Tech & Innovation

At Experian, we are continually innovating and using technology to find solutions to global issues, modernize the financial services industry and increase financial access for all.

Financial Empowerment

Our deep commitment to social and financial inclusion is reflected in our workplace culture, our partnerships and our efforts to break down the barriers to financial equity.

Financial Health

Our initiatives are dedicated to getting tools, resources and information to underserved communities so that consumers can best understand and improve their financial health.

Latest Posts:

Experian®, the leading global information services company, today announced that it has joined forces with Moody’s Analytics to create a business index and detailed report that provides insight into the health of U.S. businesses.

Experian®, the leading global information services company, today announced that it has joined forces with Moody’s Analytics to create a business index and detailed report that provides insight into the health of U.S. businesses.

Secure and convenient online access to your Social Security earnings and benefit information is available due in part to fraud prevention services that help the U.S. Social Security Administration (SSA).

The SSA uses Experian fraud prevention services to securely authenticate and safeguard the identities of consumers who now have online access to their Social Security earnings and benefit information through the SSA’s new online Social Security Statement.

Secure and convenient online access to your Social Security earnings and benefit information is available due in part to fraud prevention services that help the U.S. Social Security Administration (SSA).

The SSA uses Experian fraud prevention services to securely authenticate and safeguard the identities of consumers who now have online access to their Social Security earnings and benefit information through the SSA’s new online Social Security Statement.

Recently there has been one area of Consumer Financial Protection Bureau (CFPB) reform that has gained support from Republicans and Democrats in Congress, as well as the CFPB Director himself: ensuring the confidentiality of privileged information that financial institutions provide to the bureau.

Recently there has been one area of Consumer Financial Protection Bureau (CFPB) reform that has gained support from Republicans and Democrats in Congress, as well as the CFPB Director himself: ensuring the confidentiality of privileged information that financial institutions provide to the bureau.

We recently announced the availability of PowerCurve, the new decision management software portfolio, which helps organisations manage and grow their portfolios by improving the way they use information to make customer decisions. PowerCurve builds on more than 30 years of experience that Experian has providing organizations across the globe with expert decisioning tools. It is equipped with some of the most advanced decision analytics capabilities in the market today.

For those of you who did not attend Experian’s Vision Conference this week, you may have missed an opportunity to learn how to drive profitable growth by leveraging the PowerCurve software to make accurate, analytics-based decisions quickly, efficiently and repeatedly to acquire, manage and grow your customer relationships. However, it’s not too late for you to catch up.

For those of you who did not attend Experian’s Vision Conference this week, you may have missed an opportunity to learn how to drive profitable growth by leveraging the PowerCurve software to make accurate, analytics-based decisions quickly, efficiently and repeatedly to acquire, manage and grow your customer relationships. However, it’s not too late for you to catch up.

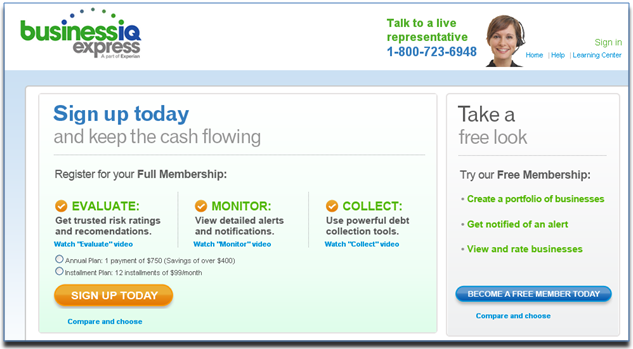

Earlier this week, Experian launched BusinessIQ Express, a new online tool designed to help small businesses improve cash flow by helping them make more informed decisions about their business relationships. Learn how this new tool can help small businesses.

Earlier this week, Experian launched BusinessIQ Express, a new online tool designed to help small businesses improve cash flow by helping them make more informed decisions about their business relationships. Learn how this new tool can help small businesses.

On March 26th, the Federal Trade Commission (FTC) released its highly anticipated final reports on consumer privacy, entitled “Protecting Consumer Privacy in an Era of Rapid Change.”

In their final report, the Commission applauded industry’s efforts towards strengthening industry self-regulations—including the Digital Advertising Alliance’s Self Regulatory Program for Online Behavioral Advertising—but called on industry to do more to protect consumer privacy.

On March 26th, the Federal Trade Commission (FTC) released its highly anticipated final reports on consumer privacy, entitled “Protecting Consumer Privacy in an Era of Rapid Change.”

In their final report, the Commission applauded industry’s efforts towards strengthening industry self-regulations—including the Digital Advertising Alliance’s Self Regulatory Program for Online Behavioral Advertising—but called on industry to do more to protect consumer privacy.

On the final day of Vision 2012, we talk with Michele Raneri, vice president, analytics, to analyze one of the industry’s most pressing issues: financial stress of the American consumer. We also get some key takeaways from Vision 2012 from Kerry Williams, Experian group president.

This Experian TV episode kicks off with a review of some of the key priorities of the CFPB and looks at some of the programs it is planning to develop. We also sit down with Keir Breitenfeld, senior director, fraud and identity solutions, to discuss fraud detection, and we go one-on-one with Amy Hysell from Arizona Federal Credit Union to look at how a troubled portfolio can be turned around using Experian tools.

We’ve all seen news clip of a tornado that twisted down a street, destroyed one house, missed the next two then demolished another block or two of people’s lives. Credit card fraud is equally indiscriminate.

We’ve all seen news clip of a tornado that twisted down a street, destroyed one house, missed the next two then demolished another block or two of people’s lives. Credit card fraud is equally indiscriminate.

As more Americans emerge from the economic depths of the recession, they’re reminded by one significant fact: not all consumers reduced their debt burdens during 2011. Super-prime VantageScore® consumers — those with scores of 901 to 990 — actually increased debt by $100 billion from Q4 of 2010, notably in new mortgage, bankcard and auto debt.

As more Americans emerge from the economic depths of the recession, they’re reminded by one significant fact: not all consumers reduced their debt burdens during 2011. Super-prime VantageScore® consumers — those with scores of 901 to 990 — actually increased debt by $100 billion from Q4 of 2010, notably in new mortgage, bankcard and auto debt.

To gear up for the second full day of Vision 2012, we chat with Kerry Williams, Experian group president, to discuss how clients can achieve growth using three key strategies. Check out the video to see his recommendations.