Latest Posts

What difference does $4.40 make? It can’t buy you much on its own, but it can make a world of difference when you’re handling the aftermath of a data breach or other cyberattack. That’s how much cyber insurance protection reduces the per-record cost of a data breach, according to the Ponemon Institute’s 2015 Cost of a Data Breach report. Whether you’re a small business owner with just a few hundred customers or a global corporation with records in the millions, the cost of being without cyber insurance in the wake of an incident can be extreme. When you consider the sheer number of records involved in recent mega-breaches — more than 78 million in the Anthem breach alone — the cost reduction can easily soar into hundreds of million dollars saved. And while smaller businesses may have fewer records to be breached, the impact of an attack can be even more devastating to them than to global entities when they experience a mega-breach. Yet less than one-third (32 percent) of businesses surveyed for Ponemon’s study reported having cyber insurance. The percentage was a bit better when the Risk Management Society (RIMS) asked 284 of its members about cyber insurance; 51 percent reported having stand-alone cyber insurance policies. Even fewer small businesses report having cyber insurance. Just 5 percent of small business owners surveyed by Endurance International Group said they carried cyber insurance, despite 81 percent believing cybersecurity is a concern for small business. Those who have cyber insurance clearly understand its value. RIMS members said they bought policies to: Reduce the risk of an incident damaging their company’s reputation (79 percent). Minimize the potential impact of business interruption (78 percent). Aid in data breach response and notification (73 percent). What’s more, of the RIMS members who didn’t have cyber insurance, 74 percent said they were considering buying it within the next 12–24 months. While small business owners also appear aware of the risk, they seem less cognizant of the benefits of cyber insurance and other cybersecurity measures. Endurance found that although 94 percent of small business owners said they do think about cybersecurity issues, and nearly a third have experienced an attack or an attempt, just 42 percent have invested in cybersecurity in the past year. A widely reported study by the National Cyber Security Alliance asserts that 60 percent of small businesses that experience a data breach go out of business within six months. Cyber insurance premiums vary widely and are largely tied to a company’s revenues and exposure. Policies typically aim to address risks commonly associated with a cyberattack, including: Liability for loss of confidential information that occurs through unauthorized access to a company’s computer systems. Data breach costs including notification of affected consumers, customer support and providing credit monitoring to affected customers. The costs of restoring, improving or replacing compromised technologies. Regulatory compliance costs. Business interruption expenses. Of course, like virtually any other type of insurance, cyber insurance policies can be customized to address the risks facing the individual policy holder. Many in the insurance industry feel that cyber insurance products have matured, evolving into a type of protection that businesses both large and small simply can’t afford to do without. When you consider the devastating risk of facing a cyberattack without insurance, that simple per-record cost savings of just $4.40 takes on a much deeper meaning. While more large companies are seeing the value of cyber insurance, small business owners need to begin incorporating this valuable type of protection into their overall cyber security plans. Learn more about our Data Breach solutions

Whether its new regulations and enforcement actions from the Consumer Financial Protection Bureau or emerging legislation in Congress, the public policy environment for consumer and commercial credit is dynamic and increasingly complex. If you are interested to learn more about how to navigate an increasingly choppy regulatory environment, consider joining a breakout session at Experian’s Vision 2016 Conference that I will be moderating. I’ll be joined by several experts and practitioners, including: John Bottega, Enterprise Data Management Conor French, Funding Circle Troy Dennis, TD Bank Don Taylor, President, Automated Collection Services During our session, you’ll learn about some of the most trying regulatory issues confronting the consumer and commercial credit ecosystem. Most importantly, the session will look at how to turn potential challenges into opportunities. This includes learning how to incorporate new alternative data sets into credit scoring models while still ensuring compliance with existing fair lending laws. We’ll also take a deep dive into some of the coming changes to debt collection practices as a result of the CFPB’s highly anticipated rulemaking. Finally, the panel will take a close look at the challenges of online marketplace lenders and some of the mounting regulations facing small business lenders. Learn more about Vision 2016 and how to register for the May conference.

A recent Experian study reveals that tax filing, document collection and refund processing are done online more often, yet only 6% of consumers file taxes on a computer with up-to-date antivirus software. 79% filed their most recent tax return online, up from 73% in 2011 18% scan and save their tax documents electronically, up from 6% in 2011 More than 75% of respondents have used EFT for tax refunds As electronic filing continues to grow, identity theft is likely to increase. While consumers should take steps to protect themselves, businesses also need to employ identity theft protection solutions to safeguard consumer information. >> Identify and prevent fraud

Ensuring the quality of reported consumer credit data is a top priority for regulators, credit bureaus and consumers, and has increasingly become a frequent headline in press outlets when consumers find their data is not accurate. Think of any big financial milestone moment – securing a mortgage loan, auto loan, student loan, obtaining low-interest rate interest credit cards or even getting a job. These important transactions can all be derailed with an unfavorable and inaccurate credit report, causing consumers to hit social media, the press and regulatory entities to vent it out. Add in the laws and increased scrutiny from the Consumer Financial Protection Bureau (CFPB), and Federal Trade Commission (FTC) and it is clear data furnishers are seeking ways to manage their data in more effective ways. At Vision 2016, I am hosting a session, Achievements in data reporting accuracy – maximizing data quality across your organization, with several panel guests willing to share their journeys and learnings attached to the topic of data accuracy. Our diverse panel features leaders from varying industries: Jodi Cook, DriveTime Alissa Hess, USAA Bank Tom Danchik, Citi Julie Moroschan, Experian Each will speak to how they’ve overcome challenges to introduce a data quality program into their respective organizations, as well as best practices around assessing, monitoring and correcting credit reporting issues. One speaker will even touch on the challenging topic of securing funding for a data quality program, considering budgets are most often allocated to strategies, products and marketing directly tied to driving revenue. All lenders are advised to maintain a full 360-degree view of data reporting, from raw data submissions to the consumer credit profile. Better data input equals fewer inaccuracies, and an overarching data integrity program, can deliver a comprehensive view that satisfies regulators, improves the customer experience and provides better insight for internal decision making. To learn more about implementing a data quality plan for your organization, check out Vision 2016.

Device emulators — wolves in sheep’s clothing Despite all the fraud prevention systems and resources in the public and private sectors, online fraud continues to grow at an alarming rate, offering a low-risk, high-reward proposition for fraudsters. Unfortunately, the Web houses a number of easily accessible tools that criminals can use to perpetrate fraud and avoid detection. The device emulator is one of these tools. Simply put, a device emulator is one device that pretends to be another. What began as innovative technology to enable easy site testing for Web developers quickly evolved into a universally available tool that attackers can exploit to wreak havoc across all industry verticals. While it’s not new technology, there has been a significant increase in its use by criminals to deceive simple device identification and automated risk-management solutions to carry out fraudulent activities. Suspected device emulation (or spoofing) traffic historically has been difficult to identify because fraud solutions rely heavily on reputation databases or negative lists. Detecting and defeating these criminals in sheep’s clothing is possible, however. Leveraging Experian’s collective fraud intelligence and data modeling expertise, our fraud research team has isolated several device attributes that can identify the presence of an emulator being used to submit multiple transactions. Thanks to these latest FraudNet rule sets, financial institutions, ecommerce merchants, airlines, insurers and government entities alike now can uncloak and protect against many of these cybercriminals. Unfortunately, device emulators are just one of many tools available to criminals on the Dark Web. Join me at Vision 2016, where U.S. Secret Service and I will share more tales from the Dark Web. We will explore the scale of the global cybercrime problem, walk through the anatomy of a typical hack, explain how hackers exploit browser plug-ins, and describe how enhanced device intelligence and visibility across all channels can stop fraudsters in their tracks. Listen to Mike Gross as he shares a short overview of his Vision 2016 breakout session in this short video. Don’t miss this innovative Vision 2016 session! See you there.

Best practices and innovative strategies for banking to millennials Before we begin, a disclaimer: Banking to millennials is a long-term strategy. Many marketing campaigns will not drive immediate returns on investment, but they lay the groundwork for a lifelong, mutually beneficial relationship. Now, some good news. Millennials are just beginning their financial journey — getting ready to embark on a life that includes homes, cars, families and small businesses. Connecting with this generation today can bode well for a financial institution’s success tomorrow. With a strong relationship in place, millennials will turn to that organization when they are ready to fund their life events. Below are some key strategies that will help financial institutions build and continue banking to millennials. Keeping up with technological expectations Millennials were raised in the digital age, and therefore mobile devices are the hubs of their digital lives. They expect real-time access to their accounts for peer-to-peer payments, deposits, paying bills and customer service. Not meeting their digital expectations could drive them to seek another — more technology-oriented — financial institution that embraces CNP, mobile apps and social media. Authentic and targeted marketing messaging Millennials expect targeted messaging. Generic, catchall offers of the past fall flat for them. They want banks to figure out who they are, what they need and how they can access it with the tap of a finger. Additionally, messages to millennials should have a genuine voice that advises and supports them in achieving their goals. Many millennials are interested in taking control of their financial lives but are not prepared to do so. This is a great opportunity for financial institutions to introduce themselves. Connect millennials to something bigger Earning a millennial’s trust is one of the greatest challenges for financial institutions. While money is important, millennials are motivated by becoming a part of something bigger than themselves. Institutions can connect with millennials by creating opportunities to give back or pay-it-forward. Examples include encouraging growth in underbanked markets, such as lending circles, peer-to-peer lending and small-business lending, or partnering with local universities and nonprofits. Strategic segmentation Millennials are the most diverse population group — yet strategic segmentation is still possible. One ideal segment is recent college graduates. As a group, they yield a much different profile than their counterparts without degrees. These ambitious millennials are more likely to focus on life choices that require major financial considerations, such as getting married, having children, buying their first home and earning higher salaries. These life events will require a diverse set of financial services products, and millennials will turn to the institution that has gained their trust first. Millennials are one of the most important markets as financial institutions look to invest in future, long-term growth. Financial institutions need to show millennials that they’re committed to listening and to laying the groundwork for relationships that will help them achieve their dreams. Remember, though, reaching this audience is not about an immediate return on investment but rather a long-term strategy to develop trust and brand preference. Begin the relationship now to reap the rewards later. For more insights and innovative strategies on how to best market and develop a strong relationship with millennials, download our recent white paper, Building lasting relationships with millennials.

As automotive leasing trends to new heights, a rapid influx of off-lease vehicles are returning to market. Experian Automotive’s latest infographic explores the surge in off-lease vehicles, including which models and vehicle segments are most popular. Click here to download this infographic.

In today’s interconnected world, reaching consumers should be as simple as sending a text or calling their cell phone. However, complying with the Telephone Consumer Protection Act (TCPA) can create an almost insurmountable mountain. While the law has been in place since 1991, TCPA litigation continues to be a considerable source of potential legal and compliance risk for companies communicating with consumers. There were 1,908 TCPA lawsuits in 2014, an increase of 30 percent over the previous year, and a 231 percent increase in the last four years. Is your business facing challenges in complying with TCPA? Do you want to learn more about the changing and challenging TCPA legal and regulatory framework? Are you looking for best practices on how to win the battle of right party contact? Then you should join us for a breakout session solely focused on TCPA at Experian’s Vision 2016 Conference. The panel features a number of subject matter experts who will be able to provide attendees with a look at this law and some of the best practices to manage risk and ensure compliance. Panelists include: Mary Anne Gorman, Experian Tony Hadley, Experian Tom Gilbertson, Venable LLC To learn more more about TCPA best practices, check out Experian’s annual Vision Conference in May.

April is Financial Literacy Month, a special window of time dedicated to educating Americans about money management. But as stats and studies reveal, it might be wise to spend every month shining some attention on financial education, an area so many struggle to understand. Obviously no one wants to talk money day in and day out. It can be complicated, make us feel bad and serve as a source of stress. But as the saying goes, information is power. Over the years, Experian has worked to understand the country’s state of credit. Which states sport higher scores? Which states struggle? How do people pay down their debts? And what are the triggers for when accounts trail into collections? In the consumer space especially, we’ve surveyed individuals about how they feel about their own credit as it pertains to a number of different variables and life stages. Home Buying: 34% of future home buyers say their credit might hurt their ability to purchase a home 45% of future home buyers delayed a purchase to improve their credit to get better interest rates Holiday Shopping: 10% of consumers and 18% of millennials say holiday shopping has negatively affected their credit score Newlywed Life: 60% believe it is important for their future spouse to have a good credit score 39% say their spouse’s credit score or their credit score has been a source of stress in their marriage 35% of newlyweds believe they are “very knowledgeable” regarding credit scores and reports And let’s not forget Millennials: 71% of millennials believe they are knowledgeable when it comes to credit, yet: millennials overestimate their credit score by 29 points 32% do not know their credit score 61% check their credit report less than every 3 months 57% feel like the odds are stacked against them when it comes to finances and 59% feel like they are “going it alone” when it comes to finances The message is clear. Finances are simply a part of life, but can obviously serve as a source of stress. Establishing and growing credit often starts at a young age, and runs through every major life event. Historically, high school is where the bulk of financial literacy programs have targeted their efforts. But even older adults, who have arguably learned something about personal finances by managing their own, could stand a refresher on topics ranging from refinancing to retirement to reverse mortgages. Over the next month, Experian will touch on several timely financial education topics, including highlighting the top credit questions asked, the future of financial education in the social media space, investing in retirement, ways to teach your kids about money, and how to find a legit credit counselor. But Experian explores financial education topics weekly too, committed to providing consistent resources to both businesses and consumers via weekly tweet chats, blog posts and live discussions on periscope. There is always an opportunity to learn more about finances. Throughout the year, different issues pop up, and milestone moments mean we need to brush up on the latest ways to spend and save. It’s nice so many financial institutions make a special point to highlight financial education in April, but hopefully consumers and lenders alike continue to dedicate time to this important topic every month. Managing money is a lifelong task, so tips and insights are always welcome. Right? Check out the wealth of resources and pass it on. For a complete picture of consumer credit trends from Experian's database of over 230 million consumers, purchase the Experian Market Intelligence Brief.

According to Experian’s State of the Automotive Finance Market report, the average amount financed for a new vehicle in Q4 2015 was $29,551 — up $1,170 from 2014 and the highest amount on record since Experian began tracking auto loan amounts in 2008.

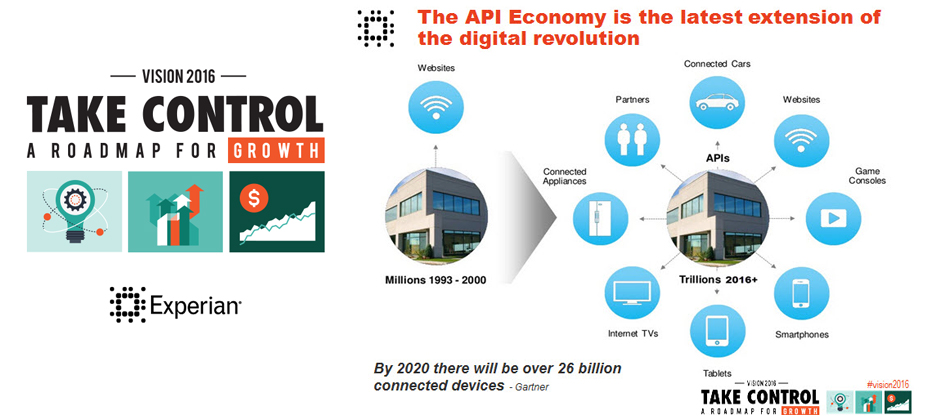

There is a revolution going on! We are in the midst of the second phase of the digital revolution and it is being fueled by API’s. API’s provide the access and mapping that allow access to and integration of the myriad of existing and new data sources available today. They do really helpful things like allow Uber to revolutionize the connection of riders to drivers as well as allow for quick, self-service credit decisions by integrating Experian data within Salesforce.com. Digital disruptors like Uber have scaled their business to massive size at breakneck speed because they can design, build and deploy solutions quickly. API’s and cloud computing play a central role in all of this. You will hear representatives from Uber share how API’s enabled the flow of Experian data through Salesforce.com enabling them to launch new business models, and enter new markets. Listen to Mike Myers as he shares a short overview of his Vision 2016 breakout session in this short video. Don’t miss this innovative Vision 2016 session! See you there.

Small business trade payment delinquencies can signal the beginning of business financial duress. However, sometimes these delinquencies are isolated events. Understanding the trade payment priorities of a business can lead to better business risk assessment. Experian understands commercial payment behaviors and can help clients more accurately interpret the risk of payment delinquencies for different kinds of trades. In his Vision 2016 breakout session “Which creditors get priority when businesses face a financial burden”, Sung Park, Analytics Consultant with Experian’s Decision Sciences discusses the types of trades or financial obligations that become delinquent first, and the conditions that most commonly signal overall business stress. What the audience will learn: The audience will have a better understanding of which type of trade delinquencies are likely isolated incidents and which ones are precursors of businesses facing a financial burden, and what actions can be taken proactively to mitigate risk. Don't miss your opportunity to catch these informative breakout sessions during Vision 2016.

According to a recent Experian study, women handle money, debt and financial decisions better than men.

Whether it is an online marketplace lender offering to refinance the student loan debt of a recent college graduate or an online small-business lender providing an entrepreneur with a loan when no one else will, there is no doubt innovation in the online lending sector is changing how Americans gain access to credit. This expanding market segment takes great pride in using “next-generation” underwriting and credit scoring risk models. In particular, many online lenders are incorporating noncredit information such as income, education history (i.e., type of degree and college), professional licenses and consumer-supplied information in an effort to strike the right balance between properly assessing credit risk and serving consumers typically shunned by traditional lenders because of a thin credit history. Regulatory concerns The exponential growth of the online lending sector has caught the attention of regulators — such as the U.S. Treasury Department, the Federal Deposit Insurance Corporation, Congress and the California Business Development Office — who are interested in learning more about how online marketplace lenders are assessing the credit risk of consumers and small businesses. At least one official, Antonio Weiss, a counselor to the Treasury secretary, has publicly raised concerns about the use of so-called nontraditional data in the underwriting process, particularly data gleaned from social media accounts. Weiss said that “just because a credit decision is made by an algorithm, doesn’t mean it is fair,” citing the need for lenders to be aware of compliance with fair lending obligations when integrating nontraditional credit data. Innovative and “tried and true” are not mutually exclusive Some have suggested the only way to assuage regulatory concerns and control risk is by using tried-and-true legacy credit risk models. The fact is, however, online marketplace lenders can — and should — continue to push the envelope on innovative underwriting and business models, so long as these models properly gauge credit risk and ensure compliance with fair lending rules. It’s not a simple either-or scenario. Lenders always must ensure their scoring analytics are based upon predictive and accurate data. That’s why lenders historically have relied on credit history, which is based upon data consumers can dispute using their rights under the Fair Credit Reporting Act. Statistically sound and validated scores protect consumers from discrimination and lenders from disparate impact claims under the Equal Credit Opportunity Act. The Office of the Comptroller of the Currency guidance on model risk management is an example of regulators’ focus on holding responsible the entities they oversee for the validation, testing and accuracy of their models. Marketplace lenders who want to push the limit can look to credit scoring models now being used in the marketplace without negatively impacting credit quality or raising fair lending risk. For example, VantageScore® allows for the scoring of 30 million to 35 million more people who currently are unscoreable under legacy credit score models. The VantageScore® credit score does this by using a broader, deeper set of credit file data and more advanced modeling techniques. This allows the VantageScore® credit score model to capture unique consumer behaviors more accurately. In conclusion, online marketplace lenders should continue innovating with their own “secret sauce” and custom decisioning systems that may include a mix of noncredit factors. But they also can stay ahead of the curve by relying on innovative “tried-and-true” credit score models like the VantageScore® credit score model. These models incorporate the best of both worlds by leaning on innovative scoring analytics that are more inclusive, while providing marketplace lenders with assurances the decisioning is both statistically sound and compliant with fair lending laws. VantageScore® is a registered trademark of VantageScore Solutions, LLC.

When checking access accounts were first introduced, it wasn’t uncommon for banks to provide new customers “basic” transaction services in starter checking accounts. These services typically included an automatic teller machine (ATM) access card and the ability to withdraw cash at their local branch. As consumers developed a relationship and established financial trust with their bank, they eventually would get a checkbook, which allowed check-writing access. This took time and a consumer demonstrating both the willingness and ability to manage finances to the bank’s expectations. Establishing the financial relationship was a trust-building process. With the onset of general-purpose debit cards and a host of other digital money-movement capabilities, such as online banking, the majority of banks now offer just basic and preferred checking. A minimum acceptance standard leaves many consumers out of the financial transaction system, which is something that concerns regulatory bodies such as the Consumer Financial Protection Bureau (CFPB). Approval criteria vary across financial institutions, but a typical basic checking account has some form of overdraft feature enabled, and some consumers may not be able to afford these fees even if they elect to opt in for overdraft functionality. Nonetheless, banks still screen applicants to ensure prior accounts at other institutions were managed with no losses incurred by other banks. In today’s modern world, it is difficult to participate fully in our credit-driven society without a checking account at a recognized bank or credit union. The answer in many cases would be checking accounts for consumers that have either overdraft functionality assigned based on the consumer’s wish to opt in or overdraft access that matches that same consumer’s ability to pay. In early February, the CFPB passed new guidelines to increase access to basic check products. While a step towards making checking accounts available to all, the most recent actions still leave unresolved regulatory actions regarding what the CFPB refers to as “affordable” checking access. For instance, for those consumers without disposable income, the issue of fees for overdraft and nonsufficient funds is still an unresolved regulatory matter. In the most recent announcement, the CFPB took several actions related to its focus on increasing consumer access to checking transaction accounts with banks: Sending a letter to CEOs of the top 25 banks encouraging them to take steps to help consumers with affordable checking account access such as “no fee” and/or “no overdraft” checking accounts Providing several new resources to consumers such as a guide to “Low Risk Checking, Managing Checking and Consumer Guide to Checking Account Denial” Introducing the Consumer Protection Principles, which include a drive toward: Faster funds availability Improved consumer transparency into checking account fee structure, funds availability and security Tailoring products to reach a larger percentage of consumers Developing no-overdraft type checking products, which only a handful of large banking institutions had What lurks ahead for banks is the need to develop products that are designed to reach a larger population that includes under banked and unbanked consumers with troubled financial repayment history. Coupling this product development effort with the CFPB desire for no-overdraft-fee type products makes me wonder if we should look to account features from several decades ago, such as creating a 21st century version of the checking account with digital money-movement features that protects consumers’ privacy, but doesn’t put them in a position to rack up large amounts of overdraft fees they can’t afford to pay in the event they overdraw the checking account. Experian® suggests taking the following steps: Conduct a Business Review to ensure that your product offering includes the type of account the CFPB is advocating and your existing core banking platform can operationalize this account Align your checking account prospect and opening procedures to key segments to ensure more consumers are approved and right-sized to the appropriate checking product Enhance your business profitability by cross-selling credit products that fit the affordability and disposable income of various consumer segments you originate These steps will make your journey “back to the future” much less turbulent and ensure you don’t break the bank in your efforts to address CFPB’s well-intentioned focus on check access for consumers.