Tag: student loan debt

If you’re a manager at a business that lends to consumers or otherwise extends credit, you certainly are aware that 10-15% of your current customers and prospective future customers are among the approximately 27 million consumers who are now – or will soon be -- fitting another bill into their monthly budgets. Early in the COVID-19 pandemic, the government issued a pause on federal student loan payments and interest. Now that the payment pause has expired, millions of Americans face a new bill averaging more than $200. Will they pay you first? If this is your concern, you aren’t alone: Experian recently held a webinar that discussed how the end of the student loan pause might affect businesses. When we surveyed the webinar attendees, nearly 3 out of 4 responses included Risk Management as a main concerns now. Another top concern is about credit scores. Lenders and investors use credit scores – bureau scores such FICO® or VantageScore® credit score or custom credit scores proprietary to their institution – to predict credit default risk. The risk managers at those companies want to know to what extent they can continue to rely on those scores as Federal student loan payments come due and consumers experience payment shock. I’ve analyzed a large and statistically meaningful sample (10% of the US consumer population in Experian’s Ascend Sandbox) to shed some light on that question. As background information, the average consumer with student loans had lower scores before the pandemic than the average of the general population. One of my Experian colleagues has explored some of the reasons at https://www.experian.com/blogs/ask-experian/research/average-student-loan-payments). Here are some of the things we can learn from comparing the credit data of the two groups of people. I looked at a period from 2019 and from 2023 to see how things have changed: Average credit scores increased during the pandemic, continuing a long-term trend during which more Americans have been willing and able to meet all their obligations. During the COVID Public Health Emergency, consumers with student loans brought up their scores by an average of 25 points; that was 7 points more than consumers without student loans. Another way to look at it: in 2019, consumers with student loans had credit scores 23 points lower than consumers without. By 2023, that difference had shrunk to 16 points. Experian research shows that there will be little immediate impact on credit scores when the new bills come due. Time will tell whether these increased credit scores accurately reflect a reduction in the risk that consumers will default on other bills such as auto loans or bankcards soon, even as some people fit student loan bills into their budgets. It is well-known that many people saved money during the public health emergency. Since then, the personal savings rate has fallen from a pandemic high of 32% to levels between 3% and 5% this year – lower than at any point since the 2009 recession. In an October 2023 Experian survey, only 36% of borrowers said they either set aside funds or they planned using other financial strategies specifically for the resumption of their student loan payments. Additional findings from that study can be found here. Furthermore, there are changes in the way your customers have used their credit cards over the last four years: Consumers’ credit card balances have increased over the last four years. Consumers with student loans have balances that are on average $282 (4%) more now than in 2019. That is a significantly smaller increase than for consumers without student loans, whose total credit card debt increased by an average of $1,932 (26%). Although their balances increased, the ratio of consumers’ total revolving debt balances to their credit limits (utilization) changed by less than 1% for both consumers with student loans and consumers without. In 2019, the utilization ratio was 9.8 percentage points lower for consumers with student loans than consumers without. Four years later, the difference is nearly the same (9.6 points). We can conclude that many student loan borrowers have been very responsible with credit during the Public Health Emergency. They may have been more mindful of their credit situation, and some may have planned for the day when their student loan payments will be due. As the student loan pause come to an end, there are a few things that lenders and other businesses should be doing to be ready: Even if you are not a student loan lender, it is important to stay on top of the rapidly evolving student loan environment. It affects many of your customers, and your business with them needs to adapt. Anticipate that fraudsters and abusers of credit will be creative now: periods of change create opportunities for them and you should be one step ahead. Build optimized strategies in marketing, account opening, and servicing. Consider using machine learning to make more accurate predictions. Those strategies should reflect trends in payments, balances, and utilization; older credit scores look at a single point in time. Continually refresh data about your customers—including their credit scores and important attributes related to payments, balances, and utilization patterns. Look for alternative data that will give you a leg up on the competition. In the coming weeks and months, Experian’s data scientists will monitor measures of performance of the scores and attributes that you depend on in your data-driven strategies — particularly focusing on the Kolmogorov-Smirnov (KS) statistics that will show changes in the predictive power of each score and attribute. (If you are a data-driven business, your data science team or a trusted partner should be doing the same thing with a more specific look at your customer base and business strategies.) In future reports and blog posts, we’ll shed light on the impact student loans are having on your customers and on your business. In the meantime, for more information about how to use data and advanced analytics to grow while controlling costs and risks, all while staying in compliance and providing a good customer experience, visit our website.

After being in place for more than three years, the student loan payment pause is scheduled to end 60 days after June 30, with payments resuming soon after. As borrowers brace for this return, there are many things that loan servicers and lenders should take note of, including: Potential risk factors demonstrated by borrowers. About one in five student loan borrowers show risk factors that suggest they could struggle when scheduled payments resume.1 These include pre-pandemic delinquencies on student loans and new non-medical collections during the pandemic. The impact of pre-pandemic delinquencies. A delinquent status dating prior to the pandemic is a statistically significant indicator of subsequent risk. An increase in non-student loan delinquencies. As of March 2023, around 2.5 million student loan borrowers had a delinquency on a non-student loan, an increase of approximately 200,000 borrowers since September 2022.2 Transfers to new servicers. More than four in ten borrowers will return to repayment with a new student loan servicer.3 Feelings of anxiety for younger borrowers. Roughly 70% of Gen Z and millennials believe the current economic environment is hurting their ability to be financially independent adults. However, 77% are striving to be more financially literate.4 How loan servicers and lenders can prepare and navigate Considering these factors, lenders and servicers know that borrowers may face new challenges and fears once student loan payments resume. Here are a few implications and what servicers and lenders can do in response: Non-student loan delinquencies can potentially soar further. Increased delinquencies on non-student loans and larger monthly payments on all credit products can make the transition to repayment extremely challenging for borrowers. Combined with high balances and interest rates, this can lead to a sharp increase in delinquencies and heightened probability of default. By leveraging alternative data and attributes, you can gain deeper insights into your customers' financial behaviors before and during the payment holidays. This way, you can mitigate risk and improve your lending and servicing decisions. Note: While many student loan borrowers have halted their payments during forbearance, some have continued to pay anyway, demonstrating strong financial ability and willingness to pay in the future. Trended data and advanced modeling provide a clearer, up-to-date view of these payment behaviors, enabling you to identify low-risk, high-value customers. Streamlining your processes can benefit you and your customers. With some student loan borrowers switching to different servicers, creating new accounts, enrolling in autopay, and confirming payment information can be a huge hassle. For servicers that will have new loans transferred to them, the number of queries and requests from borrowers can be overwhelming, especially if resources are limited. To make transitions as smooth as possible, consider streamlining your administrative tasks and processes with automation. This way, you can provide fast and frictionless service for borrowers while focusing more of your resources on those who need one-on-one assistance. Providing credit education can help borrowers take control of their financial lives. Already troubled by higher costs and monthly payments on other credit products, student loan payments are yet another financial obligation for borrowers to worry about. Some borrowers have even stated that student loan debt has delayed or prevented them from achieving major life milestones, such as getting married, buying a home, or having children.5 By arming borrowers with credit education, tools, and resources, they can better navigate the return of student loan payments, make more informed financial decisions, and potentially turn into lifelong customers. For more information on effective portfolio management, click here. 1Consumer Financial Protection Bureau. (June 2023). Office of Research blog: Update on student loan borrowers as payment suspension set to expire. 2Ibid. 3Ibid. 4Experian. (May 2023). Take a Look: Millennial and Gen Z Personal Finance Trends 5AP News. (June 2023). The pause on student loan payment is ending. Can borrowers find room in their budgets?

Student loan forbearance, part of the Coronavirus Aid, Relief, and Economic Security (CARES Act) economic stimulus bill that paused student loan repayment, interest accrual, and collections, is set to expire on May 1, 2022. Borrowers who carry federal student loans in the United States need to anticipate the resumption of repayment and interest accrual. In this article, we’ll answer questions your borrowers will be asking about the end of the student loan pause and how they can better prepare. Lenders and servicers should anticipate an influx of requests for modification and for private student loan lenders, a potential significant push for refinancing. When do student loans resume and when does student loan interest start again? Student loan repayments and resumption of interest accruals are set to resume on May 1, 2022. This means that student loans will start accruing interest again, and payments will need to resume on the existing payment date. In other words, if the due date prior to the pause was the fifth of every month, the first repayment date will be May 5, 2022. In the weeks preceding this, borrowers can expect a billing statement from their student loan servicer outlining their debt and terms or they can reach out to their servicers directly to get more information. Will student loan forbearance be extended again? Will the CARES Act be extended? There is no indication that the federal government will extend student loan forbearance beyond May 1, 2022, which was already extended beyond the original deadline in February 2022. Your borrower’s best strategy is to prepare now for the resumption of repayments, interest accrual and collections. Will Biden forgive student loans? Free community college tuition and federal student loan forgiveness up to $10,000 were a centerpiece of the Biden platform during his candidacy for president and were included in early iterations of the government's Build Back Better agenda. In February 2022, during bargaining, the administration removed the free tuition provision from the bill. The Build Back Better bill has yet to pass. Although there remains a student loan relief provision in the draft Build Back Better agenda, there is no guarantee that it will make it into the final iteration. What should borrowers do if they paid student loans using auto-debit? Most borrowers will need to restart auto-debit after the student loan pause. If auto-debit or ACH was used prior to the student loan pause went into effect on March 13, 2020, borrowers can expect to receive a communication from their servicer confirming they wish to continue with auto-debit. If the borrower doesn’t respond to this notice, the servicer may cancel auto-debit. If the borrower signed up for auto-debit after the beginning of forbearance, payments should automatically begin. How much interest will borrowers have to pay? Unless terms have changed, such as consolidating loans, the interest rate will be the same as it was before the student loan pause went into effect. Will balances be the same as they were before the student loan pause? Will it take the same amount of time to pay off the student loan? For those on a traditional repayment plan, a student loan servicer might recalculate the amount based on the principal and interest and the amount of time left in the repayment period. Borrowers will still make payments for the same number of months in total, but the end date for repayment will be pushed forward to accommodate the payment pause. In other words, if the loan terms originally stated that it would be repaid in full on January 1, 2030, the new terms will accommodate the pause and show full repayment on January 1, 2032. For those on an Income-Driven Repayment Plan (IDRP) – such as Revised Pay as You Earn Repayment (REPAYE), Pay As You Earn Repayment (PAYE), Income-Based Repayment (IBR), or Income-Contingent Repayment (ICR) – the payment amount will resume at the same rate as before the payment pause. Student loan forbearance will not delay progress towards repayment. What are borrower options if the student loan payment is too high? Enroll in an IDRP program: Available plans include REPAYE, PAYE, IBR or ICR. Student loan refinancing: When a borrower refinances, he or she can group federal and private loans and possibly negotiate a lower repayment amount. However, they will not be eligible to access federal loans protections or programs. Loan consolidation: This process allows borrowers to combine multiple federal loans into a single loan with a single payment, which can reduce monthly payments by extending the repayment period. Note this will result in more interest being charged, as the time to repay will be extended. Will this change affect those with private student loans? Private lenders are not covered by the CARES Act, so student loan forbearance did not apply to them. Most private lenders have continued collecting repayments throughout the COVID-19 pandemic. Borrowers having trouble making payments to a private lender, can discuss options such as deferment, forbearance, consolidation and modified repayment terms. What happens if a student loan payment is missed or the borrower can’t pay at all? If a payment is missed, the account will be considered delinquent. The account becomes delinquent the first day after a missed payment and remains that way until the past-due amount is paid or other arrangements are made. If the account remains delinquent, the loan may go into default. The amount of time between delinquency and default depends on the student loan servicer. If the loan goes into default, borrowers could face consequences including: Immediate collections on the entire loan and interest owed Ineligibility for benefits such as deferment and forbearance, Inability to choose a different payment plan or obtain additional federal student aid Damage to credit score Inability to buy or sell assets Withholding of tax refunds or other federal benefits Wage garnishment A lawsuit Do student loans affect credit scores? Yes, for delinquent student loans, the servicer will report the delinquency to the three major credit bureaus and the borrower’s credit score will drop.2 A poor credit score can affect a consumer’s ability to obtain credit cards or loans and may make it difficult to sign up with utilities providers, cell phone providers and insurance agencies. It can also be challenging to rent an apartment. What are the options for those who can’t pay? Can student loans be deferred? For those with federal student loans, now is the time to prepare for the end of student loan forbearance. Revisit budgets, make sure records are up to date and communicate with student loan servicers to make sure payments can be made in full and on time. For those unable to pay back loans, they can consider requesting a deferment. A deferment is a temporary pause on student loan payments. Depending on the type of loan, interest may or may not continue to accrue during the deferment. If they wish to apply for a deferment, they must meet eligibility requirements. Some common grounds for deferment are: Economic hardship Schooling Military service Cancer treatment Loan servicers and private lenders should arm themselves for the large volume of questions from borrowers who are not prepared to begin resuming payment. Now may the time to increase customer service or consider adding student loan consolidation products to serve the increase in demand. For information on mitigating risk and effectively managing your portfolio, click here.

Student loan debt is weighing down Americans of all generations, but a college education is still prized as the ticket to opportunity. So will the debt continue to climb? Where will students turn for funding? We interviewed Vince Passione, founder and CEO of LendKey, a lending-as-a-service platform specializing in student lending, to gain his perspective on the state of student lending and how the space is evolving for both consumers and lenders. We’ve all seen the headlines about U.S. student loan debt now accounting for $1.4 trillion. The majority of these loans are government-funded, but do you see this shifting? There are many factors at play here. Tuition is rising rapidly and will soon outpace the current level of governmental support available to students searching for loans. Meanwhile, today’s geopolitical climate signals that the current levels of federal funding will also decrease. With these two confounding trends, the need for competitively priced private financing and refinancing options will increase. The student loan industry will shift toward private lenders such as credit unions and banks in order for students to continue to obtain the funds they need for tuition and other college expenses. The key to helping this transition happen is for banks and credit unions to adopt the user-friendly technology platforms that appeal to these prospective student borrowers. Your end-to-end cloud-based technology platform enables lenders to get into the student loan space. How does this work and what must lenders consider as they underwrite and manage a student loan portfolio? Our turnkey platform is unique, in that it lets lenders control underwriting and pricing, unlike the “disruptive” model utilized by many other technology companies in the industry. Most community banks and credit unions lack the in-house resources to develop, implement and maintain an online lending platform. At the same time, millennials and young borrowers continue to prefer the online interface rather than engaging with a brick-and-mortar establishment. We’re committed to partnering with banks and credit unions to allow them to offer private consumer loans, such as student loans, and support them with our technology (loan application and decisioning) and people (customer service agents and loan processors). A strong grasp on the technology and support aspects of online lending platforms alone is merely the foundation for a successful program. As the student lending asset classes are highly regulated, and the regulations are constantly changing, lenders must look to partner with a firm that has a concrete understanding of the regulation, risk and customer service to translate the information to prospective borrowers. I’ve heard you use the phrase “HENRY.” Can you explain what this is and why these individuals are so lucrative for lenders? HENRY stands for “High Earners, Not Rich Yet” and is a term that can be applied to many millennials and young people in today’s economy. This demographic is typically college graduates with well-paying jobs, but have not yet established themselves financially or accrued enough wealth to subsidize larger purchases like cars, homes, renovations and advanced degrees. This is also why they are so lucrative for lenders. HENRYs have just entered their prime borrowing years and are consumers who will easily be able to pay back loans for cars, homes and renovations. But for most of this demographic, their first experience with a financial service product will be a student loan. It is important to get in on the ground floor with these borrowers through student lending to establish a trusted relationship that will result in repeat loans and referrals. You’ve done a great deal of research on millennials and how they are managing student loans. Can you share some of your key learnings? Do you believe Generation Z will behave and manage student debt similarly? It’s no secret that millennials are more apprehensive of student loans than previous generations. As Gen Z begins to enter college, many are plagued with stigmas set forward by the poor experiences millennials experienced with student loans, making them wary of debt. According to a study, 63 percent of the students said they would “possibly” take on student debt, down from 71 percent in 2016. Gen Z is better prepared by seeing the preceding generation grapple with loan issues. Many are making smarter decisions on schools and programs, and are attentive when it comes to monitoring for updates in regulation. As this generation continues to go through the typical collegiate years, the geopolitical climate, as well as rising tuition costs, will increase the need for competitively priced private financing options for Gen Zers. Finally, what trends or predictions do you see occurring in the student lending space over the next five years? The need for student loans continues to exist and shows no sign of slowing down anytime soon, but lenders are only recently opening their eyes to the opportunity that this massive market presents. With the impending drop in federal funding, more FinTech companies will continue to pop up to address this need. This spike in disruption also poses a threat to banks and credit unions, however. With more FinTechs available to help shoulder the burden of student lending, banking and credit union executives must be more judicious when vetting technology partners to ensure they’re working with a partner that meets their regulatory standards, supports their current and prospective clients, and lets them retain the control they wish to keep in-house.

School is nearly back in session. You know what that means? The next wave of college students is taking out their first student loans. It’s a milestone moment – and likely the first trade on the credit file for many of these individuals. According to the College Board, the average cost of tuition and fees for the 2016–2017 school year was $33,480 at private colleges, $9,650 for state residents at public colleges, and $24,930 for out-of-state residents attending public universities. So really, regardless of where students go, the cost of a college education is big. In fact, from January 2006 to July 2016, the Consumer Price Index for college tuition and fees increased 63 percent. So, unless mom and dad did a brilliant job saving, chances are many of today’s students will take on at least some debt to foot the college bill. But it’s not just the young who are consumed by student loan debt. In Experian’s latest State of Student Lending report, we dive into how the $1.4 trillion in student loan debt for Americans is impacting all generations in regards to credit scores, debt load and delinquencies. The document additionally looks at geographical trends, noting which states have the most consumers with student loan debt and which ones have the least. Overall, we discovered 13.4% of U.S. consumers have one or more student loan balances on their credit file with an average total balance of $34k. Additionally, these consumers have an average of 3.7 student loans with 1.2 student loans in deferment. The average VantageScore® credit score for student loan carriers is 650. As we looked across the generations, every group – from the Silents (age 70+) to Gen Z (oldest are between 18 to 20) had some student loan debt. While we can make assumptions that the Silents and Boomers are likely taking out these loans to support the educational pursuits of their children and grandchildren, it can be mixed for Gen X, who might still be paying off their own loans and/or supporting their own kids. Gen X members also reported the largest average student loan total balance at $39,802. Gen Z, the newest members to the credit file, have just started to attend college, thus their generation has the largest percent of student loan balances in deferment at 77%. Their average student loan total balance is also the lowest of all generations at $11,830, but that is to be expected given their young ages. In regards to geographical trends, the Northern states tended to sport the highest average student loan total balances, with consumers in Washington D.C. winning that race with $52.5k. Southern states, on the other hand, reported higher percentages of consumers with student loan balances 90+ days past due. South Carolina, Louisiana, Mississippi, Arkansas and Texas held the top spots in the delinquency category. Access the complete State of Student Lending report. Data from this report is representative of student loan data on file as of June 2017.

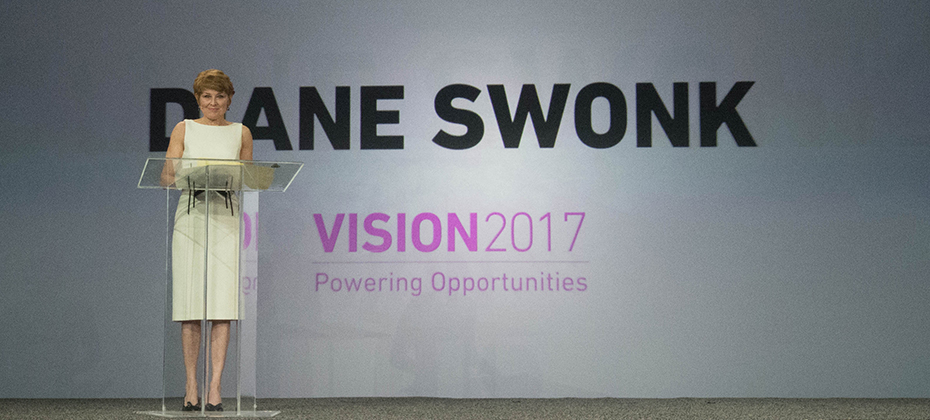

In just a few short hours, Vision attendees immersed themselves into the depths of the economy, risk models, specialty finance data, credit invisibles, student loan data, online marketplace lending and more. The morning kicked off with one of the most respected and trusted macroeconomists in the U.S., Diane Swonk. With a rap sheet filled with advising central banks and multinational companies, Swonk treated a packed house to a look back on what has transpired in the U.S. economy since the Great Recession, as well as launching into current state and speculating on the months ahead. She described the past decade not as “lost, but rather lagging.” She went onto to say this past year was transitional, and while markets slowed slightly during the months leading up the U.S. presidential election, good things are happening: We’ve finally broken out of the 2% wage rut Recruiting on college campuses has picked up The labor force is growing Debt-to-income levels have returned to where they were prerecession and Investment is coming back. “I believe we’ll see growth over 2% this year,” said Swonk. Still, change is underway. She commented on how the way U.S. consumer spending is changing, and of course we’re seeing a restructuring in the retail space. While JC Penney announces store closings, you simultaneously see Amazon moving from “click to brick,” dabbling in the opening of some actual storefronts. Globally, she said the economy is the strongest it has been in eight years. She closed by noting there is a great deal of political change and unrest in the world today, but says, “Never underestimate our abilities when we tap our human capital.” -- More than 100 attendees filled a room to hear about the current trends and the future of online lending with featured guests from Oliver Wyman, Marlette Funding and Lending USA. While speakers commented on the “hiccup” in the space last year with some layoffs and mergers, volume has continued to double every year for the past several years with roughly $40 billion in cumulative originations today. Panelists discussed the use of alternative data to decision, channel bias, the importance of partnerships and how the market will see fewer and fewer players offering just one product specialty. “It is expensive to acquire customers, so you don’t just want to have one product to sell, but rather a range,” said Sharat Shankar of Lending USA. -- The numbers in the student lending universe are astounding. In a session focused on the U.S. student loan market, new Experian data reveals there is $1.49 billion in total student loan outstandings. In fact, total outstandings have grown 21% over the past four years, while the number of trades have only grown 4%. Costs are skyrocketing. The average balance per trade has grown 17% over the past four years. “We don’t ration education in this country,” said Joe DePaulo of College Ave. Student Loans. “We give everyone access to liquidity when it comes to federal student loans – and it’s not like that in other countries.” While DePaulo notes the access is great, offering many students the opportunity to obtain higher education, he says the problem is with disclosures. Guardians are often the individuals filling out the FAFSA, but the students inherit the loans. Students, he says, rarely understand how much their monthly payment will ultimately be after graduation. For every $10,000 in student loans, he says that will generally equate to a $100 monthly payment. -- Tomorrow, Vision attendees will be treated to more breakout sessions and a concluding keynote with legendary quarterback Tom Brady.

$1.3 trillion. 41.1 million Americans. $31,590. These are the growing numbers associated with student loan debt in the United States: $1.3 trillion in outstanding student loans, spread across 41.1 million people, who are leaving college with an average balance of $31,590. The numbers are staggering, and for the first time student loan debt is playing a prominent role in a presidential election. For all of their differences, presidential nominees Hillary Clinton and Donald Trump seem to agree on one thing: student loan debt is a crushing burden. Both candidates have proposed solutions for student lending. Clinton’s “New College Compact” would allow borrowers to refinance their student loans at current rates available to students taking out new loans. She also wants to reduce interest rates on new student loans, and make it easier for borrowers to enroll in income-driven repayment programs that would cap monthly payments at 10 percent of discretionary income. Trump proposes giving more oversight to colleges to decide whether to grant loans to students based on their prospective major. The plan would also give private banks oversight over government-backed student loans—reversing a 2010 decision under President Obama to make the federal government the lender. Neither candidate, however, has outlined a solution for taming growing tuition costs. Tuition expenses are up 1,225 percent over the past 36 years, outpacing medical costs (634 percent rise) and the consumer price index (279 percent) over the same period, according to the Bureau of Labor Statistics. So it’s not surprising an Experian study shows the student loan rate has grown five percent in the past three years. What is surprising is the number of people and the average age of those people holding student loans. Experian found: 20 percent of people with a credit file hold a student loan that is being repaid or deferred. The average age of a consumer with a student loan is 37, with an average income of $47,200 compared to 53.8 and an average income is $44,500 for consumers without a student loan. The average age of a consumer with at least one deferred student loan is 32.7 with an average income of $32,900 compared to 38.7 and an average income of $53,200 for consumers with at least one non-deferred student loan. Candidate proposals aside, one thing is certain: student loan debt has a very real impact on the daily lives of people, many of whom have delayed buying homes, starting families, and saving for retirement. Until policymakers find a way to address bloated tuitions and student debt, it will take many longer to realize their dreams.

The numbers are staggering: more than $1.2 trillion in outstanding student loan debt, 40 million borrowers, and an average balance of $29,000. In fact, a recent Experian study revealed consumer debt is decreasing in every major consumer lending category with the exception of student loans. Student loans have increased by 84 percent since the recession (from 2008 to 2014) and surpassed home equity loans, home-equity lines of credit (HELOC), credit card debt and automotive debt. While the student loan issue has been looming for years, the magnitude is now taking center stage with each 2016 presidential candidate weighing in on solutions. In an effort to provide deeper insights into the student debt universe, Experian’s Kelley Motley and Holly Deason will share a new analysis at Vision 2016 in a session titled, Get educated – a study in the student lending marketplace. They will be joined by Gordon Cameron, executive vice president of PNC. Among the findings they will share include a snapshot of consumers with student loans from three time periods – Pre-recession (December 2007), Recession (December 2009) and Post-Recession/Current (December 2015). At each of these time periods, they will reveal trends around outstanding debt, delinquencies, originations, and also a compare how consumers with student loans rank when it comes to Vantage Score distribution. Finally, their data will explore opportunities for consolidation, showing segments that might be best suited for receiving offers from financial institutions based on Vantage Score, debt and total number of trades. Click here to learn more about Vision 2016 and the session on student loans.

The numbers are staggering: more than $1.2 trillion in outstanding student loan debt, 40 million borrowers, and an average balance of $29,000. With Millennials exiting college and buried in debt, it’s no surprise they are postponing marriage, having babies, home purchases and other major life events. While the student loan issue has been looming for years, the magnitude is now taking center stage. All of the 2016 presidential contenders have an opinion, and many are starting to propose solutions – some going as far as to call for “debt-free college.” The issue has also caught the eye of the Consumer Financial Protection Bureau (CFPB). In its 2014 report, the CFPB stated one in four recent college graduates is either unemployed or underemployed. They also stated when faced with the inability to repay their debt, students lack payment options and are unclear as to how to resolve their debt. There is a bright spot. Experian reported new findings stating that among adults 18 to 34 years of age, the average credit score of those who had at least one open student loan account was 640, 20 points higher than others in their age group. So, if paid in a timely manner, student loans can help younger people establish a decent credit history before they go on to buy things like homes and cars. Still, education is key. Today, only 24 U.S. states require some form of financial literacy to be included in their high school course work, with only four states (Utah, Montana, Tennessee and Virginia) devoting a full semester to a personal finance course. Education is needed before students start diving into the student loan scene, and also after they graduate, to ensure they understand their repayment options and obligations. The CFPB is calling on all parties (universities, colleges, private lenders, advocates, policy makers and even family members) to get involved. Providing financial education, financial literacy, repayment options, deferral methods and income calculators are all needed to tackle this growing problem. The Great Recession and slow recovery brought home the importance of a college degree in today’s economy for many Americans. Bachelor’s degree recipients fared much better than their counterparts who only finished high school. The question becomes how to fund it, and make sure students who rely on loans understand the finances attached to this milestone investment. Learn more about Experian’s student debt trends and credit education in The Increasing Need for Consumer Credit Education: A Review of Student Debt.