Tag: credit score

Millions of consumers lack credit history and/or have difficulty obtaining credit from mainstream financial institutions. To ease access to credit for “invisible” and below prime consumers, financial institutions have sought ways to both extend and improve the methods by which they evaluate borrowers’ risk. This initiative to effectively score more consumers has involved the use of alternative credit data.1 Alternative credit data is FCRA-compliant data that is typically not included in a traditional credit report and is used to deliver a more complete view into a consumer’s creditworthiness. “Alternative credit data helps us paint a fuller picture of a consumer so they can get better access to the financial services they need and deserve,” said Alpa Lally, Vice President of Data Business at Experian. Experian recently sponsored the FinovateSpring conference in San Francisco, where Alpa had a chance to sit down with Jacob Gaffney, Editor-in-Chief of the HousingWire News Podcast, to discuss ways consumers can improve their credit scores. As an immigrant, Alpa spoke personally about the impact of having a limited credit history and how alternative credit data can help drive greater access to credit for consumers and profitable growth for lenders through more informed lending decisions. Highlights include: How alternative and traditional credit data differ Types of alternative credit data being used by lenders How “credit-invisibles” can best leverage alternative credit data Alternative credit data product solutions, including Experian BoostTM Listen now 1When we refer to “Alternative Credit Data,” this refers to the use of alternative data and its appropriate use in consumer credit lending decisions, as regulated by the Fair Credit Reporting Act. Hence, the term “Expanded FCRA Data” may also apply in this instance and both can be used interchangeably.

Your consumers’ credit score plays an important role in how lenders and financial institutions measure their creditworthiness and risk. With a good credit score, which is generally defined as a score of 700 or above, they can quickly be approved for credit cards, qualify for a mortgage, and have easier access to loans with lower interest rates. In the spirit of Financial Literacy Month, we’ve rounded up what it takes for consumers to have a good credit score, in addition to some alternative considerations. Pay on Time Life gets busy and sometimes your consumers miss the “credit card payment due” note on their calendar squished between their work meetings and doctor’s appointment. However, payment history is one of the top factors in most credit scoring models and accounts for 35% of their credit score. As the primary objective of your consumers’ credit score is to illustrate to lenders just how likely they are to repay their debts, even one missed payment can be viewed negatively when reviewing their credit history. However, if there is a missed payment, consider checking their alternative financial services payments. They may have additional payment histories that will skew their creditworthiness more so than just their record according to traditional credit lines alone. Limit Credit Cards When your consumers apply for a new loan or credit card, lenders “pull” their credit report(s) to review their profile and weigh the risk of granting them credit or loan approval. The record of the access to their credit reports is known as a “hard” inquiry and has the potential to impact their credit score for up to 12 months. Plus, if they’re already having trouble using their card responsibly, taking on potential new revolving credit could impact their balance-to-limit ratio. For your customers that may be looking for new cards, Experian can estimate your consumers spend on all general-purpose credit and charge cards, so you can identify where there is additional wallet share and assign their credit lines based on actual spending need. Have a Lengthy Credit History The longer your consumers’ credit history, the more time they’ve spent successfully managing their credit obligations. When considering credit age, which makes up 21% of their credit score, credit scoring models evaluate the ages of your consumers’ oldest and newest accounts, along with the average age of all their accounts. Every time they open new credit cards or close an old account, the average age of their credit history is impacted. If your consumer’s score is being negatively affected by their credit history, consider adding information from alternative credit data sources for a more complete view. Manage Debt Wisely While some types of debt, such as a mortgage, can help build financial health, too much debt may lead to significant financial problems. By planning, budgeting, only borrowing when it makes sense, and setting themselves up for unexpected financial expenses, your consumers will be on the path to effective debt management. To get a better view of your consumers spending, consider Experian’s Trended3DTM, a trended attribute set that helps lenders unlock valuable insights hidden within their consumers’ credit scores. By using Trended3DTM data attributes, you’ll be able to see how much of your consumers’ credit line they typically utilize, whether they tend to revolve or transact, and if they are likely to transfer a balance. By adopting these habits and making smart financial decisions, your consumers will quickly realize that it’s never too late to rebuild their credit score. For example, they can potentially instantly improve their score with Experian Boost, an online tool that scans their bank account transactions to identify mobile phone and utility payments. The positive payments are then added to their Experian credit file and increase their FICO® Score in real time. Learn More About Experian Boost Learn More About Experian Trended 3DTM

When it comes to relationships and significant others, debt is topping lists of what people look for - or don't look for - in their partner. Where looks, pedigree, or career trajectory were previous motivation drivers for mate selection (or at least companionship), recent studies indicate debt is a deal-breaker for many looking for love. Late payments from lifestyles past, less-than-stellar credit scores, and cancelled credit cards are all exhibits of debt and destruction influencing personal relationships, not to mention the relationship financial institutions have with these consumers. Are certain relationships – or rather, specific partners – more likely to carry debt? Women were found to be more financially vulnerable, according to the Survey of Consumer Finances, conducted by the Federal Reserve, that examined how men and women who had never been married felt about debt. Recent Experian data found that while both men and women share the same amount of revolving utilization at 30%, men carry more debt than women, $27,067 compared to $23,881 for women. Men are also more likely to have larger mortgage debt at $214,908 compared to $198,622 for women. Women have more credit cards and more retail cards but lower balances than men on both. From a generational viewpoint, Gen X and Boomer generations have a higher than average number of credit cards and higher than average number of retail cards (and the highest average balance on credit cards and retail cards). Gen X also has the highest average debt by generation for both non-mortgage and mortgage debt. While Boomer and Silent Generations have lower than average mortgage debt, the boomer generation still has higher than average non-mortgage debt. With nearly 3 in 4 American adults saying they would reconsider their romantic relationship because of their partner’s debt, consumers should consider revamping their balance sheets before updating their online dating profiles. For the hopeless romantics, the star-crossed lovers, and those instead celebrating Singles Awareness Day whose finances could use a little love, perhaps a digital collections portal or personalized options to consolidate debt might speak to their love language. Or, in the meantime, maybe a list of the top cities for singles with the best credit scores could be a start.

Our 8th annual State of Credit report shows that consumer credit scores and signs of economic recovery continue on an upward trend, coming close to a prerecession environment. The average U.S. credit score is up 2 points to 675 from last year and is just 4 points away from the 2007 average. Originations are increasing across nearly all loan types, with personal loans and automotive loans showing 11% and 6% increases year-over-year, respectively. Consumer confidence is up 25% year-over-year and has increased more than 16% from this period in 2007. With employment and consumer confidence rising, the economy is expected to expand at a healthy pace this year and continue to rebound from the recession. Now is the time to capitalize on this promising credit trend. State of Credit 2017

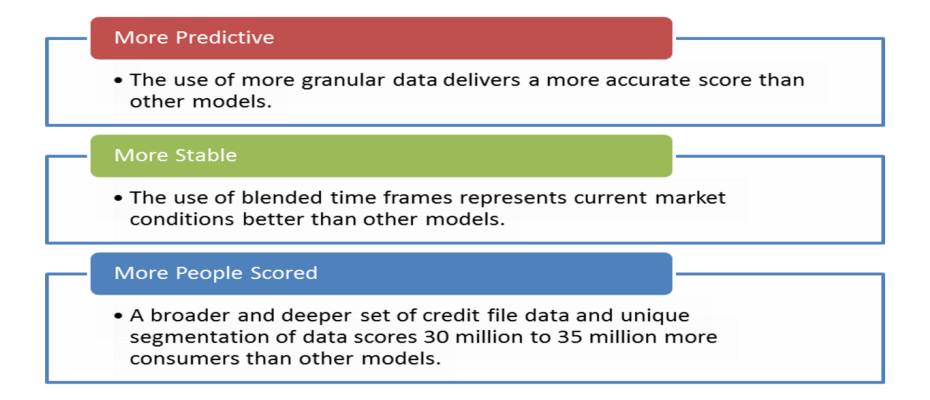

The 1990s brought us a wealth of innovative technology, including the Blackberry, Windows 98, and Nintendo. As much as we loved those inventions, we moved on to enjoy better technology when it became available, and now have smartphones, Windows 10 and Xbox. Similarly, technological and modeling advances have been made in the credit scoring arena, with new software that brings significant benefits to lenders who use them. Later this year, FICO will retire its Score V1, making it mandatory for those lenders still using the old software to find another solution. Now is the time for lenders to take a look at their software and myriad reasons to move to a modern credit score solution. Portfolio Growth As many as 70 million Americans either have no credit score or a thin credit file. One-third of Millennials have never bothered to apply for a credit card, and the percentage of Americans under 35 with credit card debt is at its lowest level in more than 25 years, according to the Federal Reserve. A recent study found that Millennials use cash and debit cards much more than older Americans. Over time, Millennials without credit histories could struggle to get credit. Are there other data sets that provide a window into whether a thin file consumer is creditworthy or not? Modern credit scoring models are now being used in the marketplace without negatively impacting credit quality. For example, the VantageScore® credit score allows for the scoring of 30 million to 35 million more people consumers who are typically unscoreable by other traditional generic credit models. The VantageScore® credit score does this by using a broader, deeper set of credit file data and more advanced modeling techniques. This allows the VantageScore® credit score model to more accurately predict unique consumer behaviors—is the consumer paying his utility bill on time?—and better evaluate thin file consumers. Mitigate Risk In today’s ever-changing regulatory landscape, lenders can stay ahead of the curve by relying on innovative credit score models like the VantageScore® credit score. These models incorporate the best of both worlds by leaning on innovative scoring analytics that are more inclusive, while providing marketplace lenders with assurances the decisioning is both statistically sound and compliant with fair lending laws. Newer solutions also offer enhanced documentation to ease the burden associated with model risk management and regulatory compliance responsibilities. Updated scores Consumer credit scores can vary depending on the type of scoring model a lender uses. If it's an old, outdated version, a consumer might be scored lower. If it's a newer, more advanced model, the consumer has a better shot at being scored more fairly. Moving to a more advanced scoring model can help broaden the base of potential borrowers. By sticking to old models—and older scores—a sizable number of consumers are left at a disadvantage in the form of a higher interest rate, lower loan amount or even a declined application. Introducing advanced scoring models can provide a more accurate picture of a consumer. As an example, for many of the newest consumer risk models, like FICO Score 9, a consumer’s unpaid medical collection agency accounts will be assessed differently from unpaid non-medical collection agency accounts. This isn't true for most pre-2012 consumer risk score versions. Each version contains different nuances for increasing your score, and it’s important to understand what they are. Upgrading your credit score to the latest VantageScore® credit score or FICO solution is easier than you think, with a switch to a modern solution taking no longer than eight weeks and your current business processes still in place. Are you ready to reap the rewards of modern credit scoring?

Divorce often affects financial health negatively. It’s expensive – often causing nearly $20,000 in losses. A recent Experian survey found: 34% say their divorce put them in financial ruin. 19% percent say things were so bad they filed for bankruptcy. 39% report they’ll never marry again because of the financial loss of a divorce. Lenders can provide support to loyal customers by providing personalized credit education and create a new revenue stream for your company. Learn more>

Good job, check. Shared interests, check. Chemistry, check. He seems like a perfect 10. Both of you enjoy your first date and while getting ready for the second, you dare to imagine that turning into another and another, and possibly happily ever after. Then one decidedly unromantic question comes to mind: What is his credit score? Reviewing a potential partner’s credit score and report is important to many singles who are looking for lasting love. According to Bankrate.com, 42 percent of Millennials said that knowing someone’s credit score would affect their desire to date them, slightly more than 40 percent of Gen Xers and 41 percent of Baby Boomers. They may be on to something. Research shows that knowing someone’s credit history and sense of financial responsibility could save people time – and potential heartache. A UCLA study about money and love shows a very strong link between high credit scores and long-lasting relationships. People with drastically different credit scores may experience more financial stress down the road, placing a burden on a relationship. An Experian report reveals 60 percent of people believe it’s important for their future spouse to have a good credit score, and 25 percent of people from the UCLA study were willing to leave a partner with poor credit before marriage so they aren’t held back. While that three-digit number doesn't tell a person’s whole financial story, it can reveal financial habits that could impact your life. Banks are wary of making loans to borrowers with tarnished scores, typically 660 and below. A low score could quash dreams of buying a home, and result in steep interest rates, up to 29 percent, for credit cards, car financing and other unsecured loans. A mid-range credit score can also hurt an application for an apartment and drive up the cost of mobile phone plans and auto insurance. Eight states have passed laws limiting employers’ ability to use credit checks when assessing job candidates, yet 13 percent of employers surveyed by the Society of Human Resource Management performed credit checks on all job applicants. Talking spending styles and revealing credit scores sooner rather than later in a relationship isn’t necessarily comfortable. But it may help you decide whether you have compatible financial outlooks and practices.

Looking to score more consumers, but worried about increased risk? A recent VantageScore® LLC study found that consumers rendered “unscoreable” by commonly used credit scoring models are nearly identical in their financial and credit behavior to scoreable consumers. To get a more detailed financial portrait of the “expanded” population, credit files were supplemented with demographic and economic data. The study found: Consumers who scored above 620 using the VantageScore® credit score exhibited profiles of sufficient quality to justify mortgage loans on par with those of conventionally scoreable consumers. 3 to 2.5 million – a majority of the 3.4 million consumers categorized as potentially eligible for mortgages – demonstrated sufficient income to support a mortgage in their geographic areas. The findings demonstrate that the VantageScore® credit score is a scalable solution to expanding mortgage credit without relaxing credit standards should the FHFA and GSEs accept VantageScore® credit scores. Want to know more?

Which part of the country has bragging rights when it comes to sporting the best consumer credit scores? Drum roll please … Honors go to the Midwest. In fact, eight of the 10 cities with the highest consumer credit scores heralded from Minnesota and Wisconsin. Mankato, Minn., earned the highest ranking with an average credit score of 708 and Greenwood, Miss., placed last with an average credit score of 622. Even better news is that the nation’s average credit score is up four points; 669 to 673 from last year and is only six points away from the 2007 average of 679, which is a promising sign as the economy continues to rebound. Experian’s annual study ranks American cities by credit score and reveals which cities are the best and worst at managing their credit, along with a glimpse at how the nation and each generation is faring. “All credit indicators suggest consumers are not as ‘credit stressed’ — credit card balances and average debt are up while utilization rates remained consistent at 30 percent,” said Michele Raneri, vice president of analytics and new business development at Experian. As for the generational victors, the Silents have an average 730, Boomers come in with 700, Gen X with 655 and Gen Y with 634. We’re also starting to see Gen Z emerge for the first time in the credit ranks with an average score of 631. Couple this news with other favorable economic indicators and it appears the country is humming along in a positive direction. The stock market reached record highs post-election. Bankcard originations and balances continue to grow, dominated by the prime borrower. And the housing market is healthy with boomerang borrowers re-emerging. An estimated 2.5 million Americans will see a foreclosure fall of their credit report between June 2016 and June 2017, creating a new pool of potential buyers with improved credit profiles. More than 12 percent who foreclosed back in the Great Recession have already boomeranged to become homeowners again, while 29 percent who experienced a short sale during that same time have also recently taken on a mortgage. “We are seeing the positive effects of economic recovery with the rise in income and low unemployment reflected in how Americans are managing their credit,” said Raneri. Which means all is good in the world of credit. Of course there is always room for improvement, but this year’s 7th annual state of credit reveals there is much to be thankful for in 2016.

Lenders are looking for ways to accurately score more consumers and grow their applicant pool without increasing risk. And it looks like more and more are turning to the VantageScore® credit score to help achieve their goals. So, who’s using the VantageScore® credit score? 9 of the top 10 financial institutions. 18 of the top 25 credit card issuers. 21 of the top 25 credit unions. VantageScore leverages the collective experience of the industry’s leading experts on credit data, modeling and analytics to provide a more consistent and highly predictive credit score. >>Want to know more?

A recent national survey by Experian revealed opportunities for businesses to build relationships with future homebuyers before they’re ready to obtain a loan. Insights include: 35% of future buyers said they don’t know what steps to take to qualify for a larger loan 75% of future buyers are not preapproved for a home loan 29% of those surveyed would purchase a more expensive home if they had better credit and could qualify for a larger loan A large portion of near-future homebuyers are millennials. Building relationships with this generation now will benefit financial institutions in the future. >> White paper: Building lasting relationships with millennials

According to a national survey by Experian, college students may be receiving their degrees, but their financial management knowledge still needs some schooling. The survey reveals some troubling data about recent graduates: Average student loan debt is $22,813 31% have maxed out a credit card 39% have accepted credit card terms and conditions without reading them Learning to manage debt and finances properly is key to young adults’ future financial success. Since students aren’t receiving credit and debt management education in college, they need to educate themselves proactively. Credit education resources are available on Experian's Website. >> Experian College Graduate Survey Report

Experian® recently released the 2015 State of Credit report, which analyzes key credit metrics across the nation.

Hello from the other side ... While Adele scores big on the Billboard Hot 100 by crooning of coming to terms with a lover from the past, a new Experian “State of Credit” reveals we are officially on the “other side” of the recession – at least if you’re looking at the nation’s credit scores. While the bottom of the Great Recession was reached in the second quarter of 2009, steady job growth was not seen until 2011, and even since, some economists claim it has been a "Tortoise Recovery.” But key findings from Experian’s 6th annual study, ranking top and bottom cities across the nation in regards to credit, suggests the U.S. is strong. “If I were to give a grade to the overall picture of credit in the United States, I would give it an A minus,” said Michele Raneri, Experian’s vice president of analytics and new business development. “I’m optimistic about the state of credit as we are seeing more loans being extended, late payments are decreasing and consumers are continuing to gain more confidence in originating loans. There definitely is growth and momentum — we’re back to prerecession levels in nearly every category, which means lenders are in a prime position to capitalize on this market and foster business growth.” Which states topped the credit charts? As in previous years, Minnesota continues to shine with three of its cities — Mankato, Rochester and Minneapolis — leading with credit scores of 706, 705 and 704, respectively. Greenwood, Miss. and Albany, Ga. ranked the lowest with scores of 612 and 622. While still at the bottom of the list with a score of 612, Greenwood, Miss., residents did improve their score by three points, more than any other city in the bottom 10. Overall, the report reveals the national credit score increased by three points over the last year (and by five points since 2013) and the 10 cities with the highest credit scores in the nation increased their scores by an average of 1.8 points. Additionally, bankcards, retail cards and mortgage lending showed significant growth, making this year’s study an indicator of the nation’s confidence in the credit market. Just in time for the election year, this year’s study includes insight into how residents of these top and bottom metropolitan statistical areas (MSAs) identify politically. The study found that half of the highest-scoring cities have residents whose views skew more middle of the road, while residents of lower-scoring cities are more likely to lean conservative. The full lists of the top 10 and bottom 10 cities are featured (scores are rounded to the nearest whole number). Detailed study highlights include the following changes over the last year: The national VantageScore® credit score is up by three points, from 666 to 669. Bankcard lending continues to increase, with new bankcards up 7.7 percent. The average number of bankcards per consumer is up 2.8 percent to 2.24 cards. Retail card lending also is on the rise, with a 10.8 percent increase in new originations. The average number of retail cards per consumer is up 0.3 percent to 1.55 cards from last year and up by 7 percent since 2013. Instances of late payments (includes bankcard and retail) decreased by 4.4 percent over the last year and by 17.3 percent since the height of the recession in 2010. Average debt2 is up 2.1 percent to $29,093 per consumer. Mortgage originations increased by 42.5 percent. For a more complete look at the above cities as well as the other MSAs studied, visit http://www.livecreditsmart.com to view a fully interactive map and infographic. Purchase The Experian Market Intelligence Brief, a quarterly report that includes more than 70 charts and data trends on loan originations, outstanding loans and delinquency performance metrics spanning three years.

According to a recent Experian analysis, millennials (ages 19–34) are now the largest segment of the U.S. population and are also the least credit savvy group.