Tag: credit education

In a labor market where 51% of employees are actively seeking new opportunities and 42% of turnover is considered preventable, employers are under increasing pressure to stand out. One of the biggest shifts driving this competition is the growing emphasis younger generations place on employee benefits when evaluating job offers. As a result, companies are looking beyond salary to attract the best talent and retain their top performers. One of the ways companies are addressing this problem is through modern, or non-traditional, employee benefits. These are typically perks and programs that go beyond the traditional compensation package of salary, health insurance, and retirement plans. They’re designed to address the evolving needs, values, and lifestyles of today’s workforce. Modern employee benefits can include flexible work options, which allow team members to perform their jobs remotely and/or with flexible hours. In addition to standard healthcare benefits, some businesses provide access to mental health services, such as counseling and mindfulness programs. Other businesses offer learning and professional development programs that include tuition reimbursement and job-related sabbaticals. Modern employee benefits could also include lifestyle rewards, such as gym memberships, wellness retreats, volunteer days or travel stipends. One of the most attractive benefits are financial wellness programs, which can consist of financial coaching, identity protection and restoration, and device and data protection tools. Financial wellness: a key modern employee benefit What exactly is financial wellness? The U.S. Consumer Financial Protection Bureau defines it as “the feeling of having financial security and financial freedom of choice, in the present and when considering the future.” How employees feel about their finances, especially in the face of rising costs and higher interest rates, can impact their job performance. Employees often find themselves under pressure from their everyday financial challenges. This pressure can bleed over into work performance, directly impacting productivity. Morgan Stanley’s State of the Workplace 2025 report found that 66% of employees indicated that financial stress was negatively impacting their work and personal life. The study further revealed that 91% would have a greater investment in the company if their employer provided financial benefits that met their specific needs. And 84% of those surveyed believed their employers should be assisting them with their financial issues. Modern employee benefits that focus on financial wellness can address this need. It’s important to note that financial wellness isn’t simply about bolstering employee savings and building their credit standing. Providing programs that enable employees to protect themselves against the threat of identity theft and fraud is equally important. One employee survey revealed that 77% of employees faced some form of identity theft in 2024, and 42% indicated that worries about this led to higher stress levels at the workplace. Providing a comprehensive financial wellness program that includes financial and credit literacy, as well as identity theft protection and restoration is not only good for employees, but for businesses as well. A closer look at financial wellness tools When modern employee benefits include financial wellness tools, companies are better able to secure top talent, improve retention, and increase overall workforce satisfaction. Some tools that can help employees include: Identity protection and restoration – Businesses can offer employees vital tools they can use to avoid falling victim to identity theft and fraud. Such a tool can monitor personal information, send potential fraud alerts, and provide invaluable resolution services to aid in faster recovery. By minimizing fraud risk, employees feel their personal information is safe, which allows them to focus on being productive. Credit education and financial management – When employers offer a comprehensive credit education and financial management program, employees can gain crucial best practices for paying down debt and increasing their credit score. This type of guidance is absolutely critical for empowering employees to set goals, make actionable plans, and track their progress. Providing instructive credit education resources demonstrates the employer’s commitment to supporting employees beyond the office. Device and data protection – Employees are acutely aware of the constant threats to their personal data. Providing tools that can empower team members to take ownership of their financial data and protect their information from falling into the wrong hands is essential. Employers can provide proactive digital privacy tools that help keep passwords and other personal information private and secure while browsing. Digital identity management and exposure remediation – As data breaches continue to rise, employees need support reclaiming control of their personal information. Digital identity management tools can help individuals identify where their data has been exposed online, remove or suppress sensitive information from risky sites, and monitor for future exposure. Modern employee benefits from a trusted source When offering modern employee benefits geared toward financial wellness, it is important that these tools come from a trusted source. Experian® is a leader in the industry, supporting and protecting more than one billion consumers with a proven track record of credit education and identity protection. Experian’s My Financial Expert® platform, which offers more than 50 powerful financial wellness features, helps employees be better prepared to manage their financial well-being. Employers can also avail themselves of an anonymized and aggregated analysis of the overall financial health of the company’s employee population. By utilizing metrics such as credit snapshot, debt-to-income (DTI) ratio, credit delinquencies and more, Experian offers a roadmap to tailor benefit strategies that meet the specific needs of employees. When modern employee benefits include robust, easy-to-use financial wellness tools, employees feel supported. By educating and enabling employees to address pressing financial and security concerns, employers are able to reduce stress, minimize distraction and improve job satisfaction. This can lead to better job retention and the ability to attract high-quality applicants. In short, modern benefits can be a potent tool that shows employers value their employees, while improving productivity and strengthening the business. Watch our recent webinar or visit our website to learn more about our financial wellness programs. Learn more Watch on-demand webinar

Financial institutions are constantly searching for ways to engage their consumers while providing valuable services that keep them financially sound and satisfied. At the same time, consumers are looking for ways to limit their risk and grow their financial power while improving and protecting their financial health. Both can be accomplished through personalized financial experiences.

During the last couple of years, volatile market conditions have made it more difficult for consumers to improve their finances. In addition, a lack of financial literacy has negatively impacted consumers’ ability to expand their buying power. This can include opening new lines of credit, which is a source of revenue for financial institutions. Empowering your consumers with credit education and resources can create opportunities for them to open more of these new accounts, which can help lead to additional revenue for your business. Credit card account openings decreased in 2023 Economic turbulence is affecting businesses everywhere, including financial institutions. Uncertain market conditions have forced banks and credit unions to take revenue-preserving actions, such as tightening their credit card loan standards for consumers. As a result, credit card digital account opening growth slowed in 2023, and the trend threatens to continue.[1] This decrease in the opening of new credit card accounts can negatively affect lenders that aim to grow their business by encouraging consumers to borrow more money. Consumers’ financial literacy also plays a role in their ability and inclination to open new accounts. Uninformed consumers may be less likely to open new accounts Without a strong understanding of finances, many consumers find themselves in an unfavorable financial situation. Less than 30% of Americans have a financial plan,[2] and lacking financial knowledge cost individuals $1,819 on average in 2022.[3] Consumers without basic knowledge of finance or credit best practices usually have lower credit scores and may be less likely to qualify for credit card offers with low interest rates. So, what can financial institutions do to counteract decreasing credit card account openings? Help improve consumers credit standing with credit education Credit education programs can have a positive effect on consumers’ credit standing and general understanding of healthy financial habits. More than 65% of consumers enrolled in a credit education program see an improvement on their credit scores.[4] Credit-educated individuals can typically attain higher credit scores, which can help improve their chances of meeting the more restrictive credit standards banks have put in place due to volatile market conditions. Consumers who are better informed about credit and finances make better financial decisions, save, and borrow more money, and may be more likely to open new credit card accounts. This presents a valuable opportunity for financial institutions to offer highly desired credit education services to the consumers who need it. Deliver services your customers want A recent study showed that 57% of consumers want their financial institution to provide resources and support to help them better manage their finances, and 54% feel that their bank is responsible for teaching strong financial habits.[5] Consumers expect these financial services from the banks they do business with. Refraining from offering them could put your business at a disadvantage when compared to the banks that do. Make sure the services you provide include credit education that empowers your consumers to become more financially confident. This can help drive consumers to borrow more money and potentially open more new credit lines, which can drive additional revenue for your business. Learn more about how offering credit education services can help your consumers save more, borrow more, and open more new accounts. Visit our website [1] eMarketer, Credit Card Marketing 2023. [2] BusinessDIT, The State of Financial Planning, April 2023. [3] National Financial Educators Council, Cost of Financial Illiteracy Survey, 2023. [4] Experian Internal Data, 2023 credit lift study for users tracked from Dec 2020 – Dec 2022. [5] MX Technologies Inc. What Influences Where Consumers Choose to Bank. 2023.

An intuitive digital customer experience in banking is more important than ever. Americans swipe, tap or insert their debit and credit cards at supermarkets, gas stations, restaurants, hotels and ATMs, conducting more than 74 million daily transactions.¹ Despite the volume of transactions, just 23% of banking customers give their bank high marks for its range of products, services and financial advice.² A hyper-digital, ever-changing banking industry means that there are more choices for financial service providers than ever before — and customers are taking full advantage of the options. On average, consumers have more than six different financial products and 82% of consumers between the ages of 18 and 24 acquired financial services products from new providers in the past 12 months.³ Digital transformation for banks is more crucial than ever, with some studies showing that 78% of bank customers prefer to access their accounts via a website or mobile app (with less than half of those surveyed ranking branch access as an important feature when shopping for a new checking account).4 Banks must embrace innovative strategies to elevate the banking customer experience in a competitive market. Here are some ways to boost customer retention and drive profitable growth. Rethink processes Complex processes and excessive paperwork needed to open accounts, approve credit cards and process loan applications can frustrate customers. In fact, more than 50% of consumers abandon the digital account opening process if it takes more than three to five minutes.5 Digital transformation initiatives can resolve these issues to improve the customer experience. Banks that leverage solutions, like artificial intelligence and automated data-driven decisioning solutions, to facilitate faster, more streamlined services can reduce friction, expedite processes and decrease wait times, resulting in improved customer satisfaction and retention. Reduce fragmentation Financial services are more fragmented than ever. Retail banking customers often use different providers for their checking and savings accounts, credit cards, investments, mortgages and other banking products. The options to access those accounts are also diverse, with customers choosing from brick-and-mortar branches, websites and mobile devices. Increased fragmentation means that the need to create an omnichannel experience should be top of mind for lenders. Additionally, the current retail banking landscape often fails to reward consumers for loyalty. Fewer than 15% of banks provide comprehensive rewards to those who use a single bank for multiple products or services, even though reducing fragmentation and taking a holistic approach to meeting customer needs can provide a competitive advantage.6 Personalize the digital experience While digital banking has reduced face-to-face interaction between banks and customers,7 consumers still expect a personalized banking experience. Experian has shown that using data analytics can lead to an improved understanding of customer needs and preferences, while customer segmentation enables the creation of targeted marketing campaigns, customized product offerings and tailored financial advice. These efforts towards a more personalized banking experience help increase customer satisfaction and loyalty. Provide more touchpoints An increasing number of branch closures and greater demand for digital banking services mean that just 3% of banking transactions are conducted in person.8 Customers are more willing to use digital channels for services like opening accounts and applying for loans. Banks can promote credit offers and product recommendations via email, social media and mobile banking applications while providing real-time digital customer experiences and prioritizing consistency across channels. Embracing a multichannel approach to marketing can help banks achieve better results, making it easier to cross-sell customers, amplify offers and meet consumer expectations for a personalized digital experience. Go beyond banking The customer experience in banking is about more than deposits, withdrawals and interest payments. Customers want resources and information to improve their financial well-being — and providing it can build trust, improve customer retention and boost revenue. Using digital channels to provide education might be more effective than encouraging appointments with customer service representatives. These tactics can help you: Leverage artificial intelligence to provide educational resources and personalized financial advice. Monitor user transactions for unusual activities and push information about online security or fraud protection. Employ chatbots to provide investment information and credit score monitoring and respond to questions about products ranging from mortgages to credit cards. Enhance your customer retention strategies by focusing on credit education and helping customers at every stage of their financial lives. Deliver a personalized customer experience in banking Globally, banks have invested $124 billion in artificial intelligence, machine learning and other technologies to make retail banking services more efficient and effective.9 Personalization is still imperative, and putting the customer first must remain the highest priority. Achieving those results requires a solid strategy for an improved banking customer experience. Experian leverages customer-level analytics and provides comprehensive solutions to expand digital transformation efforts, drive acquisition and improve customer retention. Learn more about our banking solutions. Learn more ¹Federal Reserve (2023). Commercial Automated Clearinghouse Transactions Processed by the Federal Reserve2,6-9Accenture (2023). Global Banking Customer Study3-4Forbes Advisor (2023). U.S. Consumer Banking Statistics5The Financial Brand (2023). How Credit Card Issuers Are Tackling Application Abandonment

After being in place for more than three years, the student loan payment pause is scheduled to end 60 days after June 30, with payments resuming soon after. As borrowers brace for this return, there are many things that loan servicers and lenders should take note of, including: Potential risk factors demonstrated by borrowers. About one in five student loan borrowers show risk factors that suggest they could struggle when scheduled payments resume.1 These include pre-pandemic delinquencies on student loans and new non-medical collections during the pandemic. The impact of pre-pandemic delinquencies. A delinquent status dating prior to the pandemic is a statistically significant indicator of subsequent risk. An increase in non-student loan delinquencies. As of March 2023, around 2.5 million student loan borrowers had a delinquency on a non-student loan, an increase of approximately 200,000 borrowers since September 2022.2 Transfers to new servicers. More than four in ten borrowers will return to repayment with a new student loan servicer.3 Feelings of anxiety for younger borrowers. Roughly 70% of Gen Z and millennials believe the current economic environment is hurting their ability to be financially independent adults. However, 77% are striving to be more financially literate.4 How loan servicers and lenders can prepare and navigate Considering these factors, lenders and servicers know that borrowers may face new challenges and fears once student loan payments resume. Here are a few implications and what servicers and lenders can do in response: Non-student loan delinquencies can potentially soar further. Increased delinquencies on non-student loans and larger monthly payments on all credit products can make the transition to repayment extremely challenging for borrowers. Combined with high balances and interest rates, this can lead to a sharp increase in delinquencies and heightened probability of default. By leveraging alternative data and attributes, you can gain deeper insights into your customers' financial behaviors before and during the payment holidays. This way, you can mitigate risk and improve your lending and servicing decisions. Note: While many student loan borrowers have halted their payments during forbearance, some have continued to pay anyway, demonstrating strong financial ability and willingness to pay in the future. Trended data and advanced modeling provide a clearer, up-to-date view of these payment behaviors, enabling you to identify low-risk, high-value customers. Streamlining your processes can benefit you and your customers. With some student loan borrowers switching to different servicers, creating new accounts, enrolling in autopay, and confirming payment information can be a huge hassle. For servicers that will have new loans transferred to them, the number of queries and requests from borrowers can be overwhelming, especially if resources are limited. To make transitions as smooth as possible, consider streamlining your administrative tasks and processes with automation. This way, you can provide fast and frictionless service for borrowers while focusing more of your resources on those who need one-on-one assistance. Providing credit education can help borrowers take control of their financial lives. Already troubled by higher costs and monthly payments on other credit products, student loan payments are yet another financial obligation for borrowers to worry about. Some borrowers have even stated that student loan debt has delayed or prevented them from achieving major life milestones, such as getting married, buying a home, or having children.5 By arming borrowers with credit education, tools, and resources, they can better navigate the return of student loan payments, make more informed financial decisions, and potentially turn into lifelong customers. For more information on effective portfolio management, click here. 1Consumer Financial Protection Bureau. (June 2023). Office of Research blog: Update on student loan borrowers as payment suspension set to expire. 2Ibid. 3Ibid. 4Experian. (May 2023). Take a Look: Millennial and Gen Z Personal Finance Trends 5AP News. (June 2023). The pause on student loan payment is ending. Can borrowers find room in their budgets?

Despite economic uncertainty, new-customer acquisition remains a high priority in the banking industry, especially with increasing competition from fintech and big tech companies. For traditional banks, standing out in this saturated market doesn’t just involve enhancing their processes — it requires investing in the future of their business: Generation Z. Explore what Gen Z wants from financial technology and how to win them over in 2023 and beyond: Accelerate your digital transformation As digital natives, many Gen Zers prefer interacting with their peers and businesses online. In fact, more than 70% of Gen Zers would consider switching to a financial services provider with better digital offerings and capabilities.1 With a credit prescreen solution that harnesses the power of digital engagement, you can extend and represent firm credit offers through your online and mobile banking platforms, allowing for greater campaign reach and more personalized digital interactions. READ: Case study: Drive loan growth with digital prescreen Streamline your customer onboarding process With 70% of Gen Z and millennials having already opened an account online, it’s imperative that financial institutions offer a digital onboarding experience that’s quick, intuitive, and seamless. However, 44% of Gen Z and millennials state that their digital customer experience has been merely average, noting that the biggest gaps exist in onboarding and account opening.2 To improve the onboarding process, consider leveraging a flexible decisioning platform that accepts applications from multiple channels and automates data collection and identity verification. This way, you can reduce manual activity, drive faster decisions, and provide a frictionless digital customer experience. WATCH: OneAZ Credit Union saw a 25% decrease in manual reviews after implementing an integrated decisioning system Provide educational tools and resources Many Gen Zers feel uncertain and anxious about their financial futures, with their top concern being the cost of living. One way to empower this cohort is by offering credit education tools like step-by-step guides, score simulators, and credit alerts. These resources enable Gen Z to better understand their credit and how certain choices can impact their score. As a result, they can establish healthy financial habits, monitor their progress, and gain more control of their financial lives. By helping Gen Z achieve financial wellness, you can establish trust and long-lasting relationships, ultimately leading to higher customer retention and increased revenue for your business. To learn how Experian can help you engage the next generation of consumers, check out our credit marketing solutions. Learn more 1Addressing banking’s key business challenges in 2023.

"Out with the old and in with the new" is often used when talking about a fresh start or change we make in life, such as getting a new job, breaking bad habits or making room in our closets for a new wardrobe. But the saying doesn't exactly hold true in terms of business growth. While acquiring new customers is critical, increasing customer retention rates by just 5% can increase profits by up to 95%.1 So, what can your organization do to improve customer retention? Here are three quick tips: Stay informed Keeping up with your customers’ changing interests, behaviors and life events enables you to identify retention opportunities and create personalized credit marketing campaigns. Are they new homeowners? Or likely to purchase a vehicle within the next five months? With a comprehensive consumer database, like Experian’s ConsumerView®, you can gain granular insights into who your customers are, what they do and even what they will potentially do. To further stay informed, you can also leverage Retention TriggersSM, which alert you of your customers changing credit needs, including when they shop for new credit, open a new trade or list their property. This way, you can respond with immediate and relevant retention offers. Be more than a business – be human Gen Z's spending power is projected to reach $12 trillion by 2030, and with 67% looking for a trusted source of personal finance information,2 financial institutions have an opportunity to build lifetime loyalty now by serving as their trusted financial partners and advisors. To do this, you can offer credit education tools and programs that empower your Gen Z customers to make smarter financial decisions. By providing them with educational resources, your younger customers will learn how to strengthen their financial profiles while continuing to trust and lean on your organization for their credit needs. Think outside the mailbox While direct mail is still an effective way to reach consumers, forward-thinking lenders are now also meeting their customers online. To ensure you’re getting in front of your customers where they spend most of their time, consider leveraging digital channels, such as email or mobile applications, when presenting and re-presenting credit offers. This is important as companies with omnichannel customer engagement strategies retain on average 89% of their customers compared to 33% of retention rates for companies with weak omnichannel strategies. Importance of customer retention Rather than centering most of your growth initiatives around customer acquisition, your organization should focus on holding on to your most profitable customers. To learn more about how your organization can develop an effective customer retention strategy, explore our marketing solutions. Increase customer retention today 1How investing in cardholder retention drives portfolio growth, Visa. 2Experian survey, 2023.

From awarding bonus points on food delivery purchases to incorporating social media into their marketing efforts, credit card issuers have leveled up their acquisition strategies to attract and resonate with today’s consumers. But as appealing as these rewards may seem, many consumers are choosing not to own a credit card because of their inability to qualify for one. As card issuers go head-to-head in the battle to reach and connect with new consumers, they must implement more inclusive lending strategies to not only extend credit to underserved communities, but also grow their customer base. Here’s how card issuers can stay ahead: Reach: Look beyond the traditional credit scoring system With limited or no credit history, credit invisibles are often overlooked by lenders who rely solely on traditional credit information to determine applicants’ creditworthiness. This makes it difficult for credit invisibles to obtain financial products and services such as a credit card. However, not all credit invisibles are high-risk consumers and not every activity that could demonstrate their financial stability is captured by traditional data and scores. To better evaluate an applicant’s creditworthiness, lenders can leverage expanded data sources, such as an individual’s cash flow or bank account activity, as an additional lens into their financial health. With deeper insights into consumers’ banking behaviors, card issuers can more accurately assess their ability to pay and help historically disadvantaged populations increase their chances of approval. Not only will this empower underserved consumers to achieve their financial goals, but it provides card issuers with an opportunity to expand their customer base and improve profitability. Connect: Become a financial educator and advocate Credit card issuers looking to build lifelong relationships with new-to-credit consumers can do so by becoming their financial educator and mentor. Many new-to-credit consumers, such as Generation Z, are anxious about their finances but are interested in becoming financially literate. To help increase their credit understanding, card issuers can provide consumers with credit education tools and resources, such as infographics or ‘how-to’ guides, in their marketing campaigns. By learning about the basics and importance of credit, including what a credit score is and how to improve it, consumers can make smarter financial decisions, boost their creditworthiness, and stay loyal to the brand as they navigate their financial journeys. Accessing credit is a huge obstacle for consumers with limited or no credit history, but it doesn’t have to be. By leveraging expanded data sources and offering credit education to consumers, credit card issuers can approve more creditworthy applicants and unlock barriers to financial well-being. Visit us to learn about how Experian is helping businesses grow their portfolios and drive financial inclusion. Visit us

Millions of consumers are excluded from the credit economy, whether it’s because they have limited credit history, dated information within their credit file, or are a part of a historically disadvantaged group. Without credit, it can be difficult for consumers to access the tools and services they need to achieve their financial goals. This February, Experian surveyed over 1,000 consumers across census demographics, including income, ethnicity, and age, to understand the perceptions, needs, and barriers underserved communities face along their credit journey. Our research found that: 75% of consumers with an average household income of less than $50,000 have less than $1,000 in savings. 1 in 5 consumers with an average household income of less than $35,000 say they’re confident in getting approved for credit. 80% of respondents who are not or slightly confident in getting approved for credit were women. When asked why they believed they would not get approved for credit, participants shared common responses, such as having poor payment history, a low credit score, and insufficient income. Given these findings, what can lenders provide to help underserved consumers strengthen their financial profiles and gain access to the credit they need and deserve? The power of credit education While only 20% of respondents were familiar with credit education tools, the majority expressed interest in these offerings. With Experian, lenders can develop and implement credit education programs, tools, and solutions to help consumers understand their credit and the impact certain choices can have on their credit scores. From interactive tools like Score Simulator and Score Planner to real-time alerts from Credit Monitoring, consumers can actively assess their financial health, take steps to improve their creditworthiness, and ultimately become better candidates for credit offers. In turn, consumers can feel more confident and empowered to achieve their financial goals. Credit education tools not only help consumers increase their credit literacy, confidence, and chances of approval, but they also create opportunities for lenders to build lasting customer relationships. Consumers recognize that healthy credit plays an important role in their financial lives, and by helping them navigate the credit landscape, lenders can increase engagement, build loyalty, and enhance their brand’s reputation as an organization that cares about their customers. Empowering consumers with credit education is also a way for lenders to unlock new revenue streams. By learning to borrow, save, and spend responsibly, consumers can improve their creditworthiness and be in a better position to accept extended credit offerings, driving more cross-sell and upsell opportunities for lenders. More ways experian can help Experian is deeply committed to helping marginalized and low-income communities access the financial resources they need. In addition to our credit education tools, here are a few of our other offerings: Our expanded data helps lenders make better lending decisions by providing greater visibility and transparency around a consumer’s inquiry and payment behaviors. With a holistic view of their current and prospective customers, lenders can more accurately identify creditworthy applicants, uncover new growth opportunities, and expand access to credit for underserved consumers. Experian GoTM is a free, first-of-its-kind program to help credit invisibles and those with limited credit histories begin building credit on their own terms. After authenticating their identities and obtaining an Experian credit report, users will receive ongoing education about how credit works and recommendations to further build their credit history. To learn more about building profitable customer relationships with credit education, check out our credit education solutions and watch our Three Ways to Uncover Financial Growth Opportunities that Benefit Underserved Communities webinar. Learn more Watch webinar

Credit scores play a massive role in a consumer’s financial life as they help determine an individual’s creditworthiness. While 62% of consumers are interested in improving their credit scores, a troublingly high percentage are unsure of where to start. What’s more, one in four Americans have no idea how credit scores are even determined. This knowledge gap presents an opportunity for financial institutions to help consumers increase their credit understanding and establish lasting relationships. Some of the benefits of providing credit education to consumers include: Consumer trust and loyalty Today’s consumers are looking for guidance and support on all things credit. Helping consumers navigate their credit reports, improve their credit scores and explore the impacts of various scenarios are all opportunities for financial institutions to meet this demand and foster loyalty. With the knowledge and tools needed to make confident and responsible financial decisions, consumers will continue to trust and look toward the same financial institutions for credit guidance as they navigate their financial journeys. Credit education is especially valuable to younger consumers. As rookies to the credit game, many Gen Zers may find credit to be mysterious, complex and difficult to grasp. Despite these feelings, Gen Zers have shown considerable interest in becoming financially literate. By continuously providing Gen Z consumers with reliable and accessible credit education early on, financial institutions can grow to become their valuable partner, educator and mentor for life. More cross-sell opportunities The more educational resources financial institutions provide their consumers, the more likely they are to pay their credit card bills on time, take out loans and mortgages they can meet and purchase within their buying power, making them prime candidates to approach for additional credit offerings. According to studies conducted by Visa Performance Solutions, consumers respond more to credit offers from institutions they currently have a relationship with than those they don’t. By providing credit education and relevant offers to existing customers, financial institutions can improve satisfaction while increasing their revenue. Enhances brand reputation While credit education allows financial institutions to strengthen their relationships with existing clients, it also gives them an opportunity to expand and acquire new ones. When consumers feel valued and cared for, they are more likely to recommend a business’s products and services to someone else. The more consumers see how much a financial institution invests in their customers’ financial well-being, the more likely they are to convert themselves. Ready to get started? Providing value to consumers is no longer just about offering great products and services; it’s about helping them understand the basics and importance of credit so that achieving their financial goals comes easily. To learn more about how credit education can help deepen customer relationships and drive business growth, visit our Experian Partners Solutions page. Learn more

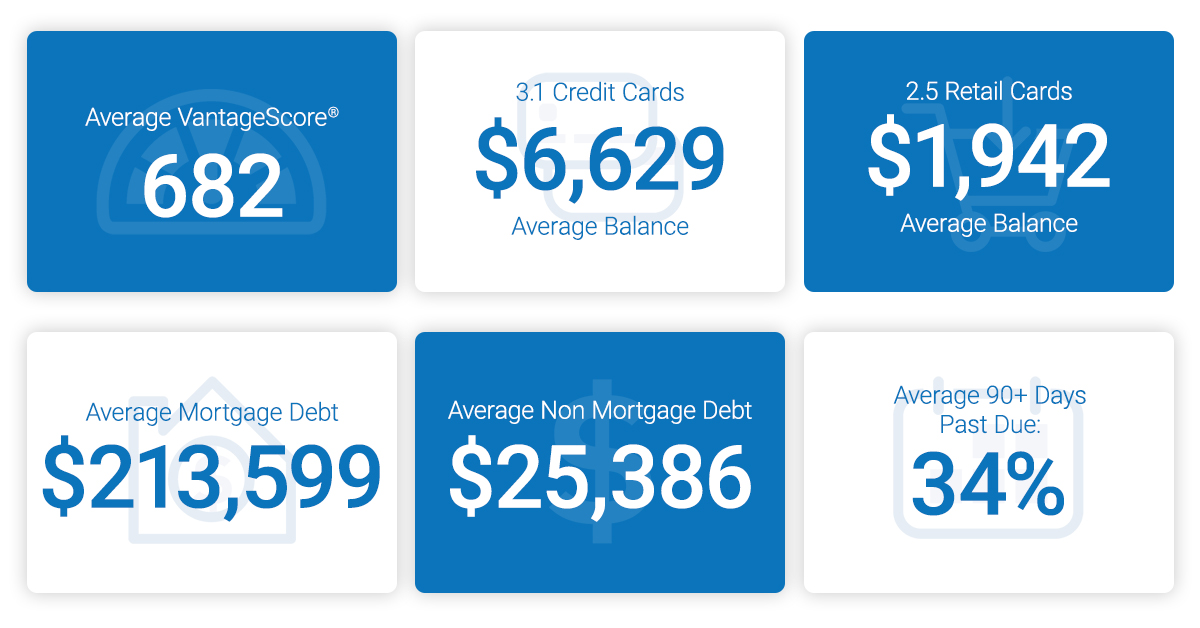

As consumers prepare for the next decade, we look at how we’re rounding out this year. The results? The average American credit score is 682, an eight-year high. Experian released the 10th annual state of credit report, which provides a comprehensive look at the credit performance of consumers across America by highlighting consumer credit scores and borrowing behaviors. And while the data is spliced to show men vs. women, as well as provides commentary at the state and generational level, the overarching trend is up. Even with the next anticipated economic correction often top of mind for financial institutions, businesses and consumers alike, 2019 was a year marked by more access, more spending and decreasing delinquencies. Things are looking up. “We are seeing a promising trend in terms of how Americans are managing their credit as we head into a new decade with average credit scores increasing two points since 2018 to 682 – the highest we’ve seen since 2011,” said Shannon Lois, Senior Vice President and Head of EAS, Analytics, Consulting & Operations for Experian Decision Analytics. “Average credit card balances and debt are up year over year, yet utilization rates remain consistent at 30 percent, indicating consumers are using credit as a financial tool and managing their debts responsibly.” Highlights of Experian’s State of Credit report: 3-year comparison 2017 2018 2019 Average number of credit cards 3.06 3.04 3.07 Average credit card balances $6,354 $6,506 $6,629 Average number of retail credit cards 2.48 2.59 2.51 Average retail credit card balances $1,841 $1,901 $1,942 Average VantageScore® credit score[1, 2] 675 680 682 Average revolving utilization 30% 30% 30% Average nonmortgage debt[3] $24,706 $25,104 $25,386 Average mortgage debt $201,811 $208,180 $231,599 Average 30 days past due delinquency rates 4.0% 3.9% 3.9% Average 60 days past due delinquency rates 1.9% 1.9% 1.9% Average 90+ days past due delinquency rates 7.3% 6.7% 6.8% In the scope of the credit score battle of the sexes, women have a four-point lead over men with an average credit score of 686 compared to 682. Their lead is a continued trend since 2017 where they’ve bested their male counterparts. According to the report, while men carry more non-mortgage and mortgage debt than women, women have more credit cards and retail cards (albeit they carry lower balances). Generationally, Generations X, Y and Z tend to carry more debt, including mortgage, non-mortgage, credit card and retail card, than older generations with higher delinquency and utilization rates. Segmented by state and gender, Minnesota had the highest credit scores for both men and women, while Mississippi was the state with the lowest average credit score for females and Louisiana was the lowest average credit score state for males. As we round out the decade and head full-force into 2020, we can reflect on the changes in the past year alone that are helping consumers improve their financial health. Just to name a few: Experian launched Experian BoostTM in March, allowing millions of consumers to add positive payment history directly to their credit file for an opportunity to instantly increase their credit score. Since then, there has been over 13 million points boosted across America. Experian LiftTM was launched in November, designed to help credit invisible and thin-file consumers gain access to fair and affordable credit. Long-standing commitments to consumer education, including the Ask Experian Blog and volunteer work by Experian’s Education Ambassadors, continue to offer assistance to the community and help consumers better understand their financial actions. From what we can tell, this is just the beginning. “Understanding the factors that influence their overall credit profile can help consumers improve and maintain their financial health,” said Rod Griffin, Experian’s director of consumer education and awareness. “Credit can be used as a financial tool. Through this report, we hope to provide insights that will help consumers make more informed decisions about credit use as we prepare to head into a new decade.” Learn more 1 VantageScore® is a registered trademark of VantageScore Solutions, LLC. 2 VantageScore® credit score range is 300 to 850. 3 Average debt for this study includes all credit cards, auto loans and personal loans/student loans.

As customer service continues its rapid shift to digital channels, consumer-finance companies have a powerful opportunity to engage customers and add value to the user experience. Credit education solutions can give customers valuable, personalized information and help lenders deliver relevant, prequalified credit offers that meet customers’ needs. The digital shift is well under way. The U.S. Consumer Financial Protection Bureau (CFPB), in its 2017 Consumer Credit Card Market Report, documents ongoing customer migration to digital platforms for every stage of the consumer interaction with creditors. In a survey of card lenders the CFPB characterizes as “mass market issuers,” which represent the majority of general-purpose and private-label credit cards issued in the U.S: In the past, mail and in-branch credit applications were the most popular conversion points for lenders, but today digital applications dominate, crushing direct mail as the biggest application generator. Beyond increasing customer acquisition and providing a channel for new applications, digital solutions are reshaping the entire consumer-finance process, creating a new end-to-end experience for banking consumers As consumers increasingly adopt digital channels for dealing with their finances, consumer finance companies face both a major opportunity and a significant challenge. Digital channels offer a powerful conduit for marketing additional products and services to customers, but fostering customer engagement with platforms can be tricky, as customer expectations are constantly evolving. The hallmark of digital channels is their convenience, which can be a double-edged sword for financial institutions. Quick, efficient digital services don’t give customers much reason to linger, and that can make it hard to create and act on cross-selling opportunities. So consumer finance companies that hope to boost engagement—and cross-sell opportunities—with their digital platforms must do so with valuable, compelling solutions—ideally interactive financial wellness tools that are personalized and highly relevant to the customer: Accenture, in its 2019 Global Financial Services Consumer Study, found significant majorities of consumers place high value on services including: Advice that is more relevant to personal circumstances Personalized services/ information that helps to reduce the risk of injury, loss, etc. Partnering with Experian, enables consumer-finance companies to provide customers with the kind of useful, high-value information customers want: Experian’s Credit Education services can help improve customers’ financial lives, Experian Identity Protection can help detect identity fraud and data theft. Experian’s credit-education services use customer credit data to help them set and track credit-improvement goals. Experian identity protection services can alert consumers immediately when suspicious activity is detected on their accounts (or in the names of their children) and can even help resolve cases of data abuse. The same access to credit data that powers Experian’s credit education services can help consumer-finance partners precision-target credit offers as their customers’ evolve in their needs and creditworthiness. Experian offers credit education and identity protection services as turnkey solutions, including fully hosted white-label platforms, hybrid options and APIs. Consumer-finance companies can quickly deploy these solutions, adapted to their own brand, to increase engagement and cross-sell opportunities and add meaningful value to the user experience. Learn more on our website

The U.S. Senate declared April to be Financial Literacy Month back in 2004. Fast forward 13 years and one has to question if we’ve moved the needle on educating Americans about personal finance and money management. There is still no national standard or common curriculum to teach our kids the basics in schools, and only five states require high school students to take one semester of personal finance in order to graduate. I read an interesting stat years back that high school seniors spend more time shopping for their prom attire than they do researching financial education options for college. No wonder there is sticker shock post-graduation when those first student loan bills coming. The lack of investment shows. In a 2016 Mintel study, very few consumers gave themselves high grades for their knowledge of personal finance, and the situation was worse among women, with twice as many assigning themselves a “C” as an “A.” Having worked in the financial services industry for more than a decade, I can say with certainty I’m a bit of a personal finance geek. Learning about the latest products and economic shifts has been rolled into my job, and I’ve sadly seen the consequences of what happens to consumers when they make poor financial decisions. Slumping credit scores. Delinquent payments. Repossessed vehicles. Hard times. The good news? There are plenty of resources to help Americans learn. The challenge? Finding the right ways to capture mind share via the right mediums at the right time. There is obviously a benefit to the consumer to be more financially literate, but financial institutions benefit as well when consumers are money smart. Individuals who understand financial products and how they can use them to achieve their goals are more likely to purchase those products throughout their financial lives. So how can financial institutions help close the financial literacy gap? Make online education and resources readily available. Research shows more consumers would like to get information about finance through the use of online resources rather than seminars. This preference is likely due to the fact that online resources can be accessed on one’s own schedule and gives the user more control over the topics s/he wants to explore. Provide parents resources to launch smart money talks with their kids. Study after study reveals parents are one of the most powerful teachers in their kids’ lives – and this includes providing an education and modeling strong money management skills. Consider adding online education for kids – or partnering with a provider who has already built a money app for youngsters. Additionally, educate parents about when it might be time to help a child establish their first savings account. Advise them on ways to finance college. Talk about co-signing on vehicles. Explain the power of saving. Train up your next wave of customers and they will likely remain loyal to you. Offer one-on-one credit education sessions. A high-touch solution is sometimes the perfect opportunity to grow a customer in the right financial direction. Perhaps a low credit score prevents an individual from securing an ideal interest rate for an auto or home loan. Each person’s financial situation is different, and a one-on-one session with a trained agent can help them understand what is specifically contributing to their low score. With a few insights, a customer can determine if they need to pay down some debt, address a few late payments, or reduce their number of credit lines. Knowledge is power, and consumers will appreciate this service and personable touch. --- Lenders have a vested interest to close the financial literacy gap, and while they can’t solve for everything, they can certainly make a difference with some basic steps and investments. If nothing else, April seems like a perfect time to evaluate what you’re doing and what resolutions you can make for the year ahead. Just as every saved penny counts, so does every effort to educate Americans on manning their money more effectively.

A recent national survey by Experian revealed opportunities for businesses to build relationships with future homebuyers before they’re ready to obtain a loan. Insights include: 35% of future buyers said they don’t know what steps to take to qualify for a larger loan 75% of future buyers are not preapproved for a home loan 29% of those surveyed would purchase a more expensive home if they had better credit and could qualify for a larger loan A large portion of near-future homebuyers are millennials. Building relationships with this generation now will benefit financial institutions in the future. >> White paper: Building lasting relationships with millennials

The numbers are staggering: more than $1.2 trillion in outstanding student loan debt, 40 million borrowers, and an average balance of $29,000. With Millennials exiting college and buried in debt, it’s no surprise they are postponing marriage, having babies, home purchases and other major life events. While the student loan issue has been looming for years, the magnitude is now taking center stage. All of the 2016 presidential contenders have an opinion, and many are starting to propose solutions – some going as far as to call for “debt-free college.” The issue has also caught the eye of the Consumer Financial Protection Bureau (CFPB). In its 2014 report, the CFPB stated one in four recent college graduates is either unemployed or underemployed. They also stated when faced with the inability to repay their debt, students lack payment options and are unclear as to how to resolve their debt. There is a bright spot. Experian reported new findings stating that among adults 18 to 34 years of age, the average credit score of those who had at least one open student loan account was 640, 20 points higher than others in their age group. So, if paid in a timely manner, student loans can help younger people establish a decent credit history before they go on to buy things like homes and cars. Still, education is key. Today, only 24 U.S. states require some form of financial literacy to be included in their high school course work, with only four states (Utah, Montana, Tennessee and Virginia) devoting a full semester to a personal finance course. Education is needed before students start diving into the student loan scene, and also after they graduate, to ensure they understand their repayment options and obligations. The CFPB is calling on all parties (universities, colleges, private lenders, advocates, policy makers and even family members) to get involved. Providing financial education, financial literacy, repayment options, deferral methods and income calculators are all needed to tackle this growing problem. The Great Recession and slow recovery brought home the importance of a college degree in today’s economy for many Americans. Bachelor’s degree recipients fared much better than their counterparts who only finished high school. The question becomes how to fund it, and make sure students who rely on loans understand the finances attached to this milestone investment. Learn more about Experian’s student debt trends and credit education in The Increasing Need for Consumer Credit Education: A Review of Student Debt.