Rising balances and delinquency rates are causing lenders to proactively minimize credit risk through pre-delinquency treatments. However, the success of these types of account management strategies depends on timely and predictive data.

Credit attributes summarize credit data into specific characteristics or variables to provide a more granular view of a consumer’s behavior.

- Credit attributes give context about a consumer’s behavior at a specific point in time, such as their current revolving credit utilization ratio or their total available credit.

- Trended credit attributes analyze credit history data for consumer behavior patterns over time, including changes in utilization rates or how often a balance exceeded an account’s credit limit during the previous 12 months.

In a recent analysis, we found that credit attributes related to utilization were highly predictive of future delinquencies in bankcard accounts, with many lenders better managing their credit risk when incorporating these attributes into their account management processes.

READ: Find out how custom attributes and models can help you stay ahead of your competitors in the “Build a profitable portfolio with credit attributes” e-book.

Using attributes to manage credit risk

An enhanced understanding of credit attributes can be leveraged to manage risk throughout the customer lifecycle. They can be important when you want to:

- Improve credit strategies and efficiencies: Overlay attributes and incorporate them into credit policy rules, such as knockout criteria, to expand your lending population and increase automation without taking on more credit risk.

- Better understand customers’ credit trends: Experian’s wide range of credit data, including trended credit attributes, can help you quickly understand how consumers are faring off-book for visibility into other lending relationships and if they’ll likely experience financial stress in the future.

Credit attributes can also help precisely segment populations. For example, attributes can help you distinguish between two people who have similar credit risk scores — but very different trajectories — and will better determine who’s the least risky customer.

Predicting 60+ day delinquencies with credit attributes

To evaluate the effectiveness of credit attributes during account review, we looked at 2.9 million open and active bankcard accounts to see which attributes best predicted the likelihood of an account reaching 60 days past due.

For this analysis, we used snapshots of bankcard accounts that were reported in October 2022 and April 2023. Additionally, we analyzed the predictive power of over 4,000 attributes from Experian Premier AttributesSM and Trended 3DTM.

Key findings

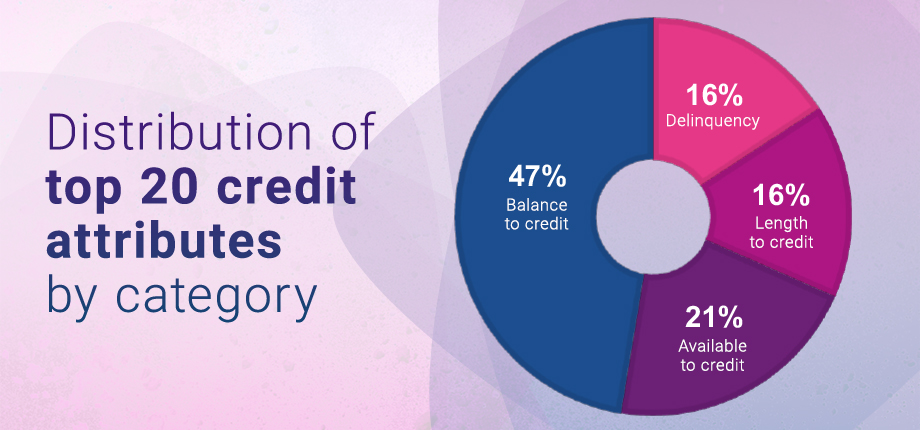

- Nine of the top 20 most predictive credit attributes were related to credit utilization rates.

- Delinquency-related attributes were predictive but weren’t part of the top 10.

- Three of the top 10 attributes were related to available credit.

Turning insight into action

While we analyzed credit attributes for account review, determining attribute effectiveness for other use cases will depend on your own portfolio and goals. However, you can use a similar approach to finding the predictive power of attributes.

Once you identify the most predictive credit attributes for your population, you can also create an account review program to track these metrics, such as changes in utilization rates or available credit balances. Using Experian’s Risk and Retention Triggers℠ can immediately notify you of customers’ daily credit activity to monitor those changes.

Ongoing monitoring of attributes and triggers can help you identify customers who are facing financial stress and are headed toward delinquency. You can then proactively take steps to reduce your risk exposure, prioritize accounts, and modify pre-collections strategy based on triggering events.

Experian offers credit attributes and the tools to use them

Creating and managing credit attributes can be a complex and never-ending task. You need to regularly monitor attributes for performance drift and to address changing regulatory requirements. You may also want to develop new attributes based on expanding data sources and industry trends.

Many organizations don’t have the resources to create, manage, and update credit attributes on their own. That’s where Experian’s 4,500+ attributes and tools can help to save time and money.

- Premier Attributes includes our core attributes and subsets for over 50 industries.

- Trended 3D attributes can help you better understand changes in consumer behavior and creditworthiness.

- Clear View AttributesTM offers insights from expanded FCRA data* that generally isn’t reported to consumer credit bureaus.

You can easily review and manage your portfolios with Experian’s Ascend Quest™ platform. The always-on access allows you to request thousands of data elements, including credit attributes, risk scores, income models, segmentation data, and payment history, at any time.

Use insights from the data and leverage Ascend Quest to quickly identify accounts that may be experiencing financial stress to limit your credit risk — and target others with retention and up-selling opportunities.

Watch the Ascend Quest demo to see it in action, or contact us to learn more about Experian’s credit attributes and account review solutions.