Experian estimates card-to-card consumer balance transfer activity to be between $35 and $40 billion a year, representing a sizeable opportunity for proactive lenders seeking to grow their revolving product line.

This opportunity, however, is a threat for reactive lenders that only measure portfolio attrition instead of working to retain current customers. While billions of dollars are transferred every year, this activity represents only a small percentage of the total card population. And given the expense of direct marketing, lenders seeking to capitalize on and protect their portfolio from balance transfer activity must leverage data insights to make more informed decisions.

Predicting a consumer’s future propensity to engage in card-to-card balance transfers starts with trended data. A credit score is a snapshot in time, but doesn’t reveal deep insights about a consumer’s past balance transfer activity. Lenders that rely only on current utilization will group large populations of balance revolvers into one bucket – and many of these individuals will have no intention of transferring to another product in the near future.

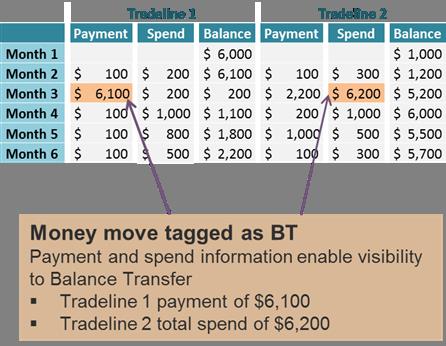

Still, balance transfer activity can be identified and predicted by utilizing trended data. By analyzing the spend and payment data over time to see when one (or multiple) trade’s payment approximately matches another trade’s spend, we have the logic that suggests there has been a card-to-card transfer.

What most people don’t realize is that trended data is difficult to work with. With 24 months of history on five fields, a single trade includes 120 data points. That’s 720 data points for a consumer with six trades on file and 72,000,000 for a file with 100,000 records, not to mention the other data fields in the file.

It’s easy to see why even the most sophisticated organizations become paralyzed working with trended data. While teams of analysts get buried in the data, projects drag, costs swell, and eventually the world changes as rates climb and fall. By the time the analysis is complete, it must be recalibrated.

But there is a solution.

Experian has developed powerful predictions tools that combine past balance transfer history, historical transfer amounts, current trades carried and utilized, payments, and spend. Combined, these data fields can help identify consumers who are most likely to transfer a balance in the future. With Experian’s Balance Transfer Index the highest scoring 10 percent of consumers capture nearly 70 percent of total balance transfer dollars. Imagine the impact on ROI of reducing 90 percent of the marketing cost of your next balance transfer campaign and still reaching 70 percent of the balance transfer activity.

Balance transfer activity represents a meaningful dollar opportunity for growth, but is concentrated in a small percentage of the population making predictive analytics key to success. Trended data is essential for identifying those opportunities, but financial institutions must assess their capabilities when it comes to managing the massive data attached.

The good news is that regardless of financial institution size, solutions now exist to capture the analytics and provide meaningful and actionable insights to lenders of all sizes.