Between November 2022 and September 2023, St. Luke’s University Health Network (SLUHN) saw a 22% uplift in self-pay collections, amounting to an additional $1.2 million in average monthly collections. What makes this particularly noteworthy is that they achieved this during ongoing staffing shortages. It’s an encouraging result for providers facing similar challenges, so how did they do it?

On a recent webinar with Experian Health, Cindy Samuels, Senior Manager of Patient Revenue Services at St. Luke’s, and Rich Wade, Strategic Product Consulting Director at Experian Health (and the Patient Revenue Services team’s designated consultant), share how Collections Optimization Manager and PatientDial allowed St. Luke’s to automate and optimize their collections efforts.

How staffing shortages wreak havoc on the collections process

Revenue cycle managers are all too familiar with the downward trend in collections recoveries over the last few years, which is exacerbated by labor shortages and rising self-pay balances. In Experian Health’s August 2023 survey, Short-Staffed for the Long Term, 100% of respondents said that staffing shortages had affected revenue cycle management. Many reported that resource shortages in patient collections made it harder to follow up on late payments or help patients who were struggling to pay.

With six vacancies in their own Patient Revenue Services team, St. Luke’s needed a way to improve efficiency. Cindy Samuels says, “more and more dollars were falling to the patient. I had a team of folks making outbound phone calls to collect outstanding dollars, but staff were leaving messages all day long and our cash wasn’t increasing. Outsourcing wasn’t an option that we wanted to pursue, so we looked at technology automation.”

Since St. Luke’s were already using Experian products in other parts of the revenue cycle, replacing their outdated call center platform with an Experian Health solution made sense.

Developing a successful strategy for collecting self-pay balances

To handle increasing self-pay balances with limited staff resources, St. Luke’s used Collections Optimization Manager to generate a daily accounts receivable (AR) file and then screen, segment and monitor accounts so they could be managed in the most efficient way. Samuels explains:

“Every active self-pay account goes through [Experian’s] scrubbing system, so they’re finding medical assistance, presumptive charity, deceased bankruptcy, and other types of insurance. So, we know to set those accounts aside. The rest are segmented into five segments [based on propensity to pay] so I know where to put my resources when it comes to reaching out to patients.”

With the help of an Experian Health consultant, Collections Optimization Manager users can then implement specific collections strategies that are tailored to each segment. For St. Luke’s, this included automating patient calls using PatientDial, a cloud-based call system that facilitates inbound, outbound and blended call environments to help collect patient balances. The combination of segmentation and automation allows St. Luke’s to have multiple call campaigns running at once, so more patients can be contacted and in a way that is more likely to lead to payment.

Maximizing collections by shifting focus from “high dollar” to “ability to pay”

Typically, collections teams focus on aged accounts with the highest dollar amounts. Unfortunately, this can result in staff chasing accounts that are unlikely to be paid. Collections Optimization Manager’s segmentation strategy means accounts are sorted according to likelihood of payment, and treated in a way that is more likely to yield results without wasting staff time.

With Collections Optimization Manager and Patient Dial, patients that are more likely to pay can be allocated to an unassisted call campaign and given an automated reminder about their balance at the appropriate time. It may not make sense to have staff spend time calling patients at the other end of the spectrum who are unable to pay or even engage with the process. An automated message with information about financial assistance may be a more appropriate approach.

St. Luke’s focused their resources on the segments in the middle, who are likely to be engaged but may have specific issues to resolve, such as needing details of payment plans or updating a credit card. This approach has helped the team reach more patients than ever and maintain an abandon rate of below 1.2%.

Samuels says, “not only have we been able to collect more cash, but we’ve also been able to resolve more accounts, because with segmentation we’ve been able to clean up the AR that don’t belong in the collections world. We can also help patients go down the financial assistance road if that’s what they need. So maybe not every call results in cash, but at least we’ve been able to speak to patients and help them resolve any questions or concerns.”

Boosting staff efficiency through automation

Around 90% of St. Luke’s Patient Services Team work remotely. This adds a new challenge for managers, who need to be sure that staff have the information they need to work confidently and effectively, while being able to monitor workloads and maintain productivity levels.

While the increase in call volumes and collections speaks to the boost in productivity, PatientDial’s reporting function has made it possible to generate a scorecard for each representative to measure performance. This allowed Samuels to identify potential training needs and foster knowledge exchange, especially when remote working means staff can’t simply ask the person next to them for help.

Samuels says her staff have welcomed the ability to handle more calls, more efficiently, without having to redial patients several times. PatientDial provides user-friendly dashboards, so call center agents have all the necessary details at their fingertips. Staff have said they find it motivating to be able to help more patients, which is reflected in high employee satisfaction scores in St. Luke’s annual employee engagement survey.

A snapshot of success

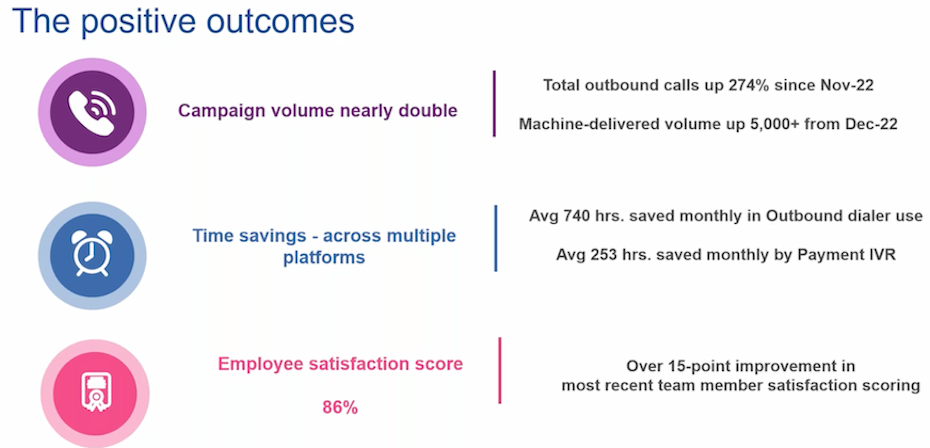

In addition to increasing average monthly collections by $1.7 million in a little under a year, St. Luke’s has seen the following results:

“We have increased our outbound call volume by 274% since last November, so we’re reaching more patients. If we’re not reaching them, we’re leaving more messages. The dialer has also saved 740 hours monthly because staff are no longer dialing numbers and getting nothing. And we’re using an interactive voice response (IVR) campaign for payments, so we’ve saved around 253 hours each month, because patients make their payment electronically over the phone with no need to speak with a representative. It was a very positive thing for us.”

Cindy Samuels provides more details of their approach on the webinar, plus her tips for others who may be considering implementing Collections Optimization Manager and PatientDial in future.

Watch the webinar for full details on how St. Luke’s increased collections despite staffing shortages, or contact us to learn how Experian Health can help optimize your collections efforts.