Driving growth in a down mortgage market can be tricky. It’s a mad scramble to obtain quality mortgage leads that convert into profitable loans. At Experian Mortgage, we have a front row seat into the efficacy of different lead generation strategies, and what we know for certain, is that data matters in both the audience creation and outreach approach. I’ve compiled several best practices for identifying qualified prospects early in the homebuying journey and using analytics to focus your outreach on those most likely to convert.

Best practice #1: credit-based triggers

First, let’s focus on borrower-behavior triggers, as they’re key for getting ahead of the competition. I occasionally hear skepticism about tried-and-true credit-based prospect triggers, but many find them indispensable. Credit triggers alert you when borrowers apply for credit and when other indicators meet your specific lending criteria, including credit scores, score trends, credit limits, utilization and much more. They’re effective – and not just for big lenders.

Our clients leverage credit-based triggers to quickly pursue “hot leads,” and have reported higher response rates, lower acquisition costs and revenue growth.

Best practice #2: property listing triggers

Another borrower behavior to watch is listing a property for sale, which can be done using property listing triggers. You can use listing triggers to monitor current customers – and with Experian, you can prospect for new customers outside your portfolio.

One of our clients instituted property listing triggers and immediately identified 40,000 homeowners in their footprint who had recently listed a property for sale. Experian research shows that a homeowner lists their property for sale, on average, 35 days before applying for a new mortgage. This means this lender had over a month to reach those consumers with a tailored message. Now that’s getting a jump on the competition!

But what about those homeowners who list a property for sale but don’t move? We hear anecdotally about more homeowners putting their homes on the market to see what offers they can get. According to recent data, a higher percentage of listings fail to sell today than last year. While property listing remains one of the most predictive behaviors for purchase, there’s room to optimize. Whether your prospect came to you via a property or credit trigger, there’s an opportunity to improve your ROI by identifying trigger leads most likely to convert.

Best practice #3: in-the-market models

A key best practice in audience segmentation is to incorporate in-the-market models (ITMM). A good model is based on sophisticated analytics across hundreds of data elements and millions of loan applications. Additionally, a good model is tailored to your product. A consumer in the market to buy their first house will “look” very different than a consumer in the market for a Home Equity Line of Credit (HELOC).

Experian clients are doing two impactful things with ITMM. First, they create their audience list by bundling ITMM with credit, income, and property data to identify qualified consumers likely to be in the market soon. Second, they optimize an existing marketing list.

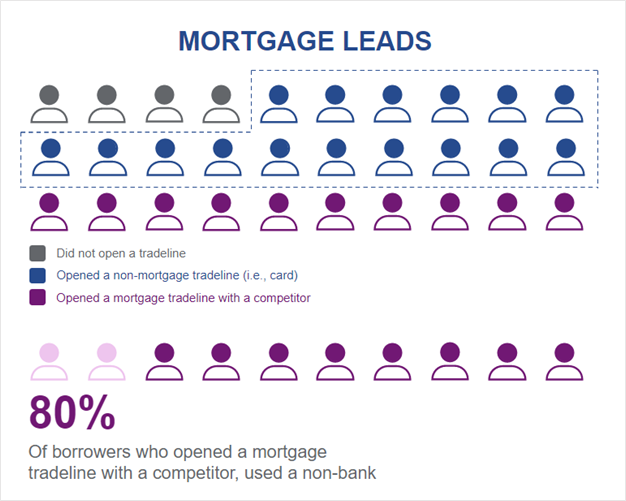

However, when it comes to a mortgage lead generation program, you can only optimize what you measure. Experian has been helping clients by analyzing their lost leads and lost loans. Several clients recently asked us to analyze their efficacy with marketing lists originating from digital mortgage lead aggregators (i.e., lists of consumers who sought information online about mortgages). I’ll focus here on the leads who did NOT originate a mortgage with our clients, but DID open a tradeline with someone else.

My first observation is that prospects who opened a tradeline were significantly more likely to open a credit card than a mortgage. My second observation is when the prospect opened a mortgage loan with a different institution, 80% of the time that lender was a non-bank. This is higher than the current non-bank share of the market, which indicates non-banks are aggressive with their leads and poised to grow their share.

Here’s where ITMM comes into play. By incorporating an ITMM specifically for your product – HELOC, purchase, refinance – you can focus attention on borrowers most likely to open a mortgage.

In summary, instituting credit and property triggers is a critical best practice and will open the door to a plethora of prospects. If you want to level up your marketing strategy, incorporating an ITMM is key and will help you segment the trigger leads and home in on those that are most likely to convert.

Be sure to check out the final blog post in this series, Lead Conversion Through Tailored Messaging and a Multichannel Mortgage Marketing Strategy.

To learn about Experian Mortgage solution offerings, click here.