Tech & Innovation

At Experian, we are continually innovating and using technology to find solutions to global issues, modernize the financial services industry and increase financial access for all.

Financial Empowerment

Our deep commitment to social and financial inclusion is reflected in our workplace culture, our partnerships and our efforts to break down the barriers to financial equity.

Financial Health

Our initiatives are dedicated to getting tools, resources and information to underserved communities so that consumers can best understand and improve their financial health.

Latest Posts:

Charles Butterworth talks about the acquisition of leading South African companies Compuscan and Scoresharp Today we announced the completion of our acquisition of Compuscan and Scoresharp in South Africa. This exciting moment creates a single, united Experian organisation that brings together the best of all we offer, not only for South Africa, but the wider African continent. Compuscan’s agile approach has driven its rapid expansion into six Sub-Saharan African countries, alongside emerging business in Australia and the Philippines. Combining Experian’s proven digital strategy with Compuscan and Scoresharp’s cost-effective operating model gives us an excellent foundation for Experian to expand into Africa. This is a commitment we’re serious about, and we’ve made the public commitment to spending at least R120 million on technological enhancements as part of establishing South Africa as an investment hub. For our clients and partners, this acquisition will see the combined organisation bringing new innovations to market, faster and at scale, enabled by our shared bureau data. Delivering additional resources for credit bureau information, decision analytics, marketing services, loyalty & rewards, and training. Allowing us to be more agile, more flexible, and to respond faster to the need of all the organisations and the people we serve. More importantly, this is a chance for us to drive financial inclusion across the region. It’s our intention to use this acquisition to accelerate our financial inclusion goals, bringing many more people into the credit economy and helping us create a better tomorrow for millions. I am delighted to be welcoming Compuscan and Scoresharp to the Experian family, and I am excited about the opportunities that lie ahead as we drive towards our goals of greater financial inclusion and better data management across South Africa and beyond.

Technology revolutionizes the way businesses operate, but implementing change within a company is often challenging. Company-wide support is vital to successfully undergo a transformation. At Experian, in 2015, we underwent the task of moving from a traditional computing architecture to the cloud. This is a monumental transformation with our massive digital infrastructure and significant global reach, but it enables us to provide customers with real-time access to data. This journey is featured in the new book, Cascades: How to Create a Movement that Drives Transformational Change, by Greg Satell. Last year Satell’s first book shone a light on Experian’s innovation story. In his latest book he talks about the power of cascades – small groups, united with a common purpose – to drive transformational change within businesses. He gives examples of how some companies succeed, while others fail. Satell uses Experian as a case study and highlights how changes to our culture, organizational structure and skills is allowing us to adopt new technologies quicker, in better collaboration with our customers, to get cutting-edge, innovative products to market faster. At Experian, we believe in the culture of inclusion, which brings a culture of innovation with the added diversity perspective that empowers our people to continue to evolve and create valuable additions to the company during this transformation. Our philosophy is about advancing a culture that not only respects differences, but also actively celebrates them. In Cascades, Satell writes about the idea of small groups, loosely connected, but united by a common purpose. We asked the author for his thoughts about Experian’s technology journey, which he refers to as our digital transformation, and why he’s used Experian as a success story in his book. Q. What are your thoughts about Experian’s digital transformation so far? Satell: What attracted me to the Experian story was how closely it tracked with so many of the social and political movements I researched for my book. Senior leadership at Experian didn’t just try to push its digital transformation through. Rather, they identified those who were already enthusiastic and empowered them to bring others into the fold and they, in turn, could bring others in. That's how you create a cascade that leads to transformational change. Q. What has impressed you the most about Experian’s digital transformation, from both technology and human perspectives? Satell: What I found most impressive is that Experian is able to break free from decades of legacy and build a new future for itself. That's a very hard thing to do. You have all this infrastructure that served the business so well for so long. I mean you're talking about decades of investment. Still, the company leadership was able to step back and say, ‘That's our past and we're proud of it, but it's not our future’, and move forward from there. Q. Have you seen any examples of how our digital transformation is driving innovation within Experian? Satell: Well I think it has driven a lot. Things like Experian’s Analytical Sandbox, the Ascend platform and much of the current work around Artificial Intelligence (AI) wouldn't be possible without moving to more of a cloud infrastructure.

Inclusion is at the heart of everything we do, and we’ve made it a priority to embrace the diversity that makes up the Experian family. This is why we’re especially proud to release our 2018 The Power of You Inclusion & Diversity Annual Report, highlighting the strides we’ve made to celebrate our diverse work force and create an inclusive company culture. "We believe that embracing a truly inclusive culture, where everyone has a real sense of belonging, is critical to building a diverse workforce and fostering innovation," says Craig Boundy, former chief executive officer of Experian North America. "We don't just encourage inclusion at Experian, we celebrate it." The Power You initiative was created to recognize ways we can create a more supportive work environment and provide greater transparency into our commitment towards diversity and inclusion. We’ve instated progressive policies and programs, such as flexible working, paid parental leave and Experian clubs, to help foster support, empowerment and employee pride about working for Experian. Here are some of the highlights from the report: 89 percent of employees across North America agree that creating a diverse and inclusive work environment is at the forefront of Experian's values More than 900 employees joined our 8 Employee Resource Groups (ERGs) From 2017 to 2018, the percentage of women hired into executive positions increased from 31% to 38% Nearly half of our job applicants were non-white, a 10% increase from 2017 Volunteer Time Off (VTO) was increased from one day to two days Experian North America was honored with a North America Great Place to Work certification and regional Top Workplaces awards From the events organized by our Employee Resource Groups (ERGs) to the support provided by our Experian Hardship Fund, The Power of You initiative is exemplified by the work and dedication our employees have invested to help in our mission to create an inclusive workplace. "Creating a better tomorrow starts within the company, and that's why we're committed to diversity and inclusion," adds Justin Hastings, former chief human resources officer of Experian North America. "We search the globe for the very best people so we can innovate and meet the needs of our increasingly diverse clients. Drawing on this collective strength is what truly makes us a top workplace." Our dedication to creating a more inclusive and supportive workplace has not gone unrecognized. We’ve been honored with a number of high-profile employer awards, including being named the #1 Top Workplace in Orange County by the Orange County Register and one of the World’s Most Innovative Companies for the fifth consecutive year by Forbes Magazine. Innovation starts with creating an inclusive culture and growing a diverse workforce. We are proud of the supportive work culture we’ve created and will continue finding ways we can further build upon the progress we’ve made. A copy of this year's report can be found here. Photos taken by Nhan T. Nguyen.

Fraud attacks continue to increase, and businesses and consumers alike are recognizing the need for more effective preventative measures. In June 2016, we launched the industry’s first open platform designed to catch fraud faster, improve compliance, and enhance the customer experience. Experian CrossCoreTM has put more control in the hands of fraud teams and it continues to receive global recognition for its impact in the industry. We are proud to announce that CrossCoreTM has been named a market leader for fraud prevention by Cyber Defense Magazine’s 7th Annual InfoSec Awards. Judged by an independent panel of certified security professionals, the InfoSec Awards recognize the best ideas, products and services in the information technology industry. In the past year, the platform was also named best fraud prevention innovation by Cybersecurity Breakthrough and as best cybersecurity initiative of the year by CIR Magazine. Since 2016, Experian has been proud to serve organizations looking for better ways to get more out of their existing fraud and identity systems and to more effectively deploy new products and offers, while improving the customer experience and minimizing risk. According to Experian’s 2019 Global Identity & Fraud Report, 55% of businesses reported an increase in online fraud-related losses over the past 12 months, predominantly around account origination and account takeover attacks. Our study shows that consumers value security and convenience. They also expect to be recognized and met with a personalized experience. Businesses can deliver both security and convenience, but to do so, they need to apply the right tools and relevant information. CrossCoreTM is helping fraud teams around the world accomplish this by adapting and deploying strategies that keep up with the pace of fraud while reducing burdens on IT and data science teams. Learn more about CrossCore.

The Human Rights Campaign (HRC) Foundation has recognized Experian with a 100 percent score on their 2019 Corporate Equality Index (CEI), earning the distinction as one of the “Best Places to Work for LGBTQ Equality”. The CEI is the nation’s premier benchmarking tool in evaluating corporate policies and practices related to LGBTQ workplace equality. We are honored to have received such top marks alongside some of America’s most respectable companies. “Our mission as a company is to create greater financial inclusion for consumers, but inclusion also means creating an open and accepting workplaces where everyone can thrive,” said Craig Boundy, former chief executive officer of Experian North America. “We work hard to make diversity and inclusion a priority in our company culture, and our efforts are showing real results.” We strive to celebrate our company’s diversity by creating an inclusive workplace environment where employees feel supported and appreciated. We’ve launched initiatives and implemented policies that have solidified our commitment to being a strong ally to the LGBTQ community. Our dedication to foster a supportive work culture for our LGBTQ employees is exemplified by such practices as: Our progressive benefit programs, which include transgender services and offer equal coverage to same and different-sex domestic partners and spouses. Our non-discrimination and equal employment policies go beyond federal requirements, ensuring equal treatment regardless of “gender identity” or “sexual orientation.” Our dedication to be inclusive through executive sponsorship and the Power of YOU initiative which facilitates Employee Resource Groups and Clubs. "The top-scoring companies on this year's CEI are not only establishing policies that affirm and include employees here in the United States, they are applying these policies to their global operations and impacting millions of people beyond our shores," said HRC president Chad Griffin. Practicing an inclusive work culture has always been one of our top priorities and being honored by the HRC demonstrates our dedication to that goal. We are proud to support our LQBTQ employees, along with the diverse work force that make up the Experian family. For more information on the 2019 Corporate Equality Index, download the HRC report.

More areas of the business are leveraging data and insight around customers than ever before. Today’s digital consumer puts more pressure on organizations to provide personal interactions across all industries, even when that individual is not interacting face-to-face. In order to accomplish that monumental feat, businesses are turning to their data assets to give them the insights they so desperately need. But that is no easy task. We find that most organizations lack trust in their data, typically due to outdated and ineffective data management practices. Businesses can no longer wait for others within the organization to improve the quality of their data. Many are looking to take more control themselves. In fact, according to a recent Experian study, 75 percent of respondents believe data quality responsibility should ultimately lie with the business with occasional help from IT. The rise of the business user is putting more pressure on the tools they leverage. While data quality is a continuous practice that requires constant care, it is certainly enabled by technology. That technology needs to be easy-to-use, intuitive, and provide value back to the business quickly. This week, the 2019 Gartner Magic Quadrant for Data Quality Tools was issued. The report provides an overview of the players in the space and the "key capabilities that organizations need in their tool portfolio, if they are to address the increasing importance and urgency of data quality." The business user is reshaping the data quality market. Now, rather than looking at just features and functions, new Experian research shows that the ease of use by business users and the ability to work with existing technology are more important. These tools need to be designed differently than they have in the past. 56% of businesses say their IT department doesn’t fully understand the data management needs of the business. That means that organizations need to put their data more in the hands of the people who leverage it every day. At Experian Data Quality, we believe in empowering business users to better understand their data assets in order to transform their businesses. We offer easy-to-implement, easy-to-use tools that are designed to help businesses maximize their data insight and build trust in their information. We want our clients to tackle their projects with speed and agility, giving them the confidence and clarity to put their data to good use. We are proud to be named a ‘Challenger’ once again in Gartner’s 2019 Magic Quadrant for Data Quality Tools. We believe in the changing nature of the business and are working to challenge the status-quo in our industry and for our clients. Access the Gartner 2019 Magic Quadrant for Data Quality Tools report.

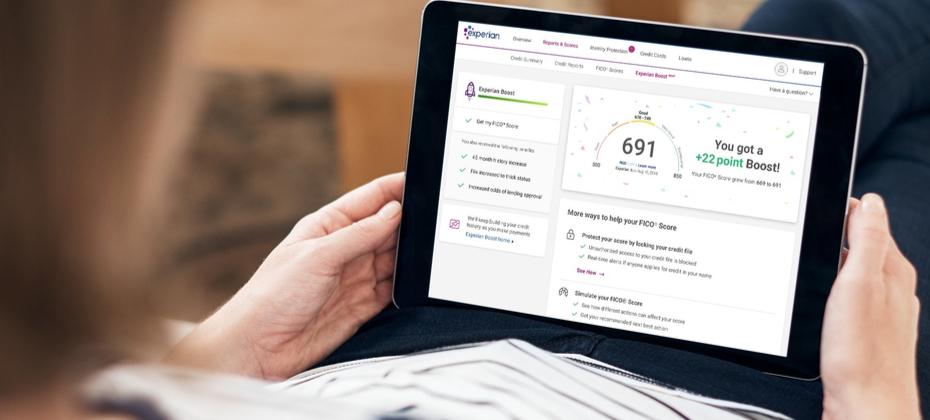

Today marks a notable milestone in our company’s history and for consumers. Today we officially launched Experian Boost, a free tool that, for the first time, will allow millions of consumers to add positive payment history directly into their credit file for an opportunity to instantly increase their credit score. For the past several years, we have been working to develop new products and innovations that will disrupt the credit industry and help improve the financial lives of consumers. This commitment to financial inclusion has defined us and created a real sense of purpose for everyone who works here – and that purpose is realized with the launch of Experian Boost today. There are more than 100 million Americans who don't have access to credit today. A low credit score, due to a thin file or incomplete information, may force these consumers to rely on high interest credit cards and loans. The fact that many of these consumers consistently and responsibly pay cell phone and utility bills on time every month hasn’t seemed to matter. At Experian, we know that’s not right. A good credit score is a gatekeeper to better financial opportunities. We need to develop products and services that make achieving and maintaining a good score easier, not harder. As the consumer’s bureau, we want to ensure that as many people as possible can access and participate in the financial system, and we believe everyone deserves a fair shot at achieving their financial dreams. We have a fundamental mission that is shared by our colleagues around the world: to strive to be a champion for the consumer. With Experian Boost, we're bringing that mission to life and I couldn’t be prouder. Many of our colleagues at Experian worked tirelessly over the last few years to make this day a reality. To everyone who’s played a part, I offer my very heartfelt thanks. It’s truly a great day to be a part of Experian, and we know there will be a lot of great days ahead for all the consumers who will benefit from having their credit score truly reflect who they are. To find out more about the Experian Boost, please visit experian.com/boost.

The Women in Experian Employee Resource Group recently celebrated International Women’s Week with a series of events, including executive panels, speakers and book club meetings. The theme of this year’s event is Better Balance = Better Experian, focusing not only on bringing awareness for gender balance, but also celebrating inclusion. The activities are part of Experian’s commitment to advancing a culture that not only respects differences, but actively celebrates them. We call this The Power of YOU. During the week, we announced that Merideth Wilson, Senior Vice President and General Manager of Revenue Cycle Solutions for Experian Health, will be the lead ambassador for the Women in Experian (WiE) Employee Resource Group in North America. Throughout the year, Wilson and a global team of female leaders from across the business will plan initiatives designed to help women achieve their ambitions and build successful careers. In a Q and A this week, Wilson shared her thoughts and provided tips for women on how to be successful in the workplace. Q. Why is confidence so important for women to reach their career goals? A. Confidence is key for anyone wanting to reach their career goals, but I find it’s especially important for women to find their voice and be able to confidently express themselves. Women need to ask for what they want more often and be vocal about their career aspirations on a regular basis versus waiting for an annual review discussion, for example. Messages typically are delivered and received more successfully using a confident tone; authenticity in a person and one’s message is also very important. Q. What advice can you provide when it comes to accountability? A. Women have to hold ourselves accountable, both professionally and personally, and deliver/drive the results we say we will (or sign up for). Being accountable means taking personal responsibility for the outcome and removing the roadblocks in our way to achieving our goals. I often find that “credibility” is tied to “accountability,” and the importance of how we as women conduct ourselves in driving to the results cannot be overstated. Q. What are your thoughts on communication skills and being self-aware? A. Women need to know their audience. Effective communication often requires different styles and mediums depending on the situation and environment. One of the greatest communication skills a woman can have is the ability to confidently present in public. Public speaking is scary to many, but with practice it can be a woman’s best asset. Q. Explain how empathy and honesty can be key to career growth. A. Integrity, honesty and trustworthiness are three key traits to help propel a person’s career growth. It is nearly impossible to grow one’s career without the ability to truly relate to others with understanding, appreciation and respect for another person’s journey or perspective. Q. Why is it important to be inspirational and optimistic in the workplace? A. Good leaders inspire others to do more, be more and produce more. I find that people generally want to work with people they like, trust, admire and find upbeat. Bringing our full selves to work each day — in mind, body and spirit — helps contribute to a happy, productive and fun work environment for all, and it’s something we should aspire to each day. About Merideth Wilson Wilson is Senior Vice President and General Manager of Revenue Cycle Solutions for Experian Health, a position she assumed in September 2014. In this role, she serves as the executive responsible for the Claims, Contract Manager, Patient Estimates and Medical Necessity solution suites and operations. Wilson joined Experian in January 2004 through the Medical Present Value, Inc. (MPV) acquisition. She has held various leadership positions in operations, product management and development, outsourcing services, client delivery, and strategic marketing and planning. Wilson earned a Master of Business Administration from Mercer University and a Bachelor of Business Administration from Baylor University.

As digital transformation follows its course, ubiquitous data and new technologies are dramatically changing the way consumers interact with businesses. The Amazons and Googles of the world are redefining customer experience on a daily basis and setting the bar higher for the rest of industries to catch up. This ‘customer-first’ era calls for innovative ways to achieve sustainable growth and market leadership. Aimed at understanding this new reality, we commissioned Forrester Consulting to survey senior executives and decision makers about how they tackle the challenges and opportunities surrounding digital transformation. What we found is that the key to succeed in today’s highly competitive and fast paced environment is creating a comprehensive, unified view into their customers and their needs. And that although businesses are committed to keeping up with the pace of change to stay relevant, there are still trying to figure out how to execute their ‘customer-first’ vision. Businesses from all over the world wonder how they can attract and retain new customers, or what are the tools they need to quickly act on insights and make consistent, relevant decisions about what matters the most to their customers. Our research shows that the early beneficiaries of digitalisation such as fintech companies and e-commerce brands have been quick to understand younger, tech savvy and convenience-hungry consumers. Both industries have leveraged decades of technology developments to meet their customers’ expectations, setting the bar high. They have evolved from one-time transactions to building relationships, creating loyal followers and facilitating repeat purchases. Financial services and other sectors can find inspiration in how customer strategies focused on relevance and personalisation deliver the curated experiences consumers demand. When you put the customer first, the opportunities to create more value from your customer relationships are endless. We believe the future is bright for the business which remains nimble and willing to evolve their business models, using technology to meet the needs of tomorrow’s customer. Key findings 81% of executives believe traditional business models will disappear over the next five years due to digital transformation. 79% of key decision makers believe their customers can seamlessly interact with their organisations across mobile, web, and in-person channels – and are generally positive about the progress they are making. Two thirds of executives believe their profitability would improve if they were able to create that single, comprehensive view of the customer. Knowing and understanding customers better than anyone else is paramount to consistently assisting them how, when and where they need it. Businesses must ensure that they offer appropriate products that their customers can afford and benefit from now and in the future, regardless of market conditions or changing personal circumstances. Six out of ten executives believe sharing their data with third parties and tapping into additional data will help them create frictionless customer experiences. But there are some challenges they need to overcome before achieving that. For example, 40 percent of executives globally still feel they cannot easily share their data. They also need to make sense and find meaning from all the data they have. They are currently investing in new technologies to make sense of their data, but these efforts are not going far enough. 53% of businesses worldwide struggle to make consistent customer decisions. Part of it due to the gathering of inconsistent data from one channel to the next. The better businesses get at managing different points of interaction, the more insight they can obtain within a given customer’s experience. Using advanced analytics helps unlock the value latent in different points of interaction along the entire relationship with your customers. 77% of executives set aside budget for advanced analytics and decision-management systems. To turn strategic priorities into action, businesses have set aside budget to invest in analytics and digital decisioning. Thanks to innovative analytical tools, businesses can deliver improved, personalised experiences when they matter, better protecting consumers and complying with regulations. Download the full report.

Financial exclusion is a global issue with an estimated 1.7 billion adults currently ‘unbanked’ . Experian’s core mission is to help bring financial inclusion to every adult in the world. There are currently millions of ‘thin file’ consumers and SMEs in sub-Saharan Africa. These are consumers with limited information on a traditional credit bureau or have no information at all, so-called ‘invisibles’, who find themselves excluded from mainstream finance. They often face more difficulty – or higher costs – when applying for financial products or services. That’s why we are proud to announce today the launch of a ground-breaking new smartphone app, GeleZAR, in South Africa, which aims to bring more micro-entrepreneurs into the mainstream economy and ensure they get the credit score they deserve.. Using the expertise of our global innovation hubs, we have developed a unique financial education and credit scoring mobile app. GeleZAR is designed to educate entrepreneurs and individuals on how to manage their finances, budget and credit score in a fun, entertaining and digestible way. It can also advise individuals on how to maintain a good credit health and recommends remedial actions where needed. In partnership with a local South African consumer and fintech developer, Experian designed the app specifically for entry-level smartphones. We are also working with one of the largest low-cost mobile phone retailers in Africa to trial the app which has been pre-installed on a range of its entry-level smartphones.. The intention is to extend the rollout and make the app accessible for free on more than six million devices annually. Working with alternative data that an individual user consents to share on the app, GeleZAR will be able to assess an individual’s stability, build a credit profile and potentially improve their credit score. This in turn could enable them to access a broader range of financial products at more affordable interest rates. This is a great example of how Experian is innovating to find new ways to empower our customers while uplifting societies. It also fulfils our passion for financial inclusion and the accurate assessment of affordability. Experian’s cutting edge technological capabilities enable us to use the power of data to transform lives, businesses and economies for the better. Through our pioneering work in this space we hope to help consumers around the world on their credit journey. GeleZAR is just one of the ways we are delivering on our mission to build and improve the credit files of millions of people in South Africa and beyond.

Today I testified before the U.S. House Committee on Financial Services. Many important questions were asked: Are we doing enough to ensure the accuracy and security of consumer data? What are we doing to help promote financial inclusion so that millions of American consumers can finally gain access to the credit they deserve and need? On behalf of everyone at Experian, I was proud to share with the committee that financial inclusion is part of our sense of purpose. This sense of purpose is what drove us to create game-changing initiatives like Experian Boost, which will help millions of Americans instantly increase their credit scores and gain access to better financial opportunities. I also commented to the committee that nothing was more important to us than ensuring the security and accuracy of consumer data, and our mobile-optimized online dispute resolution service is evidence of that ongoing commitment. You can read the full text of my written testimony here. However, the issues discussed today need to be part of a larger and ongoing dialogue. Credit is vital to buying a place to live, a car to drive and paying for everyday expenses. We know we have a special responsibility to play in what is arguably one of the most effective credit ecosystems in the world. We take that responsibility very seriously. But we also know that winning the trust of consumers is something we need to consistently earn. We hold ourselves accountable for doing that every day and agree with committee members that everyone involved in consumer credit should do the same. We are proud of what we have accomplished so far, but we know we can and must go further. We need to constantly strive to reinvent what is possible by leveraging new technologies and innovative solutions. Today’s consumers and even our lending customers should expect nothing less from us. And Congress has an important role to play, too. We strongly support legislative initiatives like the Credit Access and Inclusion Act, which would amend the Fair Credit Reporting Act and allow positive consumer credit information, such as on-time payment histories, to be shared with consumer reporting agencies. This proposed legislation would also remove barriers to financial inclusion, such as state and local laws that prevent public utilities from sharing positive customer payment data. While many voices need to contribute to a robust dialogue on the future of the credit economy, it seems clear that the most effective solutions will stem from consumer demand and not legislation or regulation. There are over 100 million American consumers who don't have access to credit today, either because their credit scores are too low, or because they don't have enough credit history. Most of these individuals have never heard of Experian and have little if any idea of what we do. That’s ok. We know the struggles they face and we have some ideas on how we can help make a difference. In many ways we already are and we’re ready to roll up our sleeves to do even more in the future. Millions are counting on us.

The following is written by Mike Kilander, Global Managing Director, Data Quality, at Experian With companies facing increasingly complex data challenges that can determine the success or failure of their business, never has it been so important to have accurate and reliable data. Businesses encounter almost continuous disruption – frequently driven by accelerated data insights – and increasing regulatory pressure to improve transparency and ensure consumer privacy. Moreover, the modern consumer brings online expectations and digital demands, requiring companies to respond ever faster and more than before. One-to-one marketing has become the new digital experience. To handle these new digital demands and market pressure, organizations must improve their ability to leverage their data and gather key insights, especially on their ever-changing customers. But while there is more information available than ever before, data is a largely untapped resource. Why are we drowning in data, yet starved for insight? There are two key areas where organizations are struggling: developing trust in the accuracy of their data and gaining access to it. Organizations told us they suspect almost a third of their data is inaccurate, which limits their ability to leverage data to drive improved business outcomes. If you can’t trust your information, how are you supposed to make big strategic business decisions with it. Second, the average business user can’t get timely access to the data or insight they need. In fact, 70% say that not having direct control over data impacts their ability to meet strategic objectives. Too often, access to data only comes after the submission of an IT ticket and weeks of waiting. We see, year after year, many businesses fail to take full advantage of the opportunity their data. Current infrastructure and management practices are often not set up to handle today’s digital consumer, the volume of data generated, and the multitude of systems collecting the data, leaving users with inaccurate data and limited access. Consequently, they have been limited in their ability to leverage new data talent, technology, and best practices that can help them gain the necessary insight to innovate and stay competitive. In the past several years managing data became more complicated because of the increasingly diverse group of stakeholders who want to leverage and have access to data. It isn’t enough now just to make sure the data is right, which most companies still have not cracked. Now you also must make sure that insight is provided with the right context, to the right business user who can make the most effective decisions for the organization. These challenges will only become more acute as organizations not only continue to delay meaningful investment in data management, but also miss the emerging trend of democratization of data control in the organization. When investing in technology, few stop to think about the overarching operational data strategy and how decentralized data manipulation has become. Organizations need the right ownership or strong data leadership that allows them to access data and take advantage of insight, while considering consumer privacy, data security and data governance. Experian just released a new report looking at customer experience data trends, developing trust in information and changing data ownership. I encourage you to read this new report in the hopes that it will shed light into best practices around leveraging data. Download the new 2019 Global Data Management report here.