Tag: generation

In what has been an unprecedented year, marked by a global pandemic and a number of economic and personal challenges for both businesses and consumers, Americans are maintaining healthy credit profiles during the COVID-19 pandemic. Experian released the 11th annual State of Credit report, which provides a comprehensive look at the credit performance of consumers across America by highlighting consumer credit scores and borrowing behaviors. This year’s report provided an extended view into how consumers are managing and repaying their debts; showing most Americans are practicing responsible credit management by reducing utilization rates, credit card balances and late payments. Even in light of the pandemic, data on American consumers across all generations shows responsible credit management including reduced utilization rates, credit card balances and late payments. “While it’s difficult to predict when the economy will return to pre-pandemic levels, we are seeing promising signs of responsible credit management, especially among younger consumers,” said Alex Lintner, group president Experian Consumer Information Services. Highlights of Experian’s State of Credit report: 2020 State of Credit Report 2019 2020 Average VantageScore® credit score [1,2] 682 688 Average number of credit cards 3.07 3.0 Average credit card balance $6,629 $5,897 Average revolving utilization rate 30% 26% Average number of retail credit cards 2.51 2.42 Average retail credit card balance $1,942 $2,044 Average nonmortgage debt [3] $25,386 $25,483 Average mortgage debt $213,599 $215,655 Average 30 - 59 days past due delinquency rates 3.9% 2.4% Average 60 - 89 days past due delinquency rates 1.9% 1.3% Average 90 - 180 days past due delinquency rates 6.8% 3.8% Though not the same, some consumers are experiencing a second economic downturn. The economic fallout stemming from COVID-19 coming after the Great Recession of 2009, which took place in the not too distant past. Silent, Boomer, Gen X and Gen Z Americans are managing responsible credit utilization rates and holding credit cards below the recommended maximum. Are the older generations more credit responsible? Average VantageScore® credit score follows rank order from oldest to youngest – though contributed to by length of time possessing credit, number of lines of credit, and other factors that drive credit score – with the Silent Generation having the highest score (729), then Boomers (716), followed by Gen X (676), Gen Y (658) and Gen Z (654). Gen X consumers have the highest average credit card balance at $7,718 and utilization at 32%, while Gen Z has the lowest average credit card balance at $2,197 and the Silent Generation has the lowest utilization at 13%. Year over year data shows positive results driven by younger borrowers. While average utilization rates dropped for every generation, the most significant decreases were seen in Gen Z borrowers who saw a 6 percent reduction in their use of available credit, followed by Millennials who saw a 5% decrease year-over-year. While Gen Z and Gen Y are carrying more credit cards than they were in 2020, their credit card balances decreased year-over-year. These factors fueled a 13-point increase in average credit scores for Gen Z and an 11-point increase for Millennials. When spliced by state, the data Minnesota had the highest credit score, while Mississippi had the lowest credit score. While the future is still uncertain, perhaps consumers can find comfort in knowing there is much they can do to improve their financial health – including their credit scores – and that there are numerous resources for them to access during these unprecedented times. “As the consumer’s bureau, we are committed to informing, guiding, and protecting consumers. Educating Americans about the factors included in their credit profile and how to manage these responsibly is of critical importance, especially on the road to economic recovery from the COVID-19 pandemic,” said Lintner. In an effort to encourage consumers to regularly monitor and understand the information in their credit reports, Experian joined forces with the other U.S. credit reporting agencies, to offer free weekly credit reports to all Americans through April 2021 via AnnualCreditReport.com. In addition to the free weekly credit report at AnnualCreditReport.com, Experian also offers consumers free access to their credit report and ongoing credit monitoring at Experian.com. Additional credit education resources and tools Experian’s #CreditChat: Hosted by @Experian on Twitter with financial experts every Wednesday at 3 p.m. Eastern time The Ask Experian blog: Find answers to common questions, advice and education about credit Experian Boost: Add positive telecom and utility payments to your Experian credit report for an opportunity to improve your credit scores experian.com/consumer-education-content/ experian.com/coronavirus 1VantageScore® is a registered trademark of VantageScore Solutions, LLC. 2VantageScore® credit score range is 300 to 850.

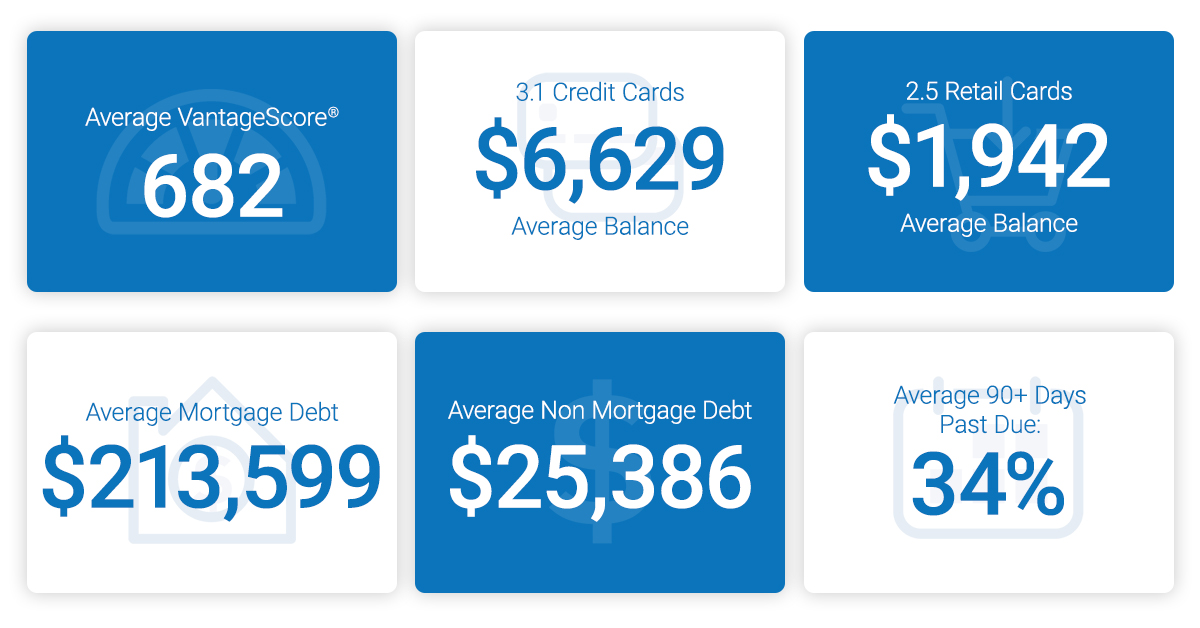

As consumers prepare for the next decade, we look at how we’re rounding out this year. The results? The average American credit score is 682, an eight-year high. Experian released the 10th annual state of credit report, which provides a comprehensive look at the credit performance of consumers across America by highlighting consumer credit scores and borrowing behaviors. And while the data is spliced to show men vs. women, as well as provides commentary at the state and generational level, the overarching trend is up. Even with the next anticipated economic correction often top of mind for financial institutions, businesses and consumers alike, 2019 was a year marked by more access, more spending and decreasing delinquencies. Things are looking up. “We are seeing a promising trend in terms of how Americans are managing their credit as we head into a new decade with average credit scores increasing two points since 2018 to 682 – the highest we’ve seen since 2011,” said Shannon Lois, Senior Vice President and Head of EAS, Analytics, Consulting & Operations for Experian Decision Analytics. “Average credit card balances and debt are up year over year, yet utilization rates remain consistent at 30 percent, indicating consumers are using credit as a financial tool and managing their debts responsibly.” Highlights of Experian’s State of Credit report: 3-year comparison 2017 2018 2019 Average number of credit cards 3.06 3.04 3.07 Average credit card balances $6,354 $6,506 $6,629 Average number of retail credit cards 2.48 2.59 2.51 Average retail credit card balances $1,841 $1,901 $1,942 Average VantageScore® credit score[1, 2] 675 680 682 Average revolving utilization 30% 30% 30% Average nonmortgage debt[3] $24,706 $25,104 $25,386 Average mortgage debt $201,811 $208,180 $231,599 Average 30 days past due delinquency rates 4.0% 3.9% 3.9% Average 60 days past due delinquency rates 1.9% 1.9% 1.9% Average 90+ days past due delinquency rates 7.3% 6.7% 6.8% In the scope of the credit score battle of the sexes, women have a four-point lead over men with an average credit score of 686 compared to 682. Their lead is a continued trend since 2017 where they’ve bested their male counterparts. According to the report, while men carry more non-mortgage and mortgage debt than women, women have more credit cards and retail cards (albeit they carry lower balances). Generationally, Generations X, Y and Z tend to carry more debt, including mortgage, non-mortgage, credit card and retail card, than older generations with higher delinquency and utilization rates. Segmented by state and gender, Minnesota had the highest credit scores for both men and women, while Mississippi was the state with the lowest average credit score for females and Louisiana was the lowest average credit score state for males. As we round out the decade and head full-force into 2020, we can reflect on the changes in the past year alone that are helping consumers improve their financial health. Just to name a few: Experian launched Experian BoostTM in March, allowing millions of consumers to add positive payment history directly to their credit file for an opportunity to instantly increase their credit score. Since then, there has been over 13 million points boosted across America. Experian LiftTM was launched in November, designed to help credit invisible and thin-file consumers gain access to fair and affordable credit. Long-standing commitments to consumer education, including the Ask Experian Blog and volunteer work by Experian’s Education Ambassadors, continue to offer assistance to the community and help consumers better understand their financial actions. From what we can tell, this is just the beginning. “Understanding the factors that influence their overall credit profile can help consumers improve and maintain their financial health,” said Rod Griffin, Experian’s director of consumer education and awareness. “Credit can be used as a financial tool. Through this report, we hope to provide insights that will help consumers make more informed decisions about credit use as we prepare to head into a new decade.” Learn more 1 VantageScore® is a registered trademark of VantageScore Solutions, LLC. 2 VantageScore® credit score range is 300 to 850. 3 Average debt for this study includes all credit cards, auto loans and personal loans/student loans.

Article written by Melanie Smith, Senior Copywriter, Experian Clarity Services, Inc. It’s been almost a decade since the Great Recession in the United States ended, but consumers continue to feel its effects. During the recession, millions of Americans lost their jobs, retirement savings decreased, real estate reduced in value and credit scores plummeted. Consumers that found themselves impacted by the financial crisis often turned to alternative financial services (AFS). Since the end of the recession, customer loyalty and retention has been a focus for lenders, given that there are more options than ever before for AFS borrowers. To determine what this looks like in the current climate, we examined today’s non-prime consumers, what their traditional scores look like and if they are migrating to traditional lending. What are alternative financial services (AFS)? Alternative financial services (AFS) is a term often used to describe the array of financial services offered by providers that operate outside of traditional financial institutions. In contrast to traditional banks and credit unions, alternative service providers often make it easier for consumers to apply and qualify for lines of credit but may charge higher interest rates and fees. More than 50% of new online AFS borrowers were first seen in 2018 To determine customer loyalty and fluidity, we looked extensively at the borrowing behavior of AFS consumers in the online marketplace. We found half of all online borrowers were new to the space as of 2018, which could be happening for a few different reasons. Over the last five years, there has been a growing preference to the online space over storefront. For example, in our trends report from 2018, we found that 17% of new online customers migrated from the storefront single pay channel in 2017, with more than one-third of these borrowers from 2013 and 2014 moving to online overall. There was also an increase in AFS utilization by all generations in 2018. Additionally, customers who used AFS in previous years are now moving towards traditional credit sources. 2017 AFS borrowers are migrating to traditional credit As we examined the borrowing behavior of AFS consumers in relation to customer loyalty, we found less than half of consumers who used AFS in 2017 borrowed from an AFS lender again in 2018. Looking into this further, about 35% applied for a loan but did not move forward with securing the loan and nearly 24% had no AFS activity in 2018. We furthered our research to determine why these consumers dropped off. After analyzing the national credit database to see if any of these consumers were borrowing in the traditional credit space, we found that 34% of 2017 borrowers who had no AFS activity in 2018 used traditional credit services, meaning 7% of 2017 borrowers migrated to traditional lending in 2018. Traditional credit scores of non-prime borrowers are growing After discovering that 7% of 2017 online borrowers used traditional credit services in 2018 instead of AFS, we wanted to find out if there had also been an improvement in their credit scores. Historically, if someone is considered non-prime, they don’t have the same access to traditional credit services as their prime counterparts. A traditional credit score for non-prime consumers is less than 600. Using the VantageScore® credit score, we examined the credit scores of consumers who used and did not use AFS in 2018. We found about 23% of consumers who switched to traditional lending had a near-prime credit score, while only 8% of those who continued in the AFS space were classified as near-prime. Close to 10% of consumers who switched to traditional lending in 2018 were classified in the prime category. Considering it takes much longer to improve a traditional credit rating, it’s likely that some of these borrowers may have been directly impacted by the recession and improved their scores enough to utilize traditional credit sources again. Key takeaways AFS remains a viable option for consumers who do not use traditional credit or have a credit score that doesn’t allow them to utilize traditional credit services. New AFS borrowers continue to appear even though some borrowers from previous years have improved their credit scores enough to migrate to traditional credit services. Customers who are considered non-prime still use AFS, as well as some near-prime and prime customers, which indicates customer loyalty and retention in this space. For more information about customer loyalty and other recently identified trends, download our recent reports. State of Alternative Data 2019 Lending Report

Fintech is quickly changing. The word itself is synonymous with constant innovation, agile technology structures and being on the cusp of the future of finance. The rapid rate at which fintech challengers are becoming established, is in turn, allowing for greater consumer awareness and adoption of fintech platforms. It would be easy to assume that fintech adoption is predominately driven by millennials. However, according to a recent market trend analysis by Experian, adoption is happening across multiple generational segments. That said, it’s important to note the generational segments that represent the largest adoption rates and growth opportunities for fintechs. Here are a few key stats: Members of Gen Y (between 24-37 years old) account for 34.9% of all fintech personal loans, compared to just 24.9% for traditional financial institutions. A similar trend is seen for Gen Z (between 18-23 years old). This group accounts for 5% of all fintech personal loans as compared to 3.1% for traditional Let’s take a closer look at these generational segments… Gen Y represents approximately 19% of the U.S. population. These consumers, often referred to as “millennials,” can be described as digital-centric, raised on the web and luxury shoppers. In total, millennials spend about $600 billion a year. This group has shown a strong desire to improve their credit standing and are continuously increasing their credit utilization. Gen Z represents approximately 26% of the U.S. population. These consumers can be described as digital centric, raised on the social web and frugal. The Gen Z credit universe is growing, presenting a large opportunity to lenders, as the youngest Gen Zers become credit eligible and the oldest start to enter homeownership. What about the underbanked as a fintech opportunity? The CFPB estimates that up to 45 million people, or 24.2 million households, are “thin-filed” or underbanked, meaning they manage their finances through cash transactions and not through financial services such as checking and savings accounts, credit cards or loans. According to Angela Strange, a general partner at Andreessen Horowitz, traditional financial institutions have done a poor job at serving underbanked consumers affordable products. This has, in turn, created a trillion-dollar market opportunity for fintechs offering low-cost, high-tech financial services. Why does all this matter? Fintechs have a unique opportunity to engage, nurture and grow these market segments early on. As the fintech marketplace heats up and the overall economy begins to soften, diversifying revenue streams, building loyalty and tapping into new markets is a strategic move. But what are the best practices for fintechs looking to build trust, engage and retain these unique consumer groups? Join us for a live webinar on November 12 at 10:00 a.m. PST to hear Experian experts discuss financial inclusion trends shaping the fintech industry and tactical tips to create, convert and extend the value of your ideal customers. Register now

It's been over 10 years since the start of the Great Recession. However, its widespread effects are still felt today. While the country has rebounded in many ways, its economic damage continues to influence consumers. Discover the Great Recession’s impact across generations: Americans of all ages have felt the effects of the Great Recession, making it imperative to begin recession proofing and better prepare for the next economic downturn. There are several steps your organization can take to become recession resistant and help your customers overcome personal financial difficulties. Are you ready should the next recession hit? Get started today