Apply CIS Tag

How can lenders ensure they’re making the most accurate and fair lending decisions? The answer lies in consistent model validations. What are model validations? Model validations are vital for effective lending and risk-based pricing programs. In addition to helping you determine which credit scoring model works best on your portfolio, the performance (odds) charts from validation results are often used to set score cutoffs and risk-based pricing tiers. Validations also provide the information you need to implement a new score into your decisioning process. Factors affecting model validations Understanding how well a score predicts behavior, such as payment delinquency or bankruptcy, enables you to make more confident lending decisions. Model performance and validation results can be impacted by several factors, including: Dynamic economic environment – Shifts in unemployment rates, interest rate hikes and other economic indicators can impact consumer behavior. Regulatory changes affecting consumers – For example, borrowers who benefited from a temporary student loan payment pause may face challenges as they resume payments. Scorecard degradation – A model that performed well several years ago may not perform as well under current conditions. When to perform model validations The Office of the Comptroller of the Currency’s Supervisory Guidance on Model Risk Management states model validations should be performed at least annually to help reduce risk. The validation process should be comprehensive and produce proper documentation. While some organizations perform their own validations, those with fewer resources and access to historical data may not be able to validate and meet the guidance recommendations. Regular validations support compliance and can also give you confidence that your lending strategies are built on solid, current data that drive better outcomes. Good model validation practices are critical if lenders are to continue to make data-driven decisions that promote fairness for consumers and financial soundness for the institution. Make better lending decisions If you’re a credit risk manager responsible for the models driving your lending policies, there are several things you can do to ensure that your organization continues to make fair and sound lending decisions: Assess your model inventory. Ensure you have comprehensive documentation showing when each model was developed and when it was last validated. Validate the scores you are using on your data, along with those you are considering, to compare how well each model performs and determine if you are using the most effective model for your needs. Produce validation documentation, including performance (odds) charts and key performance metrics, which can be shared with regulators. Utilize the performance charts produced from the validation to analyze bad rates/approval rates and adjust cutoff scores as needed. Explore alternative credit scoring models to potentially enhance your scoring process. As market conditions and regulations continue to evolve, model validations will remain an essential tool for staying competitive and making sound lending decisions. Ready to ensure your lending decisions are based on the latest data? Learn more about Experian’s flexible validation services and how we can support your ongoing success. Contact us today to schedule a consultation. Learn more

In today's data-driven business landscape, leveraging advanced targeting techniques is crucial for effective consumer engagement, particularly in the financial services sector. Prescreen targeting solutions have evolved significantly, offering a competitive edge through more precise and impactful outreach strategies. The power of data analytics and predictive modeling At the heart of modern prescreen targeting solutions lies the integration of extensive data analytics and predictive modeling. These systems combine detailed consumer information, including purchasing behaviors and credit scores, with sophisticated algorithms to identify potential customers most likely to respond positively to specific promotional campaigns. This approach not only streamlines campaign efforts but also enhances the tactical effectiveness of each interaction. Direct mail: a proven channel for financial services In the competitive North American financial services market, direct mail has demonstrated distinct advantages as a targeting channel. Its tangible nature helps cut through digital noise, capturing consumer attention effectively. For credit products, direct mail typically achieves engagement rates of 0.2-2% for prime consumers and 1-3% for near-prime and subprime consumers[1]. Key advantages of prescreen targeting solutions Enhanced response rates Custom response models can significantly boost prospect response rates by targeting a well-defined, high-propensity audience. These models have the potential to improve average response rates of prescreen direct mail campaigns by 10-25%. Risk mitigation By focusing on well-defined, high-propensity audiences, prescreen targeting via direct mail aims to attract the right prospects, minimizing fraud and delinquency risks. This targeted approach can lead to substantial savings on underwriting costs. Improved customer engagement and retention Personalized direct mail strengthens customer relationships by making recipients feel valued, leading to higher engagement and loyalty – crucial factors for long-term business success. Regulatory compliance and security Prescreen solutions come equipped with compliance safeguards, simplifying adherence to industry regulations and consumer privacy standards. This is particularly critical in the highly regulated financial sector. The future of targeting and enhancement As markets continue to evolve, the strategic importance of precise and efficient marketing techniques will only grow. Financial institutions leveraging optimized prescreen targeting and enhancement solutions can gain a significant competitive advantage, achieving higher immediate returns and fostering long-term customer loyalty and brand strength. Future advancements in AI and machine learning are expected to further refine prescreen targeting capabilities, offering even more sophisticated tools for marketers to engage effectively with their target audiences. Ascend Intelligence Services™ Target Ascend Intelligence Services Target is a sophisticated prescreening solution that boosts direct mail response rates. It uses comprehensive trended and alternative data, capturing credit and behavior patterns to iterate through direct mail response models and mathematical optimization. This enhances the target strategy and maximizes campaign response, take-up rates, and ROI within business constraints. Visit our website to learn more [1] Experian Research, Data Science Team, July 2024

The open banking revolution is transforming the financial services landscape, offering banks and financial institutions unprecedented access to consumer-permissioned data. However, during our recent webinar, “Navigating Open Banking: Strategies for Banks and Financial Institutions,” over 78% of attendees stated that they do not currently have an open banking strategy in place. This highlights a significant gap in the industry. By tapping into consumer-permissioned data, you can develop more personalized products, streamline credit decisioning, and improve overall customer engagement. With the right strategies, open banking offers a pathway to growth, innovation, and enhanced customer experiences. Here’s a snippet from the webinar’s Q&A session with Ashley Knight, Senior Vice President of Product Management, who shared her perspective on open banking trends and opportunities. Q: What specific analytic skill is the most important when working on open banking data?A: The ability to parse and transform raw data, a deep understanding of data mining, experience in credit risk, and general modeling skills to improve underwriting. Q: What lessons did the U.S. learn from the experience of other countries that implemented open banking? A: The use cases are common globally; typical uses of open banking data include second-chance underwriting to help score more consumers and customer management, which involves assessing cashflow data to leverage on an existing portfolio (first-party data). This can be used in various ways, such as cross-sell, up-sell, credit line increase, and growing/retaining deposits. Q: Does Experian have access to all a consumer’s bank accounts in cases where the consumer has multiple accounts?A: Data access is always driven by consumer permission unless the organization owns this data (i.e., first-party data). Where first-party data is unavailable, we collect it through clients or lenders who send it to us directly, having gained the proper consent. Yes, we can intake data from multiple accounts and provide a categorization and attribute calculation. Q: Where does the cashflow data come from? Is it only credit card spending?A: It includes all spending data from bank accounts, checking accounts, credit cards, savings, debit cards, etc. All of this can be categorized, and we can calculate attributes and/or scores based on that data. Q: What is the coverage of Experian’s cashflow data, and how is it distributed across risk bands?A: Cashflow data moves through Experian directly from consumer permissioning for B2B use cases or from institutions with first-party data. We perform analytics and calculate attributes on that portfolio. Don’t miss the chance to learn from our industry leaders on how to navigate the complexities of open banking. Whether you are a seasoned professional or just starting to explore its potential, this webinar will equip you with the knowledge you need to stay ahead. Watch on-demand recording Learn more Meet our expert Ashley Knight, Senior VP of Product Management, Experian Ashley leads our product management team focusing on alternative data, scores, and open banking. She fosters innovation and drives financial inclusion by using new data, such as cash flow, analytics, and Experian’s deep expertise in credit.

This series will explore our monthly State of the Economy report, which provides a snapshot of the top monthly economic and credit data for financial service professionals to proactively shape their business strategies. After the Federal Reserve announced its first cut since 2020 in September, several pieces of economic data have surpassed expectations. Job creation was almost double economists’ estimates, unemployment ticked down, and personal incomes were revised up. Alongside these areas of strength, inflation continued to prove stubborn. The October State of the Economy report fills in the rest of the developing macroeconomic story. This month’s highlights include: Unemployment decreased for the second month in a row, down to 4.1%. Core inflation increased from 3.2% to 3.3%, driven by shelter and service costs. Negative rental payment activity has declined 1.9% over the past year. Check out our report for a detailed analysis of the rest of this month’s data, including the latest trends in originations, retail sales, and consumer sentiment. Download October's report As our economy continues to fluctuate, it's critical to stay updated on the latest developments. Subscribe to our new series, The Macro Moment, for economic commentary from Experian NA’s Chief Economist, Joseph Mayans, with additional economic resources, including our new Lending Conditions Chartbook and our new Labor Market Monitor. For more economic trends and market insights, visit Experian Edge.

The Fed finally made their long-awaited rate cut. Hooray! The industry is saved! Brush off the dust everyone, it’s time to start originating mortgages like it’s 2006 again! Not so fast. While it's true that there are opportunities to take advantage of now that rates have declined, there remain open questions: How much further will rates decline? So far, only this single drop has been signaled. How many customers will realize benefit from a rate & term refinance offer given the rate drop(s)? What does this rate drop mean for the purchase market given that home prices remain at all-time highs? To put it simply, there are lending opportunities for home lenders (mortgage and home equity), but only for those with the ability to effectively leverage data and analytical strategies to identify and execute on the pockets of opportunity. By “pockets of opportunity,” we mean the following categories of consumers will benefit from specific mortgage or home equity offers. Rate & term refi: According to Experian research, over 83% of mortgages have an interest rate below 6.5%. This means that only the loans originated in the past couple of years (including one held by your author) will be eligible for a rate & term refi. The dollar amount on these loans will be high along with the interest rates, so even a minor savings on the interest rate will translate to potentially hundreds of thousands of dollars in lifetime interest savings for the borrowers. Being able to accurately identify which borrowers have an interest rate that is higher than the rate you can offer them is key to efficiently targeting and originating rate & term refinances. Cashout refi: Equity levels exploded over the past several years for homeowners. Home prices show no sign of slowing down and home equity continues to be a significant, and in many cases untapped, financial resource for borrowers. A cashout refi is an excellent option for those consumers with high amounts of available equity in their homes. Some borrowers may choose to originate a cashout refinance loan even if the interest rate is similar to their existing rate, such is the value of partially liquidating their equity position. Having the consumer-level data to identify what equity positions are and the current interest rate is crucial to crafting personalized, effective marketing offers. The ability to target qualified customers with a personalized offer is critical given that in August 2024, over 2.9 million cashout direct mail offers were mailed to consumers.1 Streamlined refi: The VA and FHA have streamlined refinance programs that minimize the consumer lift to refinance their loan. Additionally, there are also non-VA and FHA loans that could benefit from what is called an “Express Title,” which removes the need for a full title workup and expedites the originations process. Borrowers that meet the criteria for these streamlined refinance offers can be identified using credit data. Since these refinances are easier for consumers, they will be more likely to respond and book a refinance offer, which means more ROI for your marketing spend. Home equity lines/loans: Similar to cashout refi, home equity products are an option for consumers to access the equity they have in their price-appreciated homes. Although this is no mystery to most lenders, many lenders do not leverage adequate data or analytics to identify the needle in the haystack of customers that still remain to be targeted. Experian data shows over $25B in monthly HELOC originations as of August 2024. Understanding which consumers have a second lien position available, how much equity they have by leveraging trade-level mortgage data and Automated Valuation Model (AVM) data, and other methods can help your home equity products stand out from the sea of offers in the mail and online. At Experian, we help our clients target and originate all four categories of borrowers: rate & term refinancers, cashout refinancers, streamlined refinancers, and home equity borrowers. Crafting a marketing strategy with the accurate data to precisely identify which consumers qualify for which product is crucial to making the most of your marketing spend. Without the guidance of such data and the personalized offers they enable, your marketing message is liable to be lost among all of the other direct mail and email blasts. Market with confidence Crafting an effective holistic marketing strategy across these segments is crucial to campaign success. Consider these borrower situations and prepare to respond with confidence: Does the consumer have a high interest rate? Would the consumer benefit from a quick rate & term refi? If yes, ship the offer out. Does the consumer have a significant equity position and outstanding revolving debt balances, but not qualify for a rate & term due to a relatively low rate? If yes, ship them a cashout refi offer with language about using their equity to pay off revolving debt. Does the consumer meet the criteria for a streamlined refi, and would they benefit financially from such an offer? If yes, ship them a VA IRRRL (Interest Rate Reduction Refinance Loan), FHA streamline, or an offer to cover their refi title expenses if they qualify for an express title. Does the consumer have an open second lien on their primary residence, but not qualify for either kind of refi? If yes, ship them a home equity offer. By creating this kind of specialized marketing waterfall, lenders can ensure they have valuable offers for all borrowers, not just for a specialized market. Such strategies allow you to target your existing portfolio or a prospect population to facilitate portfolio growth and prevent portfolio attrition. Be sure to join our upcoming webinar, "Return of the Refi: Top Lending Strategies for Becoming a Refi Master." Register now and learn more about how Experian can help you win more mortgage and home equity customers in this declining rate environment. Register now Learn more 1 Mintel data

In this article...Understanding the scope of fintech fraudThe importance of fintech fraud preventionSynthetic identity (ID) fraud: A growing threatHow fintech fraud detection and prevention are evolvingGet started today The integration of technology with traditional financial services has unlocked unprecedented convenience and opportunities for consumers and businesses alike. However, this digital shift has opened the door for more sophisticated fraud tactics. With fraudsters continuously refining their methods, fintech companies must invest in advanced fintech fraud detection and prevention solutions. Understanding the scope of fintech fraud As fintech platforms expand, they also attract the attention of cybercriminals. The accessibility of digital financial services can create vulnerabilities that fraudsters exploit, executing everything from personal account takeovers to larger-scale breaches involving synthetic identities. Source: Experian’s U.S. Identity & Fraud Report To counter these threats, fintech companies must deploy innovative fraud management solutions powered by artificial intelligence (AI), machine learning (ML), and advanced analytics. Unlike traditional methods that often rely on static rules and manual reviews, these solutions can process vast amounts of data, learn from historical patterns, and detect anomalies in real-time. This allows organizations to identify suspicious activities before they lead to significant losses. The importance of fintech fraud prevention While detecting fraud is crucial, preventing it from occurring in the first place is even more important. Fraud prevention solutions aim to create robust systems that stop fraudsters in their tracks before they can cause damage. With the rise of digital financial services, the need for proactive fraud prevention measures has never been greater. These solutions protect both consumers and businesses from financial harm, reducing the risk of financial loss and reputational damage. Advanced fraud prevention solutions employ multilayered strategies, combining AI-driven fraud detection tools with methods such as multifactor authentication and biometric identity verification. These tools create an extra layer of security, making it difficult for fraudsters to access sensitive data or execute fraudulent transactions. Experian’s fraud prevention solutions offer businesses a comprehensive suite of tools designed to prevent various types of fraud. From real-time transaction monitoring to sophisticated user authentication methods, these solutions provide the protection businesses need to stay ahead of evolving fraud tactics. Synthetic identity (ID) fraud: A growing threat One of the most concerning forms of fraud that fintech companies face is synthetic ID fraud. This type of fraud involves the creation of a fake identity using a combination of real and fabricated information. Fraudsters often steal pieces of personal data — such as Social Security numbers or addresses—and then combine them with fictional information to create a new, synthetic identity. These synthetic identities can be used to open bank accounts, apply for credit cards, or take out loans, leaving businesses and consumers vulnerable to significant financial losses. Synthetic ID fraud is particularly difficult to detect because the synthetic identity often looks legitimate to traditional verification systems. As a result, fintech companies must deploy sophisticated fraud detection systems that can identify synthetic identities before they’re used to commit fraud. Machine learning algorithms, for instance, can analyze behavioral data, detecting discrepancies that may indicate a synthetic identity. Experian is ranked #1 by the Center for Financial Professionals (CeFPro®) for Identity and Fraud. The ranking appeared in CeFPro’s Fintech Leaders Report, a comprehensive annual study of the fintech industry. How fintech fraud detection and prevention are evolving As fraudsters continue to evolve their tactics, fintech companies must remain one step ahead by investing in cutting-edge fraud detection and prevention technologies. Real-time monitoring, predictive analytics, and biometrics are just a few of the technologies shaping the future of fraud detection. By integrating these technologies into their fraud management processes, fintech companies can offer a more secure and seamless experience for their users. With the acquisition of NeuroID, an industry leader in behavioral analytics, Experian has amplified its fraud risk suite by providing a new layer of insight into digital behavioral signals and analytics. Available through our fraud solutions on the Experian Ascend PlatformTM, clients can proactively monitor and analyze a user’s real-time digital behavior, allowing them to confidently navigate the online landscape and provide frictionless customer experiences. Get started today As the fraud landscape continues to evolve, fintech companies must adopt comprehensive solutions to stay ahead of emerging threats. By doing so, they can protect themselves and their customers, ensuring the continued success of digital financial services in the years to come. To learn more, check out our fraud management and fintech solutions. Fraud management solutions Fintech solutions

Online fraud has increased exponentially over the past few years, with the Federal Trade Commission (FTC) data showing that consumers reported losing more than $10 billion to fraud in 2023. This marks the first time that fraud losses have reached that benchmark, and it’s a 14% increase over reported losses in 2022. As a result, e-commerce merchants and retailers have reacted by adding friction to e-commerce interactions. The risk is that a legitimate user may be denied a purchase because they have incorrectly been labeled a fraudster — a “false decline.” Now, as the holiday shopping season approaches, e-commerce merchants expect a surge in online spending and transactions, which in turn creates concern for an uptick in false declines. In a recent webinar, Experian experts Senior Vice President of Business Development and eCommerce Dave Tiezzi and Senior Director of Product Management Jose Pallares explored strategies for how e-commerce merchants can determine the risk level of a transaction and ensure that they do not miss out on genuine purchases and good customers. Below are a few key perspectives from our speakers: What are the biggest challenges posed by online card transactions? DT: One of the biggest issues merchants face is false declines. In the report, The E-Commerce Fraud Enigma: The Quest to Maximize Revenue While Minimizing Fraud Experian and Aite-Novarica Group (now Datos Insights) found that 1.16% of all sales are unnecessarily rejected by merchants. While this percentage may seem small, it represents significant revenue loss during the high-volume holiday shopping season. The report also highlights that 16% of all attempted online transactions encounter some form of friction due to suspected fraud. Alarmingly, 70% of that friction is unnecessary, meaning it’s not preventing fraud but instead disrupting the purchasing process for legitimate customers. This friction translates into a poor online shopping experience, often resulting in cart abandonment, lost sales and a decline in customer loyalty. What are the key consumer trends and expectations for the upcoming holiday season? DT: Experian's 2024 Holiday Spending Trends and Insights Report reveals that while 35% of holiday shopping in 2023 occurred in December, peaking at 9% the week before Christmas, Cyber Week in November also represented 8% of total holiday sales. This highlights the importance for merchants to be prepared well before the holiday rush begins in November and extends through December. As they gear up for this high-volume season, merchants must also prioritize meeting consumer expectations for speed, ease and security—which are top-of-mind for consumers. According to our 2024 U.S. Identity & Fraud Report, 63% of consumers consider it extremely or very important for businesses to recognize them online, while 81% say they’re more trusting of businesses that can accomplish easy and accurate identification. They’re also wary of fraud, ranking identity theft (84%) and stolen credit card information (80%) as their top online security concerns. Considering these trends, it’s important for merchants to ensure seamless and secure transactions this holiday season. False declines are a persistent problem for e-commerce merchants, especially during the holidays. How can merchants minimize these declines while protecting consumers from fraud? What best practices can merchants adopt to address these risks? JP: False declines often result from overly cautious fraud detection systems that flag legitimate transactions as suspicious. While it’s essential to prevent fraud, turning away legitimate customers can severely impact both revenue and customer satisfaction. To minimize false declines, merchants should leverage advanced fraud prevention tools that combine multiple data points and behavioral insights. This approach goes beyond basic fraud detection by using attributes such as customer behavior, transaction patterns and real-time data analysis. Solutions incorporating NeuroID’s behavioral analytics and signals can also better assess whether a transaction is genuine based on the user’s interaction patterns, helping merchants filter out bad actors and make more informed decisions without disrupting the customer experience. What actionable strategies should e-commerce brands or merchants implement now to reduce cart abandonment and ensure a successful holiday season? JP: One of the most effective tools we offer is Experian Link™, a credit card owner verification solution designed to reduce false declines while protecting against fraud. Experian Link helps e-commerce merchants and additional retailers accurately assess transaction risk by answering a key question: Does this consumer own the credit card they presented for payment? This ensures that legitimate customers aren’t mistakenly turned away while suspicious transactions are properly flagged for further review. By adopting a multilayered identity and fraud prevention strategy, merchants can significantly reduce false declines, offer a frictionless checkout experience and maintain robust fraud defenses—all of which are essential for a successful holiday shopping season. Are there any examples of a retailer successfully leveraging credit card owner verification solutions? What were the results? JP: Yes. We recently partnered with a leading U.S. retailer with a significant online presence. Their primary goals were to reduce customer friction, increase conversion and identify their customers accurately. By leveraging Experian Link and its positive signals, the retailer could refine, test and optimize their auto-approval strategies. As a result, the retailer saw an additional $8 million in monthly revenue from transactions that would have otherwise been declined. They also achieved a 10% increase in auto-approvals, reducing operating expenses and customer friction. By streamlining backend processes, they delivered a more seamless shopping experience for their customers. Stay ahead this holiday season For more expert insights on boosting conversions and enhancing customer loyalty, watch our on-demand webinar, Friction-Free Festivities: Strategies to Maximize Conversion and Reduce False Declines, hosted by the Merchant Risk Council (MRC). Additionally, visit us online to learn more about how Experian Link can transform your business strategy. Watch on-demand webinar Visit us The webinar is available to MRC members. If you’re already a member, you can access this resource here. Not a member? Our team would be happy to schedule a demo on Experian Link and discuss strategies to help your business grow. Get in touch today.

Colorado has a great deal to offer first-time homebuyers (FTHBs). While the Denver area attracts many people with its combination of outdoor recreation, culture, and economic opportunities, other parts of Colorado are worthy of attention as well. Take Colorado Springs for example – it ranks third among best places to live in the U.S. when considering lifestyle, the job market, and overall popularity.1 Overview of the Colorado FTHB market Colorado accounts for 2.15% of all U.S. first-time homebuyers, according to Experian Housing’s recent first-time homebuyer report. This figure puts Colorado in the top 20 of all states across the country. Colorado's charm holds a special appeal for younger generations. Known for its wealth of enriching experiences, Colorado naturally attracts adventure-seekers. With an array of outdoor activities like hiking and skiing, it's no wonder that Generation Y and Generation Z make up 75% of all first-time homebuyers in the state, surpassing the national average of ~70%. Affordability With three-quarters of all FTHBs in the younger market segments, affordability is a key consideration in buying a home as housing costs are a significant part of an individual or family’s overall cost of living.2 What determines affordability? Affordability can be assessed through various metrics. For the purposes of this study, Experian Housing defined affordability by calculating the rent-to-mortgage ratio (RTM). This involves comparing monthly rent payments to monthly mortgage payments. A higher rent-to-mortgage ratio suggests renters may find mortgage payments more feasible, potentially making home buying a more appealing option. Comparison of rent costs to mortgage costs What we observed: Based on the RTM ratio, home buying is most affordable in Colorado Springs, Pueblo, and Castle Rock, while renting may look more attractive in Lakewood, Fort Collins, and Arvada. Additional measures to consider: Other realities play a key role in determining what is affordable. A prospective homebuyer’s income, monthly expenses, downpayment funds available, and the cost of the rent or mortgage payment as an added expense against income, factor heavily in final decision-making. In this regard, Experian Housing examined other metrics for assessing affordability. Debt-to-income What we observed: Down payments Sample of CO data observations: (High, mid, low down payments) Sale prices and income What we observed: Experian Housing examined the median sales prices and median incomes across the U.S. This metric is useful to see how much of one’s income typically is going to housing costs in a given area, which again, impacts overall cost of living. Comparison is essential because while sales prices may be higher in a given area, correlation with income helps determine affordability. A closer look at Colorado Springs Colorado Springs ranks #1 in affordability based on Experian’s research, and its status of best affordable place to live considering overall living costs, jobs, and livability is solid.4 The younger generation is the fastest growing population in Colorado Springs. Colorado Springs is expected to be the largest city in the state by 2050 given its current rate of growth and expansion.5 In addition to its five military installations, with a huge U.S. Air Force presence, key job sectors include the larger defense industry, education, technology, and manufacturing. Affordability coupled with opportunity and lifestyle suggest Colorado Springs deserves a closer look and area mortgage lenders have a lot to tout. Experian’s data system offers unique value to lenders given the ability to take a more comprehensive look at a borrower’s financial behavior. Experian uses credit, property, rental, and other alternative data sources to capture the borrower profile. Access to such data also gives Experian a unique ability to conduct research for reports like this one, and the recent reports on Texas and Florida. For more information about the lending possibilities for first-time homebuyers, download our white paper and visit us online. Download white paper Learn more 1 US News & World Report: Best Places to Live in the US 2024-2025 https://realestate.usnews.com/places/rankings/best-places-to-live 2 https://www.experian.com/blogs/insights/top-destinations-for-first-time-homebuyers/ 3 Arvada, Lakewood and Castle Rock, part of the Denver Metro Area and what is popularly known as the Front Range Urban Corridor, also have price to income ratios of 2.8%. 4 https://www.sofi.com/best-affordable-places-to-live-in-colorado/ 5 Colorado Springs Chamber & EDC, coloradospringschamberedc

This series will explore our monthly State of the Economy report, which provides a snapshot of the top monthly economic and credit data for financial service professionals to proactively shape their business strategies. During their September meeting, the Federal Reserve made a highly-anticipated announcement to cut rates for the first time since 2020. Fed officials cut rates by 50bps, while also penciling in an additional 50bps of cuts for 2024 and 100bps of cuts in 2025 in their Summary of Economic Projections. While rates are coming down and inflation continues to cool, there were downward revisions to job creation made in August and declining job openings in July. Data highlights from this month’s report include: The Federal Reserve announced a 50bps rate cut during the September meeting. Annual headline inflation cooled from 2.9% to 2.5%, getting closer to the Fed’s 2% goal. Mortgage originations increased 7.0% in August. Check out our report for a deep dive into the rest of this month’s data, including the latest trends in job creation, retail sales, and consumer sentiment. Download September's report As our economy continues to fluctuate, it's critical to stay updated on the latest developments. Subscribe to our new series, The Macro Moment, for economic commentary from Experian North America's Chief Economist, Joseph Mayans, and download our new Lending Conditions Chartbook for additional insights. For more economic trends and market insights, visit Experian Edge.

As a mortgage lender, understanding the intricacies of the New York housing market is crucial, especially when dealing with first-time homebuyers (FTHBs). While the housing market fluctuates nationwide, New York presents unique challenges and opportunities that require a nuanced approach. Distinguishing NYC from the rest of New York New York City's housing market, along with its suburbs, stands distinct from the rest of the state. With a high cost of living and unique lifestyle, NYC demands a tailored mortgage marketing strategy. This article will highlight key factors affecting affordability in New York, providing valuable insights for mortgage lenders working in this market. Overview of the New York FTHB market According to Experian Housing’s recent report on first-time homebuyers, the state of New York accounts for nearly 4.9% of all first-time homebuyers nationwide.1 More than half of first-time homebuyers are from Generation Y. When combined with Gen Z, these younger buyers make up just over 67% of the state's FTHBs, a figure slightly below the national average of 69%. Affordability metrics: The rent-to-mortgage ratio For many Americans, homeownership represents stability, security, and the future for family, community, and life. However, the decision to buy versus rent often hinges on affordability. Mortgage lenders must understand this dynamic to better assist their clients. Affordability can be defined in various ways. For the purposes of this study, Experian Housing defined affordability by comparing rental and mortgage payments, known as the rent-to-mortgage ratio (RTM ratio). A higher ratio indicates that buying a home is more economically attractive. Again, this metric does not consider incomes and debt levels, but simply housing rental prices and mortgage costs. Based solely on the RTM ratio, the transition from renting to homeownership may be more attractive in New York City, Syracuse, and Oyster Bay, while the transition may be more difficult in Cheektowaga, Amherst, and Hempstead. For mortgage lenders, understanding local markets and buyer profiles is essential. Building trust through personalized service, such as educating buyers on relevant loan programs and showcasing geographic expertise, can set you apart. With this knowledge, you can help buyers make informed decisions about affordability, whether they prefer living in the city or the suburbs. In some areas, the suburbs may offer more affordable options, while in others, the city center might be more cost-effective. Additional factors: Income, debt, and down payments Affordability extends beyond just rent and mortgage payments. Prospective homebuyers must consider their income, monthly expenses, and access to funds for a down payment. Mortgage lenders need to account for these factors when advising first-time homebuyers. Debt-to-income Average DTI across the 14 cities observed was 25.6%. The chart below highlights those at the higher and lower end of the spectrum. Down payments Down payments varied greatly, but the median across the cities observed was 16.5%. The chart below highlights an example at the high, mid, and low point. Sale prices and income Experian Housing analyzed median sales prices and incomes across the U.S., with New York serving as a prime example of the importance of this comparison in assessing affordability. This correlation is crucial; while sales prices may be high, understanding how they align with local incomes helps lenders accurately gauge market dynamics and guide buyers more effectively. In conclusion, having a deep understanding of the New York housing market is invaluable for mortgage lenders aiming to support first-time homebuyers. By leveraging insights into market dynamics, affordability metrics, and borrower profiles, lenders can offer tailored advice that meets the specific needs of their clients. This not only helps buyers navigate the complexities of homeownership but also builds lasting trust and loyalty. Equipped with these insights, you, as a lender, can play a pivotal role in making the dream of homeownership a reality for first-time buyers in New York. Let's continue to empower our clients with the knowledge and guidance they need to make informed and confident decisions in their homebuying journey. For more insights, check out our recent studies on the Florida and Texas markets and download our first-time homebuyer whitepaper. Download white paper Learn more

At Experian, we believe in fostering innovation and collaboration to solve complex challenges. Recently, Ivan Ahmed, one of our talented product management leaders at Experian Housing, had the opportunity to participate in the FHFA 2024 TechSprint, where his team won the award for the best Risk Management and Compliance idea. In this article, we share Ivan's experience as he reflects on the TechSprint, the inspiration behind his team's project, and the valuable lessons learned. Can you share your experience participating in the FHFA 2024 TechSprint? What was the atmosphere like, and how did it feel to be recognized for the best Risk Management and Compliance idea? Let me start by explaining what a TechSprint is. It is a fast-paced, high-energy collaborative workshop where diverse experts and stakeholders come together to design technological solutions to complex problems. Each team is given a high-level problem and use case. From there, stakeholders and domain experts must develop a proof of concept within 3 days to best address the problem. On the last and final day, called the “Demo Day,” teams must showcase their solution in front of a panel of judges. It’s a fun, high-energy, challenging, and rewarding experience. A TechSprint is a convergence of everything I love – technology, business, and design and I think FHFA did a wonderful job orchestrating the event. Each team consisted of representatives from different functions in the housing ecosystem, including lenders, technologists, product managers, and regulators. We were given access to a room, whiteboards, and, most importantly, delicious snacks. We were also given access to industry subject matter experts outside our teams, including representatives from Fannie Mae and Freddie Mac, FHFA, and leaders from top companies. What I found the most impactful was the ability to pressure test our ideas and solutions against these industry subject matter experts. Ideating in a vacuum can be challenging, so being able to stress test things rapidly with these experts allowed us to change course quickly as new information was introduced. Winning the best Risk Management and Compliance idea award was rewarding, especially as we were able to ideate a solution to such a critical accessibility issue. Ultimately, our goal was to help create a fairer, more equitable, and inclusive housing finance system. A big shoutout to my teammates, Wemimo Abbey, Joseph Karbowski, Will Regenauer, and Eddy Atkins. What inspired Team Arsenal to focus on identifying potential gaps in ADA compliance within multifamily buildings, and what were some of the key challenges your team faced during the process? My mother has suffered from several disabilities most of her life. With age, she has become more wheelchair-dependent, and traveling has become a major challenge. On a recent family trip, the entry to our hotel building wasn’t ADA-compliant, and I had to carry her up a flight of stairs. It was frustrating to deal with. I later went down a rabbit hole around ADA compliance and, much to my surprise, learned that only 0.15% of all homes in the U.S. are wheelchair accessible! As we explored the problem space further as a team, we learned how difficult it is to ensure that new and existing rental homes are ADA-compliant. We hypothesized that a solution is needed to establish incentives for borrowers, lenders, and GSEs to meet compliance. A technological solution could more easily enable multi-family lenders and builders to identify rental units that are non-ADA compliant and could provide ways to address the gaps. We noticed two primary challenges: an enforcement gap and an incentive gap. We learned that agency loans (Fannie Mae and Freddie Mac) account for most multi-family home loan originations. If we could tackle the enforcement challenge at the GSE level, we could set up the proper incentives for all players in the multi-family lending process. By providing tools to both the borrower and the GSE’s, we could help foster a more inclusive and accessible rental housing market. How do you envision your AI-driven solution impacting the rental housing market and improving ADA compliance for multifamily buildings? We wanted to ensure that we leveraged the true power of Generative AI, which meant that our solution could take multimodal inputs and produce multimodal outputs. For example, we could train the Generative AI model on photos of interior multi-family rental units and structured or unstructured text like building sketches, site layouts, and local building codes. We could then incorporate ADA design requirements and analyze discrepancies. The result would be a compliance report or tool outlining the adherence level to ADA design requirements and providing tips and recommendations on remediation. The solution could be delivered as a free tool by the GSEs, who could incentivize its usage by offering price concessions to borrowers. Developers could also use the tool to evaluate whether new or existing builds were ADA-compliant. How did your background and experience with Experian contribute to developing your team's winning idea at the FHFA TechSprint? Much of my role at Experian has involved exploring ways to leverage proprietary and public record property data for marketing, account review, and analytical use cases. I work very closely with property data at Experian, so I was very familiar with the types of input fields of property data that would be the most relevant to improving a generative AI model output. Specifically, in our use case, we wanted to train the model to better identify homes and features that were non-compliant with ADA and provide clear remediation steps. We knew that public record property information was available from various sources and could be leveraged as additional third-party input data to improve our model accuracy. What advice would you give to other teams or individuals looking to participate in future TechSprint events, especially those aiming to tackle complex issues like risk management and compliance? It’s important to remember that an ideal solution is both impactful and practical. Practicality is achieved when the solution has both business and technical viability. Therefore, it’s crucial to carefully vet problems and solutions by understanding their viability. Working as a team to solve the problem means leveraging the expertise of subject matter experts around you. Each team member should draw on their strengths, making the collective effort stronger than individual contribution. Most importantly, fairness, inclusivity, and accessibility matter. An effective solution should strive to have a positive social impact in addition to other considerations. Winning with purpose Ivan’s journey through the FHFA 2024 TechSprint exemplifies the innovative and collaborative spirit that drives our team at Experian. His reflections highlight the impact of well-designed technological solutions on critical issues like ADA-compliance in multifamily housing. We hope Ivan’s experience inspires others to explore their potential in solving complex problems and to participate in future TechSprints, where innovative thinking and a commitment to social good can lead to meaningful change.

Housing affordability is a pressing concern across the United States, and Florida is no exception. The affordability issue can be particularly crucial for renters looking to become first-time homebuyers (FTHBs). The desire to live in a sunny location must be measured against the cost of living, particularly housing costs. Experts at Experian Housing carefully examined data from the top 15 Florida cities (by population) to gain insights into the state of housing affordability in Florida.1 Experian examined factors such as mortgage payments, rent prices, income levels, and sales prices to assess affordability. Overview of the Florida FTHB market Experian Housing’s recent report on first-time homebuyers ranked Florida the state with the third highest percentage of FTHBs nationwide, at nearly 7.7% of FTHBs.2 It outranked New York, falling behind Texas and California. In Florida, the younger populations of Generation Y and Z account for 60% of all first-time homebuyers. Nationwide, roughly 70% of FTHBs belong to these populations. Among younger buyers, affordability is often the deciding factor in whether they continue to rent or become homeowners as they balance housing costs with student loan debt and other expenses. Let’s look at some key metrics Comparative monthly mortgage payments and rent prices How this affects affordability: The bottom line for prospective homebuyers often comes down to whether it's more affordable to continue to rent or purchase a home. While the metrics discussed all contribute to the picture of affordability, for this study, Experian Housing defined affordability by calculating the rent-to-mortgage ratio, a comparison of monthly rental payments to monthly mortgage payments. Homebuying becomes more attractive to renters when the rent-to-mortgage ratio is higher because mortgage payments are more economically practical. What we observed: Experian Housing found that Pembroke Pines, Palm Bay, and Cape Coral have the highest rent-to-mortgage ratio in Florida, at nearly 80%. In other words, for example, if the average mortgage payment is $1,000, the average rental payment is ~$800. Compare this to Tallahassee, Hialeah, and Hollywood, where the rent-to-mortgage ratio is <60%. These numbers illustrate the varying home purchase and rental market trends across the state. Debt-to-income How this affects affordability: This metric compares monthly debt responsibilities, including mortgages, car loans, student loans, and minimum credit card payments, to monthly income. A high debt-to-income ratio indicates a significant portion of income is dedicated to paying debt, leaving little room for other essential living costs and discretionary spending. What we observed: Down payments How this affects affordability: A higher down payment can also assist buyers, especially first-time buyers, by increasing attractive financing options. Importantly, a down payment of 20% avoids the need for private mortgage insurance (PMI), which is insurance for the lender, protecting the lender against loss should a foreclosure occur. PMI typically costs between 0.5% and 2% of the loan amount, annually. What we observed: Sale prices and financial hurdles How this affects affordability: In comparing home affordability across Florida, first-time homebuyers should consider home prices in relation to income. While other considerations, including an individual’s debt level and other expenses, contribute to the bottom line, this gives an indication of how much income will be consumed by the home purchase. What we observed: Experian Housing examined the median sales prices and median. Comparison is essential because sales prices may be higher in a given area, but correlation with income helps determine affordability. A Florida housing opportunity, up close: Miami metropolitan area The Miami metropolitan area is an example of an area where mortgage lenders who understand their clients and the area they seek to live may well attract first-time homebuyers, loyal clients, and more word-of-mouth business. The Miami suburb of Pembroke Pines, roughly 20 miles from Miami, offers a more affordable housing market. With Florida sunshine, nearby beaches, and access to three main highways, mortgage lenders whose knowledge base is not limited to the Miami city center may have an opportunity to turn a renter into a homeowner. Florida residents navigate the cost of living in the Sunshine State Analysis from Experian Housing highlights the diversity in housing markets and the opportunities to enhance financial well-being for residents in Florida. These insights are crucial for lenders to identify affordable opportunities for all residents. Experian’s data system offers unique value to lenders given the ability to take a more comprehensive look at a borrower’s financial behavior. Experian uses credit, property, rental, and other alternative data sources to capture the borrower profile. Access to such data also gives Experian a unique ability to conduct research for reports like this one and the recent Texas affordability study. For more information about the lending possibilities for first-time homebuyers, download our white paper and visit us online. Download white paper Learn more 1 The analysis is based on the trade and rental data reported to Experian and considered first-time homebuyers during the period between November 2022 and January 2024. 2 Based on those getting a mortgage.

This series will dive into our monthly State of the Economy report, providing a snapshot of the top monthly economic and credit data for those in financial services to proactively shape their business strategies. The labor market has been a source of strength for the U.S. economy coming out of the pandemic, providing workers with stable employment and solid wages. However, the labor market has slowed in recent months, with lower-than-expected job creation and rising unemployment, causing weakening sentiment in the broader market. This has resulted in increased pressure on the Federal Reserve to begin cutting rates and places more importance on the incoming data between now and the September FOMC meeting. Data highlights from this month’s report include: Job creation declined in July, falling short of economists’ expectations. Unemployment increased from 4.1% to 4.3%. Inflation cooled again in July, with annual headline inflation easing from 3.0% to 2.9%. GDP picked up in Q2 to 2.8%, primarily driven by strong consumer spending. Check out our report for a deep dive into the rest of this month’s data, including the latest trends in originations, retail sales, and the new housing market. Download August's report To have a holistic view of our current environment, it’s important to view the economy from different angles and through different lenses. Download our latest macroeconomic forecasting report for our views on what's to come in the U.S. economy and listen to our latest Econ to Action podcast. For more economic trends and market insights, visit Experian Edge.

Alternative lending is continuing to revolutionize the financial services landscape. From full-file public records to cash flow transactions, alternative credit data empowers financial institutions to make more informed lending decisions. This article focuses on cash flow insights and how they help financial institutions drive profitable and inclusive growth. Challenges with traditional credit underwriting Traditional underwriting often limits access to credit for marginalized communities, including young adults, immigrants, and those from low-income backgrounds. Because the process relies heavily on credit history and credit scores to determine an applicant’s ability to pay, those with less-than-ideal credit profiles could be overlooked. This then creates a cycle — those who are already disadvantaged face further barriers to accessing credit, limiting their abilities to invest in opportunities that can improve their financial situations, such as education or homeownership. Additionally, traditional underwriting models can be rigid. Consumers with stable incomes or significant assets may be denied credit if their financial profiles don’t fit the narrow criteria established by traditional models. As the financial landscape evolves, it’s important for lenders to adopt more inclusive and adaptive approaches to credit underwriting. What is cash flow underwriting? Cash flow underwriting is a modern approach to evaluating a borrower’s creditworthiness. It uses fresh, consumer-permissioned bank account transaction (balance, income and expense) data, giving lenders greater visibility into loan applicants’ financial situation. This process is made possible through open banking, an established, secure framework that enables consumers to quickly and easily share their bank account information with third-party financial service providers. READ: Learn more about the open banking landscape. Let’s look at a few quick examples: A prospective tenant is filling out a rental application. Instead of manually submitting paystubs to verify their income, open banking facilitates the digital sharing of full cash flow data in seconds, enabling property managers to quickly access the applicant’s full cash flow information. A consumer was previously denied credit due to insufficient credit history. With cash flow underwriting, the consumer is offered a second chance to qualify for the loan by including cash flow data in the lender’s decisioning model. The additional information gathered on the consumer’s ability to pay can transform the initial decline decision into an approval. Cash flow underwriting can also be used for credit line management. By assessing a borrower’s income and expense transactions, lenders can recommend optimal credit limits that cater to their spending potential while minimizing risk. Benefits of cash flow underwriting There are many benefits to integrating cash flow data into the credit underwriting process, including: Enhanced risk assessment. Going off credit scores and repayment behaviors alone won’t provide lenders with a complete or current picture of applicants. Through open banking, lenders can gain access to cash flow data in real-time, allowing them to more accurately assess consumers, increase approvals, and reduce credit risk. Inclusive lending. Millions of American adults are considered unscoreable, invisible, or subprime. However, 71% of consumers are willing to share their banking information if it could improve their chances of getting approved for credit.1 With deeper insights into consumers’ income and expenses, lenders can increase credit access in underserved communities. Improved customer experiences. Gaining a more comprehensive view of a consumer’s financial situation enables lenders to determine what loan products they’re eligible for and craft personalized options. READ: Learn more about the benefits of leveraging alternative data for credit underwriting. Get started Cash flow underwriting represents a significant step forward in the world of lending. It offers a more comprehensive approach to assessing creditworthiness, helping financial institutions drive growth and profitability. Cashflow Attributes are one of Experian's open banking solutions that provides lenders with consumer-permissioned insights into borrowers’ financial behaviors. With 940+ attributes derived from transaction data across 133 categories, financial institutions can make smarter, more inclusive lending decisions. Learn more about Cashflow Attributes Learn more about open banking 1Atomik Research survey of 2,005 U.S. adults online, matching national demographics, 2024.

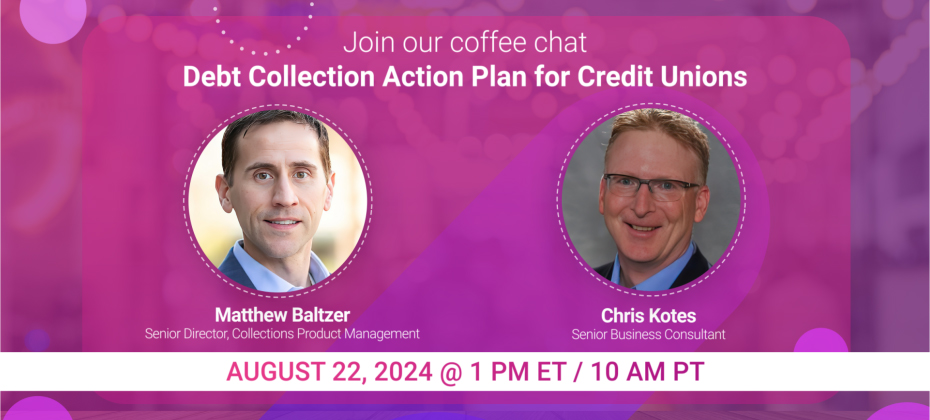

With the noticeable uptick in delinquencies, credit unions face more significant hurdles in effectively managing overdue accounts. In this challenging financial landscape, it’s imperative that you refine your account management processes to remain competitive, preserve the well-being of your members, assure operational efficiency, and increase profitability. Implementing efficient collection approaches not only improves loss rates but also helps with member retention, which is the backbone of your success. Grab a cup of coffee and join our experts on August 22 @ 1:00 p.m. ET/ 10:00 a.m. PT, for an engaging conversation on credit union collection trends and successful account management strategies. Highlights include: Current landscape: Gain valuable insight and understanding into the current debt collection environment for credit unions. Navigating challenges: Discover effective tips and strategies to tackle obstacles in your business, improve loss rates, and enhance member retention. Real-time Q&A: Participate in a live Q&A session where our experts will address your questions. Watch on-demand