Topics

Protecting consumer information is paramount in today’s digital age, especially for financial institutions. With cyber threats on the rise, robust user authentication methods are essential to safeguard sensitive data. This guide will walk you through the various user authentication types and methods, focusing on solutions that can help financial institutions enhance their security measures and protect consumers’ personal information. Understanding user authentication types Single-factor authentication (SFA) Single-factor authentication is the most basic form of authentication, requiring only one piece of information, such as a password. While it's easy to implement, SFA has significant drawbacks, particularly in the financial sector where security is critical. Passwords can be easily compromised through phishing or brute force attacks, making SFA insufficient on its own. Two-factor authentication (2FA) Two-factor authentication uses two different factors to verify a user's identity. For example, a bank might require a consumer to enter their password and then confirm their identity with a code sent to their mobile device. This method enhances security without overcomplicating the user experience. Multi-factor authentication (MFA) Multi-factor authentication adds an extra layer of security by requiring two or more verification factors. These factors typically include something you know (a password), something you have (a token or smartphone), and something you can present with your body, such as a fingerprint or facial scan (biometric data). MFA significantly reduces the risk of unauthorized access, making it a crucial component for financial institutions. Common authentication methods Password-based authentication Passwords are the most common form of authentication. However, they come with challenges, especially in the financial sector. Weak or reused passwords can be easily exploited. Financial institutions should enforce strong password policies and educate consumers on creating secure passwords. Biometric authentication Biometric authentication uses unique biological characteristics, such as fingerprints, facial recognition, or iris scans to verify identity. This method is becoming increasingly popular in banking due to its convenience and high level of security. However, a potential drawback is that it also raises privacy concerns. Token-based authentication Token-based authentication involves the use of physical or software tokens. Physical tokens, like smart cards, generate a one-time code for login. Software tokens, such as mobile apps, provide similar functionality. This method is highly secure and is often used in financial transactions. Certificate-based authentication Certificate-based authentication uses digital certificates to establish a secure connection. This method is commonly used in secure communications within financial systems. While it offers robust security, implementing and managing digital certificates can be complex. Two-factor authentication (2FA) solutions 2FA is a practical and effective way to enhance security. Popular methods include SMS-based codes, app-based authentication, and email-based verification. Each method has its pros and cons, but all provide an additional layer of security that is vital for protecting financial data. Many financial institutions have successfully implemented two factor authentication solutions. For example, a bank might use SMS-based 2FA to verify transactions, significantly reducing fraud. Another institution might adopt app-based 2FA, offering consumers a more secure and convenient way to authenticate their identity. Multi-factor authentication (MFA) solutions MFA is essential for financial institutions aiming to enhance security. Multifactor authentication solutions can provide multiple layers of protection and ensure that even if one factor is compromised, unauthorized access is still prevented. Implementing MFA requires careful planning. Financial institutions should start by assessing their current security measures and identifying areas for improvement. It's crucial to choose MFA solutions that integrate seamlessly with existing systems. Training staff and educating consumers on the importance of MFA can also help ensure a smooth transition. Knowledge-based authentication (KBA) solutions What is KBA? Knowledge-based authentication relies on information that only the user should know, such as answers to security questions. There are two types: static KBA, which uses pre-set questions, and dynamic KBA, which generates questions based on the user's transaction history or other data. Effectiveness of KBA While KBA can be effective, it has its limitations. Static KBA is vulnerable to social engineering attacks, where fraudsters gather information about the user to answer security questions. Dynamic KBA offers more security but can be more complex to implement. Financial institutions should weigh the pros and cons of KBA and consider combining it with other methods for enhanced security. Enhancing KBA security To improve KBA security, financial institutions can combine it with other user authentication types, such as MFA or 2FA. This layered approach ensures that even if one method is compromised, additional layers of security are in place. Best practices for knowledge based authentication solutions include regularly updating security questions and using questions that are difficult for others to guess. Using authentication methods to protect consumer information Choosing the right authentication methods is crucial for financial institutions to protect consumer information and maintain trust. By understanding and implementing robust authentication solutions like MFA, 2FA, and KBA, banks and financial services can significantly enhance their security posture. As cyber threats continue to evolve, staying ahead with advanced authentication methods will be key to safeguarding sensitive data and ensuring consumer confidence. Experian’s multifactor authentication solutions can enhance your existing authentication process while reducing friction, using risk-assessment tools to apply the appropriate level of security. Learn how your organization can provide faster, more agile mobile transactions, risk protection for your business, and security and peace of mind for your consumers. Visit our website to learn more This article includes content created by an AI language model and is intended to provide general information.

There’s a common saying in the fraud prevention industry: where there’s opportunity, fraudsters are quick to follow. Recent advances in technology are providing ample new opportunities for cybercriminals to exploit. One of the most prevalent techniques being observed today is password spraying. From email to financial and health records, consumers and businesses are being impacted by this pervasive form of fraud. Password spraying attacks often fly under the radar of traditional security measures, presenting a unique and growing threat to businesses and individuals. What is password spraying? Also known as credential guessing, password spraying involves an attacker applying a list of commonly used passwords against a list of accounts in order to guess the correct password. When password spraying first emerged, an individual might hand key passwords to try to gain access to a user’s account or a business’s management system. Credential stuffing is a similar type of fraud attack in which an attacker gains access to a victim’s credentials in one system (e.g., their email, etc.) and then attempts to apply those known credentials via a script/bot to a large number of sites in order to gain access to other sites where the victim might be using the same credentials. Both are brute-force attack vectors that eventually result in account takeover (ATO), compromising sensitive data that is subsequently used to scam, blackmail, or defraud the victim. As password spraying and other types of fraud evolved, fraud rings would leverage “click farms” or “fraud farms” where hundreds of workers would leverage mobile devices or laptops to try different passwords in order to perpetrate fraud attacks on a larger scale. As technology has advanced, bot attacks fueled by generative AI (Gen AI) have taken the place of humans in the fraud ring. Now, instead of hand-keying passwords into systems, workers at fraud farms are able to deploy hundreds or thousands of bots that can work exponentially faster. The rise and evolution of bots Bots are not necessarily new to the digital experience — think of the chatbot on a company’s support page that helps you find an answer more quickly. These automated software applications carry out repetitive instructions mimicking human behavior. While they can be helpful, they can also be leveraged by fraudsters, to automate fraud on a brute-force attack, often going undetected resulting in substantial losses. Generation 4 bots are the latest evolution of these malicious programs, and they’re notoriously hard to detect. Because of their slow, methodical, and deliberate human-like behavior, they easily bypass network-level controls such as firewalls and popular network-layer security. Stopping Gen4 bots For any company with a digital presence or that leverages digital networks as part of doing business, the threat from Gen AI enabled fraud is paramount. The traditional stack for fighting fraud including firewalls, CAPTCHA and block lists are not enough in the face of Gen4 bots. Companies at the forefront of fighting fraud are leveraging behavioral analytics to identify and mitigate Gen AI-powered fraud. And many have turned to industry leader, Neuro ID, which is now part of Experian. Watch our on-demand webinar: The fraud bot future-shock: How to spot & stop next-gen attacks Behavioral analytics is a key component of passive and continuous authentication and has become table stakes in the fraud prevention space. By measuring how a user interacts with a form field (e.g., a website, mobile app, etc.) our behavioral analytics solutions can determine if the user is: a potential fraudster, a bot, or a genuine user familiar with the PII entered. Because it’s available at any digital engagement, behavioral data is often the most consistent signal available throughout the customer lifecycle and across geographies. It allows risky users to be rejected or put through more rigorous authentication, while trustworthy users get a better experience, protecting businesses and consumers from Gen AI-enabled fraud. As cyber threats evolve, so must our defenses. Password spraying exemplifies the sophisticated methods and technologies attackers now employ to scale their fraud efforts and gain access to sensitive information. To fight next-generation fraud, organizations must employ next-generation technologies and techniques to better defend themselves against this and other types of cyberattacks. Experian’s approach embodies a paradigm shift where fraud detection increases efficiency and accuracy without sacrificing customer experience. We can help protect your company from bot attacks, fraudulent accounts and other malicious attempts to access your sensitive data. Learn more about behavioral analytics and our other fraud prevention solutions. Learn more

Dormant fraud, sleeper fraud, trojan horse fraud . . . whatever you call it, it’s an especially insidious form of account takeover fraud (ATO) that fraud teams often can’t detect until it’s too late. Fraudsters create accounts with stolen credentials or gain access to existing ones, onboard under the fake identity, then lie low, waiting for an opportunity to attack. It takes a strategic approach to defeat the enemy from within, and fraudsters assume you won’t have the tools in place to even know where to start. Dormant fraud uncovered: A case study NeuroID, a part of Experian, has seen the dangers of dormant fraud play out in real time. As a new customer to NeuroID, this payment processor wanted to backtest their user base for potential signs of fraud. Upon analyzing their customer base’s onboarding behavioral data, we discovered more than 100K accounts were likely to be dormant fraud. The payment processor hadn’t considered these accounts suspicious and didn’t see any risk in letting them remain active, despite the fact that none of them had completed a transaction since onboarding. Why did we flag these as risky? Low familiarity: Our testing revealed behavioral red flags, such as copying and pasting into fields or constant tab switching. These are high indicators that the applicant is applying with personally identifiable information (PII) that isn’t their own. Fraud clusters: Many of these accounts used the same web browser, device, and IP address during sign-up, suggesting that one fraudster was signing up for multiple accounts. We found hundreds of clusters like these, many with 50 or more accounts belonging to the same device and IP address within our customer’s user base. It was clear that this payment processor’s fraud stack had gaps that left them vulnerable. These dormant accounts could have caused significant damage once mobilized: receiving or transferring stolen funds, misrepresenting their financial position, or building toward a bust-out. Dormant fraud thrives in the shadows beyond onboarding. These fraudsters keep accounts “dormant” until they’re long past onboarding detection measures. And once they’re in, they can often easily transition to a higher-risk account — after all, they’ve already confirmed they’re trustworthy. This type of attack can involve fraudulent accounts remaining inactive for months, allowing them to bypass standard fraud detection methods that focus on immediate indicators. Dormant fraud gets even more dangerous when a hijacked account has built trust just by existing. For example, some banks provide a higher credit line just for current customers, no matter their activities to date. The more accounts an identity has in good standing, the greater the chance that they’ll be mistaken for a good customer and given even more opportunities to commit higher-level fraud. This is why we often talk to our customers about the idea of progressive onboarding as a way to overcome both dormant fraud risks and the onboarding friction caused by asking for too much information, too soon. Progressive onboarding, dormant fraud, and the friction balance Progressive onboarding shifts from the one-size-fits-all model by gathering only truly essential information initially and asking for more as customers engage more. This is a direct counterbalance to the approach that sometimes turns customers off by asking for too much too soon, and adding too much friction at initial onboarding. It also helps ensure ongoing checks that fight dormant fraud. We’ve seen this approach (already growing popular in payment processing) be especially useful in every type of financial business. Here’s how it works: A prospect visits your site to explore options. They may just want to understand fees and get a feel for your offerings. At this stage, you might ask for minimal information — just a name and email — without requiring a full fraud check or credit score. It’s a low commitment ask that keeps things simple for casual prospects who are just browsing, while also keeping your costs low so you don’t spend a full fraud check on an uncommitted visitor. As the prospect becomes a true customer and begins making small transactions, say a $50 transfer, you request additional details like their date of birth, physical address, or phone number. This minor step-up in information allows for a basic behavioral analytics fraud check while maintaining a low barrier of time and PII-requested for a low-risk activity. With each new level of engagement and transaction value, the information requested increases accordingly. If the customer wants to transfer larger amounts, like $5,000, they’ll understand the need to provide more details — it aligns with the idea of a privacy trade-off, where the customer’s willingness to share information grows as their trust and need for services increase. Meanwhile, your business allocates resources to those who are fully engaged, rather than to one-time visitors or casual sign-ups, and keeps an eye on dormant fraudsters who might have expected no barrier to additional transactions. Progressive onboarding is not just an effective approach for dormant fraud and onboarding friction, but also in fighting fraudsters who sneak in through unseen gaps. In another case, we worked with a consumer finance platform to help identify gaps in their fraud stack. In one attack, fraudsters probed until they found the product with the easiest barrier of entry: once inside they went on to immediately commit a full-force bot attack on higher value returns. The attack wasn’t based on dormancy, but on complacency. The fraudsters assumed this consumer finance platform wouldn’t realize that a low controls onboarding for one solution could lead to ease of access to much more. And they were right. After closing that vulnerability, we helped this customer work to create progressive onboarding that includes behavior-based fraud controls for every single user, including those already with accounts, who had built that assumed trust, and for low-risk entry-points. This weeded out any dormant fraudsters already onboarded who were trying to take advantage of that trust, as they had to go through behavioral analytics and other new controls based on the risk-level of the product. Behavioral analytics gives you confidence that every customer is trustworthy, from the moment they enter the front door to even after they’ve kicked off their shoes to stay a while. Behavioral analytics shines a light on shadowy corners Behavioral analytics are proven beyond just onboarding — within any part of a user interaction, our signals detect low familiarity, high-risk behavior and likely fraud clusters. In our experience, building a progressive onboarding approach with just these two signal points alone would provide significant results — and would help stop sophisticated fraudsters from perpetrating dormant fraud, including large-scale bust outs. Want to find out how progressive onboarding might work for you? Contact us for a free demo and deep dive into how behavioral analytics can help throughout your user journey. Contact us for a free demo

In the ever-evolving landscape of mortgage lending, efficiency and responsiveness are paramount. Greg Holmes, Chief Revenue Officer at Xactus, shares his insights on how their partnership with Experian has significantly enhanced their operations and client satisfaction. He highlights the dual nature of their relationship with Experian, describing it as strategic and tactical. This multifaceted partnership allows Xactus to swiftly address day-to-day business issues while focusing on long-term strategic goals. Experian’s willingness to listen and incorporate feedback has been a cornerstone of this successful collaboration. Holmes said, "Their willingness to listen to us and take feedback that we've been able to provide has really helped separate them." Commitment to mortgage lending According to Holmes, one of the standout aspects of Experian's service is its unwavering commitment to the mortgage lending process. This dedication is evident in their continuous investment in the sector, which has enabled faster and more accurate loan closures. He also notes, "You can truly see the investment that Experian has put into our space, which has enabled homeowners to close loans faster and more accurately for lenders." Technological advancements and automation Experian's technological advancements have played a crucial role in enhancing Xactus's operations. The integration of Experian Verify, particularly in the verification of income and employment data, has streamlined the process, contributing to the goal of achieving a digital mortgage. This automation speeds up loan origination and closure and ensures greater accuracy and efficiency. Cost control and flexibility Another key benefit of partnering with Experian is the cost control and flexibility it offers. The single price point for orders and the robust integrations with loan-origination software companies have been particularly beneficial. These integrations allow Xactus to leverage Experian's data effectively, providing a seamless experience for lenders and borrowers alike. Greg emphasizes, "They love the fact that it helps with cost control. That single price point with orders has been extremely important." The testimonial from Xactus’ Greg Holmes clearly shows how Experian's proactive approach, technological innovations, and commitment to the mortgage lending industry have made a tangible difference. According to Holmes, by listening to client feedback and continuously investing in their services, Experian has positioned itself as a vital partner in the quest for optimal efficiency in mortgage lending. Learn more about Verify

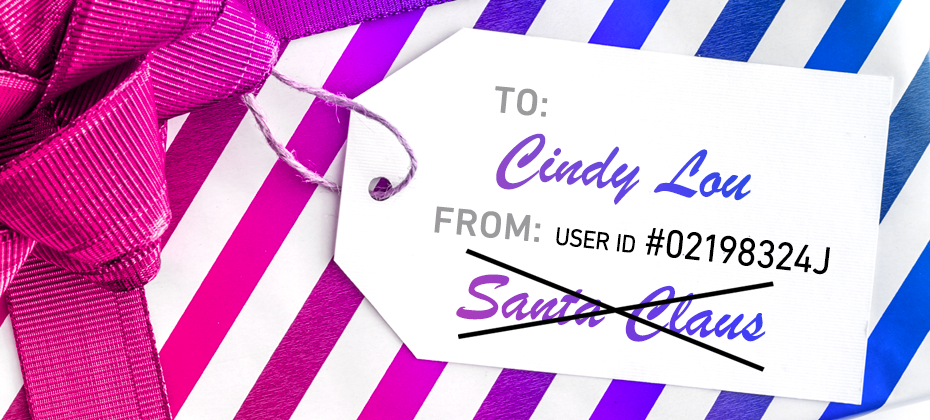

A tale of synthetic ID fraud Synthetic ID fraud is an increasing issue and affects everyone, including high-profile individuals. A notable case from Ohio involved Warren Hayes, who managed to get an official ID card in the name of “Santa Claus” from the Ohio Bureau of Motor Vehicles. He also registered a vehicle, opened a bank account, and secured an AAA membership under this name, listing his address as 1 Noel Drive, North Pole, USA. This elaborate ruse unraveled after Hayes, disguised as Santa, got into a minor car accident. When the police requested identification, Hayes presented his Santa Claus ID. He was subsequently charged under an Ohio law prohibiting the use of fictitious names. However, the court—presided over by Judge Thomas Gysegem—dismissed the charge, arguing that because Hayes had used the ID for over 20 years, "Santa Claus" was effectively a "real person" in the eyes of the law. The judge’s ruling raised eyebrows and left one glaring question unanswered: how could official documents in such a blatantly fictitious name go undetected for two decades? From Santa Claus to synthetic IDs: the modern-day threat The Hayes case might sound like a holiday comedy, but it highlights a significant issue that organizations face today: synthetic identity fraud. Unlike traditional identity theft, synthetic ID fraud does not rely on stealing an existing identity. Instead, fraudsters combine real and fictitious details to create a new “person.” Think of it as an elaborate game of make-believe, where the stakes are millions of dollars. These synthetic identities can remain under the radar for years, building credit profiles, obtaining loans, and committing large-scale fraud before detection. Just as Hayes tricked the Bureau of Motor Vehicles, fraudsters exploit weak verification processes to pass as legitimate individuals. According to KPMG, synthetic identity fraud bears a staggering $6 billion cost to banks.To perpetrate the crime, malicious actors leverage a combination of real and fake information to fabricate a synthetic identity, also known as a “Frankenstein ID.” The financial industry classifies various types of synthetic identity fraud. Manipulated Synthetics – A real person’s data is modified to create variations of that identity. Frankenstein Synthetics – The data represents a combination of multiple real people. Manufactured Synthetics – The identity is completely synthetic. How organizations can combat synthetic ID fraud A multifaceted approach to detecting synthetic identities that integrates advanced technologies can form the foundation of a sound fraud prevention strategy: Advanced identity verification tools: Use AI-powered tools that cross-check identity attributes across multiple data points to flag inconsistencies. Behavioral analytics: Monitor user behaviors to detect anomalies that may indicate synthetic identities. For instance, a newly created account applying for a large loan with perfect credit is a red flag. Digital identity verification: Implement digital onboarding processes that include online identity verification with real-time document verification. Users can upload government-issued IDs and take selfies to confirm their identity. Collaboration and data sharing: Organizations can share insights about suspected synthetic identities to prevent fraudsters from exploiting gaps between industries. Ongoing employee training: Ensure frontline staff can identify suspicious applications and escalate potential fraud cases. Regulatory support: Governments and regulators can help by standardizing ID issuance processes and requiring more stringent checks. Closing thoughts The tale of Santa Claus’ stolen identity may be entertaining, but it underscores the need for vigilance against synthetic ID fraud. As we move into an increasingly digital age, organizations must stay ahead of fraudsters by leveraging technology, training, and collaboration. Because while the idea of Spiderman or Catwoman walking into your branch may seem amusing, the financial and reputational cost of synthetic ID fraud is no laughing matter. Learn more

Generative AI (GenAI) is transforming the financial services industry, driving innovation, efficiency and cost savings across various domains. By integrating GenAI into their operations, financial institutions can better respond to rapidly changing environments. GenAI is reshaping financial services from customer engagement to compliance, leading to streamlined operations and enhanced decision-making. The strategic role of GenAI in financial services Adopting GenAI in financial services is now a strategic imperative. A 2024 McKinsey report (The State of AI in 2024) notes more than a 10% revenue increase for companies using GenAI. As institutions strive to stay competitive, GenAI provides powerful tools to enhance customer experiences, optimize operations, accelerate regulatory compliance, and expedite coding and software development. Key areas where GenAI is making an impact Enhanced customer engagement Financial institutions use GenAI to offer personalized products and services. By analyzing real-time customer data, GenAI enables tailored recommendations, boosting satisfaction and retention. Streamlining and optimizing operations GenAI automates tasks like data entry and transaction monitoring, freeing up resources for strategic activities. This accelerates workflows and reduces errors. Further, GenAI-driven efficiency directly cuts costs. By automating processes and optimizing resources, institutions can lower overhead and invest more in innovation. Deloitte’s Q2 2024 study found AI automation reduced processing times by up to 60% and operational costs by 25%. Accelerating regulatory compliance GenAI simplifies compliance by automating data collection, analysis and reporting. This ensures regulatory adherence while minimizing risks and penalties. According to a 2024 Thomson Reuters survey, AI-driven compliance reduced reporting times by 40% and costs by 15%. Developer coding support for efficiencies GenAI is an invaluable tool for programmers. It aids in code generation, task automation and debugging, boosting development speed and allowing focus on innovation. Gartner’s 2024 research highlights a 30% improvement in coding efficiency and a 25% reduction in development timeframes due to GenAI. Accelerating credit analytics with Experian Assistant Within the credit risk management space, GenAI offers a powerful solution that addresses some known pain points. These relate to mining vast amounts of data for insight generation and coding support for attribute selection and creation, model development, and expedited deployment. Experian Assistant is a game-changer in modernizing analytics workflows across the data science lifecycle. Integrated into the Experian Ascend™ platform, it’s specifically designed for analytics and data science teams to tackle the challenges of data analysis, model deployment and operational efficiency head-on. Capabilities and skills of Experian Assistant Data tutor: Offers comprehensive insights into Experian’s data assets, enabling users to make informed decisions and optimize workflows Analytics expert: Provides tailored recommendations for various use cases, helping users identify the most predictive metrics and enhance model accuracy Code advisor (data prep): Automatically generates code for tasks like data merging and sampling, streamlining the data preparation process Code advisor (analysis): Generates code for risk analytics and modeling tasks, including scorecard development and regulatory analyses Tech specialist: Facilitates model deployment and documentation, minimizing delays and ensuring a seamless transition from development to production Driving more-informed decisions Adopting GenAI will be key to maintaining competitiveness as the financial services industry evolves. With projections showing significant growth in GenAI investments by 2025, the potential for enhanced efficiencies, streamlined operations and cost savings is immense. Experian Assistant is at the forefront of this transformation, addressing the bottlenecks that slow down analytical processes and enabling financial institutions to move faster, more informed and with greater precision. By integrating the capabilities of the Experian Assistant, financial institutions can leverage GenAI in credit risk management, automate data processes, and develop customized analytics for business decision-making. This alignment with GenAI’s broader benefits—like operational streamlining and improved customer experience—ensures better risk identification, workflow optimization, and more informed decisions. To learn more about how Experian Assistant can transform your data analytics capabilities, watch our recent tech showcase and book a demo with your local Experian sales team. Watch tech showcase Learn more

This series will explore our monthly State of the Economy report, which provides a snapshot of the top monthly economic and credit data for financial service professionals to proactively shape their business strategies. The U.S. economy remains on solid footing, as GDP grew at a healthy 2.8% rate in Q3, driven by consumer spending. Alongside growth, inflation ticked up, while the labor market eased across several measures. In response to these developments, the Federal Reserve announced a quarter-point cut in November, with another cut penciled in for December. The November State of the Economy report fills in the rest of the macroeconomic story. This month’s highlights include: Annual headline inflation ticked up from 2.4% to 2.6%. 12,000 jobs were added in October, amid hurricane and strike impacts. Retail sales increased by 0.4% in October. Check out the full report for a detailed analysis of the rest of this month’s data, including the latest trends in originations, job openings, and growth. Download November's report As our economy continues to fluctuate, it’s critical to stay updated on the latest developments. Subscribe to our new series, The Macro Moment, for economic commentary from Experian NA’s Chief Economist, Joseph Mayans, with additional economic resources, including our new Election Eve’s Scenario Forecasts report. For more economic trends and market insights, visit Experian Edge.

The digital domain is rife with opportunities, but it also brings substantial risks, especially for organizations. Among the innovative tools that have risen to prominence for fraud detection and online security is browser fingerprinting. Whether you're looking to minimize security gaps or bolster your fraud prevention strategy, understanding how this technology works can provide a significant advantage in today’s ever-evolving fraud and identity landscape. This article explores the concept, functionality, and applications of browser fingerprinting while also examining its benefits and relevance for organizations. How does browser fingerprinting work? Browser fingerprinting is a powerful technology designed to collect unique identifying information about a user’s web browser and device. By compiling data points such as browser type, operating system, time zone, and installed plugins, browser fingerprinting creates a distinct profile — or "fingerprint"— that allows websites to recognize returning users without relying on cookies. Here’s a breakdown of its key steps: Data collection: When a user visits a website, their browser sends information, such as user-agent strings or metadata, to the website's servers. This data provides insights about their browser, device, and system. Fingerprint creation: The collected information is processed to generate a unique ID or fingerprint, representing the user's specific configuration. Tracking and analyzing: These fingerprints enable websites to track and analyze user behavior, detect anomalies, and identify users without relying on traditional tracking mechanisms like cookies. For organizations, employing technology that leverages such fingerprints adds an additional layer to identity verification, detecting discrepancies that may indicate fraud attempts. What are the different techniques? Not all browser fingerprinting methods are identical; varying approaches offer different strengths. The most common techniques used today include: Canvas fingerprinting: This method utilizes the "Canvas" element in HTML5. When a website sends a command to draw a hidden image on a user's device, the way the image is rendered reveals unique characteristics about the device's graphics hardware and software. Font fingerprinting: Font fingerprinting involves analyzing the fonts installed on a user's system. Since computers and browsers render text in slightly different ways based on their configurations, the resulting variations aid in identifying users. Plugin enumeration: Browsers and devices often come equipped with plugins or extensions like Flash or Java. Analyzing which plugins are installed, their versions, and their order helps websites build unique fingerprints. What are the benefits of browser fingerprinting? For organizations, browser fingerprinting is not just a technical marvel — it’s a strategic asset. Benefits include: Enhanced fraud detection: Browser fingerprinting detects inconsistencies within user accounts, flagging unauthorized logins, synthetic identity fraud, or account takeover fraud without introducing significant friction for legitimate users. By identifying patterns that deviate from the norm, organizations can better prepare for malicious activities. Learn more about addressing account takeover fraud. Supports multi-layered security: A single security measure often isn't enough to combat advanced fraudulent schemes. Browser fingerprinting pairs seamlessly with other fraud management tools, such as behavioral analytics and risk-based authentication, to provide robust security. See how behavioral analytics can help organizations spot and stop next-generation fraud bots. Seamless user experience: Unlike cookies or authentication codes, browser fingerprinting operates passively in the background. Users remain unaware of the process, ensuring their experience is unaffected while still maintaining security. Level up with Experian's fraud prevention tools Browser fingerprinting offers organizations a game-changing tool to secure online interactions. However, given the growing complexity of fraud threats, organizations will need additional layers of insights and protection. Experian offers integrated, AI-driven fraud prevention solutions tailor-made to tackle challenges in the digital space. By leveraging advanced technologies like browser fingerprinting alongside Experian’s solutions, organizations can safeguard their operations and uphold customer trust while maintaining a frictionless user experience. Learn more about our fraud prevention solutions This article includes content created by an AI language model and is intended to provide general information.

We are squarely in the holiday shopping season. From the flurry of promotional emails to the endless shopping lists, there are many to-dos and even more opportunities for financial institutions at this time of year. The holiday shopping season is not just a peak period for consumer spending; it’s also a critical time for financial institutions to strategize, innovate, and drive value. According to the National Retail Federation, U.S. holiday retail sales are projected to approach $1 trillion in 2024, , and with an ever-evolving consumer behavior landscape, financial institutions need actionable strategies to stand out, secure loyalty, and drive growth during this period of heightened spending. Download our playbook: "How to prepare for the Holiday Shopping Season" Here’s how financial institutions can capitalize on the holiday shopping season, including key insights, actionable strategies, and data-backed trends. 1. Understand the holiday shopping landscape Key stats to consider: U.S. consumers spent $210 billion online during the 2022 holiday season, according to Adobe Analytics, marking a 3.5% increase from 2021. Experian data reveals that 31% of all holiday purchases in 2022 occurred in October, highlighting the extended shopping season. Cyber Week accounted for just 8% of total holiday spending, according to Experian’s Holiday Spending Trends and Insights Report, emphasizing the importance of a broad, season-long strategy. What this means for financial institutions: Timing is crucial. Your campaigns are already underway if you get an early start, and it’s critical to sustain them through December. Focus beyond Cyber Week. Develop long-term engagement strategies to capture spending throughout the season. 2. Leverage Gen Z’s growing spending power With an estimated $360 billion in disposable income, according to Bloomberg, Gen Z is a powerful force in the holiday market. This generation values personalized, seamless experiences and is highly active online. Strategies to capture Gen Z: Offer digital-first solutions that enhance the holiday shopping journey, such as interactive portals or AI-powered customer support. Provide loyalty incentives tailored to this demographic, like cash-back rewards or exclusive access to services. Learn more about Gen Z in our State of Gen Z Report. To learn more about all generations' projected consumer spending, read new insights from Experian here, including 45% of Gen X and 52% of Boomers expect their spending to remain consistent with last year. 3. Optimize pre-holiday strategies Portfolio Review: Assess consumer behavior trends and adjust risk models to align with changing economic conditions. Identify opportunities to engage dormant accounts or offer tailored credit lines to existing customers. Actionable tactics: Expand offerings. Position your products and services with promotional campaigns targeting high-value segments. Personalize experiences. Use advanced analytics to segment clients and craft offers that resonate with their holiday needs or anticipate their possible post-holiday needs. 4. Ensure top-of-mind awareness During the holiday shopping season, competition to be the “top of wallet” is fierce. Experian’s data shows that 58% of high spenders shop evenly across the season, while 31% of average spenders do most of their shopping in December. Strategies for success: Early engagement: Launch educational campaigns to empower credit education and identity protection during this period of increased transactions. Loyalty programs: Offer incentives, such as discounts or rewards, that encourage repeat engagement during the season. Omnichannel presence: Utilize digital, email, and event marketing to maintain visibility across platforms. 5. Combat fraud with multi-layered strategies The holiday shopping season sees an increase in fraud, with card testing being the number one attack vector in the U.S. according to Experian’s 2024 Identity and Fraud Study. Fraudulent activity such as identity theft and synthetic IDs can also escalate. Fight tomorrow’s fraud today: Identity verification: Use advanced fraud detection tools, like Experian’s Ascend Fraud Sandbox, to validate accounts in real-time. Monitor dormant accounts: Watch these accounts with caution and assess for potential fraud risk. Strengthen cybersecurity: Implement multi-layered strategies, including behavioral analytics and artificial intelligence (AI), to reduce vulnerabilities. 6. Post-holiday follow-up: retain and manage risk Once the holiday rush is over, the focus shifts to managing potential payment stress and fostering long-term relationships. Post-holiday strategies: Debt monitoring: Keep an eye on debt-to-income and debt-to-limit ratios to identify clients at risk of defaulting. Customer support: Offer tailored assistance programs for clients showing signs of financial stress, preserving goodwill and loyalty. Fraud checks: Watch for first-party fraud and unusual return patterns, which can spike in January. 7. Anticipate consumer trends in the New Year The aftermath of the holidays often reveals deeper insights into consumer health: Rising credit balances: January often sees an uptick in outstanding balances, highlighting the need for proactive credit management. Shifts in spending behavior: According to McKinsey, consumers are increasingly cautious post-holiday, favoring savings and value-based spending. What this means for financial institutions: Align with clients’ needs for financial flexibility. The holiday shopping season is a time that demands precise planning and execution. Financial institutions can maximize their impact during this critical period by starting early, leveraging advanced analytics, and maintaining a strong focus on fraud prevention. And remember, success in the holiday season extends beyond December. Building strong relationships and managing risk ensures a smooth transition into the new year, setting the stage for continued growth. Ready to optimize your strategy? Contact us for tailored recommendations during the holiday season and beyond. Download the Holiday Shopping Season Playbook

Technology has dramatically transformed the financial services landscape, fostering innovation and enhancing operational efficiency. In an interview at this year’s Money20/20 conference, Scott Brown, Group President of Financial and Marketing Services for Experian, sat down with Fintech Futures’ North America Correspondent Heather Sugg to share how Experian is leveraging data, analytics, and artificial intelligence (AI) to modernize the financial services industry. During the discussion, Scott highlighted the recent launch of Experian Assistant — our newest generative AI tool designed to accelerate the modeling lifecycle, resulting in greater productivity, improved data visibility, and reduced delays and expenses. While Experian Assistant is a business-to-business solution built alongside our clients, Scott also noted its broader impact — helping increase credit access for underserved consumers. “At Experian, we’re really focused on addressing the underserved community who doesn’t have access to credit,” said Scott. “And we think that this tool helps lenders reach those customers in an easier way.” Learn more about Experian Assistant and watch our tech showcase to see the solution in action. Learn more Watch tech showcase

Despite being a decades-old technology, behavioral analytics is often still misunderstood. We’ve heard from fraud, identity, security, product, and risk professionals that exploring a behavior-based fraud solution brings up big questions, such as: What does behavioral analytics provide that I don’t get now? (Quick answer: a whole new signal and an earlier view of fraud) Why do I need to add even more data to my fraud stack? (Quick answer: it acts with your stack to add insights, not overload) How is this different from biometrics? (Quick answer: while biometrics track characteristics, behavioral analytics tracks distinct actions) These questions make sense — stopping fraud is complex, and, of course, you want to do your research to fully understand what ROI any tool will add. NeuroID, now part of Experian, is one of the only behavioral analytics-first businesses built specifically for stopping fraud. Our internal experts have been crafting behavioral-first solutions to detect everything from simple script fraud bots through to generative AI (genAI) attacks. We know how behavioral analytics works best within your fraud stack, and how to think strategically about using it to stop fraud rings, bot fraud, and other third-party fraud attacks. This primer will provide answers to the biggest questions we hear, so you can make the most informed decisions when exploring how our behavioral analytics solutions could work for you. Q1. What is behavioral analytics and how is it different from behavioral biometrics? A common mistake is to conflate behavioral analytics with behavioral biometrics. But biometrics rely on unique physical characteristics — like fingerprints or facial scans — used for automated recognition, such as unlocking your phone with Face ID. Biometrics connect a person’s data to their identity. But behavioral analytics? They don’t look at an identity. They look at behavior and predict risk. While biometrics track who a person is, behavioral analytics track what they do. For example, NeuroID’s behavioral analytics observes every time someone clicks in a box, edits a field, or hovers over a section. So, when a user’s actions suggest fraudulent intent, they can be directed to additional verification steps or fully denied. And if their actions suggest trustworthiness? They can be fast-tracked. Or, as a customer of ours put it: "Using NeuroID decisioning, we can confidently reject bad actors today who we used to take to step-up. We also have enough information on good applicants sooner, so we can fast-track them and say ‘go ahead and get your loan, we don’t need anything else from you.’ And customers really love that." - Mauro Jacome, Head of Data Science for Addi (read the full Addi case study here). The difference might seem subtle, but it’s important. New laws on biometrics have triggered profound implications for banks, businesses, and fraud prevention strategies. The laws introduce potential legal liabilities, increased compliance costs, and are part of a growing public backlash over privacy concerns. Behavioral signals, because they don’t tie behavior to identity, are often easier to introduce and don’t need the same level of regulatory scrutiny. The bottom line is that our behavioral analytics capabilities are unique from any other part of your fraud stack, full-stop. And it's because we don’t identify users, we identify intentions. Simply by tracking users’ behavior on your digital form, behavioral analytics powered by NeuroID tells you if a user is human or a bot; trustworthy or risky. It looks at each click, edit, keystroke, pause, and other tiny interactions to measure every users’ intention. By combining behavior with device and network intelligence, our solutions provide new visibility into fraudsters hiding behind perfect PII and suspicious devices. The result is reduced fraud costs, fewer API calls, and top-of-the-funnel fraud capture with no tuning or model integration on day one. With behavioral analytics, our customers can detect fraud attacks in minutes, instead of days. Our solutions have proven results of detecting up to 90% of fraud with 99% accuracy (or <1% false positive rate) with less than 3% of your population getting flagged. Q2. What does behavioral analytics provide that I don’t get now? Behavioral analytics provides a net-new signal that you can’t get from any other tools. One of our customers, Josh Eurom, Manager of Fraud for Aspiration Banking, described it this way: “You can quantify some things very easily: if bad domains are coming through you can identify and stop it. But if you see things look odd, yet you can’t set up controls, that’s where NeuroID behavioral analytics come in and captures the unseen fraud.” (read the full Aspiration story here) Adding yet another new technology with big promises may not feel urgent. But with genAI fueling synthetic identity fraud, next-gen fraud bots, and hyper-efficient fraud ring attacks, time is running out to modernize your stack. In addition, many fraud prevention tools today only focus on what PII is submitted — and PII is notoriously easy to fake. Only behavioral analytics looks at how the data is submitted. Behavioral analytics is a crucial signal for detecting even the most modern fraud techniques. Watch our webinar: The Fraud Bot Future-Shock: How to Spot and Stop Next-Gen Attacks Q3. Why do I need to add even more data to my fraud stack? Balancing fraud, friction, and financial impact has led to increasingly complex fraud stacks that often slow conversions and limit visibility. As fraudsters evolve, gaps grow between how quickly you can keep up with their new technology. Fraudsters have no budget constraints, compliance requirements, or approval processes holding them back from implementing new technology to attack your stack, so they have an inherent advantage. Many fraud teams we hear from are looking for ways to optimize their workflows without adding to the data noise, while balancing all the factors that a fraud stack influences beyond overall security (such as false positives and unnecessary friction). Behavioral analytics is a great way to work smarter with what you have. The signals add no friction to the onboarding process, are undetectable to your customers, and live on a pre-submit level, using data that is already captured by your existing application process. Without requiring any new inputs from your users or stepping into messy biometric legal gray areas, behavioral analytics aggregates, sorts, and reviews a broad range of cross-channel, historical, and current customer behaviors to develop clear, real-time portraits of transactional risks. By sitting top-of-funnel, behavioral analytics not only doesn’t add to the data noise, it actually clarifies the data you currently rely on by taking pressure off of your other tools. With these insights, you can make better fraud decisions, faster. Or, as Eurom put it: “Before NeuroID, we were not automatically denying applications. They were getting an IDV check and going into a manual review. But with NeuroID at the top of our funnel, we implemented automatic denial based on the risky signal, saving us additional API calls and reviews. And we’re capturing roughly four times more fraud. Having behavioral data to reinforce our decision-making is a relief.” The behavioral analytics difference Since the world has moved online, we’re missing the body language clues that used to tell us if someone was a fraudster. Behavioral analytics provides the digital body language differentiator. Behavioral cues — such as typing speed, hesitation, and mouse movements — highlight riskiness. The cause of that risk could be bots, stolen information, fraud rings, synthetic identities, or any combination of third-party fraud attack strategies. Behavioral analytics gives you insights to distinguish between genuine applicants and potentially fraudulent ones without disrupting your customer’s journey. By interpreting behavioral patterns at the very top of the onboarding funnel, behavior helps you proactively mitigate fraud, reduce false positives, and streamline onboarding, so you can lock out fraudsters and let in legitimate users. This is all from data you already capture, simply tracking interactions on your site. Stop fraud, faster: 5 simple uses where behavioral analytics shine While how you approach a behavioral analytics integration will vary based on numerous factors, here are some of the immediate, common use cases of behavioral analytics. Detecting fraud bots and fraud rings Behavioral analytics can identify fraud bots by their frameworks, such as Puppeter or Stealth, and through their behavioral patterns, so you can protect against even the most sophisticated fourth-generation bots. NeuroID provides holistic coverage for bot and fraud ring detection — passively and with no customer friction, often eliminating the need for CAPTCHA and reCAPTCHA. With this data alone, you could potentially blacklist suspected fraud bot and fraud ring attacks at the top of the fraud prevention funnel, avoiding extra API calls. Sussing out scams and coercions When users make account changes or transactions under coercion, they often show unfamiliarity with the destination account or shipping address entered. Our real-time assessment detects these risk indicators, including hesitancy, multiple corrections, and slow typing, alerting you in real-time to look closer. Stopping use of compromised cards and stolen IDs Traditional PII methods can fall short against today’s sophisticated synthetic identity fraud. Behavioral analytics uncovers synthetic identities by evaluating how PII is entered, instead of relying on PII itself (which is often corrupted). For example, our behavioral signals can assess users’ familiarity with the billing address they’re entering for a credit card or bank account. Genuine account holders will show strong familiarity, while signs of unfamiliarity are indicators of an account under attack. Detecting money mules Our behavioral analytics solutions track how familiar users are with the addresses they enter, conducting a real-time, sub-millisecond familiarity assessment. Risk markers such as hesitancy, multiple corrections, slow typing speed raise flags for further exploration. Stopping promotion and discount abuse Our behavioral analytics identifies risky versus trustworthy users in promo and discount fields. By assessing behavior, device, and network risk, we help you determine if your promotions attract more risky than trustworthy users, preventing fraudsters from abusing discounts. Learn more about our behavioral analytics solutions. Learn more Watch webinar

Do you know where your customers stand? Not literally, of course, but do you know how recent macroeconomic changes and their personal circumstances are currently affecting your portfolio? While refreshing your customers’ credit data quarterly works for some aspects of portfolio management, you need more frequent access to fresh data to quickly respond to risky customer behavior and new credit needs before your portfolio takes a hit. Use triggers to improve portfolio management Event-based credit triggers provide daily or real-time alerts about important changes in your customers’ financial situations. You can use these to manage risk by promptly responding to signs of changing creditworthiness or to prevent attrition by proactively reaching out to customers who are shopping for credit. Risk Triggers℠ and Retention Triggers℠ offer a real-time solution that can be customized to fit your needs for daily portfolio management. What are Risk Triggers? Experian’s Risk Triggers alert you of notable information, such as unfavorable utilization rate changes, delinquencies with other lenders and recent activity with high-interest, short-term loan products. This solution allows you to monitor how your customers manage accounts with other lenders to get ahead of potential risk on your book. You can use Risk Triggers to get daily insights into your customers’ activity — allowing you to quickly identify potentially risky behavior and take appropriate action to limit your exposure and losses. Types of Risk Triggers Choose from a defined Risk Triggers package that could help you identify high-risk customers, including: New trades Increasing credit utilization or balances over limit New collection accounts An account is charged-off A credit grantor closes an account New delinquency statuses (30 to 180 days past due) Consumers seeking access to short-term, high-risk financing options Bankruptcy and deceased events How to use Risk Triggers You can use the daily alerts from Risk Triggers to help inform your account management strategy. Depending on the circumstances, you might: Decrease credit limits Close or freeze accounts Accelerate payment requests Continue monitoring accounts for other signs of risk Spotlight on Experian’s Clarity Services events Included in Risk Triggers are events from Experian’s Clarity Services, which draw on expanded FCRA-regulated data* from a leading source of alternative financial credit data. For example, you could get an alert when someone has a new inquiry from non-traditional loans. These triggers provide a broader view of the customer – offering added protection against risky behavior. What are Retention Triggers? Experian’s Retention Triggers can alert you when a customer improves their creditworthiness, is shopping for new credit, opens a new tradeline or lists property. Proactively responding to these daily alerts can help you retain and strengthen relationships with your customers — which is often less expensive than acquiring new customers. Types of Retention Triggers Choose from over 100 Retention Triggers to bundle, including: New trades New inquiries Credit line increases Property listing statuses Improving delinquency status Past-due accounts are brought current or paid off How to use Retention Triggers You can use Retention Triggers to increase lifetime customer value by proactively responding to your customers’ needs and wants. You might: Increase credit limits Offer promotional financing, such as balance transfers Introduce perks or rewards to strengthen the relationship Append attributes for improved decisioning By appending credit attributes to Risk and Retention Trigger outputs, you can gain greater insight into your accounts. Premier AttributesSM is Experian's core set of 2,100-plus attributes. These can quickly summarize data from consumers' credit reports, allowing you to more easily segment accounts to make more strategic decisions across your portfolio. Trended 3DTM attributes can help you spot and understand patterns in a customer's behavior over time. Integrating trended attributes into a triggers program can help you identify risk and determine the next best action. Trended 3D includes more than 2,000 attributes and provides insights into industries such as bankcard, mortgage, student loans, personal loans, collections and much more. By working with both triggers and attributes, you'll proactively review an account, so you can then take the next best action to improve your portfolio's profits. Customize your trigger strategy When you partner with Experian, you can bundle and choose from hundreds of Risk and Retention Triggers to focus on risk, customer retention or both. Additionally, you can work with Experian’s experts to customize your trigger strategy to minimize costs and filter out repetitive or unneeded triggers: Use cool-off periods Set triggering thresholds Choose which triggers to monitor Establish hierarchies for which triggers to prioritize Create different strategies for segments of your portfolio Learn more about Risk and Retention Triggers. Learn more *Disclaimer: “Alternative Financial Credit Data” refers to the use of alternative data and its appropriate use in consumer credit lending decisions, as regulated by the Fair Credit Reporting Act. Hence, the term “Expanded FCRA-Regulated Data” may also apply in this instance, and both can be used interchangeably.

With cyber threats intensifying and data breaches rising, understanding how to respond to incidents is more important than ever. In this interview, Michael Bruemmer, Head of Global Data Breach Resolution at Experian, is joined by Matthew Meade, Chair of the Cybersecurity, Data Protection & Privacy Group at Eckert Seamans, to discuss the realities of data breach response. Their session, “Cyber Incident Response: A View from the Trenches,” brings insights from the field and offers a preview of Experian's 2025 Data Breach Industry Forecast, including the role of generative artificial intelligence (AI) in data breaches. From the surge in business email compromises (BEC) to the relentless threat of ransomware, Bruemmer and Meade dive into key issues facing organizations big and small today. Drawing from Experian's experience handling nearly 5,000 breaches this year, Bruemmer sheds light on effective response practices and reveals common pitfalls. Meade, who served as editor-in-chief for the Sedona Conference’s new Model Data Breach Notification Law, explains the implications of these regulatory updates for organizations and highlights how standardized notification practices can improve outcomes. Bruemmer and Meade’s insights offer a proactive guide to tackling tomorrow’s cyber threats, making it a must-listen for anyone aiming to stay one step ahead. Listen to the full interview for a valuable look at both the current landscape and what's next. Click here for more insight into safeguarding your organization from emerging cyber threats.

As online accounts become essential for activities ranging from shopping and social media to banking, "account farming" has emerged as a significant fraud risk. This practice involves creating fake or unauthorized accounts en masse, often for malicious purposes. Understanding how account farming works, why it’s done and how businesses can protect themselves is crucial for maintaining data integrity, safeguarding customer trust and protecting your bottom line. How does account farming work? Account farming is the process of creating and cultivating multiple user accounts, often using fake or stolen identities. These accounts may look like legitimate users, but they’re controlled by a single entity or organization, usually with fraudulent intent. Here’s a breakdown of the typical steps involved in account farming: Identity generation: Account farmers start by obtaining either fake or stolen personal information. They may buy these datasets on the dark web or scrape publicly available information to make each account seem legitimate. Account creation: Using bots or manual processes, fraudsters create numerous accounts on a platform. Often, they’ll employ automated tools to expedite this process, bypassing CAPTCHA or reCAPTCHA systems or using proxy servers to mask their IP addresses and avoid detection. Warm-up phase: After initial creation, account farmers often let the accounts sit for a while, engaging in limited, non-suspicious activity to avoid triggering security alerts. This “warming up” process helps the accounts seem more authentic. Activation for fraudulent activity: Once these accounts reach a level of credibility, they’re activated for the intended purpose. This might include spamming, fraud, phishing, fake reviews or promotional manipulation. Why is account farming done? There are several reasons account farming has become a widespread problem across different industries. Here are some common motivations: Monetary gain: Fraudsters use farmed accounts to commit fraudulent transactions, like applying for loans and credit products, accessing promotional incentives or exploiting referral programs. Spam and phishing: Fake accounts enable widespread spam campaigns or phishing attacks, compromising customer data and damaging brand reputation. Data theft: By creating and controlling multiple accounts, fraudsters may access sensitive data, leading to further exploitation or resale on the dark web. Manipulating metrics and market perception: Some industries use account farming to boost visibility and credibility falsely. For example, on social media, fake accounts can be used to inflate follower counts or engagement metrics. In e-commerce, fraudsters may create fake accounts to leave fake reviews or upvote products, falsely boosting perceived popularity and manipulating purchasing decisions. How does account farming lead to fraud risks? Account farming is a serious problem that can expose businesses and their customers to a variety of risks: Financial loss: Fake accounts created to exploit promotional offers or referral programs can cause victims to experience significant financial losses. Additionally, businesses can incur costs from chargebacks or fraudulent refunds triggered by these accounts. Compromised customer experience: Legitimate customers may suffer from poor experiences, such as spam messages, unsolicited emails or fraudulent interactions. This leads to diminished brand trust, which is costly to regain. Data breaches and compliance risks: Account farming often relies on stolen data, increasing the risk of data breaches. Businesses subject to regulations like GDPR or CCPA may face hefty fines if they fail to protect consumer information adequately. READ MORE: Our Data Breach Industry Forecast predicts what’s in store for the coming year. How can businesses protect themselves from account farming fraud? As account farming tactics evolve, businesses need a proactive and sophisticated approach to detect and prevent these fraudulent activities. Experian’s fraud risk management solutions provide multilayered and customizable solutions to help companies safeguard themselves against account farming and other types of fraud. Here’s how we can help: Identity verification solutions: Experian’s fraud risk and identity verification platform integrates multiple verification methods to confirm the authenticity of user identities. Through real-time data validation, businesses can verify the legitimacy of user information provided at the account creation stage, detecting and blocking fake identities early in the process. Its flexible architecture allows companies to adapt their identity verification process as new fraud patterns emerge, helping them stay one step ahead of account farmers. Behavioral analytics: One effective way to identify account farming is to analyze user behavior for patterns consistent with automated or scripted actions (AKA “bots”). Experian’s behavioral analytics solutions, powered by NeuroID, use advanced machine learning algorithms to identify unusual behavioral trends among accounts. By monitoring how users interact with a platform, we can detect patterns common in farmed accounts, like uniform interactions or repetitive actions that don’t align with human behavior. Device intelligence: To prevent account farming fraud, it’s essential to go beyond user data and examine the devices used to create and access accounts. Experian’s solutions combine device intelligence with identity verification to flag suspicious devices associated with multiple accounts. For example, account farmers often use virtual machines, proxies or emulators to create accounts without revealing their actual location or device details. By identifying and flagging these high-risk devices, we help prevent fraudulent accounts from slipping through the cracks. Velocity checks: Velocity checks are another way to block fraudulent account creation. By monitoring the frequency and speed at which new accounts are created from specific IP addresses or devices, Experian’s fraud prevention solutions can identify spikes indicative of account farming. These velocity checks work in real-time, enabling businesses to act immediately to block suspicious activity and minimize the risk of fake account creation. Continuous monitoring and risk scoring: Even after initial account creation, continuous monitoring of user activity helps to identify accounts that may have initially bypassed detection but later engage in suspicious behavior. Experian’s risk scoring system assigns a fraud risk score to each account based on its behavior over time, alerting businesses to potential threats before they escalate. Final thoughts: Staying ahead of account farming fraud Preventing account farming is about more than just blocking bots — it’s about safeguarding your business and its customers against fraud risk. By understanding the mechanics of account farming and using a multi-layered approach to fraud detection and identity verification, businesses can protect themselves effectively. Ready to take a proactive stance against account farming and other evolving fraud tactics? Explore our comprehensive solutions today. Learn More This article includes content created by an AI language model and is intended to provide general information.

In the latest episode of “The Chrisman Commentary” podcast, Experian experts Joy Mina, Director of Product Commercialization, and Ivan Ahmed, Senior Director of Product Management, explore how lenders can navigate a tight mortgage market, from rates to equity. “Current rates exceed their locked in rates,” said Ivan. “Homeowners are choosing options as alternatives to selling with the refinancing for cash outs and HELOC." Listen to the full episode for all the details and check out the previous episode to learn how mortgage companies can optimize their business expenses and protect prospects. Listen to podcast