Tag: fraud prevention

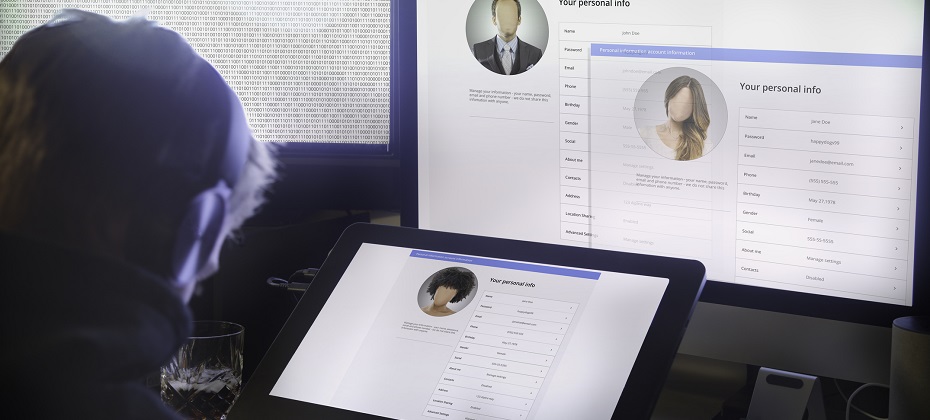

Sometimes logging into an account feels a bit like playing 20 questions. Security is vital for a positive customer experience, and engaging the right identity verification strategies is essential to proactive fraud prevention. For financial institutions and businesses, secure authentication is more important than ever. It is imperative for customer safety – which drives retention and loyalty – and your bottom line – as fraud has determinantal effects on and off the balance sheet. Information sharing has proliferated, as has the number of times consumers are prompted to provide access to sensitive information. While today’s consumer has grown accustomed to providing such information, there’s also a heightened demand for security. According to Experian’s 2023 U.S. Identity and Fraud Report, nearly two-thirds (64%) of consumers say they’re very or somewhat concerned with online safety, listing identity theft, stolen card information and online privacy as top concerns. Customers want to know who they are providing access to and whether that entity will have their safety in mind. From a business perspective, one way to ensure that only the right people can get in is by using (KBA). KBA takes traditional authentication methods, like passwords and Personal Identification Numbers (PINs), one step further by creating an additional layer of security through collecting private facts from each user. In this post, we'll look at how KBA works, what its benefits are as a form of identity verification, and how it can improve customer trust. Introducing Knowledge Based Authentication (KBA): What it is and how it works Knowledge Based Authentication can be part of a multifactor authentication solution and is one way to stay on top of privacy and security for your customers – existing and new. KBA is a feature designed to protect online accounts by verifying the account holder’s identity. It involves answering a series of personal questions, such as mother's maiden name or first pet's name, that only the account holder should know. This system has become increasingly popular due to its effectiveness in preventing fraud and identity theft. With KBA, businesses and individuals can have peace of mind that their information is protected by a reliable authentication system that is difficult for unauthorized users to breach. Benefits of implementing KBA and a multifactor authentication strategy By implementing KBA into your business, customers experience an additional layer of security by verifying the identity of users through personalized questions. This reduces the risk of fraud and enhances customer trust and confidence. Secondly, it improves the customer experience by making the authentication process faster and user-friendly. Lastly, KBA reduces costs by automating the authentication process and reducing the need for manual intervention. However, KBA is just one facet of an ideal strategy. Multifactor authentication provides confidence while reducing friction. Risk-based authentication tools allow organizations to assess risk to apply the appropriate level of security. Factors to consider adding to your authentication processes include: Generating unique one-time passwords (OTPs): By creating a new OTP for each transaction, you can increase the level of security. Confirm device ownership: A multifactored approach applies device intelligence checks to increase confidence that the message is reaching the correct user. Maintain low friction with secondary options: If the OTP fails or can’t be attempted by the user, working with a provider who allows an automatic default to another authentication service, such as a knowledge-based authentication solution, decreases end-user friction. Identifying potential security risks associated with KBA KBA relies on personal information that may easily be discovered via social media and other public records, which makes it vulnerable to fraud and identity theft. This highlights the need for a multilayered fraud and identity solution. The landscape of digital security is constantly changing, leveraging an arsenal of fraud and identity prevention strategies, like document verification, one-time passcode, and various identity authentication and verification measures, is critical for keeping your customers and business safe. Commonly used technologies for enhancing KBA security With the rising need for secure authentication, KBA systems have become increasingly popular. However, cyberthreats evolve at an alarming rate, making it imperative to stay current with the latest fraud schemes and how to enhance and supplement your security. Biometrics, like facial recognition and fingerprint scans, as a tactic is gaining traction, as evidenced by “85% of consumers report physical biometrics as the most trusted and secure authentication method they have recently encountered,” according to Experian’s 2023 U.S. Identity and Fraud Report. Additionally, machine learning algorithms detect patterns and anomalies in user behavior and flag any potential security breaches. Multi-factor authentication is another tool that adds an extra layer of security by requiring users to provide multiple forms of identification before logging in. Keeping up with these and other technological advancements can help ensure your KBA system stays one step ahead of potential cyberattacks. Interestingly, there’s a disconnect between the technologies consumers feel safe with and/or are prepared to use versus the technologies and strategies that organizations implement. According to the U.S. Identity and Fraud Report, biometrics are only currently used by 33% of businesses to detect and protect against fraud. An opportunity for business differentiation and driving customer loyalty through a better customer experience may be tapping into some of these lesser used – but sought after – technologies. Compliance with industry standards regarding KBA Ensuring that your system complies with industry standards regarding KBA is crucial for protecting sensitive information from unauthorized access. By implementing the following tips, you can stay ahead of the game and safeguard your organization's data. Analyze your system's current authentication methods and evaluate if they meet industry standards. Additionally, follow standard guidelines for data storage and encryption, limit access to only authorized personnel, and y current with regulations. Lastly, conduct frequent security audits and perform vulnerability tests to identify and address any potential threats. Knowledge-based authentication offers a robust security solution for businesses of all sizes, and incorporating KBA as part of a multifactor authentication strategy is a winning course of action. It provides an added layer of protection for personal data, encourages user accountability, and safeguards against unauthorized access. By leveraging appropriate KBA technologies and maintaining compliance with industry standards, it is possible to create a secure system for customers that gives you peace of mind for your business and bottom line. Experian can help you with knowledge-based authentication offerings, a multifactor authentication strategy and everything in between to enhance your existing authentication process without causing user fatigue. Increase your pass rates, confirm device ownership and add security to risky or high-value transactions, all while executing identity verification and fraud detection to protect your business from risk. The most important step is getting started. Learn more

It's that magical time of the year! The holiday season is fast approaching, and folks everywhere are gearing up for festive travels and family reunions. Unfortunately, holiday travel can sometimes lead to unforeseen circumstances, such as fraudulent activities orchestrated by scammers who impersonate property owners on well-known vacation rental platforms. These fraudsters employ schemes designed to deceive unsuspecting travelers into making payments through unsecured channels, resulting in significant financial losses for the gullible victims. Digital identity and hotel fraud Airline and hotel fraud encompasses illicit activities aimed at airlines, hotels, booking platforms, and other travel accommodation services, including car rentals and excursions. These services often utilize loyalty programs to incentivize repeat patronage through point-based rewards. The widespread adoption of such loyalty programs has extended their appeal beyond the travel and hospitality sectors, consequently attracting fraudulent activities. Perpetrators of airline and hospitality fraud employ a range of tactics and different techniques to execute their schemes, leveraging various online forums, marketplaces, shops, and public messaging platforms. Hotels are custodians of valuable guest data, encompassing contact information and payment details. Their operational model involves serving a large pool of potential customers who are making limited visits. Consequently, compromising a hospitality employee's account could grant an identity thief access to millions of consumer records. Moreover, hotel employees are frequent targets of foreign governments aiming to procure confidential travel records to facilitate the tracking of specific individuals and groups. In contrast, restaurants primarily store transaction records with fewer customer details. However, the landscape is evolving as more establishments adopt online ordering capabilities and loyalty programs. At present, cybercriminals typically focus on the high volume of point-of-sale transactions. As travel booms, fraudsters find new paths According to a recent Deloitte survey, Intent to travel between Thanksgiving and mid-January is up across all age and income groups. While reconnecting with friends and family remains paramount to travel during the holidays, fewer Americans are restricting their travel to visiting loved ones. The share of travelers planning to stay in hotels surged to 56%. Fraudsters will always take advantage of current circumstances, and with more people traveling again, they have taken notice — and action. The following techniques have been identified as the most employed by cybercriminals to target customers of airlines, hotels, and hospitality-related organizations: Travel-themed phishing and fraudulent travel agency operations, sales, and advertisements of travel fraud-related tutorials. Sales of compromised networks, user accounts, and databases containing reward/loyalty points and personally identifiable information (PII) that could be utilized for social engineering, money laundering, and other attack vectors. Since the emergence of cyber-enabled crime, services and activities facilitating travel fraud have been extensively promoted and sought after by threat actors. Cybercriminals mainly leverage stolen card-not-present (CNP) data and reward/loyalty points obtained from compromised bank accounts to procure flights, accommodations, and other travel-related services. Furthermore, threat actors persistently refine their strategies for harvesting reward/loyalty points through compromised accounts, deceiving victims into disclosing their travel-related documentation and data and circulating updated guidelines for circumventing hotel and airline reservation services, amongst other activities. Protecting travelers and improving the customer experience Combatting hospitality and hotel fraud requires collaboration between industry stakeholders, government entities, and financial institutions. Travel professionals should focus on: Enhancing data security: Invest in robust cybersecurity measures to protect guest information, payment systems for CNP, and loyalty programs. Implementing identity verification: Utilize advanced technologies, such as biometric authentication and behavioral analytics, to verify guests' identities and prevent account fraud. Educating staff and guests: Provide comprehensive training to employees on recognizing and reporting suspicious activities. Educate guests about potential scams and advise them to book directly through official channels. Sharing information: Establish platforms to share intelligence and best practices to stay ahead of evolving fraud techniques. Acting with the right solution As the travel and hospitality industry continues to thrive, so does the risk of hospitality fraud. Travelers and hoteliers alike must remain vigilant to protect their finances from various fraud schemes prevalent today. By staying informed, taking proactive measures, and fostering collaborative efforts, we can create a safer and more secure environment within the travel industry. Experian’s identity verification solutions power advanced capabilities across the travel lifecycle. With trusted data and advanced analytics, you can gain a complete view of your future guest to improve risk management and offer an enhanced, frictionless customer experience. Learn more *This article leverages/includes content created by an AI language model and is intended to provide general information.

The gig economy — also called the sharing economy or access economy — is an activity where people earn income by providing on-demand work, services, or goods. Often, it is through a digital platform like an application (app) or website. The gig economy seamlessly connects individuals with a diverse range of services, whether it be a skilled handyman for those long-awaited office shelves, or an experienced chauffeur to quickly drive you to the airport to not miss your flight. However, there are instances when these arrangements fall short of expectations. The hired handyman may send a substitute who’s ill-equipped for the task, or the experienced driver takes the wrong shortcut leaving you scrambling to make your flight on time. On the flip side, there are numerous risks faced by those working in the gig/sharing economy, from irritable customers to dangerous situations. In such cases, trust takes a hit. The gig economy has witnessed a surge in recent years, as individuals gravitate towards flexible, freelance, and contract work instead of traditional full-time employment. This shift has unlocked a multitude of opportunities for both workers and businesses. Nevertheless, it has also ushered in challenges pertaining to security and trust. One such challenge revolves around the escalating significance of digital identity verification within the gig economy. Digital identity verification and the gig economy Digital identity verification encompasses validating a person's identity through digital means, such as biometric data, facial recognition, or document verification. Within the gig economy, this process has high importance, as it establishes trust between businesses and their pool of freelance or contract workers. With the escalating number of remote workers and the proliferation of online platforms connecting businesses with gig workers, verifying the identities of these individuals has become more vital than ever before. Protecting gig users and improving the customer experience One primary rationale behind the mounting importance of digital identity verification in the gig economy is its role in curbing fraud. As the gig economy gains traction, the risk of individuals misrepresenting themselves or their qualifications to secure work burgeons. This scenario can lead businesses to hire unqualified or even fraudulent workers, thereby posing severe repercussions for both the company and its customers. By adopting digital identity verification processes, businesses can ensure the legitimacy and competence of their workforce, subsequently decreasing the risk of fraudulent activities. In the digital age, trust and safety are crucial for businesses to succeed. Consumers prioritize brands they can trust, and broken trust can lead to loss of customers.According to Experian's 2023 Fraud and Identity Report, over 52% of US consumers feel they’re more of a target for online fraud than they were a year ago. As such, online security continues to be a real concern for most consumers. Nearly 64% of consumers say that they are very or somewhat concerned with online security, with 32% saying they are very concerned. Establishing trust and safety measures not only protects your brand but also enhances the user experience, fosters loyalty, and boosts your business. Role of a dedicated Trust and safety team Trust and safety are the set of business practices for online platforms to follow to reduce the risk of users being exposed to harm, fraud, or other behaviors outside community guidelines. This is becoming an increasingly important function as online platforms look to protect their users while improving customer acquisition, engagement, and retention. That team also safeguards organizations from security threats and scams. They verify customers' identities, evaluate actions and intentions, and ensure a safe environment for all platform users. This enables both organizations and customers to trust each other and have confidence in the platform. Their role has evolved from fraud prevention to encompass broader areas, such as user-generated content and the metaverse. With the rise of user-generated content, platforms face challenges like fake accounts, imitations, malicious links, and inappropriate content. As a result, trust and safety teams have expanded their focus and are involved in product engineering and customer journey design. Another noteworthy factor contributing to the growing emphasis on digital identity verification for trust and safety teams stems from the necessity to adhere to diverse regulations and laws. Many countries have implemented stringent regulations to safeguard workers and ensure the legal and ethical operations of businesses. In the United States, for instance, businesses must verify the identities and work eligibility of all employees, including freelancers and contractors, as part of the Form I-9 process. By leveraging digital identity verification tools, businesses can streamline these procedures and guarantee compliance with prevailing regulations. Mitigating risk in online marketplaces To mitigate risks in online marketplaces, businesses can take several steps, including creating a clear set of user guidelines, implementing identity verification during onboarding, enforcing multi-factor authentication for all accounts, leveraging reverification during high-risk moments, performing link analysis on the user base, and applying automation. Online identity verification plays a pivotal role in safeguarding gig workers themselves. With the surge of online platforms connecting businesses with freelancers and contractors, there comes an augmented risk of workers falling prey to scams or identity theft. By mandating digital identity verification as an integral part of the onboarding process, these platforms can shield workers and ensure they only engage with bona fide businesses. While automation can be a powerful tool for fraud detection and mitigation, it is not a cure-all solution. Automated identity verification has its strengths, but it also has its weaknesses. While automation can spot risk signals that a human might miss, a human might spot risk signals that automation would have skipped. Therefore, for many companies, the goal should not be full automation but achieving the right ratio of automation to manual review. Manual review takes time, but it's necessary to ensure that all potential risks are identified and addressed. The more efficient these processes can be, the better, as it allows for a quicker response to potential threats. As the number of individuals embracing freelance and contract work surges, and businesses increasingly rely on these workers to carry out vital responsibilities, ensuring the security and trustworthiness of these individuals becomes paramount. By integrating digital identity verification processes, businesses can shield themselves against fraud, comply with regulations, and cultivate trust with their gig workers. Finding the right partner While trust and safety are concerns for all online marketplaces, there’s no universal solution that will apply to all businesses and in all cases. Your trust and safety policies need to be tailored to the realities of your business. The industries you serve, regions you operate in, regulations you are subject to, and expectations of your users should all inform your processes. Experian’s comprehensive suite of customizable identity verification solutions can help you solve the problem of trust and safety once and for all. Learn more *This article leverages/includes content created by an AI language model and is intended to provide general information.

This article was updated on April 23, 2024. Keeping your organization and consumers safe can be challenging as cybercriminals test new attack vectors and data breaches continually expose credentials. Instead of relying solely on usernames and passwords for user identity verification, adding extra security measures like multi-factor authentication can strengthen your defense. What is multi-factor authentication? Multi-factor authentication, or MFA, is a method of authenticating people using more than one type of identifier. Generally, you can put these identifiers into three categories based on the type of information: Something a person knows: Usernames, passwords, and personal information are common examples of identifiers from this category. Something a person has: These could include a phone, computer, card, badge, security key, or another type of physical device that someone possesses. Something a person is: Also called the inherence factor, these are intrinsic behaviors or qualities, such as a person's voice pattern, retina, or fingerprint. The key to MFA is it requires someone to use identifiers from different categories. For example, when you withdraw money from an ATM, you're using something you have (your ATM card or phone), and something you know (your PIN) or are (biometric data) to authenticate yourself. Common types of authenticators Organizations that want to implement multi-factor authentication can use different combinations of identifiers and authenticators. Some authenticator options include: One-time passwords: One-time passwords (OTPs) can be generated and sent to someone's mobile phone via text to confirm the person has the phone or via email. There are also security tokens and apps that can generate OTPs for authentication. (Something you know.) Knowledge-based authentication: Knowledge-based authentication (KBA) identity verification leverages the ability to verify account information or a payment card, “something you have,” by confirming some sequence of numbers from the account. (Something you know.) Security tokens: Devices that users plug into their phone or computer, or hold near the device, to authenticate themselves. (Something you have.) Biometric scans: These can include fingerprint and face scans from a mobile device, computer, or security token. (Something you are.) Why MFA is important It can be challenging to keep your users and employees from using weak passwords. And even if you enforce strict password requirements, you can't be sure they're not using the same password somewhere else or accidentally falling for a phishing attack. In short, if you want to protect users' data and your business from various types of attacks, such as account takeover fraud, synthetic identity fraud, and credential stuffing, you’ll need to require more than a username and password to authenticate users. That’s where MFA comes in. Because it uses a combination of elements to verify a consumer’s identity, if one of the required components in a transaction is missing or supplied incorrectly, the transaction won’t proceed. As a result, you can ensure you’re interacting with legitimate consumers and protect your organization from risk. LEARN MORE: Explore our fraud prevention solutions. How to provide a frictionless MFA experience While crucial to your organization, in-person and online identity verification shouldn’t create so much friction that legitimate consumers are driven away. Experian's 2023 U.S. Identity and Fraud Report found that 96 percent of consumers view OTPs as convenient identity verification solutions when opening a new account. An increasing number of consumers also view physical and behavioral biometrics as some of the most trustworthy recognition methods — 81 and 76 percent, respectively. To create a low friction MFA experience that consumers trust, you could let users choose from different MFA authentication options to secure their accounts. You can also create step-up rules that limit MFA requests to riskier situations — such as when a user logs in from a new device or places an unusually large order. To make the MFA experience even more seamless for consumers, consider adding automated identity verification (AIV) to your processes. Because AIV operates on advanced analytics and artificial intelligence, consumers can verify their identities within seconds without physical documentation, allowing for a quick, hassle-free verification experience. How Experian powers multi-factor authentication Experian offers various identity verification and risk-based authentication solutions that organizations can leverage to streamline and secure their operations, including: Experian’s CrossCore® Doc Capture confidently verifies identities using a fully supported end-to-end document verification service where consumers upload an image of a driver’s license, passport, or similar directly from their smartphone. Experian’s CrossCore Doc Capture adds another layer of security to document capture with a biometric component that enables the individual to upload a “selfie” that’s compared to the document image. Experian's OTP service uses additional verification checks and identity scoring to help prevent fraudsters from using a SIM swapping attack to get past an MFA check. Before sending the OTP, we verify that the number is linked to the consumer's name. We also review additional attributes, such as whether the number was recently ported and the account's tenure. Experian's Knowledge IQSM offers KBA with over 70 credit- and noncredit-based questions to help you engage in additional authentication for consumers when sufficiently robust data can be used to prompt a response that proves the person has something specific in their possession. You can even configure it to ask questions based on your internal data and phrase questions to match your brand's language. Learn more about how our multi-factor authentication solutions can help your organization verify consumer identities and mitigate fraud. Learn about our MFA solutions

This article was updated on November 9, 2023. Account takeover fraud is a huge, illicit business in the United States with real costs for consumers and the organizations that serve them. In fact, experts predict that by the end of 2023, account takeover losses will be over $635 billion. With consumers' data, your reputation, and your organization's financial picture on the line, now's the time to learn about account takeover fraud and how to prevent it. What is account takeover fraud? Account takeover fraud is a form of identity theft where bad actors gain unlawful access to a user's online accounts in order to commit financial crimes. This often involves the use of bots. information that enables account access can be compromised in a variety of ways. It might be purchased and sold on the dark web, captured through spyware or malware or even given “voluntarily" by those falling for a phishing scam. Account takeover fraud can do far more potential damage than previous forms of fraud because once criminals gain access to a user's online account, they can use those credentials to breach others of that user's accounts. Common activities and tools associated with account takeover fraud include: Phishing: Phishing fraud relies on human error by impersonating legitimate businesses, usually in an email. For example, a scammer might send a phishing email disguising themselves as a user's bank and asking them to click on a link that will take them to a fraudulent site. If the user is fooled and clicks the link, it can give the hackers access to the account. Credential stuffing/cracking: Fraudsters buy compromised data on the dark web and use bots to run automated scripts to try and access accounts. This strategy, called credential stuffing, can be very effective because many people reuse insecure passwords on multiple accounts, so numerous accounts might be breached when a bot has a hit. Credential cracking takes a less nuanced approach by simply trying different passwords on an account until one works. Malware: Most people are aware of computer viruses and malware but they may not know that certain types of malware can track your keystrokes. If a user inadvertently downloads a “key logger", everything they type, including their passwords, is visible to hackers. Trojans: As the name suggests, a trojan works by hiding inside a legitimate application. Often used with mobile banking apps, a trojan can overlay the app and capture credentials, intercept funds and redirect financial assets. Cross-account takeover: One evolving type of fraud concern is cross-account takeover. This is where hackers take over a user's financial account alongside another account such as their mobile phone or email. With this kind of access, fraudsters can steal funds more easily and anti-fraud solutions are less able to identify them. Intermediary new-account fraud: This type of fraud involves using a user's credentials to open new accounts in their name with the aim of draining their bank accounts. This is only an overview of some of the most prevalent types of account takeover fraud. The rise of digital technologies, smartphones, and e-commerce has opened the door to thieves who can exploit the weaknesses in digital security for their own aims. The situation has only worsened with the rapid influx of new and inexperienced online users driven by the COVID-19 pandemic. Why should you be concerned, now? Now that digital commerce and smartphone use are the norm, information used to access accounts is a security risk. If a hacker can get access to this information, they may be able to log in to multiple accounts.. The risk is no longer centralized; with every new technology, there's a new avenue to exploit. To exacerbate the situation, the significant shift to online, particularly online banking, spurred by the COVID-19 pandemic, appears to have amplified account takeover fraud attempts. In 2019, prior to the pandemic, 1.5 billion records — or approximately five records per American — were exposed in data breaches. This can potentially increase as the number of digital banking users in the United States is expected to reach almost 217 million by 2025. Aite research reported that 64 percent of financial institutions were seeing higher rates of account takeover fraud than before COVID. Unfortunately, this trend shows no sign of slowing down. The increase in first-time online users propelled by COVID has amplified the critical security issues caused by a shift from transaction fraud to identity-centric account access. Organizations, especially those in the financial and big technology sectors, have every reason to be alarmed. The impact of account takeover fraud on organizations Account takeover can be costly, damage your reputation and require significant investments to identify and correct. Protection of assets When we think of the risks to organizations of account takeover fraud, the financial impact is usually the first hazard to come to mind. It's a significant worry: According to Experian's 2023 U.S. Identity and Fraud report, account takeover fraud was among the top most encountered fraud events reported by U.S. businesses. And even worse, the average net fraud loss per case for debit accounts has been steadily increasing since early 2021. The costs to businesses of these fraudulent activities aren't just from stolen funds. Those who offer credit products might have to cover the costs of disputing chargebacks, card processing fees or providing refunds. Plus, in the case of a data breach, there may be hefty fines levied against your organization for not properly safeguarding consumer information. Add to these the costs associated with the time of your PR department, sales and marketing teams, finance department and customer service units. In short, the financial impact of account takeover fraud can permeate your entire organization and take significant time to recoup and repair. Protection of information Consumers rightfully expect organizations to have a solid cybersecurity plan and to protect their information but they also want ease and convenience. In many cases, it's the consumers themselves who engage in risky online behavior — reusing the same password on multiple sites or even using the same password on all sites. These lax security practices open users up to the possibility of multiple account takeovers. Making things worse for organizations, security strategies can annoy or frustrate consumers. If security measures are too strict, they risk alienating consumers or even generating false positives, where the security measure flags a legitimate user. Organizations are in the difficult position of having to balance effective security measures with a comfortable user experience. Reputation When there's a data breach, it does significant damage to your organization's reputation by demonstrating weaknesses in your security. Fraudulent account take-overs can affect the consumers who rely on you significantly and if you lose their trust, they're likely to sever their relationship with you. Large-scale data breaches can sully your organization's reputation with the general public, making consumers less likely to consider your services. How to build an account takeover fraud prevention strategy There are numerous ways to build an account takeover fraud prevention strategy, but to work for your and individual consumers, it must pair robust risk management with a low friction user experience. Here are some of the key elements to an account takeover fraud prevention strategy that hits the right notes. Monitor interactions The risk of account takeover is constant so your monitoring should be as well. A layered, proactive and passive fraud prevention program can monitor your interactions, reduce false positives and keep track of consumers' digital identities. Use the right tools When it comes to fraud prevention, you've got plenty of choices but you'll want to make sure you use the tools that protect you, as well as consumer data, while always providing a positive experience. We use risk-based identity and device authentication and targeted step-up authentication to keep things running smoothly and only pull in staff for deeper investigations where necessary. Automate to reduce manual processes Your organization's fraud prevention strategy likely includes manual processes, tasks that are completed by employees—but humans make mistakes that can be costly. Taking the wrong action, or even no action at all, can result in a security breach. Automated tasks like threat filtering and software and hardware updates can reduce the risk to your organization while improving response time and freeing up your team. Choose a nimble platform Technology changes quickly and so does fraud. You'll need access to a layered platform that lets you move as quickly as the bad actors do. The bottom line You can effectively mitigate against the risk of account takeover fraud and offer consumers a seamless experience. Learn more about account takeover fraud prevention and fraud management solutions. Fraud management solutions

For companies that regularly engage in financial transactions, having a customer identification program (CIP) is mandatory to comply with the regulations around identity verification requirements across the customer lifecycle. In this blog post, we will delve into the essentials of a customer identification program, what it entails, and why it is important for businesses to implement one. What is a customer identification program? A CIP is a set of procedures implemented by financial institutions to verify the identity of their customers. The purpose of a CIP is to be a part of a financial institution’s fraud management solutions, with similar goals as to detect and prevent fraud like money laundering, identity theft, and other fraudulent activities. The program enables financial institutions to assess the risk level associated with a particular customer and determine whether their business dealings are legitimate. An effective CIP program should check the following boxes: Confidently verify customer identities Seamless authentication Understand and anticipate customer activities Where does Know Your Customer (KYC) fit in? KYC policies must include a robust CIP across the customer lifecycle from initial onboarding through portfolio management. KYC solutions encompass the financial institution’s customer identification program, customer due diligence and ongoing monitoring. What are the requirements for a CIP? Customer identification program requirements vary depending on the type of financial institution, the type of account opened, and other factors. However, the essential components of a CIP include verifying the customer's identity using government-issued identification, obtaining and verifying the customer's address, and checking the customer against a list of known criminals, terrorists, or suspicious individuals. These measures help detect and prevent financial crimes. Why is a CIP important for businesses? CIP helps businesses mitigate risk by ensuring they have accurate and up-to-date information about their customers. This also helps financial institutions comply with laws and regulations that require them to monitor financial transactions for any suspicious activities. By having a robust CIP in place, businesses can establish trust and rapport with their customers. According to Experian’s 2024 U.S. Identity and Fraud Report, 63% of consumers say it's extremely or very important for businesses to recognize them online. Having an effective CIP in place is part of financial institutions showing their consumers that they have their best interests top of mind. Finding the right partner It’s important to find a partner you trust when working to establish processes and procedures for verifying customer identity, address, and other relevant information. Companies can also utilize specialized software that can help streamline the CIP process and ensure that it is being carried out accurately and consistently. Experian’s proprietary and partner data sources and flexible monitoring and segmentation tools allow you to resolve CIP discrepancies and fraud risk in a single step, all while keeping pace with emerging fraud threats with effective customer identification software. Putting consumers first is paramount. The security of their identity is priority one, but financial institutions must pay equal attention to their consumers’ preferences and experiences. It is not just enough to verify customer identities. Leading financial institutions will automate customer identification to reduce manual intervention and verify with a reasonable belief that the identity is valid and eligible to use the services you provide. Seamless experiences with the right amount of friction (I.e., multi-factor authentication) should also be pursued to preserve the quality of the customer experience. Putting it all together As cybersecurity threats are becoming more sophisticated, it is essential for financial institutions to protect their customerinformation and level up their fraud prevention solutions. Implementing a customer identification program is an essential component in achieving that objective. A robust CIP helps organizations detect, prevent, and deter fraudulent activities while ensuring compliance with regulatory requirements. While implementing a CIP can be complex, having a solid plan and establishing clear guidelines is the best way for companies to safeguard customer information and maintain their reputation. CIPs are an integral part of financial institutions security infrastructures and must be a business priority. By ensuring that they have accurate and up-to-date data on their customers, they can mitigate risk, establish trust, and comply with regulatory requirements. A sound CIP program can help financial institutions detect and prevent financial crimes and cyber threats while ensuring that legitimate business transactions are not disrupted, therefore safeguarding their customers' information and protecting their own reputation. Learn more

As the sophistication of fraudulent schemes increases, so must the sophistication of your fraud detection analytics. This is especially important in an uncertain economic environment that breeds opportunities for fraud. It's no longer enough to rely on old techniques that worked in the past. Instead, you need to be plugged into machine learning, artificial intelligence (AI) and real-time monitoring to stay ahead of criminal attempts. Your customers have come to expect cutting-edge security, and fraud analytics is the best way to meet — and surpass — those expectations. Leveraging these analytics can help your business better understand fraud techniques, uncover hidden insights and make more strategic decisions. What is fraud analytics? Fraud analytics refers to the idea of preventing fraud through sophisticated data analysis that utilizes tools like machine learning, data mining and predictive AI.1 These services can analyze patterns and monitor for anomalies that signal fraud attempts.2 While at first glance this may sound like a lot of work, it's necessary in today's technologically savvy culture. Fraud attempts are becoming more sophisticated, and your fraud detection services must do the same to keep up. Why is fraud analytics so important? According to the Experian® 2023 US Identity and Fraud Report, fraud is a growing issue that businesses cannot ignore, especially in an environment where economic uncertainty provides a breeding ground for fraudsters. Last year alone, consumers lost $8.8 billion — an increase of 30 percent over the previous year. Understandably, nearly two-thirds of consumers are at least somewhat concerned about online security. Their worries range from authorized push payment scams (such as phishing emails) to online privacy, identity theft and stolen credit cards. Unfortunately, while 75 percent of surveyed businesses feel confident in protecting against fraud, only 45 percent understand how fraud impacts their business. There's a lot of unearned confidence out there that can leave businesses vulnerable to attack, especially with nearly 70 percent of businesses admitting an increase in fraud loss in recent years. The types of fraud that businesses most frequently encounter include: Authorized push payment fraud: Phishing emails and other schemes that persuade consumers to deposit funds into fraudulent accounts. Transactional payment fraud: When fraudulent actors steal credit card or bank account information, for example, to make unauthorized payments. Account takeover: When a fraudster gains access to an account that doesn't belong to them and changes login details to make unauthorized transactions. First-party fraud: When an account holder uses their own account to commit fraud, like misrepresenting their income to get a lower loan rate. Identity theft: Any time a person's private information is used to steal their identity. Synthetic identity theft: When someone combines real and fake personal data to create an identity that's used to commit fraud. How can fraud analytics be used to help your business? More than 85% of consumers expect businesses to respond to their security and fraud concerns. A good portion of them (67 percent) are even ready to share their personal data with trusted sources to help make that happen. This means that investing in risk and fraud analytics is not only vital for keeping your business and customer data secure, but it will score points with your consumers as well. So how can your business utilize fraud analytics? Machine learning is a great place to start. Rather than relying on outdated rules-based analytic models, machine learning can vastly increase your speed in identifying fraud attempts. This means that when a new fraudulent trend emerges, your machine learning software can pinpoint it fast and flag your security team. Machine learning also lets you automatically analyze large data sets across your entire customer portfolio, improving customer experiences and your response time. In general, the best way for your business to use fraud analytics is by utilizing a multi-layered approach, such as the robust fraud management solutions offered by Experian. Instead of a one-size-fits-all solution, Experian lets you customize a framework of physical and digital data security that matches your business needs. This framework includes a cloud-based platform, machine learning for streamlined data analytics, biometrics and other robust identity-authentication tools, real-time alerts and end-to-end integration. How Experian can help Experian's platform of fraud prevention solutions and advanced data analytics allows you to be at the forefront of fraud detection. The platform includes options such as: Account takeover prevention. Account takeovers can go unnoticed without strong fraud detection. Experian's account takeover prevention tools automatically flag and monitor unusual activities, increase efficiency and can be quickly modified to adapt to the latest technologies. Bust-out fraud prevention. Experian utilizes proactive monitoring and early detection via machine learning to prevent bust-out fraud. Access to premium credit data helps enhance detection. Commercial entity fraud prevention. Experian's Sentinel fraud solutions blend consumer and business datasets to create predictive insights on business legitimacy and credit abuse likelihood. First-party fraud prevention. Experian's first-party fraud prevention tools review millions of transactions to detect patterns, using machine learning to monitor credit data and observations. Global data breach protection. Experian also offers data breach protection services, helping you use turnkey solutions to build a program of customer notifications and identity protection. Identity protection. Experian offers identity protection tools that deliver a consistent brand experience across touchpoints and devices. Risk-based authentication. Minimize risk with Experian's adaptive risk-based authentication tools. These tools use front- and back-end authentication to optimize cost, risk management and customer experience. Synthetic identity fraud protection. Synthetic identity fraud protection guards against the fastest-growing financial crimes. Automated detection rules evaluate behavior and isolate traits to reduce false positives. Third-party fraud prevention. Experian utilizes third-party prevention analytics to identify potential identity theft and keep your customers secure. Your business's fraud analytics system needs to increase in sophistication faster than fraudsters are fine-tuning their own approaches. Experian's robust analytics solutions utilize extensive consumer and commercial data that can be customized to your business's unique security needs. Experian can help secure your business from fraud Experian is committed to helping you optimize your fraud analytics. Find out today how our fraud management solutions can help you. Learn more 1 Pressley, J.P. "Why Banks Are Using Advanced Analytics for Faster Fraud Detection," BizTech, July 25, 2023. https://biztechmagazine.com/article/2023/07/why-banks-are-using-advanced-analytics-faster-fraud-detection 2 Coe, Martin and Melton, Olivia. "Fraud Basics," Fraud Magazine, March/April 2022. https://www.fraud-magazine.com/article.aspx?id=4295017143

In this article...Fraud fueled by real-time paymentsReimbursement is vital to victimsAuthorized push payment fraud preventionTaking the next steps with the right partner Authorized Push Payment fraud, also known as APP fraud or APP scams, involves a fraudster persuading a victim to willingly deposit funds to their account or to the account of a complicit third party, also known as a money mule. This type of fraud often includes social engineering of the victim using fake investment schemes, impersonation scams, purchase scams or other schemes. Social engineering clouds victims' judgments and encourages them to make payments willingly to one or more money mules, with funds eventually reaching fraudsters' accounts. This type of fraud has become more attractive to criminals since the advent of real-time payment systems, which are now a reality worldwide. Fraud fueled by real-time payments Authorized push payment fraud is becoming more prevalent, and it is imperative that you know how to detect and prevent it to safeguard your organization. Real-time payment systems, such as Faster Payments in the United Kingdom (UK), PIX in Brazil, the New Payments Platform in Australia, and FedNow in the USA, make real-time payment fraud a reality. APP fraud is notoriously difficult for banks to prevent because the victim is sending the money themselves, and steps that banks take to authenticate customers are ineffective, as the customer will pass identity checks. The victims cannot reverse a payment once they realize they have been conned, as payments made using real-time payment schemes are irrevocable. APP fraud is particularly prevalent in countries where banks have an infrastructure that facilitates fast or immediate transfers, like the UK. Reimbursment is vital to victims Some common types of authorized push payment fraud include attacks on individuals like romance scams, family emergency swindles, targeting property transactions, and intercepting supplier payments. To protect against APP fraud, it is important to employ layered fraud protection across all products and channels used to manage real-time payments. But that alone is not enough. Reimbursement is vital in reversing the financial distress caused by APP scams, but it cannot reverse the emotional distress these scams cause. Prevention, detection, and awareness measures must be moved up on the agenda for banks, non-traditional lenders, PSPs (Payment Service Providers), and customers alike to ensure that the customer is protected at every stage of the payment journey. Effective alerts are a key focus area for preventing customers from falling victim to APP scams. An effective warning is one that is dynamic and tailored to the customer’s payment journey. Recent research indicates that minor changes to notifications across banking apps can have the potential to drastically reduce the number of individuals that fall victim to APP fraud. The biggest effects were achieved when a combination of risk-based and Call to Action (CTA) warnings were implemented over a period of time. A collective effort across the banking industry and beyond is crucial to protect customers and tackle the fight against APP fraud. Banks, non-traditional lenders, and PSPs can raise awareness to educate their customers on the signs and risks of APP scams, and work with industry oversight bodies to commit to voluntary standards and codes to ensure good customer outcomes. Online forums, social media platforms, and influential voices also have a role to play in raising awareness of and preventing scams. Customers can also help by being vigilant and reading and acting upon warnings and information presented to them. Authorized push payment fraud prevention To effectively combat authorized push payment fraud, financial institutions must implement a range of measures, including: Direct communication with consumers. Enhanced transaction monitoring. Effective risk mitigation and management. Improved employee education. Public awareness campaigns. In response to this growing threat, banks have introduced various checks and balances, such as the Confirmation of Payee (CoP) service in the UK, which cross-references bank details with the account holder's name when processing online payments. Banks are also leveraging sophisticated fraud prevention software stacks, incorporating machine learning and contextual data to identify and flag suspicious transactions. By utilizing AI technologies, financial institutions can process data points faster and enhance their fraud detection capabilities, mitigating identity risk and safeguarding customer accounts. Clear communication with customers is essential in the fight against APP fraud. Higher-risk companies now include warnings in their communications, advising customers not to act on messages that request payment into new bank accounts. Financial institutions can also offer cool-off periods before payments are sent, increase due diligence around payment destinations, and monitor accounts that regularly receive high-value payments. Additionally, financial institutions can play a crucial role in educating their customers and promoting awareness around this increasingly common type of fraud. By combining these approaches with robust fraud prevention software, the public can fight against this type of fraudulent attack. Taking the next steps with the right partner At Experian, we offer rich data sources, advanced analytics capabilities, and the consultancy services needed to rapidly adopt data analytics solutions that mitigate fraud risks. Our solutions are used by PSPs of all types and sizes – including some of the largest banks – to identify potentially fraudulent customers and transactions, and to ensure that action is taken in real time to prevent fraudulent payments being made. Learn more about our fraud management solutions

In financial crime, fraudsters are always looking for new avenues to exploit. The mortgage industry has traditionally been a primary target for fraudsters. But with the 30-year fixed-mortgage rate average above 7.19% for the month of September, it has caused an inherent slowdown in the volume of home purchases. As a result, criminals are turning to other lucrative opportunities in mortgage transactions. They have evolved their techniques to capitalize on unsuspecting homeowners and lenders by shifting their focus from home purchases to Home Equity Line of Credit (HELOC), as they see it as a more compelling option. Understanding mortgage fraud Mortgage fraud occurs when individuals or groups intentionally misrepresent information during the mortgage application process for personal gain. The most common forms of mortgage fraud include income misrepresentation, false identity, property flipping schemes, and inflated property appraisals. Over the years, financial institutions and regulatory bodies have implemented robust measures to combat such fraudulent activities. As the mortgage industry adapts to counter established forms of fraud, perpetrators are constantly seeking new opportunities to circumvent detection. This has led to a shift in fraud trends, with fraudsters turning their focus to alternative aspects of the mortgage market. One area that has captured recent attention is HELOC fraud, also known as home equity loan fraud. HELOC fraud: An attractive target for fraudsters What is a HELOC? HELOCs are financial products that allow homeowners to borrow against the equity in their homes, often providing flexible access to funds. While HELOCs can be a valuable financial tool for homeowners, they also present an attractive opportunity for fraudsters due to their unique characteristics. HELOC fraud schemes An example of a home equity loan fraud scheme is a fraudster misrepresenting himself to deceive a credit union call center employee into changing a member’s address and phone number. Three days later, the fraudster calls back to reset the member’s online banking password, allowing the fraudster to login to the member’s account. Once logged in, the fraudster orders share drafts to be delivered to the new address they now control. The fraudster then forges three share drafts totaling $309,000 and funds them through unauthorized advances against the member’s HELOC through online banking platforms. Why HELOCs are becoming the next target for mortgage fraud Rising popularity: HELOCs have gained significant popularity in recent years, enticing fraudsters seeking out opportunities with larger potential payouts. Vulnerabilities in verification: The verification process for HELOCs might be less rigorous than traditional mortgages. Fraudsters could exploit these vulnerabilities to manipulate property valuations, income statements, or other critical information. Lack of awareness: Unlike conventional mortgages, there may be a lack of awareness among homeowners and lenders regarding the specific risks associated with HELOCs. This knowledge gap can make it easier for fraudsters to perpetrate their schemes undetected. Home equity loans do not have the same arduous process that traditional first mortgages do. These loans do not require title insurance, have less arduous underwriting processes, and do not always require the applicant to be physically present at a closing table to gain access to cash. The result is that those looking to defraud banks can apply for multiple HELOC loans simultaneously while escaping detection. Prevention and safeguards There are several preventive measures and fraud prevention solutions that can be established to help mitigate the risks associated with HELOCs. These include: Education and awareness: Homeowners and lenders must stay informed about the evolving landscape of mortgage fraud, including the specific risks posed by HELOCs. Awareness campaigns and educational materials can play a significant role in spreading knowledge and promoting caution. Enhanced verification protocols: Lenders should implement advanced verification processes and leverage data analytics and modeling thorough property appraisals, income verification, and rigorous background checks. Proper due diligence can significantly reduce the chances of falling victim to HELOC-related fraud. Collaboration and information sharing: Collaboration between financial institutions, regulators, and law enforcement agencies is essential to combat mortgage fraud effectively. Sharing information, best practices, and intelligence can help identify emerging fraud trends and deploy appropriate countermeasures. Acting with the right solution Mortgage fraud is a constant threat that demands ongoing vigilance and adaptability. As fraudsters evolve their tactics, the mortgage industry must stay one step ahead to safeguard homeowners and lenders alike. With concerns over HELOC-related fraud rising, it is vital to raise awareness, strengthen preventive measures, and foster collaboration to protect the integrity of the mortgage market. By staying informed and implementing robust safeguards, we can collectively combat and prevent mortgage fraud from disrupting the financial security of individuals and the industry. Experian mortgage is powering advanced capabilities across the mortgage lifecycle by gaining market intelligence, enhancing customer experience to remove friction and tapping into industry leading data sources to gain a complete view of borrower behavior. To learn more about our HELOC fraud prevention solutions, visit us online or request a call. *This article leverages/includes content created by an AI language model and is intended to provide general information.

In today's fast-paced financial landscape, financial institutions must stay ahead of the curve when it comes to account opening and onboarding. Digital account opening, empowering a prospective client to securely and efficiently open a new account, is key to how banks, credit unions and other financial institutions grow their business and expand their portfolio. Regardless of the time, money and other resources a financial institution invests in marketing to the right target prospect and tailoring an attractive offer, it’s worthless if that prospective customer can’t complete the process due to a poor account opening experience. Unhappy customers vote with their feet. A recent Experian study found that of the more 2,000 consumers surveyed who’d opened a new account in the last six months, 37% took their business elsewhere due to a negative account opening experience. The choice of a reliable partner can make all the difference to your account opening and onboarding experience. The right partner must provide your financial institution with access to the freshest credit data; advanced analytics, scores and models to empower you to say yes to the right customers that meet your lending criteria; and industry-leading decision engines that make the best decisions and enable you to provide a seamless customer experience. Moreover, the right partner will also help you in maintaining high levels of security without compromising user experience, all while adhering to regulatory compliance. Recently, Liminal, a leading advisory and market intelligence firm specializing in the digital identity, cybersecurity, and fintech markets, released its highly anticipated Link™ Index Report for Account Opening in Financial Services, which evaluates solution providers in the financial sector, in the areas of compliance and fraud prevention for account opening. The report recognized Experian as a market leader for compliance and fraud prevention capabilities and market execution. Experian’s identity verification and fraud prevention solutions, including CrossCore® and Precise ID®, received the highest score out of the 32 companies highlighted in the report. It found that Experian was recognized by 94% of buyers and 89% identified Experian as a market leader. “We’re thrilled to be named the top market leader in compliance and fraud prevention capabilities and execution by Liminal’s Link Index Report,” said Kathleen Peters, Chief Innovation Officer for Experian’s Decision Analytics business in North America. “We’re continually innovating to deliver the most effective identity verification and fraud prevention solutions to our clients so they can grow their business, mitigate risk and provide a seamless customer experience.” You can access the full report here. To learn more about Experian’s award-winning fraud solutions, visit our identity fraud hub. Download Liminal Link Index Report

"Grandma, it’s me, Mike.” Imagine hearing the voice of a loved one (or what sounds like it) informing you they were arrested and in need of bail money. Panicked, a desperate family member may follow instructions to withdraw a large sum of money to provide to a courier. Suspicious, they even make a video call to which they see a blurry image on the other end, but the same voice. When the fight or flight feeling settles, reality hits. Sadly, this is not the scenario of an upcoming Netflix movie. This is fraud – an example of a new grandparent scam/family emergency scam happening at scale across the U.S. While generative AI is driving efficiencies, personalization and improvements in multiple areas, it’s also a technology being adopted by fraudsters. Generative AI can be used to create highly personalized and convincing messages that are tailored to a specific victim. By analyzing publicly available social media profiles and other personal information, scammers can use generative AI to create fake accounts, emails, or phone calls that mimic the voice and mannerisms of a grandchild or family member in distress. The use of this technology can make it particularly difficult to distinguish between real and fake communication, leading to increased vulnerability and susceptibility to fraud. Furthermore, generative AI can also be used to create deepfake videos or audio recordings that show the supposed family member in distress or reinforce the scammer's story. These deepfakes can be incredibly realistic, making it even harder for victims to identify fraudulent activity. What is Generative AI? Generative artificial intelligence (GenAI) describes algorithms that can be used to create new content, including audio, code, images, text, simulations, and videos. Generative AI has the potential to revolutionize many industries by creating new and innovative content, but it also presents a significant risk for financial institutions. Cyber attackers can use generative AI to produce sophisticated malware, phishing schemes, and other fraudulent activities that can cause data breaches, financial losses, and reputational damage. This poses a challenge for financial organizations, as human error remains one of the weakest links in cybersecurity. Fraudsters capitalizing on emotions such as fear, stress, desperation, or inattention can make it difficult to protect against malicious content generated by generative AI, which could be used as a tactic to defraud financial institutions. Four types of Generative AI used for Fraud: Fraud automation at scale Fraudulent activities often involve multiple steps which can be complex and time-consuming. However, GenAI may enable fraudsters to automate each of these steps, thereby establishing a comprehensive framework for fraudulent attacks. The modus operandi of GenAI involves the generation of scripts or code that facilitates the creation of programs capable of autonomously pilfering personal data and breaching accounts. Previously, the development of such codes and programs necessitated the expertise of seasoned programmers, with each stage of the process requiring separate and fragmented development. Nevertheless, with the advent of GenAI, any fraudster can now access an all-encompassing program without the need for specialized knowledge, amplifying the inherent danger it poses. It can be used to accelerate fraudsters techniques such as credential stuffing, card testing and brute force attacks. Text content generation In the past, one could often rely on spotting typos or errors as a means of detecting such fraudulent schemes. However, the emergence of GenAI has introduced a new challenge, as it generates impeccably written scripts that possess an uncanny authenticity, rendering the identification of deceit activities considerably more difficult. But now, GenAI can produce realistic text that sounds as if it were from a familiar person, organization, or business by simply feeding GenAI prompts or content to replicate. Furthermore, the utilization of innovative Language Learning Model (LLM) tools enables scammers to engage in text-based conversations with multiple victims, skillfully manipulating them into carrying out actions that ultimately serve the perpetrators' interests. Image and video manipulation In a matter of seconds, fraudsters, regardless of their level of expertise, are now capable of producing highly authentic videos or images powered by GenAI. This innovative technology leverages deep learning techniques, using vast amounts of collected datasets to train artificial intelligence models. Once these models are trained, they possess the ability to generate visuals that closely resemble the desired target. By seamlessly blending or superimposing these generated images onto specific frames, the original content can be replaced with manipulated visuals. Furthermore, the utilization of AI text-to-image generators, powered by artificial neural networks, allows fraudsters to input prompts in the form of words. These prompts are then processed by the system, resulting in the generation of corresponding images, further enhancing the deceptive capabilities at their disposal. Human voice generation The emergence of AI-generated voices that mimic real people has created new vulnerabilities in voice verification systems. Firms that rely heavily on these systems, such as investment firms, must take extra precautions to ensure the security of their clients' assets. Criminals can also use AI chatbots to build relationships with victims and exploit their emotions to convince them to invest money or share personal information. Pig butchering scams and romance scams are examples of these types of frauds where AI chatbots can be highly effective, as they are friendly, convincing, and can easily follow a script. In particular, synthetic identity fraud has become an increasingly common tactic among cybercriminals. By creating fake personas with plausible social profiles, hackers can avoid detection while conducting financial crimes. It is essential for organizations to remain vigilant and verify the identities of any new contacts or suppliers before engaging with them. Failure to do so could result in significant monetary loss and reputational damage. Leverage AI to fight bad actors In today's digital landscape, businesses face increased fraud risks from advanced chatbots and generative technology. To combat this, businesses must use the same weapons than criminals, and train AI-based tools to detect and prevent fraudulent activities. Fraud prediction: Generative AI can analyze historical data to predict future fraudulent activities. By analyzing patterns in data and identifying potential risk factors, generative AI can help fraud examiners anticipate and prevent fraudulent behavior. Machine learning algorithms can analyze patterns in data to identify suspicious behavior and flag it for further investigation. Fraud Investigation: In addition to preventing fraud, generative AI can assist fraud examiners in investigating suspicious activities by generating scenarios and identifying potential suspects. By analyzing email communications and social media activity, generative AI can uncover hidden connections between suspects and identify potential fraudsters. To confirm the authenticity of users, financial institutions should adopt sophisticated identity verification methods that include liveness detection algorithms and document-centric identity proofing, and predictive analytics models. These measures can help prevent bots from infiltrating their systems and spreading disinformation, while also protecting against scams and cyberattacks. In conclusion, financial institutions must stay vigilant and deploy new tools and technologies to protect against the evolving threat landscape. By adopting advanced identity verification solutions, organizations can safeguard themselves and their customers from potential risks. To learn more about how Experian can help you leverage fraud prevention solutions, visit us online or request a call

Trust is the primary factor in any business building a long-lasting relationship, especially when a company operates globally and wants to build a loyal customer base. With the rapid acceleration of digital shopping and transactions comes a growing fraud landscape. And, given the continual increase of people wanting to transact online, marketplace companies – from ecommerce apps, ridesharing, to rental companies – need to have ideal strategies in place to protect themselves and their customers from fraudulent activities. Without ideal risk mitigation or comprehensive fraud and identity proofing strategies, marketplaces may find themselves facing the following: Card-not-present (CNP) Fraud: As online shopping increases, customers can’t provide a credit card directly to the merchant. That’s why fraudsters can use stolen credit card information to make unauthorized transactions. And in most cases, card owners are unaware of being compromised. Without an integrated view of risk, existing credit card authentication services used in isolation can result in high false positives, friction and a lack of card issuer support. Unverified Consumer Members, Vendors, Hosts & Drivers: From digital marketplace merchants like Etsy and Amazon, to peer-to-peer sharing economies like AirBnB, Uber and Lyft, the marketplace ecosystem is prone to bad actors who use false ID techniques to exploit both the platform and consumers for monetary gain. Additionally, card transaction touchpoints across the customer lifecycle increases risks of credit card authentication. This can be at account opening, account management when changes to existing account information is necessary, or at checkout. Buy Now, Pay Later (BNPL) Muling: While a convenient way for consumers to plan for their purchases, experts warn that without cautionary and security measures, BNPL can be a target for digital fraud. Fraudsters may use their own or fabricated identities or leverage account takeover to gain access to a legitimate user’s account and payment information to make purchases with no intent to repay. This leaves the BNPL provider at the risk of unrecoverable monetary losses that can impact the business’ risk tolerance. Forged Listings & Fake Accounts: Unauthorized vendors that create a fake account using falsified identities, stolen credit cards and publish fake listings and product reviews are another threat faced by ecommerce marketplaces. These types of fraud can happen without the vast data sources necessary to assess the risk of a customer and authenticate credit cards among other fraud and identity verification solutions. By not focusing on establishing trust, fraud mitigation management solutions and identity proofing strategies, businesses can often find themselves with serious monetary, reputational, and security qualms. Interested in learning more? Download Experian’s Building Trust in Digital Marketplaces e-book and discover the strategies digital marketplaces, like the gig economy and peer-to-peer markets, can take to keep their users safe, and protected from fraudulent activity. For additional information on how Experian is helping businesses mitigate fraud, explore our comprehensive suite of identity and fraud solutions. Download e-book

Today’s digital-first world is more interconnected than ever. Financial transactions take place across borders and through various channels, leaving financial institutions and their customers at increasing risk from evolving threats like identity theft, fraud and others from sophisticated crime rings. And consumers are feeling that pressure. A recent Experian study found that over half of consumers feel like they are more of a target for online fraud than a year ago. Likewise, more than 40% of businesses reported increased fraud losses in recent years. It’s not only critical that organizations ensure the security and trustworthiness of digital transactions and online account activity to reduce risk and losses but what consumers expect. In the same Experian study, more than 85% of consumers said they expect businesses to respond to their fraud concerns, an expectation that has increased over the last several years. Businesses and financial institutions most successful at mitigating fraud and reducing risk have adopted a layered, interconnected approach to identity confirmation and fraud prevention. One vital tool in this process is identity document verification. This crucial step not only safeguards the integrity of financial systems but also protects individuals and organizations from fraud, money laundering and other illicit activities. In this blog, we will delve into the significance of identity document verification in financial services and explore how it strengthens the overall security landscape. Preventing identity theft and fraud Identity document verification plays a vital role in thwarting identity theft and fraudulent activities. By verifying the authenticity of identification documents, financial institutions can ensure that the individuals accessing their services are who they claim to be. Sophisticated verification processes, including biometric identification and document validation, help detect counterfeit documents, stolen identities and impersonation attempts. By mitigating these risks, financial institutions can protect their customers from unauthorized access to accounts, fraudulent transactions and potential financial ruin. Compliance with regulatory requirements Financial institutions operate in an environment governed by stringent regulatory frameworks designed to combat money laundering, terrorist financing and other financial crimes. Identity document verification is a key component of these regulatory requirements. By conducting thorough verification checks, financial service providers can adhere to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Compliance safeguards the institution's reputation and helps combat illicit financial activities that can have far-reaching consequences for national security and stability. Mitigating risk and enhancing trust Effective identity document verification mitigates risks associated with financial services. By verifying the identity of customers, financial institutions can reduce the likelihood of fraudulent activities, such as account takeovers, unauthorized transactions and loan fraud. This verification process bolsters the overall security of the financial system and creates a more trustworthy environment for stakeholders. Trust is fundamental in establishing long-lasting customer relationships and attracting new clients to financial institutions. Facilitating digital onboarding and seamless customer experience As financial services embrace digital transformation, identity document verification becomes essential for smooth onboarding processes. Automated identity verification solutions enable customers to open accounts and access services remotely, eliminating the need for in-person visits or cumbersome paperwork. By streamlining the customer experience and minimizing the time and effort required for account setup, financial institutions can attract tech-savvy individuals and enhance customer satisfaction. Combating money laundering and terrorist financing Proper document verification is a key component of combating money laundering and terrorist financing activities. By verifying customer identities, financial institutions can establish the source of funds and detect suspicious transactions that may be linked to illicit activities. This proactive approach helps protect the integrity of the financial system, supports national security efforts, and contributes to the global fight against organized crime and terrorism. Identity document verification is a vital component in the layered, interconnected approach to mitigating and preventing fraud in modern financial services. By leveraging advanced technologies and robust verification processes, financial institutions can ensure the authenticity of customer identities, comply with regulatory requirements, mitigate risk and enhance trust. As financial services continue evolving in an increasingly digital landscape, identity document verification will remain a crucial tool for safeguarding the security and integrity of the global financial system. For more information on how Experian can help you reduce fraud while delivering a seamless customer experience, visit our fraud management solutions hub. Learn more