Tag: Vision

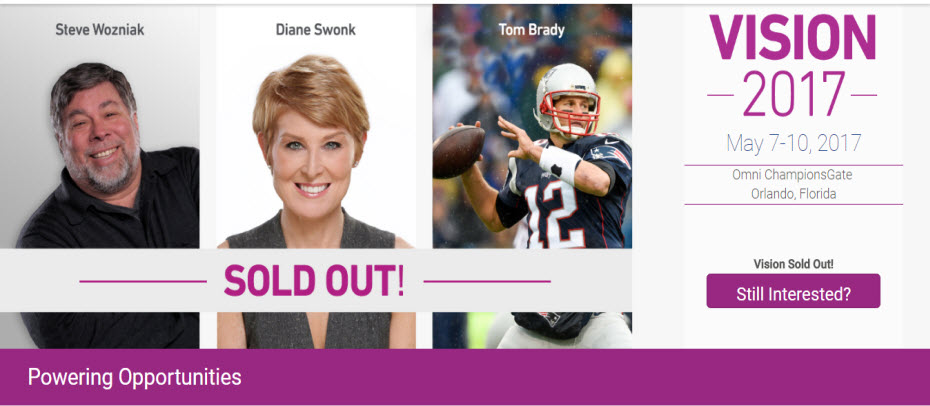

Experian’s annual Vision Conference, a four-day event designed to bring business leaders together to discuss the latest ideas and solutions surrounding targeting new markets, growing customer bases and profitability, reducing fraud and more, begins Sunday evening in Orlando, Florida. Over the course of the week, a total of 65 sessions will touch on newsworthy and breaking trends. Attendees will discover: The latest generational insights – including a first look at the coming-of-age Gen Z crowd – regarding credit scores, spend patterns and digital behaviors Multiple presentations on the economy, the mortgage market, student lending, small business forecasts and new developments in online marketplace lending Deep dives on fraud in relation to the epidemic of synthetic IDs, Know Your Customer (KYC) compliance strategies, maturing your organization to defeat fraud, and the dark web Regulatory round-ups touching on everything from the Military Lending Act (MLA), the Telephone Consumer Protection Act (TCPA), Current Expected Credit Loss (CECL) and what is emerging from the new administration Best-in-class sessions on data and analytics, modeling, virtual collections, trended data and credit marketing Intel on the state of commercial lending, the rise of the mircopreneur and the business credit profile across various life stages. Beyond a jam-packed schedule of breakout sessions, the conference will additionally host a series of general session speakers sure to educate and entertain. On Monday, Steve Wozniak, also known as “The Woz” takes the stage to talk about his experiences as co-founder of Apple Computer Inc. and his years in the emerging technology space. Diane Swonk, CEO of DS Economics, will address the crowd on Tuesday to provide details and analysis on the state of the global and U.S. economies. Finally, legendary quarterback and recent Super Bowl MVP and winner Tom Brady will speak on Wednesday to close out the event. Conference attendees can follow everything utilizing their Experian Vision app. Hot stats, pictures and event news will also be shared on multiple social handles using #ExperianVision.

Last week we had the pleasure of joining more than 400 clients at the 35th annual Vision Conference — connecting business leaders to ideas and solutions. Over the next few weeks, we’ll be sharing some insights from our fraud and identity dedicated session track. I had the pleasure of presenting alongside the U.S. Secret Service, and we had a packed session to discuss the Dark Web — what it is, how it’s accessed, how criminals are exploiting it to commit fraud and the human impact of the massive global cybercrime problem. According to McAfee®, cybercrime represents a $500 billion cost to the global economy — and that’s projected to rise to $600 billion this year, outpacing any other form of crime. With the Internet economy generating between $2 trillion and $3 trillion annually, that means cybercrime is extracting roughly 15 to 20 percent of the entire value created by the Internet. This is a massive problem, and it’s not going away. Unfortunately, there are countless tools and services to commit fraud available on the Web, providing attackers with the cloak of anonymity they need to compromise accounts, mimic legitimate users and submit fraudulent transactions. Device intelligence helps unmask these activities. It is a critical component to defend against the threat, and it provides insight into every interaction throughout a typical customer journey (from account setup to login and account maintenance to transactions). Without this visibility into users’ historical behavior and typical population patterns, organizations often have limited options to target attackers and identify anomalous behaviors. This is key to a successful cybercrime detection and mitigation strategy. Another important point in the session regarded recent law enforcement and private industry successes in identifying, tracking, apprehending and prosecuting online attackers. We thankfully have made significant strides in this area, as evidenced by the work of the Secret Service and other law enforcement organizations, but the collaboration must continue — and intensify. As mentioned in a CNBC story published on the same day as our presentation, the Dark Web is an increasingly mainstream source for everything from financial crime to drug trade and human trafficking. Unfortunately, most businesses are in the dark about the growing criminal underground, but Experian can help. With proper fraud expertise and innovative tools to defend against these ever-evolving threats, organizations can uncloak the attackers and safeguard the business.

James W. Paulsen, Chief Investment Strategist for Wells Capital Management, kicked off the second day of Experian’s Vision 2016, sharing his perspective on the state of the economy and what the future holds for consumers and businesses alike. Paulsen joked this has been “the most successful, disappointing recovery we’ve ever had.” While media and lenders project fear for a coming recession, Paulsen stated it is important to note we are in the 8th year of recovery in the U.S., the third longest in U.S. history, with all signs pointing to this recovery extending for years to come. Based on his indicators – leverage, restored household strength, housing, capital spending and better global growth – there is still capacity to grow. He places recession risk at 20 to 25 percent – and only quotes those numbers due the length of the recovery thus far. “What is the fascination with crisis policies when there is no crisis,” asks Paulsen. “I think we have a good chance of being in the longest recovery in U.S. history.” Other noteworthy topics of the day: Fraud prevention Fraud prevention continues to be a hot topic at this year’s conference. Whether it’s looking at current fraud challenges, such as call-center fraud, or looking to future-proof an organization’s fraud prevention techniques, the need for flexible and innovative strategies is clear. With fraudsters being quick, and regularly ahead of the technology fighting them, the need to easily implement new tools is fundamental for you to protect your businesses and customers. More on Regulatory The Military Lending Act has been enhanced over the past year to strengthen protections for military consumers, and lenders must be ready to meet updated regulations by fall 2016. With 1.46 million active personnel in the U.S., all lenders are working to update processes and documentation associated with how they serve this audience. Alternative Data What is it? How can it be used? And most importantly, can this data predict a consumer’s credit worthiness? Experian is an advocate for getting more entities to report different types of credit data including utility payments, mobile phone data, rental payments and cable payments. Additionally, alternative data can be sourced from prepaid data, liquid assets, full file public records, DDA data, bill payment, check cashing, education data, payroll data and subscription data. Collectively, lenders desire to assess someone’s stability, ability to pay and willingness to repay. If alternative data can answer those questions, it should be considered in order to score more of the U.S. population. Financial Health The Center for Financial Services Innovation revealed insights into the state of American’s financial health. According to a study they conducted, 57 percent of Americans are not financially healthy, which equates to about 138 million people. As they continue to place more metrics around defining financial health, the center has landed on four components: how people plan, spend, save and borrow. And if you think income is a primary factor, think again. One-third of Americans making more than $60k a year are not healthy, while one-third making less than $60k a year are healthy. --- Final Vision 2016 breakouts, as well as a keynote from entertainer Jay Leno, will be delivered on Wednesday.

It’s impossible to capture all of the insights and learnings of 36 breakout sessions and several keynote addresses in one post, but let’s summarize a few of the highlights from the first day of Vision 2016. 1. Who better to speak about the state of our country, specifically some of the threats we are facing than Leon Panetta, former Secretary of Defense and Director of the CIA. While we are at a critical crossroads in the United States, there is room for optimism and his hope that we can be an America in Renaissance. 2. Alex Lintner, Experian President of Consumer Information Services, conveyed how the consumer world has evolved, in large part due to technology: 67 percent of consumers made purchases across multiple channels in the last six months. More than 88M U.S. consumers use their smartphone to do some form of banking. 68 percent of Millennials believe within five years the way we access money will be totally different. 3. Peter Renton of Lend Academy spoke on the future of Online Marketplace Lending, revealing: Banks are recognizing that this industry provides them with a great opportunity and many are partnering with Online Marketplace Lenders to enter the space. Millennials are not the largest consumers in this space today, but they will be in the future. Sustained growth will be key for this industry. The largest platforms have everything they need in place to endure – even through an economic downturn.In other words, Online Marketplace Lenders are here to stay. 4. Tom King, Experian’s Chief Information Security Officer, addressed the crowds on how the world of information security is growing increasingly complex. There are 1.9 million records compromised every day, and sadly that number is expected to rise. What can businesses do? “We need to make it easier to make the bad guys go somewhere else,” says King. 5. Look at how the housing market has changed from just a few years ago: Inventory continues to be extraordinarily lean. Why? New home building continues to run at recession levels. And, 8.5 percent of homeowners are still underwater on their mortgage, preventing them from placing it on the market. In the world of single-family home originations, 2016 projections show that there will be more purchases, less refinancing and less volume. We may see further growth in HELOC’s. With a dwindling number of mortgages benefiting from refinancing, and with rising interest rates, a HELOC may potentially be the cheapest and easiest way to tap equity. 6. As organizations balance business needs with increasing fraud threats, the important thing to remember is that the customer experience will trump everything else. Top fraud threats in 2015 included: Card Not Present (CNP) First Party Fraud/Synthetic ID Application Fraud Mobile Payment/Deposit Fraud Cross-Channel FraudSo what do the experts believe is essential to fraud prevention in the future? Big Data with smart analytics. 7. The need for Identity Relationship Management can be seen by the dichotomy of “99 percent of companies think having a clear picture of their customers is important for their business; yet only 24 percent actually think they achieve this ideal.” Connecting identities throughout the customer lifecycle is critical to bridging this gap. 8. New technologies continue to bring new challenges to fraud prevention. We’ve seen that post-EMV fraud is moving “upstream” as fraudsters: Apply for new credit cards using stolen ID’s. Provision stolen cards into mobile wallet. Gain access to accounts to make purchases.Then, fraudsters are open to use these new cards everywhere. 9. Several speakers addressed the ever-changing regulatory environment. The Telephone Consumer Protection Act (TCPA) litigation is up 30 percent since the last year. Regulators are increasingly taking notice of Online Marketplace Lenders. It’s critical to consider regulatory requirements when building risk models and implementing business policies. 10. Hispanics and Millennials are a force to be reckoned with, so pay attention: Millennials will be 81 million strong by 2036, and Hispanics are projected to be 133 million strong by 2050. Significant factors for home purchase likelihood for both groups include VantageScore® credit score, age, student debt, credit card debt, auto loans, income, marital status and housing prices. More great insights from Vision coming your way tomorrow!

It’s one of our favorite times of year. Yes, spring is in the air, and we’re delighted to spend a few days away from the office in picturesque Scottsdale, Arizona. But what really has us excited is the opportunity to connect with a diverse network of industry leaders from across the country at our 35th annual Vision Conference. We have a full agenda, featuring sessions on advanced data analytics, market trends, fraud and identity, regulatory hot topics and more. And our theme for this year is geared toward giving participants the tools and insights they need to take control of their respective businesses to grow new markets, increase existing customer bases, reduce fraud and increase profits. In addition to 70-plus breakout session, guests will be treated to several keynote addresses: Leon Panetta, former U.S. Secretary of defense and former Director of the CIA James W. Paulsen, Chief Investment Strategist, Wells Capital Management Jay Leno, Television Host, Author and Comedian Listen to Experian North America CEO Craig Boundy’s welcome message, and start your Vision three-day event with the goal of meeting and engaging with as many old and new contacts as possible. For individuals not attending this year’s Vision, stay tuned for learnings and insights that will be shared in the coming weeks. Attendees and non-attendees alike can also follow updates on Twitter and via #vision2016.

Businesses are looking to international markets to fuel growth, but meeting regulatory requirements across the globe poses significant challenges. Changes in Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements are evolving at break-neck speed. In the past few years, financial institutions and corporations have incurred billions of dollars in fines, reputation damage, and even the possibility of criminal prosecution for not enforcing adequate regulatory controls. KPMG found that 70 percent of its respondents had received a regulatory visit within the past year focused on KYC and total investment in AML had increased by an average rate of 53 percent. As large as this additional investment may seem, there may be an even bigger cost to doing regulatory compliance the right way. For many businesses the customer experience is the biggest casualty of implementing a robust KYC program. In their Vision 2016 breakout session “Know your customer, meeting commercial requirements in a global marketplace,” Greg Carmean, Experian senior product manager, will be joined by Adel Shrufi, software development manager at Amazon Transaction Risk Management Systems. They will discuss: • How to streamline compliance to optimize the client experience • How to evaluate and select the best vendors to reduce compliance costs and operational vulnerabilities • What businesses need to consider to ensure successful launches in new international markets Watch our session preview video below: We’ll look forward to seeing you as we provide a road map for growth at this year’s Vision conference.