Preparation is key – whether you’re an amateur/professional sports, free-soloing up El Capitan, or business contingency planning as part of a recession readiness strategy.

Preparation is key – whether you’re an amateur/professional sports, free-soloing up El Capitan, or business contingency planning as part of a recession readiness strategy.

It’s not so much predicting when events will occur, or trying to foresee and pivot for every possible outcome, but rather, acting now so that your business can act faster and smarter in the future.

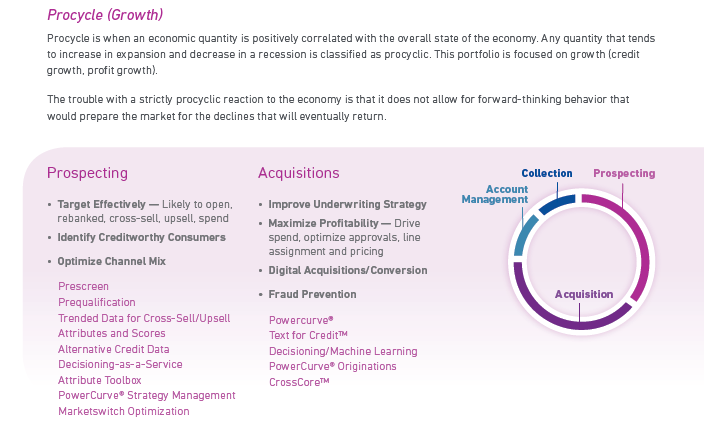

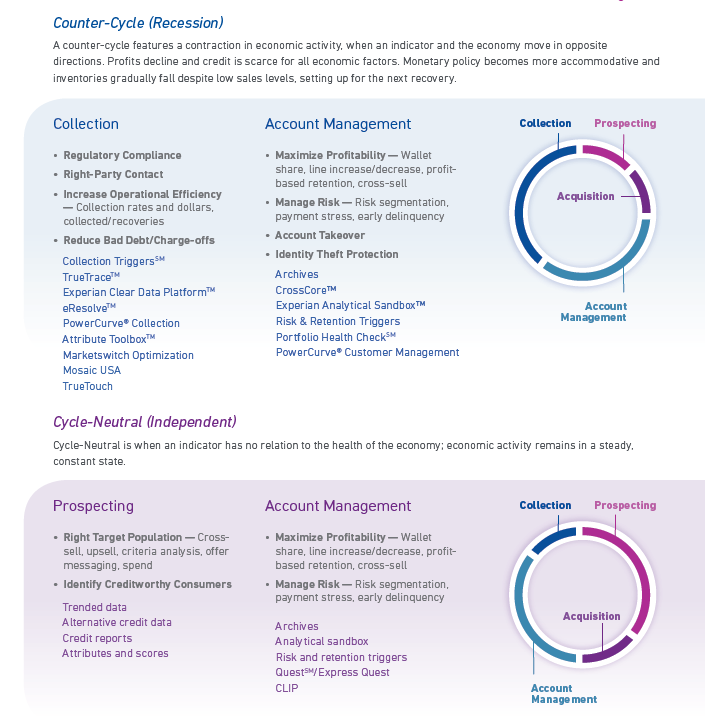

There are certain priorities that have come to be associated with what are widely accepted as the three environments the economy can sustain at any one time:

As with recessions throughout the country’s history, those periods have often been characterized by layoffs, charge-offs, delinquencies, and other behaviors as the economy turns to a counter-cycle environment. Rather than wait to implement reactive strategies , the time to manage accounts, plan, stress test and implement contingency plans for when the next economic correction comes, is now.

While economists and financial services industry experts argue over when a recession will hit and how severe its implications may be (in comparison with the Great Recession of 2008), there’s a need to start tactical business discussions now.

Even in the face of a strong economy, that has seen high employment levels and increased spending, 45% of Americans (112.5 million) say they do not have enough savings to cover at least three months of living expenses, according to a 2018 survey by the Center for Financial Services Innovation.

Regardless of the economic environment – pro-cycle, counter-cycle, and cycle-neutral – those statistics paint an alarming picture of consumers’ financial health as a whole.

These are four crucial considerations you should be taking now:

- Create individualized treatments while reducing manual interactions

- Meet the growing expectation for digital consumer self-service

- Understand your customer to ensure fair treatment

- React quickly and effectively to market changes

While it may not be on the immediate horizon just yet, it’s important to prepare.

For more information, including portfolio mixes, collections considerations and macroeconomic trends, download our latest white paper on recession readiness.