Tag: alternative financial services

Over the past few decades, the financial industry has gone through significant changes. One of the most notable changes is the use of alternative credit data1 for lending. This type of data is becoming increasingly essential in consumer and small business lending. In this blog post, we’ll explore the importance of alternative credit data and the insights you can gain from our new 2023 State of Alternative Credit Data Report. Benefits and uses of alternative credit data and alternative lending Alternative credit data and alternative financial services offer substantial benefits to lenders, borrowers, and society as a whole. The primary advantage of alternative credit data is that it provides a more comprehensive and accurate credit history of the borrower. Unlike traditional credit data that focuses on a borrower’s financial past, alternative credit data includes information from non-traditional sources like rent payments, full-file public records, utility bills, and income and employment data. This additional data allows you to gain a better understanding of financial behavior and assess creditworthiness more accurately.Alternative credit data can be used throughout the loan lifecycle, from underwriting to servicing. In the underwriting phase, alternative credit data can help lenders expand their pool of potential borrowers, especially those who lack or have limited traditional credit history. Additionally, alternative credit data can help lenders identify risks and minimize fraud. In the servicing phase, alternative credit data can help lenders monitor financial health and provide relevant services and an enhanced customer experience.Alternative lending is critical for driving financial inclusion and profitability. Traditional credit models often exclude individuals who have limited or no access to credit, causing them to turn to high-cost alternatives like payday loans. Alternative credit data can provide a more accurate assessment of their ability to pay, making it easier for them to access affordable credit. This increased accessibility improves the borrower's financial health and creates new opportunities to expand your customer base. “Lenders can access credit data and real-time information about consumers’ incomes, employment statuses, and how they are managing their finances and get a more accurate view of a consumer’s financial situation than previously possible.”— Scott Brown, President of Consumer Information Services, Experian State of alternative credit data Our new 2023 State of Alternative Credit Data Report provides exclusive insight into the alternative lending market, new data sources, inclusive finance opportunities and innovations in credit attributes and scoring that are making credit scoring more accurate, transparent and inclusive. For instance, the use of machine learning algorithms and artificial intelligence is enabling lenders to develop more predictive alternative credit scoring models and enhance risk assessment. Findings from the report include: 54% of Gen Z and 52% of millennials feel more comfortable using alternative financing options rather than traditional forms of credit.2 62% of financial institution firms are using alternative data to improve risk profiling and credit decisioning capabilities.3 Modern credit scoring methods could allow lenders to grow their pool of new customers by almost 20%.4 By understanding the power of alternative credit data and staying on top of the latest industry trends, you can widen your pool of borrowers, drive financial inclusion, and grow sustainably. Download now 1When we refer to “Alternative Credit Data,” this refers to the use of alternative data and its appropriate use in consumer credit lending decisions, as regulated by the Fair Credit Reporting Act. Hence, the term “Expanded FCRA Data” may also apply in this instance and both can be used interchangeably.2Experian commissioned Atomik Research to conduct an online survey of 2,001 adults throughout the United States. Researchers controlled for demographic variables such as gender, age, geographic region, race and ethnicity in order to achieve similar demographic characteristics reported in the U.S. census. The margin of error of the overall sample is +/-2 percentage points with a confidence level of 95 percent. Fieldwork took place between August 22 and August 28, 2023. Atomik Research is a creative market research agency. 3Experian (2022). Reaching New Heights with Financial Inclusion 4Oliver Wyman (2022). Financial Inclusion and Access to Credit

Today's top lenders use traditional and alternative credit data1 – or expanded Fair Credit Reporting Act (FCRA) regulated data – including consumer permissioned data, to enhance their credit decisioning. The ability to gain a more complete and timely understanding of consumers' financial situation allows lenders to better gauge creditworthiness, make faster decisions and grow their portfolios without taking on additional risk. Why lenders need to go beyond traditional credit data Traditional credit data is — and will remain — important to understanding the likelihood that a borrower will repay a loan as agreed. However, lenders who solely base credit decisions on traditional credit data and scores may overlook creditworthy consumers who don't qualify for a credit score — sometimes called unscorable or credit invisible consumers. Additionally, they may be spending time and money on manual reviews for applications that are low risk and should be automatically approved. Or extending offers that aren't a good fit. What is consumer permissioned data? Consumer permissioned data, or user permissioned data, includes transactional and account-level data, often from a bank, credit union or brokerage account, that a consumer gives permission to view and use in credit decisioning. To access the data, lenders create secure connections to financial institutions or data aggregators. The process and approach give consumers the power to authorize (and later retract) access to accounts of their choosing — putting them in control of their personal information — while setting up security measures that keep their information secure. In return for sharing access to their account information, consumers may qualify for more financial products and better terms on credit offers. What does consumer permissioned data include? Consumers can choose to share different types of information with lenders, including their account balances and transaction history. While there may be other sources for estimated or historic account-level data, permissioned data can be updated in real-time to give lenders the most accurate and timely view of a consumer's finances. There is also a wealth of information available within these transaction records. For example, consumers can use Experian Boost™ to get credit for non-traditional bills, including phone, utility, rent and streaming service payments. These bills generally don't appear in traditional credit reports and don't impact every type of credit score. But seeing a consumer's history of making these payments can be important for understanding their overall creditworthiness. What are the benefits of leveraging consumer permissioned data? You can incorporate consumer permissioned data into custom lending models, including the latest explainable machine learning models. As part of a loan origination system, the data can help with: Portfolio expansion Accessing and using new data can expand your lending universe in several ways. There are an estimated 28 million U.S. adults who don't have a credit file at the bureaus, and an additional 21 million who have a credit file but lack enough information to be scorable by conventional scoring models. These people aren't necessarily a credit risk — they're simply an unknown. Increased insights can help you understand the real risk and make an informed decision. Additionally, a deeper insight into consumers' creditworthiness allows you to swap in applications that are a good credit risk. In other words, approving applications that you wouldn't have been able to approve with an older credit decision process. Increase financial inclusion Many credit invisibles and thin-file applicants also fall into historically marginalized groups.2 Almost a third of adults in low-income neighborhoods are credit invisible.3 Black Americans are much more likely (1.8 times) to be credit invisible or unscorable than white Americans.4 Recent immigrants may have trouble accessing credit in the U.S., even if they had a good credit history in their home country.5 As a result, using consumer permissioned data to expand your portfolio can align with your financial inclusion efforts. It's one example of how financial inclusion is good for business and society. Enhance decisioning and minimize risk Consumer-permissioned data can also improve and expand automated decisions, which can be important throughout the entire loan underwriting journey. In particular, you may be able to: Verify income faster: By linking to consumers’ accounts and reviewing deposits, lenders can quickly verify their income and ability to pay. Make better decisions: Consumer permissioned data also give lenders a new lens for understanding an applicant’s credit risk, which can let you say yes more often without taking on additional risk. Process more applications: A better understanding of applicants’ credit risk can also decrease how many applications you send to manual review, which allows you to process more applications using the same resources. Increase customer satisfaction: Put it all together, and faster decisions and more approvals lead to happier customers. While consumer permissioned data can play a role in all of these, it's not the only type of alternative data that lenders use to grow their portfolios. What are other types of alternative data sources? In addition to consumer permissioned data, alternative credit data can include information from: Alternative financial services: Credit data from alternative financial services firms includes information on small-dollar installment loans, single-payment loans, point-of-sale financing, auto title loans and rent-to-own agreements. Rental agreement: Rent payment data from landlords, property managers, collection companies and rent payment services. Public records: Full-file public records go beyond what’s in a consumer’s credit report and can include professional and occupational licenses, property deeds and address history. Why partner with Experian? As an industry leader in consumer credit and data analytics, Experian is continuously building on its legacy in the credit space to help lenders access and use various types of alternative data. Along with Experian Boost™ for consumer permissioned data, Experian RentBureau and Clarity Services are trusted sources of alternative data that comply with the FCRA. Experian also offers services for lenders that want help understanding and using the data for marketing, lending and collections. For originations, the Lift Premium™ credit model can use alternative credit data to score over 65% of traditionally credit-invisible consumers. Expand your lending universe Lenders are turning to new data sources to expand their portfolios and remain competitive. The results can provide a win-win, as lenders can increase approvals and decrease application processing times without taking on more risk. At the same time, these new strategies are helping financial inclusion efforts and allowing more people to access the credit they need. Learn more 1When we refer to “Alternative Credit Data," this refers to the use of alternative data and its appropriate use in consumer credit lending decisions, as regulated by the Fair Credit Reporting Act. Hence, the term “Expanded FCRA Data" may also apply in this instance and both can be used interchangeably.2-5Oliver Wyman (2022). Driving Growth With Greater Credit Access

Even before the COVID-19 pandemic, many Americans lacked equal access to financial products and services — from tapping into affordable banking services to credit cards to financing a home purchase. The global pandemic likely exacerbated those existing issues and inequalities. That reality makes financial inclusion — a concerted effort to make financial products and services affordable and accessible to all consumers — more crucial than ever. The playing field wasn't level before the pandemic The Federal Reserve reported that in 2019, Black and Hispanic/Latino families had median wealth that was just 13 to 19 percent of that of White families — $24,100 and $36,100, respectively, compared to $188,200 for White families. That inequity is also reflected in credit score disparities. While credit scores, income, and wealth aren't synonymous, the traditional credit scoring system leads marginalized communities to be disproportionately labeled unscoreable or credit invisible, and face challenges in accessing credit. New research from Experian shows that in over 200 cities, there can be more than a 100-point difference in credit scores between neighborhoods — often within just a few miles from each other. Marginalized communities bore the financial brunt Minority communities were also disproportionately impacted by COVID-19 in terms of infections, job losses, and financial hardship. In mid-2020, the Economic Policy Institute (EPI) reported Black and Hispanic/Latino workers were more likely than White workers to have lost their jobs or to be classified as essential workers — leading to economic or health insecurity. Government initiatives — including the Coronavirus Aid, Relief, and Economic Security (CARES) Act, the Paycheck Protection Program (PPP) and the American Rescue Plan — created expanded unemployment benefits, paused loan payments, eviction moratoriums, and direct cash payments. These helped consumers' immediate financial well-being. The National Bureau of Economic Research found that, on average, U.S. households spent approximately 40 percent of their first two stimulus checks, with about 30 percent used for savings and another 30 percent used to pay down debt. In some communities highly affected by COVID-19, consumers were able to pay down nearly 40 percent of their credit card balances and close more than 9 percent of their bank card accounts, according to recent data. Stimulus payments have been credited with reducing childhood poverty and helping families save for financial emergencies. That being said, people on the upper end of the income scale were able to improve their financial situation even more. Their wealth grew at a much faster pace than people at the bottom end of the income distribution scale, according to data from the Federal Reserve. How the pandemic deepened financial exclusion Although hiring has picked up in low-wage industries, research indicates that low-wage jobs have been the slowest to return. According to a survey by the Pew Research Center, among respondents who said their financial situation worsened during the pandemic, 44 percent believe it will take three years or more to get back to where they were a year ago. About 10 percent don't think their finances will ever recover. Recent Experian data shows that consumers in certain communities that were already struggling to pay their debts fell into an even bigger hole. These consumers missed payments on 56 percent more accounts in the period between spring 2019 to spring 2020 compared to the year prior. Credit scores in these neighborhoods fell by an average of over 20 points during the first 18 months of COVID-19. That being said, U.S. consumers overall increased their median credit scores by an average of 21 points from the end of 2019 to the end of 2021. When consumers with deteriorating credit encounter financial stresses, often their only recourse is to pile on additional debt. Even worse, those who can't access traditional credit often turn to alternative credit arrangements, such as short-term loans, which may charge significantly higher interest rates. READ MORE: More Than a Score: The Case for Financial Inclusion What can the financial sector do? Without access to affordable financial services and products, subprime or credit invisible consumers may not get approved for a mortgage or car loan — things that might come much easier for consumers with better scores. This is just one reason why financial inclusion is so important — and why financial services companies have a big role to play in driving it. One place to start is by taking a broader view of what makes a creditworthy consumer. In addition to traditional credit scoring models, new tools can leverage artificial intelligence and machine learning, along with alternative data, to analyze the creditworthiness of consumers. By qualifying for credit, more consumers can access affordable mortgages, car loans, business loans and insurance - freeing up money for other expenses and allowing them to grow their wealth.. READ MORE: What Is Alternative and Non-Traditional Data? Last word Marginalized communities were already struggling economically before the pandemic, and the impact of COVID-19 has made the wealth disparities worse. With the pandemic waning, now is the time for financial institutions to take action on financial inclusion. Not only does it help improve your customers' lives and make them better prepared for the next crisis, but it also fuels your business's growth and bottom line.

These days, the call for financial inclusion is being answered by a disruptive force of new financial products and services. From fintech to storied institutional players, we're seeing a variety of offerings that are increasingly accessible and affordable for consumers. It's a step in the right direction. And beyond the moral imperative, companies that meet the call are finding that financial inclusion can be a source of business growth and a necessity for staying relevant in a competitive marketplace. A diaspora of credit-invisible consumers To start, let's put the problem in context. A 2022 Oliver Wyman report found about 19 percent of the adult population is either credit invisible (has no credit file) or unscoreable (not enough credit information to be scoreable by conventional credit scoring models). But some communities are disproportionately impacted by this reality. Specifically, the report found: Black Americans are 1.8 times more likely to be credit invisible or unscoreable than white Americans. Recent immigrants may have trouble accessing credit in the U.S., even if they're creditworthy in their home country. About 40 percent of credit invisibles are under 25 years old. In low-income neighborhoods, nearly 30 percent of adults are credit invisible and an additional 16 percent are unscoreable. Younger and older Americans alike may shy away from credit products because of negative experiences and distrust of creditors. Similarly, the Federal Deposit Insurance Corporation (FDIC) reports that an estimated 5.4 percent (approximately 7.1 million) households, were unbanked in 2019 — often because they can't meet minimum balance requirements or don't trust banks. Credit invisibles and unscoreables may prefer to deal in a cash economy and turn to alternative credit and banking products, such as payday loans, prepaid cards, and check-cashing services. But these products can perpetuate negative spirals. High fees and interest can create a vicious cycle of spending money to access money, and the products don't help the consumers build credit. In turn, the lack of credit keeps the consumers from utilizing less expensive, mainstream financial products. The emergence of new players Recently, we've seen explosive growth in fintech — technology that aims to improve and automate the delivery and use of financial services. According to market research firm IDC, fintech is expected to achieve a compound annual growth rate (CAGR) of 25 percent through 2022, reaching a market value of $309 billion. It's reaching mass adoption by consumers: Plaid® reports that 88 percent of U.S. consumers use fintech apps or services (up from 58 percent in 2020), and 76 percent of consumers consider the ability to connect bank accounts to apps and services a top priority. Some of these new products and services are aimed at helping consumers get easier and less expensive access to traditional forms of credit. Others are creating alternative options for consumers. Free credit-building tools. Experian Go™ lets credit invisibles quickly and easily establish their credit history. Likewise, consumers can use Experian Boost™ to build their credit with non-traditional payments, including their existing phone, utility and streaming services bills. Alternative credit-building products. Chime® and Varo® , two neobanks, offer credit builder cards that are secured by a bank account that customers can easily add or withdraw money from. Mission Asset Fund, a nonprofit focused on helping immigrants, offers a fee- and interest-free credit builder loan through its lending circle program. Cash-flow underwriting. Credit card issuers and lenders, including Petal and Upstart, are using cash-flow underwriting for their consumer products. Buy now, pay later. Several Buy Now Pay Later (BNPL) providers make it easy for consumers to pay off a purchase over time without a credit check. Behind the scenes, it's easier than ever to access alternative credit data1 — or expanded Fair Credit Reporting Act (FCRA)-regulated data — which includes rental payments, small-dollar loans and consumer-permissioned data. And there are new services that can help turn the raw data into a valuable resource. For example, Lift PremiumTM uses multiple sources of expanded FCRA-regulated data to score 96 percent of American adults — compared to the 81 percent that conventional scoring models can score with traditional credit data. While we dig deeper to help credit invisibles, we're also finding that the insights from previously unreported transactions and behavior can offer a performance lift when applied to near-prime and prime consumers. It truly can be a win-win for consumers and creditors alike. Final word There's still a lot of work to be done to close wealth gaps and create a more inclusive financial system. But it's clear that consumers want to participate in a credit economy and are looking for opportunities to demonstrate their creditworthiness. Businesses that fail to respond to the call for more inclusive tools and practices may find themselves falling behind. Many companies are already using or planning to use alternative data, advanced analytics, machine learning, and AI in their credit-decisioning. Consider how you can similarly use these advancements to help others break out of negative cycles. 1When we refer to “Alternative Credit Data," this refers to the use of alternative data and its appropriate use in consumer credit lending decisions, as regulated by the Fair Credit Reporting Act. Hence, the term “Expanded FCRA Data" may also apply in this instance and both can be used interchangeably.

Credit reports and conventional credit scores give lenders a strong starting point for evaluating applicants and managing risk. But today's competitive environment often requires deeper insights, such as credit attributes. Experian develops industry-leading credit attributes and models using traditional methods, as well as the latest techniques in machine learning, advanced analytics and alternative credit data — or expanded Fair Credit Reporting Act (FCRA)-regulated data)1 to unlock valuable consumer spending and payment information so businesses can drive better outcomes, optimize risk management and better serve consumers READ MORE: Using Alternative Credit Data for Credit Underwriting Turning credit data into digestible credit attributes Lenders rely on credit attributes — specific characteristics or variables based on the underlying data — to better understand the potentially overwhelming flow of data from traditional and non-traditional sources. However, choosing, testing, monitoring, maintaining and updating attributes can be a time- and resource-intensive process. Experian has over 45 years of experience with data analytics, modeling and helping clients develop and manage credit attributes and risk management. Currently, we offer over 4,500 attributes to lenders, including core attributes and subsets for specific industries. These are continually monitored, and new attributes are released based on consumer trends and regulatory requirements. Lenders can use these credit attributes to develop precise and explainable scoring models and strategies. As a result, they can more consistently identify qualified prospects that might otherwise be missed, set initial limits, manage credit lines, improve loyalty by applying appropriate treatments and limit credit losses. Using expanded credit data effectively Leveraging credit attributes is critical for portfolio growth, and businesses can use their expanding access to credit data and insights to improve their credit decisioning. A few examples: Spot trends in consumer behavior: Going beyond a snapshot of a credit report, Trended 3DTM attributes reveal and make it easier to understand customers' behavioral patterns. Use these insights to determine when a customer will likely revolve, transact, transfer a balance or fall into distress. Dig deeper into credit data: Making sense of vast amounts of credit report data can be difficult, but Premier AttributesSM aggregates and summarizes findings. Lenders use the 2,100-plus attributes to segment populations and define policy rules. From prospecting to collections, businesses can save time and make more informed decisions across the customer lifecycle. Get a clear and complete picture: Businesses may be able to more accurately assess and approve applicants, simply by incorporating attributes overlooked by traditional credit bureau reports into their decisioning process. Clear View AttributesTM uses data from the largest alternative financial services specialty bureau, Clarity Services, to show how customers have used non-traditional lenders, including auto title lenders, rent-to-own and small-dollar credit lenders. The additional credit attributes and analysis help lenders make more strategic approval and credit limit decisions, leading to increased customer loyalty, reduced risk and business growth. Additionally, many organizations find that using credit attributes and customized strategies can be important for measuring and reaching financial inclusion goals. Many consumers have a thin credit file (fewer than five credit accounts), don’t have a credit file or don’t have information for conventional scoring models to score them. Expanded credit data and attributes can help lenders accurately evaluate many of these consumers and remove barriers that keep them from accessing mainstream financial services. There's no time to wait Businesses can expand their customer base while reducing risk by looking beyond traditional credit bureau data and scores. Download our latest e-book on credit attributes to learn more about what Experian offers and how we can help you stay ahead of the competition. Download e-book Learn more 1When we refer to “Alternative Credit Data," this refers to the use of alternative data and its appropriate use in consumer credit lending decisions, as regulated by the Fair Credit Reporting Act. Hence, the term “Expanded FCRA Data" may also apply in this instance and both can be used interchangeably.

Many financial institutions have made inclusion a strategic priority to expand their reach and help more U.S. consumers access affordable financial services. To drive deeper understanding, Experian commissioned Forrester to do new research to identify key focal points for firms and how they are moving the needle. The study found that more than two-thirds of institutions had a strategy created and implemented while one-quarter reported they are already up and running with their inclusion plans.1 Tapping into the underserved The research examines the importance of engaging new audiences such as those that are new to credit, lower-income, thin file, unbanked and underbanked as well as small businesses. To tap into these areas, the study outlines the need to develop new products and services, adopt willingness to change policies and processes, and use more data to drive better decisions and reach.2 Expanded data for improved risk decisioning The research underlines the use of alternative data and emerging technologies to expand reach to new audiences and assist many who have been underserved. In fact, sixty-two percent of financial institutions surveyed reported they currently use or are planning to use expanded data to improve risk profiling and credit decisions, with focus on: Banking data Cash flow data Employment verification data Asset, investments, and wealth management data Alternative financial services data Telcom and utility data3 Join us to learn more at our free webinar “Reaching New Heights Together with Financial Inclusion” where detailed research and related tools will be shared featuring Forrester’s principal analyst on Tuesday, May 24 from 10 – 11 a.m. PT. Register here for more information. Find more financial inclusion resources at www.experian.com/inclusionforward. Register for webinar Visit us 1 Based on Forrester research 2 Ibid. 3 Ibid.

For decades, the credit scoring system has relied on traditional data that only examines existing credit captured on a credit report – such as credit utilization ratio or payment history – to calculate credit scores. But there's a problem with that approach: it leaves out a lot of consumer activity. Indeed, research shows that an estimated 28 million U.S. adults are “credit invisible," while another 21 million are “unscorable."1 But times are changing. While conventional credit scoring systems cannot generate a score for 19 percent of American adults,1 many lenders are proactively turning to expanded FCRA-regulated data – or "alternative data" – for solutions. Types of expanded FCRA-regulated data By tapping into technology, lenders can access expanded FCRA-regulated data, which offers a powerful and complete view of consumers' financial situations. Expanded public record data This can include professional and occupational licenses, property deeds and address history – a step beyond the limited public records information found in standard credit reports. Such expanded public record data is available through consumer reporting agencies and does not require the customer's permission to use it since it's a public record.1 “Experian has partnerships with these agencies and can access public records that provide insight into factors like income and housing stability, which have a direct correlation with how they'll perform," said Greg Wright, Chief Product Officer for Experian Consumer Information Services. “For example, lenders can see if a consumer's professional license is in good standing, which is a strong correlation to income stability and the ability to pay back a loan." Rental payment data Experian RentBureau draws updated rental payment history data every 24 hours from property managers, electronic rent payment services and collection companies. It can also track the frequency of address changes. “Such information can be a good indicator of risk," said Wright. “It allows lenders to make informed judgments about the financial health and positive payment history of consumers." Consumer-permissioned data With permission from consumers, lenders can look at different types of financial transactions to assess creditworthiness. Experian Boost™, for example, enables consumers to factor positive payment history, such as utilities, cell phone or even streaming services, into an Experian credit file. “Using the Experian Boost is free, and for most users, it instantly improves their credit scores," said Wright. “Overall, those 'boosted' credit scores allow for fairer decisioning and better terms from lenders – which gives customers a second chance or opportunity to receive better terms." Financial Management Insights Financial Management Insights considers data that is not captured by the traditional credit report such as cash flow and account transactions. For instance, this could include demand deposit account (DDA) data, like recurring payroll deposits, or prepaid account transactions. “Examining bank account transaction data, prepaid accounts, and cash flow data can be a good indicator of ability to pay as it helps verify income, which gives lenders insights into consumers' cash flow and ability to pay," Wright added. Clarity Credit Data With Experian's Clarity Credit Data, lenders can see how consumers use expanded FCRA-regulated data along with their related payment behavior. It provides visibility into critical non-traditional loan information, including more insights into thin-file and no-file segments allowing for a more comprehensive view of a consumer's credit history. Lift Premium™ By using multiple sources of expanded FCRA-regulated data to feed composite scores, along with artificial intelligence and machine learning, Lift Premium™ can vastly increase the number of consumers who can be scored. For example, research shows that Lift Premium™ can score 96 percent of American adults – a significant increase from the 81 percent that are scorable with conventional scores relying on only traditional credit data. Additionally, such enhanced composite scores could enable 6 million of today's subprime population to qualify for “mainstream" (prime or near-prime) credit.1 How is expanded FCRA-regulated data changing the credit scoring system? The current credit scoring system is rapidly evolving, and modern technology is making it easier for lenders to access expanded FCRA-regulated data. Indeed, this data disruption is changing lender business in a positive way. “When lenders use expanded credit data assets, they see that many unscorable and credit invisible consumers are in fact creditworthy," said Wright. “Layering in expanded FCRA-regulated data gives a clearer picture of consumers' financial situation." By expanding data assets, tapping into artificial intelligence and machine learning, lenders can now score many more consumers quickly and accurately. Moreover, forward-thinking lenders see these expanded data assets as offering a competitive edge: it's estimated that modern credit scoring methods could allow lenders to grow their pool of new customers by almost 20 percent.1 Case study: Consumer-permissioned data To date, over 9 million people have used Experian Boost. The technology uses positive payment history as a way to recognize customers who exhibit strong credit behaviors outside of traditional credit products. “Boosted" consumers were able to add on average 14 points to their FICO scores in 2022 so far, making many eligible for additional financial products with better terms or better product offerings. Active Boost consumers, post new origination performed on par or better than the average U.S. originator, consistently over time. “In other words, having this additional lens into a consumer's financial health means lenders can expand their customer base without taking on additional credit risk," explains Wright. The bottom line The world of credit data is undergoing a revolution, and forward-thinking lenders can build a sound business strategy by extending credit to consumers previously excluded from it. This not only creates a more equitable system, but also expands the customer base for proactive lenders who see its potential in growing business. Learn more 1Oliver Wyman white paper, “Financial Inclusion and Access to Credit,” January 12, 2022.

Lenders are under pressure to improve access to financial services, but can it also be a vehicle for driving growth? With the global pandemic and social justice movements exposing societal issues of equity, financial institutions are being called upon to do their part to address these problems, too. Lenders are increasingly under pressure to improve access to the financial system and help close the wealth gap in America. Specifically, there are calls to improve financial inclusion – the process of ensuring financial products and services are accessible and affordable to everyone. Financial inclusion seeks to remove barriers to accessing credit, which can ultimately help individuals and businesses create wealth and elevate communities. Activists and regulators have singled out the current credit scoring system as a significant obstacle for a large portion of U.S. consumers. From an equity standpoint, tackling financial inclusion is a no-brainer: better access to credit allows more consumers to secure safer housing and better schools, which could lead to higher-paying jobs, as well as the ability to start businesses and get insurance. Being able to access credit in a regulated and transparent way underpins financial stability and prosperity for communities and is key to creating a stronger economic system. Beyond “doing the right thing," research shows that financial inclusion can also fuel business growth for lenders. Get ahead of the game There is mounting regulatory pressure to embrace financial inclusion, and financial institutions may soon need to comply with new mandates. Current lending practices overlook many marginalized communities and low-income consumers, and government agencies are seeking to change that. Government agencies and organizations, such as the Consumer Financial Protection Bureau (CFPB) and Office of the Comptroller of the Currency (OCC), are requiring greater scrutiny and accountability of financial institutions, working to overhaul the credit reporting system to ensure fairness and equality. As a lender, it makes good business sense to tackle this problem now. For starters, as more institutions embrace Corporate Social Responsibility (CSR) mandates—something that's increasingly demanded by shareholders and customers alike—financial inclusion is a natural place to start. It demonstrates a commitment to CSR principles and creates a positive brand built on equity. Further, financial institutions that embrace these changes gain an early adopter advantage and can build a loyal customer base. As these consumers begin to build wealth and expand their use of financial products, lenders will be able to forge lifelong relationships with these customers. Why not get a head start on making positive organizational change before the law compels it? Grow your business (and profits) To be sure, financial inclusion is a pressing moral imperative that financial institutions must address. But financial inclusion doesn't come at the expense of profit. It represents an enormous opportunity to do business with a large, untapped market without taking on additional risk. In many instances, unscorable and credit invisible consumers exhibit promising credit characteristics, which the conventional credit scoring system does not yet recognize. Consider consumers coming to the U.S. from other countries. They may have good credit histories in their home countries but have not yet established a credit history here. Likewise, many young, emerging consumers haven't generated enough history to be categorized as creditworthy. And some consumers may simply not utilize traditional credit instruments, like credit cards or loans. Instead, they may be using non-bank credit instruments (like payday loans or buy-now-pay-later arrangements) but regularly make payments. Ultimately, because of the way the credit system works, research shows that lenders are ignoring almost 20 percent of the U.S. population that don't have conventional credit scores as potential customers. These consumers may not be inherently riskier than scored consumers, but they often get labelled as such by the current credit scoring system. That's a major, missed opportunity! Modern credit scoring tools can help fill the information gap and rectify this. They draw on wider data sources that include consumer activities (like rent, utility and non-bank loan payments) and provide holistic information to assist with more accurate decisioning. For example, Lift Premium™ can score 96 percent of Americans with this additional information—a vast improvement over the 81 percent who are currently scored with conventional credit data.1 By tapping into these tools, financial institutions can extend credit to underserved populations, foster consumer loyalty and grow their portfolio of profitable customers. Do good for the economy Research suggests that financial inclusion can provide better outcomes for both individuals and economies. Specifically, it can lead to greater investment in education and businesses, better health, lower inequality, and greater entrepreneurship. For example, an entrepreneur who can access a small business loan due to an expanded credit scoring model is subsequently able to create jobs and generate taxable revenue. Small business owners spend money in their communities and add to the tax base – money that can be used to improve services and attract even more investment. Of course, not every start-up is a success. But if even a portion of new businesses thrive, a system that allows more consumers to access opportunities to launch businesses will increase that possibility. The last word Financial inclusion promotes a stronger economy and thriving communities by opening the world of financial services to more people, which benefits everyone. It enables underserved populations to leverage credit to become homeowners, start businesses and use credit responsibly—all markers of financial health. That in turn creates generational wealth that goes a long way toward closing the wealth gap. And widening the credit net also enables lenders to uncover new revenue sources by tapping new creditworthy consumers. Expanded data and advanced analytics allow lenders to get a fuller picture of credit invisible and unscorable consumers. Opening the door of credit will go a long way to establishing customer loyalty and creating opportunities for both consumers and lenders. Learn more

In an era where financial health is closely tied to economic mobility, the ability to obtain access to credit remains one of the most critical—and unequal—factors in determining long-term financial opportunities. While traditional credit data remains a powerful tool, it doesn’t always capture the full picture of a consumer’s financial story, especially for thin-file, new-to-credit, or nontraditional consumers. To drive true financial inclusion, financial institutions must go beyond conventional data sources and adopt a broader, more dynamic approach, one that includes alternative data and real-time financial behavior, such as cash flow insights. The financial inclusion gap: who’s being left out? Nearly 19 million U.S. households remain unbanked — yet many individuals within these communities possess the ability to borrow responsibly, save diligently and build long-term wealth. Traditional credit models alone may not fully capture these behaviors, leaving lenders with incomplete information and consumers without access to credit and the financial services they need. For lenders, inclusion isn’t just a mission, it's a market opportunity to unlock new revenue streams, reduce portfolio risk through diversification and build trust with tomorrow’s borrowers. By incorporating deeper insights, such as income patterns and alternative financial behaviors, you can obtain a more accurate picture of a consumer’s financial health. This will lead to more informed lending decisions and pave the way for a new era of inclusive, sustainable growth. Traditional credit scores tell part of the story — cash flow tells the rest Real-time cash flow data — sourced from consumer-permissioned information such as income streams, bank account balances and credit card activity — offers a more holistic and timely view of a borrower’s financial health. This dynamic data captures the day-to-day realities of a consumer’s financial behavior, enabling lenders to assess risk and creditworthiness more accurately. By leveraging cash flow insights, you can better understand and serve individuals with thin or no credit files, design more tailored financial products and align offerings with real consumer needs and financial rhythms. The result: smarter, faster decision-making that expands access to credit while enhancing portfolio performance. Introducing Experian’s Credit + Cash Flow Score To help financial institutions harness the power of both traditional and alternative data, we've developed the Credit + Cash Flow Score—a hybrid model that blends bureau-based insights with real-time cash flow data. This score gives lenders: A stronger foundation for inclusive lending strategies Deeper visibility into an applicant’s current financial behavior Improved risk segmentation, even for thin-file or new-to-credit applicants Better approval decisions, while maintaining portfolio integrity Taking the next step toward inclusive growth Financial institutions don’t have to choose between growth and responsibility. By integrating our financial inclusion tools, such as cash flow insights and alternative credit data, into your lending strategy, you can reach new customer segments, reduce friction in the decision-making process, and make smarter, more equitable credit decisions.Let’s work together to make financial inclusion more than a goal—let’s make it a reality. Learn more Download infographic

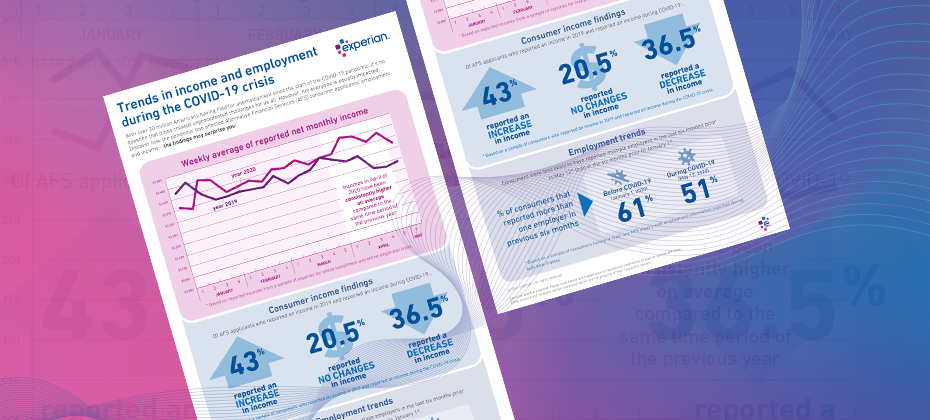

With many individuals finding themselves in increasingly vulnerable positions due to COVID-19, lenders must refine their policies based on their consumers’ current financial situations. Alternative Financial Services (AFS) data helps you gain a more comprehensive view of today's consumer. The COVID-19 pandemic has had far-reaching economic consequences, leading to drastic changes in consumers’ financial habits and behavior. When it comes to your consumers, are you seeing the full picture? See if you qualify for a complimentary hit rate analysis Download AFS Trends Report

Article written by Melanie Smith, Senior Copywriter, Experian Clarity Services, Inc. It’s been almost a decade since the Great Recession in the United States ended, but consumers continue to feel its effects. During the recession, millions of Americans lost their jobs, retirement savings decreased, real estate reduced in value and credit scores plummeted. Consumers that found themselves impacted by the financial crisis often turned to alternative financial services (AFS). Since the end of the recession, customer loyalty and retention has been a focus for lenders, given that there are more options than ever before for AFS borrowers. To determine what this looks like in the current climate, we examined today’s non-prime consumers, what their traditional scores look like and if they are migrating to traditional lending. What are alternative financial services (AFS)? Alternative financial services (AFS) is a term often used to describe the array of financial services offered by providers that operate outside of traditional financial institutions. In contrast to traditional banks and credit unions, alternative service providers often make it easier for consumers to apply and qualify for lines of credit but may charge higher interest rates and fees. More than 50% of new online AFS borrowers were first seen in 2018 To determine customer loyalty and fluidity, we looked extensively at the borrowing behavior of AFS consumers in the online marketplace. We found half of all online borrowers were new to the space as of 2018, which could be happening for a few different reasons. Over the last five years, there has been a growing preference to the online space over storefront. For example, in our trends report from 2018, we found that 17% of new online customers migrated from the storefront single pay channel in 2017, with more than one-third of these borrowers from 2013 and 2014 moving to online overall. There was also an increase in AFS utilization by all generations in 2018. Additionally, customers who used AFS in previous years are now moving towards traditional credit sources. 2017 AFS borrowers are migrating to traditional credit As we examined the borrowing behavior of AFS consumers in relation to customer loyalty, we found less than half of consumers who used AFS in 2017 borrowed from an AFS lender again in 2018. Looking into this further, about 35% applied for a loan but did not move forward with securing the loan and nearly 24% had no AFS activity in 2018. We furthered our research to determine why these consumers dropped off. After analyzing the national credit database to see if any of these consumers were borrowing in the traditional credit space, we found that 34% of 2017 borrowers who had no AFS activity in 2018 used traditional credit services, meaning 7% of 2017 borrowers migrated to traditional lending in 2018. Traditional credit scores of non-prime borrowers are growing After discovering that 7% of 2017 online borrowers used traditional credit services in 2018 instead of AFS, we wanted to find out if there had also been an improvement in their credit scores. Historically, if someone is considered non-prime, they don’t have the same access to traditional credit services as their prime counterparts. A traditional credit score for non-prime consumers is less than 600. Using the VantageScore® credit score, we examined the credit scores of consumers who used and did not use AFS in 2018. We found about 23% of consumers who switched to traditional lending had a near-prime credit score, while only 8% of those who continued in the AFS space were classified as near-prime. Close to 10% of consumers who switched to traditional lending in 2018 were classified in the prime category. Considering it takes much longer to improve a traditional credit rating, it’s likely that some of these borrowers may have been directly impacted by the recession and improved their scores enough to utilize traditional credit sources again. Key takeaways AFS remains a viable option for consumers who do not use traditional credit or have a credit score that doesn’t allow them to utilize traditional credit services. New AFS borrowers continue to appear even though some borrowers from previous years have improved their credit scores enough to migrate to traditional credit services. Customers who are considered non-prime still use AFS, as well as some near-prime and prime customers, which indicates customer loyalty and retention in this space. For more information about customer loyalty and other recently identified trends, download our recent reports. State of Alternative Data 2019 Lending Report

Are You #TeamTrended or #TeamAlternative? There’s no such thing as too much data, but when put head to head, differences between the data sets are apparent. Which team are you on? Here’s what we know: With the entry and incorporation of alternative credit data into the data arena, traditional credit data is no longer the sole determinant for credit worthiness, granting more people credit access. Built for the factors influencing financial health today, alternative credit data essentially fills the gaps of the traditional credit file, including alternative financial services data, rental payments, asset ownership, utility payments, full file public records, and consumer-permissioned data – all FCRA-regulated data. Watch this video to see more: Trended data, on the other hand shows actual, historical credit data. It provides key balance and payment data for the previous 24 months to allow lenders to leverage behavior trends to determine how individuals are utilizing their credit. Different splices of that information reveal particular behavior patterns, empowering lenders to then act on that behavior. Insights include a consumer’s spend on all general purpose credit and charge cards and predictive metrics that identify consumers who will be in the market for a specific type of credit product. In the head-to-head between alternative credit data and trended data, both have clear advantages. You need both on your roster to supplement traditional credit data and elevate your game to the next level when it comes to your data universe. Compared to the traditional credit file, alternative credit data can reveal information differentiating two consumers. In the examples below, both consumers have moderate limits and have making timely credit card payments according to their traditional credit reports. However, alternative data gives insight into their alternative financial services information. In Example 1, Robert Smith is currently past due on his personal loan, whereas Michelle Lee in Example 2 is current on her personal loan, indicating she may be the consumer with stronger creditworthiness. Similarly, trended data reveals that all credit scores are not created equal. Here is an example of how trended data can differentiate two consumers with the same score. Different historical trends can show completely different trajectories between seemingly similar consumers. While the traditional credit score is a reliable indication of a consumer’s creditworthiness, it does not offer the full picture. What insights are you missing out on? Go to Infographic Get Started Today

From the time we wake up to the minute our head hits the pillow, we make about 35,000 conscious and unconscious decisions a day. That’s a lot of processing in a 24-hour period. As part of that process, some decisions are intuitive: we’ve been in a situation before and know what to expect. Our minds make shortcuts to save time for the tasks that take a lot more brainpower. As for new decisions, it might take some time to adjust, weigh all the information and decide on a course of action. But after the new situation presents itself over and over again, it becomes easier and easier to process. Similarly, using traditional data is intuitive. Lenders have been using the same types of data in consumer credit worthiness decisions for decades. Throwing in a new data asset might take some getting used to. For those who are wondering whether to use alternative credit data, specifically alternative financial services (AFS) data, here are some facts to make that decision easier. In a recent webinar, Experian’s Vice President of Analytics, Michele Raneri, and Data Scientist, Clara Gharibian, shed some light on AFS data from the leading source in this data asset, Clarity Services. Here are some insights and takeaways from that event. What is Alternative Financial Services? A financial service provided outside of traditional banking institutions which include online and storefront, short-term unsecured, short-term installment, marketplace, car title and rent-to-own. As part of the digital age, many non-traditional loans are also moving online where consumers can access credit with a few clicks on a website or in an app. AFS data provides insight into each segment of thick to thin-file credit history of consumers. This data set, which holds information on more than 62 million consumers nationwide, is also meaningful and predictive, which is a direct answer to lenders who are looking for more information on the consumer. In fact, in a recent State of Alternative Credit Data whitepaper, Experian found that 60 percent of lenders report that they decline more than 5 percent of applications because they have insufficient information to make a loan decision. The implications of having more information on that 5 percent would make a measurable impact to the lender and consumer. AFS data is also meaningful and predictive. For example, inquiry data is useful in that it provides insight into the alternative financial services industry. There are also more stability indicators in this data such as number of employers, unique home phone, and zip codes. These interaction points indicate the stability or volatility of a consumer which may be helpful in decision making during the underwriting stage. AFS consumers tend to be younger and less likely to be married compared to the U.S. average and traditional credit data on File OneSM . These consumers also tend to have lower VantageScore® credit scores, lower debt, higher bad rates and much lower spend. These statistics lend themselves to seeing the emerging consumer; millennials, immigrants with little to no credit history and also those who may have been subprime or near prime consumers who are demonstrating better credit management. There also may be older consumers who may have not engaged in traditional credit history in a while or those who have hit a major life circumstance who had nowhere else to turn. Still others who have turned to nontraditional lending may have preferred the experience of online lending and did not realize that many of these trades do not impact their traditional credit file. Regardless of their individual circumstances, consumers who leverage alternative financial services have historically had one thing in common: their performance in these products did nothing to further their access to traditional, and often lower cost, sources of credit. Through Experian’s acquisition and integration of Clarity Services, the nation’s largest alternative finance credit bureau, lenders can gain access to powerful and predictive supplemental credit data that better detect risk while benefiting consumers with a more complete credit history. Alternative finance data can be used across the lending cycle from prospecting to decisioning and account review to collections. Alternative data gives lenders an expanded view of consumer behavior which enables more complete and confident lending decisions. Find out more about Experian’s alternative credit data: www.experian.com/alternativedata.

2019 is here — with new technology, new regulations and new opportunities on the docket. What does that mean for the financial services space? Here are the five trends you should keep your eye on and how these affect your credit universe. 1. Credit access is at an all-time high With 121 million Americans categorized as credit-challenged (subprime scores and a thin or nonexistent credit file) and 45 million considered credit-invisible (no credit history), the credit access many consumers take for granted has appeared elusive to others. Until now. The recent launch of Experian BoostTM empowers consumers to improve their credit instantly using payment history from their utility and phone bills, giving them more control over their credit scores and making them more visible to lenders and financial institutions. This means more opportunities for more people. Coupled with alternative credit data, which includes alternative financial services data, rental payments, and full-file public records, lenders and financial institutions can see a whole new universe. In 2019, inclusion is key when it comes to universe expansion goals. Both alternative credit and consumer-permissioned data will continue to be an important part of the conversation. 2. Machine learning for the masses The financial services industry has long been notorious for being founded on arguably antiquated systems and steeped in compliance and regulations. But the industry’s recent speed of disruption, including drastic changes fueled by technology and innovation, may suggest a changing of the guard. Digital transformation is an industry hot topic, but defining what that is — and navigating legacy systems — can be challenging. Successfully integrating innovation is the convergence at the center of the Venn diagram of strategy, technology and operations. The key, according to Deloitte, is getting “a better handle on data to extract the greatest value from technology investments.” How do you get the most value? Risk managers need big data, machine learning and artificial intelligence strategies to deliver market insights and risk evaluation. Between the difficulty of leveraging data sets and significant investment in time and money, it’s impossible for many to justify. To combat this challenge, the availability and access to an analytical sandbox (which contains depersonalized consumer data and comparative industry intel) is crucial to better serve clients and act on opportunities in lenders’ credit universe and beyond. “Making information analysis easily accessible also creates distinct competitive advantages,” said Vijay Mehta, Chief Innovation Officer for Experian’s Consumer Information Services, in a recent article for BAI Banking Strategies. “Identifying shifts in markets, changes in regulations or unexpected demand allows for quick course corrections. Tightening the analytic life cycle permits organizations to reach new markets and quickly respond to competitor moves.” This year is about meaningful metrics for action, not just data visualization. 3. How to fit into the digital-first ecosystem With so many things available on demand, the need for instant gratification continues to skyrocket. It’s no secret that the financial services industry needs to compete for attention across consumers’ multiple screens and hours of screen time. What’s in the queue for 2019? Personalization, digitalization and monetization. Consumers’ top banking priorities include customized solutions, omnichannel experience improvement and enhancing the mobile channel (as in, can we “Amazonize” everything?). Financial services leaders’ priorities include some of the same things, such as enhancing the mobile channel and delivering options to customize consumer solutions (BAI Banking Strategies). From geolocation targeting to microinteractions in the user experience journey to leveraging new strategies and consumer data to send personalized credit offers, there’s no shortage of need for consumer hyper-relevance. 33 percent of consumers who abandon business relationships do so because personalization is lacking, according to Accenture data for The Financial Brand. This expectation spans all channels, emphasizing the need for a seamless experience across all devices. 4. Keeping fraudsters out Many IT professionals regard biometric authentication as the most secure authentication method currently available. We see this technology on our personal devices, and many companies have implemented it as well. Biometric hacking is among the predicted threats for 2019, according to Experian’s Data Breach Industry Forecast, released last month. “Sensors can be manipulated and spoofed or deteriorate with too much use. ... Expect hackers to take advantage of not only the flaws found in biometric authentication hardware and devices, but also the collection and storage of data,” according to the report. 5. Regulatory changes and continued trends Under the Trump Administration, the regulatory front has been relatively quiet. But according to the Wall Street Journal, as Democrats gain control of the House of Representatives, lawmakers may be setting their sights on the financial services industry — specifically on legislation in response to the credit data breach in 2017. The Democratic Party leadership has indicated that the House Financial Services Committee will be focused on protecting consumers and investors, preserving sector stability, and encouraging responsible innovation in financial technology, according to Deloitte. In other news, the focus on improving accuracy in data reporting, transparency for consumers in credit scoring and other automated decisions can be expected to continue. Consumer compliance, and specifically the fair and responsible treatment of consumers, will remain a top priority. For all your needs in 2019 and beyond, Experian has you covered. Learn more

What if you had an opportunity to boost your credit score with a snap of your fingers? With the announcement of Experian BoostTM, this will soon be the new reality. As part of an increasingly customizable and instant consumer reality in the marketplace, Experian is innovating in the space of credit to allow consumers to contribute information to their credit profiles via access to their online bank accounts. For decades, Experian has been a leader in educating consumers on credit: what goes into a credit score, how to raise it and how to maintain it. Now, as part of our mission to be the consumer’s bureau, Experian is ushering in a new age of consumer empowerment with Boost. Through an already established and full-fledged suite of consumer products, Experian Boost is the next generation offering a free online platform that places the control in the consumers’ hands to influence their credit scores. The platform will feature a sign-in verification, during which consumers grant read-only permission for Experian Boost to connect to their online bank accounts to identify utility and telecommunications payments. After they verify their data and confirm that they want the account information added to their credit file, consumers will receive an instant updated FICO® Score. The history behind credit information spans several centuries from a group of London tailors swapping information on customers to keeping credit files on index cards being read out to subscribers over the telephone. Even with the evolution of the credit industry being very much in the digital age today, Experian Boost is a significant step forward for a credit bureau. This new capability educates the consumer on what types of payment behavior impacts their credit score while also empowering them to add information to change it. This is a big win-win for consumers and lenders alike. As Experian is taking the next big step as a traditional credit bureau, adding these data sources is a new and innovative way to help consumers gain access to the quality credit they deserve as well as promoting fair and responsible lending to the industry. Early analysis of Experian’s Boost impact on the U.S. consumer credit scores showed promising results. Here’s a snapshot of some of those findings: These statistics provide an encouraging vision into the future for all consumers, especially for those who have a limited credit history. The benefit to lenders in adding these new data points will be a more complete view on the consumer to make more informed lending decisions. Only positive payment histories will be collected through the platform and consumers can elect to remove the new data at any time. Experian Boost will be available to all credit active adults in early 2019, but consumers can visit www.experian.com/boost now to register for early access. By signing up for a free Experian membership, consumers will receive a free credit report immediately, and will be one of the first to experience the new platform. Experian Boost will apply to most leading consumer credit scores used by lenders. To learn more about the platform visit www.experian.com/boost.