Latest Posts

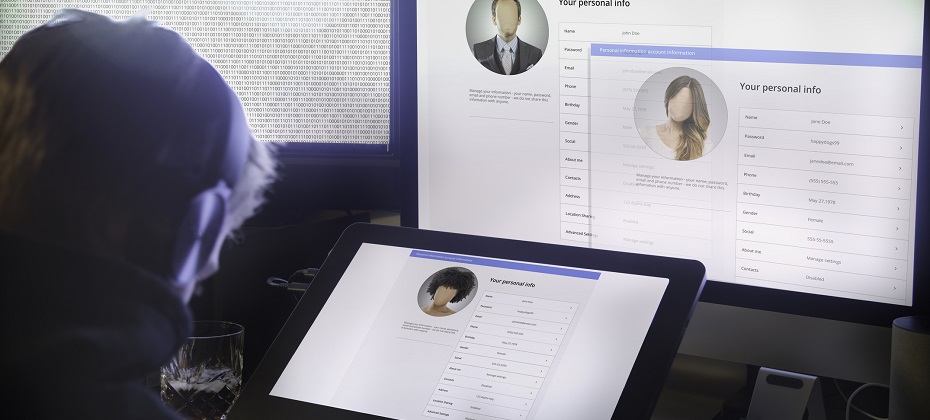

Friend or foe? Sophisticated criminals put a great deal of effort into creating convincing, verifiable personas (AKA synthetic identities). Once the fictional customer has embedded itself in your business, everything from the acquisition of financial instruments to healthcare benefits, utility services, and tax filings and refunds become vulnerable to synthetic identity fraud. Information attached to synthetic IDs can run several levels deep and be so complete that it includes public record data, credit information, documentary evidence and social media profiles that may even contain photo sets and historical details intended to deceive—all complicating your efforts to identify these fake customers before you do business with them. See real-world examples of how synthetic identity fraud is souring various markets – from auto and healthcare to financial services and public sector – in our tip sheet, Four common synthetic scenarios. Stopping synthetic ID fraud — at the door and thereafter. There are efforts underway in the market to collectively improve your ability to identify, shut down and prevent synthetic identities from entering your portfolio. This overall trend is great news for the future, but there are also near-term solutions you can apply to protect your business starting now. While it’s important to identify synthetic identities when they knock on your door, it’s just as important to conduct regular portfolio checkups to prevent negative impacts to your collections efforts. Every circumstance has its own unique parameters, but the overarching steps necessary to mitigate fraud from synthetic IDs remain the same: Identify current and near-term exposure using targeted segmentation analysis. Apply technology that alerts you when identity data doesn’t add up. Differentiate fraudulent identities from those simply based on bad data. Review front- and back-end screening procedures until they satisfy best practices. Achieve a “single view of the customer” for all account holders across access channels—online, mobile, call center and face-to-face. The right tools for the job. In addition to the steps mentioned above, stopping these fake customers from entering and then stealing from your organization isn’t easy—but with the right tools and strategies, it is possible. Here are a few of our top recommendations: Forensics Isolate and segment identities based on signals received during early account pathing, from both individuals and their device. For example, even sophisticated fraud networks can’t mimic natural per-device user interaction because these organizations work with hundreds or thousands of synthetic identities using just a few devices. It’s highly unlikely that multiple geographically separate account holders would share the same physical device. High-risk fraud scores Not all synthetic identity fraud manifests the same way. Using sophisticated logic and unique combinations of data, a high-risk fraud score looks at a consumer’s credit behavior and credit relationships over time to uncover previously undetectable risk. These scores are especially successful in detecting identities that are products of synthetic identity farms. And by targeting a specific data set and relationships, you can maintain a frictionless customer experience and reduce false positives. Analytics Use a solution that develops models of bad applicant behavior, then compares and scores your portfolio against these models. There isn’t a single rule for detecting fraudulent identities, but you can develop an informed set of rules and targeted models with the right service partner. Cross-referencing models designed to isolate high-risk identity theft cases, first-party or true-name fraud schemes, and synthetic identities can be accomplished in a decisioning strategy or via a custom model that incorporates the aggregate scores and attributes holistically. Synthetic identity detection rules These specialized rules consist of numerous conditions that evaluate a broad selection of consumer behaviors. When they occur in specific combinations, these behaviors indicate synthetic identity fraud. This broad-based approach provides a comprehensive evaluation of an identity to more effectively determine if it’s fabricated. It also helps reduce the incidence of inaccurately associating a real identity with a fictitious one, providing a better customer experience. Work streams Address synthetic identities confidently by applying analytics to work streams throughout the customer life cycle: Credit risk assessment Know Your Customer/Customer Identification Program checks Risk-based identity proofing and authentication Existing account management Manual reviews, investigations and charge-offs/collections activities Learn more about these tools and others that can help you mitigate synthetic identities in our white paper, Synthetic identities: getting real with customers. If your organization is like most, detecting SIDs hasn't been your top priority. So, there's no time to waste in preventing them from entering your portfolio. Criminals are highly motivated to innovate their approaches as rapidly as possible, and it’s important to implement a solution that addresses the continued rise of synthetic IDs from multiple engagement points. With the right set of analytics and decisioning tools, you can reduce exposure to fraud and losses stemming from synthetic identity attacks from the beginning and across the customer life cycle. We can help you detect and mitigate these fake customers before they become delinquent. Learn more

You can do everything you can to prepare for the unexpected. But similar to how any first-time parent feels… you might need some help. Call in the grandparents! Experian has extensive expertise and has been around for a long time in the industry, but unlike your traditional grandparents, Experian continuously innovates, researches trends, and validates best practices in fraud and identity verification. That’s why we explored two prominent fraud reports, Javelin’s 2019 Identity Fraud Study: Fraudsters Seek New Targets and Victims Bear the Brunt and Experian’s 2019 Global Identity and Fraud Report — Consumer trust: Building meaningful relationships online, to help you identify and respond to new trends surrounding fraud. What we found – and what you need to know – is there are trends, technology and tactics that can help and hinder your fraud-prevention efforts. Consider the many digital channels available today. A full 91 percent of consumers transacted online in 2018. This presents a great opportunity for businesses to serve and develop relationships with customers. It also presents a great opportunity for fraudsters as well – as almost half of consumers have experienced a fraudulent online event. Since the threat of fraud is not impacting customers’ willingness to transact online, businesses are held responsible for adapting and evolving to not only protect their customers, but to secure their bottom line. This becomes increasingly important as fraudsters continue to target and expose vulnerabilities across inexperienced lines of businesses. Or, how about passwords. Research has shown that both businesses and consumers have greater confidence in biometrics, but neither is ready to stop using passwords. The continued reliance on traditional authentication methods is a delicate balance between security, trust and convenience. Passwords provide both authentication and consumer confidence in the online experience. It also adds friction to the user experience – and sometimes aggravation when passwords are forgotten. Advanced methods, like physical and behavioral biometrics and device intelligence, are gaining user confidence by both businesses and consumers. But a completely frictionless authentication experience can leave consumers doubting the safeness of their transaction. As you respond and adapt to our ever-evolving world, we encourage you to build and strengthen a trusted relationship with your customers through transparency. Consumers know that businesses are collection data about them. When a business is transparent about the use of that data, digital trust and consumer confidence soars. Through a stronger relationship, customers are more willing to accept friction and need fewer signs of security. Learn more about these and other trends, technology and tactics that can help and hinder your authentication efforts in our new E-book, Upcoming fraud trends and how to combat them.

Vehicle affordability has been a main topic of conversation in the auto industry for some time, and based on the data, it’s not going unnoticed by consumers. The average new vehicle loan in Q1 2019 reached $32,187, while the average new vehicle monthly loan payment hit $554. How are car shoppers reacting? Perhaps the biggest shift in Q1 2019 was the growth of prime and super prime customers opting for used vehicles. The percentage of prime (61.88 percent) and super-prime (44.78 percent) consumers choosing used vehicles reached an all-time high in Q1 2019, according to Experian data. Not only are we seeing new payment amounts increase, but used loan amounts and payments are on the rise as well, though the delta between the two can be one of the reason we’re seeing more prime and super prime opt for used. The average used vehicle loan was slightly above $20,000 in Q1 2019, while the average used vehicle payment was $391. We know that consumers often shop based on the monthly payment amount, and given the $163 difference between average monthly payments for new and used, it’s not surprising to see more people opt for used vehicles. Another way that consumers can look to have a smaller payment amount is through leasing. We’re continuing to see that the top vehicles leased are more expensive CUVs, trucks and SUVs, which are pricier vehicles to purchase. But with the average lease payment being $457 per month, there’s an average difference of $97 compared to loan payments. In Q1 2019, leasing was down slightly year-over-year, but still accounted for 29.07 percent of all vehicle financing. On the other side of the affordability equation, beyond cost of vehicles, is concern around delinquencies: will consumers be able to make their payments in a timely manner? So far, so good. In Q1 2019, 30-day delinquencies saw an increase to 1.98 percent, up from 1.9 percent a year ago. That said, banks, credit unions and finance companies all saw slight decreases in 30-day delinquency rates, and 60-day delinquencies remained relatively stable at 0.68 percent year-over-year. It’s important to keep in mind that the 30-day delinquency rate is still well-below the high-water mark in Q1 2009 (2.81 percent). The vehicle finance market appears to remain strong overall, despite rising vehicle costs, loan amounts and monthly payments. Expect consumers to continue to find ways to minimize monthly payments. This could continue the shift into used vehicles. Overall, as long as delinquencies stay flat and vehicle sales don’t taper too badly, the auto finance market should stay on a positive course. To watch the full Q1 2019 State of the Automotive Finance Market webinar, click here.

Would you hire a new employee strictly by their resume? Surely not – there’s so much more to a candidate than what’s written on paper. With that being said, why would you determine your consumers’ creditworthiness based only on their traditional credit score? Resumes don’t always give you the full picture behind an applicant and can only tell a part of someone’s story, just as a traditional credit score can also be a limited view of your consumers. And lenders agree – findings from Experian’s 2019 State of Alternative Credit Data revealed that 65% of lenders are already leveraging information beyond the traditional credit report to make lending decisions. So in addition to the resume, hiring managers should look into a candidate’s references, which are typically used to confirm a candidate’s positive attributes and qualities. For lenders, this is alternative credit data. References are supplemental but essential to the resume, and allow you to gain new information to expand your view into a candidate – synonymous to alternative credit data’s role when it comes to lending. Lenders are tasked with evaluating their consumers to determine their stability and creditworthiness in an effort to prevent and reduce risk. While traditional credit data contains core information about a consumer’s credit data, it may not be enough for a lender to formulate a full and complete evaluation of the consumer. And for over 45 million Americans, the issue of having no credit history or a “thin” credit history is the equivalent of having a resume with little to no listed work experience. Alternative credit data helps to fill in the gaps, which has benefits for both lenders and consumers. In fact, 61% of consumers believe adding payment history would have a positive impact on their credit score, and therefore are willing to share their data with lenders. Alternative credit data is FCRA-compliant and includes information like alternative finance data, rental payments, utility payments, bank account information, consumer-permissioned data and full-file public records. Because this data shows a holistic view of the customer, it helps to determine their ability to repay debts and reveals any delinquent behaviors. These insights help lenders to expand their consumer lending universe– all while mitigating and preventing risk. The benefits can also be seen for home-based and small businesses. Fifty percent of all US small businesses are home-based, but many small business owners lack visibility due to their thin-file nature – making it extremely difficult to secure bank loans and capital to fund their businesses. And, younger generations and small business owners account for 58% of business owners who rely on short term lending. By leveraging alternative credit data, lenders can get greater insights into a small business owner’s credit profile and gauge risk. Entrepreneurs can also benefit from this information being used to build their credit profiles – making it easier for them to gain access to investment capital to fund their new ventures. Like a hiring manager, it’s important for lenders to get a comprehensive view to find the most qualified candidates. Using alternative credit data can expand your choices – read our 2019 State of Alternative Credit Data Whitepaper to learn more and register for our upcoming webinar. Register Now

Alex Lintner, Group President at Experian, recently had the chance to sit down with Peter Renton, creator of the Lend Academy Podcast, to discuss alternative credit data,1 UltraFICO, Experian Boost and expanding the credit universe. Lintner spoke about why Experian is determined to be the leader in bringing alternative credit data to the forefront of the lending marketplace to drive greater access to credit for consumers. “To move the tens of millions of “invisible” or “thin file” consumers into the financial mainstream will take innovation, and alternative data is one of the ways which we can do that,” said Lintner. Many U.S. consumers do not have a credit history or enough record of borrowing to establish a credit score, making it difficult for them to obtain credit from mainstream financial institutions. To ease access to credit for these consumers, financial institutions have sought ways to both extend and improve the methods by which they evaluate borrowers’ risk. By leveraging machine learning and alternative data products, like Experian BoostTM, lenders can get a more complete view into a consumer’s creditworthiness, allowing them to make better decisions and consumers to more easily access financial opportunities. Highlights include: The impact of Experian Boost on consumers’ credit scores Experian’s take on the state of the American consumer today Leveraging machine learning in the development of credit scores Expanding the marketable universe Listen now Learn more about alternative credit data 1When we refer to "Alternative Credit Data," this refers to the use of alternative data and its appropriate use in consumer credit lending decisions, as regulated by the Fair Credit Reporting Act. Hence, the term "Expanded FCRA Data" may also apply in this instance and both can be used interchangeably.

There were 276 million vehicles on the road in Q1 2019.

Debt management is becoming increasingly complex. People don’t answer their phones anymore. There are many, many communication channels available (email, text, website, etc.) and just as many preferences from consumers regarding how they communicate. Prioritizing how much time and effort to spend on a debtor often requires help from advanced analytics and machine learning to optimize those strategies. Whether you are manually managing your collections strategies or are using advanced optimization to increase recovery rates, we’ve got keys to help you improve your recover rates. Watch our webinar, Keys to unlocking debt management success, to learn about: Minimizing the flow of accounts into collections and ensuring necessary information (e.g. risk, contact data) is used to determine the best course of action for accounts entering collections Recession readiness – prepare for the next recession to minimize impact Reducing costs and optimizing collections treatment strategies based on individual consumer circumstances and preferences Increasing recovery rates and improving customer experience by enabling consumers to interact with your organization in the most effective, efficient and non-threatening way possible Watch on-demand now>

Once you have kids, your bank accounts will never be the same. From child care to college, American parents spend, on average, over $233,000 raising a child from birth through age 17. While moms and dads are facing the same pile of bills, they often don’t see eye to eye on financial matters. In lieu of Father’s Day, where spending falls $8 million behind Mother’s Day (sorry dads!), we’re breaking down the different spending habits of each parent: Who pays the bills? With 80% of mothers working full time, the days of traditional gender roles are behind us. As both parents share the task of caring for the children, they also both take on the burden of paying household bills. According to Pew Research, when asked to name their kids’ main financial provider, 45% of parents agreed they split the role equally. Many partners are finding it more logical to evenly contribute to shared joint expenses to avoid fighting over finances. However, others feel costs should be divvied up according to how much each partner makes. What do they splurge on? While most parents agree that they rarely spend money on themselves, splurge items between moms and dads differ. When they do indulge, moms often purchase clothes, meals out and beauty treatments. Dads, on the other hand, are more likely to binge on gadgets and entertainment. According to a recent survey on millennial dads, there’s a strong correlation between the domestic tasks they’re taking on and how they’re spending their money. For instance, most dads are involved in buying their children’s books, toys and electronics, as well as footing the bill for their leisure activities. Who are they more likely to spend on? No parent wants to admit favoritism. However, research from the Journal of Consumer Psychology found that you’re more likely to spend money on your daughter if you’re a woman and more likely to spend on your son if you’re a man. The suggested reasoning behind this is that women can more easily identify with their daughters and men with their sons. Overall, parents today are spending more on their children than previous generations as the cost of having children in the U.S. has exponentially grown. How are they spending? When it comes to money management both moms and dads claim to be the “saver” and label the other as the “spender.” However, according to Experian research, there are financial health gaps between men and women, specifically when it pertains to credit. For example, women have 11% less average debt than men, a higher average VantageScore® credit score and the same revolving debt utilization of 30%. Even with more credit cards, women have fewer overall debts and are managing to pay those debts on time. There’s no definite way to say whether moms are spending “better” than dads, or vice versa. Rather, each parent has their own strengths and weaknesses when it comes to allocating money and managing expenses.

Financial institutions preparing for the launch of the Financial Accounting Standard Board’s (FASB) new current expected credit loss model, or CECL, may have concerns when it comes to preparedness, implications and overall impact. Gavin Harding, Experian’s Senior Business Consultant and Jose Tagunicar, Director of Product Management, tackled some of the tough questions posed by the new accounting standard. Check out what they had to say: Q: How can financial institutions begin the CECL transition process? JT: To prepare for the CECL transition process, companies should conduct an operational readiness review, which includes: Analyzing your data for existing gaps. Determining important milestones and preparing for implementation with a detailed roadmap. Running different loss methods to compare results. Once losses are calculated, you’ll want to select the best methodology based on your portfolio. Q: What is required to comply with CECL? GH: Complying with CECL may require financial institutions to gather, store and calculate more data than before. To satisfy CECL requirements, financial institutions will need to focus on end-to-end management, determine estimation approaches that will produce reasonable and supportable forecasts and automate their technology and platforms. Additionally, well-documented CECL estimations will require integrated workflows and incremental governance. Q: What should organizations look for in a partner that assists in measuring expected credit losses under CECL? GH: It’s expected that many financial institutions will use third-party vendors to help them implement CECL. Third-party solutions can help institutions prepare for the organization and operation implications by developing an effective data strategy plan and quantifying the impact of various forecasted conditions. The right third-party partner will deliver an integrated framework that empowers clients to optimize their data, enhance their modeling expertise and ensure policies and procedures supporting model governance are regulatory compliant. Q: What is CECL’s impact on financial institutions? How does the impact for credit unions/smaller lenders differ (if at all)? GH: CECL will have a significant effect on financial institutions’ accounting, modeling and forecasting. It also heavily impacts their allowance for credit losses and financial statements. Financial institutions must educate their investors and shareholders about how CECL-driven disclosure and reporting changes could potentially alter their bottom line. CECL’s requirements entail data that most credit unions and smaller lenders haven’t been actively storing and saving, leaving them with historical data that may not have been recorded or will be inaccessible when it’s needed for a CECL calculation. Q: How can Experian help with CECL compliance? JT: At Experian, we have one simple goal in mind when it comes to CECL compliance: how can we make it easier for our clients? Our Ascend CECL ForecasterTM, in partnership with Oliver Wyman, allows our clients to create CECL forecasts in a fraction of the time it normally takes, using a simple, configurable application that accurately predicts expected losses. The Ascend CECL Forecaster enables you to: Fulfill data requirements: We don’t ask you to gather, prepare or submit any data. The application is comprised of Experian’s extensive historical data, delivered via the Ascend Technology PlatformTM, economic data from Oxford Economics, as well as the auto and home valuation data needed to generate CECL forecasts for each unsecured and secured lending product in your portfolio. Leverage innovative technology: The application uses advanced machine learning models built on 15 years of industry-leading credit data using high-quality Oliver Wyman loan level models. Simplify processes: One of the biggest challenges our clients face is the amount of time and analytical effort it takes to create one CECL forecast, much less several that can be compared for optimal results. With the Ascend CECL Forecaster, creating a forecast is a simple process that can be delivered quickly and accurately. Q: What are immediate next steps? JT: As mentioned, complying with CECL may require you to gather, store and calculate more data than before. Therefore, it’s important that companies act now to better prepare. Immediate next steps include: Establishing your loss forecast methodology: CECL will require a new methodology, making it essential to take advantage of advanced statistical techniques and third-party solutions. Making additional reserves available: It’s imperative to understand how CECL impacts both revenue and profit. According to some estimates, banks will need to increase their reserves by up to 50% to comply with CECL requirements. Preparing your board and investors: Make sure key stakeholders are aware of the potential costs and profit impacts that these changes will have on your bottom line. Speak with an expert

What is CECL? CECL (Current Expected Credit Loss) is a new credit loss model, to be leveraged by financial institutions, that estimates the expected loss over the life of a loan by using historical information, current conditions and reasonable forecasts. According to AccountingToday, CECL is considered one of the most significant accounting changes in decades to affect entities that borrow and lend money. To comply with CECL by the assigned deadline, financial institutions will need to access much more data than they’re currently using to calculate their reserves under the incurred loss model, Allowance for Loan and Lease Losses (ALLL). How does it impact your business? CECL introduces uncertainty into accounting and growth calculations, as it represents a significant change in the way credit losses are currently estimated. The new standard allows financial institutions to calculate allowances in a variety of ways, including discounted cash flow, loss rates, roll-rates and probability of default analyses. “Large banks with historically good loss performance are projecting increased reserve requirements in the billions of dollars,” says Experian Advisory Services Senior Business Consultant, Gavin Harding. Here are a few changes that you should expect: Larger allowances will be required for most products As allowances will increase, pricing of the products will change to reflect higher capital cost Losses modeling will change, impacting both data collection and modeling methodology There will be a lower return on equity, especially in products with a longer life expectancy How can you prepare? “CECL compliance is a journey, rather than a destination,” says Gavin. “The key is to develop a thoughtful, data-driven approach that is tested and refined over time.” Financial institutions who start preparing for CECL now will ultimately set their organizations up for success. Here are a few ways to begin to assess your readiness: Create a roadmap and initiative prioritization plan Calculate the impact of CECL on your bottom line Run altered scenarios based on new lending policy and credit decision rules Understand the impact CECL will have on your profitability Evaluate current portfolios based on CECL methodology Run different loss methods and compare results Additionally, there is required data to capture, including quarterly or monthly loan-level account performance metrics, multiple year data based on loan product type and historical data for the life of the loan. How much time do you have? Like most accounting standards, CECL has different effective dates based on the type of reporting entity. Public business entities that file financial statements with the Security and Exchange Commission will have to comply by 2020, non-public entity banks must comply by 2022 and non-SEC registered companies have until 2023 to adopt the new standard. How can we help: Complying with CECL may require you to gather, store and calculate more data than before. Experian can help you comply with CECL guidelines including data needs, consulting and loan loss calculation. Experian industry experts will help update your current strategies and establish an appropriate timeline to meet compliance dates. Leveraging our best-in-class industry data, we will help you gain CECL compliance quickly and effectively, understand the impacts to your business and use these findings to improve overall profitability. Learn more

Many may think of digital transformation in the financial services industry as something like emailing a PDF of a bank statement instead of printing it and sending via snail mail. After working with data, analytics, software and fraud-prevention experts, I have found that digital transformation is actually much more than PDFs. It can have a bigger and more positive influence on a business’s bottom line – especially when built on a foundation of data. Digital transformation is the new business model. And executives agree. Seventy percent of executives feel the traditional business model will disappear in the next five years due to digital transformation, according to recent Experian research. Our new e-book, Powering digital transformation: Transforming the customer experience with data, analytics and automation, says, “we live in a world of ‘evolve or fail.’ From Kodak to Blockbuster, we’ve seen businesses resist change and falter. The need to evolve is not new. What is new is the speed and depth needed to not only compete, but to survive. Digital startups are revolutionizing industries in months and years instead of decades and centuries.” So how do businesses evolve digitally? First, they must understand that this isn’t a ‘one-and-done’ event. The e-book suggests that the digital transformation life cycle is a never-ending process: Cleanse, standardize and enrich your data to create features or attributes Analyze your data to derive pertinent insights Automate your models and business practices to provide customer-centric experiences Test your techniques to find ways to improve Begin the process again Did you notice the key word or phrase in each of these steps is ‘data’ or ‘powered by data?’ Quality, reliable data is the foundation of digital transformation. In fact, almost half of CEOs surveyed said that lack of data or analytical insight is their biggest challenge to digital transformation. Our digital world needs better access to and insight from data because information derived from data, tempered with wisdom, provides the insight, speed and competitive advantage needed in our hypercompetitive environment. Data is the power behind digital transformation. Learn more about powering your digital transformation in our new e-book>

Consumer credit trends are continuously changing, making it imperative to keep up with the latest developments in originations, delinquencies on mortgages, credit cards and auto loans. By monitoring consumer behavior and market trends over time, you can predict and prepare for potential issues within each market. In this 30-minute webinar, our featured speakers, Gavin Harding, Experian Senior Business Consultant, and Alan Ikemura, Experian Data Analytics Senior Product Manager, reveal Q1 2019 market intelligence data and explore recent advances in consumer credit trends. Watch our on-demand webinar

You’ve Got Mail! Probably a lot of it. Birthday cards from Mom, a graduation announcement from your third cousin’s kid whose name you can’t remember and a postcard from your dentist reminding you you’re overdue for a cleaning. Adding to your pile, are the nearly 850 pieces of unsolicited mail Americans receive annually, according to Reader’s Digest. Many of these are pre-approval offers or invitations to apply for credit cards or personal loans. While many of these offers are getting to the right mailbox, they’re hitting a changing consumer at the wrong time. The digital revolution, along with the proliferation and availability of technology, has empowered consumers. They now not only have access to an abundance of choices but also a litany of new tools and channels, which results in them making faster, sometimes subconscious, decisions. Three Months Too Late The need to consistently stay in front of customers and prospects with the right message at the right time has caused a shortening of campaign cycles across industries. However, for some financial institutions, the customer acquisition process can take up to 120 days! While this timeframe is extreme, customer prospecting can still take around 45-60 days for most financial institutions and includes: Bureau processing: Regularly takes 10-15 days depending on the number of data sources and each time they are requested from a bureau. Data aggregation: Typically takes anywhere from 20-30 days. Targeting and selection: Generally, takes two to five days. Processing and campaign deployment: Usually takes anywhere from three days, if the firm handles it internally, or up to 10 days if an outside company handles the mailing. A Better Way That means for many firms, the data their customer acquisition campaigns are based off is at least 60 days old. Often, they are now dealing with a completely different consumer. With new card originations up 20% year-over-year in 2019 alone, it’s likely they’ve moved on, perhaps to one of your competitors. It’s time financial institutions make the move to a more modern form of prospecting and targeting that leverages the power of cloud technology, machine learning and artificial intelligence to accelerate and improve the marketing process. Financial marketing systems of the future will allow for advanced segmentation and targeting, dynamic campaign design and immediate deployment all based on the freshest data (no more than 24-48 hours old). These systems will allow firms to do ongoing analytics and modeling so their campaign testing and learning results can immediately influence next cycle decisions. Your customers are changing, isn’t it time the way you market to them changes as well?

The universe has been used as a metaphor for many things – vast, wide, intangible – much like the credit universe. However, while the man on the moon, a trip outside the ozone layer, and all things space from that perspective may seem out of touch, there is a new line of access to consumers. In Experian's latest 2019 State of Alternative Credit Data report, consumers and lenders alike weigh in on the growing data set and how they are leveraging the data in use cases across the lending lifecycle. While the topic of alternative credit data is no longer as unfamiliar as it may have been a year or two ago, the capabilities and benefits that can be experienced by financial institutions, small businesses and consumers are still not widely known. Did you know?: - 65% of lenders say they are using information beyond the traditional credit report to make a lending decision. - 58% of consumers agree that having the ability to contribute payment history to their credit file make them feel empowered. - 83% of lenders agree that digitally connecting financial account data will create efficiencies in the lending process. These and other consumer and lender perceptions of alternative credit data are now launched with the latest edition of the State of Alternative Credit Data whitepaper. This year’s report rounds up the different types of alternative credit data (from alternative financial services data to consumer-permissioned account data, think Experian BoostTM), as well as an overview of the regulatory landscape, and a number of use cases across consumer and small business lending. In addition, consumers also have a lot to say about alternative credit data: With the rise of machine learning and big data, lenders can collect more data than ever, facilitating smarter and more precise decisions. Unlock your portfolio’s growth potential by tapping into alternative credit data to expand your consumer universe. Learn more in the 2019 State of Alternative Credit Data Whitepaper. Read Full Report View our 2020 State of Alternative Credit Data Report for an updated look at how consumers and lenders are leveraging alternative credit data.

Earlier this month, Experian joined FinovateSpring in San Francisco, CA to demonstrate innovations impacting financial health to over 1,000 attendees. The Finovate conference promotes real-world solutions while highlighting short-form demos and key insights from thought-leaders on digital lending, banking, payments, artificial intelligence and the customer experience. With more than 100 million Americans lacking fair access to credit, it's more important than ever for companies to work to improve the financial health of consumers. In addition to the show's abundance of fintech-centered content, Experian hosted an exclusive, cutting-edge breakout series demonstrating innovations that are positively impacting the financial health of consumers across the nation. Finovate Day One Overview While fintechs, banks, venture capitalist, entrepreneurs and industry analysts ascended on the general conference floor for a fast-paced day of demos, a select subset gathered for a luncheon presented by Experian North America CEO, Craig Boundy, and Group President, Alex Lintner. Attendees were given an in-depth look at new, alternative credit data streams and tools that are helping to increase financial access. Demos included: Experian Boost™: a free, groundbreaking online platform that allows consumers to instantly boost their credit scores by adding telecommunications and utility bill payments to their credit file. More than half a million consumers have leveraged Experian Boost, increasing their score by an average of 13 points. Cumulatively, Experian Boost has helped add more than 2.8 million points to consumers’ credit scores. Ascend Analytical Sandbox™: A first-of-its-kind data and analytics platform that gives companies instant access to more than 17 years of depersonalized credit data on more than 220 million U.S. consumers. It has been the most successful product launch in Experian’s history and recently earned the title of “Best Overall Analytics Platform” at this year’s Fintech Breakthrough Awards. Alternative Credit Data: Comprised of data from alternative credit sources, this data helps lenders make smarter and more informed lending decisions. Additionally, Experian’s Clear Data Platform is next-level credit data that adds supplemental FCRA-compliant credit data to enrich decisions across the entire credit spectrum. This new platform features alternative credit data, rental data, public records, consumer-permissioned data and more Upon conclusion of the luncheon, Alpa Lally, Experian’s Vice President of Data Business at Consumer Information Services, was interviewed for the HousingWire Podcast with Jacob Gaffney, HousingWire Editor in Chief, to discuss how new forms of data streams are helping improve consumers’ access to credit by giving lenders a clearer picture of their creditworthiness and risk. “Alternative credit data is different than traditional credit data and helps us paint a fuller picture of the consumer in terms of their ability to pay, willingness to pay and stability. It helps consumers get better access overall to the credit they deserve so that they can actively participate in the economy,” said Lally. Finovate Day Two Overview On the last day of the conference, expert speakers took to the main stage to analyze the latest fintech trends, opportunities and challenges. Alex Lintner and Sandeep Bhandari, Chief Strategy Officer and Chief Risk Officer at Affirm, participated in a fireside chat titled “Improving the Financial Health of America’s 100 Million Credit Underserved Consumers.” Moderated by David Penn, Finovate Analyst, the session explored the latest innovations, trends and technologies – from machine learning to alternative data – that are making a difference in positively impacting the financial health of Americans and expanding financial opportunities for underserved consumers. The panel discussed the efforts made to put financial health at the center of their business and the impact it’s had on their organizations. Following the fireside chat, Experian hosted a second lunch briefing, presented by Vijay Mehta, Chief Innovation Officer, and Greg Wright, EVP Chief Product Officer. The lunch included exclusive table discussions and open conversations to help attendees leave with a better understanding of the importance of prioritizing financial health to build trust, reach new customers and ultimately grow their business. "We are actively seeking out unresolved problems and creating products and technologies that will help transform the way businesses operate and consumers thrive in our society. But we know we can't do it alone," Experian North American CEO, Craig Boundy said in a recent blog post on Experian's fintech partnerships and Finovate participation. "That's why over the last year, we have built out an entire time of account executives and other support staff that are fully dedicated to developing and supporting partnerships with leading fintech companies. We've made significant strides that will help us pave the way for the next generation of lending while improving the financial health of more people around the world." For more information on how Experian is partnering with fintechs, visit experian.com/fintech or read our recent blog article on consumer-permissioned data for an in-depth discussion on Experian BoostTM.