By: Joel Pruis

Part I – New Application Volume and the Business Banker:

Generating small business or business banking applications may be one of the hottest topics in this segment at this time. Loan demand is down and the pool of qualified candidates seems to be down as well. Trust me, I am not going to jump on the easy bandwagon and state that the financial institutions have stopped pursuing small business loan applications. As I work across the country, I have yet to see a financial institution that is not actively pursuing small business loan applications. Loan growth is high on everyone’s priority and it will be for some time.

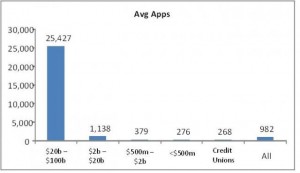

But where have all the applicants gone? Based upon our data, the trend in application volume from 2006 to 2010 is as follows:

Chart displays 2010 values:

So at face value, we see that actually, overall applications are down (1,032 in 2006 to 982 in 2010) while the largest financial institutions in the study were actually up from 18,616 to 25,427. Furthermore the smallest financial institutions with assets less than $500 million showed a significant increase from 167 to 276. An increase of 65% from the 2006 levels!

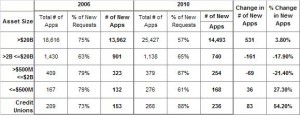

But before we get too excited, we need to look a little further. When we are talking about increasing application volume we are focusing on applications for new exposure or a new extension of credit and not renewals. The application count in the above chart includes renewals. So let’s take a look at the comparison of New Request Ratio between 2006 and 2010.

Chart displays 2010 values:

So using this data in combination with the total application count we get the following measurements of new application volume in actual numbers.

So once we get under the numbers, we see that the gross application numbers truly don’t tell the whole story. In fact we could classify the change in new application volume as follows:

So why did the credit unions and community banks do so well while the rest held steady or dropped significantly? The answer is based upon a few factors:

Field Resources pursuing Small Business Applications

The Business Banker

Focus. Focus. Focus. The success of the small business segment depends upon the focus of the field pursuing the applications. As we move up in the asset size of the financial institution we see more dedicated field resources to the Small Business/Business Banking segment. Whether these roles are called business bankers, small business development officers or business banking specialists, the common denominator is that they are dedicated to the small-business/ business banking space. Their goals depend on their performance in this segment and they cannot pursue other avenues to achieve their targets or goals.

When we start to review the financial institutions in the less than $20B segment, the use of a dedicated business banker begins to diminish. Marketing segments and/or business development segmentation is blurred at best and the field resource is better characterized as a Commercial Lender or Commercial Relationship Manager. The Commercial Lender is tasked with addressing the business lending needs across a particular region. Goals are based upon total dollars generated and there is no restriction outside of the legal or in house lending limit of the specific financial institution. In this scenario, the notion of any focus on small business is left to the individual commercial lender. You will find some commercial lenders that truly enjoy and devote their efforts to the small business/business banking space. These individuals enjoy working with the smaller business for a variety of reasons such as the consultative approach (small businesses are hungry for advice while the larger businesses tend to get their advice elsewhere) or the ability to use one’s lending authority. Unfortunately while your financial institution may have such commercial lenders (one’s that are truly working solely in the small business or business banking segment) to change that individual’s title or formally commit them to working only in the small business/business banking segment is often perceived as a demotion. It is this perception that continues to hinder the progress of financial institutions with assets between $500 million and $20 billion from truly excelling in the small business/business banking space.

Reality is that the best field resource to generate the small business/business banking application volume available to your financial institution is through the dedicated individual known as the Business Banker. Such an individual is capable of generate up to 250 applications (for the truly high performing) per year. Even if we scale this back to 150 applications in a given year for new credit volume at an average request of $106,929 (the lowest dollar of the individual peer groups), the business banker would be generating total application dollars of $16,039,350. If we imply a 50% approval/closure rate, the business banker would be able to generate a total of $8,019,675 in new credit exposure annually. Such exposure would have the potential of generating a net interest margin of $240,590 assuming a 3% NIM. Not too bad.