Conventional credit scoring systems are based on models developed over six decades. As consumer behavior evolves, it’s important to seek newer, fresher sources of data to assess creditworthiness. Because the data used by conventional credit scoring models does not provide the full picture of a consumer’s financial health, a large population segment of the United States is excluded from accessing credit.

With changing times and new technology, forward-thinking financial institutions are using alternative data1 to gain a more holistic consumer view. A move toward inclusive finance, including incorporating alternative data in credit scoring models, is a crucial step towards promoting financial inclusion and helping millions of consumers achieve their financial and personal goals. More importantly, it provides the insight needed for lender confidence, which can help fuel business growth.

Understanding limitations of the conventional scoring system

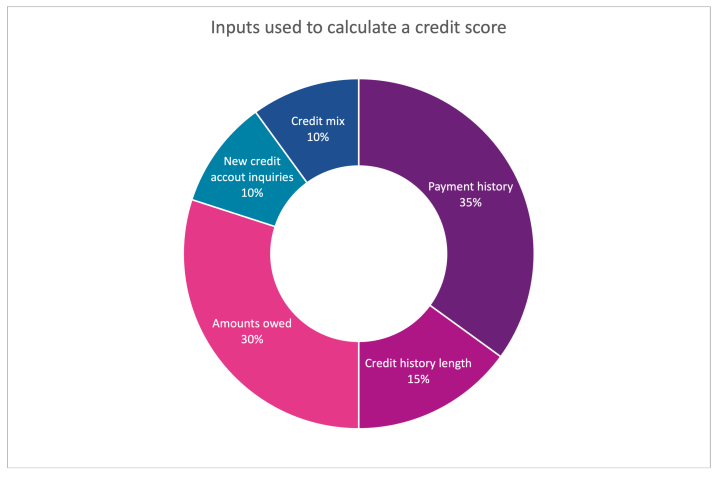

Credit scores can be obtained from any one of the major credit bureaus based on information found in a consumer’s credit report and are incorporated into a lender’s credit-decisioning process. While there are various credit scoring models based on lender preference that could yield slightly different scores, all traditional scores are comprised of credit characteristics within these categories: payment history, credit mix, credit history length, amounts owed and new credit account inquires.

Lenders use past credit performance to predict whether extending credit is a risk, posing a major challenge for credit invisible and thin-file consumers and leaving millions at a disadvantage.

This dilemma also limits business growth for lenders. Consumers who are unable to access mainstream credit often turn to the alternative financial services (AFS) industry, a $140 billion market that continues to grow by 7-10 percent each year.2 The AFS industry offers consumers additional products, like payday loans, cash advances, short-term installment loans, and rent-to-own loans, none of which are included in a traditional credit file. With alternative credit data, lenders can obtain a more holistic view of creditworthiness and risk, helping to enhance inclusive lending by broadening their pool of potential loan candidates.

Why conventional scoring models simply aren’t enough

Because of the criteria used to assess creditworthiness, conventional credit scoring models do not accurately capture an individual’s financial behavior or health. Indeed, many people demonstrate financial responsibility in other legitimate ways that are not reported to the major credit bureaus.

In contrast, non-traditional data considers a consumer’s everyday financial behavior to provide a more accurate score for lenders. It can include a range of indicators, such as:

- Bill payments: Consistent payment history on typical household bills (which may have been paid from a debit account).

- Bank account data: Shows average balance and withdrawal activity and recurring payroll deposits (indicating that a consumer is employed and receives a regular income).

- Rental data: Indicates a consumer’s long-term stability in making regular, on-time monthly rent payments.

- Registered licenses: Registered licenses or membership with a skilled trade or profession can indicate the likelihood to generate income.

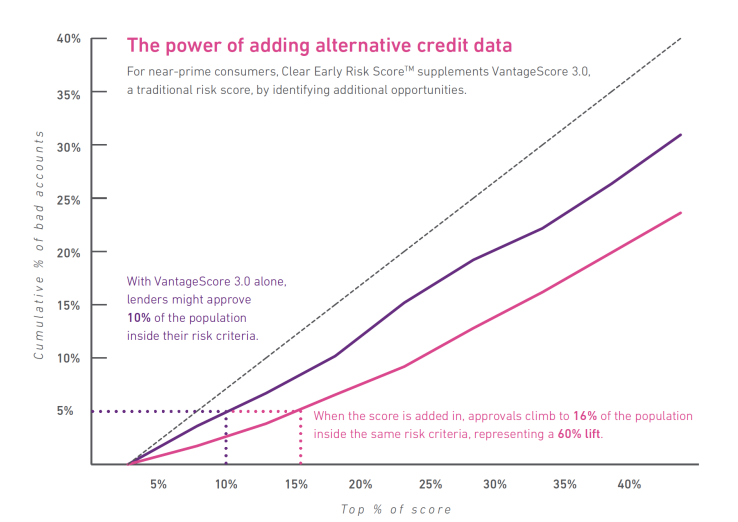

Including this type of data can benefit both lenders and applicants. According to an Experian report, by adding alternative credit data to a near-prime population, lenders could see an increase in approvals for consumers historically being left behind. When Clear Early Risk Score™ is paired with the VantageScore® credit score, approvals climb to 16 percent of the population inside the same risk criteria, representing a 60 percent lift in credit approvals for near-prime consumers.2

The pool of people from whom this type of alternative data can reliably be collected is growing, with 70 percent of consumers willing to provide additional financial information to a lender if it increases their chance for approval or improves their interest rate for a mortgage or car loan.3

Plenty of available yet untapped data exists that can add value to a consumer’s profile and lead to greater inclusive lending. For example, 95 percent of Americans own a cell phone and about two-thirds of households headed by young adults are being rented. Reporting on this data could potentially “thicken” a credit file and provide deeper insight into a consumer’s credit behavior.3

Indeed, turning to non-traditional data can expand the credit universe and lead to more inclusive credit scoring models, especially by leveraging existing technology and financial inclusion solutions. Research shows that with Lift Premium™, virtually all of the 21 million conventionally unscorable consumers would become scoreable, and over 1 million of them would have scores in the near-prime range or better. Of these, 1.7 million would be Black American and Hispanic/Latino people.3 For lenders, these numbers reveal potential opportunities to grow their businesses.

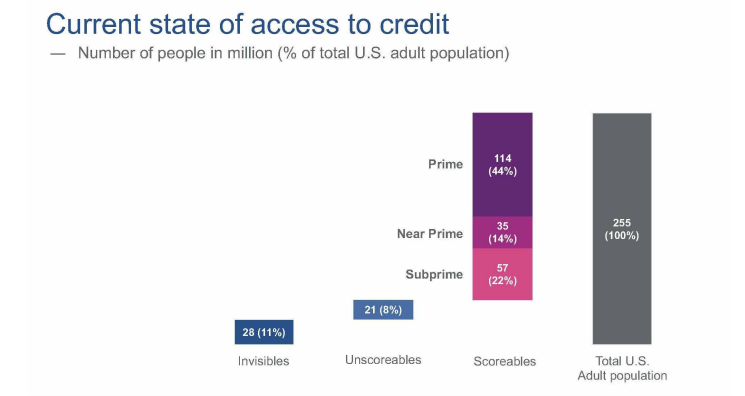

- Of the 255 million adults in the U.S., 19 percent of credit eligible adults are left out of mainstream scoring systems.

- 28 million are considered credit invisible – meaning they have no credit history (11%).

- 21 million are considered unscorable – have partial credit history but not enough to generate a score using conventional models (8%).

- Of the remaining credit eligible adults, 57 million were considered subprime (22%).

- 106 million U.S. adults can’t get mainstream credit rates (42%).

Adopting inclusive finance lending practices is not only the right thing to do but also provides financial institutions with the chance to reach untapped markets, grow their business and promote a healthier economy. Financial inclusion is not a destination, but an ever-evolving journey. Don’t miss out on this critical opportunity to join the movement.

Learn more about our financial inclusion tools to help enhance your inclusive lending approach.

1“Alternative Credit Data,” refers to the use of alternative data and its appropriate use in consumer credit lending decisions, as regulated by the Fair Credit Reporting Act. Hence, the term “Expanded FCRA Data” may also apply in this instance and both can be used interchangeably.

2Experian: 2020 State of Alternative Credit Data.

3Oliver Wyman white paper, “Financial Inclusion and Access to Credit,” January 12, 2022.