All posts by Kirsten Von Busch

With wider model availability and technology continuing to develop, the electric vehicle (EV) market experienced shifting in 2023, most notably among the top five newly registered models. According to Experian’s Electric Vehicles 2023 Year in Review, Tesla only made up two of the top five newly registered models in 2023, compared to four of the top five a year prior. The Tesla Model Y made up 36.8% of new retail EV registrations in 2023, followed by the Tesla Model 3 (19.6%), Volkswagen ID.4 (3.4%), Ford Mustang Mach-E (2.9%) and Chevrolet Bolt EUV (2.8%). The Volkswagen ID.4 and Chevrolet Bolt EUV were the newest entrants to the top five, replacing the Tesla Model X and Tesla Model S. EV registrations grow We’re also witnessing shoppers gravitate toward EVs more often than in years past. For instance, of the 11.8 million new retail registrations in 2023, more than 8% were EVs. Comparatively, of the 12.3 million new retail registrations in 2022, just over 6% were EVs. It’s notable that EVs continue to be most popular on the West Coast—particularly in California and Washington. According to the data, 33% of new retail EV registrations were in California—Los Angeles (170,000+), San Francisco (90,000+) and San Diego (30,000+) were among the top five DMAs for new retail EV registrations, along with Seattle, Washington (35,000+). While California exhibits robust EV registration growth, other states show the potential to expand, something automotive professionals should keep in mind. For instance, El Paso, Texas, was the fastest growing DMA for new retail EV registrations—with an 89.5% five year, year-over-year growth average, Savannah, Georgia, came in second at 81.8%, followed by Peoria-Bloomington, Illinois (76.7%), and Waco, Texas (73.7%). EV buyer insight Beyond the “what” and “where” of the EV market, the “who” is perhaps most important. Which customers have the highest propensity to buy an EV? According to the data, Gen Xers accounted for 32.0% of new retail registrations in 2023, however they accounted for 37.7% of new EV retail registrations over the same period. Similarly, millennials accounted for 24.5% of new retail registrations, yet made up 30.6% of new EV retail registrations in 2023; the only two generational demographics to over index on EV purchases. As professionals in the automotive industry find ways to stay ahead of the evolving EV landscape, leveraging data will enable them to understand and identify emerging opportunities to tailor their marketing strategies to a consumer’s needs. To learn more about EV trends, view the full Electric Vehicles 2023 Year in Review.

As the evolution of the automotive industry continues to unfold, certain vehicles retain their prominence, offering not only versatility but adaptability. In particular, vans have long embodied myriad lifestyles and needs—painting an intriguing picture of consumer preferences and economic trends. For instance, data from Experian’s Automotive Consumer Trends Report: Q4 2023 found there are currently more than 18 million vans in operation in the United States. Furthermore, there were over 245,000 new van retail registrations in the last 12 months—with mini vans such as the Honda Odyssey accounting for 79.4% of new van retail registrations and full-size vans including the Mercedes-Benz Sprinter making up the remaining 20.5%. Diving into the details, Honda comprised 27.3% of the market share by make in Q4 2023, followed by Toyota (19.3%), KIA (16.7%), Chrysler (13.7%), and Mercedes-Benz (9.0%). When looking at the most sought after vans, the Honda Odyssey led the market share by model this quarter—coming in at 27.3%. The Toyota Sienna trailed behind at 19.3%, followed by KIA Carnival at 16.7%, Chrysler Pacifica (13.5%), and Mercedes-Benz Sprinter (9.3%). While understanding the broader trends in van registrations is important for automotive professionals, exploring the demographics more in depth will help tailor marketing strategies effectively and personalize guidance to those who are in the market for a vehicle. For example, Gen X made up the largest portion of retail van registrations in Q4 2023 at 36.0%, followed by Millennials at 27.6%, Boomers (25.3%), Gen Z (7.5%), and Silent (3.3%). In order to align their strategies with the needs and preferences of van buyers, professionals throughout the automotive industry should delve into the nuances of who is buying and the models they’re interested in. This will also enable them to sustain the foundation for success in the dynamic automotive landscape. To learn more about vans, view the full Automotive Consumer Trends Report: Q4 2023 presentation.

According to Experian’s Automotive Consumer Trends Report: Q3 2023, CUVs accounted for 48.3% of new retail registrations and SUVs comprised 13.0%.

Electric vehicles (EVs) are sustaining prominence throughout the automotive industry, and data from the second quarter of 2023 shows registrations are still on the rise. According to Experian’s Automotive Consumer Trends Report: Q2 2023, 7.50% of new vehicle registrations were EVs, resulting in more than 2.7 million EVs in operation in the US, an increase from the approximate 1.7 million this time last year. Though, despite the continued growth in EV popularity, data found that 85% of EV owners also have a gas-powered vehicle in their household garage and 11% have a hybrid vehicle. It’s possible that majority of consumers prefer to have a secondary vehicle for comfortability, considering charging stations aren’t as accessible in some states and gas operated vehicles offer more miles. That said, it’s important for automotive professionals to have additional insight when helping consumers find a vehicle that fits their lifestyle, such as if they have plans to keep another vehicle in addition to their EV and the type of vehicle they’re interested in. Luxury EVs dominate market share When looking at new EV registrations by vehicle class in the last 12 months, luxury EVs accounted for 77.73%, while non-luxury made up the remaining 22.67%. It’s notable that Tesla led the luxury EV registration market share in Q2 2023 at 81.61%, followed by BMW at 4.42%, Rivian at 3.76%, Mercedes-Benz at 3.27%, and Audi coming in at 2.52%. For non-luxury EVs, Chevrolet accounted for 24.21% of new registration market share this quarter and Ford was not far behind at 24.00%, followed by Volkswagen at 15.77%, Hyundai at 15.22%, and Kia at 9.17%. Breaking the data down further, Tesla made up four of the top five models for luxury EVs in Q2 2023, which explains the dominance in overall luxury EV market share. This quarter, the Model Y came in at 47.36%, followed by the Model 3 at 27.30%, the Model X (4.42%), the BMW i4 (2.82%), and the Model S (2.53%). Meanwhile, the Chevrolet Bolt EUV accounted for 17.67% of the non-luxury EV market share in Q2 2023 and the Volkswagen ID.4 came in second at 15.77%, followed closely by the Ford Mustang Mach-E at 15.74%, and the Hyundai IONIQ 5 at 11.13%. Despite Tesla comprising the majority of luxury EV market share, something professionals should keep in mind is other OEMs making their way into the market, which will give consumers more models to choose from as the gas alternative vehicles continue to grow in popularity. This will be important data to leverage in years to come when helping a consumer find a vehicle. To learn more about EV insights, view the full Automotive Consumer Trends Report: Q2 2023 presentation.

Pickup trucks have long been a staple of the automotive industry, and the data show this is still the case—even seeing some growth in the third quarter of 2022. Experian’s Automotive Consumer Trends Report: Q3 2022 took a deeper dive into pickup trucks and found they accounted for 20.4% of new retail vehicle registrations, increasing from 16% in Q3 2021 and surpassing sedans (16.5%) and SUVs (11.4%). The growth in pickup truck popularity is partially due to their functionality and towing capabilities, among other features that smaller vehicles may not offer. As more consumers continue to be drawn to pickup trucks, it’s important for automotive professionals to not oversimplify by grouping potential shoppers together, but instead, dive into the data to understand the current trends, such as who is buying and the type of truck segments they may be interested in. Breaking down pickup truck registration trends by generation When looking at who is in the market for a pickup truck, data shows Gen X made up the largest percentage of buyers in Q3 2022, comprising 34.6%, with Baby Boomers coming in at 28.3%, and Millennials not too far behind at 25.2% this quarter. Knowing who is making up majority of the pickup truck registrations and the types of trucks they are looking for goes hand-in-hand when automotive professionals are searching for ways to market strategically and ensure they are reaching the right audience. For instance, in Q3 2022, 43.1% of Gen X buyers opted for a full-size luxury truck, such as the Rivian R1T, while 35.7% preferred a full-size truck, such as the Ford F-150, and 32.9% bought a midsize truck, such as the Toyota Tacoma. By comparison, 20.4% of Baby Boomers bought a full-size luxury truck in Q3 2022, 27% chose a full-size truck, and 30.7% opted for a midsize truck. Data shows Millennials preferred a full-size luxury truck over any other type—coming in at 30.6%, while 26% opted for a full-size truck, and 23.3% bought a midsize truck. As consumer preference continues to shift throughout the automotive industry, analyzing and leveraging data will allow professionals to properly assist consumers when looking for a vehicle that fits their needs, as well as stay up-to-date on the current trends. To learn more about pickup trucks and other consumer trends, watch the entire Automotive Consumer Trends Report: Q3 2022 webinar.

According to Experian’s Automotive Consumer Trends Report: Q2 2022, EVs comprised more than 1.7 million vehicles in operation throughout the US, quite a jump from more than 400,000 EVs just five years ago in Q2 2018.

We conducted a study of thousands of online listings to better understand what details are crucial for VDPs, which Kirsten Von Busch will be debuting the results of at the NADA Show in March.

The AutoCheck FREE Flood Risk Check site has been updated with Hurricane Ida information New cars have been in short supply due to the worldwide microchip shortage, so consumers quickly turned their attention to used cars. Unfortunately, dealers continue to struggle with obtaining enough used car inventory to meet demand. To add to an already challenging year, Hurricane Ida hit the gulf coast in August resulting in an estimated 250,000 cars sustaining flood damage. It’s more important than ever that dealers be careful about obtaining pre-owned cars that could potentially have flood damage. The best way to mitigate the risk of purchasing a flood damaged vehicle is to start by running an AutoCheck Free Flood Risk Check. Visitors simply enter any vehicle's 17-digit VIN and the tool will check for flood brands and provide information if the vehicle was registered in a region impacted by a FEMA disaster declaration. Two levels of reporting available The first level of reporting determines whether the vehicle has been titled/registered 12 months prior in a county that has been identified as requiring public and individual assistance (FEMA categories A and B) for a FEMA-declared major disaster. This would yield a “Yes” result. For instance, you would get a “Yes” result if the vehicle was registered in an impacted area during the time of a FEMA-declared major disaster like Hurricane Ida. The “Yes” result should not be interpreted as confirmation of flood damage or even possible flood damage. The data is provided merely as information regarding the location of the vehicle’s registration/title history so users can be aware of risk exposure. For example, the Hurricane Ida region had thousands of damaged cars, but some cars in the region may not have been damaged by the hurricane — the owner could have driven the car when they evacuated, or a child or other family member may have been out of town with the car when the hurricane hit. The second level of reporting is based on search results from Experian data such as flood title and problem records, including flood State title brands, auction flood announcements, salvage auction flood designations, and other vehicle records determined by Experian to relate to or suggest an increased likelihood of flood damage or risk exposure. It takes time for claims and updates to vehicle title information to appear on a vehicle’s history and although the DMV requires that title brands be issued for vehicles damaged by floods, not every vehicle flood event is reported by car owners. Unreported flood events may not appear on an AutoCheck Flood Risk Check or AutoCheck Vehicle History Report. Although Experian provides flood related records from available data sources, we cannot provide assurance that an AutoCheck Flood Risk Check that does not produce any records means that the subject vehicle has not experienced flood damage. That’s why it’s important to review a full AutoCheck Vehicle History Report, which—in addition to potential flood damage—includes reported accidents, branded titles, recalls, number of owners and more. Once you run the full Vehicle History Report we recommend an independent evaluation and inspection of the vehicle to determine and confirm a vehicle’s condition prior to purchase. Try the AutoCheck Flood Risk Check today to help mitigate the risk of purchasing flood damaged vehicles. Not an AutoCheck subscriber? Contact us to become an AutoCheck client.

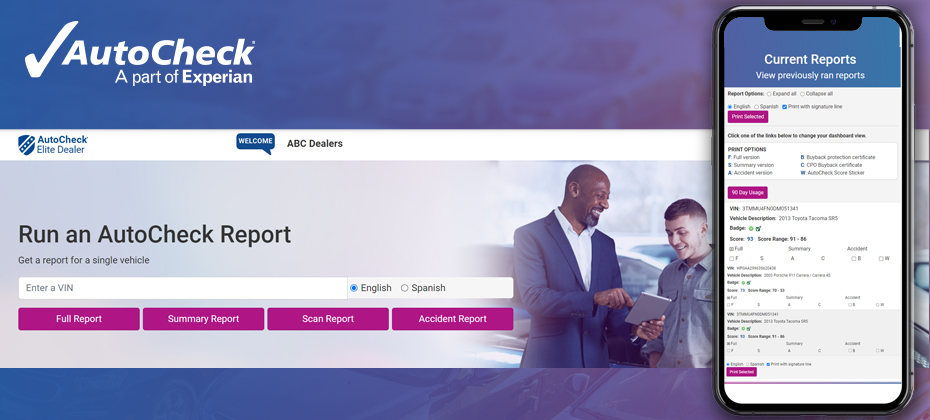

We’re excited to announce that the AutoCheck Member Website has received a facelift! AutoCheck has always been the industrial strength Vehicle History Report that automotive professionals trust to help manage risk and confidently buy and sell the right vehicles. We’ve made this great solution even greater by improving our Member Site user experience. Based on extensive research and user feedback, we’ve added many visual and workflow enhancements which make it easier for users to use the site. One noticeable change to the Member Website is the addition of Experian’s brand and color scheme. You’ll know right away that you’re accessing AutoCheck data backed by Experian, the industry experts for reliable data. The entire site is now mobile responsive—optimizing the experience for tablet and mobile users to provide even more shopping convenience. The new site will allow full functionality from a tablet or mobile device. As always, subscribers can continue to access AutoCheck reports via our mobile app or AutoCheck Fast Link℠ integration within their DMS, CRM, inventory management, online vehicle listings or many other integrated solutions. In addition, the AutoCheck Member Website is now WCAG 2.1 compliant. Web Content Accessibility Guidelines (WCAG) were developed to make web content more accessible to people with disabilities. This ‘web content’ usually refers to text, images and sounds on a webpage or web application. It also may include code that defines structure and presentation of the page of application. While a generated AutoCheck was already WCAG2.1 compliant, the entire member site now also meets the accessibility guidelines. AutoCheck Members can expect the same great functionality once they have signed into the site: Run single or multiple reports Print and email AutoCheck reports Print the Buyback Protection Certificate and the AutoCheck Score Sticker View the Track their 90-day usage Access AutoCheck brand materials including logos, videos and showroom materials Review Best Practices and Frequently Asked Questions Update account information …and much more! Below are a couple of examples which highlight the new user experience. Already an AutoCheck Member? Contact us or call us at 1.888.409.2204 if you have any questions about navigating the redesigned website. Not an AutoCheck subscriber? Contact us to become an AutoCheck client and take advantage of all the benefits.

Your local auto market changes every day. Today’s challenge is securing the inventory needed to keep new and repeat customers coming in the door. Tomorrow it might be finding the right customers for the inventory you have secured. Either way, understanding the competitive activity in your market is key to developing ongoing strategies for success. Important competitive insights include the ability to: • Gauge your performance against the competition by identifying each unit registered in your market • Discover what vehicles are popular among your consumers by make and model • Identify the key characteristics of customers in your area. In yet another benefit, Experian provides our AutoCheck Elite dealer clients with complimentary access to in-depth market reporting, including these comprehensive reports: The AutoCount Market Ranking Report Learn whether you’re getting your share of vehicle sales in your local market’s top zip codes. This report: • Lists all sales activity within a 15-mile radius of your dealership • Provides unbiased monthly information from state DMVs on new and used vehicle sales • Includes access to our web-based portal to provide instant access to a variety of customizable reports • Identifies vehicle registration by ZIP code to pinpoint marketing opportunities The AutoCount Vehicle Model Ranking Report Stock the right inventory by learning what vehicles are popular among your consumers (see example below). This report: • Provides an expanded view of the dealership’s market, which leads to more informed decisions that maximize untapped profit potential • Track the top 25 new and used vehicles within a 15-mile radius of your dealership as well as the top gainers and losers in the market • Offers an easy-to-read graphical summary of critical market information, including lender ranking • Gives an unbiased scorecard of dealership performance in the local market to determine market share and competitive insight Having access to monthly DMV reports and analysis can help deliver a competitive edge to your dealership. To become an AutoCheck member today, contact us or call 1.888.409.2204.

Have you ever wanted to ask a customer to sign an AutoCheck vehicle history report to indicate they have received and reviewed the report and they are aware of the status of the vehicle they are purchasing?

The AutoCheck® Elite program enables auto dealerships to better understand the vehicles in their market. And, right now, making strategic decisions about stocking the right inventory and marketing to the right consumers has never been more important.

AutoCheck® is a powerful vehicle history report that helps take the unknown out of the used car buying process, so you can confidently understand, compare, and select a vehicle that is right for you. Only AutoCheck vehicle history reports include the patented AutoCheck Score, which summarizes vehicle history data into an easy to understand ‘Score” along with an equivalent score range. The patented AutoCheck Score predicts the likelihood a car will be on the road in 5 years. It compares vehicles of similar age and class based on a scale of 1-100. The AutoCheck Score is based on a proprietary model to help you understand a vehicles predicted reliability as it pertains to age, number of owners, accidents and other vehicle history factors. Watch this video to learn more about the AutoCheck vehicle history report and how it can help you identify hidden damage and accident events to avoid costly mistakes. Contact us to learn more about becoming an AutoCheck subscriber.

As the used vehicle market continues to thrive, a vehicle history report is more vital than ever. There can be hidden risk associated with used cars. It’s important for dealers to ensure the safety of their inventory for car shoppers. This is why dealers need to consistently use vehicle history reports when acquiring vehicles from the auction. AutoCheck vehicle history reports include data from 95% of all U.S. Auction Houses, with most providing exclusive structural damage announcement information. We want to help dealers feel more confident in the used vehicles they bring into their inventory. Contact us to learn more about becoming an AutoCheck subscriber.

AutoCheck Buyback Protection is a policy that will compensate a consumer by buying back their vehicle under certain circumstances...