry-leading collection decisioning and optimization capabilities. Reduced costs Advanced analytics can significantly reduce operational costs by streamlining the collection process and targeting accounts with higher recovery potential. Automated processes and optimized resource allocation mean you can achieve more with less, ultimately increasing profitability. Better customer relationships With debt collection analytics, digital communication tools, artificial intelligence (AI), and ML processes, you can enhance your collections efforts to better engage with consumers and increase response rates. Adopting a more empathetic and customer-centric approach that embraces omnichannel collections can foster positive customer relationships. Implementing advanced analytics: A step-by-step guide Step 1: Data collection and integration The first step in implementing advanced analytics is to gather and integrate data from various sources. This includes payment histories, account information, demographic data, and external data such as credit scores. Ensuring data quality and consistency is crucial for accurate analysis. Step 2: Data analysis and modeling Once the data is collected, the next step is to apply advanced analytical techniques. This involves developing predictive models, training machine learning algorithms, and conducting statistical analyses to identify notable patterns and trends. Step 3: Strategy development Based on the insights gained from the analysis, you can develop targeted collection strategies. These may include segmenting accounts, prioritizing high-potential recoveries, and choosing the most effective communication methods. It’s essential to test and refine these strategies to ensure optimal performance continually. Step 4: Automation and implementation Implementing advanced analytics often involves automation. Workflow automation tools can streamline routine tasks, ensuring strategies are executed consistently and efficiently. Integrating these tools with existing debt collection systems can enhance overall effectiveness. Step 5: Monitoring and optimization Finally, continuously monitor the performance of your advanced analytics initiatives. Use key performance indicators (KPIs) to track success and identify areas for improvement. Regularly update models and strategies based on new data and evolving trends to maintain high recovery rates. Putting it all together Advanced analytics hold immense potential for transforming delinquent debt collection and can drive better return on investment. By leveraging predictive modeling, machine learning, data mining, and statistical analysis, financial institutions and debt collection agencies can perfect their collection best practices, prioritize accounts effectively, and make more informed decisions. Our debt collection analytics and recovery tools empower your organization to see the complete behavioral, demographic, and emerging view of customer portfolios through extensive data assets, advanced analytics, and platforms. As the financial landscape evolves, working with an expert to adopt advanced analytics will be critical for staying competitive and achieving sustainable success in debt collection. Learn more *This article includes content created by an AI language model and is intended to provide general information.