Like every other industry, the automotive market is driven by consumer preferences and behavior. While there are a myriad of options to choose from, fuel-type seems to dominate media headlines as a hot topic of conversation among industry pundits and consumers, alike. Little surprise then that alternative fuel vehicles, which include diesels and hybrids, have maintained a steady demand over the past few years. But, there’s a specific segment that’s beginning to emerge.

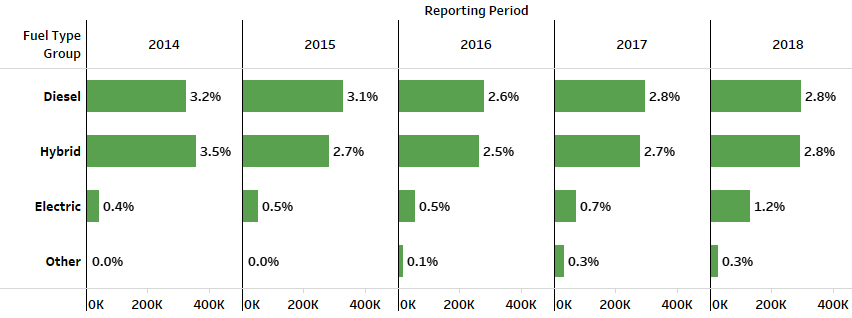

As we detailed in our earlier blog series, electric vehicles (EVs) are began to stand out as a prominent alternative fuel vehicle. And during Q3 2018, we saw more of the same. EVs held 1.8 percent share of total vehicle registrations. While that number may seem small, consider this. Just two years ago, in 2016, EVs comprised only 0.5 percent of registrations, growing at a much slower pace since 2014, when it was 0.4 percent.

It’s worth noting that gasoline-powered cars still dominate the market, making up 92.9 percent of registered vehicles through Q3 2018. But, the demand for alternative fuel type options should not be underestimated. Alternative fuel vehicles are becoming a significant segment in today’s auto market, and the large growth in EVs are a testament to that growth.

While EVs are proving to be a popular option compared to other alternative fuel types, other options remained steady. Diesel vehicles maintained 2.8 percent of the market year-over-year, while hybrid vehicles saw a slight increase since 2017, growing from 2.6 to 2.8 percent of the market.

A picture of the alternative fuel buyer

So, who’s investing in these alternative fuel vehicles? We see that most buyers tend to be married, single family home owners with a college education, and belong to either the Baby Boomer generation or Gen X. It’s interesting to note that EVs make up a notable percentage of registrations of alternative fuel type preferences across generational car buyers, according to Q3 registration data.

Among Baby Boomers, EVs fall second to hybrids, accounting for 1.0 percent of registered alternative fuel type vehicles compared to 1.2 percent respectively. But, EVs made up the biggest share of alternative fuel type registrations among Millennials (1.1 percent) and Gen X’ers (1.2 percent).

With the number of vehicle options available on the market today, EVs stand out as a segment to watch within the auto industry. There’s a greater story beyond the numbers and understanding how to leverage the data at hand can provide the industry with a greater understanding of the EV market and its potential.

To learn more about the electric vehicle market and other alternative fuel type vehicles, view the full Q3 2018 Automotive Market Trends Analysis webinar.