Tag: fraud prevention

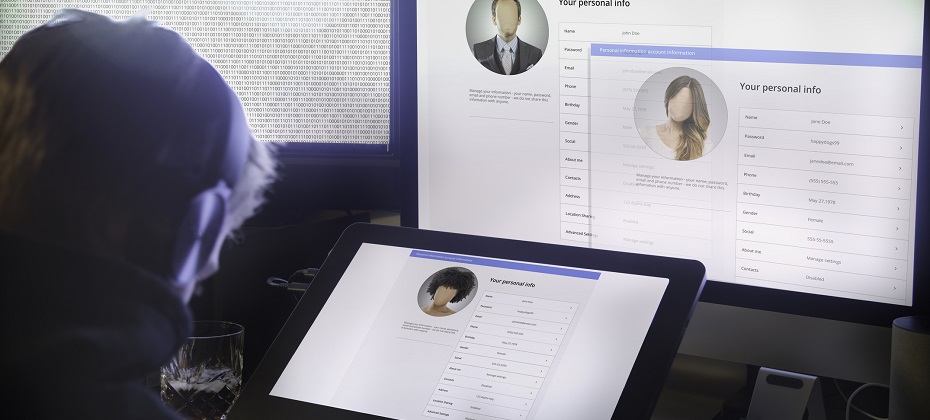

The COVID-19 pandemic and resulting rush to transition to a remote lifestyle made it clear that many businesses need a refreshed digital authentication and fraud prevention strategy that includes an investment in technology and provides consumer assurance. This is particularly important when it comes to identity, as many of the standard in-person verification methods and tools are currently unavailable. The meaning of identity is growing and shifting Technology trends are intersecting with social trends to create heightened awareness, and a whole new public conversation has emerged around customer trust and privacy. Attitudes and ideas are changing—even to the point of what we mean by “identity.” An identity is no longer just a name, date of birth, and SSN. Now, there are digital manifestations everywhere you look: screen names, email addresses, mobile phone numbers, device identifiers, and the other “exhaust” we leave behind as we travel the internet. This leads to concerns about what an identity is, who owns it, and who manages and protects it. Businesses have to be able to prove to their ability to protect their customers’ identities through investment in technology and a robust fraud strategy. Consumer attitudes are changing Several years ago, consumers were excited by all the new digital capabilities and the speed, ease, and convenience they provided. Last year, Experian found that consumers still wanted those things, with 70% willing to provide more information to businesses if there was a perceived benefit. However, they also wanted more security in the balance. In Experian’s most recent Global Identity and Fraud Report, we found that 74% of consumers say that security is the most important factor when deciding to engage with a business. Consumers are particularly more tolerant of friction during the enrollment process—as a means of building trust. But, when they return to the app or website, they want to be recognized. This means achieving a balance by using layered technologies, some of which are active and visible to the consumer, and some of which are invisibly working in the background to confirm the identity of returning consumers. Consumer attitudes vs. regulatory pressure The drivers behind the business changes are twofold: shifting consumer attitudes and regulatory changes. While regulations are becoming stricter on a national and global level, they’re not keeping pace with technology and social change. The digital world is evolving at a rapid pace, opening up more new ways for companies to collect information about consumers and use it to identify and verify, and also to target goods and services. With all of this data available, it’s important for businesses to use the tools in the market to help protect identity information. Next steps in technology The bottom line is, businesses can’t wait for regulations to dictate how best to protect information. Instead, they should be looking to technologies like physical and behavioral biometrics to help provide identity authentication and protection – layering those solutions with information from the user and from third parties to give a holistic consumer view. Businesses should adopt a platform approach for identity and fraud in order to be able to adapt quickly, whether to incorporate new kinds of technology or to prevent emerging types of fraud. By investing in technology now, even in the midst of the COVID-19 pandemic, businesses can build the flexibility needed to respond to future crises and help offset future fraud losses. In turn, those fraud-loss savings can then be used to help grow the business in the future. Learn more about Experian’s commitment to helping businesses maximize their investment in technology to safeguard against fraud. Learn more

For the last several years, as the global economy flourished, the opportunities created by removing friction and driving growth guided business strategies governing identity and fraud. The amount of profitable business available in a low-friction environment simply outweighed the fraud that could be mitigated with more stringent verification methods. Now that we’re facing a global crisis, it’s time to reconsider the approach that drove the economic boom that defined that last decade. Recognizing how economic changes impact fraud At the highest level, we separate fraud into two types; third party fraud and first party fraud. In simple terms, third party fraud involves the misuse of a real customer’s identity or unauthorized access to a real customer’s accounts or assets. First party fraud involves the use of an identity that the fraudster controls—whether it’s their own identity, a manipulated version of their own identity, or a synthetic identity that they have created. The important difference in this case is that the methods of finding and stopping third party fraud remain constant even in the event of an economic downturn – establish contact with the owner of the identity and verify whether the events are legitimate. Fraud tactics will evolve, and volumes increase as perpetrators also face pressure to generate income, but at the end of the day, a real person is being impersonated, and a victim exists that will confirm when fraud is taking place. Changes in first party fraud during an economic downturn are dramatically different and much more problematic. The baseline level of first party fraud using synthetic, manipulated and the perpetrator’s own identity continue, but they are augmented by real people facing desperate circumstances and existing “good” customers who over-extend while awaiting a turn-around. The problem is that there is no “victim” to confirm fraud is occurring, and the line between fraud (which implies intent) and credit default (which does not) becomes very difficult to navigate. With limited resources and pressures of their own, at some point lenders must try to distinguish deliberate theft from good customers facing bad circumstances and manage cases accordingly. The new strategy When times are good, it’s easier to build up a solid book of business with good customers. Employment rates are high, incomes are stable, and the risks are manageable. Now, we’re experiencing rapidly changing conditions, entire industries are disrupted, unemployment claims have skyrocketed and customers will need assistance and support from their lenders to help them weather the storm. This is a reciprocal relationship – it behooves those same lenders to help their customers get through to the other side. Lenders will look to limit losses and strengthen relationships. At the same time, they’ll need to reassess their existing fraud and identity strategies (among others) as every interaction with a customer takes on new meaning. Unexpected losses We’ve all been bracing for a recession for a while. But no one expected it to show up quite like it did. Consumers who have been model customers are suddenly faced with a complete shift in their daily life. A job that seemed secure may be less so, investments are less lucrative in the short term, and small business owners are feeling the pressure of a change in day-to-day commerce. All of this can lead to unexpected losses from formerly low-risk customers. As this occurs, it becomes more critical than ever to identify and help good customers facing grim circumstances and find different ways to handle those that have malicious intent. Shifting priorities When the economy was strong, many businesses were able to accept higher losses because those losses were offset by immense growth. Unfortunately, the current crisis means that some of those policies could have unforeseen consequences. For instance – the loss of the ability to differentiate between a good customer who has fallen on hard times and someone who’s been a bad actor from the start. Additionally, businesses need to revise their risk management strategies to align with shifting customer needs. The demand for emergency loans and will likely rise, while loans for new purchases like cars and homes will fall as consumers look to keep their finances secure. As the need to assist customers in distress rises and internal resources are stressed, it’s critical that companies have the right tools in place to triage and help customers who are truly in need. The good news The tools businesses like yours need to screen first party fraud already exist. In fact, you may already have the necessary framework in place thanks to an existing partnership, and a relatively simple process could prepare your business to properly screen both new and existing customers at every touchpoint. This global crisis is nowhere near over, but with the right tools, your business can protect itself and your customers from increased fraud risks and losses of all sorts – first party, stolen identities, or synthetic identities, and come out on the other side even stronger. Contact Experian for a review of your current fraud strategy to help ensure you’re prepared to face upcoming challenges. Contact us

Experian’s 7th Annual Data Breach Preparedness Study is available now, and its findings show organizations struggling in a few areas that are sure to see data breach activity increase this year. New to report this year: we surveyed IT and IT security, compliance, and privacy professionals in both the U.S. and the EMEA to compare the regional differences amongst organizations and their outlook around data breach preparedness. A few themes that stuck out in the study this year were: Spear Phishing and Ransomware 69% of respondents had one or more spear phishing attacks in 2019 Since 2017, respondents who say their organizations are very confident or confident in their ability to deal with spear phishing attacks has declined from 31% to 23% 36% of respondents say their organizations had a ransomware attack last year with only 20% feeling confident in their ability to deal with it The average ransom was $6,128, and 68% of respondents say the ransom was paid Confidence in Data Breach Response Plans From a reputation standpoint, only 23% of respondents say their organization is confident in its ability to minimize the financial and reputational consequences of a material data breach Only 38% of respondents believe they are effective at doing what needs to be done following a data breach to prevent the loss of customers’ and business partners’ trust and confidence Global Data Breaches Only 34% of respondents say they are confident their organizations are able to respond to global breaches, as breaches increasingly become international in scope Read the full results of Experian's 7th Annual Data Breach Preparedness Study and see how you compare to other organizations when it comes to data breach preparedness. Download the full study

Last month, Kenneth Blanco, Director of the Financial Crimes Enforcement Network, warned that cybercriminals are stealing data from fintech platforms to create synthetic identities and commit fraud. These actions, in turn, are alleged to be responsible for exploiting fintech platforms’ integration with other financial institutions, putting banks and consumers at risk. According to Blanco, “by using stolen data to create fraudulent accounts on fintech platforms, cybercriminals can exploit the platforms’ integration with various financial services to initiate seemingly legitimate financial activity while creating a degree of separation from traditional fraud detection efforts.” Fintech executives were quick to respond, and while agreeing that synthetic IDs are a problem, they pushed back on the notion that cybercriminals specifically target fintech platforms. Innovation and technology have indeed opened new doors of possibility for financial institutions, however, the question remains as to whether it has also created an opportunity for criminals to implement more sophisticated fraud strategies. Currently, there appears to be little evidence pointing to an acute vulnerability of fintech firms, but one thing can be said for certain: synthetic ID fraud is the fastest-growing financial crime in the United States. Perhaps, in part, because it can be difficult to detect. Synthetic ID is a type of fraud carried out by criminals that have created fictitious identities. Truly savvy fraudsters can make these identities nearly indistinguishable from real ones. According to Kathleen Peters, Experian’s SVP, Head of Fraud and Identity, it typically takes fraudsters 12 to 18 months to create and nurture a synthetic identity before it’s ready to “bust out” – the act of building a credit history with the intent of maxing out all available credit and eventually disappearing. These types of fraud attacks are concerning to any company’s bottom line. Experian’s 2019 Global Fraud and Identity Report further details the financial impact of fraud, noting that 55% of businesses globally reported an increase in fraud-related losses over the past 12 months. Given the significant risk factor, organizations across the board need to make meaningful investments in fraud prevention strategies. In many circumstances, the pace of fraud is so fast that by the time organizations implement solutions, the shelf life may already be old. To stay ahead of fraudsters, companies must be proactive about future-proofing their fraud strategies and toolkits. And the advantage that many fintech companies have is their aptitude for being nimble and propensity for early adoption. Experian can help too. Our Synthetic Fraud Risk Level Indicator helps both fintechs and traditional financial institutions in identifying applicants likely to be associated with a synthetic identity based on a complex set of relationships and account conditions over time. This indicator is now available in our credit report, allowing organizations to reduce exposure to identity fraud through early detection. To learn more about Experian’s Synthetic Fraud Risk Level Indicator click here, or visit experian.com/fintech.

What do movie actors Adam Sandler and Hugh Grant, jazz singer Michael Bublé, Russian literary giant Leo Tolstoy, and Colonel Sanders, the founder of KFC, have in common? Hint, it’s not a Nobel Prize for Literature, a Golden Globe, a Grammy Award, a trademark goatee, or a “finger-lickin’ good” bucket of chicken. Instead, they were all born on September 9, the most common birth date in the U.S. Baby Boom According to real birth data compiled from 20 years of American births, September is the most popular month to give birth to a child in America – and December, the most popular time to make one. With nine of the top 10 days to give birth falling between September 9 and September 20, one may wonder why the birth month is so common. Here are some theories: Those who get to choose their child’s birthday due to induced and elective births tend to stay away from the hospital during understaffed holiday periods and may plan their birth date around the start of the school year. Several of the most common birth dates in September correspond with average conception periods around the holidays, where couples likely have more time to spend together. Some studies within the scientific community suggest that our bodies may actually be biologically disposed to winter conceptions. While you may not be feeling that special if you were born in September, the actual differences in birth numbers between common and less common birthdays are often within just a few thousand babies. For example, September 10, the fifth most common birthday of the year, has an average birth rate of 12,143 babies. Meanwhile, April 20, the 328th most common birthday, has an average birth rate of 10,714 newborns. Surprisingly, the least common birthdays fall on Christmas Eve, Christmas Day and New Year’s Day, with Thanksgiving and Independence Day also ranking low on the list. Time to Celebrate – but Watch out! Statistically, there’s a pretty good chance that someone reading this article will soon be celebrating their birthday. And while you should be getting ready to party, you should also be on the lookout for fraudsters attempting to ruin your big day. It’s a well-known fact that cybercriminals can use your birth date as a piece of the puzzle to capture your identity and commit identity theft – which becomes a lot easier when it’s being advertised all over social media. It’s also important for employers to safeguard their organization from fraudsters who may use this information to break into corporate accounts. While sharing your birthday with a lot of people could be a good or bad thing depending on how much undivided attention you enjoy – you’re in great company! Not only can you plan a joint party with Michelle Williams, Afrojack, Cam from Modern Family, four people I went to high school with on Facebook and a handful of YouTube stars that I’m too old to know anything about, but there will be more people ringing in your birthday than any other day of the year! And that’s pretty cool.

Friend or foe? Sophisticated criminals put a great deal of effort into creating convincing, verifiable personas (AKA synthetic identities). Once the fictional customer has embedded itself in your business, everything from the acquisition of financial instruments to healthcare benefits, utility services, and tax filings and refunds become vulnerable to synthetic identity fraud. Information attached to synthetic IDs can run several levels deep and be so complete that it includes public record data, credit information, documentary evidence and social media profiles that may even contain photo sets and historical details intended to deceive—all complicating your efforts to identify these fake customers before you do business with them. See real-world examples of how synthetic identity fraud is souring various markets – from auto and healthcare to financial services and public sector – in our tip sheet, Four common synthetic scenarios. Stopping synthetic ID fraud — at the door and thereafter. There are efforts underway in the market to collectively improve your ability to identify, shut down and prevent synthetic identities from entering your portfolio. This overall trend is great news for the future, but there are also near-term solutions you can apply to protect your business starting now. While it’s important to identify synthetic identities when they knock on your door, it’s just as important to conduct regular portfolio checkups to prevent negative impacts to your collections efforts. Every circumstance has its own unique parameters, but the overarching steps necessary to mitigate fraud from synthetic IDs remain the same: Identify current and near-term exposure using targeted segmentation analysis. Apply technology that alerts you when identity data doesn’t add up. Differentiate fraudulent identities from those simply based on bad data. Review front- and back-end screening procedures until they satisfy best practices. Achieve a “single view of the customer” for all account holders across access channels—online, mobile, call center and face-to-face. The right tools for the job. In addition to the steps mentioned above, stopping these fake customers from entering and then stealing from your organization isn’t easy—but with the right tools and strategies, it is possible. Here are a few of our top recommendations: Forensics Isolate and segment identities based on signals received during early account pathing, from both individuals and their device. For example, even sophisticated fraud networks can’t mimic natural per-device user interaction because these organizations work with hundreds or thousands of synthetic identities using just a few devices. It’s highly unlikely that multiple geographically separate account holders would share the same physical device. High-risk fraud scores Not all synthetic identity fraud manifests the same way. Using sophisticated logic and unique combinations of data, a high-risk fraud score looks at a consumer’s credit behavior and credit relationships over time to uncover previously undetectable risk. These scores are especially successful in detecting identities that are products of synthetic identity farms. And by targeting a specific data set and relationships, you can maintain a frictionless customer experience and reduce false positives. Analytics Use a solution that develops models of bad applicant behavior, then compares and scores your portfolio against these models. There isn’t a single rule for detecting fraudulent identities, but you can develop an informed set of rules and targeted models with the right service partner. Cross-referencing models designed to isolate high-risk identity theft cases, first-party or true-name fraud schemes, and synthetic identities can be accomplished in a decisioning strategy or via a custom model that incorporates the aggregate scores and attributes holistically. Synthetic identity detection rules These specialized rules consist of numerous conditions that evaluate a broad selection of consumer behaviors. When they occur in specific combinations, these behaviors indicate synthetic identity fraud. This broad-based approach provides a comprehensive evaluation of an identity to more effectively determine if it’s fabricated. It also helps reduce the incidence of inaccurately associating a real identity with a fictitious one, providing a better customer experience. Work streams Address synthetic identities confidently by applying analytics to work streams throughout the customer life cycle: Credit risk assessment Know Your Customer/Customer Identification Program checks Risk-based identity proofing and authentication Existing account management Manual reviews, investigations and charge-offs/collections activities Learn more about these tools and others that can help you mitigate synthetic identities in our white paper, Synthetic identities: getting real with customers. If your organization is like most, detecting SIDs hasn't been your top priority. So, there's no time to waste in preventing them from entering your portfolio. Criminals are highly motivated to innovate their approaches as rapidly as possible, and it’s important to implement a solution that addresses the continued rise of synthetic IDs from multiple engagement points. With the right set of analytics and decisioning tools, you can reduce exposure to fraud and losses stemming from synthetic identity attacks from the beginning and across the customer life cycle. We can help you detect and mitigate these fake customers before they become delinquent. Learn more

For most businesses, building the best online experience for consumers requires a balance between security and convenience. But the challenge has always been finding a happy medium between the two – offering enough security that won’t get in the way of convenience and vice versa. In the past, it was always believed that one would always come at the expense of the other. But technology and innovation is changing how businesses approach security and is allowing them to give the maximum potential of both. Consumers want security AND convenience Consumers consider security and convenience as the foundation of their online experience. Findings from our 2019 Global Identity and Fraud Report revealed approximately 74 percent of consumers ranked security as the most important part of their online experience, followed by convenience. In other words, they expect businesses to provide them with both. We see this with how consumers are typically using the same security information each time they open a new digital account – out of convenience. But if one account is compromised, the consumer becomes vulnerable to possible fraudulent activity. With today’s technology, businesses can give consumers an easier and more secure way to access their digital accounts. Creating the optimal online experience More security usually meant creating more passwords, answering more security questions, completing CAPTCHA tests, etc. While consumers are willing to work through these friction-inducing methods to complete a transaction or access an account, it’s not always the most convenient process. Advanced data and technology has opened doors for new authentication methods, such as physical and behavioral biometrics, digital tokenization, device intelligence and machine learning, to maximize the potential for businesses to provide the best online experience possible. In fact, consumers have expressed greater confidence in businesses that implement these advanced security methods. Rates of consumer confidence in passwords was only 44 percent, compared to a 74 percent rate of consumer confidence in physical biometrics. Consumers are willing to embrace the latest security technology because it provides the security and convenience they want from businesses. While traditional forms of security were sufficient, advanced authentication methods have proven to be more reliable forms of security that consumers trust and can improve their online experience. The optimal online experience is a balance between security and convenience. Innovative technologies and data are helping businesses protect people’s identities and provide consumers with an improved online experience.

Any responsible business manager knows that protection business and client data is a vital part of running a success organization. Now a new report identifies key factors that can improve a company’s ability to avoid hacks and prevent data breaches. And here’s the good news: These tactics really work. During 2018, the number of personal records exposed in data breaches soared — a total of 446.5 million pieces of data – an increase that was more than double the number of records breached during 2017, according to the Identity Theft Resource Center. The business, healthcare and financial sectors were the top three sectors hit, with hacking being the most common form of attack. But among the companies surveyed in the latest annual study sponsored by Experian Data Breach Resolution, there are important signs of hope. Despite the startling increase in the number of records stolen by data thieves – a gain of 126 percent – the number of survey participants reporting a breach increased by just 5 percent. This trend demonstrates that while hackers might be grabbing more data when they do manage to crack a database, the smaller increase in total breaches reported in the survey indicate that a growing number of institutions are improving their abilities to fend off cybercriminals. What’s their secret? To encourage more effective strategies to handle and prevent breaches, “Is Your Company Ready for a Big Data Breach?” uncovers several important lessons learned from companies that are successfully insulating themselves – and their customers – from data theft. Prevention is the best response: The overarching lesson that researches found is that an effective data breach response plan starts with preventing breaches in the first place, rather than reacting after customer and business data has been stolen. Of the 643 U.S. business people surveyed who work on privacy, compliance and IT security, 29 percent reported that their organizations had prevented any breach involving more than 1,000 records for the past two years. Rate your plan: The Ponemon researchers found that the percentage of companies that find their data breach response plans to be very effective increased from 42 percent in 2016 to 52 percent in 2018. Not surprisingly, more people at organizations that didn’t report a breach rated their response plans as effective – 62 percent – while 45 percent of those at companies that suffered data theft nonetheless felt their plans were effective. Money matters: Ponemon researchers found that more investment in cybersecurity technology seemed to pay off. One of the most common factors among companies that prevented breaches was increased spending on technology to detect and prevent attacks. Of companies that prevented breaches, 73 percent increased their tech spending, versus 61 percent of those companies that were breached. No train, no gain: An even bigger improvement came from training employees and making them aware of privacy and data protection issues and practices. The likelihood of a data breach was significantly reduced when awareness training specifically targeted employees and other stakeholders in business processes who work with or access sensitive or confidential personal data. At organizations that implemented training, 79 percent avoided a breach versus 69 percent of those that were hacked. Cybersafety starts at the top: Executive engagement also matters. Making data security a priority among C-suite executives and corporate board members translates into keeping records safer. The study found that 54 percent of executives and 39 percent of directors were knowledgeable and engaged in planning data breach responses. At companies that were breached, 49 percent of executives and 32 percent of board members were involved with cybersecurity response. Sharing is caring: Another key finding in preventing breaches is that organizations that sharing their insights and experiences in handling and preventing breaches improved their cybersafety. Operations that participated in learning about data protection and hacks from industry peers and government agencies were more likely to avoid a breach – 59 percent of those who joined sharing programs didn’t suffer an attack, while 46 percent of those participating experienced a breach. Cybersafety is a process: Finally, organizations that want to stay cyber-safe might want to adopt the Boy Scout motto, “Be Prepared.” Companies that successfully prevented a data breach took several preventive measures to guard against attacks. That includes conducting regular reviews of physical security and access to confidential information, instituting third-party cybersecurity assessments, making data breach response part of their business continuity plans and creating backup websites that can be activated to provide content and information should a breach occur. For the study, Ponemon researchers surveyed 643 professionals working in information technology and security, compliance and privacy who deal with data breach response plans in their organizations. The entire comprehensive survey of cybersecurity practices – “Sixth Annual Study: Is Your Company Ready for a Big Data Breach?” – is available to download now. The Ponemon Institute, headquartered in Traverse City, Michigan, conducts independent research on data protection and emerging information technologies. Experian Data Breach Resolution helps businesses of all sizes manage the risk of fines, customer loss, negative press and litigation due to a breach of data, and is a subsidiary of Experian, the global leader in consumer and business credit reporting and marketing service operating in 80 countries. Download the Ponemon study Learn more about our Data Breach solutions

How can fintech companies ensure they’re one step ahead of fraudsters? Kathleen Peters discusses how fintechs can prepare for success in fraud prevention.

As our society becomes ever more dependent on everything mobile, criminals are continually searching for and exploiting weaknesses in the digital ecosystem, causing significant harm to consumers, businesses and the economy. In fact, according to our 2018 Global Fraud & Identity Report, 72 percent of business executives are more concerned than ever about the impact of fraud. Yet, despite the awareness and concern, 54 percent of businesses are only “somewhat confident” in their ability to detect fraud. That needs to change, and it needs to change right away. Our industry has thrived by providing products and services that root out bad transactions and detect fraud with minimal consumer friction. We continue to innovate new ways to authenticate consumers, apply new cloud technologies, machine learning, self-service portals and biometrics. Yet, the fraud issue still exists. It hasn’t gone away. How do we provide effective means to prevent fraud without inconveniencing everyone in the process? That’s the conundrum. Unfortunately, a silver bullet doesn’t exist. As much as we would like to build a system that can detect all fraud, eliminate all consumer friction, we can’t. We’re not there yet. As long as money has changed hands, as long as there are opportunities to steal, criminals will find the weak points – the soft spots. That said, we are making significant progress. Advances in technology and innovation help us bring new solutions to market more quickly, with more predictive power than ever, and the ability to help clients to turn these services on in days and weeks. So, what is Experian doing? We’ve been in the business of fraud detection and identity verification for more than 30 years. We’ve seen fraud patterns evolve over time, and our product portfolio evolves in lock-step to counter the newest fraud vectors. Synthetic identity fraud, loan stacking, counterfeit, identity theft; the specific fraud attacks may change but our solution stack counters each of those threats. We are on a continuous innovation path, and we need to be. Our consumer and small business databases are unmatched in the industry for quality and coverage, and that is an invaluable asset in the fight against fraud. It used to be that knowing something about a person was the same as authenticating that same person. That’s just not the case today. But, just because I may not be the only person who knows where I live, doesn’t mean that identity information is obsolete. It is incredibly valuable, just in different ways today. And that’s where our scientists come into their own, providing complex predictive solutions that utilize a plethora of data and insight to create the ultimate in predictive performance. We go beyond traditional fraud detection methods, such as knowledge-based authentication, to offer a custom mix of passive and active authentication solutions that improve security and the customer experience. You want the latest deep learning techniques? We have them. You want custom models scored in milliseconds alongside your existing data requests. We can do that. You want a mix of cloud deployment, dedicated hosted services and on-premise? We can do that too. We have more than 20 partners across the globe, creating the most comprehensive identity management network anywhere. We also have teams of experts across the world with the know how to combine Experian and partner expertise to craft a bespoke solution that is unrivaled in detection performance. The results speak for themselves: Experian analyzes more than a billion credit applications per year for fraud and identity, and we’ve helped our clients save more than $2 billion in annual fraud losses globally. CrossCore™, our fraud prevention and identity management platform, leverages the full breadth of Experian data as well as the data assets of our partners. We execute machine learning models on every decision to help improve the accuracy and speed with which decisions are made. We’ve seen CrossCore machine learning result in a more than 40 percent improvement in fraud detection compared to rules-based systems. Our certified partner community for CrossCore includes only the most reputable leaders in the fraud industry. We also understand the need to expand our data to cover those who may not be credit active. We have the largest and most unique sets of alternative credit data among the credit bureaus, that includes our Clarity Services and RentBureau divisions. This rich data helps our clients verify an individual’s identity, even if they have a thin credit file. The data also helps us determine a credit applicant’s ability to pay, so that consumers are empowered to pursue the opportunities that are right for them. And in the background, our models are constantly checking for signs of fraud, so that consumers and clients feel protected. Fraud prevention and identity management are built upon a foundation of trust, innovation and keeping the consumer at the heart of every decision. This is where I’m proud to say that Experian stands apart. We realize that criminals will continue to look for new ways to commit fraud, and we are continually striving to stay one step ahead of them. Through our unparalleled scale of data, partnerships and commitment to innovation, we will help businesses become more confident in their ability to recognize good people and transactions, provide great experiences, and protect against fraud.

Keeping your customers happy is critical to success. And while reducing fraud is imperative, it shouldn’t detract from a positive customer experience. Here are 3 fraud detection and prevention strategies that can help you reduce fraud and protect (and retain) customers. Use customer-centric strategies — Recognizing legitimate customers online is more important than ever, particularly since the web’s built-in anonymity makes it a breeding ground for scammers and fraudsters. Balance fraud prevention and the customer experience — When implementing security protocols, consider consumers’ fluctuating and potentially diminishing tolerance levels for security protocols. Embrace new fraud protection technologies — Multilayered approaches should include data-driven, artificial intelligence–powered systems that will recognize customers while keeping their transactions stress-free. Fraud prevention shouldn’t discourage honest customers from buying, but it should instill confidence and strengthen the customer relationship. Learn more>

Believe it or not, 66% of consumers want to see some visible signs of security and barriers when accessing their accounts so they can be sure that a transaction is more secure. Other takeaways from our 2018 Global Fraud and Identity Report: Nearly 3/4 of surveyed businesses cite fraud as growing over the past 12 months. 30% of surveyed businesses are experiencing more fraud losses year-over-year. While 83% of businesses believe that their fraud solutions are scalable, cost is the biggest obstacle to adopting new tactics. There’s a delicate balance in delivering a digital experience that instills confidence while allowing for easy and convenient account access. It’s not easy to deliver both — but it is possible.

Although it’s hard to imagine, some synthetic identities are being used for purposes other than fraud. Here are 3 types of common synthetic identities and why they’re created: Bad — To circumvent lag times and delays in establishing a legitimate identity and data footprint. Worse — To “repair” credit, hoping to start again with a higher credit rating under a new, assumed identity. Worst — To commit fraud by opening various accounts with no intention of paying those debts or service fees. While all these synthetic identity types are detrimental to the ecosystem shared by consumers, institutions and service providers, they should be separated by type — guiding appropriate treatment. Learn more in our new white paper produced with Whitepages Pro, Fighting synthetic identity theft: getting beyond Social Security numbers. Download now>

The business case for identity verification and risk assessment tools is most compelling when it includes a broad range of both direct and indirect factors. Here are 3 indirect measures we suggest you consider: Customer experience improvement — With 72% of businesses focused on service, according to Forrester Research,* the value of reduced friction can’t be overstated Reputation and brand protection — The monetary cost of fraud losses can be high, but the impact on customer relationships and brand integrity can be even higher. Compliance — Noncompliance costs an average of 2.65 times more than investing in a technology-based compliance solution. Justifying investment in fraud prevention technology can be challenging. A business case built on the right data can pave the way to upgrading your identity verification and risk assessment technology. Learn more in our buyer's guide>

Identify your customers to spot fraud. It’s a simple concept, but it’s not so simple to do. In our 2018 Global Fraud and Identity Report, we found that consumers expect to be recognized and welcomed wherever and whenever they do business. Here are some other interesting findings regarding recognition and fraud: 66% of consumers surveyed appreciate seeing visible security when doing business online because it makes them feel protected. 75% of businesses want security measures that have little impact on consumers. More than half of businesses still rely on passwords as their top form of authentication. Even though you can’t see your customers face-to-face, the importance of being recognized can’t be overemphasized. How well are you recognizing your customers? Can you recognize your customers?