In the ever-expanding financial crime landscape, envision the most recent perpetrator targeting your organization. Did you catch them? Could you recover the stolen funds? Now, picture that same individual attempting to replicate their scheme at another establishment, only to be thwarted by an advanced system flagging their activity. The reason? Both companies are part of an anti-fraud data consortium, safeguarding financial institutions (FIs) from recurring fraud.

In the relentless battle against fraud and financial crime, FIs find themselves at a significant disadvantage due to stringent regulations governing their operations. Criminals, however, operate without boundaries, collaborating across jurisdictions and international borders. Recognizing the need to level the playing field, FIs are increasingly turning to collaborative solutions, such as participation in fraud consortiums, to enhance their anti-fraud and Anti-Money Laundering (AML) efforts.

Understanding consortium data for fraud prevention

A fraud consortium is a strategic alliance of financial institutions and service providers united in the common goal of comprehensively understanding and combatting fraud.

As online transactions surge, so does the risk of fraudulent activities. However, according to Experian’s 2023 U.S. Identity and Fraud Report, 55% of U.S. consumers reported setting up a new account in the last six months despite concerns around fraud and online security. The highest account openings were reported for streaming services (43%), social media sites and applications (40%), and payment system providers (39%).

Organizations grappling with fraud turn to consortium data as a robust defense mechanism against evolving fraud strategies. Consortium data for fraud prevention involves sharing transaction data and information among a coalition of similar businesses. This collaborative approach empowers companies with enhanced data analytics and insights, bolstering their ability to combat fraudulent activities effectively.

The logic is simple: the more transaction data available for analysis by artificial-intelligence-powered systems, the more adept they become at detecting and preventing fraud by identifying patterns and anomalies.

Advantages of data consortiums for fraud and AML teams

Participation in an anti-fraud data consortium provides numerous advantages for a financial institution’s risk management team. Key benefits include:

- Case management resolution: Members can exchange detailed case studies, sharing insights on how they responded to specific suspicious activities and financial crime incidents. This collaborative approach facilitates the development of best practices for incident handling.

- Perpetrator IDs: Identifying repeat offenders becomes more efficient as consortium members share data on suspicious activities. Recognizing patterns in names, addresses, device fingerprints, and other identifiers enables proactive prevention of financial crimes.

- Fraud trends: Consortium members can collectively analyze and share data on the frequency of various fraud attempts, allowing for the calibration of anti-fraud systems to effectively combat prevalent types of fraud.

- Regulatory changes: Staying ahead of evolving financial regulations is critical. Consortiums enable FIs to promptly share updates on regulatory changes, ensuring quick modifications to anti-fraud/AML systems for ongoing compliance.

Who should join a fraud consortium?

A fraud consortium can benefit any organization that faces fraud risks and challenges, especially in the financial industry. However, some organizations may benefit more, depending on their size, type, and fraud exposure. Some of the organizations that should consider joining a fraud consortium are:

- Financial institutions: Banks, credit unions, and other financial institutions are prime targets for fraudsters, who use various methods such as identity theft, account takeover, card fraud, wire fraud, and loan fraud to steal money and information from them.

- Fintech companies: Fintech companies are innovative and disruptive players in the financial industry, who offer new and alternative products and services such as digital payments, peer-to-peer lending, crowdfunding, and robot-advisors.

- Online merchants: Online merchants are vulnerable to fraudsters, who use various methods such as card-not-present fraud, friendly fraud, and chargeback fraud to exploit their online transactions and payment systems.

Why partner with Experian?

What companies need is a consortium that allows FIs to collaboratively research anti-fraud and AML information, eliminating the need for redundant individual efforts. This approach promotes tighter standardization of anti-crime procedures, expedited deployment of effective anti-fraud/AML solutions, and a proactive focus on preventing financial crime rather than reacting to its aftermath.

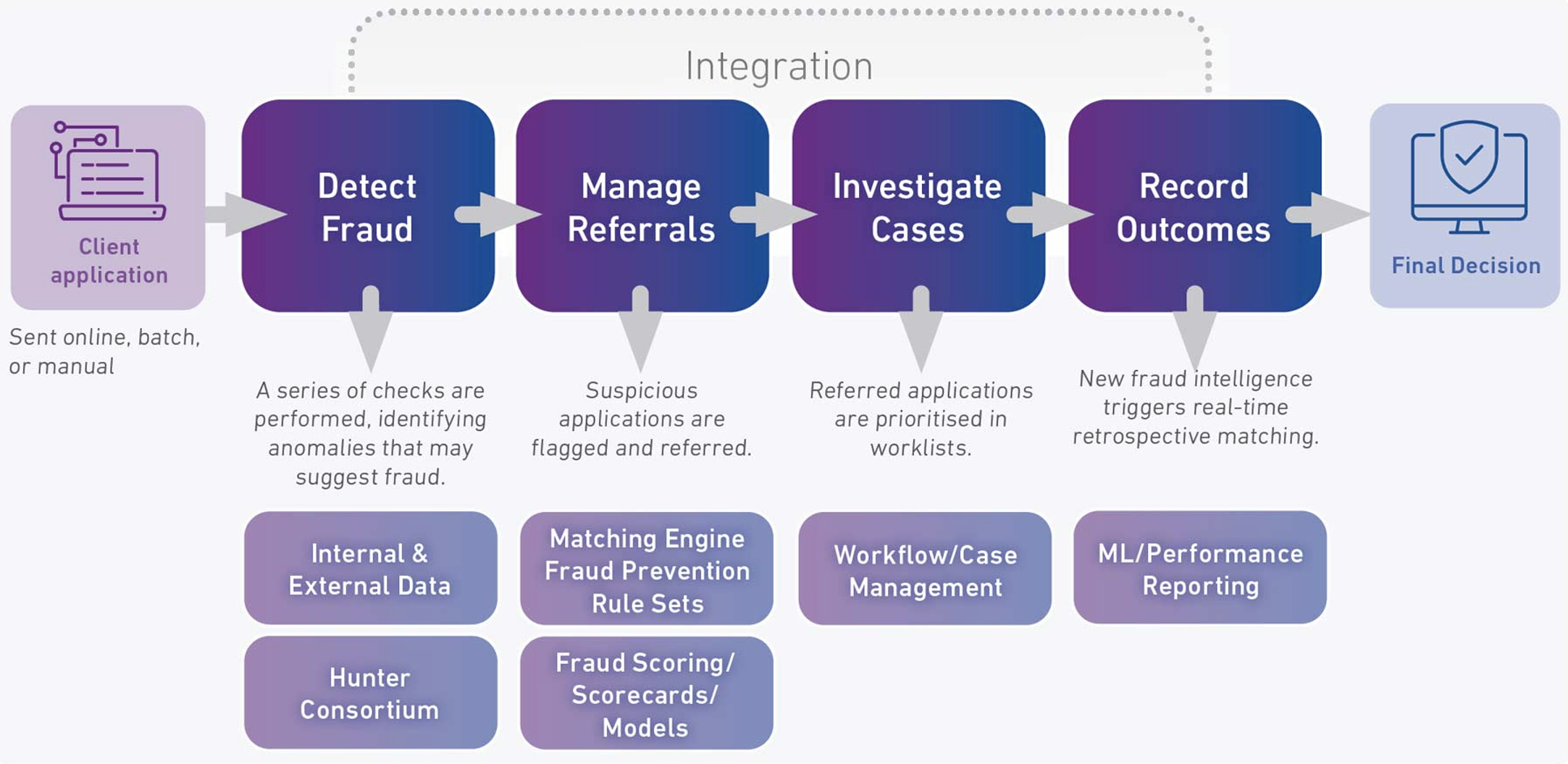

Experian Hunter is a sophisticated global application fraud and risk management solution. It leverages detection rules to screen incoming application data for identifying and preventing fraudulent activities.

It matches incoming application data against multiple internal and external data sources, shared fraud databases and dedicated watch lists. It uses client-flexible matching rules to crossmatch data sources for highlighting data anomalies and velocity attempts. In addition, it looks for connections to previous suspected and known fraudulent applications. Hunter generates a fraud score to indicate a fraud risk level used to prioritize referrals. Suspicious applications are moved into the case management tool for further investigation.

Overall, Hunter prevents application fraud by highlighting suspicious applications, allowing you to investigate and prevent fraud without inconveniencing genuine customers.

To learn more about our fraud management solutions, visit us online or request a call.

This article includes content created by an AI language model and is intended to provide general information.