Tag: collections

Debt collection is rapidly evolving. Traditional methods are becoming increasingly ineffective as consumer preferences shift, regulations tighten and operational inefficiencies lead to bottlenecks.Agencies and debt buyers that rely on outdated strategies are experiencing the consequences: lower recovery rates, increased compliance risks and weaker consumer engagement. However, there’s good news — modern tools, powered by advanced data, analytics and digital platforms, are transforming these challenges into opportunities. Common collections challenges: Real-world scenarios In our latest e-book, we examine four fictional scenarios that illustrate how collections teams are addressing today’s primary challenges by updating their methods. Here’s a preview: Smarter segmentation = Higher recovery: Sally, head of collections at Midwest Debt Solutions, realized her team’s one-size-fits-all approach was costing them. By adopting advanced segmentation powered by data and analytics, she shifted her focus from chasing low-value accounts to targeting those most likely to repay, boosting recovery rates and team morale. Better data in, better decisions out: Jerry, a risk analyst at Bay & Associates, relied on a legacy credit model that overlooked crucial alternative signals. By incorporating trended credit data, utility payments and behavioral signals, his team significantly enhanced their prioritization approach and forecasting accuracy. Modern engagement for the modern consumer: John, a collections agent, was having trouble reaching consumers through traditional methods, such as phone calls and letters. With a digital self-service platform, John’s team gained real-time insight into engagement preferences and was able to connect through the channels consumers use, like SMS and email. Personalization at scale: Rachel, an account manager at Union Collections, knew manual processes were slowing her team down. By implementing personalized communications and multichannel outreach, they enhanced consumer experiences, increased repayment rates and minimized compliance risks — all while saving time. Why it matters These scenarios share a common thread: with the right tools, data and strategy, collections teams can turn today’s pain points into measurable progress. At Experian®, we help agencies: Prioritize accounts more effectively with advanced segmentation. Make smarter predictions using dynamic, modern scoring models. Streamline operations with self-service platforms and automation. Strengthen consumer relationships with personalized outreach. Download the e-book Want to dive deeper into each use case? Access the full e-book to learn how forward-thinking agencies are adapting their collections strategies to recover more, spend less and build stronger consumer relationships. Download the e-book

In today's fast-paced world, the ability to locate individuals quickly and accurately is crucial for debt collectors and lenders. Leading skip tracing software is differentiated by data accuracy and data source expansion that delivers increased right-party contact (RPC) rates, better cost efficiency, and improved user experience. The need for improved skip tracing The landscape of skip tracing has changed dramatically in recent years. Call blocking and mislabeling have led to a decline in RPC rates, while increased scam activity has caused many consumers to ignore calls and texts. Additionally, the sheer volume of new information available makes efficiently organizing and delivering helpful results a higher priority than simply gathering data. Here are a few quick stats: Email addresses go stale at a rate of 3% each month There are 820 million changes across all contact databases every 90 days Human errors lead to 50% of data issues, such as a typo that results in a bounced email[1] As a result, we’ve made significant improvements to our skip tracing solution, TrueTrace™. What is TrueTrace? TrueTrace, a powerful skip tracing solution, is a go-to resource for both small and enterprise collectors. For locating hard-to-find individuals, TrueTrace is now even more effective, leveraging advanced technology and more data to enhance its performance. Some organizations that tested TrueTrace saw a 10% lift in RPC rates compared to the competition.[2] Here’s a look at some of the improvements we’ve made: Enhanced data accuracy: TrueTrace now runs on an identity graph to tie data from disparate sources to a unique persistent ID for each consumer. This upgrade improves data matching and accuracy, ensuring that users can rely on the information provided. Expanded data sources: The new version of TrueTrace incorporates email appending, making it a convenient all-in-one solution. By including new and unique data sources, TrueTrace increases hit rates and provides more quality results. With these improvements, here are some potential benefits to your business: Increased RPC rates: Improved data quality and accuracy lead to higher RPC rates, making it easier for collectors to reach the right individuals. Cost efficiency: Reducing operational costs associated with wrong-party contacts and outdated information helps businesses save money and improve their bottom line. Improved user experience: Easier access to accurate data leads to more efficient operations and a better overall user experience. Using an identity graph to organize data points Identity graphs allow organizations to build customer profiles based on a combination of data points. Companies can also use cloud-based services to implement additional, larger sets of data. Within an outreach strategy, skip tracing tools can use identity graphs to associate names, phone numbers, email address, physical address, and assets from multiple, unrelated databases into a single source of accurate information. This can help organizations save time and increase efficiency. Upgrades to skip tracing help businesses enhance efficiency The latest enhancements to TrueTrace represent a significant advancement in skip tracing technology. With upgraded data accuracy, expanded data sources, real-time updates, and flexible integration, TrueTrace offers a comprehensive solution for businesses looking to improve their outreach strategy. This tool can help businesses achieve higher RPC rates, reduce costs, and enhance their overall operational efficiency. To learn more about TrueTrace and its new features, read our latest whitepaper or visit our website or contact us for further inquiries. Discover how TrueTrace can help your business achieve better skip tracing with higher quality results today. Read the whitepaper Visit our website [1] Experian (2023). Revolutionizing your email strategy. [2] Experian TrueTrace data

Debt collectors face a multitude of challenges when it comes to contacting the right people at the right time and improving their processes for collections. We interviewed Matt Baltzer, Senior Product Management Director at Experian, to learn more about how his team is helping debt collectors engage their customers and optimize their collection strategies.

In today's evolving financial landscape, debt collection remains a critical function for financial institutions. However, traditional methods often fall short in efficiency and customer satisfaction. Enter artificial intelligence (AI), a game-changer poised to revolutionize the debt collection industry. This blog post explores the benefits and uses of AI in debt collection, shedding light on how financial institutions can leverage this technology to enhance their strategies. Understanding AI in debt collection Artificial intelligence, which encompasses machine learning, natural language processing, and other advanced technologies, is transforming various industries, including debt collection. AI in debt collection involves using these technologies to automate and optimize processes, making them more efficient and effective. Examples of AI technologies in debt collection include predictive analytics, chatbots, and automated communication systems. Predictive analytics. Predictive debt collection analytics is a powerful tool in AI collections. By analyzing patterns and trends in debtor behavior, AI can forecast the likelihood of repayment. This information allows financial institutions to tailor their collection strategies to individual debtors, improving the chances of successful recovery. Chatbots and virtual assistants. AI-powered chatbots and virtual assistants handle routine customer interactions, providing instant responses to common queries. These tools can escalate complex issues to human agents when necessary, ensuring that customers receive the appropriate level of support. By automating routine tasks, chatbots free up human agents to focus on more complex cases. Automated communication. AI can automate communication with debtors, sending payment reminders and notifications through various channels such as email, SMS, and phone calls. These messages can be customized based on debtor profiles, ensuring that communication is personalized and effective. Automated communication helps maintain consistent contact with debtors, increasing the likelihood of timely payments. Key benefits of AI-powered debt collection Beyond practical applications, AI delivers substantial value across an organization’s debt collection strategy. From streamlining operations to improving customer engagement and decision-making, the benefits outlined below illustrate how AI helps financial institutions reduce costs, optimize resources, and achieve better outcomes. Improved operational efficiency. One of the most significant advantages of AI in debt collection is improved operational efficiency. AI can automate repetitive tasks such as sending payment reminders and processing payments, reducing the need for manual intervention. This automation speeds up the process, reduces costs, and minimizes human errors, ensuring more accurate and timely collections. Better decision-making. AI collections leverage predictive analytics to assess debtor risk and provide data-driven insights. This information enables financial institutions to develop more effective collection strategies and prioritize high-risk accounts. By making informed decisions based on predictive models, institutions can optimize collections processes and increase their chances of successful debt recovery. More cost savings. Automation through AI can lead to significant cost savings. Financial institutions can achieve higher profitability by reducing the need for human intervention and lowering operational costs. Additionally, increased recovery rates due to better cure strategies contribute to overall cost efficiency. Enhanced customer experience. AI-driven chatbots and virtual assistants can provide personalized communication, enhancing the customer experience. These AI tools are available 24/7, allowing customers to get instant responses to their queries at any time. By offering a seamless and responsive service, financial institutions can improve customer satisfaction and engagement strategies. Challenges and considerations While AI offers numerous benefits, there are challenges and considerations to keep in mind. Data privacy and security are paramount, as financial institutions must ensure compliance with regulations such as General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA). Balancing automation with the need for a human touch is also crucial, as some customers may prefer interacting with human agents. Additionally, addressing potential biases in AI algorithms is essential to ensure fair and equitable treatment of all debtors. Our debt management and collection solutions The future of AI in debt collection looks promising, with emerging technologies poised to make a significant impact. Integration of AI with other technologies such as blockchain and the Internet of Things (IoT) could further enhance the efficiency and security of debt collection processes. As AI continues to evolve, financial institutions must stay abreast of these trends to remain competitive and effective in their collection strategies. With more than 25 years of experience and a comprehensive suite of collection products, our enhanced decisioning, improved processes, and account prioritization can enable your organization to move toward a customer-centric approach that helps reduce losses and control costs. AI in debt collection offers a myriad of benefits, from improved efficiency and enhanced customer experience to better decision-making and cost savings. By leveraging AI technologies such as predictive analytics, chatbots, and automated communication, financial institutions can optimize their debt collection strategies and achieve higher recovery rates. As the industry continues to evolve, embracing AI will be crucial for financial institutions looking to stay ahead of the curve. Discover how Experian’s AI-powered debt management and collection solutions can help you recover more while improving customer relationships. Learn more

We are squarely in the holiday shopping season. From the flurry of promotional emails to the endless shopping lists, there are many to-dos and even more opportunities for financial institutions at this time of year. The holiday shopping season is not just a peak period for consumer spending; it’s also a critical time for financial institutions to strategize, innovate, and drive value. According to the National Retail Federation, U.S. holiday retail sales are projected to approach $1 trillion in 2024, , and with an ever-evolving consumer behavior landscape, financial institutions need actionable strategies to stand out, secure loyalty, and drive growth during this period of heightened spending. Download our playbook: "How to prepare for the Holiday Shopping Season" Here’s how financial institutions can capitalize on the holiday shopping season, including key insights, actionable strategies, and data-backed trends. 1. Understand the holiday shopping landscape Key stats to consider: U.S. consumers spent $210 billion online during the 2022 holiday season, according to Adobe Analytics, marking a 3.5% increase from 2021. Experian data reveals that 31% of all holiday purchases in 2022 occurred in October, highlighting the extended shopping season. Cyber Week accounted for just 8% of total holiday spending, according to Experian’s Holiday Spending Trends and Insights Report, emphasizing the importance of a broad, season-long strategy. What this means for financial institutions: Timing is crucial. Your campaigns are already underway if you get an early start, and it’s critical to sustain them through December. Focus beyond Cyber Week. Develop long-term engagement strategies to capture spending throughout the season. 2. Leverage Gen Z’s growing spending power With an estimated $360 billion in disposable income, according to Bloomberg, Gen Z is a powerful force in the holiday market. This generation values personalized, seamless experiences and is highly active online. Strategies to capture Gen Z: Offer digital-first solutions that enhance the holiday shopping journey, such as interactive portals or AI-powered customer support. Provide loyalty incentives tailored to this demographic, like cash-back rewards or exclusive access to services. Learn more about Gen Z in our State of Gen Z Report. To learn more about all generations' projected consumer spending, read new insights from Experian here, including 45% of Gen X and 52% of Boomers expect their spending to remain consistent with last year. 3. Optimize pre-holiday strategies Portfolio Review: Assess consumer behavior trends and adjust risk models to align with changing economic conditions. Identify opportunities to engage dormant accounts or offer tailored credit lines to existing customers. Actionable tactics: Expand offerings. Position your products and services with promotional campaigns targeting high-value segments. Personalize experiences. Use advanced analytics to segment clients and craft offers that resonate with their holiday needs or anticipate their possible post-holiday needs. 4. Ensure top-of-mind awareness During the holiday shopping season, competition to be the “top of wallet” is fierce. Experian’s data shows that 58% of high spenders shop evenly across the season, while 31% of average spenders do most of their shopping in December. Strategies for success: Early engagement: Launch educational campaigns to empower credit education and identity protection during this period of increased transactions. Loyalty programs: Offer incentives, such as discounts or rewards, that encourage repeat engagement during the season. Omnichannel presence: Utilize digital, email, and event marketing to maintain visibility across platforms. 5. Combat fraud with multi-layered strategies The holiday shopping season sees an increase in fraud, with card testing being the number one attack vector in the U.S. according to Experian’s 2024 Identity and Fraud Study. Fraudulent activity such as identity theft and synthetic IDs can also escalate. Fight tomorrow’s fraud today: Identity verification: Use advanced fraud detection tools, like Experian’s Ascend Fraud Sandbox, to validate accounts in real-time. Monitor dormant accounts: Watch these accounts with caution and assess for potential fraud risk. Strengthen cybersecurity: Implement multi-layered strategies, including behavioral analytics and artificial intelligence (AI), to reduce vulnerabilities. 6. Post-holiday follow-up: retain and manage risk Once the holiday rush is over, the focus shifts to managing potential payment stress and fostering long-term relationships. Post-holiday strategies: Debt monitoring: Keep an eye on debt-to-income and debt-to-limit ratios to identify clients at risk of defaulting. Customer support: Offer tailored assistance programs for clients showing signs of financial stress, preserving goodwill and loyalty. Fraud checks: Watch for first-party fraud and unusual return patterns, which can spike in January. 7. Anticipate consumer trends in the New Year The aftermath of the holidays often reveals deeper insights into consumer health: Rising credit balances: January often sees an uptick in outstanding balances, highlighting the need for proactive credit management. Shifts in spending behavior: According to McKinsey, consumers are increasingly cautious post-holiday, favoring savings and value-based spending. What this means for financial institutions: Align with clients’ needs for financial flexibility. The holiday shopping season is a time that demands precise planning and execution. Financial institutions can maximize their impact during this critical period by starting early, leveraging advanced analytics, and maintaining a strong focus on fraud prevention. And remember, success in the holiday season extends beyond December. Building strong relationships and managing risk ensures a smooth transition into the new year, setting the stage for continued growth. Ready to optimize your strategy? Contact us for tailored recommendations during the holiday season and beyond. Download the Holiday Shopping Season Playbook

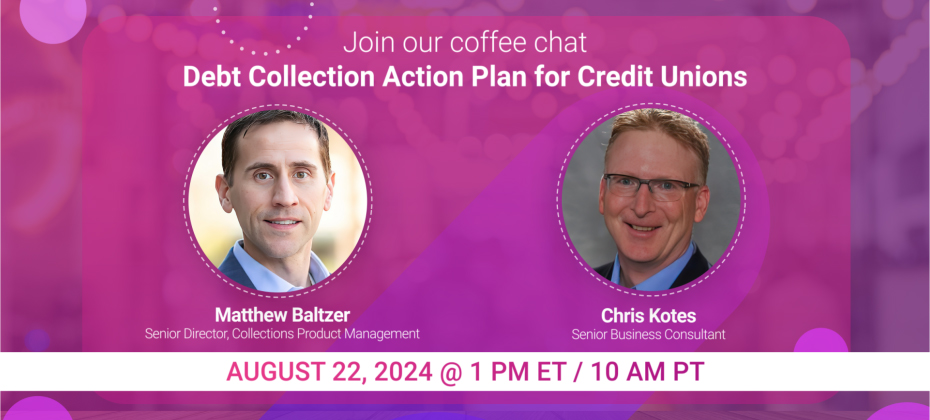

With the noticeable uptick in delinquencies, credit unions face more significant hurdles in effectively managing overdue accounts. In this challenging financial landscape, it’s imperative that you refine your account management processes to remain competitive, preserve the well-being of your members, assure operational efficiency, and increase profitability. Implementing efficient collection approaches not only improves loss rates but also helps with member retention, which is the backbone of your success. Grab a cup of coffee and join our experts on August 22 @ 1:00 p.m. ET/ 10:00 a.m. PT, for an engaging conversation on credit union collection trends and successful account management strategies. Highlights include: Current landscape: Gain valuable insight and understanding into the current debt collection environment for credit unions. Navigating challenges: Discover effective tips and strategies to tackle obstacles in your business, improve loss rates, and enhance member retention. Real-time Q&A: Participate in a live Q&A session where our experts will address your questions. Watch on-demand

Dealing with delinquent debt is a challenging yet crucial task, and when faced with economic uncertainties, the need for effective debt management and collections strategies becomes even more pressing. Thankfully, advanced analytics offers a promising solution. By leveraging data-driven insights, you can enhance operational efficiency, better prioritize accounts, and make more informed decisions. This article explores how advanced analytics can revolutionize debt collection and provides actionable strategies to implement treatment. Understanding advanced analytics in debt collection Advanced analytics involves using sophisticated techniques and tools to analyze complex datasets and extract valuable insights. In debt collection, advanced analytics can encompass various methodologies, including predictive modeling, machine learning (ML), data mining, and statistical analysis. Predictive modeling Predictive modeling leverages historical data to forecast future outcomes. By applying predictive models to debt collection, you can estimate each account's repayment likelihood. This helps prioritize your efforts toward accounts with a higher chance of recovery. Machine learning Machine learning algorithms can automatically identify patterns in large datasets, enabling more accurate predictions and classifications. For debt collectors, this means better segmenting delinquent accounts based on likelihood of repayment, risk, and customer behavior. Data mining Data mining involves exploring large datasets to unearth hidden patterns and correlations. In debt collection, data mining can reveal previously unnoticed trends and behaviors, allowing you to tailor your strategies accordingly. Statistical analysis Statistical methods help quantify relationships within data, providing a clearer picture of the factors influencing debt repayment and focusing on statistically significant repayment drivers, which aids in refining collection strategies. Benefits of advanced analytics in delinquent debt collection The benefits of employing advanced analytics in delinquent debt collection are multifaceted and valuable. By integrating these technologies, financial institutions can achieve greater efficiency, reduce operational costs, and improve recovery rates. Enhanced prioritization and decisioning With data and predictive analytics, you can gain a complete view of existing and potential customers to determine risk exposure and prioritize accounts effectively. By analyzing payment histories, credit scores, and other consumer behavior, you can enhance your collectoins prioritization strategies and focus on accounts more likely to pay or settle. This ensures that resources are allocated efficiently, and decisions are informed, maximizing your return on investment. Watch: In our recent tech showcase, learn how to harness the power of our industry-leading collection decisioning and optimization capabilities. Reduced costs Advanced analytics can significantly reduce operational costs by streamlining the collection process and targeting accounts with higher recovery potential. Automated processes and optimized resource allocation mean you can achieve more with less, ultimately increasing profitability. Better customer relationships With debt collection analytics, digital communication tools, artificial intelligence (AI), and ML processes, you can enhance your collections efforts to better engage with consumers and increase response rates. Adopting a more empathetic and customer-centric approach that embraces omnichannel collections can foster positive customer relationships. Implementing advanced analytics: A step-by-step guide Step 1: Data collection and integration The first step in implementing advanced analytics is to gather and integrate data from various sources. This includes payment histories, account information, demographic data, and external data such as credit scores. Ensuring data quality and consistency is crucial for accurate analysis. Step 2: Data analysis and modeling Once the data is collected, the next step is to apply advanced analytical techniques. This involves developing predictive models, training machine learning algorithms, and conducting statistical analyses to identify notable patterns and trends. Step 3: Strategy development Based on the insights gained from the analysis, you can develop targeted collection strategies. These may include segmenting accounts, prioritizing high-potential recoveries, and choosing the most effective communication methods. It’s essential to test and refine these strategies to ensure optimal performance continually. Step 4: Automation and implementation Implementing advanced analytics often involves automation. Workflow automation tools can streamline routine tasks, ensuring strategies are executed consistently and efficiently. Integrating these tools with existing debt collection systems can enhance overall effectiveness. Step 5: Monitoring and optimization Finally, continuously monitor the performance of your advanced analytics initiatives. Use key performance indicators (KPIs) to track success and identify areas for improvement. Regularly update models and strategies based on new data and evolving trends to maintain high recovery rates. Putting it all together Advanced analytics hold immense potential for transforming delinquent debt collection and can drive better return on investment. By leveraging predictive modeling, machine learning, data mining, and statistical analysis, financial institutions and debt collection agencies can perfect their collection best practices, prioritize accounts effectively, and make more informed decisions. Our debt collection analytics and recovery tools empower your organization to see the complete behavioral, demographic, and emerging view of customer portfolios through extensive data assets, advanced analytics, and platforms. As the financial landscape evolves, working with an expert to adopt advanced analytics will be critical for staying competitive and achieving sustainable success in debt collection. Learn more *This article includes content created by an AI language model and is intended to provide general information.

The morning kicked off with the buzz of innovation. Shri Santhanam, Financial Services and Data General Managers Platforms and Software, and leaders from Experian debuted the latest enhancements for the Experian Ascend Technology PlatformTM. The demo touted faster automation, seamless data integration, security and compliance, and simplified experience. Resiliency, security and gen AI capabilities are all core components and outputs of the new platform. Keynote speakers: Steffi Graf and Andre AgassiTennis icons Steffi Graf and Andre Agassi captivated the audience with stories of their memorable matches, how they met and their foray into pickleball. From notorious rivals to the pivotal moments that were part of their weeks at seeding in the number 1 position – 377 weeks and 101 weeks respectively. Keynote speaker: Jason SudeikisEmmy-award winning actor, comedian, writer and producer – and also known as the affable Ted Lasso – Jason Sudeikis had the crowd laughing reminiscing his favorite skits from his time at Saturday Night Live and outtakes from his numerous films. He talked about the impact of Ted Lasso and the origin of the “Believe” sign, as well as what’s ahead. Sessions – Day 2 highlights The conference hall was buzzing with conversations, discussions and thought leadership. Some themes definitely rose to the top — the increasing proliferation of fraud and how to combat it without diminishing the customer experience, leveraging AI and transformative technology in decisioning and how Experian is pioneering the GenAI era in finance and technology. Alternative dataAlternative data can be used to holistically measure a consumer's creditworthiness. Property data to banking insights to consumer-permissioned data and more can be a critical part of your strategies to segment, analyze and underwrite unbanked and new-to-credit consumers. EngagementEconomic headwinds and fierce competition in the banking industry have acquisition costs soaring, making it more important than ever to be critical of your organization’s advertising spend. Meanwhile, consumers are trending back toward the convenience of banking bundles, and they expect their financial institutions to help them improve their financial health. These conditions create a unique opportunity to extract value from digital experiences. CollectionsData, advanced analytics and machine learning are transforming all aspects of collections during a time when consumer debt pressure is building. Organizations can harness the power of data-driven insights, predictive modeling, enhanced segmentation and optimized decisions to ensure they have the strongest contact data and best collections strategy to reduce delinquencies and boost recovery rates. See you next year for Vision 2025!

Join us as we dive into the world of decisioning and optimization during our upcoming tech showcase, where we’ll be demoing our innovative debt management solutions, Experian® Optimize and PowerCurve® Customer Management. Discover how you can leverage these tools to not only increase profitability but also improve your operational efficiency. We'll show you how our debt collection solutions can enable you to: Turn insight into action with a more holistic consumer view. Increase right-party contact with the best channel and time. Reduce bad debt levels and manage overall exposure. Leading this tech showcase will be Experian’s Matthew Baltzer, Senior Director of Collections Product Management, and Holly Deason, Senior Director of Solution Engineering. Watch on-demand

This article was updated on January 31, 2024. Debt. For many, it’s a struggle – and a constant one. In fact, total consumer debt balances have increased year-over-year.1 High inflation and fears of a recession aren't letting up either. Successful third-party debt collections can be achieved by investing in the right data and technologies. Overcoming debt collections challenges While third-party debt collectors may take a more specialized approach to collections, they face unique challenges. Debt collectors must find the debtor, get them to respond, collect payment, and stay compliant. With streamlined processes and enhanced strategies, lending institutions and collection agencies can recoup more costs. Embrace automationAutomation, artificial intelligence, and machine learning are at the forefront of the continued digital transformation within the world of collections. When implemented well, automation can ease pressure on call center agents and improve the customer experience. Automated systems can also help increase recovery rates while minimizing the risk of human error and the corresponding liability. READ: Three Tips for Successful Automated Debt CollectionsMaximize digitalizationIntegrating and expanding digital technologies is mandatory to be successful in the third-party debt collections space. Third-party debt collectors must be at the forefront of adopting digital communication tools (i.e., email, text, chatbots, and banking apps), to connect more easily with debtors and provide a frictionless customer experience. A digital debt recovery solution helps third-party debt collectors streamline processes, maintain debt collection compliance, and maximize collections efforts. READ: The Ultimate Guide to Successful Debt Collection TechniquesLeverage the best data Consumer data is ever-changing, especially during times of economic distress. Capturing accurate consumer information through a combination of data sources — and continually evaluating the data’s validity — is key to reducing risk throughout the consumer life cycle. By gaining a fresher, more complete view of existing and potential customers, third-party debt collectors can better determine an individual’s propensity to pay and enhance their overall decisioning. Keep pace with changing regulations With increasing scrutiny on the financial services industry and ever-evolving consumer protection and privacy regulations, remaining compliant is a top priority for third-party debt collections departments and agencies. The increased focus on regulations and compliance has also brought to the surface the need for teams to include debt collectors with soft skills who can communicate effectively with indebted consumers. With the right processes and third-party debt collections tools, you can better develop a robust compliance management strategy that works to prevent reputational risk and minimize costly violations. Finding the right debt collections partner In today's climate, it's never been more important to build the right third-party debt collections strategies for your business. By creating a more effective, consumer-focused collections process, you can maximize your recovery efforts, make more profitable decisions and focus your resources where they’re needed most. Our third-party debt management solutions empower your organization to see the complete behavioral, demographic, and emerging view of customer portfolios through extensive data assets, debt collection predictive analytics innovative platforms. For more insights to strengthen your debt collection strategy, download our tip sheet. Access tip sheet

Consumer debt topped $17 trillion in the first quarter of 2023 — an increase of almost $3 trillion compared to 20191 — with challenging inflation levels, increases in consumer demand and low unemployment levels leading consumers to spend.2 A significant portion of mortgages, auto loans and leases, credit card debt and student loans aren't paid on time. Recent data reveals that 2.6 percent of accounts in the U.S. are delinquent1, with 175 million consumer credit reports showing past-due accounts.3 More debt means more pressure on collection agencies, requiring effective strategies to collect on delinquent accounts. Implementing effective debt collection strategies is especially crucial in the face of challenges like staff shortages, regulatory pressures and the declining success of outbound calling.4 The approach to successful debt collection has changed. Debt collectors and agencies that implement these debt collection techniques and debt recovery tools can improve their performance and bottom line. Debt collection techniques that work Leverage data Outdated approaches to collections ignore consumer contact preferences. Research shows that credit card customers with overdue balances prefer to be contacted via email or text (SMS) over phone calls. Among those with low credit scores and balances under $1,000, 56% preferred emails compared to 18% who preferred to be contacted about their delinquent debt over the phone.5 Data analytics allow you to segment customers based on the amount owed, payment histories, credit scores and past behaviors. This information makes it easier to target those most likely to repay their debt and offer personalized, pre-approved debt solutions. Customers with delinquent debt who preferred digital contact over traditional channels, like phone and mail, were up to 30% more likely to make a payment when debt collectors made contact through a digital channel.4 By leveraging data and analytics, you can create a contact management strategy that increases efficency and profitability. Embrace automation Using digital tools can help streamline the debt collection process. Automation, data, analytics and artificial intelligence (AI) make it easier to create customer profiles and enhance account prioritization.4 Incorporating self-service debt collection options is also essential. Customers want to learn about their options, set up their payment terms and repayment schedules and address their debt at a convenient time via their preferred platform. Digital approaches can be helpful when recovering payments on accounts that are more than 30 days overdue. Research shows that 73% of customers contacted via digital channels for overdue accounts made at least a partial payment compared with just 50% who were contacted via traditional channels.6 Overall, digital-first approaches have been linked to a 25% increase in the resolution of accounts that are more than 30 days past due, a 15% reduction in collections cost and customer engagement levels that are five times higher than traditional collections methods.7 Investments in automation and other digital tools are necessary to replace outdated methods of debt collection that don’t put customers first or place an extra burden on staff. Prioritize the customer experience Leveraging data for customer segmentation is not the only way debt collectors can increase recovery rates. Delivering personalized debt solutions that are proactive, fair and customer-focused is also essential to achieving higher recovery returns.5 Predictive analytics provide insight into customer behavior, making it easier to identify those who need additional support and allowing debt collectors to be responsive to their needs.5 Collections used to be a linear process, but with customer migration to digital — with 64% of consumers using more than four devices per day — collectors need to rethink their approach.8 Consumers expect convenient interactions and relevant communications. Debt collectors that prioritize omnichannel communications can make debt repayment more convenient, resulting in improved customer retention. Remain compliant Digital tools have made it easier for debt collectors to connect with consumers, but legal compliance is still essential. In 2021, the Consumer Finance Protection Bureau (CFPB) passed Regulation F (Reg F) to govern electronic communications for debt collections. The regulations state that electronic communication, including email, text messages and social media, are allowed with direct consent from the consumer; limits on call frequencies do not apply to electronic communications but contacting consumers at inconvenient times and general harassment are still prohibited. Opt-out notices that are clear and prominent are required in all electronic communications.9 Predictive analytics and process automation can also play a role in minimizing regulatory risk by reducing gaps in the contact strategy and helping debt collectors avoid fines. Debt collectors face significant challenges in recovering delinquent debt. A digital-first strategy that prioritizes the customer experience while remaining compliant is essential. Why partner with Experian Increased automation, self-service processes and individualized approaches allow you to focus on accounts with the greatest recovery potential while minimizing charge-offs and ensuring compliance. Implementing an efficient and effective collections prioritization strategy can require a lot of work, but you don’t have to go at it alone. Experian offers various debt collection solutions that can help optimize processes and free up your organization’s resources and agents’ time. Learn more about our debt collection techniques 1Federal Reserve Bank of New York. “Quarterly Report on Household Debt and Credit." 2Experian. “Average Consumer Debt Levels Increase in 2022."Published February 24, 2023. Accessed July 31, 2023.3Consumer Financial Protection Bureau. “Market Snapshot: An Update on Third-Party Debt Collections Tradelines Reporting.” Published February 2023. Accessed July 31, 2023.4McKinsey & Company. “Going digital in collections to improve resilience against credit losses.” Published April 29, 2019. Accessed July 31, 2023.5EY. “Five ways banks can transform their collections processes.” Published November 19, 2020. Accessed July 31, 2023.6McKinsey & Company. “The customer mandate to digitize collections strategies." Published July 29, 2019. Accessed July 31, 2023.7McKinsey & Company. “Holistic customer assistance through digital-first collection.” Published May 21, 2021. Accessed July 31, 2023.8Consumer Finance Protection Bureau. “1006.6 Communications in connection with debt collection." Published November 30, 2021. Accessed July 31, 2023

This article was updated on August 9, 2023. Debt collections can be frustrating — for both consumers and lenders alike. Coupled with ever-changing market conditions and evolving consumer expectations for their digital experience, lending institutions and collections agencies must develop the right collections strategies to reduce costs and maximize recovery rates. How can they do this? By following the three Cs — communication, choice and control. Communication To increase response rates and successfully retrieve payments, lenders must cater to consumers’ preferences for communication, or more specifically, make the right type of contact at the right time. With debt collection predictive analytics, you can gain a more holistic view of consumers and further insight into their behavioral and contact channel preferences. This way, you can better assess an individual's propensity to pay, determine the best way and time to reach them and develop more personalized treatment strategies. Control Debt collection solutions that provide a more comprehensive customer view can also give individuals greater control as they’re able to engage with collectors via a channel that may be easier or more comfortable for them than a phone call, such as email, text or chatbots. Providing consumers with various options is especially important as 81% think more highly of brands who offer multiple digital touchpoints. To further improve your methods of communication, consider streamlining monotonous processes with collection optimization. By automating repetitive tasks and outreach, you can reduce errors and free up your agents’ time to focus on accounts that need more attention, creating a customer-centric collections experience. Choice Ultimately, the success of collections initiatives relies heavily on how well collection practices are accepted and adopted by the end user. Consumers want to make informed decisions and want to be offered choices – therefore giving them more control in a decision-making process and with their finances. “Consumers have made a monumental shift to digital. To enhance your collections performance, it is critical to engage consumers in the method and channel of their choosing,” said Paul Desaulniers, Head of Scoring, Alternative Data and Collections at Experian. Lending institutions and third-party collection agencies that are able to communicate across all consumer channels will see more success in their collections strategies. Are your debt collection tactics and strategies up-to-par? READ: Strengthening Your Debt Collection Strategy Improve your collections strategy By catering to consumers’ communication preferences, giving them control and offering them choices, financial institutions and collections agencies can more effectively reach their customer base, with less effort. It’s a win-win for all. Experian offers various debt management and collections systems that can help you optimize processes, reduce costs and increase recovery rates. To get started, visit us today. Learn more

It's easy to ignore a phone call—especially from an unknown number—or delete an email without looking past the subject line. Even physical letters get thrown out without being opened. But nearly everyone will quickly open and read a text. Surveys have repeatedly found text message open rates can range from around 90 to 98 percent. And now, debt collectors that are serious about streamlining operations and connecting with consumers via their preferred channel can integrate text messaging into their process. Learn more Using text messages in debt collection It's been a couple of years since the Consumer Financial Protection Bureau (CFPB) revised Regulation F, which implements the Fair Debt Collection Practices Act (FDCPA). The ruling was effective starting November 2021 and confirmed that debt collectors could use emails, text messages and other digital communication channels. Businesses in many other industries have been communicating with customers by text for years. At a high level, the changes to Regulation F allow debt collectors to add new outreach methods to their debt collection tools. However, even with the go-ahead to communicate via text, strategy and compliance must be top of mind. WATCH: Webinar: Keeping pace with collections compliance changes The move to digital debt collections Incorporating text messaging could be part of a larger shift toward digitizing operations. Some debt collection agencies are also using artificial intelligence, big data and automation to help verify consumers' contact information, assist call center agents and follow up with consumers. As the Experian 2022 Global Insights Report reports, 81 percent of consumers think more highly of brands if they have a positive online experience with that brand that involves multiple digital touchpoints. And over half of consumers trust organizations that use AI.1 Your website or mobile app is an important starting point. And digital tools, such as chatbots that can answer common questions and virtual negotiators offering payment plans, could be part of that experience. Your automated and manual text message outreach could also be increasingly important in the coming years. The benefits of debt collection text messages A text message strategy can be part of an omnichannel approach, and it offers debt collectors a few distinct benefits: Get direct access to consumers who will likely see and read your messages. Allow consumers to respond and ask questions via a channel that may be easier or more comfortable for them than a phone call. Start a two-way dialogue and build rapport. Save time by texting multiple consumers simultaneously and automating responses to common questions. However, collection agencies also need to beware of the potential drawbacks. Consumers might see your texts as a nuisance if you frequently send messages or if you're messaging people who truly can't afford a payment right now. Many consumers are also rightly wary of scammers texting them and asking them to click on a link. You'll want to carefully think through your messaging strategy. Starting by getting consent to send a text message while you're on the phone or when the consumer fills out a form online—and then immediately sending a text with an opt-in—can help overcome this potential barrier. How to leverage debt collection text messages Sending payment requests via text to consumers who have a high propensity to repay, and including a link to self-service payment portals, could offer a quick and easy win. However, it may be best to think through how you'll use text messaging to optimize your outreach rather than replace other communication channels. WATCH: Webinar: Adapting to the new collections landscape Perhaps you've spoken directly with someone and helped them set up a payment plan. You could now use automated texts to remind them of upcoming payment due dates and thank them for their payments. It's a simple way to test the water without sending debt collection-related messages that may fall under stricter regulatory requirements. Staying compliant while texting As part of a highly regulated industry, debt collection agencies must consider compliance. And it's especially important to consider when trying new technology that directly interacts with consumers. Laws and rulings may change, and it's important to consult your counsel before making any decisions or implementing a text message strategy. However, at a high level, the Regulation F requires debt collectors to: Prioritize capturing consent.You must obtain direct consent from a consumer or indirect consent from an original creditor that got the consumer's consent. The initial communication before sending a text or email must be written. Debt collectors that use specific procedures for obtaining consent may receive safe harbor protections against inadvertent disclosures to third parties. Make opting out easy. You must send consumers a clear and conspicuous opt-out notice and offer them a reasonable and simple method to opt out of text messaging or other electronic communications. Debt collectors must identify when they receive an opt-out request, even if the request doesn't follow their specific instructions. For example, if a consumer sends “end," you may need to recognize that as an opt-out even if your opt-out instructions tell them to send “stop." Continue complying with FDCPA harassment guidelines. There's no specific federal limit on how often you can text consumers. However, you'll still need to comply with the FDCPA's general rules regarding harassment and contacting consumers at convenient times. In general, you may want to send texts between 8 a.m. and 9 p.m. local time (for the consumer), unless they request a different time. Limiting how many texts you send can also improve consumers' experiences and may lead to better long-term results. Reconfirm consent every 60 days. Even if consumers don't opt out, the implied or expressed consent you received could only be valid for 60 days. To continue texting a consumer, you may need to have them reconfirm their consent or use a complete and accurate database to confirm that their phone number was not reassigned.2 You may also be subject to more stringent state or local laws. For instance, Washington State laws might prohibit debt collectors from sending more than two texts in a day.3 And Washington, D.C. forbids debt collectors from initiating communications with consumers via written or electronic communications (including text messages) during and for at least 60 days following a public health emergency. READ: A Digital Debt Collection Future: Maximizing Collections and Staying Compliant Partnering with Experian Experian offers access to vast data sources, skip tracing tools for collections and advanced analytical capabilities that help debt collectors move into the digital age. From optimizing outreach with the AI-driven Experian Decisioning to verifying real-time phone ownership using Phone Number ID™ with Contact Monitor™, you can integrate the latest technology while remaining compliant. You can then decide the best ways to use text messages, or other electronic communication methods, to make profitable decisions and maximize recovery rates. Learn more about Experian's debt collection solutions. ¹Experian. (April 2022). Experian 2022 Global Insights Report ²Consumer Financial Protection Bureau. (2023). 1006.6 Communications in connection with debt collection. ³Washington State Legislator. (2023). RCW 19.16.250 Prohibited practices

As economic conditions shift and consumer behavior fluctuates, first- and third-party debt collectors must adapt to continually maintain effective debt collection strategies. In this article, we explore collections best practices that can empower collectors to improve operational efficiency, better prioritize accounts and enhance customer interactions, all while ensuring compliance with changing regulations. Best practices for improving your collection efforts 1. Implement a data-driven collection strategy Many collectors are already using artificial intelligence (AI) and machine learning (ML) to gain a more complete view of their consumers, segment accounts and create data-driven prioritization strategies. The data-backed approach is clearly a trend that's going to stick. But access to better (i.e., more robust and hygienic) data and debt collection analytics will distinguish the top performers.You can use traditional credit data, alternative credit data, third-party data and advanced analytics to more precisely segment consumers based on their behavior and financial situation — and to determine their propensity to pay. Supplementary data sources can also help with verifying consumers' current contact information and improving your right-party contact rates.Cloud-based platforms and access to various data sources give debt collectors real-time insights. Quickly identifying consumers who may be stretched thin or trending in the wrong direction allows you to proactively reach out with an appropriate pre-collection plan.And for consumers who are already delinquent, the more precise segmentation and tracking can help you determine the best contact channels, times and personalized treatments. For instance, you could optimize outreach based on specific account details (rather than general time-based metrics) and offer payment plans that the customer can likely afford. 2. Use technology to maximize your resources Data-driven prioritization strategies can help you determine who to contact, how to contact them and the treatment options you offer. But you may need to invest in technology to efficiently execute these findings. Although budgets may be limited, the investment in debt recovery tools can be important for handling rising account volumes without increasing headcount. Some opportunities include: Automate processes and outreach: Look for opportunities to automate tasks, particularly monotonous tasks, to reduce errors and free up your agents' time to focus on more valuable work. You could also use automated messages, texts, chatbots and virtual negotiators with consumers who will likely respond well to these types of outreaches. Establish self-service platforms: Create self-service platforms that give consumers the ability to choose how and when to make a payment. This can be especially effective when you can accurately segment consumers based on the likelihood that they'll self-cure and then automate your outreach to that segment. Keep consumer data up to date: Have systems in place that will automatically verify and update consumers' contact information, preferences and previous collection attempts. Reprioritize old accounts based on significant changes: Tools like Experian's Collection Triggers℠ allow you to monitor accounts and automatically get alerted when consumers experience a significant change, such as a new job, that could prompt you to put their account back into your queue. 3. Prioritize customer experience In some ways, debt collectors today often work like marketers by embracing digital debt collection and a customer-first philosophy to improve the consumers' experiences. Your investment in technology goes together with this approach. You'll be able to better predict and track consumers' preferences and offer self-cure options for people who don't want to speak directly with an agent. You also may need to review your regular onboarding and training programs. Teaching your call center agents to use empathy-based communication techniques and work as a partner with consumers to find a viable payment plan can take time. But the approach can help you build trust and improve customer lifetime value. 4. Continue to carefully monitor regulatory requirements Keeping up with regulatory requirements is a perennial necessity for collectors, and you'll need to consider how to stay compliant while adding new communications channels and storing consumer data. For example, make sure there are “clear and conspicuous" opt-out notices in your electronic communications and that your systems can track which channels consumers opt out of and their electronic addresses.1In some cases, the customer-first approach may help minimize regulatory risks, as you'll be training agents to listen to consumers and act in their interest. Similarly, data-driven optimizations can help you increase collections with fewer contacts.WATCH: Explore credit union collection trends and successful account management strategies. Partner with a top provider to achieve success Experian has partnered with many debt collectors to help them overcome challenges and increase recovery rates. There are multiple solutions available that you can use to improve your workflow: TrueTrace™ and TrueTrace Live™: Leverage access to the consumer credit database that has information on over 245 million consumers, and additional alternative databases, to maintain current addresses and phone numbers. PriorityScore for Collections ℠ Know which accounts you should focus on with over 60 industry-specific debt recovery scores. You can choose to prioritize based on likelihood to pay or expected recovery amount. Collection Triggers℠: Daily customer monitoring can tell you when it's time to approach a consumer based on life events, such as new employment or recent credit inquiries. Phone Number ID™ with Contact Monitor™: Increase right-party contact rates and avoid Telephone Consumer Protection Act (TCPA) violations with real-time phone ownership and type monitoring from over 5,000 local exchange carriers. Experian's PowerCurve® Collections and Experian® Optimize solutions also make AI-driven automated systems accessible to debt collectors that previously couldn't afford such advanced capabilities. Building on Experian's access to many sources of credit and non-credit data, these solutions can help you design debt collection strategies, predict consumer behavior and automate decisioning.Learn more about Experian's debt collection solutions. Learn more

The economic volatility of the last several years has left local, state, and even federal budgets tighter than usual, meaning agencies must collect every dollar owed and do it efficiently. So how do agencies continue to deliver the services citizens expect and have given their tax dollars to support? It starts with an efficient, effective collections strategy. The need for collections An important source of revenue for many government agencies is overdue obligations. These might include: Business, personal, and property taxesChild supportFinesCourt fees By collecting on these obligations – and doing so efficiently – agencies can better fund themselves to serve their citizens. Debt collections process While many agencies are, at least initially, responsible for their debt management efforts, there are many layers to the collections process. Step 1: The agency manages the collections process independently (manually or automatically). Step 2: The Bureau of Fiscal Service takes over servicing delinquent debts and work with the debtor to pay it, suspend it, or end collections efforts. Step 3: The debt may be sent to a Private Collection Agency (PCA). Better collections with better data To collect effectively, agencies need to prioritize and streamline debt assessment and collection, which starts with better data. First, better data – like the data provided via skip tracing – enables better management of data surrounding moves, name changes, changes in marital status, and more, all of which makes for better collections efforts. Second is prioritizing collections efforts to focus on those citizens with the best ability to repay, making the most of existing resources and leveraging automated tools where available. Third is keeping collections efforts compliant with all rules and regulations, which is made easier with the right partner. How Experian can help Experian assists organizations of all shapes and sizes to monitor, segment, and prioritize receivable accounts. We leverage timely and relevant information for greater insight into skip tracing, identify the best times for collections efforts, and monitor, measure, test, and refine strategies to maximize results. To learn more about how Experian can help your agency maximize your collections efforts, visit us or request a call. Learn more