Credit Lending

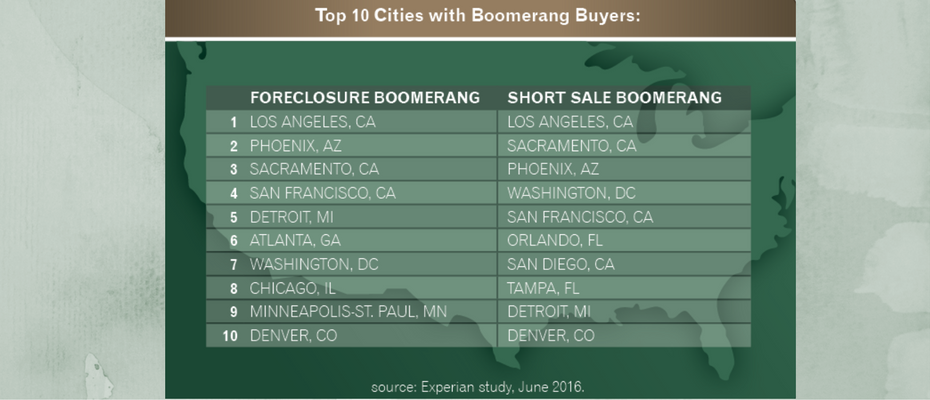

A recent Experian analysis shows that about 2.5 million consumers will have a foreclosure, short sale or bankruptcy fall off their credit report between June 2016 and June 2017 — with 68% of these consumers scoring in the near-prime or high credit segments. Additional highlights include: Nearly 29% of those who short-sold between 2007 and 2010 have opened a new mortgage. Delinquencies for this group are below the national average for bankcard and auto loan payments. More than 12% of those who foreclosed now have boomeranged (opened new mortgages). With millions of borrowers potentially re-entering the housing market, the trends are promising for both the mortgage seeker and the lender. Want to know more?

U.S. Communities national contract awarded to Experian to use their data and analytic solutions in order to enable state and local government agencies to help consumers and better serve their communities for the future.

Much has been written about Millennials over the past few years, and many continue to speculate on how this now largest living generation will live, age and ultimately change the world. Will they still aspire to achieve the “American Dream” of education, home and raising a family? Do they wish for something different? Or has the “Dream” simply been delayed with so many individuals saddled with record-high student loan debt? According to a recent study by Pew, for the first time in more than 130 years, adults ages 18 to 34 were slightly more likely to be living in their parents’ home than they were to be living with a spouse or partner in their own household. It’s no secret the median age of first marriage has risen steadily for decades. In fact, a growing share of young adults may be eschewing marriage altogether. Layer on the story that about half of young college graduates between the ages of 22 and 27 are said to be “underemployed”—working in a job that hasn’t historically required a college degree – and it’s clear if nothing else that the “American Dream” for many Millennials has been delayed. So what does this all mean for the world of homeownership? While some experts warn the homeownership rate will continue to decrease, others – like Freddie Mac – believe that sentiment is overly pessimistic. Freddie Mac Chief Economist Sean Becketti says, “The income and education gaps that are responsible for some of the differences may be narrowed or eliminated as the U.S. becomes a 'majority minority' country.” Mortgage interest rates are still near historic lows, but home prices are rising far faster than incomes, negating much of the savings from these low rates. Experian has taken the question a step further, diving into not just “Do Millennials want to buy homes” but “Can Millennials buy homes?” Using mortgage readiness underwriting criteria, the bureau took a large consumer sample and assessed Millennial mortgage readiness. Experian then worked with Freddie Mac to identify where these “ready” individuals had the best chance of finding homes. The two factors that had the strongest correlation on homeownership were income and being married. From a credit perspective, 33 percent of the sample had strong or moderate credit, while 50 percent had weak credit. While the 50 percent figure is startling, it is important to note 40 percent of that grouping consisted of individuals aged 18 to 26. They simply haven’t had enough time to build up their credit. Second, of the weak group, 31 percent were “near-moderate,” meaning their VantageScore® credit score is 601 to 660, so they are close to reaching a “ready” status. Overall, student debt and home price had a negative correlation on homeownership. In regards to regions, Millennials are most likely to live in places where they can make money, so urban hubs like Los Angeles, San Francisco, Chicago, Dallas, Houston, Boston, New York and DC currently serve as basecamp for this group. Still, when you factor in affordability, findings revealed the Greater New York, Houston and Miami areas would be good areas for sourcing Millennials who are mortgage ready and matching them to affordable inventory. Complete research findings can be accessed in the Experian-Freddie Mac co-hosted webinar, but overall signs indicate Millennials are increasingly becoming “mortgage ready” as they age, and will soon want to own their slice of the “American Dream.” Expect the Millennial homeownership rate of 34 percent to creep higher in the years to come. Brokers, lenders and realtors get ready.

In this age of content and increasing financial education available to all, most entities are familiar with credit bureaus, including Experian. They are known for housing enormous amounts of data, delivering credit scores and helping businesses decision on credit. On the consumer side, there are certainly myths about credit scores and the credit report. But myths exist among businesses as well, especially as it pertains to the topic of reporting credit data. How does it work? Who’s responsible? Does reporting matter if you’re a small lender? Let’s tackle three of the most common myths surrounding credit reporting and shine a light on how it really is essential in creating a healthy credit ecosystem. Myth No. 1: Reporting to one bureau is good enough. Well, reporting to one bureau is definitely better than reporting to none, but without reporting to all three bureaus, there could be gaps in a consumer’s profile. Why? When a lender pulls a consumer’s profile to evaluate it for extending additional credit, they ideally would like to see a borrower’s complete credit history. So, if one of their existing trades is not being reported to one bureau, and the lender makes a credit pull from a different bureau to use for evaluation purposes, no knowledge of that trade exists. In cases like these, credit grantors may offer credit to your customer, not knowing the customer already has an obligation to you. This may result in your customer getting over-extended and negatively impacting their ability to pay you. On the other side, in the cases of a thin-file consumer, not having that comprehensive snapshot of all trades could mean they continue to look “thin” to other lenders. The best thing you can do for a consumer is report to all three bureaus, making their profile as robust as it can be, so lenders have the insights they need to make informed credit offers and decisions. Some believe the bureaus are regional, meaning each covers a certain part of the country, but this is false. Each of the bureaus are national and lenders can report to any and all. Myth No. 2: Reporting credit data is hard. Yes, accurate and timely data reporting requires a few steps, but after you get familiar with Metro 2, the industry standard format for consumer data reporting, choose a strategy, and register for e-Oscar, the process is set. The key is to do some testing, and also ensure the data you pass is accurate. Myth No. 3: Reporting credit data is a responsibility for the big institutions –not smaller lenders and companies. For all lenders, credit bureau data is vitally important in making informed risk determinations for consumer and small business loans. Large financial institutions have been contributing to the ecosystem forever. Many smaller regional banks and credit unions have reported consistently as well. But just think how much stronger the consumer credit profile would be if all lenders, utility companies and telecom businesses reported? Then you would get a true, complete view into the credit universe, and consumers benefit by having the most comprehensive profile --- Bottom line is that when comprehensive data on consumer credit histories is readily available, it’s a good thing for consumers and lenders. And the truth is all businesses - big and small - can make this a reality.

Historically, the introduction of EMV chip technology has resulted in a significant drop in card-present fraud, but a spike in card-not-present (CNP) fraud. CNP fraud accounts for 60% to 70% of all card fraud in many countries and is increasing. Merchants and card issuers in the United States likely will see a rise in CNP fraud as EMV migration occurs — although it may be more gradual as issuers and merchants upgrade to chip-based cards. As fraud continues to evolve, so too should your fraud-prevention strategies. Make a commitment to stay abreast of the latest fraud trends and implement sophisticated, cross-channel fraud-prevention strategies. >>Protecting Growth Ambitions Against Rising Fraud Threats

Prescriptive solutions: Get the Rx for your right course of action By now, everyone is familiar with the phrase “big data” and what it means. As more and more data is generated, businesses need solutions to help analyze data, determine what it means and then assist in decisioning. In the past, solutions were limited to simply describing data by creating attributes for use in decisioning. Building on that, predictive analytics experts developed models to predict behavior, whether that was a risk model for repayment, a propensity model for opening a new account or a model for other purposes. The next evolution is prescriptive solutions, which go beyond describing or predicting behaviors. Prescriptive solutions can synthesize big data, analytics, business rules and strategies into an environment that provides businesses with an optimized workflow of suggested options to reach a final decision. Be prepared — developing prescriptive solutions is not simple. In order to fully harness the value of a prescriptive solution, you must include a series of minimum capabilities: Flexibility — The solution must provide users the ability to make quick changes to strategies to adjust to market forces, allowing an organization to pivot at will to grow the business. A system that lacks agility (for instance, one that relies heavily on IT resources) will not be able to realize the full value, as its recommendations will fall behind current market needs. Expertise — Deep knowledge and a detailed understanding of complex business objectives are necessary to link overall business goals to tactical strategies and decisions made about customers. Analytics — Both descriptive and predictive analytics will play a role here. For instance, the use of a layered score approach in decisioning — what we call dimensional decisioning — can provide significant insight into a target market or customer segment. Data — It is assumed that most businesses have more data than they know what to do with. While largely true, many organizations do not have the ability to access and manage that data for use in decision-making. Data quality is only important if you can actually make full use of it. Let’s elaborate on this last point. Although not intuitive, the data you use in the decision-making process should be the limiting factor for your decisions. By that, I mean that if you get the systems, analytics and strategy components of the equation right, your limitation in making decisions should be data-driven, and not a result of another part of the decision process. If your prescriptive environment is limited by gaps in flexibility, expertise or analytic capabilities, you are not going to be able to extract maximum value from your data. With greater ability to leverage your data — what I call “prescriptive capacity” — you will have the ability to take full advantage of the data you do have. Taking big data from its source through to the execution of a decision is where prescriptive solutions are most valuable. Ultimately, for a business to lead the market and gain a competitive advantage over its competitors — those that have not been able to translate data into meaningful decisions for their business — it takes a combination of the right capabilities and a deep understanding of how to optimize the ecosystem of big data, analytics, business rules and strategies to achieve success.

Experian conducted a joint-survey that uncovered insights into the topic of conversational commerce and voice assistants. The survey audience constituted nearly 1300 smartphone users of smart voice assistant tools. The survey asked about most requested tasks and general consumer satisfaction with the voice-recognition capabilities of Amazon's Alexa relative to other smart voice assistants such as Siri and Google.

The first six months of 2016 has shown that the total credit card limits among the subprime and deep subprime credit range totaled $6.4 billion, the highest amount reported for those groups in the last five years. Our Q2 2016 Experian-Oliver Wyman Market Intelligence Report webinar will analyze the trends impacting consumer credit decisions in the current economy. The data is from the latest Experian Market Intelligence Brief report.

Consumers want to pay less. This is true in retail and in lending. No big surprise, right? So in order for lenders to capitalize and identify the right consumers for their respective portfolios, they need insights. Lenders want to better understand what rates consumers have. They want to know how much interest their customers pay. They want to know if consumers within their portfolio are at risk of leaving, and they want visibility into new prospects they can market to in an effort to grow. Luckily, lenders can look to trade level fields to be in the know. These inferred data fields, powered by Trended Data, allow lenders to offer products and terms that serve two purposes: First, their use in response models and offer alignment strategies drive better performance, ROI and life-time value. As noted earlier, consumers want to pay less, so if they are offered a better rate or money-saving offer, they’re more likely to respond. Second, they ultimately save consumers money in a way that benefits each consumer’s unique financial situation- overall savings on interest paid over the life of the loan, or consolidation of other debt often combined for a lower monthly payment. These trade level fields allow lenders to dig into various trends and insights surrounding consumers. For example, Experian data can identify big spenders and transactors (those who pay off their purchases every month). Research reveals these individuals love to be rewarded for how they use credit, demanding rewards, airline miles or other goodies for the spending they do. They also really like to be rewarded with higher credit lines, whether they use the increased line or not. Fail to serve these transactors in the right way and lenders could be faced with lackluster performance in the form poor response rates, booking rates, activation rates and early attrition. Thus, a little trade level insight can go a long way in helping lenders personalize products, offers and anticipate future financial needs. Knowing the profitability of a customer across all of their accounts is important, and accessing this intelligence in a seamless way is ideal. The data exists. For lenders, it’s just a matter of unlocking it, making those small, but meaningful changes and keeping a pulse on the portfolio. Together, these strategies can help lenders keep their best customers and acquire new ones that stick around longer.

Consumer card balance transfer activity is estimated to be $35 billion to $40 billion a year. How do lenders identify these consumers before they make transfers? By using trended data. While extremely valuable, trended data is very complex and difficult to work with. For example, with 24 months of history on five fields, a single account includes 120 data points. That’s 720 data points for a consumer with six accounts on file and 72 million for a file with 100,000 consumers — not to mention the other data fields in the file. Trended data allows lenders to effectively predict where a consumer is going based on where they’ve been. And that can make all the difference when it comes to smart lending decisions. >>What is trended data?

As regulators continue to warn financial institutions of the looming risk posed by HELOCs reaching end of draw, many bankers are asking: Why should I be concerned? What are some proactive steps I can take now to reduce my risk? This blog addresses these questions and provides clear strategies that will keep your bank on track. Why should I be concerned? Just a quick refresher: HELOCs provide borrowers with access to untapped equity in their residences. The home is taken as collateral and these loans typically have a draw period from five to 10 years. At the end of the draw period, the loan becomes amortized and monthly payments could increase by hundreds of dollars. This payment increase could be debilitating for borrowers already facing financial hardships. The cascading affect on consumer liquidity could also impact both credit card and car loan portfolios as borrowers begin choosing what debt they will pay first. The breadth of the HELOC risk is outlined in an excerpt from a recent Experian white paper. The chart below illustrates the large volume of outstanding loans that were originated from 2005 to 2008. The majority of the loans that originated prior to 2005 are in the repayment phase (as can be seen with the lower amount of dollars outstanding). HELOCs that originated from 2005 to 2008 constitute $236 billion outstanding. This group of loans is nearing the repayment phase, and this analysis examines what will happen to these loans as they enter repayment, and what will happen to consumers’ other loans. What can you do now? The first step is to perform a portfolio review to assess the extent of your exposure. This process is a triage of sorts that will allow you to first address borrowers with higher risk profiles. This process is outlined below in this excerpt from Experian’s HELOC white paper. By segmenting the population, lenders can also identify consumers who may no longer be credit qualified. In turn, they can work to mitigate payment shock and identify opportunities to retain those with the best credit quality. For consumers with good credit but insufficient equity (blue box), lenders can work with the borrowers to extend the terms or provide payment flexibility. For consumers with good credit but sufficient equity (purple box), lenders can work with the borrowers to refinance into a new loan, providing more competitive pricing and a higher level of customer service. For consumers with good credit but insufficient equity (teal box), a loan modification and credit education program might help these borrowers realize any upcoming payment shock while minimizing credit losses. The next step is to determine how you move forward with different customers segments. Here are a couple of options: Loan Modification: This can help borrowers potentially reduce their monthly payments. Workouts and modification arrangements should be consistent with the nature of the borrower’s specific hardship and have sustainable payment requirements. Credit Education: Consumers who can improve their credit profiles have more options for refinancing and general loan approval. This equates to a win-win for both the borrower and lender. HELOCs do not have to pose a significant risk to financial institutions. By being proactive, understanding your portfolio exposure and helping borrowers adjust to payment changes, banks can continue to improve the health of their loan portfolios. Ancin Cooley is principal with Synergy Bank Consulting, a national credit risk management and strategic planning firm. Synergy provides a rangeof risk management services to financial institutions, which include loan reviews, IT audits, internal audits, and regulatory compliance reviews. As principal, Ancin manages a growing portfolio of clients throughout the United States.

Experian defines how businesses should approach Identity Relationship Management for identity and devices to enable better fraud protection through our latest perspective paper, The 3 Pillars of Identity Relationship Management: How organizations can reduce risk and increase engagement.

Ten years after homeowners took advantage of a thriving real-estate market to borrow against their homes, many are falling behind on payments, potentially leaving banks with millions of dollars in losses tied to housing. Most banks likely have homeowners with home-equity lines of credit (HELOCs) nearing end-of-draw within their portfolio, as more than $236 billion remain outstanding on loans originated between 2004 and 2007. The reality is many consumers are unprepared to repay their HELOCs. In 2014, borrowers who signed up for HELOCs in 2004 were 30 or more days late on $1.8 billion worth of outstanding balances just four months after principal payments began, reported RealtyTrac. That accounts for 4.3 percent of the balance on outstanding 2004 HELOCs. In practice, this is what an average consumer faces at end-of-draw: A borrower has $100,000 in HELOC debt. During the draw period, he makes just interest-only payments. If the interest rate is 6 percent, then the monthly payment is $500. Fast forward 10 years to the pay-down period. The borrower still has the $100,000 debt and five years to repay the loan. If the interest rate is 6 percent, then the monthly payment for principal and interest is $1,933 – nearly four times the draw payment. For many borrowers, such a massive additional monthly payment is unmanageable, leaving many with the belief that they are unable to repay the loan. The Experian study also revealed consumer behaviors in the HELOC end-of-draw universe: People delinquent on their HELOC are also more likely to be delinquent on other types of debt. If consumers are 90 days past due on their HELOC at end of draw, there is a 112 percent, 48.5 percent and 24 percent increase in delinquency on their mortgage, auto loan and credit cards, respectively People with HELOCs at end-of-draw are more likely to both close and open other HELOCs in the next 12 months That same group is also more likely to open or close a mortgage in the next 12 months. Now is the time to assess borrowers’ ability to repay their HELOC, and to give them solutions for repayment to minimize their payment stress. Identify borrowers with HELOCs nearing end of term and the loan terms to determine their potential payment stress Find opportunities to keep borrowers with the best credit quality. This could mean working with borrowers to extend the loan terms or providing payment flexibility Consider the opportunities. Consumers who have the ability to pay may also seek another HELOC as their loan comes to an end or they may shop for other credit products, such as a personal loan.

Fraudsters invited into bank branches The days of sending an invitation in the mail have for the most part gone by the wayside. Aside from special invitations for weddings and milestone anniversaries, electronic and email invitations have become the norm. However, one major party planner has refused to change practices — banks inviting fraudsters into their banking centers. As a fraud consultant I have the privilege of meeting many banking professionals, and I hear the same issues and struggles over and over again. It’s clear that the rapid increase of fraudulent account-opening applications are top of mind to many. What the executives making policy don’t realize is they’re facing fraud because they’re literally inviting the fraudsters into their branches. Think I’m exaggerating? Let me explain. I often encounter bank policymakers who explain their practice of directing a suspicious person into a banking center. Yes, many banks still direct applicants who cannot be properly verified over the phone or online into their banking center to show proof of identity. Directing or inviting criminals into your bank instead of trying to keep them out is an outdated, high-risk practice — what good can possibly come of it? The argument I typically hear from non-fraud banking professionals: “The bad guys know that if they come into the bank we will have them on film.” Other arguments include that the bad guys are not typically bold enough to actually come into the banking center or that their physical security guards monitor high-traffic banking centers. But often that is where bank policies and employee training ends. Based on my years of experience dealing with banks of all sizes, from the top three global card issuers to small regional banks, let me poke a few holes in the theory that it is a good deterrent to invite perpetrators into your banking center. Let’s role-play how my conversation goes: Me: “When an underwriter with limited fraud training making the decision to direct a suspicious applicant into a banking center, what is the policy criteria to do so?” Bank policymaker: (typical response) “What do you mean?” Me: “What high-risk authentication was used by the underwriter to make the decision to extend an invitation to a high-risk applicant to come into the banking center? If the applicant failed your high-risk authentication questions and you were not able to properly identify them, what authentication tools do the branch managers have that the underwriters do not?” Bank: “Nothing, but they can usually tell when someone is nervous or seems suspicious.” Me: “Then what training do they receive to identify suspicious behaviors?” (You guessed it …) Bank: “None.” (I then switch to the importance of customer experience.) Me: “How do you notify the banking center in advance that the suspicious applicant was invited to come in to provide additional verification?” Bank: “We do not have a policy to notify the banking center in advance.” Me: “What is considered acceptable documentation? And are banking center employees trained on how to review utility statements, state ID cards, drivers’ licenses or other accepted media?“ Bank: “We do not have a list of acceptable documentation that can be used for verification; it is up to the discretion of the banking center representative.” Me: “How do you ensure the physical safety of your employees and customers when you knowingly invite fraudsters and criminals into your banking center? How do you turn down or ask the suspicious person to leave because they do not have sufficient documentation to move forward with the original application for credit? If a suspicious person provides your employee with a possible stolen identification card, is that employee expected to keep it and notify police or return it to the applicant? Are employees expected to make a photocopy of the documentation provided?” The response that I usually receive is, “I am not really sure.” I hope by now you are seeing the risk of these types of outdated practices on suspicious credit applications. The fact is that technology has allowed criminals to make fairly convincing identification at a very low cost. If employees in banking centers are not equipped, properly trained, and well-documented procedures do not exist in your fraud program — perhaps it’s time to reconsider the practice or seek the advice of industry experts. I have spent two decades trying to keep bad guys out of banks, but I can’t help but wonder — why do some still send open invitations to criminals to come visit their bank? If you are not yet ready to stop this type of bad behavior, at the very least you must develop comprehensive end-to-end policies to properly handle such events. This fraud prevention tactic to invite perpetrators into banks was adopted long before the age of real-time decisions, robust fraud scores, big data, decision analytics, knowledge-based authentication, one-time passcodes, mobile banking and biometrics. The world we bank in has changed dramatically in the past five years; customers expect more and tolerate less. If a seamless customer experience and reducing account-opening and first-party fraud are part of your strategic plan, then it is time to consider Experian fraud solutions and consulting.

Time heals countless things, including credit scores. Many of the seven million people who saw their VantageScore® credit scores drop to sub-prime levels after suffering a foreclosure or short sale during the Great Recession have recovered and are back in the housing market. These Boomerang Buyers — people who foreclosed or short sold between 2007 and 2014 and have opened a new mortgage — will be an important segment of the real estate market in the coming years. According to Experian data, through June 2016 roughly 800,000 people had boomeranged, with Los Angeles, Phoenix, and Sacramento housing the most buyers. Some analysts believe more than three million Americans will become eligible for a home over the next three years. Are potential Boomerang Buyers a great opportunity to boost market share or a high risk for a portfolio? Early trends are positive. The majority of Boomerang Buyers who opened mortgages between 2011 and June 2016 are current on their debts. An Experian study revealed more than 29 percent of those who short sold have boomeranged, and just 1.5 percent are delinquent on their mortgage —falling below the national average of 2.8 percent. This group is also ahead of or even with the national average for delinquency on auto loans (1.2 percent vs. the national average of 2.2 percent), bankcards (3 percent vs. 4.3 percent) and retail (even at 2.7 percent). For those Boomerang Buyers who had foreclosed, the numbers are also strong. More than 12 percent have boomeranged, with just 3 percent delinquent on their mortgage. They also match or are below national average delinquency rates on auto loans (1.9 percent) and bankcards (4.1 percent), and have a slightly higher delinquency rate for retail (3.5 percent). Due to their positive credit behaviors, Boomerang Buyers also have higher VantageScore® credit scores than before. On average, the overall non-boomerang group’s credit score sunk during a foreclosure but went up 10 percent higher than before the foreclosure, and Boomerang Buyers rose by nearly 14 percent. For people who previously had a prime credit score, their number dropped by nearly 5 percent, while those who boomeranged returned to the score they had prior to the foreclosure. By comparison, the overall non-boomerang and boomerang group saw their credit score drop during a short sale and increase more than 11 percent from before the short sale. For people who previously had prime credit, they dropped 2 percent while those who boomeranged were almost flat to where they were before the short sale. Another part of the equation is the stabilized housing market and relatively low loan-to-value (LTV) limits that lenders have maintained. In the past, borrowers most often strategically defaulted on their mortgages when their LTV ratios were well over 100 percent. So as long as lenders maintain relatively low LTV limits and the housing market remains strong, strategic default is unlikely to re-emerge as a risk.