Tag: identity verification

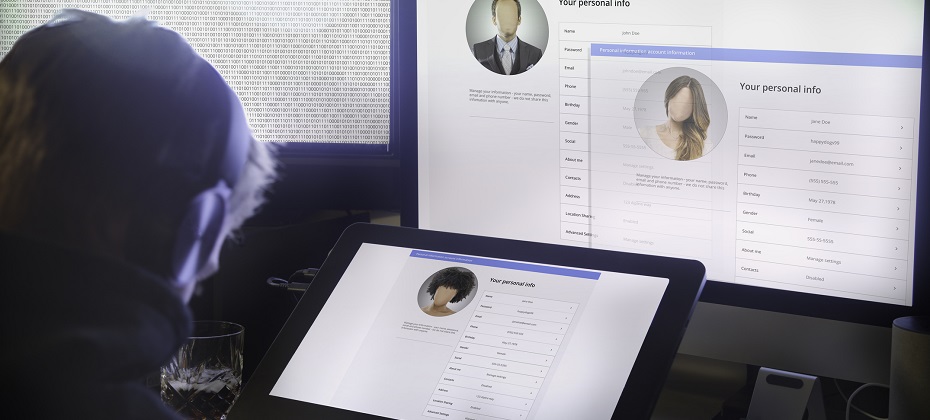

Online identity verification has become a basic necessity for everyday life. Consumers today might expect to upload a picture of their driver's license or answer security questions before creating a new account. And it's crucial to them — 63% say it's extremely or very important for businesses to be able to recognize them online. While many organizations have a consumer recognition strategy, moving from strategy to action and then getting the desired result isn't easy. That's particularly true when you're working to create seamless experiences for customers while fighting increasingly sophisticated fraudsters. Why is online identity verification challenging? Identity verification in the physical world might be as simple as checking a government-issued ID card — and perhaps an additional form of identification (or two) when the stakes are higher. Verification becomes more complicated as you move into the digital realm, especially when you need to automate decisions. There are many specific challenges to overcome, but some of the main ones fall into four categories. Finding the right friction: In an ideal world, every legitimate user will flow through your verification checks with ease. In reality, you may need to introduce some roadblocks to comply with know your customer (KYC) rules and prevent fraud. Finding the friction-right balance can be tricky. Accessing and using data: Using expanded data sources, such as behavior and device info, can improve outcomes without adding friction. But simply having more data isn’t the goal. You need to be able to organize, process and use the data in a compliant manner to quickly and accurately verify identities. Fighting fraud: You’re up against formidable foes who consistently test your systems for weaknesses and share the results with other fraudsters. You have to be able to spot first-party fraud, identity thieves and synthetic identities. Securing the data: Accessing and storing customer data is vital for a successful identity verification system, but it’s your responsibility to securely protect customers’ data. It also may be a legal requirement, and you need to be mindful of all the applicable regulations. These aren't fixed challenges that you can overcome in a single hurdle. Consumer preferences, fraud tactics and regulations are continually evolving, and your identity verification platform needs to keep up. Potential benefits throughout the customer lifecycle Companies that want to create, manage and continuously identify consumers are starting to take an enterprise-wide approach that relies on creating a single-customer view. The idea is to have a single identity that you can expand as you learn more about a person’s preferences and behavior. Otherwise, business units can wind up with fragmented views that lead to jumbled messaging, errors and missed opportunities. While it can be difficult to implement well, the single-view approach can also be powerful in action: Targeting and onboarding: Marketing, acquisition and onboarding aren’t necessarily handled by the same teams, but a smooth process can create a lasting good impression. There are also recent developments that can provide pre-fill capabilities with their identification verification solutions, which can create a nearly friction-free onboarding process. Prevent fraud: The single-view approach also lets you leverage cross-device and real-time data to detect and prevent fraud, and determine the right-size verification method. Using identity graphs to verify identities in real-time can also help you detect fraud, including account takeovers and first-party fraud. Customer experience: Consistently identifying customers can improve their experience — particularly when different departments can easily access and update the same identification material. In turn, this can lead to brand loyalty and the potential to upsell and cross-sell customers. The need for accurate verification is growing as people spend more time living and shopping online. Only 16% of consumers are confident businesses can consistently recognize them online, which also means there’s an opportunity to surprise and delight the skeptics. What do consumers want? Most people want to be recognized as they move throughout their digital lives. But data breaches and identity theft continuously make headlines, and people aren't ignorant of the dangers of sharing their personal information. In fact, consumers ranked identity theft (80%) as their top online security concern, a sizable +20% jump from the previous year. Finding the right balance of privacy, security and due diligence is important for earning customers' trust. However, the best approach to online identity verification may depend on who your customers are and how they interact with your products and services. Finding a great online identity verification partner Knowing how important online identity verification can be for the success of your business, you need to be sure that the digital identity solutions providers you partner with can meet your current and future needs. A good fit can: Give you access to multidimensional data: You can use online and offline data to support your digital identity verification systems. Some vendors can also help you use internal data,deterministic dataand outputs from probabilistic models to improve your results. Scale to meet future challenges: Many businesses are exploring how to use machine learning and artificial intelligencefor identity resolution and verification. These can be especially powerful when combined with robust data sources and may become more important as additional data sources come online. Protect your business: Identity verification solutions need to help you comply with the regulatory requirements and detect fraud with low false-positive rates to protect your business. First and foremost, you want to work with a partner who knows thatidentity is personal. Your customers are more than data points, and putting their needs and wants first will ultimately help you earn their trust and business. Learn more about Experian’s customer-centric identity verification solutions. Learn more

It is a New Year and a new start. How about a new job? That is what thousands of employees will consider over the next month. It is also a time for employers to attract new talents, but they must be aware of different types of employment fraud. The rise of remote work has significantly increased the prevalence of remote hiring practices, from the initial job application to the onboarding process and beyond. Unfortunately, this shift has also opened the door to a surge in imposter employees, also known as ‘candidate fraud,’ posing a significant concern for organizations. How does employment identity theft happen? Instances of potential job candidates utilizing real-time deepfake video and deepfake audio, along with personally identifiable information (PII), during remote interviews to secure positions within American companies have been on the rise. The Federal Bureau of Investigation (FBI) reports that fraudulent individuals often acquire PII through fake job opening posts, which enable them to gather candidate information and resumes. Surprisingly, the tools necessary for impersonation on live video calls do not require sophisticated or expensive hardware or software. Employment identity theft can occur in several ways. Here are a few examples: Inaccurate credentials: Employers may inadvertently hire someone with false or stolen credentials if they fail to conduct comprehensive background checks. When the employer discovers the deception, it can be challenging to trace the true identity of the person they unknowingly hired. Limited-term job offers: Some industries offer temporary job opportunities in distant locations. Individuals with criminal backgrounds may steal victims' identities to apply for these jobs, hoping that their crimes will go unnoticed until after the job is complete. Perpetrated by colleagues: In rare instances, jealous colleagues or coworkers can commit employment identity theft. They may steal a coworker's information during a data breach and sell it on the dark web or use the victim's credentials to frame them for fraudulent workplace actions. Preventing employment identity theft In addition to the reported cases of imposter employee fraud, it is crucial to acknowledge the potential for other scams that exploit new technologies and the prevalence of remote work. Malicious cyber attackers could secure employment using stolen credentials, enabling them to gain unauthorized access to sensitive data or company systems. A proficient hacker possessing the necessary IT skills may find it relatively easy to leverage social engineering techniques during the hiring process. Consequently, the reliability of traditional methods for employee verification, such as face-to-face interactions and personal recognition, is diminishing in the face of remote work and the technological advancements that enable individuals to manipulate their appearance, voice, and identity. To mitigate risks associated with hiring imposters, it is imperative to incorporate robust measures into the recruitment process. Here are some key considerations: Establish clear policies and employment contracts: Clearly communicate your organization's policies regarding moonlighting in employment contracts, employee handbooks, or other official documents. Confidentiality and non-compete agreements: Implement confidentiality and non-compete agreements to protect your company's sensitive information and intellectual property. Monitoring: Automate employment and income verification of your employees. Provide training on cybersecurity best practices: Educate employees about cyber-attacks and identity scams, such as phishing scams, through seminars and workplace training sessions. Implement robust security measures: Use firewalls, encrypt sensitive employee information, and limit access to personal data. Minimize the number of employees who have access to this information. Thoroughly screen new employees: Verify the accuracy of Social Security numbers and other information during the hiring process. Conduct comprehensive background checks, including checking bank account information and credit reports and fight against synthetic identities. Offer identity theft protection as a benefit: Consider providing identity theft protection services to your employees as part of their benefits package. These services can detect and alert victims of potential identity theft, facilitating a fast response. The new era of remote work necessitates a fresh perspective on the hiring process. It is crucial to reevaluate HR practices and leverage AI fraud detection technologies to ensure that the individuals you hire, and employ are who they claim to be, guarding against the infiltration of imposters. Navigating employment fraud with effective solutions Employment fraud presents significant risks and challenges for employers, including conflicts of interest, reputation damage, and breaches of confidentiality. By taking the right preventative measures, you can safeguard your organization and employees. Streamlining the hiring process is essential to remain competitive. But how do you balance the need for speed and ease of use with essential ID checks? By combining the best data with our automated ID verification processes, Experian helps you protect your business and onboard new talents efficiently. Our best-in-class solutions employ device recognition, behavioral biometrics, machine learning and global fraud databases to spot and block suspicious activity before it becomes a problem. Learn more about preventing employement fraud *This article includes content created by an AI language model and is intended to provide general information.

Meeting Know Your Customer (KYC) regulations and staying compliant is paramount to running your business with ensured confidence in who your customers are, the level of risk they pose, and maintained customer trust. What is KYC?KYC is the mandatory process to identify and verify the identity of clients of financial institutions, as required by the Financial Conduct Authority (FCA). KYC services go beyond simply standing up a customer identification program (CIP), though that is a key component. It involves fraud risk assessments in new and existing customer accounts. Financial institutions are required to incorporate risk-based procedures to monitor customer transactions and detect potential financial crimes or fraud risk. KYC policies help determine when suspicious activity reports (SAR) must be filed with the Department of Treasury’s FinCEN organization. According to the Federal Financial Institutions Examinations Council (FFIEC), a comprehensive KYC program should include:• Customer Identification Program (CIP): Identifies processes for verifying identities and establishing a reasonable belief that the identity is valid.• Customer due diligence: Verifying customer identities and assessing the associated risk of doing business.• Enhanced customer due diligence: Significant and comprehensive review of high-risk or high transactions and implementation of a suspicious activity-monitoring system to reduce risk to the institution. The following organizations have KYC oversight: Federal Financial Institutions Examinations Council (FFIEC), Federal Reserve Board, Federal Deposit Insurance Corporation (FDIC), national Credit Union Administration (NCUA), Office of the Comptroller of the Currency (OCC) and the Consumer Financial Protection Bureau (CFPB). How to get started on building your Know Your Customer checklist 1. Define your Customer Identification Program (CIP) The CIP outlines the process for gathering necessary information about your customers. To start building your KYC checklist, you need to define your CIP procedure. This may include the documentation you require from customers, the sources of information you may use for verification and the procedures for customer due diligence. Your CIP procedure should align with your organization’s risk appetite and be comply with regulations such as the Patriot Act or Anti-money laundering laws. 2. Identify the customer's information Identifying the information you need to gather on your customer is key in building an effective KYC checklist. Typically, this can include their first and last name, date of birth, address, phone number, email address, Social Security Number or any government-issued identification number. When gathering sensitive information, ensure that you have privacy and security controls such as encryption, and that customer data is not shared with unauthorized personnel. 3. Determine the verification method There are various methods to verify a customer's identity. Some common identity verification methods include document verification, facial recognition, voice recognition, knowledge-based authentication, biometrics or database checks. When selecting an identity verification method, consider the accuracy, speed, cost and reliability. Choose a provider that is highly secure and offers compliance with current regulations. 4. Review your checklist regularly Your KYC checklist is not a one and done process. Instead, it’s an ongoing process that requires periodic review, updates and testing. You need to periodically review your checklist to ensure your processes are up to date with the latest regulations and your business needs. Reviewing your checklist will help your business to identify gaps or outdated practices in your KYC process. Make changes as needed and keep management informed of any changes. 5. Final stage: quality control As a final step, you should perform a quality control assessment of the processes you’ve incorporated to ensure they’ve been carried out effectively. This includes checking if all necessary customer information has been collected, whether the right identity verification method was implemented, if your checklist matches your CIP and whether the results were recorded correctly. KYC is a vital process for your organization in today's digital age. Building an effective KYC checklist is essential to ensure compliance with regulations and mitigate risk factors associated with fraudulent activities. Building a solid checklist requires a clear understanding of your business needs, a comprehensive definition of your CIP, selection of the right verification method, and periodic reviews to ensure that the process is up to date. Remember, your customers' trust and privacy are at stake, so iensuring that your security processes and your KYC checklist are in place is essential. By following these guidelines, you can create a well-designed KYC checklist that reduces risk and satisfies your regulatory needs. Taking the next step Experian offers identity verification solutions as well as fully integrated, digital identity and fraud platforms. Experian’s CrossCore & Precise ID offering enables financial institutions to connect, access and orchestrate decisions that leverage multiple data sources and services. By combining risk-based authentication, identity proofing and fraud detection into a single, cloud-based platform with flexible orchestration and advanced analytics, Precise ID provides flexibility and solves for some of financial institutions’ biggest business challenges, including identity and fraud as it relates to digital onboarding and account take over; transaction monitoring and KYC/AML compliance and more, without adding undue friction. Learn more *This article includes content created by an AI language model and is intended to provide general information.

The online gaming industry has experienced tremendous growth in recent years, with millions of players engaging in immersive virtual worlds and competitive gameplay. Unfortunately, this surge in popularity has also sparked an increase in online gaming fraud. Unscrupulous individuals have sought to exploit the industry through fraudulent activities, leading to financial losses and reputational damage for gaming vendors.According to a recent study conducted by Lloyds Bank, children are spending more time playing online games than ever before – over five million children between the ages of three and 15 are now regularly playing games online, up from approximately 4.6 million in 2019.Fraudsters, always ready to take advantage of opportunities presented by new trends, are now increasingly targeting this rising demographic. Gaming vendors have a responsibility to shield minors from fraud in online gaming by implementing robust safety measures, educating young players and their parents, and actively monitoring and addressing fraudulent activities. A vulnerable target That same study from Lloyds revealed that over a third (36%) of parents are concerned about the possibility of their children falling victim to gaming fraud and losing money. In today's tech-savvy world, the ease of payment authorization has only exacerbated these concerns. All it takes for a child to make a payment is to key in their parents' online store username and password. It is a practice fraught with danger. Parents can only do so much to safeguard their children while gaming, and despite their best efforts, there will always remain a lingering possibility of encountering scammers. Gaming vendors should establish robust age verification processes during account creation to ensure that minors are not exposed to age-inappropriate content. Additionally, they should incorporate comprehensive parental controls that allow parents to regulate their children's online activities, including chat limitations, spending controls, and access to certain features.But contrary to common assumptions, the gaming population is not restricted to teenagers or young adults. With an average age of 35, gamers have significant purchasing power and actively participate in the gaming ecosystem. They spend an average of over six hours per week gaming, dedicating nearly an hour each day to their preferred gaming experiences. This engagement is spread across all age groups and financial profiles, making the gaming community a vast market to attract cybercrime. Types of fraud in online gaming In 2022, the revenue from the worldwide gaming market was estimated at almost 347 billion U.S. dollars, with the mobile gaming market generating an estimated 248 billion U.S. dollars of the total. The gaming market is constantly evolving, and technological advancements are opening new possibilities for game developers to create more immersive and engaging experiences.But alarming reports indicate that scammers have honed in on the younger demographic of gamers, leveraging their innocence to exploit their finances and identities. Identity theft (67%) and hacking (61%) rank as the two most prevalent forms of fraud experienced by young gamers, according to the Lloyds Bank study. Here are some different types of online gaming fraud: Account hacking: Hackers employ various techniques like phishing, keylogging, and credential stuffing to gain unauthorized access to players' accounts. Once compromised, accounts could be used for fraudulent activities, including unauthorized in-game transactions or selling virtual assets for real money. Chargeback fraud: This occurs when players make legitimate purchases within a game using real money and then issue chargebacks, falsely claiming that the transaction was unauthorized or fraudulent. This results in financial losses for gaming vendors as they lose the revenue and virtual goods/services provided to the player. Virtual asset fraud: Virtual assets, such as in-game currency, items, or characters, hold economic value. Fraudsters engage in scams involving fake virtual asset transactions or market manipulation, exploiting players' desires to acquire rare or high-value items. Match-fixing and cheating: Competitive gaming is at the heart of many online games. Fraudsters seek to manipulate matches, exploit glitches, or use cheat software to gain an unfair advantage over others. This undermines the integrity of the gaming experience and discourages fair competition. The game changer for online platforms: fraud prevention strategies Given the anticipated growth of these threats in the foreseeable future, it is imperative that online platforms prioritize the protection of young gamers and their parents. In line with the enhanced safeguards and anti-fraud initiatives observed in banks and financial institutions, it is high time for game companies to elevate their security and consumer protection measures by adopting the following guidelines: Implement strong account security measures: Encourage players to create unique, complex passwords, and consider implementing multifactor authentication solutions. Regularly educate players about common hacking techniques and promote safe browsing habits to prevent phishing attempts. Utilize fraud detection systems: Invest in advanced fraud detection tools that employ machine learning algorithms and biometrics templates to identify suspicious activities and patterns. These systems can flag potentially fraudulent transactions, allowing you to take appropriate measures promptly. Monitor and analyze user behavior: Keep an eye on players' activities and digital identity, such as unusual login patterns, high-value transactions, or frequent chargebacks. Analyze gameplay data, interactions, and purchasing behavior to identify patterns indicative of fraud or cheating. Secure payment processing systems: Choose reputable payment gateways that prioritize security measures. Employ tokenization and encryption technologies to safeguard players' payment information during transactions. Regularly test and update your payment system's security infrastructure. Raise player awareness: Educate your player community about common fraud techniques and the importance of securing their accounts with identity authentication. Share security tips through newsletters, blog posts, and in-game messaging. Foster a culture of vigilance and encourage players to report any suspicious activities. Foster fair gameplay and zero tolerance policy: Implement robust anti-cheat measures and regularly update your game to address vulnerabilities and exploits. Promote fair competition and enforce a zero-tolerance policy against cheating, match-fixing, and other forms of unfair gameplay. Leveling-up Ultimately, the ability to protect players online could be the ultimate gamechanger for gaming platforms. By embracing identity verification mechanisms that rely on secure and privacy-centric facial recognition, online fraud and identity theft can be significantly curtailed. Moreover, the verification and onboarding processes can be streamlined, simplifying the user experience further. Just as bringing top-tier games on board is crucial, game platforms must ensure their customers engage in a secure gaming environment. Streamlining the onboarding and sign-in process is essential to remain competitive. But how do you balance the need for speed and ease of use with essential ID checks? By combining the best data with our automated ID verification checks, Experian helps you safeguard your business and onboard customers efficiently. Using passive, invisible checks when customers sign into their accounts helps to keep fraudsters at bay and protects legitimate players without the need for irritating security challenges. Experian’s best-in-class solutions employ device recognition, behavioral biometrics, machine learning and global fraud databases to spot and block suspicious activity before it becomes a problem. Learn more *This article leverages/includes content created by an AI language model and is intended to provide general information.

While today’s consumers expect a smooth, frictionless digital experience, many financial institutions still rely on outdated technology and manual reviews to acquire new customers. These old processes can prevent lenders from making accurate and timely credit decisions, leading to lost opportunities, revenue, and goodwill. By optimizing their customer acquisition strategies, financial institutions can allocate their resources effectively and say yes to consumers faster. This guide will walk you through the current challenges facing customer acquisition and how robust optimization strategies can help. Current challenges in customer acquisition To stay competitive and engage high-value customers, you’ll need an efficient customer acquisition process that weeds out both fraudulent actors and risky consumers. However, achieving this balancing act comes with a unique set of challenges. Because today’s consumers can access goods and services almost anywhere online at any time, more than 54 percent of customers expect a heightened digital and frictionless experience. Failing to meet this expectation can lead to huge losses for lenders. Some of the most common challenges in customer acquisition include: Although 52 percent of consumers prefer digital banking options over visiting branches in person, many lenders still rely on paper documents, which can add weeks to the onboarding process. Requiring consumers to provide substantial information about themselves during an application process can lead to abandoned applications. 67 percent of consumers will leave an application if they experience complications. Verifying consumer identities is growing increasingly important. In fact, about 35 percent of customers drop out of digital onboarding because their identity can't be confirmed. Poorly defined campaign planning can cause businesses to market to the wrong population segments, resulting in wasted time and resources. What is optimization for customer acquisition? Customer acquisition optimization is the process of implementing new methods and solutions to make acquiring new customers more efficient and cost-effective. For lenders, this means streamlining steps in the credit decisioning process to focus on the right prospects and reduce friction. What types of processes can be optimized for customer acquisition? You might be surprised just how many processes can be optimized for customer acquisition. Here are just a few examples: Having a holistic view of consumers allows you to take the guesswork out of targeting so you can better identify and engage high-potential customers. Utilizing predictive and lifestyle data enables you to pinpoint a more precisely segmented audience for marketing. Digital application solutions that reach across multiple channels, allowing applicants to leave one channel and pick up right where they left off in another. Real-time identity verification and fraud detection during onboarding and after, helping expedite approvals and mitigate risks. Utilizing API integration to leverage multiple metrics beyond credit scores when screening applicants' financial situation. Building custom risk models that pair to your existing data so you can say yes to more customers and better manage portfolio risk. Benefits of customer acquisition optimization Optimization can bring numerous benefits to your business, providing a faster return on investment. Here are some examples. By better pinpointing your marketing through predictive and lifestyle data, you can achieve increased conversions. Faster onboarding with less friction helps retain more customers. Real-time fraud detection and identity verification reduce customer roadblocks, allowing you to realize significant growth. Custom risk models and decisioning platforms can pair your data with additional data elements, providing more than just a credit score rating for your applicants. This can help you say yes to more customers. Using AI and machine learning tools will reduce the need for manual reviews and thus increase booking rates and applications. A real-life example of these benefits can be found with the Michigan State University Federal Credit Union (MSUFCU.) With over $7.2 billion in assets and 330,000 members, the client was manually reviewing all its applications. Experian reviewed the client's risk levels and approvals, comparing their risk and bankruptcy scores to determine which were most predictive. This analysis led Experian to recommend a new decisioning platform (Experian Decisioning) for instant credit decisions, an alternative data score tool, and Experian Advisory Services for risk-based pricing. After implementing these optimization solutions, MSUFCU saw a 55 percent increase in average monthly automations, four times improved online application response time and began competing more effectively in the marketplace. How Experian can help Experian offers a number of customer acquisition tools, allowing companies to be more responsive in an increasingly competitive market, while still reducing fraud risk. These tools include: Acquisition optimization marketing Experian offers a web-based platform that lets clients manage their marketing efforts all in the same place. You can upload and enhance client files, identify lookalike prospects, and use firmographic and credit data to get a holistic view of your clients and your prospects. Data-driven acquisition and decisioning engine Experian Decisioning is a data-driven decisioning engine that accepts applications from multiple channels, automates data collection and verification and proactively monitors decision results. It's flexible enough to reach across multiple channels, letting customers set aside their application in one digital channel and resume where they left off in another. It also provides businesses with access to comprehensive data assets, proactive monitoring and streamlined development with minimal coding. Enhanced fraud detection and identity verification Experian's Precise ID® is a risk-based fraud detection and prevention platform that provides analytics to accurately verify customers and mitigate fraud loss behind the scenes, ensuring a smoother onboarding process. Robust consumer attributes for better customized models Experian gives clients access to a wider berth of consumer attributes, helping you better screen applicants beyond just looking at credit scores. Trended 3DTM attributes let you uncover unique patterns in consumers' behavior over time, allowing you to manage portfolio risk, build better models and determine the next best actions. Premier AttributesSM aggregates credit data at the most granular and meaningful levels to provide clear insights into consumer credit behavior. It encompasses more than 2,100 attributes across 51 industries to help you develop highly predictive custom models. Enterprise-wide credit decisioning engine Experian's enterprise-wide credit decision platform lets you combine machine learning with proprietary data to return optimized decisions and quickly respond to requests. Robust credit decisioning software lets you convert data into meaningful actions and strategies. With Experian's machine learning decisioning options, companies are realizing a 25 percent reduction in manual reviews, a 25 percent increase in loan and credit applications and a 26 percent increase in booking rates. Highly predictive custom models Experian's Ascend Intelligence ServicesTM can help you create highly predictive custom models that create sophisticated decisioning strategies, allowing you to accurately predict risk and make the best decisions fast. This end-to-end suite of solutions lets you achieve a more granular view of every application and grow portfolios while still minimizing risk. Experian can help optimize your customer acquisition Experian provides a suite of decisioning engines, consumer attributes and customized modeling to help you optimize your customer acquisition process. These tools allow businesses to better target their marketing efforts, streamline their onboarding with less friction and improve their fraud detection and mitigation efforts. The combination can deliver a powerful ROI. Learn more about Experian's customer acquisition solutions. Learn more

Financial institutions are under increasing pressure to grow deposits and onboard more demand deposit accounts (DDA). But as demand increases, so do fraud attempts from scammers. While a robust mitigation effort is needed to stop fraud, this same effort can also drive away potential clients. In fact, 37 percent of U.S. adults said that they abandoned opening an account online due to experiencing friction. This leaves institutions in a unique quandary: how do they stop DDA fraud without scaring away potential clients? The answer lies in utilizing robust, machine learning tools that can help you navigate fraud attempts without increasing onboarding friction. Chris Ryan, Go to Market Lead for Experian Identity and Fraud, shares his thoughts on demand deposit account fraud and which decisioning tools can best combat it. Q: What is a demand deposit account and how is it used? "Demand deposit is just your basic checking account," Ryan explains." The funds are deposited and held by an institution, which enables you to spend those assets or resources, whether it be through checks, debit cards, person-to-person, Automated Clearing House (ACH) — all the things we do every day as consumers to manage our operating budget." Q: What is demand deposit account fraud? "There are two different ways that demand deposit account fraud works," Ryan says. "One is with existing account holders, and the other is with the account opening process.” When fraud affects existing account holders, it typically involves tricking an account holder into sending money to a scammer or using fraudulent actions, like phishing emails or credit card skimmers, to gain access to their accounts. There is also a resurgence in fraud involving duplication, theft and forgery of paper checks, Ryan explains. Fraud impacting the account opening process occurs when scammers originate new DDAs. This can work in a variety of ways, such as these three examples: A scammer steals your identity and opens an account at the same bank where you have a home equity loan. They link their DDA to your line of credit, transferring your money into their new account and withdrawing the funds. A scammer uses a synthetic identity (SID) to open a fraudulent DDA. They will then use this new DDA to open more lucrative accounts that the institution cross-sells to them. A scammer uses a stolen or SID to open “mule” accounts to receive funds they dupe consumers into sending through fake relationship schemes, bogus merchandise sales and dozens of similar scams. While both types of fraud need to be dealt with, account opening fraud can have especially large repercussions for lenders or financial institutions. Q: What are the consequences of DDA fraud for organizations? "Fraud hurts in a number of ways," Ryan explains. "There are direct losses, which is the money that criminals take from our financial system. Under most circumstances, the financial institution replaces the money, so the consumer doesn’t absorb the loss, but the money is still gone. That takes money away from lending, community engagement and other investments we want banks to make. The direct losses are what most people focus on." But there are even more repercussions for institutions beyond losing money, and this can include the attempts that institutions put into place to stop the fraud. "Preventing fraud requires some friction for the end consumer," Ryan says. "The volume of fraudulent attempts is overwhelmingly large in the DDA space. This forces institutions to apply more friction. The friction is costly, and it often drives would-be-customers away. The results include high costs for the institutions and low booking rates. At the same time, institutions are hungry for deposit money right now. So, it's kind of a perfect storm." Q: What is the impact of DDA fraud on customer experience? Experian’s 2023 Identity and Fraud Report revealed that up to 37 percent of U.S. adults in the survey had abandoned a new account entirely in the previous six months because of the friction they encountered during onboarding. And 51 percent reported considering abandoning the process because of problems they encountered. Unfortunately, fraud mitigation and deposit fraud detection efforts can end up driving customers away. "People can be impatient," Ryan says, "and in the online world, a competing product is a mouse-click away. So, while it is tempting to ask new applicants for more information, or further proof of identity, that conflicts with their need for convenience and can impact their experience.” Companies looking for cheap and fast mitigation can end up impeding customers trying to onboard to sweep out the bad actors, Ryan explains. "How do you get the bad people without interrupting the good people?" Ryan asks. "That's the million-dollar question." Q: What are some other problems with how organizations traditionally combat DDA fraud? Unfortunately, traditional attempts to combat DDA fraud are inefficient due to the fragmentation of technology. Ryan says this was revealed by Liminal, an industry analyst think tank. "Nearly half of institutions use four-or-more-point solutions to manage identity and fraud-related risk," Ryan explains. "But all of those point solutions were meant to work on their own. They weren't developed to work together. So, there's a lot of overlap. And in the case of fraud, there's a high likelihood that the multiple solutions are going to find the same fraud. So, you create a huge inefficiency." To solve this challenge, institutions need to shift to integrated identity platforms, such as Experian CrossCore®. Q: How is Experian trying to change the way organizations approach DDA fraud? Experian is pushing a paradigm shift for institutions that will increase fraud detection efficiency and accuracy, without sacrificing customer experience. "Organizations need to start thinking of identity through a different lens," Ryan says. Experian has developed an identity graph that aggregates consumer information in a manner that reaches far beyond what an institution can create on its own. "Experian is able to bring the entire breadth of every identity presentation we see into an identity graph," Ryan says. "It's a cross-industry view of identity behavior." This is important because people who commit fraud manipulate data, and those manipulations can get lost in a busy marketplace. For example, Ryan explains, if you're newly married, you may have recently presented your identity using two different surnames: one under your maiden name and one under your married name. Traditional data sources may show that your identity was presented twice, but they won’t accurately reflect the underlying details; like the fact that different surnames were used. The same holds true for thousands of other details seen at each presentation but not captured in a way that enables changes over time to be visible, such as information related to IP addresses, email accounts, online devices, or phone numbers. "Our identity graph is unlocking the details behind those identity presentations," Ryan says. "This way, when a customer comes to us with a DDA application, we can say, 'That's Chris's identity, and he's consistently presenting the same information, and all that underlying data remains very stable.'" This identity graph, part of Experian's suite of fraud management solutions — also connects unique identity details to known instances of fraud, helping catch fraudulent attempts much faster than traditional methods. "Let's say you and your spouse share an address, phone numbers, all the identity details that married couples typically share," Ryan explains. "If an identity thief steals your identity and uses it along with a brand-new email and IP address not associated with your spouse, that might be concerning. However, perhaps you started a new job, and the email/IP data is legitimate. Or maybe it’s a personal email using a risky internet service provider that shares a format commonly used by a known ring of identity thieves. Traditional data might flag the email and IP information as new, but our identity graph would go several layers deeper to confirm the possible risks that the new information brings. Q: Why is this approach superior to traditional methods of fraud detection? "Historically, organizations were interested in whether an identity was real,” Ryan says. "The next question was if the provided data (I.e., addresses, date of birth, Social Security numbers, etc.) have been historically associated with the identity. Last, the question would be whether there’s known risk associated with any of the identity components.” The identity graph turns that approach upside down. "The identity graph allows us to pull in insights from past identity presentations, " Ryan says. "Maybe the current presentation doesn’t include a phone number. Our identity graph should still recognize previously provided phone numbers and the risks associated with them. Instead of looking at identity as a small handful of pieces of data that were given at the time of the presentation, we use the data given to us to get to the identity graph and see the whole picture." Q: How are businesses applying this new paradigm? The identity graph is part of Experian's Ascend Fraud Platform™ and a full suite of fraud management solutions. Experian's approach allows companies to clean out fraud that already occurred and stop new fraudulent actors before they're onboarded. "Ideally, you want to start with cleaning up the house, and then figure out how to protect the front door," Ryan says. In other words, institutions can start by applying this view to recently opened accounts to identify problematic identities that they missed. The next step would be to bring these insights into the new account onboarding process. Q: Is this new fraud platform accessible to both small and large businesses? The Ascend Fraud Platform will support several use cases that will bring value to a broad range of businesses, Ryan explains. It can not only enable Experian experts to build and deliver better tools but can enable self-serve analytical development too. "Larger organizations that have robust, internal data science capabilities will find that it’s an ideal environment for them to work in," Ryan says. "They can add their own internal data assets to ours, and then have a better place to develop analytics. Today, organizations spend months assembling data to develop analytics internally. Our Ascend Fraud Platform will reduce the timeline of the data assembly and analytical development process to weeks, and speed to market is critical when confronting continually changing fraud threats. "But for customers who have less robust analytical teams, we're able to do that on their behalf and bring solutions out to the marketplace for them," Ryan explains. Q: What type of return on investment (ROI) are businesses experiencing? "Some customers recover their investment in days," Ryan says. "Part of this is from mitigating fraud risks among recently opened accounts that slipped through existing defenses.” "In addition to reducing losses, institutions we're working with are also seeing potentially millions of dollars a month in additional bookings, as well as significant cost savings in their account opening processes," Ryan says. "We're able to help clients go back and audit the people who had fallen out of their process, to figure out how to fine-tune their tools to keep those people in," Ryan says. “By reducing risks among existing accounts, better protecting the front door against future fraud, and growing more efficiently, we’re helping clients Q: What are Experian's plans for this service? "We're working with top-tier financial institutions on the do-it-yourself techniques," Ryan says. "In parallel, we're launching our first offerings that are created for the broader marketplace. That will start with the portfolio review capability, along with making the most predictive attributes available through our integrated identity resolution platform. And while the Ascend Fraud Platform has a strong use case for DDA fraud, its uses extend beyond that to small business lending and other products. In fact, Experian offers an entire suite of fraud management solutions to help keep your DDA accounts secure and your customers happy. Experian can help optimize your DDA fraud detection Experian is revolutionizing the approach to combating DDA fraud, helping institutions create a faster onboarding process that retains more customers, while also stopping more bad actors from gaining access. It's a win-win for everyone. Experian's full suite of fraud management solutions can optimize your business's DDA fraud detection, from scrubbing your current portfolio to gatekeeping bad actors before they're onboarded. Learn more Speak with a specialist About our expert: Chris Ryan has over 20 years of experience in fraud prevention and uses this knowledge to identify the most critical fraud issues facing individuals and businesses in North America, and he guides Experian’s application of technology to mitigate fraud risk.

Sometimes logging into an account feels a bit like playing 20 questions. Security is vital for a positive customer experience, and engaging the right identity verification strategies is essential to proactive fraud prevention. For financial institutions and businesses, secure authentication is more important than ever. It is imperative for customer safety – which drives retention and loyalty – and your bottom line – as fraud has determinantal effects on and off the balance sheet. Information sharing has proliferated, as has the number of times consumers are prompted to provide access to sensitive information. While today’s consumer has grown accustomed to providing such information, there’s also a heightened demand for security. According to Experian’s 2023 U.S. Identity and Fraud Report, nearly two-thirds (64%) of consumers say they’re very or somewhat concerned with online safety, listing identity theft, stolen card information and online privacy as top concerns. Customers want to know who they are providing access to and whether that entity will have their safety in mind. From a business perspective, one way to ensure that only the right people can get in is by using (KBA). KBA takes traditional authentication methods, like passwords and Personal Identification Numbers (PINs), one step further by creating an additional layer of security through collecting private facts from each user. In this post, we'll look at how KBA works, what its benefits are as a form of identity verification, and how it can improve customer trust. Introducing Knowledge Based Authentication (KBA): What it is and how it works Knowledge Based Authentication can be part of a multifactor authentication solution and is one way to stay on top of privacy and security for your customers – existing and new. KBA is a feature designed to protect online accounts by verifying the account holder’s identity. It involves answering a series of personal questions, such as mother's maiden name or first pet's name, that only the account holder should know. This system has become increasingly popular due to its effectiveness in preventing fraud and identity theft. With KBA, businesses and individuals can have peace of mind that their information is protected by a reliable authentication system that is difficult for unauthorized users to breach. Benefits of implementing KBA and a multifactor authentication strategy By implementing KBA into your business, customers experience an additional layer of security by verifying the identity of users through personalized questions. This reduces the risk of fraud and enhances customer trust and confidence. Secondly, it improves the customer experience by making the authentication process faster and user-friendly. Lastly, KBA reduces costs by automating the authentication process and reducing the need for manual intervention. However, KBA is just one facet of an ideal strategy. Multifactor authentication provides confidence while reducing friction. Risk-based authentication tools allow organizations to assess risk to apply the appropriate level of security. Factors to consider adding to your authentication processes include: Generating unique one-time passwords (OTPs): By creating a new OTP for each transaction, you can increase the level of security. Confirm device ownership: A multifactored approach applies device intelligence checks to increase confidence that the message is reaching the correct user. Maintain low friction with secondary options: If the OTP fails or can’t be attempted by the user, working with a provider who allows an automatic default to another authentication service, such as a knowledge-based authentication solution, decreases end-user friction. Identifying potential security risks associated with KBA KBA relies on personal information that may easily be discovered via social media and other public records, which makes it vulnerable to fraud and identity theft. This highlights the need for a multilayered fraud and identity solution. The landscape of digital security is constantly changing, leveraging an arsenal of fraud and identity prevention strategies, like document verification, one-time passcode, and various identity authentication and verification measures, is critical for keeping your customers and business safe. Commonly used technologies for enhancing KBA security With the rising need for secure authentication, KBA systems have become increasingly popular. However, cyberthreats evolve at an alarming rate, making it imperative to stay current with the latest fraud schemes and how to enhance and supplement your security. Biometrics, like facial recognition and fingerprint scans, as a tactic is gaining traction, as evidenced by “85% of consumers report physical biometrics as the most trusted and secure authentication method they have recently encountered,” according to Experian’s 2023 U.S. Identity and Fraud Report. Additionally, machine learning algorithms detect patterns and anomalies in user behavior and flag any potential security breaches. Multi-factor authentication is another tool that adds an extra layer of security by requiring users to provide multiple forms of identification before logging in. Keeping up with these and other technological advancements can help ensure your KBA system stays one step ahead of potential cyberattacks. Interestingly, there’s a disconnect between the technologies consumers feel safe with and/or are prepared to use versus the technologies and strategies that organizations implement. According to the U.S. Identity and Fraud Report, biometrics are only currently used by 33% of businesses to detect and protect against fraud. An opportunity for business differentiation and driving customer loyalty through a better customer experience may be tapping into some of these lesser used – but sought after – technologies. Compliance with industry standards regarding KBA Ensuring that your system complies with industry standards regarding KBA is crucial for protecting sensitive information from unauthorized access. By implementing the following tips, you can stay ahead of the game and safeguard your organization's data. Analyze your system's current authentication methods and evaluate if they meet industry standards. Additionally, follow standard guidelines for data storage and encryption, limit access to only authorized personnel, and y current with regulations. Lastly, conduct frequent security audits and perform vulnerability tests to identify and address any potential threats. Knowledge-based authentication offers a robust security solution for businesses of all sizes, and incorporating KBA as part of a multifactor authentication strategy is a winning course of action. It provides an added layer of protection for personal data, encourages user accountability, and safeguards against unauthorized access. By leveraging appropriate KBA technologies and maintaining compliance with industry standards, it is possible to create a secure system for customers that gives you peace of mind for your business and bottom line. Experian can help you with knowledge-based authentication offerings, a multifactor authentication strategy and everything in between to enhance your existing authentication process without causing user fatigue. Increase your pass rates, confirm device ownership and add security to risky or high-value transactions, all while executing identity verification and fraud detection to protect your business from risk. The most important step is getting started. Learn more

It's that magical time of the year! The holiday season is fast approaching, and folks everywhere are gearing up for festive travels and family reunions. Unfortunately, holiday travel can sometimes lead to unforeseen circumstances, such as fraudulent activities orchestrated by scammers who impersonate property owners on well-known vacation rental platforms. These fraudsters employ schemes designed to deceive unsuspecting travelers into making payments through unsecured channels, resulting in significant financial losses for the gullible victims. Digital identity and hotel fraud Airline and hotel fraud encompasses illicit activities aimed at airlines, hotels, booking platforms, and other travel accommodation services, including car rentals and excursions. These services often utilize loyalty programs to incentivize repeat patronage through point-based rewards. The widespread adoption of such loyalty programs has extended their appeal beyond the travel and hospitality sectors, consequently attracting fraudulent activities. Perpetrators of airline and hospitality fraud employ a range of tactics and different techniques to execute their schemes, leveraging various online forums, marketplaces, shops, and public messaging platforms. Hotels are custodians of valuable guest data, encompassing contact information and payment details. Their operational model involves serving a large pool of potential customers who are making limited visits. Consequently, compromising a hospitality employee's account could grant an identity thief access to millions of consumer records. Moreover, hotel employees are frequent targets of foreign governments aiming to procure confidential travel records to facilitate the tracking of specific individuals and groups. In contrast, restaurants primarily store transaction records with fewer customer details. However, the landscape is evolving as more establishments adopt online ordering capabilities and loyalty programs. At present, cybercriminals typically focus on the high volume of point-of-sale transactions. As travel booms, fraudsters find new paths According to a recent Deloitte survey, Intent to travel between Thanksgiving and mid-January is up across all age and income groups. While reconnecting with friends and family remains paramount to travel during the holidays, fewer Americans are restricting their travel to visiting loved ones. The share of travelers planning to stay in hotels surged to 56%. Fraudsters will always take advantage of current circumstances, and with more people traveling again, they have taken notice — and action. The following techniques have been identified as the most employed by cybercriminals to target customers of airlines, hotels, and hospitality-related organizations: Travel-themed phishing and fraudulent travel agency operations, sales, and advertisements of travel fraud-related tutorials. Sales of compromised networks, user accounts, and databases containing reward/loyalty points and personally identifiable information (PII) that could be utilized for social engineering, money laundering, and other attack vectors. Since the emergence of cyber-enabled crime, services and activities facilitating travel fraud have been extensively promoted and sought after by threat actors. Cybercriminals mainly leverage stolen card-not-present (CNP) data and reward/loyalty points obtained from compromised bank accounts to procure flights, accommodations, and other travel-related services. Furthermore, threat actors persistently refine their strategies for harvesting reward/loyalty points through compromised accounts, deceiving victims into disclosing their travel-related documentation and data and circulating updated guidelines for circumventing hotel and airline reservation services, amongst other activities. Protecting travelers and improving the customer experience Combatting hospitality and hotel fraud requires collaboration between industry stakeholders, government entities, and financial institutions. Travel professionals should focus on: Enhancing data security: Invest in robust cybersecurity measures to protect guest information, payment systems for CNP, and loyalty programs. Implementing identity verification: Utilize advanced technologies, such as biometric authentication and behavioral analytics, to verify guests' identities and prevent account fraud. Educating staff and guests: Provide comprehensive training to employees on recognizing and reporting suspicious activities. Educate guests about potential scams and advise them to book directly through official channels. Sharing information: Establish platforms to share intelligence and best practices to stay ahead of evolving fraud techniques. Acting with the right solution As the travel and hospitality industry continues to thrive, so does the risk of hospitality fraud. Travelers and hoteliers alike must remain vigilant to protect their finances from various fraud schemes prevalent today. By staying informed, taking proactive measures, and fostering collaborative efforts, we can create a safer and more secure environment within the travel industry. Experian’s identity verification solutions power advanced capabilities across the travel lifecycle. With trusted data and advanced analytics, you can gain a complete view of your future guest to improve risk management and offer an enhanced, frictionless customer experience. Learn more *This article leverages/includes content created by an AI language model and is intended to provide general information.

This article was updated on April 23, 2024. Keeping your organization and consumers safe can be challenging as cybercriminals test new attack vectors and data breaches continually expose credentials. Instead of relying solely on usernames and passwords for user identity verification, adding extra security measures like multi-factor authentication can strengthen your defense. What is multi-factor authentication? Multi-factor authentication, or MFA, is a method of authenticating people using more than one type of identifier. Generally, you can put these identifiers into three categories based on the type of information: Something a person knows: Usernames, passwords, and personal information are common examples of identifiers from this category. Something a person has: These could include a phone, computer, card, badge, security key, or another type of physical device that someone possesses. Something a person is: Also called the inherence factor, these are intrinsic behaviors or qualities, such as a person's voice pattern, retina, or fingerprint. The key to MFA is it requires someone to use identifiers from different categories. For example, when you withdraw money from an ATM, you're using something you have (your ATM card or phone), and something you know (your PIN) or are (biometric data) to authenticate yourself. Common types of authenticators Organizations that want to implement multi-factor authentication can use different combinations of identifiers and authenticators. Some authenticator options include: One-time passwords: One-time passwords (OTPs) can be generated and sent to someone's mobile phone via text to confirm the person has the phone or via email. There are also security tokens and apps that can generate OTPs for authentication. (Something you know.) Knowledge-based authentication: Knowledge-based authentication (KBA) identity verification leverages the ability to verify account information or a payment card, “something you have,” by confirming some sequence of numbers from the account. (Something you know.) Security tokens: Devices that users plug into their phone or computer, or hold near the device, to authenticate themselves. (Something you have.) Biometric scans: These can include fingerprint and face scans from a mobile device, computer, or security token. (Something you are.) Why MFA is important It can be challenging to keep your users and employees from using weak passwords. And even if you enforce strict password requirements, you can't be sure they're not using the same password somewhere else or accidentally falling for a phishing attack. In short, if you want to protect users' data and your business from various types of attacks, such as account takeover fraud, synthetic identity fraud, and credential stuffing, you’ll need to require more than a username and password to authenticate users. That’s where MFA comes in. Because it uses a combination of elements to verify a consumer’s identity, if one of the required components in a transaction is missing or supplied incorrectly, the transaction won’t proceed. As a result, you can ensure you’re interacting with legitimate consumers and protect your organization from risk. LEARN MORE: Explore our fraud prevention solutions. How to provide a frictionless MFA experience While crucial to your organization, in-person and online identity verification shouldn’t create so much friction that legitimate consumers are driven away. Experian's 2023 U.S. Identity and Fraud Report found that 96 percent of consumers view OTPs as convenient identity verification solutions when opening a new account. An increasing number of consumers also view physical and behavioral biometrics as some of the most trustworthy recognition methods — 81 and 76 percent, respectively. To create a low friction MFA experience that consumers trust, you could let users choose from different MFA authentication options to secure their accounts. You can also create step-up rules that limit MFA requests to riskier situations — such as when a user logs in from a new device or places an unusually large order. To make the MFA experience even more seamless for consumers, consider adding automated identity verification (AIV) to your processes. Because AIV operates on advanced analytics and artificial intelligence, consumers can verify their identities within seconds without physical documentation, allowing for a quick, hassle-free verification experience. How Experian powers multi-factor authentication Experian offers various identity verification and risk-based authentication solutions that organizations can leverage to streamline and secure their operations, including: Experian’s CrossCore® Doc Capture confidently verifies identities using a fully supported end-to-end document verification service where consumers upload an image of a driver’s license, passport, or similar directly from their smartphone. Experian’s CrossCore Doc Capture adds another layer of security to document capture with a biometric component that enables the individual to upload a “selfie” that’s compared to the document image. Experian's OTP service uses additional verification checks and identity scoring to help prevent fraudsters from using a SIM swapping attack to get past an MFA check. Before sending the OTP, we verify that the number is linked to the consumer's name. We also review additional attributes, such as whether the number was recently ported and the account's tenure. Experian's Knowledge IQSM offers KBA with over 70 credit- and noncredit-based questions to help you engage in additional authentication for consumers when sufficiently robust data can be used to prompt a response that proves the person has something specific in their possession. You can even configure it to ask questions based on your internal data and phrase questions to match your brand's language. Learn more about how our multi-factor authentication solutions can help your organization verify consumer identities and mitigate fraud. Learn about our MFA solutions

This article was updated on November 9, 2023. Fraud – it’s a word that comes up in conversations across every industry. While there’s a general awareness that fraud is on the rise and is constantly evolving, for many the full impact of fraud is misunderstood and underestimated. At the heart of this challenge is the tendency to lump different types of fraud together into one big problem, and then look for a single solution that addresses it. It’s as if we’re trying to figure out how to un-bake a terrible cake instead of thinking about the ingredients and the process needed to put them together in the first place. This is the first of a series of articles in which we’ll look at some of the key ingredients that create different types of fraud, including first party, third party, synthetic identity, and account takeover. We’ll talk about why they’re unique and why we need to approach each one differently. At the end of the series, we’ll get a result that’s easier to digest. I had second thoughts about the cake metaphor, but in truth it really works. Creating a good fraud risk management process is a lot like baking. We need to know the ingredients and some tried-and-true methods to get the best result. With that foundation in place, we can look for ways to improve the outcome every time. Let’s start with a look at the best known type of fraud, third party. What is third-party fraud? Third-party fraud – generally known as identity theft – occurs when a malicious actor uses another person’s identifying information to open new accounts without the knowledge of the individual whose information is being used. When you consider first-party vs third-party fraud, or synthetic identity fraud, third-party stands out because it involves an identifiable victim that’s willing to collaborate in the investigation and resolution, for the simple reason that they don’t want to be responsible for the obligation made under their name. Third-party fraud is often the only type of activity that’s classified as fraud by financial institutions. The presence of an identifiable victim creates a high level of certainty that fraud has indeed occurred. That certainty enables financial institutions to properly categorize the losses. Since there is a victim associated with it, third party fraud tends to have a shorter lifespan than other types. When victims become aware of what’s happening, they generally take steps to protect themselves and intervene where they know their identity has been potentially misused. As a result, the timeline for third-party fraud is shorter, with fraudsters acting quickly to maximize the funds they’re able to amass before busting out. How does third-party fraud impact me? As the digital transformation continues, more and more personally identifiable information (PII) is available on the dark web due to data breaches and phishing scams. Given that consumer spending is expected to increase1, we anticipate that the amount of PII readily available to criminals will only continue to grow. All of this will lead to identity theft and increase the risk of third-party fraud. More than $43 billion in total losses was reported due to identity theft and fraud in the U.S. in 2022.2 Solving the third-party fraud problem We’ve examined one part of the fraud problem, and it is a complex one. With Experian as your partner, solving for it isn’t. Continuing my cake metaphor, by following the right steps and including the right ingredients, businesses can detect and prevent fraud. Third-party fraud detection and prevention involves two distinct steps. Analytics: Driven by extensive data that captures the ways in which people present their identity—plus artificial intelligence and machine learning—good analytics can detect inconsistencies, and patterns of usage that are out of character for the person, or similar to past instances of known fraud. Verification: The advantage of dealing with third-party fraud is the availability of a victim that will confirm when fraud is happening. The verification step refers to the process of making contact with the identity owner to obtain that confirmation and may involve identity resolution. It does require some thought and discipline to make sure that the contact information used leads to the identity owner—and not to the fraudster. In a series of articles, we’ll be exploring first-party fraud, synthetic identity fraud, and account takeover fraud and how a layered fraud management solution can help keep your business and customers safe and manage third-party fraud detection, first-party fraud, synthetic identity fraud, and account takeover fraud prevention. Let us know if you’d like to learn more about how Experian is using our identity expertise, data, and analytics to create robust fraud prevention solutions. Contact us 1 Experian Ascend Sandbox 2 2023 U.S. Identity and Fraud Report, Experian.

For companies that regularly engage in financial transactions, having a customer identification program (CIP) is mandatory to comply with the regulations around identity verification requirements across the customer lifecycle. In this blog post, we will delve into the essentials of a customer identification program, what it entails, and why it is important for businesses to implement one. What is a customer identification program? A CIP is a set of procedures implemented by financial institutions to verify the identity of their customers. The purpose of a CIP is to be a part of a financial institution’s fraud management solutions, with similar goals as to detect and prevent fraud like money laundering, identity theft, and other fraudulent activities. The program enables financial institutions to assess the risk level associated with a particular customer and determine whether their business dealings are legitimate. An effective CIP program should check the following boxes: Confidently verify customer identities Seamless authentication Understand and anticipate customer activities Where does Know Your Customer (KYC) fit in? KYC policies must include a robust CIP across the customer lifecycle from initial onboarding through portfolio management. KYC solutions encompass the financial institution’s customer identification program, customer due diligence and ongoing monitoring. What are the requirements for a CIP? Customer identification program requirements vary depending on the type of financial institution, the type of account opened, and other factors. However, the essential components of a CIP include verifying the customer's identity using government-issued identification, obtaining and verifying the customer's address, and checking the customer against a list of known criminals, terrorists, or suspicious individuals. These measures help detect and prevent financial crimes. Why is a CIP important for businesses? CIP helps businesses mitigate risk by ensuring they have accurate and up-to-date information about their customers. This also helps financial institutions comply with laws and regulations that require them to monitor financial transactions for any suspicious activities. By having a robust CIP in place, businesses can establish trust and rapport with their customers. According to Experian’s 2024 U.S. Identity and Fraud Report, 63% of consumers say it's extremely or very important for businesses to recognize them online. Having an effective CIP in place is part of financial institutions showing their consumers that they have their best interests top of mind. Finding the right partner It’s important to find a partner you trust when working to establish processes and procedures for verifying customer identity, address, and other relevant information. Companies can also utilize specialized software that can help streamline the CIP process and ensure that it is being carried out accurately and consistently. Experian’s proprietary and partner data sources and flexible monitoring and segmentation tools allow you to resolve CIP discrepancies and fraud risk in a single step, all while keeping pace with emerging fraud threats with effective customer identification software. Putting consumers first is paramount. The security of their identity is priority one, but financial institutions must pay equal attention to their consumers’ preferences and experiences. It is not just enough to verify customer identities. Leading financial institutions will automate customer identification to reduce manual intervention and verify with a reasonable belief that the identity is valid and eligible to use the services you provide. Seamless experiences with the right amount of friction (I.e., multi-factor authentication) should also be pursued to preserve the quality of the customer experience. Putting it all together As cybersecurity threats are becoming more sophisticated, it is essential for financial institutions to protect their customerinformation and level up their fraud prevention solutions. Implementing a customer identification program is an essential component in achieving that objective. A robust CIP helps organizations detect, prevent, and deter fraudulent activities while ensuring compliance with regulatory requirements. While implementing a CIP can be complex, having a solid plan and establishing clear guidelines is the best way for companies to safeguard customer information and maintain their reputation. CIPs are an integral part of financial institutions security infrastructures and must be a business priority. By ensuring that they have accurate and up-to-date data on their customers, they can mitigate risk, establish trust, and comply with regulatory requirements. A sound CIP program can help financial institutions detect and prevent financial crimes and cyber threats while ensuring that legitimate business transactions are not disrupted, therefore safeguarding their customers' information and protecting their own reputation. Learn more

Signing new residents is not just about offering the right apartment home at the right price. Granted, that's obviously a huge part of the equation, but operators also need to provide prospective residents with a seamless shopping and leasing experience. If potential renters encounter any friction or hardships during this time, they are likely to take their home search elsewhere. Today's prospective renters want to be able to tour and gather information about apartments on their own time, and they want a quick "yes" or "no" after completing their lease application. With that in mind, automated income and employment verification - among other tools and solutions like self-guided and virtual tools, chatbots, and automated form fills, is one of the main features and technologies operators should consider implementing if they haven't already done so, to ensure we are meeting the renter where they are. Automated verification of identity, income, assets and employment For leasing managers, automated technology eliminates the need to manually collect the documents required to verify a prospect's self-reported information, which can be a tremendously time-consuming task that extends the overall leasing timeline and increases the exposure due to unoccupied units. Automated verification also reduces the opportunity for bad-faith applicants to submit fraudulent documents related to their financials or employment history. The best part about verification is the variety of options available; leasing managers can pick and choose verification options which meet their needs without breaking the tenant screening budget. Experian has multiple verification solutions and use cases to compare which one may work best for your community. The Experian difference To learn more about our suite of rental property solutions and ways we support the tenant screening process with data-driven insights, and verifications, please visit us at www.experian.com/rental. This article was originally published on MFI. Read more on MFI for a detailed look at additional tools and technologies operators should consider.