Tag: credit score

This article was updated on February 12, 2024. The Buy Now, Pay Later (BNPL) space has grown massively over the last few years. But with rapid growth comes an increased risk of fraud, making "Buy Now, Pay Never" a crucial fraud threat to watch out for in 2024 and beyond. What is BNPL? BNPL, a type of short-term financing, has been around for decades in different forms. It's attractive to consumers because it offers the option to split up a specific purchase into installments rather than paying the full total upfront. The modern form of BNPL typically offers four installments, with the first payment at the time of purchase, as well as 0% APR and no hidden fees. According to an Experian survey, consumers cited managing spending (34%), convenience (31%), and avoiding interest payments (23%) as main reasons for choosing BNPL. Participating retailers generally offer BNPL at point-of-sale, making it easy for customers to opt-in and get instantly approved. The customer then makes a down payment and pays off the installments from their preferred account. BNPL is on the rise The fintech and online-payment-driven world is seeing a rise in the popularity of BNPL. According to Experian research, 3 in 4 consumers have used BNPL in 2023, with 11% using BNPL weekly to make purchases. The interest in BNPL also spans generations — 36% of Gen Z, 43% of Millennials, 32% of Gen X, and 12% of Baby Boomers have used this payment method. The risks of BNPL While BNPL is a convenient, easy way for consumers to plan for their purchases, experts warn that with lax checkout and identity verification processes it is a target for digital fraud. Experian predicts an uptick in three primary risks for BNPL providers and their customers: identity theft, first-party fraud, and synthetic identity fraud. WATCH: Fraud and Identity Challenges for Fintechs Victims of identity theft can be hit with charges from BNPL providers for products they have never purchased. First-party and synthetic identity risks will emerge as a shopper's buying power grows and the temptation to abandon repayment increases. Fraudsters may use their own or fabricated identities to make purchases with no intent to repay. This leaves the BNPL provider at the risk of unrecoverable monetary losses and can impact the business' risk tolerance, causing them to narrow their lending band and miss out on properly verified consumers. An additional risk lies with fraudsters who may leverage account takeover to gain access to a legitimate user's account and payment information to make unauthorized purchases. READ: Payment Fraud Detection and Prevention: What You Need to Know Mitigating BNPL risks Luckily, there are predictive credit, identity verification, and fraud prevention tools available to help businesses minimize the risks associated with BNPL. Paired with the right data, these tools can give businesses a comprehensive view of consumer payments, including the number of outstanding BNPL loans, total BNPL loan amounts, and BNPL payment status, as well as helping to detect and apply the relevant treatment to different types of fraud. By accurately identifying customers and assessing risk in real-time, businesses can make confident lending and fraud prevention decisions. To learn more about how Experian is enabling the protection of consumer credit scores, better risk assessments, and more inclusive lending, visit us or request a call. And keep an eye out for additional in-depth explorations of our Future of Fraud Forecast. Learn more Future of Fraud Forecast

If you’re a manager at a business that lends to consumers or otherwise extends credit, you certainly are aware that 10-15% of your current customers and prospective future customers are among the approximately 27 million consumers who are now – or will soon be -- fitting another bill into their monthly budgets. Early in the COVID-19 pandemic, the government issued a pause on federal student loan payments and interest. Now that the payment pause has expired, millions of Americans face a new bill averaging more than $200. Will they pay you first? If this is your concern, you aren’t alone: Experian recently held a webinar that discussed how the end of the student loan pause might affect businesses. When we surveyed the webinar attendees, nearly 3 out of 4 responses included Risk Management as a main concerns now. Another top concern is about credit scores. Lenders and investors use credit scores – bureau scores such FICO® or VantageScore® credit score or custom credit scores proprietary to their institution – to predict credit default risk. The risk managers at those companies want to know to what extent they can continue to rely on those scores as Federal student loan payments come due and consumers experience payment shock. I’ve analyzed a large and statistically meaningful sample (10% of the US consumer population in Experian’s Ascend Sandbox) to shed some light on that question. As background information, the average consumer with student loans had lower scores before the pandemic than the average of the general population. One of my Experian colleagues has explored some of the reasons at https://www.experian.com/blogs/ask-experian/research/average-student-loan-payments). Here are some of the things we can learn from comparing the credit data of the two groups of people. I looked at a period from 2019 and from 2023 to see how things have changed: Average credit scores increased during the pandemic, continuing a long-term trend during which more Americans have been willing and able to meet all their obligations. During the COVID Public Health Emergency, consumers with student loans brought up their scores by an average of 25 points; that was 7 points more than consumers without student loans. Another way to look at it: in 2019, consumers with student loans had credit scores 23 points lower than consumers without. By 2023, that difference had shrunk to 16 points. Experian research shows that there will be little immediate impact on credit scores when the new bills come due. Time will tell whether these increased credit scores accurately reflect a reduction in the risk that consumers will default on other bills such as auto loans or bankcards soon, even as some people fit student loan bills into their budgets. It is well-known that many people saved money during the public health emergency. Since then, the personal savings rate has fallen from a pandemic high of 32% to levels between 3% and 5% this year – lower than at any point since the 2009 recession. In an October 2023 Experian survey, only 36% of borrowers said they either set aside funds or they planned using other financial strategies specifically for the resumption of their student loan payments. Additional findings from that study can be found here. Furthermore, there are changes in the way your customers have used their credit cards over the last four years: Consumers’ credit card balances have increased over the last four years. Consumers with student loans have balances that are on average $282 (4%) more now than in 2019. That is a significantly smaller increase than for consumers without student loans, whose total credit card debt increased by an average of $1,932 (26%). Although their balances increased, the ratio of consumers’ total revolving debt balances to their credit limits (utilization) changed by less than 1% for both consumers with student loans and consumers without. In 2019, the utilization ratio was 9.8 percentage points lower for consumers with student loans than consumers without. Four years later, the difference is nearly the same (9.6 points). We can conclude that many student loan borrowers have been very responsible with credit during the Public Health Emergency. They may have been more mindful of their credit situation, and some may have planned for the day when their student loan payments will be due. As the student loan pause come to an end, there are a few things that lenders and other businesses should be doing to be ready: Even if you are not a student loan lender, it is important to stay on top of the rapidly evolving student loan environment. It affects many of your customers, and your business with them needs to adapt. Anticipate that fraudsters and abusers of credit will be creative now: periods of change create opportunities for them and you should be one step ahead. Build optimized strategies in marketing, account opening, and servicing. Consider using machine learning to make more accurate predictions. Those strategies should reflect trends in payments, balances, and utilization; older credit scores look at a single point in time. Continually refresh data about your customers—including their credit scores and important attributes related to payments, balances, and utilization patterns. Look for alternative data that will give you a leg up on the competition. In the coming weeks and months, Experian’s data scientists will monitor measures of performance of the scores and attributes that you depend on in your data-driven strategies — particularly focusing on the Kolmogorov-Smirnov (KS) statistics that will show changes in the predictive power of each score and attribute. (If you are a data-driven business, your data science team or a trusted partner should be doing the same thing with a more specific look at your customer base and business strategies.) In future reports and blog posts, we’ll shed light on the impact student loans are having on your customers and on your business. In the meantime, for more information about how to use data and advanced analytics to grow while controlling costs and risks, all while staying in compliance and providing a good customer experience, visit our website.

Generation Z, or people born between 1997 and 2012, make up about 27% of the American population[1] and have $360B in disposable income[2]. While they may be a young demographic now, Gen Z will soon represent a significant portion of buyers and borrowers in the United States, creating an enormous opportunity for financial institutions to start engaging with them now. Here are three reasons why you should be marketing financial services to Gen Z. Improving financial wellness is a priority for Gen Z Gen Z is a pragmatic cohort of consumers, but they’re also uncertain and anxious about their financial future. The top concern amongst Gen Z is the cost of living. For these reasons, businesses have a unique opportunity to help those consumers feel less stressed and more confident by providing them with financial services. This can turn those consumers into loyal, long-standing customers. Gen Z has the lowest credit score of any generation Gen Z ranks lowest in average and median VantageScore® credit score* compared to all other generations, including Gen Y (or millennials), Gen X, and baby boomers.[4] While this is partially due to Gen Z being younger than the others, it’s also a result of having shorter credit histories and fewer lines of credit. This presents a great chance for businesses to help Gen Z individuals establish responsible financial habits, such as opening a new line of credit to begin building a healthy credit history. Gen Z is actively seeking support now Consumers in the Gen Z age range recognize the importance of personal finance, but they also realize that they don’t have the knowledge needed to be successful. While people in Gen Z are still young (currently between the ages of about 11 and 26), many need guidance now for their financial wellness and many need help to keep their financial future secure. This means now is the perfect time to start building a lifetime relationship with them and become a trusted advisor by providing financial products and services to help them through their financial journey. There are about 72 million Americans in the Gen Z demographic[1]. A large percentage of this group may feel strongly about improving their financial wellness. With high levels of financial stress and generally low credit scores, many of them are looking for companies they can trust to help them build good credit and take control of their personal finances. Since 2019, the number of consumers under the age of 30 enrolled in Experian Partner Solutions credit monitoring and identity protection services has doubled from 9% to 18%. Offering these financial tools to Gen Z is essential to building their trust and financial wellness, which can lead to an increase in future acquisition, retention, and revenue for your business. Click here to learn more *Calculated on the VantageScore® model. Your VantageScore® credit score from Experian® indicates your credit risk level and is not used by all lenders, so don’t be surprised if your lender uses a score that’s different from your VantageScore® credit score. Click here to learn more. [1] Insider Intelligence. 2023. Generation Z News: Latest characteristics, research, and facts. [2] Forbes. 2022. As Gen Z’s Buying Power Grows, Businesses Must Adapt Their Marketing. [3] Deloitte. Deloitte Gen Z and Millennial Survey 2022. Jan 2022. [4] Experian State of Credit Report. 2021. [5] Greenlight Financial Technology, Inc. Survey finds Gen Z lacks knowledge and confidence in personal finance and investing. 2021. [6] NAPFA. NAPFA Survey on Americans’ sources for financial planning and retirement investing advice. 2021.

Recent statistics certainly illustrate why many renters are feeling anxious lately. More than 40% of renter households in the U.S. — that’s 19 million households — spent more than 30% of their total income on housing costs during the 2017–2021 period, according to the U.S. Census Bureau’s new American Community Survey (ACS). Households that spend more than 30% of their income on housing costs — including rent or mortgage payments, utilities, and other fees — are considered “housing cost burdened” by the U.S. Department of Housing and Urban Development. Digging a little deeper, nearly 8% of the nation’s 3,143 counties had a median housing cost ratio for renters above 30% during the five-year period, according to ACS, and nearly a third of all U.S. renters lived in these counties. Unsurprisingly, 60% of Americans say they’re “very concerned” about the cost of housing, according to the Pew Research Center. The financial plight of renters today underscores the importance of incorporating renter payment history into screening efforts. It also indicates why reporting positive rent payments to credit bureaus can be such a powerful amenity. Rental data: The key to optimizing the screening process Simply put, a screening process that includes an applicant’s rental payment history provides a more comprehensive understanding of their risk profile and likelihood of paying rent on time and in full. That’s especially critical in an environment when paying rent can be something of a financial burden for many. Wouldn’t an apartment manager want to make a leasing decision by taking into consideration every possible bit of relevant data, especially the most relevant data available — rental payment history? Credit scores are often at the heart of an operator’s screening process. A credit score can give a very general sense of the risk posed by a prospect, but it doesn't provide crystal-clear insight into the likelihood of an applicant paying their rent on time and in full. Even people who are financially responsible and diligent about paying their rent can find themselves with less-than-ideal credit scores. Maybe they were injured in an accident, came down with a serious illness or lost their job, and then suffered a host of financial consequences that harmed their credit score. It can't be assumed people who have been through these situations won't pay their rent on time. At the same time, especially given the burden rent payments pose for many renters, reporting positive payments to credit bureaus can serve as an effective way to attract residents. Unfortunately, unlike homeowners, apartment residents traditionally have not seen a positive impact on their credit reports for making their rent payments on time and in full, even though these payments can very large and usually make up their largest monthly expense. Rental reporting According to the Credit Builders Alliance (CBA), renters are seven times more likely to be credit invisible — meaning they lack enough credit history to generate a credit score — when compared to homeowners. But by reporting their on-time rent payments to credit bureaus, apartment communities can help renters build their credit histories, which can make it easier for them to do things such as secure a car loan or credit card — and to do so at favorable interest rates. Additionally, rent reporting gives residents a strong incentive to pay their rent on time and in full. And it can provide apartment communities with a competitive advantage since this financial amenity is not widespread throughout the rental-housing industry. The data is clear: this is a challenging time for many renters. But by making rental payment histories part of their screening, operators can minimize their risk. And by reporting positive rental payments, they can attract residents and help them build a better financial future. To learn more about Experian’s largest rental payment database and how to start reporting with us, visit us online. Experian RentBureau™

Experian’s State of the Automotive Finance Market Report: Q3 2022 found that consumers with credit scores between 300 and 660—also considered as the nonprime segments—are continuing to opt for used vehicles rather than new.

Millions of consumers are excluded from the credit economy, whether it’s because they have limited credit history, dated information within their credit file, or are a part of a historically disadvantaged group. Without credit, it can be difficult for consumers to access the tools and services they need to achieve their financial goals. This February, Experian surveyed over 1,000 consumers across census demographics, including income, ethnicity, and age, to understand the perceptions, needs, and barriers underserved communities face along their credit journey. Our research found that: 75% of consumers with an average household income of less than $50,000 have less than $1,000 in savings. 1 in 5 consumers with an average household income of less than $35,000 say they’re confident in getting approved for credit. 80% of respondents who are not or slightly confident in getting approved for credit were women. When asked why they believed they would not get approved for credit, participants shared common responses, such as having poor payment history, a low credit score, and insufficient income. Given these findings, what can lenders provide to help underserved consumers strengthen their financial profiles and gain access to the credit they need and deserve? The power of credit education While only 20% of respondents were familiar with credit education tools, the majority expressed interest in these offerings. With Experian, lenders can develop and implement credit education programs, tools, and solutions to help consumers understand their credit and the impact certain choices can have on their credit scores. From interactive tools like Score Simulator and Score Planner to real-time alerts from Credit Monitoring, consumers can actively assess their financial health, take steps to improve their creditworthiness, and ultimately become better candidates for credit offers. In turn, consumers can feel more confident and empowered to achieve their financial goals. Credit education tools not only help consumers increase their credit literacy, confidence, and chances of approval, but they also create opportunities for lenders to build lasting customer relationships. Consumers recognize that healthy credit plays an important role in their financial lives, and by helping them navigate the credit landscape, lenders can increase engagement, build loyalty, and enhance their brand’s reputation as an organization that cares about their customers. Empowering consumers with credit education is also a way for lenders to unlock new revenue streams. By learning to borrow, save, and spend responsibly, consumers can improve their creditworthiness and be in a better position to accept extended credit offerings, driving more cross-sell and upsell opportunities for lenders. More ways experian can help Experian is deeply committed to helping marginalized and low-income communities access the financial resources they need. In addition to our credit education tools, here are a few of our other offerings: Our expanded data helps lenders make better lending decisions by providing greater visibility and transparency around a consumer’s inquiry and payment behaviors. With a holistic view of their current and prospective customers, lenders can more accurately identify creditworthy applicants, uncover new growth opportunities, and expand access to credit for underserved consumers. Experian GoTM is a free, first-of-its-kind program to help credit invisibles and those with limited credit histories begin building credit on their own terms. After authenticating their identities and obtaining an Experian credit report, users will receive ongoing education about how credit works and recommendations to further build their credit history. To learn more about building profitable customer relationships with credit education, check out our credit education solutions and watch our Three Ways to Uncover Financial Growth Opportunities that Benefit Underserved Communities webinar. Learn more Watch webinar

Credit scores play a massive role in a consumer’s financial life as they help determine an individual’s creditworthiness. While 62% of consumers are interested in improving their credit scores, a troublingly high percentage are unsure of where to start. What’s more, one in four Americans have no idea how credit scores are even determined. This knowledge gap presents an opportunity for financial institutions to help consumers increase their credit understanding and establish lasting relationships. Some of the benefits of providing credit education to consumers include: Consumer trust and loyalty Today’s consumers are looking for guidance and support on all things credit. Helping consumers navigate their credit reports, improve their credit scores and explore the impacts of various scenarios are all opportunities for financial institutions to meet this demand and foster loyalty. With the knowledge and tools needed to make confident and responsible financial decisions, consumers will continue to trust and look toward the same financial institutions for credit guidance as they navigate their financial journeys. Credit education is especially valuable to younger consumers. As rookies to the credit game, many Gen Zers may find credit to be mysterious, complex and difficult to grasp. Despite these feelings, Gen Zers have shown considerable interest in becoming financially literate. By continuously providing Gen Z consumers with reliable and accessible credit education early on, financial institutions can grow to become their valuable partner, educator and mentor for life. More cross-sell opportunities The more educational resources financial institutions provide their consumers, the more likely they are to pay their credit card bills on time, take out loans and mortgages they can meet and purchase within their buying power, making them prime candidates to approach for additional credit offerings. According to studies conducted by Visa Performance Solutions, consumers respond more to credit offers from institutions they currently have a relationship with than those they don’t. By providing credit education and relevant offers to existing customers, financial institutions can improve satisfaction while increasing their revenue. Enhances brand reputation While credit education allows financial institutions to strengthen their relationships with existing clients, it also gives them an opportunity to expand and acquire new ones. When consumers feel valued and cared for, they are more likely to recommend a business’s products and services to someone else. The more consumers see how much a financial institution invests in their customers’ financial well-being, the more likely they are to convert themselves. Ready to get started? Providing value to consumers is no longer just about offering great products and services; it’s about helping them understand the basics and importance of credit so that achieving their financial goals comes easily. To learn more about how credit education can help deepen customer relationships and drive business growth, visit our Experian Partners Solutions page. Learn more

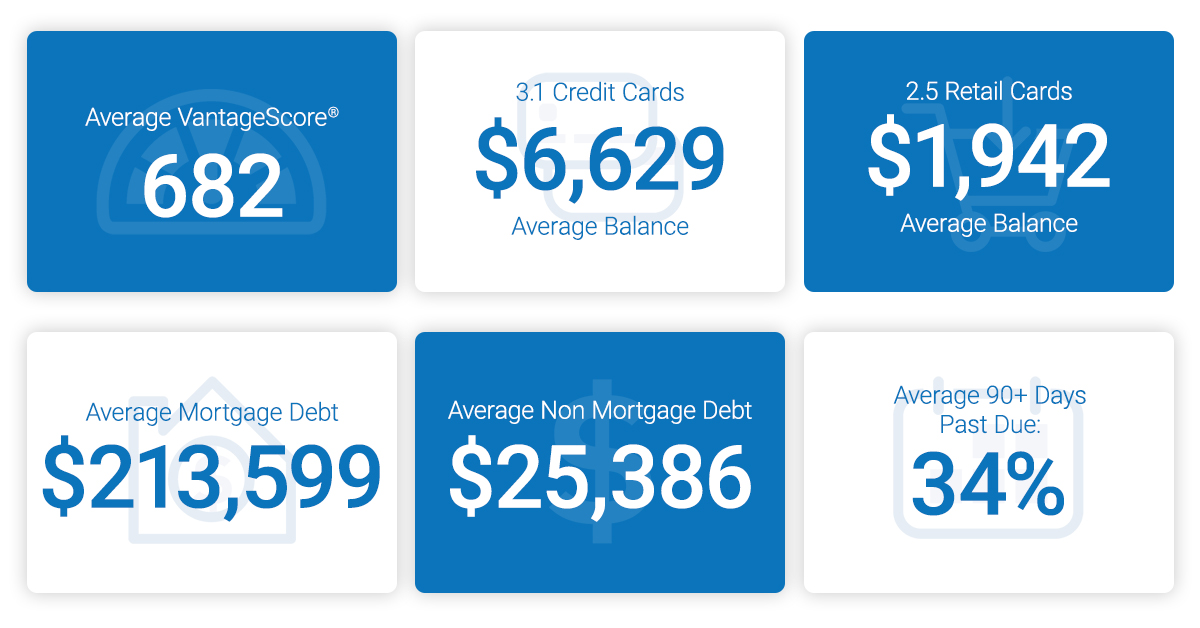

In what has been an unprecedented year, marked by a global pandemic and a number of economic and personal challenges for both businesses and consumers, Americans are maintaining healthy credit profiles during the COVID-19 pandemic. Experian released the 11th annual State of Credit report, which provides a comprehensive look at the credit performance of consumers across America by highlighting consumer credit scores and borrowing behaviors. This year’s report provided an extended view into how consumers are managing and repaying their debts; showing most Americans are practicing responsible credit management by reducing utilization rates, credit card balances and late payments. Even in light of the pandemic, data on American consumers across all generations shows responsible credit management including reduced utilization rates, credit card balances and late payments. “While it’s difficult to predict when the economy will return to pre-pandemic levels, we are seeing promising signs of responsible credit management, especially among younger consumers,” said Alex Lintner, group president Experian Consumer Information Services. Highlights of Experian’s State of Credit report: 2020 State of Credit Report 2019 2020 Average VantageScore® credit score [1,2] 682 688 Average number of credit cards 3.07 3.0 Average credit card balance $6,629 $5,897 Average revolving utilization rate 30% 26% Average number of retail credit cards 2.51 2.42 Average retail credit card balance $1,942 $2,044 Average nonmortgage debt [3] $25,386 $25,483 Average mortgage debt $213,599 $215,655 Average 30 - 59 days past due delinquency rates 3.9% 2.4% Average 60 - 89 days past due delinquency rates 1.9% 1.3% Average 90 - 180 days past due delinquency rates 6.8% 3.8% Though not the same, some consumers are experiencing a second economic downturn. The economic fallout stemming from COVID-19 coming after the Great Recession of 2009, which took place in the not too distant past. Silent, Boomer, Gen X and Gen Z Americans are managing responsible credit utilization rates and holding credit cards below the recommended maximum. Are the older generations more credit responsible? Average VantageScore® credit score follows rank order from oldest to youngest – though contributed to by length of time possessing credit, number of lines of credit, and other factors that drive credit score – with the Silent Generation having the highest score (729), then Boomers (716), followed by Gen X (676), Gen Y (658) and Gen Z (654). Gen X consumers have the highest average credit card balance at $7,718 and utilization at 32%, while Gen Z has the lowest average credit card balance at $2,197 and the Silent Generation has the lowest utilization at 13%. Year over year data shows positive results driven by younger borrowers. While average utilization rates dropped for every generation, the most significant decreases were seen in Gen Z borrowers who saw a 6 percent reduction in their use of available credit, followed by Millennials who saw a 5% decrease year-over-year. While Gen Z and Gen Y are carrying more credit cards than they were in 2020, their credit card balances decreased year-over-year. These factors fueled a 13-point increase in average credit scores for Gen Z and an 11-point increase for Millennials. When spliced by state, the data Minnesota had the highest credit score, while Mississippi had the lowest credit score. While the future is still uncertain, perhaps consumers can find comfort in knowing there is much they can do to improve their financial health – including their credit scores – and that there are numerous resources for them to access during these unprecedented times. “As the consumer’s bureau, we are committed to informing, guiding, and protecting consumers. Educating Americans about the factors included in their credit profile and how to manage these responsibly is of critical importance, especially on the road to economic recovery from the COVID-19 pandemic,” said Lintner. In an effort to encourage consumers to regularly monitor and understand the information in their credit reports, Experian joined forces with the other U.S. credit reporting agencies, to offer free weekly credit reports to all Americans through April 2021 via AnnualCreditReport.com. In addition to the free weekly credit report at AnnualCreditReport.com, Experian also offers consumers free access to their credit report and ongoing credit monitoring at Experian.com. Additional credit education resources and tools Experian’s #CreditChat: Hosted by @Experian on Twitter with financial experts every Wednesday at 3 p.m. Eastern time The Ask Experian blog: Find answers to common questions, advice and education about credit Experian Boost: Add positive telecom and utility payments to your Experian credit report for an opportunity to improve your credit scores experian.com/consumer-education-content/ experian.com/coronavirus 1VantageScore® is a registered trademark of VantageScore Solutions, LLC. 2VantageScore® credit score range is 300 to 850.

Today’s lending market has seen a significant increase in alternative business lending, with companies utilizing new data assets and technology. As the lending landscape becomes increasingly competitive, consumers have more choices than ever when it comes to lending products. To drive profitable growth, lenders must find new ways to help applicants gain access to the loans they need. How Spring EQ is leveraging Experian BoostTM Home equity lender Spring EQ turned to Experian’s first-of-its-kind financial tool that empowers consumers to add positive payments directly into their credit file to assist applicants with attaining the best loan opportunities and rates. By using Experian BoostTM, which captures the value of consumer’s utility and telecom trade lines, in their current lending process, Spring EQ can help applicants near approval or risk thresholds move to higher risk tiers and qualify for better loan terms and conditions. Driving growth with consumer-permissioned data Over 40 million consumers in the U.S. either have no credit file or have insufficient information in their files to generate a traditional credit score. Consumer-permissioned data empowers these individuals to leverage their online financial data and payment histories to gain better access to loans and other financial services while providing lenders with a more comprehensive view of their creditworthiness. According to Experian research, 70% of consumers see the benefits of sharing additional financial information and contributing positive payment history to their credit file if it increases their odds of approval and helps them access more favorable credit terms. Read our case study for more insight on using Experian Boost to: Make better lending decisions Offer or underwrite credit to more people Promote the right credit products Increase conversion and utilization rates Read case study Learn more about Experian Boost

With new legislation, including the Coronavirus Aid, Relief, and Economic Security (CARES) Act impacting how data furnishers will report accounts, and government relief programs offering payment flexibility, data reporting under the coronavirus (COVID-19) outbreak can be complicated. Especially when it comes to small businesses, many of which are facing sharp declines in consumer demand and an increased need for capital. As part of our recently launched Q&A perspective series, Greg Carmean, Experian’s Director of Product Management and Matt Shubert, Director of Data Science and Modelling, provided insight on how data furnishers can help support small businesses amidst the pandemic while complying with recent regulations. Check out what they had to say: Q: How can data reporters best respond to the COVID-19 global pandemic? GC: Data reporters should make every effort to continue reporting their trade experiences, as losing visibility into account performance could lead to unintended consequences. For small businesses that have been negatively affected by the pandemic, we advise that when providing forbearance, deferrals be reported as “current”, meaning they should not adversely impact the credit scores of those small business accounts. We also recommend that our data reporters stay in close contact with their legal counsel to ensure they follow CARES Act guidelines. Q: How can financial institutions help small businesses during this time? GC: The most critical thing financial institutions can do is ensure that small businesses continue to have access to the capital they need. Financial institutions can help small businesses through deferral of payments on existing loans for businesses that have been most heavily impacted by the COVID-19 crisis. Small Business Administration (SBA) lenders can also help small businesses take advantage of government relief programs, like the Payment Protection Program (PPP), available through the CARES Act that provides forgiveness on up to 75% of payroll expenses and 25% of other qualifying expenses. Q: How do financial institutions maintain data accuracy while also protecting consumers and small businesses who may be undergoing financial stress at this time? GC: Following bureau recommendations regarding data reporting will be critical to ensure that businesses are being treated fairly and that the tools lenders depend on continue to provide value. The COVID-19 crisis also provides a great opportunity for lenders to educate their small business customers on their business credit. Experian has made free business credit reports available to every business across the country to help small business owners ensure the information lenders are using in their credit decisioning is up-to-date and accurate. Q: What is the smartest next play for financial institutions? GC: Experian has several resources that lenders can leverage, including Experian’s COVID-19 Business Risk Index which identifies the industries and geographies that have been most impacted by the COVID crisis. We also have scores and alerts that can help financial institutions gain greater insights into how the pandemic may impact their portfolios, especially for accounts with the greatest immediate exposure and need. MS: To help small businesses weather the storm, financial institutions should make it simple and efficient for them to access the loans and credit they need to survive. With cash flow to help bridge the gap or resume normal operations, small businesses can be more effective in their recovery processes and more easily comply with new legislation. Finances offer the support needed to augment currently reduced cash flows and provide the stability needed to be successful when a return to a more normal business environment occurs. At Experian, we’re closely monitoring the updates around the coronavirus outbreak and its widespread impact on both consumers and businesses. We will continue to share industry-leading insights to help data furnishers navigate and successfully respond to the current environment. Learn more About Our Experts Greg Carmean, Director of Product Management, Experian Business Information Services, North America Greg has over 20 years of experience in the information industry specializing in commercial risk management services. In his current role, he is responsible for managing multiple product initiatives including Experian’s Small Business Financial Exchange (SBFE), domestic and international commercial reports and Corporate Linkage. Recently, he managed the development and launch of Experian’s Global Data Network product line, a commercial data environment that provides a single source of up to date international credit and firmographic information from Experian commercial bureaus and Tier 1 partners across the globe. Matt Shubert, Director of Data Science and Modelling, Experian Data Analytics, North America Matt leads Experian’s Commercial Data Sciences Team which consists of a combination of data scientists, data engineers and statistical model developers. The Commercial Data Science Team is responsible for the development of attributes and models in support of Experian’s BIS business unit. Matt’s 15+ years of experience leading data science and model development efforts within some of the largest global financial institutions gives our clients access to a wealth of knowledge to discover the hidden ROI within their own data.

In the face of severe financial stress, such as that brought about by an economic downturn, lenders seeking to reduce their credit risk exposure often resort to tactics executed at the portfolio level, such as raising credit score cut-offs for new loans or reducing credit limits on existing accounts. What if lenders could tune their portfolio throughout economic cycles so they don’t have to rely on abrupt measures when faced with current or future economic disruptions? Now they can. The impact of economic downturns on financial institutions Historically, economic hardships have directly impacted loan performance due to differences in demand, supply or a combination of both. For example, let’s explore the Great Recession of 2008, which challenged financial institutions with credit losses, declines in the value of investments and reductions in new business revenues. Over the short term, the financial crisis of 2008 affected the lending market by causing financial institutions to lose money on mortgage defaults and credit to consumers and businesses to dry up. For the much longer term, loan growth at commercial banks decreased substantially and remained negative for almost four years after the financial crisis. Additionally, lending from banks to small businesses decreased by 18 percent between 2008-2011. And – it was no walk in the park for consumers. Already faced with a rise in unemployment and a decline in stock values, they suddenly found it harder to qualify for an extension of credit, as lenders tightened their standards for both businesses and consumers. Are you prepared to navigate and successfully respond to the current environment? Those who prove adaptable to harsh economic conditions will be the ones most poised to lead when the economy picks up again. Introducing the FICO® Resilience Index The FICO® Resilience Index provides an additional way to evaluate the quality of portfolios at any point in an economic cycle. This allows financial institutions to discover and manage potential latent risk within groups of consumers bearing similar FICO® Scores, without cutting off access to credit for resilient consumers. By incorporating the FICO® Resilience Index into your lending strategies, you can gain deeper insight into consumer sensitivity for more precise credit decisioning. What are the benefits? The FICO® Resilience Index is designed to assess consumers with respect to their resilience or sensitivity to an economic downturn and provides insight into which consumers are more likely to default during periods of economic stress. It can be used by lenders as another input in credit decisions and account strategies across the credit lifecycle and can be delivered with a credit file, along with the FICO® Score. No matter what factors lead to an economic correction, downturns can result in unexpected stressors, affecting consumers’ ability or willingness to repay. The FICO® Resilience Index can easily be added to your current FICO® Score processes to become a key part of your resilience-building strategies. Learn more

As consumers prepare for the next decade, we look at how we’re rounding out this year. The results? The average American credit score is 682, an eight-year high. Experian released the 10th annual state of credit report, which provides a comprehensive look at the credit performance of consumers across America by highlighting consumer credit scores and borrowing behaviors. And while the data is spliced to show men vs. women, as well as provides commentary at the state and generational level, the overarching trend is up. Even with the next anticipated economic correction often top of mind for financial institutions, businesses and consumers alike, 2019 was a year marked by more access, more spending and decreasing delinquencies. Things are looking up. “We are seeing a promising trend in terms of how Americans are managing their credit as we head into a new decade with average credit scores increasing two points since 2018 to 682 – the highest we’ve seen since 2011,” said Shannon Lois, Senior Vice President and Head of EAS, Analytics, Consulting & Operations for Experian Decision Analytics. “Average credit card balances and debt are up year over year, yet utilization rates remain consistent at 30 percent, indicating consumers are using credit as a financial tool and managing their debts responsibly.” Highlights of Experian’s State of Credit report: 3-year comparison 2017 2018 2019 Average number of credit cards 3.06 3.04 3.07 Average credit card balances $6,354 $6,506 $6,629 Average number of retail credit cards 2.48 2.59 2.51 Average retail credit card balances $1,841 $1,901 $1,942 Average VantageScore® credit score[1, 2] 675 680 682 Average revolving utilization 30% 30% 30% Average nonmortgage debt[3] $24,706 $25,104 $25,386 Average mortgage debt $201,811 $208,180 $231,599 Average 30 days past due delinquency rates 4.0% 3.9% 3.9% Average 60 days past due delinquency rates 1.9% 1.9% 1.9% Average 90+ days past due delinquency rates 7.3% 6.7% 6.8% In the scope of the credit score battle of the sexes, women have a four-point lead over men with an average credit score of 686 compared to 682. Their lead is a continued trend since 2017 where they’ve bested their male counterparts. According to the report, while men carry more non-mortgage and mortgage debt than women, women have more credit cards and retail cards (albeit they carry lower balances). Generationally, Generations X, Y and Z tend to carry more debt, including mortgage, non-mortgage, credit card and retail card, than older generations with higher delinquency and utilization rates. Segmented by state and gender, Minnesota had the highest credit scores for both men and women, while Mississippi was the state with the lowest average credit score for females and Louisiana was the lowest average credit score state for males. As we round out the decade and head full-force into 2020, we can reflect on the changes in the past year alone that are helping consumers improve their financial health. Just to name a few: Experian launched Experian BoostTM in March, allowing millions of consumers to add positive payment history directly to their credit file for an opportunity to instantly increase their credit score. Since then, there has been over 13 million points boosted across America. Experian LiftTM was launched in November, designed to help credit invisible and thin-file consumers gain access to fair and affordable credit. Long-standing commitments to consumer education, including the Ask Experian Blog and volunteer work by Experian’s Education Ambassadors, continue to offer assistance to the community and help consumers better understand their financial actions. From what we can tell, this is just the beginning. “Understanding the factors that influence their overall credit profile can help consumers improve and maintain their financial health,” said Rod Griffin, Experian’s director of consumer education and awareness. “Credit can be used as a financial tool. Through this report, we hope to provide insights that will help consumers make more informed decisions about credit use as we prepare to head into a new decade.” Learn more 1 VantageScore® is a registered trademark of VantageScore Solutions, LLC. 2 VantageScore® credit score range is 300 to 850. 3 Average debt for this study includes all credit cards, auto loans and personal loans/student loans.

Article written by Melanie Smith, Senior Copywriter, Experian Clarity Services, Inc. It’s been almost a decade since the Great Recession in the United States ended, but consumers continue to feel its effects. During the recession, millions of Americans lost their jobs, retirement savings decreased, real estate reduced in value and credit scores plummeted. Consumers that found themselves impacted by the financial crisis often turned to alternative financial services (AFS). Since the end of the recession, customer loyalty and retention has been a focus for lenders, given that there are more options than ever before for AFS borrowers. To determine what this looks like in the current climate, we examined today’s non-prime consumers, what their traditional scores look like and if they are migrating to traditional lending. What are alternative financial services (AFS)? Alternative financial services (AFS) is a term often used to describe the array of financial services offered by providers that operate outside of traditional financial institutions. In contrast to traditional banks and credit unions, alternative service providers often make it easier for consumers to apply and qualify for lines of credit but may charge higher interest rates and fees. More than 50% of new online AFS borrowers were first seen in 2018 To determine customer loyalty and fluidity, we looked extensively at the borrowing behavior of AFS consumers in the online marketplace. We found half of all online borrowers were new to the space as of 2018, which could be happening for a few different reasons. Over the last five years, there has been a growing preference to the online space over storefront. For example, in our trends report from 2018, we found that 17% of new online customers migrated from the storefront single pay channel in 2017, with more than one-third of these borrowers from 2013 and 2014 moving to online overall. There was also an increase in AFS utilization by all generations in 2018. Additionally, customers who used AFS in previous years are now moving towards traditional credit sources. 2017 AFS borrowers are migrating to traditional credit As we examined the borrowing behavior of AFS consumers in relation to customer loyalty, we found less than half of consumers who used AFS in 2017 borrowed from an AFS lender again in 2018. Looking into this further, about 35% applied for a loan but did not move forward with securing the loan and nearly 24% had no AFS activity in 2018. We furthered our research to determine why these consumers dropped off. After analyzing the national credit database to see if any of these consumers were borrowing in the traditional credit space, we found that 34% of 2017 borrowers who had no AFS activity in 2018 used traditional credit services, meaning 7% of 2017 borrowers migrated to traditional lending in 2018. Traditional credit scores of non-prime borrowers are growing After discovering that 7% of 2017 online borrowers used traditional credit services in 2018 instead of AFS, we wanted to find out if there had also been an improvement in their credit scores. Historically, if someone is considered non-prime, they don’t have the same access to traditional credit services as their prime counterparts. A traditional credit score for non-prime consumers is less than 600. Using the VantageScore® credit score, we examined the credit scores of consumers who used and did not use AFS in 2018. We found about 23% of consumers who switched to traditional lending had a near-prime credit score, while only 8% of those who continued in the AFS space were classified as near-prime. Close to 10% of consumers who switched to traditional lending in 2018 were classified in the prime category. Considering it takes much longer to improve a traditional credit rating, it’s likely that some of these borrowers may have been directly impacted by the recession and improved their scores enough to utilize traditional credit sources again. Key takeaways AFS remains a viable option for consumers who do not use traditional credit or have a credit score that doesn’t allow them to utilize traditional credit services. New AFS borrowers continue to appear even though some borrowers from previous years have improved their credit scores enough to migrate to traditional credit services. Customers who are considered non-prime still use AFS, as well as some near-prime and prime customers, which indicates customer loyalty and retention in this space. For more information about customer loyalty and other recently identified trends, download our recent reports. State of Alternative Data 2019 Lending Report

A few months ago, I got a letter from the DMV reminding me that it was finally time to replace my driver’s license. I’ve had it since I was 21 and I’ve been dreading having to get a new one. I was especially apprehensive because this time around I’m not just getting a regular old driver’s license, I’m getting a REAL ID. For those of you who haven’t had this wonderful experience yet, a REAL ID is the new form of driver’s license (or state ID) that you’ll need to board a domestic flight starting October 1, 2020. Some states already offered compliant IDs, but others—like California, where I’m from—didn’t. This means that if I want to fly within the U.S. using my driver’s license next year, I can’t renew by mail. It’s Easier Than It Looks Imagine my surprise when I started the process to schedule my appointment, and the California DMV website made things really easy! There’s an online application you can fill out before you get to the DMV and they walk you through the documents to bring to the appointment (which I was able to schedule online). Despite common thought that the DMV and agencies like it are slow to adopt technology, the ease of this process may indicate a shift toward a digital-first mindset. As financial institutions embrace a similar shift, they’ll be better positioned to meet the needs of customers. Case in point, the electronic checklist the DMV provided to prepare me for my appointment. I sailed through the first two parts of the checklist, confirming that I’ll bring my proof of identity and social security number, but I paused when I got to the “Two Proofs of Residency” screen. Like many people my age—read: 85% of the millennial population, according to a recent Experian study—I don’t have a mortgage or any other documents relating to property ownership. I also don’t have my name on my utilities (thanks, roomie) or my cell phone bill (thanks Mom). I do however have a signed lease with my name on it, plus my renter’s insurance, both of which are acceptable as proof of residency. And just like that, I’m all set to get my REAL ID, even though I don’t have some of the basic adulting documents you might expect, because the DMV took into account the fact that not all REAL ID applicants are alike. Imagine if lenders could adopt that same flexibility and create opportunities for the more than 45 million U.S. consumers1 who lack a credit report or have too little information to generate a credit score. The Bigger Picture By removing some of the usual barriers to entry, the DMV made the process of getting my REAL ID much easier than it might have been and corrected my assumptions about how difficult the process would be. Experian has the same line of thought when it comes to helping you determine whether a borrower is credit-worthy. Just because someone doesn’t have a credit card, auto loan or other traditional credit score contributor doesn’t mean they should be written off. That’s why we created Experian BoostTM, a product that lets consumers give read-only access to their bank accounts and add in positive utility and telecommunications bill payments to their credit file to change their scores in real time and demonstrate their stability, ability and willingness to repay. It’s a win-win for lenders and consumers. 2 out of 3 users of Experian Boost see an increase in their FICO Score and of those who saw an increase, 13% moved up a credit tier. This gives lenders a wider pool to market to, and thanks to their improved credit scores, those borrowers are eligible for more attractive rates. Increasing your flexibility and removing barriers to entry can greatly expand your potential pool of borrowers without increasing your exposure to risk. Learn more about how Experian can help you leverage alternative credit data and expand your customer base in our 2019 State of Alternative Data Whitepaper. Read Full Report 1Kenneth P. Brevoort, Philipp Grimm, Michelle Kambara. “Data Point: Credit Invisibles.” The Consumer Financial Protection Bureau Office of Research. May 2015.

Earlier this month, Experian joined FinovateSpring in San Francisco, CA to demonstrate innovations impacting financial health to over 1,000 attendees. The Finovate conference promotes real-world solutions while highlighting short-form demos and key insights from thought-leaders on digital lending, banking, payments, artificial intelligence and the customer experience. With more than 100 million Americans lacking fair access to credit, it's more important than ever for companies to work to improve the financial health of consumers. In addition to the show's abundance of fintech-centered content, Experian hosted an exclusive, cutting-edge breakout series demonstrating innovations that are positively impacting the financial health of consumers across the nation. Finovate Day One Overview While fintechs, banks, venture capitalist, entrepreneurs and industry analysts ascended on the general conference floor for a fast-paced day of demos, a select subset gathered for a luncheon presented by Experian North America CEO, Craig Boundy, and Group President, Alex Lintner. Attendees were given an in-depth look at new, alternative credit data streams and tools that are helping to increase financial access. Demos included: Experian Boost™: a free, groundbreaking online platform that allows consumers to instantly boost their credit scores by adding telecommunications and utility bill payments to their credit file. More than half a million consumers have leveraged Experian Boost, increasing their score by an average of 13 points. Cumulatively, Experian Boost has helped add more than 2.8 million points to consumers’ credit scores. Ascend Analytical Sandbox™: A first-of-its-kind data and analytics platform that gives companies instant access to more than 17 years of depersonalized credit data on more than 220 million U.S. consumers. It has been the most successful product launch in Experian’s history and recently earned the title of “Best Overall Analytics Platform” at this year’s Fintech Breakthrough Awards. Alternative Credit Data: Comprised of data from alternative credit sources, this data helps lenders make smarter and more informed lending decisions. Additionally, Experian’s Clear Data Platform is next-level credit data that adds supplemental FCRA-compliant credit data to enrich decisions across the entire credit spectrum. This new platform features alternative credit data, rental data, public records, consumer-permissioned data and more Upon conclusion of the luncheon, Alpa Lally, Experian’s Vice President of Data Business at Consumer Information Services, was interviewed for the HousingWire Podcast with Jacob Gaffney, HousingWire Editor in Chief, to discuss how new forms of data streams are helping improve consumers’ access to credit by giving lenders a clearer picture of their creditworthiness and risk. “Alternative credit data is different than traditional credit data and helps us paint a fuller picture of the consumer in terms of their ability to pay, willingness to pay and stability. It helps consumers get better access overall to the credit they deserve so that they can actively participate in the economy,” said Lally. Finovate Day Two Overview On the last day of the conference, expert speakers took to the main stage to analyze the latest fintech trends, opportunities and challenges. Alex Lintner and Sandeep Bhandari, Chief Strategy Officer and Chief Risk Officer at Affirm, participated in a fireside chat titled “Improving the Financial Health of America’s 100 Million Credit Underserved Consumers.” Moderated by David Penn, Finovate Analyst, the session explored the latest innovations, trends and technologies – from machine learning to alternative data – that are making a difference in positively impacting the financial health of Americans and expanding financial opportunities for underserved consumers. The panel discussed the efforts made to put financial health at the center of their business and the impact it’s had on their organizations. Following the fireside chat, Experian hosted a second lunch briefing, presented by Vijay Mehta, Chief Innovation Officer, and Greg Wright, EVP Chief Product Officer. The lunch included exclusive table discussions and open conversations to help attendees leave with a better understanding of the importance of prioritizing financial health to build trust, reach new customers and ultimately grow their business. "We are actively seeking out unresolved problems and creating products and technologies that will help transform the way businesses operate and consumers thrive in our society. But we know we can't do it alone," Experian North American CEO, Craig Boundy said in a recent blog post on Experian's fintech partnerships and Finovate participation. "That's why over the last year, we have built out an entire time of account executives and other support staff that are fully dedicated to developing and supporting partnerships with leading fintech companies. We've made significant strides that will help us pave the way for the next generation of lending while improving the financial health of more people around the world." For more information on how Experian is partnering with fintechs, visit experian.com/fintech or read our recent blog article on consumer-permissioned data for an in-depth discussion on Experian BoostTM.